Asset tokenization is a groundbreaking concept that is reshaping the way we approach ownership and investment across various asset classes. By converting both physical and intangible assets into digital tokens on a blockchain, it creates a pathway for investors to access a much broader spectrum of opportunities. This transformation enhances liquidity, improves efficiency, and democratizes investment by making previously inaccessible markets available to a wider pool of investors. Tokenization also plays a pivotal role in reducing entry barriers for smaller investors and enabling fractional ownership of assets, which opens the doors to innovative financial ecosystems.

In traditional finance, high-value assets such as real estate, fine art, or private equity investments were often reserved for institutional investors or those with substantial capital. With asset tokenization, these assets can now be broken down into smaller digital shares, allowing individuals to invest in portions of these assets. This not only diversifies investment portfolios but also enhances liquidity by enabling easier buying, selling, and trading of these tokenized assets on global markets.

The growth of blockchain technology and decentralized finance (DeFi) has accelerated the emerging trends in asset tokenization, offering new ways for businesses and investors to engage with assets and their underlying value. By leveraging smart contracts, asset tokenization ensures that transactions are secure, transparent, and automated, providing an efficient alternative to traditional financial systems. As more industries explore tokenization, it is becoming clear that the future of finance is set to be radically different, offering opportunities previously only available to a select few.

In this article, we will dive into the current state of asset tokenization, highlight the trends of asset tokenization that are reshaping the landscape, and explore their impact on various asset classes. We will examine how tokenization is influencing the future of industries such as real estate, commodities, and intellectual property, and what implications these changes have for investors and businesses alike. By staying informed on the latest asset tokenization trends, both individual investors and financial institutions can position themselves to thrive in this fast-evolving market, seizing new opportunities and adapting to the digital revolution that is already underway.

Market Overview of Asset Tokenization

The market for asset tokenization is witnessing rapid and explosive growth, making it one of the most promising sectors in the world of digital finance. The global market size for tokenized assets, which encompasses a wide range of physical and intangible assets, is projected to surpass $2 trillion by 2025, according to industry analysts. This remarkable growth is largely driven by the increasing adoption of blockchain technology and tokenization across multiple sectors, including real estate, financial services, art, and commodities. Investors are becoming more confident in the value of tokenized assets, paving the way for a more accessible and democratized investment landscape.

As businesses and financial institutions explore the immense potential of tokenized assets, the financial world is beginning to realize the benefits that blockchain-powered transactions can offer, such as improved liquidity, reduced costs, enhanced transparency, and fractional ownership of high-value assets. This transformative shift is not limited to small startups and niche markets but is being embraced by major institutional investors and market leaders.

Major Regions Leading the Charge in Asset Tokenization

The adoption of asset tokenization trends is not confined to a single geographic region. In fact, key regions like the United States, Europe, and Asia are at the forefront of this transformative movement. These regions are establishing themselves as global hubs for asset tokenization, drawing significant investments and fostering blockchain innovation.

- United States: The U.S. continues to be a global leader in blockchain and tokenization technologies, with major financial institutions and technology firms driving developments. The regulatory landscape is also evolving, with authorities providing clearer frameworks to accommodate the growth of tokenized assets.

- Europe: Europe has seen widespread regulatory advancements that are creating a conducive environment for emerging trends in asset tokenization. Countries like Switzerland have already established themselves as blockchain innovation hubs, offering favorable regulatory environments for startups and financial institutions alike. Additionally, nations within the European Union are progressively implementing regulations that allow for the safe and efficient tokenization of assets.

- Asia: Asia is also a key player in the trends of asset tokenization, with Singapore leading the charge. The city-state’s progressive regulatory framework and favorable business environment have made it a magnet for blockchain innovation. Other Asian countries are following suit, offering tax incentives and legal structures to encourage investment in tokenized assets.

Industry Players Driving the Asset Tokenization Revolution

Key players in the asset tokenization market are helping to establish the necessary infrastructure and services for this rapidly growing sector. These platforms facilitate the tokenization process while ensuring that security, compliance, and regulatory standards are met. Leading platforms such as Securitize, Tokeny, and tZERO are at the forefront of driving tokenization across asset classes. They provide the tools and services required to turn traditional assets into digital tokens, enabling easier trade, transfer, and ownership of these assets on the blockchain.

