Imagine a world where owning a piece of real estate, a rare work of art, or even a share of a valuable commodity is as simple as clicking a button on your smartphone. This is the reality made possible by asset tokenization. In an age of digital innovation reshaping traditional finance, the process of asset tokenization converts rights to various assets into digital tokens on a blockchain.

As financial markets evolve, the demand for accessible, transparent, and efficient investment methods grows. How does asset tokenization work to meet these needs? By enabling individuals to invest in fractions of high-value assets, it democratizes opportunities once reserved for the wealthy elite. Blockchain technology enhances liquidity, reduces transaction costs, and strengthens security in asset management.

What This Guide Covers

- A detailed explanation of the asset tokenization process.

- The importance of tokenization in modern finance.

- Step-by-step insights into how to tokenize assets.

- The benefits it brings to investors and businesses.

- Challenges and risks in how asset tokenization works.

We will also explore real-world examples of how to tokenize physical assets across various industries, showcasing its transformative impact on investment landscapes.

Whether you are an investor looking to diversify your portfolio or a business aiming to leverage cutting-edge technologies, understanding the process of asset tokenization is crucial. Join us as we unpack this revolutionary concept and uncover how it can reshape your financial future.

Understanding Asset Tokenization

Asset tokenization is a groundbreaking process that enables both physical and digital assets to be represented as digital tokens on a blockchain. This innovative approach enhances investment accessibility while introducing unprecedented levels of liquidity and security in asset management. By grasping the fundamentals of the process of asset tokenization, investors and businesses can better navigate this rapidly evolving financial landscape.

What is Asset Tokenization?

At its core, asset tokenization involves creating a digital representation of an asset that can be easily traded on blockchain platforms. These tokens can signify ownership rights, shares, or specific attributes of the underlying asset.

For example, when real estate is tokenized, each token could represent a fraction of ownership in the property. This approach allows multiple investors to participate in the asset, making how to tokenize assets a key consideration for democratizing high-value investments.

Read More: Tokenization and Asset Financing: Transforming Finance

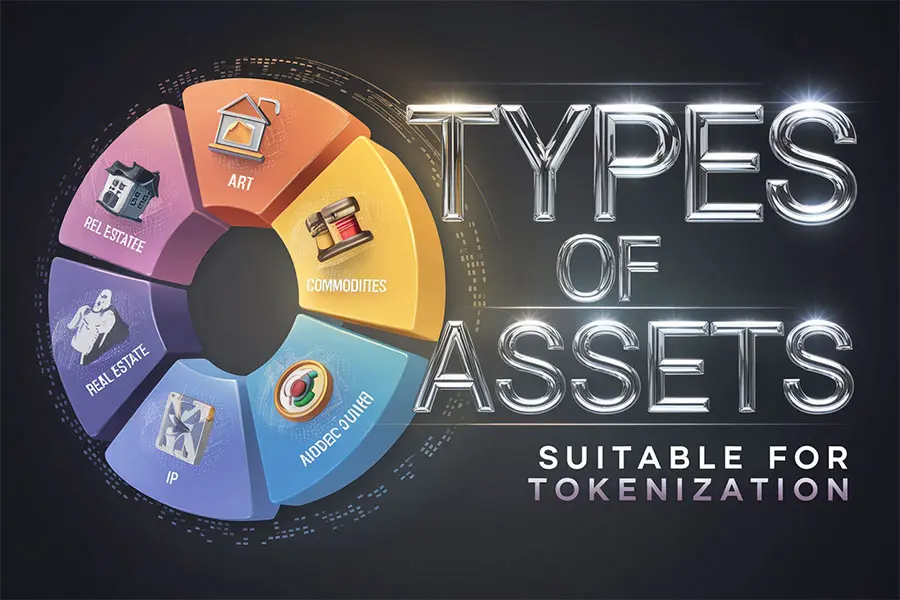

Types of Assets Suitable for Tokenization

Tokenization can be applied to a wide range of assets, enabling enhanced liquidity, accessibility, and investment opportunities. The following categories illustrate the versatility of the process of asset tokenization.

