In today’s rapidly evolving financial landscape, investors are constantly looking for innovative ways to diversify their portfolios and maximize returns. One such innovation that is gaining significant traction is the tokenization of alternative investments. This process allows individuals to invest in high-value assets, such as prime real estate, private equity, and fine art, using the convenience and flexibility of digital transactions.

Tokenization utilizes blockchain technology to transform these traditionally exclusive and illiquid assets into easily tradable digital tokens. This approach democratizes access and enhances liquidity, making these investments more available to a broader range of investors.

This comprehensive guide delves into the intricacies of tokenizing alternative investments. We will explore what alternative investments are, how tokenization works, the benefits and challenges associated with this process, and real-world case studies demonstrating its transformative potential. Whether you are a seasoned investor looking to expand your portfolio or a newcomer seeking new investment avenues, understanding tokenization can provide you with the tools to navigate this promising frontier.

What Are Alternative Investments?

Before delving into tokenization, it’s essential to understand the landscape of alternative investments. Unlike traditional investments such as stocks, bonds, or cash, alternative investments encompass a diverse range of asset classes that often operate outside the conventional financial system. These investments can offer unique opportunities for diversification and potentially higher returns, albeit with different risk profiles.

Definition and Examples

Alternative investments refer to asset classes that fall outside the traditional categories of stocks, bonds, and cash. They typically include:

Private Equity: Investments in private companies that are not listed on public exchanges. Private equity funds often focus on startups, growth-stage companies, or businesses undergoing restructuring, aiming for substantial long-term returns.

Real Estate: Direct ownership or investments in property, including residential, commercial, and industrial real estate. Real estate investments can provide steady income through rents and potential appreciation in property values.

Hedge Funds: Pooled investment funds that employ diverse strategies to earn active returns for their investors. Hedge funds may use leverage, derivatives, and short-selling to achieve their investment goals, often targeting absolute returns irrespective of market conditions.

Collectibles: Tangible assets such as fine art, rare wines, vintage automobiles, and other unique items. Collectibles can appreciate in value based on rarity, condition, and market demand.

Specialty-Food-Producing Farmland: Agricultural investments focusing on high-demand, niche products like heirloom cacao, organic honey, or sustainable fisheries. These investments can offer both financial returns and support sustainable practices.

Having Doubts?

Key Characteristics

Alternative investments are typically characterized by:

Illiquidity: These assets are not easily sold or exchanged for cash without a substantial loss in value. For example, selling a piece of fine art or a stake in a private equity fund often involves lengthy processes and may require finding a specific buyer.

Exclusivity: Often reserved for accredited or institutional investors due to high minimum investment requirements. This exclusivity means that only a select group of investors can participate, limiting broader market access.

High Barriers to Entry: Significant capital investment and specialized knowledge are usually necessary to participate. Investing in private equity or real estate often requires understanding complex financial structures and market dynamics.

According to Preqin, a leading source of data on the alternative assets industry, the global alternative assets market was valued at over $16.8 trillion in 2023, reflecting significant growth from previous years. This sector continues to offer diversification benefits, as alternative assets typically exhibit low correlation with traditional markets, which can help reduce overall portfolio volatility and enhance risk-adjusted returns.

Traditional Barriers in Alternative Investments

Alternative investments have long been attractive to seasoned investors seeking diversification and higher returns. However, they come with significant barriers that have limited their accessibility.

High Minimum Investment Thresholds

One of the most significant barriers to entry in alternative investments is the high minimum investment requirement. For example, investing in a private equity fund or a high-end real estate project often requires capital commitments ranging from hundreds of thousands to millions of dollars. This exclusivity limits participation to wealthy individuals and institutional investors, leaving out a vast majority of potential investors.

Complex Regulatory Requirements

Navigating the regulatory landscape for alternative investments can be daunting. Different jurisdictions have varying rules regarding securities, investor qualifications, and compliance standards. This complexity can deter investors and issuers alike, making cross-border transactions particularly challenging.

Illiquidity and Long Holding Periods

Alternative investments are typically illiquid, meaning they cannot be easily converted into cash. Investors may need to lock up their capital for extended periods, sometimes spanning several years, before realizing returns. This lack of liquidity restricts the ability to rebalance portfolios or respond to market changes promptly.

