The future of decentralized finance promises frictionless, borderless, and trustless systems, connecting global participants in ways never imagined before. This phenomenon will revolve around blockchain technology and smart contracts that eliminate the need for centralized authorities. This vision directly addresses long-standing inefficiencies in traditional finance, offering solutions like ultra-fast settlement times, lower fees, improved transparency, and unstoppable innovation. As major Blockchain Financial Services emerge, we witness growth in lending, borrowing, asset management, trading, insurance, and even more exotic use cases such as tokenized real-world assets.

Understanding what lies ahead is critical because this knowledge empowers you to position yourself and your business to harness the full potential of upcoming DeFi Innovations and Predictions. By staying informed and actively engaged, you can make decisions that align with evolving Decentralized Finance Trends and ensure that you benefit from the radical reshaping of financial markets, rather than being left behind.

Whether you are an entrepreneur seeking to integrate DeFi into your business model, an investor exploring new avenues of yield generation, or a financial professional preparing for disruptive changes, this guide will equip you with the insights needed to navigate the Future of Decentralized Finance confidently and strategically.

Current State of Decentralized Finance

The future of decentralized finance (DeFi) is unfolding before us as it evolves from a niche concept into a transformative force in global financial systems. Over the years, DeFi protocols have witnessed exponential growth, with Total Value Locked (TVL) soaring past $70 billion in 2023 a stark contrast to the mere billions seen in its early days(Source). This rapid expansion highlights the trust users and investors place in decentralized platforms powered by smart contracts, eliminating the need for intermediaries.

Key Developments Shaping Decentralized Finance Trends

- Rising TVL and Adoption: The TVL metric showcases the growing capital within DeFi platforms, a testament to global confidence in these systems. The adoption of DeFi services for lending, borrowing, and trading is driven by the promise of higher yields and transparency, appealing to both retail users and institutional players.

- Broadening User Base: With over 6 million unique active users globally, DeFi is maturing into a stable and reliable ecosystem. Activities such as yield farming, staking, and liquidity provision are becoming mainstream among tech-savvy users, while simplified interfaces aim to attract new participants.(source)

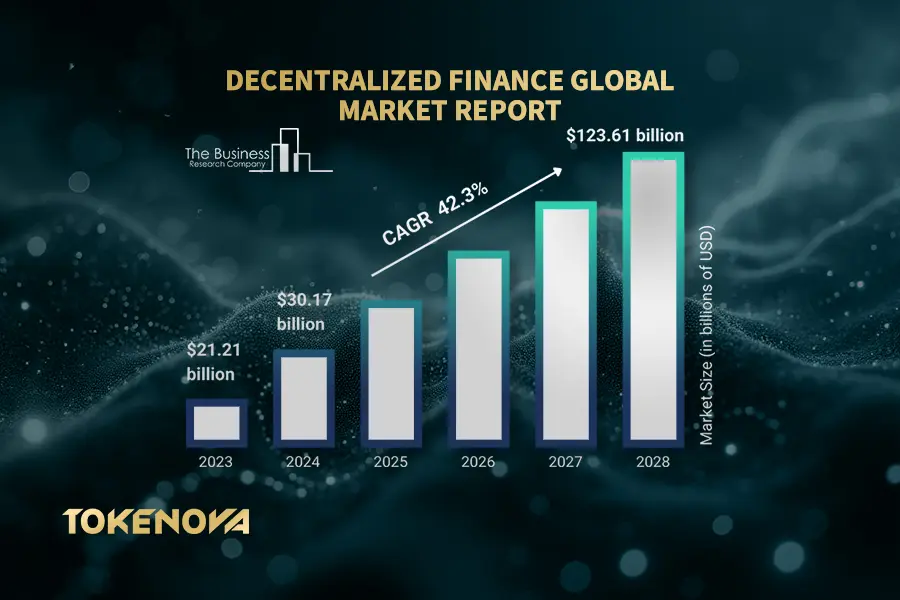

- Market Projections: Experts predict a 46.8% compound annual growth rate (CAGR) for DeFi in the coming decade. This growth is spurred by DeFi innovations like regulatory clarity, better blockchain technology, and increased interest from traditional financial institutions.(source)

Leading Platforms Driving Blockchain Financial Services

The most significant players in DeFi continue to innovate, setting the stage for more accessible and efficient blockchain financial services:

- Ethereum: As the pioneer, Ethereum remains the backbone of DeFi, with layer-2 solutions like zkRollups and Optimistic Rollups enhancing its scalability and reducing transaction costs.