1. Physical Assets

Physical assets are tangible items that can be tokenized to facilitate fractional ownership and improve liquidity.

- Real Estate:

Tokenizing real estate allows investors to own fractional shares of properties without needing full ownership. Platforms like RealT enable users to invest in residential and commercial properties starting from as little as $50. This democratizes access to real estate investments, opening opportunities previously reserved for high-net-worth individuals. - Commodities:

Precious metals like gold or oil can also be tokenized, allowing investors to trade these assets without managing physical storage. For example, Paxos offers gold-backed tokens, enabling users to buy and sell gold digitally.

2. Digital Assets

Digital assets, which exist in intangible, digital forms, are equally suited for tokenization.

- Intellectual Property:

Rights to patents or trademarks can be tokenized to simplify licensing and transfer. Artists, for example, can tokenize music rights, allowing them to receive royalties directly from consumers without relying on intermediaries. - Digital Art:

Non-fungible tokens (NFTs) have transformed the art world by enabling artists to tokenize their work. Platforms like OpenSea allow creators to sell their art as NFTs, ensuring provenance, enabling fractional ownership, and creating unique revenue streams for artists.

Overview of Blockchain Technology in Tokenization

Blockchain technology is the foundation of how asset tokenization works, offering a secure and transparent system for recording transactions.

- Decentralized Ledger:

A blockchain serves as a decentralized ledger that records all transactions immutably, reducing fraud risks and enhancing trust among participants. Once a transaction is recorded, it cannot be altered or deleted.

Smart Contracts in Blockchain Tokenization

Smart contracts are self-executing agreements with terms directly coded into them. They play a critical role in the process of asset tokenization by automating key processes, such as:

- Transferring ownership upon payment confirmation.

- Reducing reliance on intermediaries.

- Lowering transaction costs by automating workflows.

Examples of Blockchain Platforms for Tokenization

Several blockchain platforms facilitate how to tokenize assets effectively:

- Ethereum:

Renowned for its smart contract capabilities, Ethereum is widely used for tokenizing assets across various industries. - Hyperledger Fabric:

This permissioned blockchain framework is tailored for enterprise solutions. It enables organizations to create private networks for secure transactions. Platforms like Atomyze leverage Hyperledger Fabric for tokenizing tangible assets, ensuring efficient, high-throughput transaction processing.

By understanding the applications and technological underpinnings of how to tokenize physical assets, businesses and investors can fully harness the potential of asset tokenization to diversify portfolios and innovate in asset management.

Read More: Asset Tokenization Trends: Transforming the Financial Landscape

The Asset Tokenization Process

The asset tokenization process involves a structured series of steps that convert traditional assets into digital tokens on a blockchain. Each phase is vital for maximizing the advantages of tokenization while minimizing associated risks. Understanding this process equips businesses and investors with the tools to leverage tokenization in their financial strategies.

Step 1: Asset Selection

Criteria for Choosing Assets

Selecting the right asset is the foundation of the process of asset tokenization. Not all assets are equally suitable, so it is crucial to evaluate based on the following criteria:

- Market Demand: Assets with high demand attract more investors, ensuring successful token sales. For instance, luxury real estate in prime locations often garners strong interest, making it ideal for tokenization.

- Liquidity Potential: Highly liquid assets, such as stocks or commodities, perform better in tokenized formats as they are easier to trade or convert into cash.

- Legal Considerations: Certain assets may have legal restrictions or regulatory requirements that could impact tokenization. Understanding these factors is crucial for a seamless process.

Step 2: Legal and Regulatory Compliance

Ensuring Adherence to Laws

Compliance is critical for avoiding legal challenges during tokenization. Key considerations include:

- Securities Regulations: Tokens resembling investment contracts must comply with securities laws, requiring registration with regulatory bodies like the SEC in the U.S.

- Anti-Money Laundering (AML) Laws: Robust AML policies, including customer verification processes, prevent illicit activities.