Opaqueness and Lack of Transparency

Many alternative investments suffer from a lack of transparency, making it difficult for investors to assess the true value and risks associated with the asset. Limited disclosure and complex valuation methods can foster mistrust and discourage new participants from entering the market.

What Is the Tokenization of Alternative Investments?

Tokenization is revolutionizing how alternative investments are accessed and managed. It involves converting ownership rights in an asset into digital tokens on a blockchain, thereby enhancing accessibility and liquidity.

Tokenization of alternative investments refers to the conversion of ownership rights in an asset into digital tokens on a blockchain. These tokens represent a secure, verifiable claim on the underlying asset, allowing for easier buying, selling, and trading. The process typically involves several key steps:

The Process of Tokenizing Alternative Investments

- Identifying the Asset: Selecting a suitable alternative asset for tokenization, such as real estate, private equity, or fine art. The asset’s value and potential must be well-understood, often requiring due diligence and valuation by experts.

- Creating Tokens: Developing digital tokens that represent fractional ownership of the asset. These tokens are typically created on a blockchain platform like Ethereum, which supports smart contract functionality.

- Smart Contracts: Utilizing smart contracts to automate transactions, compliance, and governance. Smart contracts are self-executing contracts with the terms directly written into code, ensuring that all conditions are met before transactions are completed.

- Distribution and Trading: Offering tokens on digital platforms where they can be traded in secondary markets. These platforms facilitate the buying and selling of tokens, providing liquidity to what were previously illiquid assets.

Benefits of Tokenization for Alternative Investments

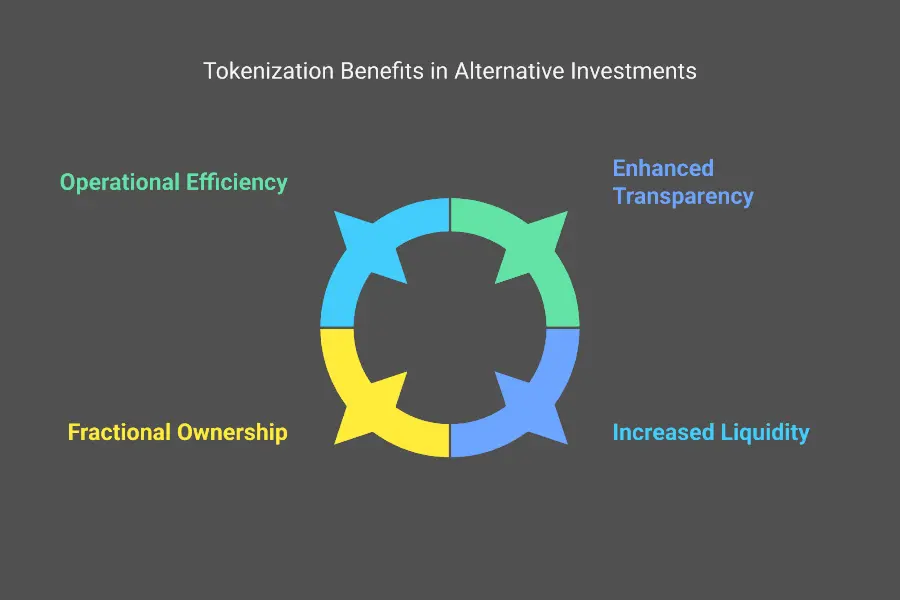

Tokenization offers several key advantages that directly address the inherent challenges and barriers in traditional alternative investments:

Increased Liquidity for Illiquid Assets: By converting traditionally illiquid alternative assets into smaller, tradable tokens, investors gain the ability to buy and sell fractions of these assets more easily. This enhanced liquidity allows for quicker and more flexible portfolio adjustments, a significant improvement over the typical long holding periods and complex sales processes associated with alternative investments like real estate or private equity.

Fractional Ownership & Democratized Access: Tokenization dramatically lowers the barrier to entry for alternative investments. By enabling fractional ownership, it allows a broader range of investors to participate with smaller capital commitments. For example, instead of needing to invest a substantial sum in an entire piece of fine art or a whole private equity fund, investors can purchase fractions represented by tokens, making these previously exclusive alternative investments accessible to more people.

