Tokenization in real estate stands out as a groundbreaking innovation and one might say that it has become a “need” in some countries. As we step into a new era of digital transformation, the concept of real estate tokenization signifies bringing real estate money back to life by providing fractionalized ownership in a secure and decentralized manner. Blockchain technology plays a crucial role in efficient property management by enhancing security and transparency, ensuring that property transactions are not only quick but also impeccably trustworthy.

Stay with us as we elaborate on the benefits of tokenizing real estate and what we do to facilitate this journey for you.

A Brief Introduction to Tokenization in Real Estate

Tokenization in real estate refers to the creation of digital tokens that represent real estate assets. This burgeoning trend within the digital economy provides a new way to handle property investments by leveraging blockchain technology. As we have seen with Bitcoin and other cryptocurrencies, blockchain’s decentralized nature offers an unprecedented level of security and transparency, which is now being applied to real estate. It opens up investment opportunities, allowing for more efficient and secure property management practices.

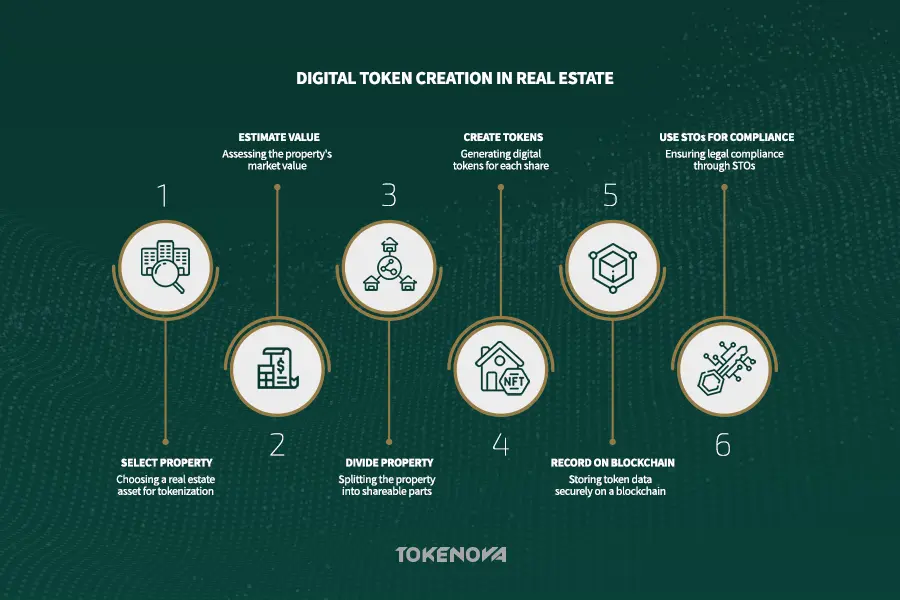

How Tokenization Works Here

Second, the bulk of the property is divided. Each share is digitally represented by an asset known as a token which’s record is kept on a blockchain.

These tokens may then be purchased, sold, or exchanged for other tokens in the same way that ordinary stocks in a business entity are traded. Security Token Offerings (STOs) are used here to maintain compliance with the laws. Like an IPO for stocks only referring to tokenized assets, the STOs function in compliance with financial legislation.

Such transactions are secure because they involve using smart contracts which are self-executing contracts with coded terms. They guarantee both trust and accuracy since title transferring, among other processes, is implemented without using middlemen.

Advantages of Real Estate Tokenization

Tokenized real estate offers a plethora of benefits that traditional real estate simply can’t match:

1. Increased Liquidity: Tokenization substantially speeds up transaction times. Traditional real estate deals can take weeks or even months to finalize, whereas tokenized deals can occur almost instantly, providing investors with quicker access to cash flow.

2. Fractional Ownership: It means that investors can own small segments of valuable property- a concept that makes real estate investment more accessible to people.

3. Global Market Access: With tokenization, the pool of potential investors now becomes everybody on the global market, not just local citizens.

4. Enhanced Transparency and Security: Making all transactions on the Blockchain platform unalterable makes transactions even more transparent.

5. Cost Efficiency: In most cases, tokenized assets enable a reduction of operating and or administrative costs since few go-betweens are involved when compared to traditional practices.