- Know Your Customer (KYC) Requirements: KYC procedures ensure fraud prevention by verifying investor identities through personal documents and background checks.

Read More: Decentralized Finance (DeFi) Definition: Revolutionizing the Future of Finance

Step 3: Asset Valuation

Methods for Accurate Valuation

Proper valuation ensures fair pricing of tokens. Common methods include:

- Market Comparisons: Benchmarking against similar assets sold in the market helps determine a competitive value.

- Income Approaches: Estimating potential income generated by the asset, such as rental earnings, provides a dynamic valuation metric.

- Cost-Based Assessments: Assessing costs associated with asset acquisition or reproduction offers insights into its market value, especially for unique assets.

Step 4: Digital Representation Creation

Blockchain Platform Selection

Choosing the right blockchain platform is pivotal in ensuring the tokenization’s success:

- Ethereum: Popular for its advanced smart contract functionality and widespread adoption in sectors like real estate and digital art.

- Binance Smart Chain: Known for lower fees and faster transaction speeds, ideal for cost-sensitive projects.

Smart Contract Development

Smart contracts automate transactions and enforce ownership terms. Key aspects include:

- Functionality: Defining ownership transfer rules and payment conditions.

- Security: Regular audits to identify and mitigate vulnerabilities before deployment.

Step 5: Token Issuance

Distribution Methods

Tokens can be issued through various channels:

- Private Sales: Targeted offerings to accredited investors, creating exclusivity but with limited visibility.

- Public Offerings: Broader access for retail investors, supported by extensive marketing efforts.

Initial Token Offering (ITO)

An ITO allows early investors to purchase tokens, often at discounted rates. Successful ITOs include detailed whitepapers outlining the project’s goals, technology, and roadmap to build trust.

Step 6: Secondary Market Trading

Platforms for Trading Tokenized Assets

Tokenized assets are traded on platforms that enhance liquidity:

- OpenSea: A marketplace for NFTs, facilitating seamless buying and selling of digital art and collectibles.

- RealT: Specializes in real estate tokenization, offering fractional ownership opportunities.

Liquidity Considerations

Liquidity affects how easily assets can be traded. High liquidity stabilizes prices, attracting more investors. Tokenized assets with higher trading volumes experience less price volatility, enhancing their market appeal.

The asset tokenization process is a detailed journey requiring meticulous planning at each stage. From asset selection to secondary market trading, each phase contributes to successful tokenization. By mastering this process, businesses and investors can unlock innovative opportunities and capitalize on the transformative potential of tokenization in modern finance.

Read More: Asset Tokenization and Leasing: Revolutionizing Finance

Benefits of Asset Tokenization

Asset tokenization is transforming traditional financial systems by changing how assets are owned, traded, and managed. This blockchain-powered innovation introduces a new level of liquidity, accessibility, and security across asset classes, creating significant advantages for investors, businesses, and markets.

1. Enhanced Liquidity

Asset tokenization addresses the historical challenge of illiquidity in markets such as real estate and collectibles.

- Fractional Ownership for Liquidity: Through tokenization, high-value assets can be divided into smaller units, enabling fractional ownership and easy trading. For instance, tokenized real estate allows investors to buy shares of a property, making markets more dynamic and accessible.

- Secondary Market Access: Security tokens backed by assets can be traded on secondary exchanges, providing investors with an easy exit route. This ensures flexibility, as tokenized assets can be traded similarly to stocks.

2. Fractional Ownership Opportunities

Tokenization democratizes access to traditionally exclusive investments by allowing fractional ownership.

- Lower Barriers to Entry: Platforms like RealT enable individuals to invest in high-value assets such as luxury real estate with as little as $50. This opens up opportunities for retail investors who might otherwise lack the capital to participate.

- Portfolio Diversification: Investors can diversify across multiple assets, including real estate, commodities, and collectibles, mitigating risks and improving returns without requiring large sums of money.

3. Increased Transparency

Transparency is a cornerstone of blockchain technology, and it greatly benefits tokenized assets.