- Binance Smart Chain (BSC): Known for low transaction fees and Ethereum compatibility, BSC is a haven for developers and users seeking cost-effective solutions.

- Polygon: By enabling interoperability and scalability, Polygon connects various blockchain networks, streamlining asset transfers and communication between platforms.

Emerging DeFi Innovations and Predictions

New contenders like Solana and Avalanche are redefining the DeFi landscape, offering unparalleled transaction speeds and reduced costs. As these platforms gain traction, they foster a competitive environment where decentralized financial services become more robust, inclusive, and user-friendly.

The current state of decentralized finance reflects its journey from an experimental phase to a scalable and innovative ecosystem poised to revolutionize traditional financial systems. With technological advancements and a growing user base, the future looks incredibly promising.

Technological Advancements Driving DeFi

The next generation of decentralized finance (DeFi) relies on three core pillars: scalability, intelligence, and automation. These innovations are addressing persistent challenges, shaping a more efficient and accessible financial ecosystem.

Solving Scalability Challenges

Scalability is a key hurdle for DeFi’s mass adoption, but several groundbreaking solutions are paving the way. Sharding is a major breakthrough that divides blockchain networks into smaller sections, allowing parallel transaction processing. For example, Ethereum’s upcoming sharding upgrade aims to significantly enhance its capacity.

Layer 2 solutions like Optimistic Rollups and zkRollups are another vital innovation. These technologies speed up transactions and cut costs by processing data off-chain while preserving blockchain security. Leading platforms such as Arbitrum and Polygon are already using these methods to handle higher transaction volumes. Similarly, sidechains like xDai operate alongside main networks, offering fast and stable transactions for specific use cases.

Together, these advancements create the infrastructure needed for DeFi to handle growing demand without compromising efficiency or security.

How AI is Transforming DeFi

Artificial intelligence (AI) is reshaping DeFi by introducing intelligence and automation into its processes. In decentralized lending, AI-powered tools can analyze on-chain data to predict borrower creditworthiness, enhancing loan security and reliability.

Smart contracts also benefit from AI, which automates complex financial operations, reduces errors, and optimizes transaction costs. For users, predictive analytics driven by AI deliver real-time insights into market trends, helping them make informed investment decisions based on historical and live data.

By making decentralized platforms smarter and more intuitive, AI is opening the doors for broader participation in DeFi.

Ethereum and Emerging Competitors

Ethereum remains the backbone of DeFi, hosting most decentralized applications (dApps) and major protocols like Uniswap and MakerDAO. However, its popularity has led to congestion and high fees, prompting innovative solutions. Layer 2 technologies such as Optimistic Rollups and zkRollups are helping Ethereum handle transactions more efficiently and cost-effectively.

Meanwhile, emerging blockchains like Solana, Avalanche, and Binance Smart Chain are gaining traction by offering faster transaction speeds and lower fees. These alternatives are fostering a competitive, multi-chain ecosystem. Additionally, interoperability solutions like Polkadot and Cosmos allow seamless communication between blockchains, enabling liquidity sharing and reducing fragmentation.

Smarter and More Adaptable Smart Contracts

Smart contracts remain central to DeFi, enabling automated, trustless financial transactions. Recent advancements are making them even more flexible. Composable protocols allow developers to integrate features from multiple platforms, creating complex financial products like earning yield while using the same assets as collateral.

Upgradable smart contracts ensure that platforms can adapt to changing market conditions without disrupting operations. This adaptability keeps DeFi protocols responsive and user-focused.

Prioritizing Privacy

As DeFi grows, privacy is becoming increasingly important. Innovations like zero-knowledge proofs (ZKPs) verify transactions without exposing sensitive details, striking a balance between privacy and transparency.

