You know that feeling when you’re about to launch something amazing, but then reality hits you like a brick wall?

That’s exactly what happened to countless NFT marketplace developers in 2024. One day, they’re coding smart contracts and designing sleek interfaces. The next day, they’re scrambling to understand why OpenSea got slapped with a Wells Notice from the SEC.

Here’s the thing – building an NFT marketplace isn’t just about the tech anymore. The legal landscape shifted so fast that even seasoned entrepreneurs got caught off guard.

But here’s the good news: You don’t have to learn this the hard way.

In this guide, you’ll discover everything you need to know about the legal framework for NFT marketplace development. We’ll walk through regulatory requirements, intellectual property protection, and consumer compliance, and give you a practical checklist that’ll keep you out of legal trouble.

Ready to turn legal complexity into your competitive advantage? Let’s dive in.

Understanding the NFT Marketplace Legal Landscape

Picture this: You’re at a party two years ago, and everyone’s talking about NFTs like they’re digital baseball cards. Fast forward to today, and regulators are treating them like potential securities.

What changed? Everything.

The NFT marketplace legal environment went from zero to sixty faster than anyone expected. Unlike your typical e-commerce platform, NFT marketplaces now sit at the crossroads of several regulatory worlds: securities law, intellectual property, consumer protection, anti-money laundering, and data privacy.

It’s like trying to navigate a maze where the walls keep moving.

The recent SEC enforcement actions made one thing crystal clear – regulators aren’t playing games anymore. They’re asking tough questions: Are certain NFTs securities? Are marketplaces operating as unregistered exchanges? Are platforms protecting consumers?

I’ve been following the discussions on Reddit, and you can feel the anxiety. Developers are worried about “continuing regulatory uncertainty” that’s forcing platforms to shut down or completely restructure.

Here’s what makes this especially tricky: The challenge isn’t just compliance – it’s predicting what comes next.

As one legal expert pointed out on Twitter after the OpenSea Wells Notice, “The SEC continues to decline to issue regulatory guidance, instead focusing on selective enforcement actions.”

Translation? They’re making the rules as they go.

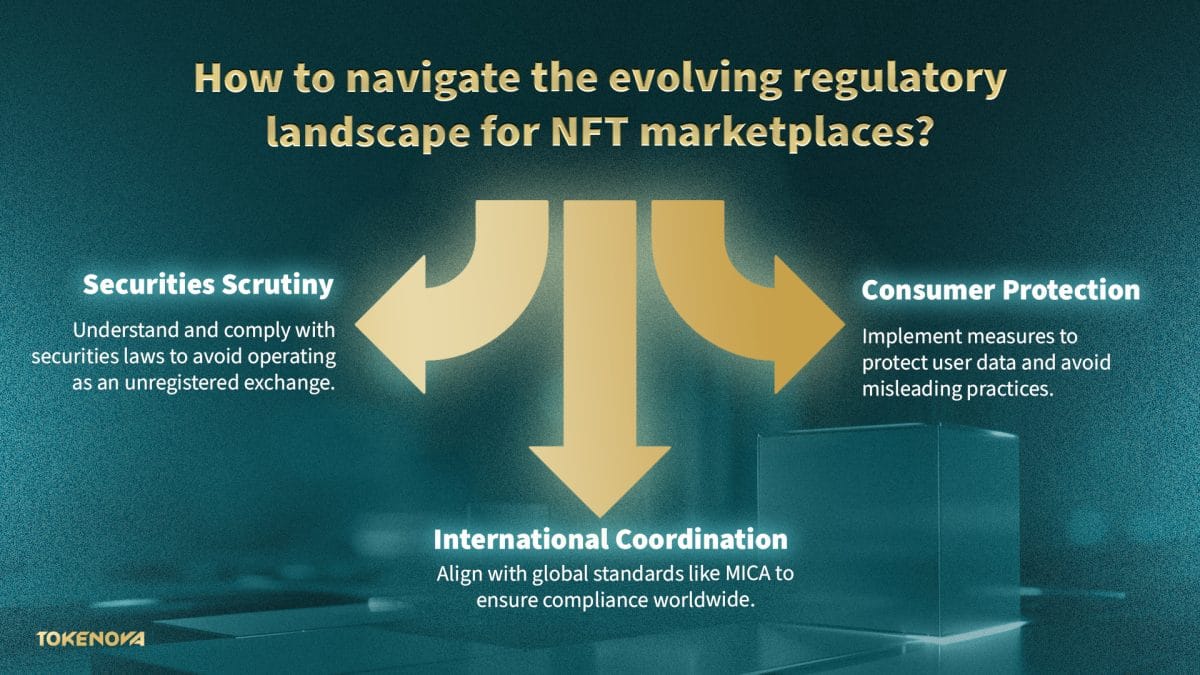

Three big trends are reshaping everything:

First, securities scrutiny is getting intense. Regulators are using the Howey test to figure out if NFTs are investment contracts. If your marketplace helps people trade NFTs that promise profits from someone else’s work, you might accidentally be running an unregistered securities exchange.

Second, consumer protection is front and center. The FTC and state attorneys general are digging into platforms for misleading practices, poor disclosures, and failing to protect user data.

Third, international coordination is ramping up. What happens in the U.S. ripples globally. The EU’s Markets in Crypto-Assets (MiCA) regulation is setting standards that influence compliance approaches worldwide.

The bottom line? Legal compliance isn’t optional anymore. It’s the price of admission for any serious NFT marketplace operation.

But don’t let that scare you. Think of it as building a moat around your business. The companies that get compliance right will have a massive advantage over those that don’t.

Regulatory Classification Types for NFT Platforms

Not all NFT marketplaces are created equal in the eyes of regulators. The way they classify your platform determines everything from licensing requirements to compliance costs.

Understanding this framework is like having a roadmap through regulatory complexity. Legal experts at LegalNodes have broken down the key categories that determine your obligations.

Custodial vs. Non-Custodial: The Big Divide

Custodial marketplaces are like traditional banks – they hold your users’ private keys and control their NFTs directly. These platforms face the heaviest regulatory burden because they’re acting as middlemen with direct control over digital assets.

If you go the custodial route, you’ll likely need to comply with Virtual Asset Service Provider (VASP) regulations wherever they exist. This means implementing robust AML and KYC procedures, keeping detailed transaction records, and possibly getting specific licenses.

Non-custodial marketplaces let users keep control of their private keys and assets. While this reduces some regulatory burden, you’re not completely off the hook. You’ll still need to think about consumer protection laws, intellectual property compliance, and potential securities regulations.

Auction vs. Direct Sales: Different Rules Apply

Auction-based platforms that organize centralized bidding often fall under e-commerce auction regulations rather than securities laws. But you’ll need transparent bidding processes, fair dispute resolution, and crystal-clear terms of sale.

Direct sales platforms that facilitate immediate transactions between users face different compliance requirements, especially around payment processing and transaction reporting.

Universal vs. Specialized: Scope Matters

Universal marketplaces like OpenSea that allow any NFT type face broader compliance challenges. You can’t control what gets listed, so you need comprehensive content moderation, IP protection systems, and flexible compliance frameworks.

Specialized marketplaces focusing on specific categories (gaming items, art, music) can implement more targeted compliance measures. But you still need to address core regulatory requirements.

Here’s the key takeaway: Your platform’s technical setup and business model directly impact your regulatory classification. Choose carefully because changing later can be expensive and complicated.

Feeling overwhelmed by all these classification requirements? That’s totally normal. If you need help figuring out which regulatory framework applies to your specific NFT marketplace idea, talking with our experts can provide the clarity you need before investing in development.

Read More: Web3 Legal Framework for Startups

Licensing Requirements by Jurisdiction

Where you set up your NFT marketplace determines which licenses you need. And trust me, the requirements vary dramatically between jurisdictions.

The licensing landscape has become a complex web of federal, state, and international requirements that can make or break your marketplace launch. Let me break down the key jurisdictions and what they actually require.

United States: Federal and State Complexity

At the federal level: The U.S. doesn’t have specific NFT marketplace licensing yet, but existing financial regulations still apply. If your platform processes payments, you might need money transmitter licenses in multiple states.

Here’s a big one coming: California’s Digital Financial Assets Law, effective July 2026, will require licensing for any “digital financial asset business activity” with California residents. This is huge, and other states will likely follow.

At the state level: Requirements are all over the map. New York’s BitLicense might apply if you’re handling certain digital assets. Wyoming has crypto-friendly laws, while other states are still figuring things out.