- Immutable Ledger: Every transaction is recorded on a decentralized, tamper-proof blockchain, providing an accurate and transparent record of ownership.

- Fraud Reduction: Enhanced transparency minimizes the risk of fraudulent activities, increasing investor confidence in tokenized markets.

- Automated Trust: Smart contracts ensure fair execution of terms, such as rental income distribution, eliminating reliance on intermediaries.

4. Improved Security

Blockchain technology significantly enhances the security of asset ownership and transactions.

- Decentralized Infrastructure: Data is stored across a network of nodes, eliminating single points of failure and making the system resistant to cyberattacks.

- Smart Contracts for Security: Automated protocols enforce ownership rights and prevent unauthorized transactions, providing peace of mind for investors handling high-value assets like art or luxury goods.

5. Operational Efficiency and Cost Reduction

Tokenization simplifies complex processes, reducing time and costs associated with asset management and trading.

- Streamlined Processes: Smart contracts automate key functions such as compliance checks and transaction settlements, reducing the need for intermediaries.

- Faster Transactions: Blockchain eliminates lengthy settlement periods, enabling near-instantaneous ownership transfers.

- Lower Transaction Costs: Automation minimizes the reliance on third parties, cutting down on fees typically associated with traditional systems.

6. Access to Diverse Asset Classes

Tokenization expands investment opportunities by opening up new markets.

- Commodities and Precious Metals: Assets like gold or oil can be tokenized, allowing fractional ownership without the need for physical handling or storage.

- NFTs for Digital Assets: Non-fungible tokens (NFTs) offer a way to tokenize unique assets such as digital art, collectibles, and intellectual property, providing new revenue streams for creators.

7. Global Reach and Accessibility

Tokenized assets break geographical barriers, enabling a truly global marketplace.

- Borderless Investment: Blockchain platforms, through Tokenization in Banking, allow investors worldwide to participate without relying on traditional banking systems, facing currency exchange restrictions, or being limited by regional boundaries.

- Inclusive Finance: By opening markets to international participants, tokenization fosters greater inclusion and diversity in investment demographics.

The benefits of asset tokenization extend far beyond traditional investment models, offering unparalleled advantages in liquidity, transparency, security, and global accessibility. By democratizing ownership and enabling fractional investments, tokenization paves the way for a more inclusive and efficient financial ecosystem.

As blockchain technology evolves, asset tokenization is set to reshape the future of finance, making it imperative for investors and businesses to adopt and leverage this transformative trend. With its potential to unlock new growth opportunities and redefine investment paradigms, asset tokenization is not just a technological advancement it’s a revolution in modern finance.

Challenges and Risks in Asset Tokenization

While asset tokenization offers numerous advantages, its adoption is not without significant challenges and risks. These issues span regulatory, technological, and operational domains, requiring careful navigation to ensure successful implementation. Below, we explore the key hurdles and risks associated with this transformative process.

1. Regulatory Uncertainties

Regulation remains one of the most significant barriers to widespread adoption of asset tokenization.

- Inconsistent Global Frameworks: Different countries have varying interpretations and classifications for tokenized assets. For instance, in the U.S., the Securities and Exchange Commission (SEC) often categorizes tokens as securities, subjecting them to complex regulations. Conversely, jurisdictions like Germany evaluate tokenization on a case-by-case basis.

- Cross-Border Complications: Businesses seeking to tokenize assets across multiple regions face a patchwork of laws, creating costly compliance challenges.

- Evolving Legislation: The fast-evolving regulatory environment introduces uncertainty for both issuers and investors, deterring participation and innovation.

Example: Companies in emerging markets may hesitate to tokenize assets due to fear of inadvertently violating international financial regulations.

2. Technological Risks

The reliance on blockchain and smart contracts introduces several technological vulnerabilities.

- Coding Flaws in Smart Contracts: Errors in code or inadequate testing can lead to security breaches, as seen in various decentralized finance (DeFi) hacks.