Enhanced Transparency in Opaque Markets: Blockchain technology brings a new level of transparency to alternative investments, which have historically been characterized by opaqueness. All transactions are recorded transparently and immutably on the blockchain, building trust by providing a clear and verifiable history of ownership and asset performance. This transparency helps address the lack of visibility that has often been a concern in alternative investment markets.

Operational Efficiency & Streamlined Processes: The automation enabled by smart contracts significantly streamlines the often complex and labor-intensive operational processes of alternative investments. From reducing administrative overhead to speeding up transaction settlements, tokenization leads to greater efficiency, lower costs, and faster execution times compared to traditional, often cumbersome, methods of managing and trading alternative assets.

Building Wealth Brick by Brick: The Story of Real Estate Tokenization

Imagine a prime commercial property in New York City being tokenized. Instead of requiring an investor to commit $1 million for a stake, the property is divided into 1,000 tokens, each worth $1,000. Investors can purchase as many tokens as they can afford, gaining proportional ownership and the ability to trade their tokens on a secondary market, thus enhancing liquidity and accessibility. This approach not only makes real estate investment more accessible but also allows for greater diversification within the property market.

The Role of Blockchain in Alternative Investments

Blockchain technology is central to the tokenization of alternative investments, acting as the core infrastructure that unlocks their potential. Its key roles directly address the traditional limitations of alternative assets, making them more accessible, efficient, and liquid.

Blockchain’s Impact on Alternative Investments

Democratization via Fractionalization: Blockchain enables the tokenization of alternative assets, allowing for fractional ownership. This democratizes access to previously exclusive investments like private equity and real estate, opening them to a wider range of investors. This is a fundamental shift in alternative investments.

Security and Trust through Transparency: For blockchain in alternative investments, security and transparency are paramount. Blockchain’s inherent security and immutable ledger build trust by providing verifiable records of ownership and transactions. This enhanced transparency is crucial for investor confidence in digital securities in alternative investments.

Efficiency and Automation with Smart Contracts: Tokenization of alternative investments leverages smart contracts on the blockchain to automate processes. This increases operational efficiency, streamlining administration, compliance, and distributions, reducing costs and complexities associated with traditional alternative assets.

Liquidity Enhancement for Illiquid Assets: A major role of blockchain in alternative investments is to enhance liquidity. By creating tradable digital securities in alternative investments, blockchain facilitates secondary markets. This liquidity boost makes previously illiquid alternative assets more attractive and versatile for investors.

How Tokenization is Transforming Private Equity Investments

Quadrant Biosciences’ equity tokenization serves as a powerful real-world example of blockchain’s transformative roles in alternative investments. Let’s see how their case embodies these key roles:

- Democratization: Quadrant Biosciences’ tokenization directly democratized access to private equity. By issuing tokens, they lowered the minimum investment, allowing a wider range of investors to participate in their growth a key role of blockchain in making alternative investments more inclusive.

- Efficiency: Quadrant Biosciences leveraged blockchain to achieve greater efficiency in fundraising. Tokenization streamlined the capital raise process, potentially reducing administrative overhead and speeding up investor onboarding demonstrating blockchain’s role in creating more efficient alternative investment processes.

- Transparency: While specific transparency statistics aren’t available for Quadrant Biosciences’ case, the use of blockchain inherently brought a degree of enhanced transparency compared to traditional private equity raises. Blockchain provides an immutable record of token ownership, laying the foundation for more transparent operations showcasing blockchain’s role in building trust through transparency in alternative investments.

- Enabling Digital Securities: Quadrant Biosciences’ issuance of “Quadrant Tokens” is the creation of digital securities in alternative investments. This directly exemplifies blockchain’s fundamental role in enabling the very existence of tokenized alternative assets, paving the way for new forms of investment and ownership.

In 2018, through this application of blockchain, Quadrant Biosciences tokenized 17% of its equity and raised $13 million. These statistics underscore the tangible impact of blockchain in making alternative investments more accessible and efficient, as clearly demonstrated by Quadrant Biosciences’ pioneering approach.

Digital Securities in Alternative Investments

Digital securities, also known as security tokens, play a crucial role in the tokenization of alternative investments by ensuring regulatory compliance and investor protection.