Private smart contracts add another layer of confidentiality by ensuring that transaction logic and data remain secure and hidden from public access. These developments provide users with greater control over their information while maintaining the trustless nature of DeFi.

Regulatory Landscape and Its Impact on the Future of Decentralized Finance

The future of decentralized finance (DeFi) depends heavily on how regulatory frameworks evolve. Striking a balance between innovation and compliance will shape whether DeFi becomes a mainstream financial system or remains confined to niche markets. This article explores the current regulations, anticipated changes, and their impact on DeFi innovations and the broader ecosystem of blockchain financial services.

Current Regulations Affecting Decentralized Finance

Governments worldwide are taking varied approaches to DeFi regulation, reflecting its complexity and novelty. These efforts aim to bring accountability and protection to users while addressing systemic risks.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements

To combat illicit activities like money laundering, many jurisdictions are mandating that DeFi platforms implement AML and KYC processes. For example, the European Union’s AMLD5 requires crypto exchanges to register with local authorities and adhere to stringent compliance measures.

Consumer Protection

Regulators are introducing frameworks to protect users from fraud and malpractice. These measures include requiring clear terms of service, transparent trading practices, and effective dispute-resolution mechanisms. In the U.S., agencies like the SEC are actively setting these rules to enhance user trust.

Taxation Policies

Tax authorities are developing clear guidelines to ensure users report earnings from DeFi activities such as staking and yield farming. For instance, the IRS in the United States has updated forms to include crypto-related income, signaling an increased focus on taxing blockchain financial services.

Anticipated Regulatory Changes in Decentralized Finance

As DeFi matures, several key changes in regulations are anticipated to address its growing adoption and complexity.

Standardized Global Guidelines

There is a push for international organizations to create unified regulations. This would simplify compliance for DeFi projects operating across borders, fostering global blockchain financial services interoperability.

Licensing Requirements

Regulators may require licenses for DeFi services like lending platforms. Licensing will ensure these platforms meet specific standards for security, operational transparency, and capital reserves, creating a safer environment for users.

Expanded Tax Policies

Tax authorities worldwide are expected to issue detailed guidelines on how to classify and report DeFi activities. This includes clearer definitions of taxable events, such as staking rewards and yield farming income, ensuring users can comply with local tax laws.

Regional Differences in DeFi Regulation

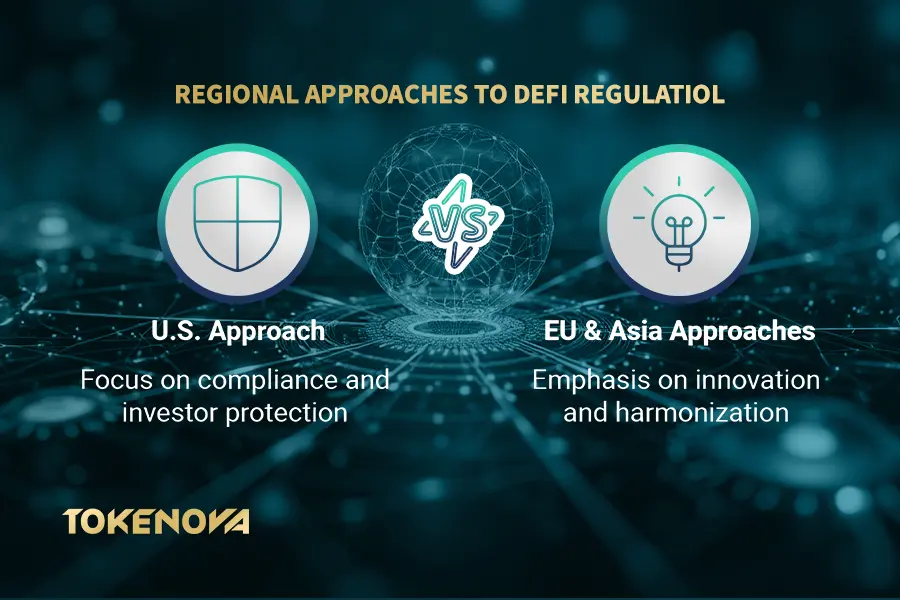

The future of decentralized finance faces a fragmented regulatory landscape, with different regions taking varied approaches:

United States

U.S. regulators, including the SEC and CFTC, are defining rules focusing on investor protection and preventing illegal activities. DeFi platforms operating in the U.S. must comply with AML, KYC, and tax reporting requirements.