Challenges and Limitations

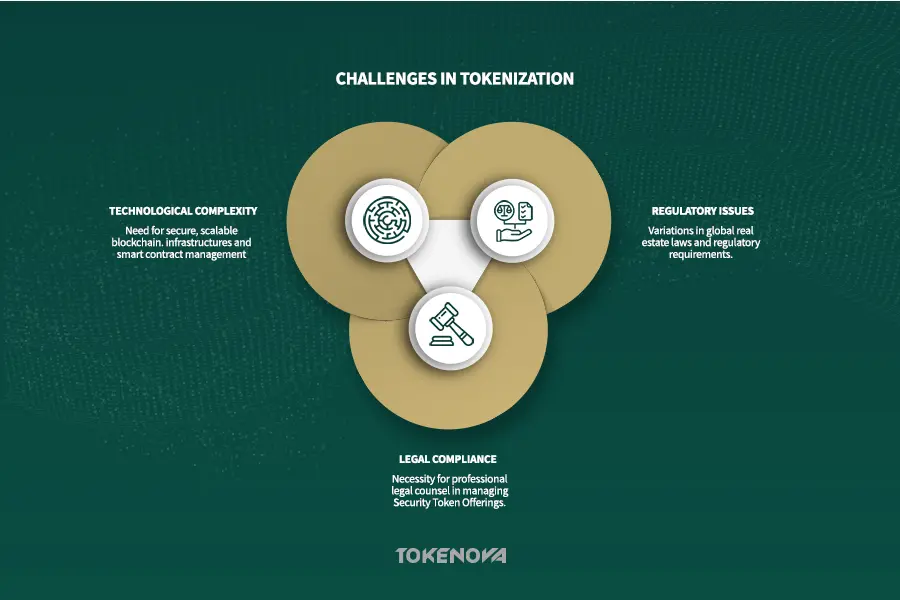

Despite its many advantages, real estate tokenization faces several hurdles:

– Regulatory Hurdles: Tokenized assets have legal restraints that differ from one country to another and present problems to growth on a global level.

– Market Adoption: The real estate business is typically marked by slow adaptation to employing new technologies. There is considerable awareness that has to be created for more people to begin using the system.

– Technological Complexities: This endeavor corresponds with building infrastructure necessary for blockchain and, tokenization entails a core level of specialized technical and resource provider skills.

– Risks Associated with Tokenized Assets: Issues such as security, volatility, and legal risks are inherent in tokenized real estate, and as such investors need to undertake their research.

Case Studies and Examples

These kinds of projects have completely changed the real estate market as RealT has made it possible to tokenize real estate assets. RealT focalizes investment in rental homes by enabling investors to own stakes or fractions of the homes this leads to lowering the barriers to entry. The aforementioned strategy is in contrast with conventional funding of properties as most real estate deals are capital-intensive as well as time-consuming.

The Future of Tokenization in Real Estate

As blockchain technology continues to advance, the potential for real estate tokenization to grow exponentially is significant. Analysts predict substantial market growth as more investors and property managers recognize the benefits of tokenization. This shift could disrupt traditional models, making real estate investments more digital and efficient than ever before.

Tokenization in real estate is not just a trend but a transformative force with the potential to reshape the way we approach property investments and ownership. Let’s delve deeper into the many layers of this groundbreaking shift, expanding on key points and exploring additional facets that contribute to the growing importance of tokenized real estate.

Expanding the Concept of Fractional Ownership

One of the standout benefits of real estate tokenization is the concept of fractional ownership, which significantly democratizes real estate investment. Traditionally, owning real estate has been a privilege reserved for those with substantial capital. Large, valuable properties whether they be commercial buildings or high-end residential units have been out of reach for the average investor. Tokenization changes that dynamic by allowing properties to be divided into smaller, more affordable shares.

This approach isn’t just beneficial for new investors looking to get their foot in the door it also serves as an attractive option for seasoned investors aiming to diversify their portfolios. Instead of putting all their capital into one or two large properties, investors can now spread their money across multiple tokenized real estate assets, potentially minimizing risk and enhancing returns. For example, an individual could own a fraction of a luxury apartment building in New York while simultaneously holding shares in a beachfront property in California, all through the simple purchase of digital tokens.