- Securitize: Securitize offers end-to-end tokenization solutions and is recognized for its regulatory compliance platform, which ensures that tokenized assets comply with securities laws. The company has been instrumental in bringing security token offerings (STOs) to market, allowing businesses to raise capital via tokenized assets.

- Tokeny: Tokeny is a blockchain-based platform that enables the tokenization of various assets, ranging from real estate to equity and debt. Tokeny focuses on providing secure, compliant, and scalable solutions for businesses looking to tokenize their assets.

- tZERO: A subsidiary of Overstock.com, tZERO offers blockchain technology for tokenized securities, providing a platform that facilitates the trading of security tokens and other tokenized assets. The company’s platform aims to bridge the gap between traditional financial markets and the emerging world of digital assets.

These platforms are essential in supporting the asset tokenization trends, ensuring that assets are tokenized in a way that is compliant with existing financial regulations while providing enhanced security and operational efficiency.

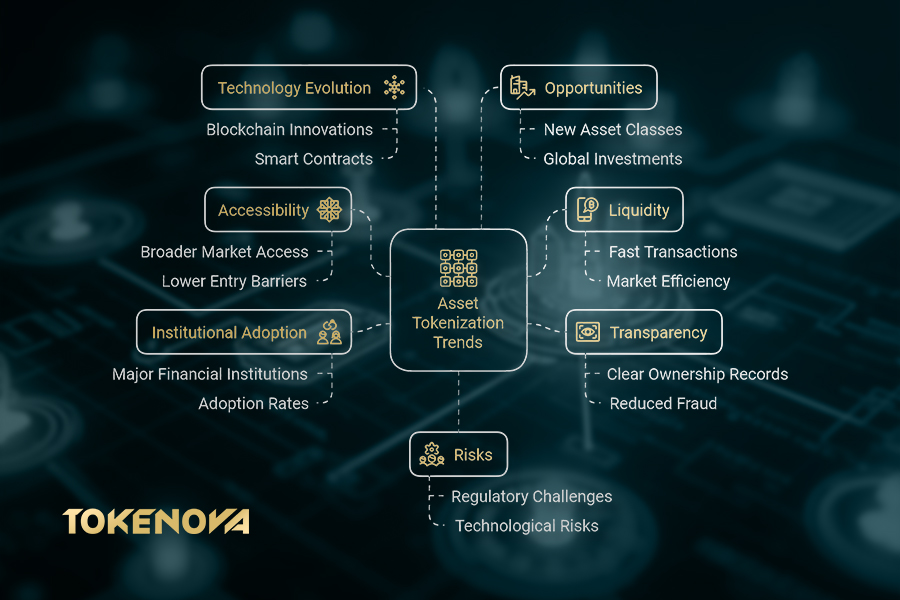

Institutional Investment Trends in Asset Tokenization

A noteworthy trend driving the expansion of asset tokenization is the increasing involvement of institutional investors. Large-scale financial institutions like BlackRock, Goldman Sachs, and others are making significant investments in tokenized assets, signaling strong confidence in the long-term viability of this market.

Institutional investors recognize the potential of tokenized assets to offer increased liquidity, improved asset management, and greater diversification opportunities. By entering the tokenized space, these firms are positioning themselves to capture the early benefits of blockchain technology and digital asset investments. This surge in institutional interest also suggests that asset tokenization trends are becoming increasingly mainstream and accepted by traditional finance. With larger players entering the market, the credibility and growth potential of tokenized assets are further solidified.

Moreover, the growing recognition of tokenized assets by global regulatory bodies is encouraging more institutional investment, as investors feel more confident about compliance and transparency in these markets. As more industry giants commit resources to this area, the emerging trends in asset tokenization will continue to evolve, ushering in an era of digital ownership and innovative investment opportunities.

Key Trends Shaping the Asset Tokenization Landscape

Asset tokenization is not just a passing trend but a significant shift in how assets are viewed and traded across global markets. The digital transformation enabled by blockchain technology is paving the way for more innovative and accessible ways to own, trade, and invest in traditional and alternative asset classes. Several key trends are playing a critical role in shaping the future of asset tokenization, driving its adoption and influencing its impact on various industries.

