In an era where technology entwines with tradition, gold tokenization emerges as a captivating frontier, weaving the timeless allure of gold with the cutting-edge possibilities of blockchain technology. Picture the steadfast brilliance of gold, gleaming through millennia, now transformed into a digital marvel that promises accessibility, transparency, and innovation in finance. This melding of old and new captures our imagination and invites us to explore how the tokenization of gold can redefine the investment landscape.

Introduction to Gold Tokenization

Gold tokenization is the process of converting physical gold into digital tokens that reside on a blockchain. This revolutionary concept marries the historical stability of gold with modern digital advances, creating a bridge between tangible assets and digital currencies. As we delve into this new territory, we uncover substantial benefits, such as increased liquidity in markets, the possibility for fractional ownership, and enhanced transparency that lends greater trust and ease to investors worldwide.

Current Trends in Gold Tokenization

The digital asset revolution is upon us, with tokenized commodities, including the tokenization of gold, witnessing unprecedented demand. Blockchain technology, with its ability to convert traditional gold investments into more accessible and efficient ventures, plays a central role in this transformation. Global interest has seen companies like Digix and Paxos leading the charge, offering innovative projects that highlight significant growth. The gold tokenization market, currently valued at over $1 billion, is poised for continual expansion, driven by the promise of easier access and streamlined operations.

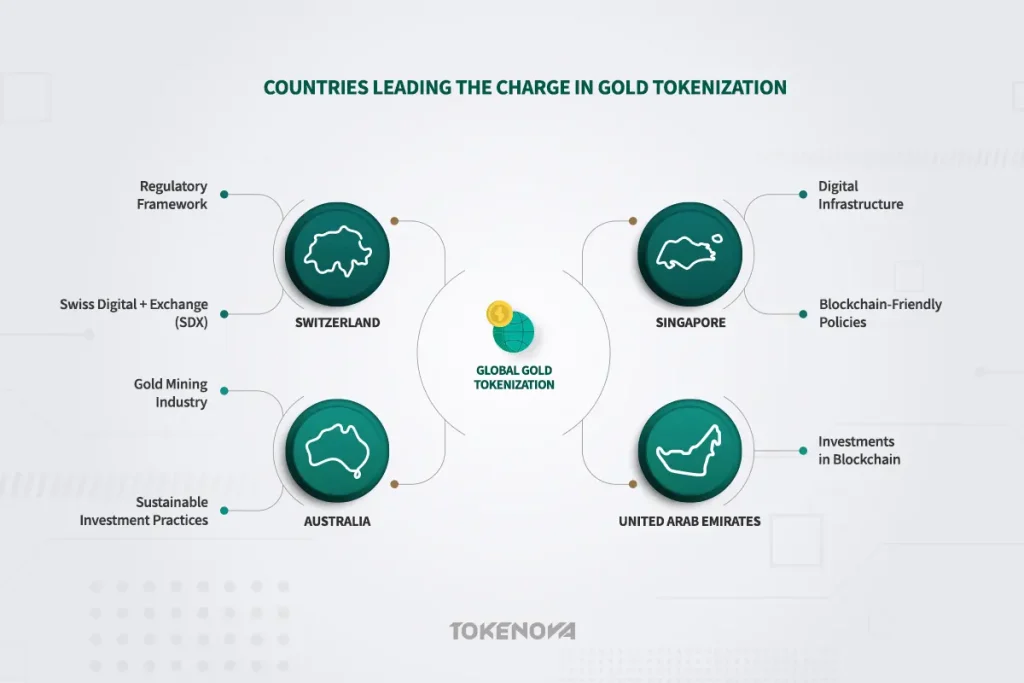

Countries Leading the Charge in Gold Tokenization

The tokenization of gold has gained traction across various countries, each leveraging blockchain technology to enhance transparency, liquidity, and accessibility in gold markets. Here’s an expanded view of some countries at the forefront of this digital transformation, supported by statistics and trends observed in 2024.