- Blockchain Compatibility Issues: Rapid advancements in blockchain technology may render existing solutions obsolete, necessitating constant upgrades and compatibility checks.

- Scalability Concerns: Blockchains used for tokenization must handle large transaction volumes efficiently, a challenge for many networks.

Example: In 2016, the DAO hack exploited a vulnerability in Ethereum smart contracts, resulting in a loss of millions and highlighting the risks of relying on untested code.

3. Market Adoption Hurdles

Widespread adoption of asset tokenization remains a challenge due to limited understanding and acceptance.

- Lack of Awareness: Many investors and businesses are unfamiliar with blockchain technology and its potential applications, leading to skepticism.

- Resistance from Traditional Institutions: Established financial institutions may view tokenization as a threat to their traditional business models and hesitate to adopt it.

- Integration Costs: Transitioning to a tokenized framework requires significant investments in infrastructure and process redesigns.

Example: Real estate firms looking to tokenize properties must educate clients about the benefits while simultaneously integrating tokenized systems into their operations.

4. Security Concerns

Although blockchain technology offers robust security features, it does not eliminate risks.

- Cybersecurity Threats: Exchanges and platforms facilitating tokenized asset trading remain attractive targets for hackers, potentially leading to substantial financial losses.

- No Central Authority: Decentralized platforms lack mechanisms for dispute resolution or recovery in cases of fraud or theft, unlike traditional financial systems.

- Reputation Risks: High-profile breaches can erode trust in tokenized assets as a secure investment option.

Example: The Mt. Gox exchange hack demonstrated how vulnerabilities in platforms can undermine confidence in blockchain-based assets.

5. Investor Protection Issues

Ensuring adequate investor protection in tokenized markets is a critical concern.

- Lack of Standardization: Inconsistent legal frameworks for tokenized assets can leave investors uncertain about their rights and protections.

- Inadequate Disclosure: Some token issuers fail to provide comprehensive information about underlying assets, increasing risks for uninformed investors.

- Limited Legal Recourse: Tokens representing ownership may lack enforceable legal recognition, leaving investors vulnerable.

Example: An investor in a tokenized art piece might face difficulties claiming ownership if the issuing platform ceases to exist.

6. Complexity of Tokenization Processes

The multifaceted nature of tokenizing assets introduces operational complexities.

- Multistep Processes: Legal compliance, asset valuation, smart contract development, and issuance must all align seamlessly, which can strain resources.

- Resource-Intensive: Tokenization demands specialized expertise and substantial financial investment, particularly for large-scale projects.

- Lack of Industry Standards: As more sectors explore tokenization, the absence of standardized best practices leads to inefficiencies and confusion.

Example: Tokenizing a luxury property might require months of legal and technical preparation, discouraging smaller businesses from pursuing similar initiatives.

The challenges and risks of asset tokenization are significant but not insurmountable. Regulatory uncertainties, technological vulnerabilities, adoption barriers, security concerns, investor protection issues, and process complexities all require proactive solutions.

To address these hurdles effectively, stakeholders should:

- Engage with Regulators: Work towards creating clear and consistent global standards for tokenized assets.

- Invest in Security and Infrastructure: Ensure robust technological frameworks with regular updates and audits.

- Educate Stakeholders: Increase awareness among investors, businesses, and institutions about the benefits and risks of tokenization.

- Develop Industry Standards: Foster collaboration to establish best practices across sectors.

By understanding and mitigating these challenges, the full potential of asset tokenization can be unlocked, driving innovation and inclusivity in the global financial landscape.

Real-World Applications of Asset Tokenization

Asset tokenization is revolutionizing the way assets are owned, managed, and traded across industries. By converting physical and digital assets into blockchain-based tokens, it creates unprecedented opportunities to enhance liquidity, transparency, and accessibility. Below, we explore key applications of asset tokenization across various sectors.

1. Real Estate Tokenization

Real estate has traditionally been a high-barrier market characterized by illiquidity and high costs. Tokenization is transforming this landscape.