Fractional Ownership and Democratization of Assets

One of the most groundbreaking asset tokenization trends is the concept of fractional ownership, which has the potential to fundamentally change how high-value assets like real estate, fine art, and luxury goods are bought and sold. Traditionally, investing in such assets required large amounts of capital, which made it difficult for most individuals to access these markets. However, tokenization has revolutionized this model by allowing investors to purchase fractional shares of these high-value assets through digital tokens, making it possible to own a portion of real estate, art, or collectibles without needing to purchase the entire asset.

- Broader Access: Tokenization essentially democratizes investment opportunities by lowering the financial barriers to entry. Individual investors, even those with relatively small amounts of capital, can now diversify their portfolios by investing in tokenized portions of previously out-of-reach assets. This shift is creating a more inclusive investment ecosystem, where a wider range of people, including those from lower-income brackets, can access asset classes that were traditionally exclusive to institutional investors or the wealthy elite.

- Increased Liquidity: Fractional ownership is also increasing liquidity in markets that were traditionally illiquid, such as real estate and fine art. Tokenized assets can be easily traded on blockchain-based platforms, allowing investors to buy and sell fractional shares without the time-consuming and costly processes of traditional market exchanges.

This trend is not only expanding investment opportunities but is also driving innovation in how assets are managed and transacted in the global market, making emerging trends in asset tokenization more mainstream.

Institutional Adoption and Expanding Asset Classes

| Aspect | Real Estate Tokenization | Private Equity Tokenization |

| Investment Vehicle | Tokenized real estate funds | Tokenized private equity funds |

| Investor Types | Accessible to both institutional and retail investors | Primarily aimed at institutional investors, but increasingly accessible to retail investors |

| Capital Requirements | Lower capital outlays allow entry into property markets without high transaction costs | Addresses liquidity issues, enabling trading of shares in private companies |

| Liquidity | Provides liquidity through fractional ownership of properties | Enhances liquidity by allowing shares in illiquid private companies to be traded |

| Diversification | Investors can buy shares in individual properties or portfolios, facilitating diversification | Offers access to a broader range of private investments, previously difficult for smaller investors |

| Credibility & Scalability | Institutional adoption boosts credibility and scalability | Growing institutional interest enhances the perceived value and market acceptance |

| Market Impact | Facilitates easier access to real estate markets, democratizing investment opportunities | Creates new asset classes, improving accessibility and flexibility for investors seeking liquidity |

| Challenges | Regulatory hurdles and market acceptance | Similar regulatory challenges, plus the need for robust trading platforms |

| Future Outlook | Potential for mainstream adoption as technology and regulations evolve | Increasingly viewed as a viable investment strategy, transforming engagement with private equity markets |

Another powerful trend in the asset tokenization landscape is the growing adoption of tokenization by institutional players. While individual investors have been quick to recognize the benefits of tokenized assets, institutional investors are now beginning to enter the market, which significantly boosts the credibility and scalability of asset tokenization.

- Real Estate: A notable example of institutional adoption is the tokenization of real estate assets. Tokenized real estate funds are emerging as a key investment vehicle, offering a new way for both institutional and retail investors to participate in property markets without incurring the high transaction costs or capital requirements associated with traditional real estate investments. Through tokenization, investors can buy shares in individual properties or property portfolios, making it easier to diversify their investments and enter the real estate market with smaller capital outlays.

- Private Equity: Tokenization is also disrupting the world of private equity, providing a solution to the liquidity issues typically associated with private investments. Tokenized private equity funds enable investors to trade their shares in previously illiquid private companies, unlocking value and enhancing the flexibility of these investments. This trend is fostering the creation of new asset classes that were once difficult to access for smaller investors or those looking for more liquidity in their portfolios.

The growing institutional interest in asset tokenization underscores the increasing belief that tokenized assets can deliver tangible value in terms of liquidity, efficiency, and accessibility.

Global Expansion and Regulatory Developments

As the adoption of asset tokenization expands globally, regulatory frameworks are evolving to keep pace with the rapid growth and innovation in this space. Regulators in the U.S., Europe, and Asia are making significant strides in developing legal structures that aim to both protect investors and foster innovation, which will likely further accelerate the growth of emerging trends in asset tokenization.

- New Regulations: In major markets, such as the United States, Europe, and Asia, governments are introducing new regulations designed to provide clear guidelines for asset tokenization, making it easier for companies and investors to navigate this evolving landscape. These regulations are crucial in ensuring that tokenized assets comply with existing financial laws while protecting investors from potential risks. For example, security token offerings (STOs), which are a type of regulated tokenized investment, are gaining popularity as an alternative to traditional securities, offering benefits such as lower costs and faster settlement times.