Switzerland

Switzerland has long been a global hub for both gold trading and financial innovation. With its strong regulatory framework and leading financial institutions, Switzerland has embraced gold tokenization to offer more secure and transparent investment opportunities. Major initiatives in the Swiss market are supported by companies like the Swiss Digital Exchange (SDX), which has been instrumental in developing secure tokenized assets.

Singapore

Known for its robust digital infrastructure and forward-thinking regulatory environment, Singapore has also become a leader in the tokenization of gold. The country’s blockchain-friendly policies make it an attractive destination for fintech companies seeking to issue tokenized gold products. This approach is reflected in the increasing number of gold-backed tokens being traded on local exchanges, which has significantly boosted investor participation.

United Arab Emirates

The United Arab Emirates (UAE), particularly Dubai, is rapidly emerging as a key player in the gold tokenization landscape. The UAE government has invested heavily in blockchain technologies, aiming to position the region as a digital economy leader. In 2024, the UAE launched several gold token initiatives to attract global investors, thereby enhancing its reputation as a safe haven for digital asset trading.

Australia

Australia’s rich gold mining industry provides a strong foundation for gold tokenization projects. The country has started to experiment with blockchain technology to improve the efficiencies of trading gold assets. Australia’s focus on sustainable and transparent investment practices aligns well with the principles of tokenized assets, making it a country to watch in the coming years.

Statistics and Market Impact

In 2024, the global tokenization market is estimated to reach a transaction volume of over $6 billion, with gold tokenization comprising a significant portion of this growth. In Switzerland and Singapore alone, tokenized gold exchanges have reported increased volumes, with some platforms experiencing a 30% year-on-year rise in trading activities. Such developments underscore the growing investor confidence in tokenized gold as a viable asset class.

These countries are setting benchmarks for gold tokenization, creating models that others might soon follow. Each has leveraged its unique strengths in regulation, technology, and market expertise to facilitate this digital asset revolution, offering insights into how tokenized gold can be integrated into investment portfolios globally.

For further details, you might want to explore sources like this article on Medium, which provides an in-depth look at gold tokenization trends and developments.