- Fractional Ownership: Tokenization allows investors to own a fraction of a property rather than the entire asset. Platforms like RealT enable individuals to purchase fractional shares in properties for as little as $50, making real estate investment accessible to retail investors.

- Enhanced Liquidity: Tokenized real estate assets can be traded on secondary markets, enabling investors to liquidate holdings quickly. This is a stark contrast to traditional real estate, where selling properties can take months.

- Smart Contracts for Efficiency: Processes like rent distribution and ownership transfer are automated using smart contracts, reducing administrative overhead and ensuring transparency. For instance, rental income can be automatically disbursed to token holders based on ownership percentages.

Example: A luxury apartment in New York could be tokenized and sold as 1,000 individual tokens, allowing investors worldwide to participate in property ownership without geographical or financial constraints.

2. Art and Collectibles

The art and collectibles market is embracing tokenization to address challenges like illiquidity and fraud.

- Non-Fungible Tokens (NFTs): Artists tokenize their works as NFTs, ensuring authenticity and provenance while enabling royalties from secondary sales. Platforms like OpenSea allow global trade of digital art, creating new revenue streams for artists.

- Fractional Ownership: Tokenization of high-value artworks enables multiple investors to own a share in masterpieces, democratizing access to the exclusive art market. Platforms like Myco have implemented this model, making renowned artworks accessible to a broader audience.

Example: An investor can buy a token representing 1% ownership in a Picasso painting, making high-value art more inclusive.

3. Commodities and Natural Resources

Gold tokenization and the broader tokenization of commodities like oil and agricultural products introduce new ways to trade and invest, making these assets more accessible and efficient.

- Gold-Backed Tokens: Companies such as Paxos offer tokens backed by physical gold stored in secure vaults, providing a digital method to invest in the precious metal without physical storage concerns.

- Oil Tokenization: Investors can trade oil-backed tokens on digital exchanges, which enhances market efficiency and reduces barriers to entry for individual investors.

Example: A single token might represent one gram of gold or one barrel of oil, enabling seamless global trading.

4. Agriculture Financing

The agriculture sector benefits from tokenization in financing and risk management.

- Tokenized Crop Insurance: Farmers can tokenize crop insurance policies, enabling automated claim payouts via smart contracts based on predefined triggers, such as weather conditions.

- Future Contracts for Crops: Tokenizing agricultural products allows farmers to secure financing ahead of harvest by selling tokens backed by expected yields. This model improves cash flow and market efficiency.

Example: A farmer in Brazil could tokenize a coffee harvest, allowing global investors to purchase tokens representing future coffee yields.

5. Decentralized Finance (DeFi)

DeFi platforms leverage tokenized assets to create innovative financial products and services.

- Collateralized Lending: Tokenized assets, such as tokenized real estate or art, can be used as collateral to borrow funds.

- Liquidity Pools: Tokenized assets are pooled in decentralized exchanges (DEXs), providing liquidity for trading pairs and enabling yield farming opportunities.

Example: A tokenized real estate asset might be locked in a DeFi platform to secure a loan while earning passive income from rental yields.

6. Security Token Offerings (STOs)

STOs combine the benefits of blockchain technology with regulatory oversight to enhance investor confidence.

- Fundraising Opportunities: Companies issue security tokens representing shares or bonds backed by real-world assets, providing secure investment options for investors.

- Global Reach: STOs enable businesses to raise capital from a global investor base while maintaining compliance with regional regulations.

Example: A renewable energy project might tokenize its infrastructure, allowing global investors to fund the project by purchasing security tokens representing future revenue.

The applications of asset tokenization span a wide array of industries, offering solutions to longstanding challenges like illiquidity, high entry barriers, and inefficiencies. By leveraging blockchain technology, tokenization enhances transparency, democratizes access, and opens new markets for innovation.

As technology and regulatory frameworks continue to mature, asset tokenization has the potential to redefine global finance. Understanding these real-world applications empowers stakeholders to harness its transformative benefits effectively, unlocking economic growth and fostering inclusivity in investment opportunities.