- Regulatory Clarity: Clear regulations are also building investor trust by addressing concerns related to fraud, market manipulation, and security. As more countries introduce comprehensive regulatory frameworks, the asset tokenization space is becoming more secure and attractive to both retail and institutional investors alike.

As asset tokenization trends continue to evolve, the regulatory landscape will play a critical role in ensuring the long-term success and sustainability of these markets.

Technology and Security Enhancements

The rapid advancement of blockchain technology is essential to the success of asset tokenization. Technological innovations are not only improving the efficiency and scalability of tokenized assets but also enhancing their security. Investors are more likely to engage in asset tokenization when they are assured that the underlying technology is secure, transparent, and reliable.

- Blockchain Innovations: The continuous improvement of blockchain protocols is increasing the speed, security, and transparency of asset tokenization. Technologies such as zero-knowledge proofs and multi-signature wallets are enhancing the privacy and safety of transactions, providing investors with confidence that their investments are secure. These innovations allow for more complex transaction structures and ensure that tokenized assets are not only compliant with regulations but also protected from hacking and fraud.

- Smart Contracts: Smart contracts are becoming a cornerstone of the asset tokenization process. These self-executing contracts automatically enforce the terms of agreements, reducing the need for intermediaries and further lowering costs. As blockchain technology continues to improve, the reliability and automation of tokenized asset transactions will continue to increase, making the entire process more efficient and less prone to errors or disputes.

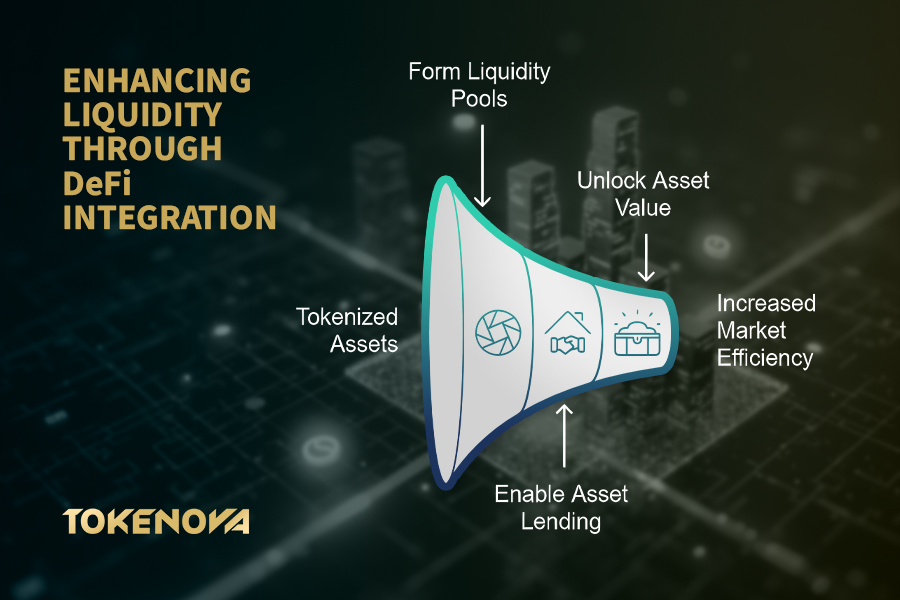

Integration of DeFi with Tokenized Assets

The integration of decentralized finance (DeFi) with tokenized assets is an emerging trend that is transforming how liquidity is managed in these markets. DeFi protocols are enabling tokenized assets to function in a broader ecosystem that includes lending, borrowing, and trading platforms.

- Liquidity Pools: The combination of DeFi and asset tokenization is creating new opportunities for liquidity pools, which provide a mechanism for investors to trade tokenized assets in a decentralized manner. These pools allow token holders to lend their assets to others in exchange for interest or other rewards, significantly improving the liquidity and accessibility of tokenized markets.

- Decentralized Lending Protocols: DeFi platforms that allow for tokenized asset lending are growing rapidly. These platforms enable users to borrow against their tokenized assets, using them as collateral in a secure and decentralized manner. This provides a new avenue for generating income and unlocking the value of previously illiquid assets.

As DeFi continues to merge with asset tokenization, it will bring about even more opportunities for liquidity, innovation, and efficiency within digital asset markets.