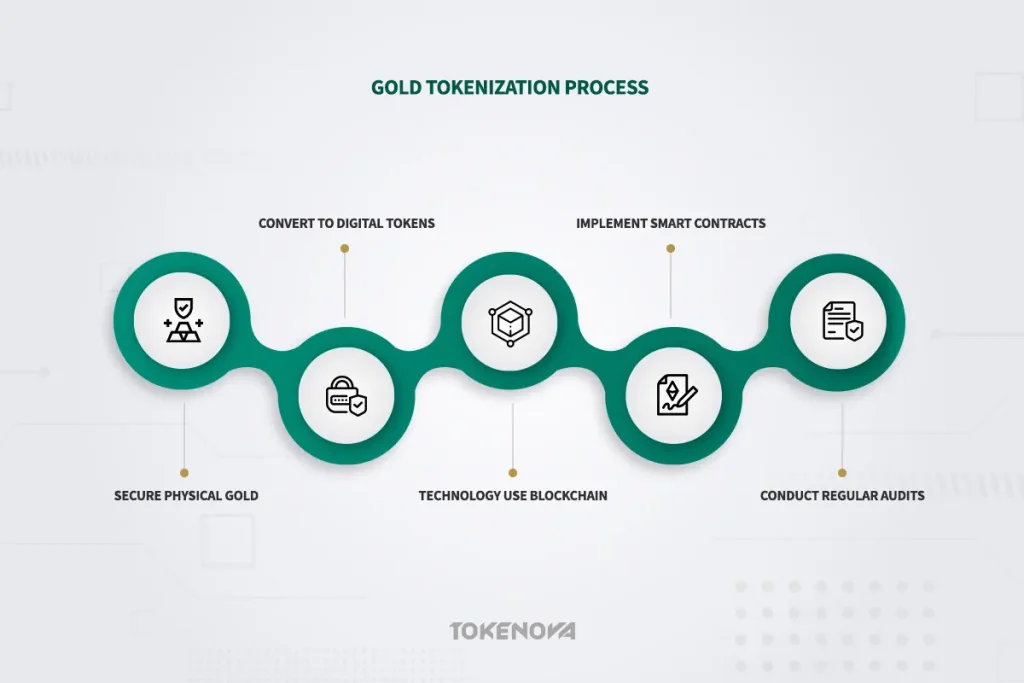

How Gold Tokenization Works

The process of gold tokenization begins with securing the physical gold in highly protected vaults. Renowned and trusted depositories are used to ensure that the gold is safely stored, with each asset numbered and accounted for down to the fraction. This physical gold serves as the solid foundation upon which digital tokens are built, embodying the timeless value of gold within the digital realm.

Once the gold is securely stored, it is then converted into digital tokens on a blockchain platform. This involves creating a digital equivalent each token represents a specific weight or value of gold, such as a gram or an ounce. Blockchain technology provides the critical infrastructure for this conversion, ensuring that each transaction is immutable and transparently recorded for future reference.

Smart contracts play a pivotal role in maintaining the security and efficiency of tokenized gold transactions. These are self-executing contracts with the terms of the agreement directly written into code. They automatically enforce compliance with transaction rules and conditions, significantly reducing the need for intermediaries. This automation guarantees that transactions are conducted securely and transparently, providing a reliable record that eliminates the potential for human error or manipulation.

Integral to the trust and stability of gold tokens is the use of secure vaulting and rigorous audits. When it comes to tokenization of gold, regular audits are conducted by independent third-party firms to verify that the physical gold exists and matches the volume of tokens issued. This builds investor confidence, ensuring that each digital token is genuinely backed by tangible assets.

Key Benefits of Gold Tokenization

The tokenization of gold brings to the forefront several key advantages, reshaping the dynamics of gold investment markets. Primarily, enhanced liquidity is a standout benefit. Traditional gold investments often suffer from liquidity constraints, but with tokenization, buying, selling, and trading can be executed swiftly and seamlessly. This increased market fluidity allows investors to respond quickly to market conditions without the delays associated with conventional gold trading.

Reduced transaction costs and settlement times further amplify the attractiveness of gold tokenization. Since blockchain transactions are automated and direct, they eliminate many of the fees typically associated with intermediaries in traditional trades. Settlement can occur almost instantaneously, minimizing the time and financial resources usually expended in the process.

Tokenization also paves the way for fractional ownership, democratizing access to gold markets. Instead of requiring significant capital to purchase entire bars or coins, investors can now own small portions of gold. This opens the door for a broader range of participants, from retail investors to smaller institutions, who can customize their investment exposure according to their financial capabilities.

Increased market accessibility is another profound effect of tokenization. By lowering the entry barriers and enabling fractional investments, a more diverse pool of investors can engage in gold markets, fostering a competitive and inclusive financial ecosystem. Both institutional and retail investors benefit from streamlined access to gold investment opportunities that were historically out of reach for many.

Challenges and Risks in Gold Tokenization

| Aspect | Benefits | Challenges/Risks |

| Liquidity | Enhanced liquidity for faster trading | Potential liquidity issues in volatile markets |

| Transaction Costs | Reduced transaction costs through automation | Initial setup costs for blockchain infrastructure |

| Ownership Structure | Enables fractional ownership | Complexity in managing fractional ownership rights |

| Market Accessibility | Increased access for a diverse range of investors | Regulatory hurdles across jurisdictions |

| Security | Improved transparency and traceability | Cybersecurity risks and vulnerabilities |

| Price Stability | Potential for more accurate pricing mechanisms | Risks of price manipulation and volatility |

Despite the numerous benefits, the tokenization of gold presents a set of challenges and risks that must be carefully managed. Regulatory challenges are particularly significant, as asset-backed tokens are subject to varying legal frameworks across jurisdictions. This lack of standardization can complicate compliance and limit the seamless cross-border trading of tokenized gold. Firms must navigate these regulatory landscapes prudently to ensure lawful operations.