European Union

The EU is introducing the Markets in Crypto-Assets (MiCA) regulation to harmonize rules across member states. MiCA aims to provide clear guidelines for blockchain financial services, enhancing trust and fostering growth in the region.

Asia

Countries like Singapore and Japan are adopting innovation-friendly approaches to regulation. For example, Singapore supports DeFi development through a proactive regulatory framework while maintaining safeguards to protect users.

Balancing Innovation and Compliance in DeFi

Regulatory frameworks must strike the right balance to foster growth without stifling innovation. Over-regulation risks slowing development, while under-regulation could lead to fraud and loss of trust in DeFi platforms.

Collaborative Approaches

Regulatory sandboxes allow DeFi projects to test new products under the supervision of authorities. This collaboration ensures that platforms innovate responsibly while addressing compliance concerns.

Transparency and Self-Regulation

DeFi platforms can proactively build trust by adopting internal compliance measures, such as regular audits and transparent governance processes. Self-regulation can also help projects align with legal standards without waiting for external mandates.

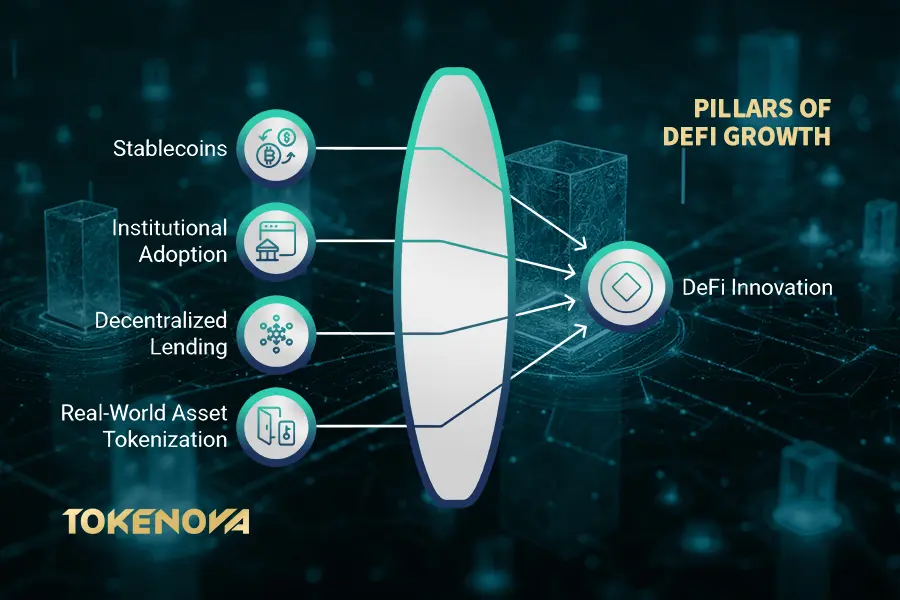

Emerging Trends in Decentralized Finance

The future of decentralized finance (DeFi) is being shaped by groundbreaking DeFi innovations that are redefining traditional finance and driving global adoption. From stablecoins to institutional adoption, these trends highlight DeFi’s transformative potential in blockchain financial services.

Stablecoins: The Backbone of DeFi

Stablecoins are indispensable in DeFi, providing stability and reducing volatility risks in transactions.

Growing Usage

Stablecoins like USDC, USDT, and DAI dominate DeFi transactions, enabling seamless lending, borrowing, and trading. Platforms like Uniswap rely on stablecoin pairs to maintain liquidity and reduce risk for traders. On decentralized exchanges (DEXs) and lending protocols, stablecoins act as collateral and facilitate cross-border transactions, cementing their role in the ecosystem.