Real World Asset Tokenization vs. In-Game Asset Tokenization

When discussing asset tokenization, it’s essential to differentiate between real-world asset (RWA) tokenization and in-game asset tokenization. These two types of tokenization leverage blockchain technology but serve different markets and purposes.

Real World Asset Tokenization

| Aspect | Real World Asset Tokenization | In-Game Asset Tokenization |

| Definition | Converting tangible assets (real estate, commodities, artwork) into digital tokens on a blockchain. | Representing digital items within video games as tokens on a blockchain. |

| Target Market | Traditional investors seeking financial returns and portfolio diversification. | Gamers and virtual world enthusiasts looking for ownership and control over in-game assets. |

| Liquidity | Enhances liquidity by allowing fractional ownership and easier trading of traditionally illiquid assets. | Provides players with true ownership, enabling them to trade or sell items independently from game developers. |

| Accessibility | Lowers financial barriers for investing in high-value assets, making them accessible to a broader range of investors. | Allows players to own fractions of valuable in-game items, promoting participation in gaming economies. |

| Ownership Control | Investors have clear ownership rights through tokenized representation of physical assets. | Players gain true ownership of their digital possessions, allowing for trading and transfer outside the game. |

| Interoperability | Generally limited to specific asset classes and markets; cross-platform use is less common. | Potential for interoperability across different games and platforms, enhancing player experiences and economies. |

| Transparency | Utilizes blockchain for transparent ownership records and transaction histories, reducing fraud risk. | Blockchain technology ensures verifiable ownership and transaction history for in-game assets. |

| Monetization Opportunities | Enables new investment vehicles and financial products in traditional markets. | Offers gamers opportunities to monetize their skills by creating and selling valuable in-game items. |

| Regulatory Landscape | Subject to stricter financial regulations due to the nature of tangible assets involved. | More focused on gaming regulations, which are still evolving as the market matures. |

Real-world asset (RWA) tokenization involves converting tangible assets such as real estate, commodities, or artwork into digital tokens on a blockchain. By doing so, it enables the creation of a new class of investments that are more accessible, liquid, and transparent. This process has gained significant attention due to its potential to unlock traditional asset classes to a broader range of investors.

Advantages of Real World Asset Tokenization

- Liquidity: Traditional physical assets, like real estate or art, often suffer from liquidity issues, as selling them typically involves lengthy processes and high costs. Tokenizing these assets breaks them into fractional ownership units, allowing investors to trade smaller portions of the asset on secondary markets. This provides greater liquidity, enabling assets to be bought or sold more easily and quickly.

- Accessibility: Tokenization lowers the financial barrier to entry for investing in high-value assets. Instead of needing significant capital to purchase entire properties or artworks, investors can now buy small fractions of these assets through digital tokens, making them accessible to a broader group of people, including individual investors who previously couldn’t afford to invest in these markets.

- Transparency: By using blockchain technology, asset tokenization offers greater transparency. Ownership records and transaction histories are securely stored on a blockchain, creating an immutable, transparent ledger. This feature reduces the risk of fraud and ensures that every transaction is publicly verifiable, adding an extra layer of security and trust.

In-Game Asset Tokenization

On the other hand, in-game asset tokenization pertains to digital items within video games or virtual environments being represented as tokens on a blockchain. This type of tokenization offers a set of unique benefits tailored to the gaming community.

Benefits of In-Game Asset Tokenization

- Ownership Control: Traditionally, in-game items are controlled by the game developer, meaning players do not have true ownership of their digital possessions. With in-game asset tokenization, players gain true ownership of their items, such as weapons, skins, or characters, which can be traded, sold, or transferred independently from the game developer’s platform. This allows players to control their assets, outside of the traditional confines of the game world.

- Interoperability: Another exciting aspect of in-game asset tokenization is the potential for interoperability. If supported by compatible systems, tokens representing in-game assets can be used across different games or platforms. For instance, an item tokenized within one game might be transferable to another game or even a virtual metaverse environment, creating new cross-platform economies and experiences for players.

- Monetization Opportunities: Tokenization offers gamers new monetization opportunities. Players can create valuable items or characters within a game and then sell them on secondary markets or blockchain-based marketplaces. This opens up a whole new avenue for earning money through gaming, as individuals can profit from the assets they’ve accumulated or created within virtual worlds.