Pro Tips for Successful Asset Tokenization

Asset tokenization unlocks substantial value, but achieving success requires strategic planning and careful execution. Follow these expert tips to maximize your project’s potential.

1. Conduct Thorough Market Research

Understanding the market dynamics is crucial before tokenizing assets. Whether it’s real estate, art, or commodities, research helps you:

- Assess market demand and liquidity potential for tokenized assets.

- Ensure accurate asset valuation through expert appraisers or tools.

- Stay updated on regulatory environments to avoid compliance risks.

Tip: Informed decisions make it easier to select the right assets and structure your offerings for success.

2. Engage Legal Experts

Consult legal professionals specializing in digital assets to navigate complex regulations. They can ensure:

- Compliance with jurisdictional laws and investor protection.

- Clarity in ownership rights and royalties for tokenized intellectual property or art.

Tip: A solid legal foundation prevents costly mistakes and ensures a trustworthy, compliant tokenization process.

3. Choose the Right Technology Partner

Partner with reputable blockchain developers to ensure your tokenization project runs smoothly. Key considerations include:

- Secure smart contracts that automate asset transactions.

- Scalable blockchain platforms like Ethereum or Polkadot.

- Regular security audits to protect against vulnerabilities.

Tip: A skilled technology partner ensures your platform is secure, scalable, and compliant with regulations.

4. Educate Your Audience

Educating investors is key to successful adoption. Provide:

- Clear, easy-to-understand resources like explainer videos and blogs.

- Webinars and workshops to engage and inform potential investors.

Tip: Transparency and education foster investor confidence, encouraging broader adoption of your tokenized assets.

5. Implement Strong Security Measures

Security is essential in asset tokenization. Protect your project with:

- Regular security audits to identify vulnerabilities.

- Multi-factor authentication and encryption to safeguard user data and transactions.

- A proactive incident response plan to address any security breaches.

Tip: Robust security practices build trust, ensuring the long-term success of your tokenization platform.

By following these pro tips conducting thorough research, working with legal experts, choosing the right technology partner, educating your audience, and prioritizing security you’ll maximize the potential of your asset tokenization project. These strategies help mitigate risks, enhance transparency, and foster investor confidence.

Tokenova Services

In the dynamic world of asset tokenization, Tokenova is dedicated to providing clients with expert consulting services tailored to their unique needs. Our mission is to empower businesses and investors to navigate the complexities of tokenization with confidence and clarity. With a deep understanding of blockchain technology and extensive industry experience, Tokenova offers comprehensive support throughout the asset tokenization journey.

Overview of Tokenova’s Expertise

At Tokenova, we pride ourselves on our extensive expertise in asset tokenization. Our team consists of seasoned professionals with backgrounds in blockchain development, legal compliance, and asset management. We are committed to offering personalized consulting services that help clients make informed decisions about their tokenization strategies. With a proven track record of successful projects across various sectors, we are well-equipped to guide you through the intricacies of asset tokenization.

Services Offered

Tokenova provides a range of specialized consulting services designed to facilitate your asset tokenization process:

Asset Selection Assistance

Selecting the right assets for tokenization is critical for maximizing your investment potential. At Tokenova, we work closely with you to understand your investment goals and risk tolerance. Our consulting team conducts thorough market research and analysis to identify suitable assets based on market demand, liquidity potential, and legal considerations. We help you make informed choices that align with your strategic objectives.

Legal and Regulatory Guidance

Navigating the regulatory landscape can be daunting, but you don’t have to do it alone. Tokenova offers expert legal and regulatory consulting to ensure your asset tokenization complies with local and international laws. Our legal advisors will assist you in developing clear documentation outlining ownership rights, transferability, and any restrictions associated with your tokenized assets. This proactive approach mitigates legal risks and fosters confidence among your investors.