Enhanced Stability

Innovations in algorithmic and collateralized stablecoins are increasing resilience:

- Algorithmic stablecoins like Frax dynamically adjust supply to maintain their value peg.

- Collateralized stablecoins such as DAI lock excess crypto assets to ensure stability even during volatile market conditions.

Hybrid models are emerging, combining algorithmic mechanisms with collateralization to enhance reliability.

Institutional Adoption of DeFi

Traditional financial institutions are embracing DeFi for its high yields and transparent infrastructure.

High-Yield Opportunities

Mechanisms like staking and liquidity provision offer competitive returns, attracting institutional investors. For instance, liquidity provision on platforms like Curve enables institutions to earn fees while supporting stablecoin trading pairs.

Transparent Infrastructure

DeFi’s blockchain-based transparency appeals to institutions by reducing risks associated with opaque financial systems. Smart contracts automate processes, cutting costs and improving security. Increasing regulatory clarity is also encouraging institutional engagement.

Decentralized Lending and Borrowing

DeFi lending protocols are transforming access to capital by bypassing traditional credit systems.

Accessibility

Platforms like Aave and Compound enable borrowing without credit checks, using crypto assets as collateral. This approach provides global access to credit, especially in underbanked regions, supporting DeFi’s goal of inclusivity.

Innovative Features & Protocols of DeFi Lending

- Flash Loans: Instant, collateral-free loans repaid within a single transaction for arbitrage and portfolio rebalancing.

- Dynamic Interest Rates: Real-time rate adjustments based on supply and demand.

- Multi-Asset Collateral: Combining assets to diversify risk and increase borrowing capacity.

Other Noteworthy Trends

DAO Governance

Decentralized autonomous organizations (DAOs) are shaping DeFi governance, allowing token holders to decide on protocol upgrades and operations. Examples include MakerDAO and Aave, which empower communities in decision-making.

Cross-Chain Interoperability

Projects like Polkadot and Cosmos enable seamless transactions across blockchains, fostering a unified DeFi ecosystem and expanding access to multiple protocols.

Real-World Asset Tokenization

DeFi is tokenizing real-world assets, such as real estate, enabling fractional ownership and improving liquidity in traditionally illiquid markets.

A Scalable and Inclusive Future

These decentralized finance trends are propelling DeFi into the mainstream. From stablecoins to tokenized assets, DeFi innovations and predictions point toward a scalable, transparent, and inclusive financial ecosystem that continues to redefine global finance.

Opportunities for Growth and Expansion in Decentralized Finance

DeFi innovations are positioning DeFi as a vital component of blockchain financial services and the global financial landscape.

Interoperability: Building a Unified Financial Ecosystem

Interoperability is crucial for DeFi’s scalability and success, enabling seamless interaction between blockchains and expanding liquidity across platforms.

Cross-Chain Protocols

Technologies like Polkadot and Cosmos are paving the way for blockchain interoperability. Polkadot’s parachain system connects blockchains to share security, liquidity, and resources, while Cosmos uses its Inter-Blockchain Communication (IBC) protocol to facilitate asset transfers across independent blockchains. These advancements eliminate the need for centralized intermediaries, ensuring a more integrated DeFi ecosystem.

Unified Ecosystem

A unified ecosystem allows for seamless user experiences by reducing fragmentation within the DeFi space. Developers can create multi-chain applications that leverage the strengths of Ethereum, Binance Smart Chain, and Solana, offering users a single platform to manage cross-chain assets effectively.

Liquidity Sharing

Interoperability supports liquidity sharing, enabling deeper asset pools across blockchains. This reduces inefficiencies, enhances price stability, and boosts the functionality of decentralized exchanges and lending platforms.

DeFi’s Role in Emerging Markets

DeFi is uniquely positioned to tackle financial inclusion challenges in underbanked regions, providing accessible and affordable financial services.

Financial Inclusion

Platforms like Celo are designed to offer microloans, savings accounts, and peer-to-peer lending, empowering individuals and small businesses in underserved regions. These blockchain solutions eliminate the need for intermediaries, reducing costs and enabling participation in the global economy.