European Union: Getting Organized

MiCA Regulation is bringing standardized requirements across EU member states. While it doesn’t specifically address NFTs yet, marketplaces that facilitate trades of tokens qualifying as crypto-assets under MiCA will need authorization.

The EU’s Anti-Money Laundering Directive already covers “persons trading or acting as intermediaries in the trade of works of art,” which could include NFT marketplaces.

The Crypto-Friendly Spots

Based on industry analysis, several places offer more favorable environments:

The Cayman Islands – Where Axie marketplace calls home. They offer flexible corporate structures and clear frameworks for digital assets.

Hong Kong – Crypto.com NFT operates here, benefiting from progressive digital asset regulations and clear licensing pathways.

Canada – NBA Top Shot’s base provides regulatory clarity while maintaining consumer protection standards.

United Kingdom – Offers common law flexibility with developing crypto-specific regulations that provide more certainty than the U.S. approach.

UAE: The Rising Star

The UAE has become a hotspot for crypto businesses. Dubai’s VARA (Virtual Assets Regulatory Authority) provides clear licensing pathways for digital asset businesses, including NFT marketplaces.

Beyond VARA licensing, entrepreneurs should consider the broader UAE free zone advantages for crypto businesses, which offer tax benefits and regulatory clarity that make the UAE attractive for NFT marketplace operations.

For those considering UAE establishment, understanding DIFC company formation can provide additional regulatory benefits and international market access for sophisticated NFT marketplace operations.

For comparison, understanding how to form companies in ADGM provides another UAE option that might better suit certain NFT marketplace business models, particularly those focusing on institutional clients.

What you’re looking at:

- Full marketplace activities license vs. limited services license

- Minimum capital requirements (typically $150,000-$500,000)

- Local presence and management requirements

- Ongoing compliance and reporting obligations

Asia-Pacific: Mixed Bag

Singapore offers clear frameworks through the Monetary Authority of Singapore (MAS), with specific guidance for digital payment token services.

Japan has comprehensive crypto regulations that may apply to certain NFT marketplace activities, especially if tokens have payment-like characteristics.

One Reddit user shared their experience with GameStop’s marketplace shutdown, noting that “regulatory uncertainty” was a primary factor in shutting down operations.

My advice? Don’t wait for perfect regulatory clarity. Pick a jurisdiction with existing frameworks you can work within, and build compliance into your platform from day one. The cost of adding compliance later far exceeds the upfront investment in proper legal structuring.

The licensing requirements are complex, but they’re absolutely navigable. The key is choosing the right jurisdiction for your business model and making sure you understand all requirements before launch.

Read More: UAE Free Zone vs On-Shore vs Off-Shore Business Setup

Intellectual Property Considerations

IP issues are among the trickiest parts of running an NFT marketplace. And honestly, they’re getting more complicated as the space grows.

Here’s the uncomfortable truth: Most NFT marketplaces are sitting on potential IP liability time bombs. According to legal analysis, “An NFT marketplace can be liable for infringement since it permits for profit any place to be used for infringing purposes.”

That sounds scary, but it’s manageable if you know what you’re doing.

Copyright and the DMCA Safe Harbor

The DMCA Safe Harbor provisions might protect your marketplace from copyright liability, but only if you jump through all the hoops. Legal experts are clear that “these safe harbors could potentially protect NFT marketplaces from copyright liability, but only if ALL the conditions are met.”

Here’s what you need:

- Register a designated agent with the Copyright Office

- Remove infringing content quickly when notified

- Have a policy for terminating repeat infringers

- Don’t have actual knowledge of infringement

- Don’t make money directly from infringing activity

But here’s the catch – DMCA protection isn’t automatic. You need to actively implement and maintain these procedures.

Trademark Troubles

Trademark issues are trickier because they involve consumer confusion and brand protection. If your marketplace allows NFTs using trademarked logos, characters, or brand names without permission, you could face both direct and contributory infringement claims.

The USPTO and USCO joint study found that “minting and marketing NFTs in NFT marketplaces may implicate a copyright owner’s reproduction, public display, and public performance rights.”

Where the Liability Falls

Understanding who’s responsible is crucial. As recent legal analysis points out, “There is possibility that the NFT marketplace could bear legal liability” for IP violations by users.