Key Differences Between Real World and In-Game Asset Tokenization

While both real-world and in-game asset tokenization leverage blockchain technology to enhance ownership rights and liquidity, they cater to distinctly different markets.

- Target Markets: Real-world asset tokenization is focused on traditional investments like real estate and commodities, appealing to investors seeking financial returns and the opportunity to diversify their portfolios. In contrast, in-game asset tokenization is tailored to gamers and virtual world enthusiasts, giving them control over their in-game possessions and creating new economies within gaming ecosystems.

- Value Proposition: Real-world asset tokenization focuses on enhancing liquidity and accessibility of high-value assets, while in-game asset tokenization primarily aims to empower players with true ownership of their digital possessions and offers them the opportunity to earn through secondary markets.

- Regulatory Landscape: Real-world asset tokenization is often subject to stricter financial regulations as it deals with tangible assets, whereas in-game asset tokenization is more focused on gaming regulations and digital economies, which are still evolving.

Asset Classes Experiencing Tokenization Growth

Asset tokenization is expanding beyond traditional investments, with several asset classes seeing significant growth. Here’s an overview of some key areas:

Real Estate

Tokenized real estate has gained traction, offering enhanced liquidity and accessibility for investors. Platforms like RealT allow fractional ownership of rental properties, enabling more people to invest in real estate without needing large amounts of capital.

Art and Collectibles

Tokenization is also transforming the art and collectibles market. By enabling fractional ownership of artworks, platforms like Myco allow investors to participate in high-value markets with lower financial commitments.

Commodities and Precious Metals

Commodities such as gold and oil are being tokenized to increase trading efficiency. For example, Paxos offers gold-backed tokens, providing a digital alternative to holding physical gold, making it easier for investors to trade and store commodities.

Intellectual Property and Royalties

Tokenizing intellectual property (IP) and royalties is an emerging trend, allowing creators to monetize their work more efficiently. This opens up new investment opportunities for patents and royalties, providing creators with liquidity and broader access to capital.

This growing trend of asset tokenization across diverse asset classes is reshaping investment opportunities, offering more accessible and liquid markets for a range of traditionally illiquid assets.

Advantages of Asset Tokenization in Emerging Markets

Asset tokenization presents several advantages in emerging markets:

Diversified Ownership: Investors can access a wide range of assets across borders, mitigating risks associated with local economies.

Enhanced Liquidity: Digital tokens facilitate faster transactions compared to traditional methods, improving overall market efficiency.

Reduced Operational Costs: Utilizing digital ledger systems lowers operational costs associated with managing physical assets.

Improved Transparency: Blockchain technology enhances transparency in transactions, attracting more global investors seeking trustworthy investment opportunities.

Challenges and Risks in the Evolving Tokenization Landscape

While asset tokenization offers numerous advantages, there are several challenges and risks that could impact its growth and adoption. These hurdles need to be addressed for the technology to reach its full potential.

Regulatory Uncertainty

One of the biggest challenges in the tokenization landscape is regulatory uncertainty. Different countries have adopted varying regulatory approaches, creating confusion for investors and businesses. This lack of uniformity can result in compliance issues and hinder the global expansion of asset tokenization. Clearer and more consistent regulations are needed to foster trust and facilitate cross-border transactions.

Technological Gaps

Despite significant advancements, the technology behind asset tokenization is still evolving. Scalability and reliability issues persist, especially as tokenized assets grow in volume. For widespread adoption, there is a need for stronger and more robust infrastructure to handle increased transaction volumes while maintaining security.

Market Maturity Risks

Another challenge is the market maturity of tokenized assets. Establishing secondary markets for tokenized assets is crucial for enabling liquidity. However, the lack of established platforms or trading mechanisms for tokenized assets may limit investors’ ability to quickly buy or sell these digital assets. As the market matures, it will be important to address these liquidity challenges to ensure seamless trading.

Investor Trust

Overcoming investor skepticism remains one of the key hurdles for mainstream adoption of tokenized assets. Traditional investors may be hesitant to trust a new, digital form of asset ownership, especially when they are accustomed to established asset classes and markets. Building investor trust through better education, stronger security measures, and regulatory clarity will be essential to attracting more institutional and retail investors into the tokenized asset space.

Despite these challenges, the potential for asset tokenization to reshape investment markets remains vast. Addressing these risks will be critical for the technology’s future growth and the realization of its full potential in democratizing investment opportunities.