Stablecoin Adoption

Stablecoins pegged to local currencies are pivotal in emerging markets, offering a stable store of value and medium of exchange. For instance, Terra’s region-specific stablecoins allow users to transact and save with minimal fees, bridging the gap between traditional finance and DeFi.

Low-Cost Infrastructure

Operating on decentralized networks, DeFi eliminates the need for physical branches and reduces operational costs. This efficiency enables DeFi platforms to offer loans and remittances at significantly lower rates compared to traditional providers.

Bridging Traditional Finance and DeFi

Integrating DeFi with traditional financial systems is a key opportunity for growth, enabling hybrid financial solutions and institutional participation.

Hybrid Financial Products

Combining DeFi’s efficiency with the stability of traditional finance facilitates the creation of innovative products like decentralized insurance and tokenized mutual funds, catering to diverse investment needs.

Institutional Partnerships

Collaboration between DeFi platforms and traditional financial institutions can accelerate adoption. For example, banks can leverage DeFi protocols to streamline cross-border payments, lower operational costs, and offer decentralized investment opportunities to their clients.

Case Studies: Successful DeFi Projects

Examining the achievements of pioneering decentralized finance (DeFi) platforms provides valuable insights into the strategies and innovations that have shaped the industry. Projects like Uniswap, Aave, and MakerDAO exemplify the transformative impact of DeFi on blockchain financial services.

Uniswap: Revolutionizing Decentralized Trading

Uniswap introduced the automated market maker (AMM) model, eliminating the need for order books and intermediaries. Liquidity providers deposit funds into smart contract-based pools, enabling traders to swap tokens directly against these pools.

- High Liquidity: As of November 2024, Uniswap holds approximately $6.19 billion in total value locked (TVL), ranking it among the top decentralized exchanges (DEXs) by liquidity.

- User-Friendly Interface: Uniswap’s intuitive design and seamless integration with popular wallets have made it accessible to a broad audience, contributing to its widespread adoption.

- Continuous Innovation: The launch of Uniswap V3 introduced features like concentrated liquidity, allowing liquidity providers to allocate capital more efficiently and enhance trading flexibility.

Aave: Transforming Lending and Borrowing

Aave revolutionized DeFi lending by introducing flash loans unsecured loans that must be repaid within a single transaction. This innovation has enabled complex arbitrage opportunities and debt restructuring.

- Flash Loans: Aave’s flash loans allow users to borrow assets without collateral, provided the loan is repaid within the same transaction. This feature has facilitated over $1.7 billion in flash loans since its inception.

- Interest Rate Switching: Aave enables borrowers to switch between fixed and variable interest rates, offering flexibility in loan management.

- Community Governance: Aave’s governance model empowers token holders to vote on key protocol decisions, ensuring decentralized and transparent management.

MakerDAO: Anchoring Stability in DeFi

MakerDAO’s DAI stablecoin demonstrated how algorithmically managed assets could maintain value stability in volatile markets. By collateralizing assets and using smart contracts to adjust parameters dynamically, MakerDAO created a decentralized stablecoin that serves as a cornerstone of the DeFi ecosystem.

- Decentralized Stability: DAI maintains its peg through a robust collateralization system and decentralized governance, offering a stable medium of exchange within DeFi.

- Collateral Diversity: MakerDAO accepts a wide range of collateral types, enhancing the resilience and flexibility of its stablecoin.

- Community Governance: Token holders actively participate in governance, ensuring that decisions reflect the collective interests of the ecosystem.

These case studies highlight the importance of innovation, user-centric design, and community involvement in the success of DeFi platforms. As the industry evolves, these examples provide a blueprint for future ventures aiming to capitalize on the growing trends in decentralized finance.

The Power of Community and Governance in DeFi

The future of decentralized finance (DeFi) depends not only on technological advancements but also on the active involvement of its communities. Decentralized governance ensures transparency, inclusivity, and adaptability, allowing DeFi platforms to evolve in alignment with their users’ collective interests. By empowering participants with a voice in critical decisions, DeFi introduces a model of collaboration that traditional financial systems cannot match.