Direct infringement happens when the platform itself creates or distributes infringing content. This is rare but carries the highest liability.

Contributory infringement occurs when you knowingly help others infringe. This is where most marketplace liability happens.

Vicarious infringement applies when you can control infringing activity and make money from it.

The User-Generated Content Problem

This is where most headaches come from. Users can mint NFTs of copyrighted works, trademarked materials, or stolen digital art without you knowing.

Based on discussions on Dev.to, developers are working on “robust legal frameworks” that balance openness with IP protection.

The complexity of IP management in NFT marketplaces mirrors challenges faced in broader tokenization applications, where smart contracts must balance automation with legal compliance requirements.

Practical ways to protect yourself:

- Set up content verification systems

- Require users to swear they own what they’re minting

- Have responsive takedown procedures

- Use automated content filtering where possible

- Partner with IP monitoring services

Rights Confusion is Real

One of the biggest user complaints is confusion about what rights come with NFT purchases. The Eurojust analysis notes that “no verification of copyright or trademarked ownership is required for NFT marketplaces.”

This creates confusion where buyers think they’re getting more rights than they receive.

Best practices:

- Use clear licensing terms for each NFT category

- Standardize rights descriptions

- Have transparent creator verification processes

- Educate users about NFT rights vs. copyright ownership

The IP landscape is challenging, but manageable with the right systems. The key is being proactive rather than reactive to IP issues.

Consumer Protection Laws and Compliance

Consumer protection in NFT marketplaces has become a regulatory priority, and the enforcement actions are getting more aggressive.

The regulatory focus has shifted dramatically. What started as concerns about investor protection has expanded into comprehensive consumer protection enforcement covering everything from deceptive advertising to data privacy violations.

Disclosure Requirements

Transparency is no longer optional – it’s a legal requirement. The FTC has made clear that NFT marketplaces must provide adequate disclosure about what consumers are actually purchasing and the risks involved.

Legal analysis from Crunchbase emphasizes that “if an NFT marketplace adequately fails to inform its customers about what they are purchasing and the risks involved, the FTC may argue deceptive or unfair advertising, which may lead to hefty fines.”

Required disclosures typically include:

- What rights (if any) come with NFT ownership

- Environmental impact of blockchain transactions

- Potential for total loss of value

- Technical risks and platform dependencies

- Resale limitations and marketplace fees

Advertising and Marketing Compliance

The FTC is cracking down on deceptive NFT marketing. Recent enforcement actions show regulators are particularly focused on claims about investment potential, utility, and exclusive access rights.

Common compliance issues include:

- Inflated or manipulated volume statistics

- Misleading celebrity endorsements

- Promises of future utility that may not materialize

- Hidden fees or transaction costs

- Fake scarcity claims

A recent study published in 2025 found that “65% of NFT investors in 2024” faced opacity issues with marketplace operations, highlighting the need for clearer consumer disclosures.

Data Privacy and Security Requirements

Data protection has become a critical compliance area. NFT marketplaces collect substantial personal information for KYC, transaction processing, and user experience enhancement.

Key privacy compliance requirements:

- GDPR compliance for EU users (regardless of where you’re based)

- CCPA compliance for California residents

- Clear privacy policies and data use disclosures

- User consent mechanisms for data collection

- Data security and breach notification procedures

AML and KYC Implementation

Anti-money laundering compliance is no longer optional for most NFT marketplaces. According to compliance experts, “NFT platforms must implement robust AML and KYC measures to prevent illicit activities, such as money laundering.”

This connects directly to broader blockchain business registration requirements that every NFT marketplace operator needs to understand when establishing their platform legally.

AML/KYC requirements typically include:

- Customer identification and verification procedures

- Suspicious transaction monitoring and reporting

- Record-keeping for specified time periods

- Sanctions screening for users and transactions

- Enhanced due diligence for high-risk customers

Recent statistics show that “92% of centralized crypto exchanges globally are fully KYC compliant as of 2025, up from 85% in 2024,” indicating the trend toward mandatory compliance.

Platform Liability for User Actions

Understanding your liability exposure is crucial. Consumer protection laws can hold platforms responsible for user actions in certain circumstances.