Security risks associated with digital assets also pose a concern. Cybersecurity threats, such as hacking and data breaches, are perpetual risks in the digital space. Smart contracts, despite their efficiency, can contain vulnerabilities that might be exploited if not properly secured. Safeguarding the physical gold is another layer of security; precautions must be taken to prevent theft or misallocation.

Concerns around price manipulation and the valuation accuracy of tokenized gold also exist. Because cryptocurrency markets can be volatile, ensuring that the token values accurately reflect the underlying physical gold prices is crucial. This requires continual market monitoring and robust pricing mechanisms to maintain price stability and investor trust.

In sum, while gold tokenization offers a revolutionary approach to gold investment that blends the best of physical and digital assets, it requires careful consideration of the accompanying challenges and risks. Through the diligent application of robust processes and frameworks, the potential of this innovative financial instrument can be fully realized.

Case Studies and Real-World Examples

Gold tokenization has seen a range of innovative projects and companies leading the way in transforming traditional gold investments into digital assets. Here, we provide an overview of some successful efforts in this space, examining their market performance, adoption trends, and key takeaways.

Overview of Successful Gold Tokenization Projects and Leading Companies

Gold tokenization is revolutionizing the investment landscape by merging the physical assets of gold with blockchain technology, leading to innovative projects and companies that enhance accessibility, liquidity, and security in gold investments.

Digix Global:

- Project: DGX tokens represent one gram of gold each, stored in secure vaults in Singapore.

- Innovation: Pioneering transparency by providing real-time audits and proof-of-reserve, ensuring each token is backed by verifiable gold.

- Adoption: Has gained a loyal user base due in part to its transparency and commitment to security.

Paxos:

- Project: PAX Gold (PAXG), which provides institutional-grade gold tokens equivalent to one troy ounce of a London Good Delivery gold bar.

- Innovation: Offers immediate liquidity and the flexibility to redeem shares for physical gold bars or cash.

- Adoption: Widely adopted due to its regulatory compliance and strong reputation, making it popular among institutional investors.

Tether Gold:

- Project: Designed similar to their stablecoin, XAUT tokens represent ownership of gold stored in Swiss vaults.

- Innovation: Combines the liquidity of digital currencies with the tangibility of gold, catering to both crypto-savvy and traditional investors.

- Adoption: Quickly captured market interest, benefiting from Tether’s existing user base and robust infrastructure.

AurusGOLD:

- Project: Aimed at democratizing the gold market through easy-to-trade tokens.

- Innovation: Emphasizes low barriers to entry and high liquidity, using a decentralized network of vaults.

- Adoption: Gained traction in emerging markets where access to traditional gold investments is limited.

Detailed Analysis of Market Performance, Adoption Rates, and Impact

These projects of tokenization of gold have significantly influenced the gold investment ecosystem, driving increased interest and participation. For instance, Paxos’ introduction of PAXG allowed for integration within existing trading platforms, enhancing liquidity and market visibility. The adoption rates have consistently grown as more investors seek the dual benefits of digital convenience and stable asset backing.

Market performance varies among these projects, with some seeing rapid uptake due to strategic partnerships and robust marketing efforts. PAX Gold, for example, leveraged partnerships with fintech platforms to enhance its reach and functionality. Digix and Tether Gold have successfully tapped into the cryptocurrency community, offering a solid alternative to typical crypto investments.

These initiatives are reshaping investor perception, proving that digital and traditional assets can complement each other, thus expanding the demographic and geographic reach of gold investment markets.