Smart Contract Development Consulting

Smart contracts are essential for automating transactions in the tokenization process. Our team at Tokenova provides consulting on best practices for smart contract development tailored to your specific needs. We ensure that your smart contracts accurately reflect the terms of ownership, automate processes such as dividend distribution, and incorporate robust security measures to protect against vulnerabilities. We guide you through the development process to ensure a seamless implementation.

Token Issuance and Management Support

Launching your tokens is just the beginning; effective management is key to long-term success. Tokenova offers consulting services for token issuance and ongoing management. We assist you in navigating the complexities of launching your tokens on suitable blockchain platforms while ensuring a smooth transition from initial offering to ongoing operations. Our team provides insights into tracking token performance, managing investor relations, and facilitating secondary market trading.

Why Choose Tokenova?

When it comes to asset tokenization, choosing the right consulting partner is crucial for success. Here’s why Tokenova should be your go-to choice:

Proven Track Record

Tokenova has successfully guided numerous clients through the asset tokenization process across various industries, including real estate, art, and commodities. Our proven track record showcases our ability to deliver tailored solutions that meet client expectations while adhering to regulatory standards.

Global Partnerships

We have established strategic partnerships with key players in the blockchain ecosystem, enhancing our consulting capabilities and expanding our resources. These collaborations enable us to provide you with access to cutting-edge technologies and insights that drive successful tokenization initiatives.

Secure Blockchain Solutions

Security is paramount in asset tokenization. At Tokenova, we prioritize security throughout every phase of the process. Our team conducts regular security audits and employs best practices in blockchain development to ensure that our solutions are resilient against cyber threats, giving you peace of mind as you embark on your tokenization journey.

Contact Tokenova Today for Expert Consulting on Your Tokenization Journey

Are you ready to explore the transformative potential of asset tokenization? Contact Tokenova today for expert consulting tailored to your specific needs. Whether you’re looking to tokenize real estate, art, or other valuable assets, our knowledgeable team is here to guide you every step of the way. Don’t miss out on the opportunity to unlock new investment possibilities reach out now for a consultation!

Conclusion

The asset tokenization process represents a transformative shift in how we perceive ownership and investment opportunities across various sectors. By leveraging blockchain technology, businesses can enhance liquidity, improve transparency, reduce operational costs, and democratize access to investments previously reserved for wealthier individuals or institutions. As the financial industry continues to evolve rapidly, embracing asset tokenization will be crucial for staying competitive and meeting modern demands while addressing challenges through innovation.

Key Takeaways

- Asset tokenization converts rights to an asset into digital tokens on a blockchain.

- It enhances liquidity and offers fractional ownership opportunities across various asset types.

- Compliance with legal regulations is vital throughout the tokenization process; engaging legal experts can mitigate risks.

- Challenges include regulatory uncertainties and technological barriers that need addressing through education and collaboration with experts.

What is asset tokenization, and how does it work?

Asset tokenization is the process of converting rights to a physical or digital asset into a digital token on a blockchain. This involves creating a unique token that represents ownership or a share of the asset, allowing for easier trading and transferability.

Can any asset be tokenized, or are there limitations?

While many types of assets can be tokenized, such as real estate, art, and commodities, certain legal and regulatory considerations may limit which assets can be tokenized. It’s essential to evaluate the asset’s market demand, liquidity potential, and compliance with local laws before proceeding.

How does Tokenova ensure the security of tokenized assets?

Tokenova prioritizes security by implementing robust measures throughout the tokenization process. This includes conducting regular security audits, utilizing secure blockchain technology, and developing smart contracts that incorporate best practices to protect against vulnerabilities.

What are the costs associated with asset tokenization?

The costs of asset tokenization can vary widely depending on factors such as the complexity of the asset, legal compliance requirements, and the chosen blockchain platform. Tokenova provides transparent pricing and works with clients to develop cost-effective solutions tailored to their specific needs.

How can I get started with asset tokenization through Tokenova?

To begin your asset tokenization journey with Tokenova, simply reach out to our team for a consultation. We will assess your needs, provide guidance on suitable assets for tokenization, and outline the steps involved in launching your project successfully.