Areas of platform liability include:

- Failure to implement adequate fraud prevention

- Inadequate dispute resolution procedures

- Misleading or absent terms of service

- Poor security leading to user financial losses

- Facilitating transactions with sanctioned entities

Accessibility and Fair Trading

Accessibility compliance is often overlooked but increasingly important. NFT marketplaces must be accessible to users with disabilities under various national laws.

Fair trading requirements include:

- Non-discriminatory access policies

- Clear and fair dispute resolution procedures

- Reasonable fee structures and transparency

- Protection against market manipulation

- Fair listing and delisting policies

The consumer protection landscape is complex, but compliance is achievable with proper planning and implementation. The key is building protection into your platform design rather than trying to add it later.

If you’re concerned about implementing comprehensive consumer protection measures while maintaining platform functionality, our legal consultation services can help you develop compliant policies that work for your specific marketplace model.

Read More: Essential Guide to Blockchain Business Registration

Jurisdiction Selection Strategy

Choosing where to establish your NFT marketplace is one of the most critical decisions you’ll make, and it affects everything from regulatory compliance to operational costs.

This isn’t just about finding the easiest regulations – it’s about finding the right balance of regulatory clarity, business-friendly policies, market access, and long-term stability for your specific marketplace model.

Regulatory Clarity vs. Flexibility Trade-offs

The regulatory spectrum ranges from crystal clear to completely uncertain. On one end, you have jurisdictions like the UAE with specific NFT marketplace licensing pathways. On the other, you have places with no regulations yet, which sounds appealing until you realize that regulatory uncertainty can kill your business overnight.

Based on legal structuring analysis, successful NFT marketplaces have generally chosen jurisdictions that offer “legal flexibility, including regulations concerning intellectual property” while maintaining “necessary legal frameworks.”

High clarity jurisdictions:

- UAE (Dubai VARA framework)

- Singapore (MAS digital payment token guidelines)

- UK (developing but comprehensive crypto regulations)

- Switzerland (clear FINMA guidance)

High flexibility jurisdictions:

- Cayman Islands (proven track record with Axie)

- British Virgin Islands (corporate flexibility)

- Delaware (U.S. corporate law advantages)

Market Access Considerations

Your jurisdiction choice affects which markets you can easily serve. If you establish in a jurisdiction that’s on regulatory blacklists or has poor international cooperation agreements, you might find yourself blocked from major markets.

Key market access factors:

- Regulatory cooperation agreements

- International banking relationships

- Payment processor acceptance

- User trust and perception

- Marketing and operational restrictions

Tax Implications and Optimization

Tax structure can make or break your marketplace economics. Different jurisdictions treat NFT transactions, royalties, and platform fees very differently.

Tax considerations include:

- Corporate income tax rates

- Withholding taxes on international transactions

- VAT/sales tax on NFT sales

- Capital gains treatment for users

- Double taxation treaty networks

The UAE offers significant tax advantages with 0% corporate tax for qualifying activities and extensive double taxation treaty networks.

Operational and Staffing Requirements

Some jurisdictions require local presence, local staff, or local board members. These requirements can significantly impact your operational costs and complexity.

Common requirements:

- Local office or registered address

- Local directors or shareholders

- Minimum local staffing

- Local bank account requirements

- Regular local reporting obligations

Long-term Regulatory Stability

Regulatory stability matters more than current regulations. A jurisdiction that changes rules frequently can be more dangerous than one with strict but stable requirements.

Recent Reddit discussions about GameStop’s marketplace shutdown highlight how “continuing regulatory uncertainty” can force even well-funded platforms to cease operations.

Stability indicators:

- Consistent regulatory approach over time

- Clear regulatory roadmaps

- Industry consultation processes

- Grandfathering provisions for existing businesses

- Appeals and review processes

Multi-Jurisdictional Strategies

Many successful marketplaces use multi-jurisdictional structures to optimize different aspects of their operations. This might involve:

- Incorporation in one jurisdiction for regulatory clarity

- Operational headquarters for talent access

- Banking and payment processing in a third for financial services

- IP holding companies in tax-optimized jurisdictions

Popular combinations:

- Cayman Islands + Singapore operations

- UAE + UK operational presence

- Delaware + various international subsidiaries

Risk Assessment Framework

Evaluate jurisdictions based on your specific risk profile:

High-volume, retail-focused marketplaces need strong consumer protection frameworks and clear regulatory compliance paths.