What Are Digital Securities?

Digital securities are blockchain-based tokens that represent ownership in an asset, similar to traditional securities. They are regulated financial instruments that comply with securities laws, providing investor protection and ensuring legitimacy. Unlike utility tokens, which are often used within a specific platform or ecosystem, digital securities are designed to function as actual investment vehicles with legal and financial rights attached.

Benefits of Digital Securities

Regulatory Compliance: Adhere to securities regulations, ensuring legal protection for investors. Digital securities must comply with local and international securities laws, which typically include requirements for investor accreditation, disclosures, and reporting.

Ease of Transfer: Simplifies the process of transferring ownership, making it faster and more efficient. Digital securities can be traded 24/7 on blockchain-based exchanges, providing investors with greater flexibility and control over their investments.

Programmable Features: Incorporate features like automated dividend payments and governance rights directly into the token’s code. This automation enhances operational efficiency and ensures that all parties adhere to the agreed-upon terms without manual intervention.

Masterworks and Fractional Ownership of Iconic Art

Masterworks stands as a prime example of how digital securities are applied in the alternative investment space. They have successfully tokenized numerous iconic artworks, offering investors the opportunity to:

- Invest in SEC-Compliant Art Securities: Purchase shares in artworks through SEC-qualified offerings, ensuring regulatory compliance and investor protection.

- Trade Art Shares on a Secondary Market (planned): While currently shares are offered in primary offerings, Masterworks aims to create a secondary trading platform for their digital securities, further enhancing liquidity.

- Access Blue-Chip Art Ownership: Own fractions of multi-million dollar masterpieces with investment levels starting much lower than whole-artwork purchases, opening up fine art investment to a broader audience.

Masterworks‘ use of digital securities demonstrates how this technology is making alternative investments in fine art more accessible, compliant, and liquid. Platforms like Tokenova, and companies like Masterworks, are pioneering a new era of investing in unique assets through the power of tokenization and digital securities.

Your Tokenization Partner

How Tokenization of Alternative Assets Works

Tokenization transforms traditional investment processes into a seamless, digital experience. Here’s a detailed look at how it works.

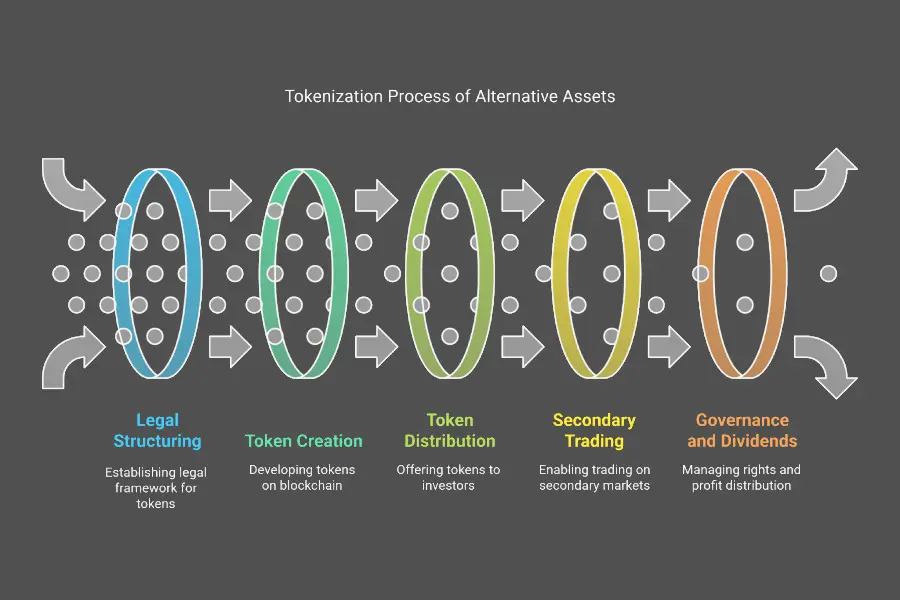

Step-by-Step Process

Identify the Asset: Choose an alternative asset suitable for tokenization, such as a private equity fund or real estate property. The asset’s value and potential must be well-understood, often requiring due diligence and valuation by experts.