The ability to own a fraction of a property opens up real estate to millions of potential investors who previously lacked the necessary funds to participate. This inclusive investment model broadens the market, enabling people from all over the world to own a piece of prime real estate in a highly liquid, easily transferable form.

Read More: How to Invest in Tokenized Assets

Tokenization’s Impact on Liquidity and Global Participation

Liquidity has long been a challenge in real estate. Unlike stocks or bonds, selling a property is a complex, time-consuming process that often requires months to complete. Tokenization offers a game-changing solution to this issue by enabling faster transactions. Since tokens can be bought and sold on digital marketplaces, investors can liquidate their holdings with far greater ease than is possible with traditional real estate assets. This immediate access to liquidity is a major draw for investors who need flexibility in their portfolios.

Moreover, global market access is another critical advantage of tokenization. Investors from across the globe can participate in the tokenized real estate market without the typical geographic or financial limitations. Blockchain operates without borders, enabling seamless cross-border transactions and opening up markets to a wider range of participants. A real estate developer in Europe, for instance, can attract investors from Asia, America, or the Middle East without the complexities of international regulations and banking logistics.

Tackling the Barriers Caused by Regulation and Technology

As can be seen, although tokenization is one of the approaches that can be used in order to mitigate the risks associated with the application of blockchain and cryptography, it is not quite free from problems, one of the most essential of which refers to regulatory issues. Real estate laws differ between different countries and legal systems and the rules that are applying to tokened assets are still under development.

Meanwhile, some countries are more accepting of blockchain and digital assets than others and some apply very high regulatory requirements that make the process challenging. An undertaking needs to abide by the laws in the country, especially in issues to do with Security Token Offerings (STOs). Managing such legal matters is complicated and for this reason, the management of these issues always involves professional legal counsel and active regulation.

From a technological perspective, the structures that enable tokenization are complex infrastructures. Blockchain platforms must be secure, scalable, and usable in order to increase their adoption. On the same note, the use of smart contracts in real estate dealing brings about another issue in the sense that real estate professionals need to learn more in the technical side. There are numerous features of transactions that smart contracts can manage automatically, however handling thereof must be designed very thoroughly with desirable legal and financial scenarios in mind.

The implication of Real Estate Tokenization to Traditional Models

Thus, tokenization has the potential to completely dismantle traditional approaches to real estate business models. Real estate has remained more traditional for many years with little to no investment in technology by being in the digital era. But as for the growth of blockchain technology, a radical transformation in the process of purchasing properties, selling, and management of real estate should be expected. In most traditional markets, there is a large number of intermediaries such as brokers agents, and even banks which are all likely to take their commissions. Tokenization simplifies such transactions by eliminating most of these middlemen hence cutting costs and shortening time.

Furthermore, the shift towards tokenization may encourage greater transparency in property dealings. Blockchain’s immutable ledger ensures that every transaction is recorded permanently and cannot be altered, providing a clear and indisputable record of ownership and transaction history. This level of transparency could help reduce fraud and disputes in real estate, fostering a higher degree of trust among all parties involved.