Institutional or high-value NFT platforms need robust financial regulations and a strong rule of law.

Innovative or experimental platforms might benefit from regulatory sandboxes or innovation-friendly jurisdictions.

The key is matching your business model, risk tolerance, and growth plans with the right jurisdictional framework. There’s no one-size-fits-all solution, but there are better and worse choices for specific marketplace types.

Implementation Checklist for Legal Compliance

Creating a compliant NFT marketplace requires systematic implementation of legal requirements across multiple domains. Here’s your practical roadmap.

This checklist represents the minimum viable compliance framework based on current regulatory requirements and industry best practices. Missing any of these elements could expose your marketplace to significant legal and financial risks.

Pre-Launch Legal Foundation

Corporate Structure and Registration

- [ ] Form appropriate corporate entity in chosen jurisdiction

- [ ] Register for required business licenses and permits

- [ ] Establish a compliant corporate governance structure

- [ ] Draft comprehensive Terms of Service and Privacy Policy

- [ ] Create user agreement templates for creators and collectors

- [ ] Implement clear intellectual property policies

Regulatory Compliance Setup

- [ ] Obtain required money transmitter licenses (if applicable)

- [ ] Register as Virtual Asset Service Provider (where required)

- [ ] Implement AML/KYC compliance procedures

- [ ] Establish sanctions screening protocols

- [ ] Create transaction monitoring and reporting systems

- [ ] Develop suspicious activity reporting procedures

Technical Compliance Implementation

Smart Contract and Platform Security

- [ ] Conduct comprehensive smart contract audits

- [ ] Implement secure key management systems

- [ ] Establish cybersecurity incident response procedures

- [ ] Create data backup and recovery protocols

- [ ] Implement multi-signature transaction controls

- [ ] Establish bug bounty and vulnerability disclosure programs

Smart Contract and Platform Security requirements directly relate to comprehensive smart contract development best practices that ensure your marketplace’s technical foundation meets both security and regulatory requirements.

When implementing user protection systems, consider how smart contract security principles apply specifically to NFT marketplace operations, as vulnerabilities in smart contracts can create both technical and legal liabilities.

User Protection Systems

- [ ] Build robust content moderation tools

- [ ] Implement automated IP infringement detection

- [ ] Create efficient dispute resolution mechanisms

- [ ] Establish customer support systems

- [ ] Develop clear refund and reversal policies

- [ ] Implement accessibility compliance measures

Operational Compliance Measures

Daily Operations Management

- [ ] Train staff on compliance requirements and procedures

- [ ] Establish regular compliance monitoring and review processes

- [ ] Create incident response and escalation procedures

- [ ] Develop regular legal and regulatory update protocols

- [ ] Implement transaction limits and risk management controls

- [ ] Establish regular third-party compliance audits

Consumer Protection Implementation

- [ ] Create clear and comprehensive user education materials

- [ ] Implement transparent fee disclosure systems

- [ ] Establish fair and efficient customer complaint procedures

- [ ] Develop clear marketing and advertising compliance guidelines

- [ ] Create user verification and authentication systems

- [ ] Implement data privacy and protection measures

Ongoing Monitoring and Adaptation

Regulatory Change Management

- [ ] Subscribe to regulatory updates from relevant authorities

- [ ] Establish legal counsel relationships in operating jurisdictions

- [ ] Create regular compliance review and update schedules

- [ ] Develop regulatory change impact assessment procedures

- [ ] Maintain relationships with industry associations and advocacy groups

- [ ] Establish government relations and regulatory communication channels

Performance and Risk Monitoring

- [ ] Implement compliance metrics and reporting dashboards

- [ ] Create regular legal risk assessment procedures

- [ ] Establish compliance cost monitoring and budgeting

- [ ] Develop regulatory examination and investigation response procedures

- [ ] Maintain comprehensive compliance documentation and records

- [ ] Create regular board and stakeholder compliance reporting

The implementation timeline typically takes 6-12 months for a comprehensive marketplace launch, depending on jurisdiction complexity and platform sophistication.