Notable Case Studies in Asset Tokenization

The successful implementation of asset tokenization can be seen through various pioneering case studies. These examples demonstrate how the tokenization process is revolutionizing traditional markets and creating new opportunities for both investors and issuers.

BlackRock’s Tokenized Fund on Ethereum Blockchain

BlackRock, one of the world’s largest asset management firms, has taken a significant step towards embracing asset tokenization with the launch of a tokenized fund on the Ethereum blockchain. This initiative highlights how traditional financial institutions are adopting blockchain technology to improve fund management. By tokenizing their assets, BlackRock has increased transparency, improved efficiency in asset transfer, and enhanced liquidity in the fund. This case study underscores the growing interest and trust in blockchain by major players in the finance industry.

Securitize’s Platform for Real Estate

Securitize is leading the way in real estate tokenization. The platform provides a compliant infrastructure for issuing security tokens tied to real estate assets, simplifying the process for both issuers and investors. By enabling fractional ownership of properties, Securitize has opened up opportunities for smaller investors to participate in high-value real estate markets. Their platform has also streamlined regulatory compliance, making it easier to manage tokenized real estate transactions, and increasing liquidity in what has traditionally been a less liquid market.

TokenBridge by Beesfund

Beesfund has developed the TokenBridge platform to make investments more accessible through tokenization. TokenBridge allows retail investors to purchase shares in startups and other assets that were previously restricted to larger, institutional investors. By implementing innovative tokenization strategies, Beesfund has democratized investment, enabling a wider range of people to invest in early-stage ventures and diversified portfolios. This approach provides liquidity, transparency, and lower barriers to entry for retail investors.

These case studies demonstrate how asset tokenization is not just a theoretical concept, but a practical solution being embraced by major institutions and startups alike. They highlight the real-world applications and advantages of tokenizing traditional assets, paving the way for more innovative financial services in the future.

Future Outlook: Emerging Trends in Asset Tokenization

Looking ahead, the asset tokenization landscape is poised for continued evolution. Several emerging trends and predictions offer insight into where the market is headed, influencing both investors and businesses looking to leverage tokenized assets.

Regulatory Alignment

One of the key trends expected in the near future is regulatory alignment. As more countries and regions explore the potential of blockchain and asset tokenization, we anticipate increased collaboration among regulators. The move toward standardized global regulations will help create a more cohesive market, reducing compliance complexity for businesses and providing clearer guidelines for investors. This regulatory clarity will be crucial for fostering widespread adoption and increasing investor confidence in tokenized assets.

New Asset Classes

As awareness of asset tokenization grows, more asset classes are likely to be tokenized beyond traditional real estate and art. Commodities, intellectual property, private equity, and even fine wines could soon find their place on blockchain platforms as tokenized assets. This diversification will offer investors an expanded range of opportunities, enabling them to access new, alternative investment markets with greater ease. The potential for new asset classes will open doors to previously untapped areas, increasing the depth and appeal of tokenized portfolios.

Blockchain Advancements

Blockchain advancements will continue to be a driving force behind the evolution of asset tokenization. Innovations in blockchain technology, such as improved consensus mechanisms, zero-knowledge proofs, and shard chains, will increase transaction speed and scalability, allowing tokenized assets to be traded more efficiently. These innovations will reduce transaction costs, improve security, and help blockchain networks handle higher volumes of tokenized assets, paving the way for seamless integration into the broader financial ecosystem.

Cross-Border Trading Trends

As the world becomes more interconnected, cross-border trading of tokenized assets will become increasingly important. The ability to trade assets across borders without the need for intermediaries or complex regulatory procedures will democratize global markets. Blockchain’s ability to facilitate instant and secure international transactions will empower investors to diversify their portfolios across geographic regions with greater ease. This trend will be especially significant for institutional investors looking to expand their reach into new, emerging markets.

Pro Tips for Navigating Asset Tokenization

As the asset tokenization market evolves, investors should stay proactive in navigating its complexities and opportunities. Here are some key tips for successfully investing in tokenized assets:

1. Stay Informed About Regulatory Changes

Given the ever-changing regulatory landscape surrounding asset tokenization, it is essential for investors to stay up-to-date with any legal changes that could affect their holdings. Global regulations may vary significantly, and understanding the latest rules will help you make informed decisions and avoid potential legal pitfalls.