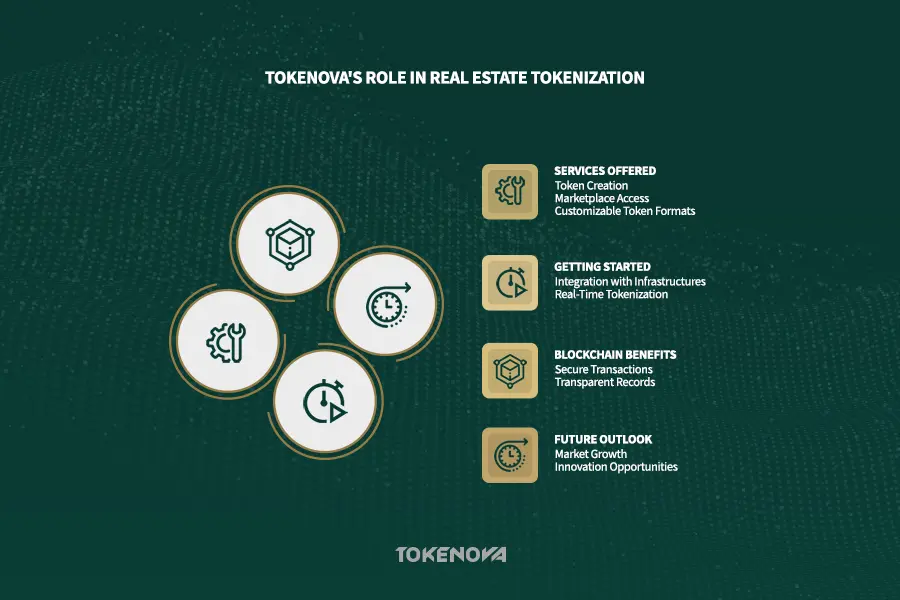

The Role of Tokenova in Real Estate Tokenization

Tokenova (link be real estate services page) is emerging as a key player in the real estate tokenization ecosystem, offering a range of services that cater to businesses and investors alike. By specializing in token creation and management, Tokenova helps facilitate the transition from traditional to tokenized assets. Their services include marketplace access, allowing investors to easily buy and sell tokenized properties, and customizable token formats, which cater to the specific needs of different real estate projects.

Tokenova also stands out for its emphasis on security and transparency. Their use of blockchain ensures that all transactions are secure and that property records remain transparent and tamper-proof. In an industry where trust is paramount, Tokenova’s blockchain-based solutions provide a robust framework for the tokenization of real estate assets.

Future Outlook: What Lies Ahead?

Looking forward, the future of tokenization in real estate is bright. As blockchain adoption continues to grow, so too will the opportunities for tokenization. Experts predict that tokenized real estate could become a multi-billion-dollar market in the coming years, driven by the demand for more efficient, transparent, and liquid investment opportunities. Fractional ownership and global participation will likely become the norm, as the barriers to real estate investment continue to fall.

Tokenization is also likely to spur further innovation in real estate, as developers and investors explore new ways to leverage blockchain for property management, rental agreements, and even city planning. While the road ahead is not without challenges particularly in terms of regulation and infrastructure the potential for real estate tokenization to revolutionize the industry is undeniable.

How to Get Started

Tokenova is at the forefront of this revolution, providing services that facilitate token creation, management, and marketplace access. They offer specialized blockchain solutions to ensure secure and transparent transactions, essential for modern real estate dealings. As part of validating their offerings, Tokenova emphasizes customizable token formats and real-time tokenization, which allow for seamless integration with existing infrastructures.

Conclusion

In conclusion, tokenization represents a pivotal shift in the real estate market, offering benefits like increased liquidity, fractional ownership, and enhanced transparency. Despite the challenges, the potential for innovation and efficiency makes it a compelling prospect for stakeholders. As we look ahead, embracing tokenization could redefine how we invest in and manage real estate, pushing the industry into a new age of digital sophistication.

As we’ve seen, tokenization in real estate offers a range of exciting benefits, from increased liquidity and global market access to enhanced security and transparency. While challenges remain, particularly in terms of regulation and market adoption, the future of tokenization looks promising. Companies like Tokenova are leading the charge, providing the tools and services necessary to facilitate this shift. In an industry ripe for innovation, tokenization is paving the way for a more inclusive, efficient, and secure real estate market.

Like traditional investments, the value of tokenized assets can fluctuate. Investors need to stay informed and assess risks regularly.

1. What is the primary difference between tokenized and traditional real estate investments?

Tokenized real estate allows for fractional ownership and quicker transactions, unlike traditional investments, which require more capital and time.

2. Can anyone get involved in real estate tokenization, or is it only for accredited investors?

While tokenization opens up the market, regulations may still require investors to meet certain criteria, such as being accredited, depending on the region.

3. How does blockchain ensure the security of tokenized real estate assets?

Blockchain uses cryptographic algorithms to secure data, ensuring that once data is recorded, it cannot be altered or deleted.

4. Are there any environmental concerns associated with blockchain used in real estate tokenization?

Some blockchain technologies consume significant energy; however, alternative blockchains are emerging that offer more eco-friendly solutions.