Lessons Learned: Best Practices and Potential Pitfalls

- Transparency: Projects like Digix have shown the value of providing transparent, real-time auditing processes to build trust.

- Regulatory Compliance: Paxos and others have highlighted the importance of working within regulatory frameworks to ensure project longevity and investor confidence.

- Accessibility and Education: AurusGOLD demonstrated the benefit of educating potential users on the advantages of tokenized gold to drive adoption, particularly in regions with limited investment options.

Potential Pitfalls:

- Security Risks: Ensuring robust security measures to protect digital and physical assets is paramount, as evidenced by previous challenges some companies faced with cyber threats.

- Volatility and Market Perception: The combination of gold’s stability with the volatility of digital markets must be carefully managed to avoid investor skepticism and maintain trust.

- Regulatory Uncertainty: Navigating the evolving legal landscape requires agility and foresight; failing to prepare for regulatory changes can lead to setbacks.

How Tokenova Can Mitigate These Risks

Tokenova is well-positioned to address these potential pitfalls through its comprehensive suite of services designed to facilitate secure and transparent transactions in the digital space.

- Enhancing Security Measures: Tokenova employs advanced blockchain technology to protect digital tokens, ensuring they are secure from cyber threats. Their robust encryption and authentication processes safeguard both digital and physical assets, providing clients with peace of mind in the face of potential security breaches.

- Managing Volatility and Perception: Tokenova helps balance the stability of gold with the dynamic nature of digital markets by offering transparent and real-time access to market data. This transparency allows investors to make informed decisions, thereby enhancing trust and confidence in tokenized gold investments.

- Navigating Regulatory Challenges: Tokenova actively monitors the evolving regulatory landscape to ensure compliance with all applicable laws and guidelines. By providing expert guidance and staying ahead of legal changes, Tokenova helps clients mitigate risks associated with regulatory uncertainty, ensuring smooth operations and sustained investor confidence.

In summary, while tokenizing gold presents certain risks, partnering with a knowledgeable and proactive service provider like Tokenova can significantly mitigate these challenges and enhance the overall security and attractiveness of such investments.

The Future of Gold Tokenization

As we look forward, the prospects of gold tokenization appear boundless. With blockchain advancements and evolving token standards like ERC-20, this field is set to revolutionize traditional gold markets. The seamless integration of technology promises not only to expand access to gold investments but also to disrupt longstanding norms, ushering in an era where digital assets complement and enhance traditional financial instruments.

Tokenova’s Role in Gold Tokenization

Tokenova stands at the forefront, offering crucial support to projects aiming to tokenize gold and other assets. By helping navigate the intricacies of launching and managing asset-backed tokens, Tokenova ensures compliance and operational excellence. Their expertise in the digital asset domain positions them as a valuable ally for clients aspiring to integrate gold into the burgeoning world of tokenized investments.

Conclusion

In closing, the tokenization of gold heralds a transformative impact on both traditional and digital markets. By revolutionizing the accessibility and tradeability of gold, tokenization provides fresh opportunities for investors and reshapes the future of gold investments. As we continue to explore this dynamic intersection of technology and finance, the potential for innovation and progress seems limitless.

What is the environmental impact of gold tokenization?

Gold tokenization can reduce the physical movement of gold, potentially lowering carbon emissions associated with transportation and storage.

Can gold tokens be exchanged for physical gold?

Yes, many tokenization platforms offer the option to redeem digital tokens for physical gold.

How do smart contracts in gold tokenization ensure security?

Smart contracts provide automated compliance checks and secure transaction execution without human intervention, enhancing safety.

Are there tax implications for investing in tokenized gold?

Tax implications vary by jurisdiction, so it is essential to consult with financial advisors to understand local tax laws related to digital assets.

What measures ensure the physical gold backing the tokens remains secure?

Secure vaulting, regular audits, and robust insurance policies are typically employed to protect the gold reserves backing digital tokens.