2. Diversify Your Portfolio

The diverse opportunities offered through asset tokenization mean investors can easily diversify their portfolios by exploring different asset classes. Don’t limit yourself to just real estate or art; consider expanding into other tokenized assets such as commodities, intellectual property, or private equity. Diversification helps mitigate risk and enhances potential returns in the evolving tokenization space.

3. Leverage Technology Platforms with Robust Security Features

When investing in tokenized assets, it’s crucial to choose platforms that prioritize security. Look for platforms offering multi-signature wallets, two-factor authentication, and other advanced security measures to safeguard your investments. Ensuring your assets are protected from cyber threats should be a top priority when entering the tokenized market.

4. Engage with Industry Experts or Platforms for Insights

To make the most of asset tokenization, connect with industry experts and platforms like Tokenova for insights into best practices for managing your investments. These resources can help you understand market trends, identify promising investment opportunities, and keep you informed about new technologies or regulatory changes affecting the asset tokenization space.

By staying informed, diversifying investments, and leveraging reliable platforms, investors can position themselves to succeed in the evolving world of asset tokenization.

Unlock the Future of Asset Tokenization with Tokenova

At Tokenova, we specialize in tokenization consulting and strategic solutions for businesses and investors looking to capitalize on the opportunities presented by digital asset transformation. Our tailored services provide seamless access to tokenized assets, allowing you to navigate the complexities of blockchain technology and unlock a wealth of new opportunities in investment and ownership.

Tokenova’s Unique Consulting Approach

Tokenova offers a holistic, end-to-end consulting service that goes beyond just the technology. From initial legal compliance and regulatory framework setup to asset security, we ensure every aspect of your tokenization journey is handled with precision. We understand the intricacies of the market and work closely with our clients to ensure their tokenization projects are fully compliant with evolving regulations and protected by the latest security protocols. Whether you’re a business ready to tokenize your assets or an investor seeking strategic guidance, Tokenova provides expertise in navigating the complex landscape of digital assets.

Why Choose Tokenova as Your Tokenization Partner?

Choosing Tokenova means having a trusted partner who understands the nuances of asset tokenization trends and helps you stay ahead of the curve. We work with businesses to unlock the potential of tokenized real estate, intellectual property, private equity, and more, positioning you for success in a rapidly changing market. Our team’s expertise in blockchain technologies, regulatory compliance, and market insights allows us to provide actionable, data-driven strategies to help you seize new market opportunities.

Partner with Tokenova for Tailored Tokenization Solutions

If you’re ready to transform your business or investment strategy with the power of tokenization, contact Tokenova today for a personalized consultation. Our team of experts will guide you through each step, from concept to execution, ensuring you fully leverage the benefits of tokenized assets. Let us help you stay ahead of the market, mitigate risks, and drive success with tailored tokenization solutions that fit your specific needs. Reach out now to schedule a consultation and explore the future of digital asset ownership.\

Conclusion

In conclusion, asset tokenization trends are fundamentally transforming the financial sector by improving accessibility, liquidity, and transparency across a diverse range of asset classes. As more institutional players adopt blockchain-based asset models and technology continues to evolve, the need for investors and businesses to stay informed is more critical than ever. Recognizing these emerging trends allows stakeholders to seize new opportunities while effectively managing the risks inherent in this evolving space.

The future of finance is intrinsically tied to the ongoing development of asset tokenization, and staying ahead of the curve will be crucial for anyone looking to thrive in this dynamic environment. Tokenization is not just a passing trend it is reshaping the way we think about ownership, investment, and capital markets, and its impact will only intensify as more industries adopt blockchain-based solutions.

Key Takeaways

- The tokenization market is projected to hit $2 trillion by 2025, highlighting its rapid growth and the vast opportunities it presents.

- Emerging trends shaping the landscape include fractional ownership, institutional adoption, regulatory evolution, technological advancements, and the integration of DeFi (Decentralized Finance).

- Diverse asset classes such as real estate, art, commodities, and intellectual property are leading the way in tokenization, offering new avenues for investment.

- However, challenges such as regulatory uncertainty, technological gaps, market maturity risks, and investor trust must be carefully navigated to ensure success in this space.

By understanding these factors and staying informed on the trends of asset tokenization, stakeholders can make well-informed decisions and position themselves to thrive in this rapidly evolving market.