Legal Structuring: Establish a legal framework to hold the asset and issue tokens representing ownership stakes. This involves setting up a legal entity that owns the asset and ensures that token holders have defined rights and protections.

Create Tokens: Develop digital tokens on a blockchain platform, embedding smart contracts to automate processes and enforce compliance. These tokens are designed to represent fractional ownership and can include specific terms related to dividends, governance, and transfer restrictions.

Distribute Tokens: Offer tokens to investors through a regulated platform, ensuring that all legal and compliance requirements are met. This step often involves marketing the token offering, conducting investor onboarding, and managing the sale of tokens.

Secondary Trading: List tokens on secondary markets, allowing investors to buy and sell tokens easily, thereby enhancing liquidity. Secondary trading platforms provide the infrastructure for ongoing trading and price discovery, similar to traditional stock exchanges.

Governance and Dividends: Utilize smart contracts to manage governance rights and automate dividend distributions based on the asset’s performance. This ensures that investors receive their share of profits and can participate in decision-making processes.

Farmfolio’s Farmland Tokenization

Farmfolio tokenizes farmland in regions known for specialty food production, such as cacao plantations in Colombia. Here’s how the process works:

- Asset Identification: Farmfolio selects a cacao plantation with high-demand heirloom cacao beans, ensuring the asset has strong growth potential and market demand.

- Legal Structuring: A legal entity is created to own the plantation. This entity issues tokens that represent ownership stakes in the farmland, outlining the rights and obligations of token holders.

- Token Creation: Security tokens are developed on a blockchain platform, encoding ownership rights and profit-sharing mechanisms. Each token represents a fractional ownership interest in the plantation.

- Token Distribution: Tokens are offered to investors through Farmfolio’s regulated platform. Investors complete KYC/AML checks, review offering documents, and purchase tokens, enabling participation with smaller capital investments.

- Secondary Trading: Tokens are listed on licensed secondary marketplaces, allowing investors to trade their stakes easily. This provides liquidity and enables investors to exit their positions without waiting for the asset to be sold.

- Profit Distribution: Smart contracts automate profit sharing by distributing earnings from cacao sales directly to token holders. This ensures timely and accurate payments based on the asset’s performance.

This approach not only diversifies investment portfolios but also supports sustainable agricultural practices by connecting farmers directly with a global investor base. Investors benefit from the plantation’s success, while farmers gain access to capital without the need for traditional financing methods.

Tokenization revolutionizes alternative investments by offering transformative benefits that overcome traditional barriers. By breaking down high-value assets into digital tokens, tokenization increases liquidity, enables fractional ownership for broader investor access, enhances transparency and trust through blockchain’s immutable records, and improves operational efficiency via smart contract automation.

While these advantages are significant, it’s important to acknowledge that challenges such as regulatory uncertainty and market adoption still exist in this evolving space. These benefits, alongside the considerations, are crucial for understanding the transformative potential of alternative assets. For a deeper understanding of the tokenization process itself, please refer to our article, “What is Tokenization?”.

Real-World Case Studies & Industry Examples

To fully appreciate the transformative power of tokenization of alternative investments, consider some real-world examples where theory meets reality. These scenarios not only provide proof-of-concept but also highlight the variety and global breadth of tokenized offerings.

Dreaming of Luxury Real Estate? Tokenization Makes it Possible with St. Regis Aspen Resort

Ever fantasized about owning a piece of a luxury getaway, like the famous St. Regis Aspen Resort? For most of us, owning a ski-in condo at a place like that sounds like a distant dream. But tokenization is changing that. The St. Regis Aspen Resort actually offered something called AspenCoin, a digital token that represented a slice of ownership in this high-end resort. Imagine that! Here’s what it meant for investors like you:

- Finally, a Piece of Luxury: Suddenly, owning a part of a prestigious resort wasn’t just for the super-rich. Tokenization opened the door to a level of luxury real estate investment previously reserved for institutions and the wealthiest individuals.

- Invest Without Millions: You didn’t need to put down millions for a whole condo. AspenCoin allowed you to invest with a fraction of the usual capital, making luxury real estate accessible to a much wider range of people.