Why Decentralized Governance Matters

Decentralized governance is a cornerstone of blockchain financial services, shifting control from centralized authorities to communities. This model achieves its goals through several key mechanisms:

Governance Tokens

Governance tokens grant holders the right to vote on platform decisions, ranging from protocol upgrades to resource allocation. The voting influence is often proportional to the number of tokens held, ensuring that stakeholders with a vested interest have a say in shaping the platform’s future. This structure fosters shared accountability and drives meaningful participation.

Transparent Decision-Making

Blockchain technology ensures every proposal and vote is recorded immutably, creating a transparent and verifiable governance process. This openness prevents manipulation and builds trust among participants, as all actions are traceable and auditable.

Community Engagement

Active user involvement is vital to the sustainability of DeFi platforms. By contributing ideas and votes, community members not only influence outcomes but also foster innovation and adaptation. An engaged community drives the continuous evolution of protocols, keeping them competitive and relevant in a dynamic market.

How is Community-Driven Governance Helping Companies?

The impact of decentralized governance can be seen in projects like Aave and Yearn Finance, which exemplify the power of collective decision-making.

Proposal Mechanisms

Aave’s governance model allows users to propose and vote on changes ranging from technical upgrades to liquidity adjustments. These decisions reflect community priorities, ensuring the protocol evolves with its users’ needs.

Strategic Resource Allocation

In Yearn Finance, the community votes on how resources are allocated across development, marketing, and growth initiatives. This decentralized approach prioritizes the needs of the broader user base, ensuring funds are used effectively to maximize impact.

Shaping Strategic Direction

Community involvement ensures that decisions align with user interests and market trends. For example, decisions around integrating with other DeFi protocols or expanding to new blockchain networks are often guided by community input, ensuring relevance and adaptability.

The Benefits of Decentralized Governance for Platforms & Companies

Platforms that adopt decentralized governance reap numerous benefits, solidifying their position in the evolving DeFi landscape:

✅Trust and Transparency: Recording all governance actions on the blockchain instills confidence among users, creating a loyal and engaged community.

✅Resilience to Centralized Failures: Decentralized models reduce the risks associated with corruption or mismanagement, strengthening security and stability.

✅Rapid Adaptation: Communities can respond quickly to changing conditions or technological advancements, ensuring the protocol remains competitive and innovative.

Transform Your DeFi Vision with Tokenova

Ready to lead in the future of decentralized finance? Tokenova equips businesses, institutions, and entrepreneurs with the expertise to unlock the full potential of blockchain financial services. From tokenizing assets to building secure DeFi platforms, Tokenova turns complex challenges into growth opportunities.

Why Tokenova?

- Innovate with Confidence: Develop cutting-edge DeFi solutions tailored to your goals.

- Stay Compliant: Navigate regulations seamlessly with expert insights.

- Secure Your Platform: Protect your operations with industry-leading audits and best practices.

Take the First Step Today

Lead the way in DeFi innovations with solutions designed to drive growth, stability, and differentiation. Contact Tokenova now and position your venture at the forefront of the decentralized revolution.

Expert Guidance to Thrive in DeFi: 6 Valuable Tips

Success in DeFi demands more than capital it requires foresight, strategy, and a willingness to adapt as the market evolves. Consider these strategies to gain an edge:

- Stay Informed: The Future of Decentralized Finance evolves at breakneck speed, so following reputable news outlets, industry thought leaders, and research platforms keeps you ahead of the curve. Subscribe to newsletters, attend webinars, and participate in community forums to stay updated.

- Prioritize Security: Use hardware wallets, enable multi-factor authentication, and verify contract addresses before interacting with protocols. Regularly review project audits, and never share private keys. Implementing robust security measures protects your assets and builds trust.

- Diversify Your Portfolio: Spreading your assets across multiple DeFi platforms reduces risk. Experiment with lending, DEXs, yield farming, and stablecoin staking to identify what best aligns with your goals. Diversification enhances stability and maximizes returns.

- Engage in Community Governance: Acquire governance tokens and participate in votes. By shaping protocol policies, you have a say in your investments’ future and can influence decisions that drive protocol value. Active participation fosters a sense of ownership and influence.