Critical success factors include:

- Early legal counsel engagement

- Adequate budget allocation for compliance (typically 15-25% of development costs)

- Regular stakeholder communication and buy-in

- Flexible technical architecture that can adapt to regulatory changes

- Strong project management and milestone tracking

Remember that compliance is an ongoing process, not a one-time setup. Regulations continue evolving, and your compliance framework needs to evolve with them.

If you’re feeling overwhelmed by the complexity of implementing comprehensive legal compliance across multiple jurisdictions and regulatory domains, our specialized legal team can help you develop and implement a compliance framework tailored to your specific marketplace model and target markets.

Read More: Complete Technical Guide to Building NFT Marketplaces

Looking Ahead: The Future of NFT Marketplace Regulation

The NFT marketplace regulatory landscape is evolving rapidly, and understanding the trajectory helps you prepare for what’s coming next.

Regulatory clarity is coming, but it won’t be uniform globally. The introduction of the New Frontiers in Technology (NFT) Act in Congress signals a potential shift toward clearer U.S. federal guidance, but implementation timelines remain uncertain.

Key trends shaping the future:

Increased standardization across jurisdictions as international bodies develop coordinated approaches to NFT regulation. The EU’s MiCA framework is likely to influence global standards.

Technology-specific regulations are emerging alongside broader Web3 legal frameworks that entrepreneurs need to understand when building any blockchain-based business, including NFT marketplaces.

Enhanced consumer protection requirements as regulators respond to high-profile fraud cases and consumer complaints. Expect more stringent disclosure requirements and platform liability standards.

Understanding the intersection between tokenization fundamentals and NFT marketplace operations helps builders create platforms that align with emerging regulatory approaches to digital asset classification.

The Trump administration’s appointment of crypto-friendly regulators suggests potential policy shifts in the U.S., but meaningful change will take time to implement.

Practical preparation strategies:

- Build flexible compliance systems that can adapt to regulatory changes

- Maintain strong legal counsel relationships across operating jurisdictions

- Participate in industry associations and regulatory consultations

- Document compliance efforts comprehensively for future regulatory reviews

The marketplace operators who survive and thrive will be those who view compliance as a competitive advantage rather than a burden. Strong legal frameworks enable sustainable growth, user trust, and long-term business success.

Ready to build your compliant NFT marketplace? The legal framework is complex, but it’s navigable with the right guidance and preparation. Focus on building strong foundations now, and you’ll be positioned to succeed as the regulatory landscape continues to evolve.

Have questions about implementing these legal frameworks in your specific NFT marketplace project? Drop them in the comments below – our legal team reviews and responds to help clarify real-world compliance challenges.

Want to stay updated on the latest NFT regulation developments and marketplace compliance strategies? Join our newsletter for monthly insights delivered directly to your inbox.

FAQ

What licenses do I need to operate an NFT marketplace? License requirements vary by jurisdiction and marketplace type. Most platforms need basic business licenses, but custodial marketplaces may require Virtual Asset Service Provider (VASP) licenses. Money transmitter licenses are often required if you process payments. California’s Digital Financial Assets Law (effective 2026) will require specific licensing for digital asset businesses serving California residents.

Are NFTs considered securities by regulators? It depends on the specific NFT and how it’s marketed. The SEC applies the Howey test to determine if NFTs are investment contracts (securities). NFTs that promise profits from others’ efforts or are marketed as investments are more likely to be classified as securities. The regulatory approach varies by jurisdiction and continues evolving.

What are the main intellectual property risks for NFT marketplaces? Primary IP risks include copyright infringement liability, trademark violations, and DMCA compliance failures. Marketplaces can face contributory or vicarious infringement claims if they knowingly facilitate IP violations or financially benefit from infringing content. Implementing proper takedown procedures and user verification systems helps mitigate these risks.

Do NFT marketplaces need AML/KYC compliance? Yes, most NFT marketplaces need some level of AML/KYC compliance, especially if they’re custodial or process significant transaction volumes. Requirements include customer identity verification, suspicious transaction monitoring, and reporting obligations. The specific requirements depend on your jurisdiction and business model.

How do I choose the best jurisdiction for my NFT marketplace? Consider regulatory clarity, market access, tax implications, operational requirements, and long-term stability. Popular choices include the UAE (clear regulations), Singapore (comprehensive framework), Cayman Islands (corporate flexibility), and the UK (developing regulations). Match your business model and risk tolerance with the appropriate jurisdictional framework.