- Flexibility to Buy and Sell: Unlike traditional real estate that can be tough to sell quickly, AspenCoin tokens could be traded on secondary markets. This offered investors a chance to get in and out of the investment with more ease and control.

Don’t Just Go With the Wave

Private Equity No Longer Just for the Elite: Access Tokenized Funds via Platforms Like Securitize

Private equity it often sounds like something only Wall Street insiders and massive institutions can get into, right? Historically, that’s been largely true, with huge minimum investments acting as a major barrier. But tokenization is breaking down those walls. Platforms like Securitize are partnering with private equity funds to tokenize their shares, making them available to a broader audience. Here’s the exciting part for investors:

- Say Goodbye to Huge Minimums: You don’t need to be a millionaire to consider private equity anymore. Tokenization can slash minimum investments from hundreds of thousands of dollars down to amounts like $10,000, or even less, making it feasible for more investors to participate.

- Spread Your Bets: Investing smaller amounts means you can diversify your portfolio across multiple private equity funds. Instead of putting all your eggs in one basket, you can spread your risk and potentially increase your overall returns.

- Invest with Confidence: Platforms like Securitize are focused on regulatory compliance, meaning tokenized private equity offerings are designed with investor protection in mind. This adds a layer of trust and security to this newly accessible market.

Fine Wine Investing, Made Liquid and Accessible with WiV

Fine wine it’s often seen as a sophisticated and potentially lucrative alternative investment. But let’s be honest, dealing with physical bottles of rare wine, storage, and selling them can be a hassle. WiV is changing that by tokenizing fine wines, bringing this niche market to a wider audience. Here’s how investors benefit:

- Enter the World of Fine Wine Without the Fuss: You don’t need to become a wine connoisseur or build a wine cellar to invest in fine wine. Platforms like WiV handle the complexities, allowing you to invest in digital tokens representing valuable wine collections.

- Liquidity in a Traditionally Illiquid Market: Selling physical wine can be slow and cumbersome. WiV tokens, however, can be traded on secondary markets, offering a much faster and easier way to buy and sell your wine investments.

- Leave the Storage to the Experts: No need to worry about temperature-controlled storage or insurance. Tokenization platforms often take care of the secure storage and professional management of the underlying physical wine assets.

Investing in Farmland, Sustainably: Tokenized Agriculture with Farmfolio

Want to invest in something tangible and sustainable? Farmland, especially farms focused on specialty and organic foods, is gaining traction as an alternative investment. But again, buying a whole farm is out of reach for most. Farmfolio is making it possible to invest in tokenized farmland. Here’s what’s appealing for investors:

- Invest in Real Assets, Sustainably: You can put your money into actual farmland, supporting sustainable agriculture and the production of specialty foods, aligning your investments with your values.

- Lower the Entry Barrier to Farmland: Tokenization breaks down the large capital requirement of farmland ownership, allowing you to invest with a smaller amount and participate in agricultural ventures.

- Transparent and Fair Profit Sharing: Farmfolio uses tokenization to ensure that profits from the sale of farm produce are distributed fairly and transparently to token holders, creating a clear and accountable investment process.

Commercial Real Estate for the Everyday Investor: RealT Opens the Door to Property Investment

Commercial real estate think office buildings, and apartment complexes it’s a classic investment, but often requires significant capital and expertise. RealT is changing this by tokenizing commercial and residential properties, particularly in the US rental market, making it accessible to a wider range of investors. Here’s the investor advantage:

- Tap into the US Real Estate Market: You can invest in income-producing US rental properties, diversifying your portfolio with a tangible asset class that has historically shown long-term value.

- Potential for Monthly Income: RealT focuses on rental properties, so token holders have the potential to earn monthly rental income, providing a stream of passive income from their real estate tokens.

- More Liquid Real Estate: Compared to the traditional process of buying and selling property, RealT tokens offer significantly improved liquidity. You can trade your tokens on secondary markets, giving you more flexibility and control over your investment.

Tokenization: Alternative Investments, Now Within Reach

These real-world examples paint a clear picture: tokenization is democratizing alternative investments. It’s making markets that were once exclusive and difficult to access open to a much broader range of investors. Thanks to platforms like these, and potentially Tokenova, the world of alternative assets is becoming more inclusive, efficient, and exciting for everyone.