- Research Compliance: Anticipate regulatory changes and adapt accordingly. Working with experts like Tokenova can ensure your strategies remain both profitable and compliant. Understanding regulatory landscapes mitigates legal risks and enhances operational stability.

- Embrace Education: Understand the fundamentals of smart contracts, liquidity pools, and yield optimization. Knowledge is the ultimate resource for successfully navigating DeFi Innovations and Predictions. Continuous learning empowers informed decision-making and strategic planning.

Implementing these expert strategies will position you to thrive in the dynamic and ever-evolving landscape of decentralized finance.

Conclusion

The dawn of decentralized finance reshapes expectations, catalyzes innovation, and inspires a new era of global empowerment. The Future of Decentralized Finance heralds a fundamental shift in how we transact, invest, and manage wealth. DeFi challenges long-standing power dynamics by distributing opportunities more equitably. As regulatory clarity emerges, interoperability improves, and security measures strengthen, the potential for sustained growth and transformative impact becomes undeniable.

Stakeholders be they entrepreneurs, investors, established financial institutions, or everyday users stand at the brink of a financial revolution. By embracing DeFi Innovations and Predictions, staying informed on Decentralized Finance Trends, and leveraging the right partnerships, you can tap into vast new markets, diversify risk, and capitalize on unrivaled efficiency. As we transition into a world where technology, community, and trust converge, it’s not just about succeeding in DeFi; it’s about reimagining the very fabric of finance itself.

Key Takeaways

These concise points highlight the critical lessons and actionable insights from our comprehensive exploration of decentralized finance.

- The Future of Decentralized Finance promises more inclusive, accessible, and globally connected financial systems, overcoming the limitations of traditional finance.

- Decentralized Finance Trends like DAOs, DEXs, and tokenized assets redefine how value is created, managed, and distributed.

- Advances in scalability, AI integration, and improved smart contracts foster DeFi Innovations and Predictions that improve efficiency, security, and user experience.

- Regulatory clarity, combined with responsible innovation, ensures that Blockchain Financial Services gain mainstream acceptance, attracting institutional investors and cautious users.

- Overcoming challenges in security, interoperability, and user experience will unlock further growth, delivering real benefits to businesses, investors, and communities worldwide.

- Engaging with expert consultants like Tokenova can provide strategic advantages, ensuring successful integration and compliance in the evolving DeFi landscape.

Embracing these insights will position you to navigate and thrive in the evolving landscape of decentralized finance.

1. Will emerging DeFi protocols integrate with advanced AI-driven wealth management tools?

Yes. As AI capabilities mature, we expect DeFi platforms to partner with AI-driven wealth management solutions. This can create fully automated portfolios that optimize yields and diversify assets without requiring manual intervention. By blending advanced analytics with transparent Decentralized Finance Trends, users gain sophisticated strategies once reserved for elite financial advisors. AI integration can also enhance personalized financial planning, providing users with tailored investment recommendations based on their risk profiles and financial goals.

2. How might traditional insurance giants interact with DeFi’s risk mitigation products?

Insurance companies can tap into decentralized coverage models to underwrite protocols, smart contracts, or entire ecosystems. By collaborating with DeFi insurance platforms, insurers can access new revenue streams, while DeFi users enjoy more robust safety nets. This synergy can drive DeFi Innovations in insurance products, blending centuries-old risk management expertise with decentralized transparency. Additionally, traditional insurers can leverage blockchain for transparent claims processing and fraud prevention, enhancing the overall reliability and efficiency of insurance services within the DeFi ecosystem.

3. Could DeFi technology reshape the global remittance market?

Absolutely. The remittance industry, plagued by high fees and slow transfers, stands to benefit tremendously. DeFi solutions can streamline cross-border payments using stablecoins, bypassing intermediaries and reducing transaction costs for migrant workers sending money home. Over time, integrating DeFi rails into remittance networks could revolutionize a market worth hundreds of billions of dollars annually. By leveraging blockchain’s efficiency and transparency, DeFi can provide faster, cheaper, and more secure remittance services, enhancing financial inclusion and economic stability for recipients in developing regions.