Future Outlook

The future of tokenization of alternative investments looks incredibly promising. As regulatory clarity improves, user-friendly platforms proliferate, and success stories accumulate, we’ll likely see an explosion in the variety and volume of tokenized assets.

Growth and Trends

According to a 2023 report by the World Economic Forum, tokenized markets could account for a significant portion of global GDP by 2030, highlighting the transformative potential of this technology. As regulatory frameworks become clearer and more standardized, the adoption of tokenization is expected to accelerate, driving innovation and expanding investment opportunities.

Emerging trends in tokenization include:

Increased Institutional Participation: More institutional investors are recognizing the benefits of tokenization, leading to greater adoption and market maturation. Institutions bring substantial capital and expertise, enhancing the credibility and stability of tokenized markets.

Advanced Smart Contracts: The development of more sophisticated smart contracts will enable complex financial instruments and automated compliance, further enhancing the functionality of tokenized assets. These advancements can support features like dynamic pricing, automated governance, and real-time compliance monitoring.

Global Market Expansion: Tokenization breaks down geographic barriers, allowing for a truly global investment market where assets from different regions can be easily accessed and traded. This global access fosters a more diversified and resilient investment ecosystem, connecting investors and assets from around the world.

Sustainable and Impact Investing: Tokenization can support sustainable and impact investing by enabling investments in environmentally friendly projects and socially responsible assets, with transparent tracking of outcomes. Investors can directly support initiatives like renewable energy projects, sustainable agriculture, and socially responsible businesses, aligning their investments with their values.

Impact on Traditional Financial Markets

Tokenization is poised to disrupt traditional financial markets by introducing greater efficiency, transparency, and accessibility. Traditional financial institutions are beginning to explore blockchain and tokenization as ways to enhance their offerings, streamline operations, and attract a broader investor base. This integration could lead to a more dynamic and competitive financial ecosystem, where tokenized assets coexist with traditional investment vehicles.

For example, banks and investment firms might adopt tokenization to offer fractional ownership in assets like real estate and private equity, enhancing their product offerings and attracting a more diverse clientele. Additionally, tokenization can streamline back-office operations by automating processes like settlements and compliance, reducing costs and improving operational efficiency.

Bring it on the “Chain”

Investor Perspectives on Tokenization

Investor sentiment towards digital assets is shifting positively as awareness and understanding of blockchain technology grow. Many investors now recognize the potential of tokenization to unlock value and provide new investment opportunities that were previously inaccessible.

Opportunities for Retail and Institutional Investors

Retail Investors: Tokenization democratizes access to high-value alternative investments, allowing retail investors to participate with smaller capital commitments. This inclusivity opens up diverse investment avenues, from fine art to specialty-food-producing farmland, enhancing portfolio diversification. Retail investors can now access investment opportunities that were once limited to institutional players, providing greater flexibility and potential for higher returns.

Institutional Investors: For institutional players, tokenization offers enhanced liquidity, operational efficiency, and the ability to quickly adjust investment positions. Institutions can benefit from the transparent and secure nature of blockchain-based tokens, improving risk management and reporting capabilities. Tokenization allows institutions to optimize their portfolios by easily reallocating capital across different asset classes and regions, responding swiftly to market changes.

Potential Challenges for New Investors

While tokenization offers numerous benefits, new investors may face challenges such as:

1️⃣Understanding Technology: Grasping the fundamentals of blockchain and smart contracts is essential for navigating tokenized markets. Without a basic understanding of how these technologies work, investors may find it difficult to assess the risks and opportunities associated with tokenized assets.

2️⃣Navigating Platforms: Selecting reliable and regulated tokenization platforms requires due diligence. Investors must evaluate the platform’s security measures, regulatory compliance, and track record to ensure that their investments are protected and managed effectively.

3️⃣Managing Digital Assets: Securing digital tokens and managing private keys necessitates a level of technical proficiency to prevent loss or theft. Investors need to adopt best practices for digital asset security, such as using hardware wallets, enabling multi-factor authentication, and regularly updating security protocols.

In the Shoes of a Retail Investor

A retail investor interested in real estate can now invest in a tokenized property with as little as $1,000, gaining exposure to the real estate market without the need for significant capital. This accessibility allows for greater portfolio diversification and the potential for higher returns, previously unattainable for smaller investors. Additionally, the ability to trade tokens on secondary markets provides liquidity, enabling investors to realize gains more easily compared to traditional real estate investments.

For instance, an investor could purchase tokens representing ownership in a tokenized office building in London. As the property appreciates in value or generates rental income, the investor benefits from these gains proportionally to their token holdings. If the investor wishes to liquidate their position, they can sell their tokens on a secondary market, accessing their capital more quickly and conveniently than through traditional real estate transactions.

Transform Your Investments with Tokenova

Unlock the potential of your assets with Tokenova, your trusted partner in tokenization. We specialize in converting traditional investments like real estate, private equity, and art into blockchain-powered tokens, making them scalable, tradable, and globally accessible.

Why Tokenova?

- Custom Solutions: Tailored tokenization strategies for your unique needs.

- Regulatory Expertise: Ensuring compliance with global standards.

- End-to-End Support: From planning to execution, we’ve got you covered.

Start your tokenization journey today with Tokenova. Visit Tokenova.co to learn more.

Conclusion

The tokenization of alternative investments represents a transformative shift in the investment landscape, breaking down traditional barriers and unlocking new opportunities for investors worldwide. By leveraging blockchain technology, tokenization enhances liquidity, transparency, and accessibility, making high-value assets like real estate, private equity, fine art, and specialty-food-producing farmland available to a broader audience.

As regulatory frameworks become more defined and technological advancements continue, the adoption of tokenization is poised to accelerate, reshaping how we approach and manage alternative investments. Real-world examples from platforms like Securitize, WiV, Farmfolio, and Meridio demonstrate the tangible benefits and growing impact of tokenization across various asset classes.

For investors, tokenization offers a more inclusive, efficient, and diversified investment environment. Whether you are a seasoned institutional investor or a retail investor seeking new avenues for growth, tokenization provides a compelling strategy to optimize your investment portfolio.

Embracing tokenization means participating in the future of investing where digital innovation meets financial opportunity, creating a more dynamic and equitable market for all.

Key Takeaways

- Tokenization transforms illiquid alternative assets into tradable digital tokens, enhancing liquidity and accessibility.

- Blockchain technology ensures security, transparency, and operational efficiency, building trust among investors.

- Fractional ownership democratizes access to high-value investments, allowing broader participation with smaller capital commitments.

- Real-world case studies like St. Regis Aspen Resort, Securitize, and Farmfolio illustrate the practical benefits and growing adoption of tokenization.

- Future growth is driven by regulatory clarity, technological advancements, and increased market adoption, positioning tokenization as a cornerstone of modern investing.

How Are Tokenized Alternative Investments Valued?

Valuation of tokenized assets follows similar principles to their traditional counterparts but is enhanced by the transparency and real-time data provided by blockchain. Market demand, underlying asset performance, and peer comparisons are key factors. Platforms often use independent appraisers or automated valuation models to ensure accuracy and reliability.

What Are the Risks Associated with Tokenization?

While tokenization offers numerous benefits, it also introduces risks such as technological vulnerabilities, regulatory changes, and market volatility. Investors must be aware of cybersecurity threats, platform reliability, and the potential for regulatory shifts that could impact tokenized assets’ legality and value.

Can Tokenization Facilitate Cross-Border Investments?

Yes, tokenization inherently supports cross-border investments by leveraging blockchain’s decentralized nature. Investors from different countries can participate in tokenized assets without the need for intermediaries, simplifying the investment process and reducing associated costs.

How Do Smart Contracts Ensure Compliance in Tokenization?

Smart contracts embed compliance rules directly into the token’s code, automating processes like KYC/AML checks and restricting transfers to authorized parties. This ensures that all transactions adhere to regulatory requirements, reducing the risk of non-compliance and enhancing operational efficiency.

What Role Do Custodians Play in Tokenized Investments?

Custodians are responsible for securely holding the underlying assets or digital tokens, ensuring their safekeeping and integrity. In tokenized investments, custodians manage the storage of physical assets and the security of digital tokens, providing an additional layer of protection for investors.