Are you a crypto investor seeking the next big opportunity, or a project founder looking to enhance your token’s value?

This happens sometimes; the total supply of a cryptocurrency decreases and each remaining coin becomes more valuable due to scarcity. This is the concept of token burning. It involves permanently removing a specific quantity of cryptocurrency tokens from circulation. While it may lead to potential price increases, it’s important to ask whether token burning is a legitimate strategy for long-term value creation or a tactic for market manipulation. Understanding its impact on market prices is crucial for navigating the volatile crypto landscape.

In this guide, we will explore the mechanics of token burning, the different methods used by various projects, and the reasons behind implementing it. We will also address the potential drawbacks and the risk of exploitation for illicit purposes. By the end, you will have a clearer understanding of token burning, its advantages, and its risks, enabling you to make informed investment decisions.

Understanding Token Burns

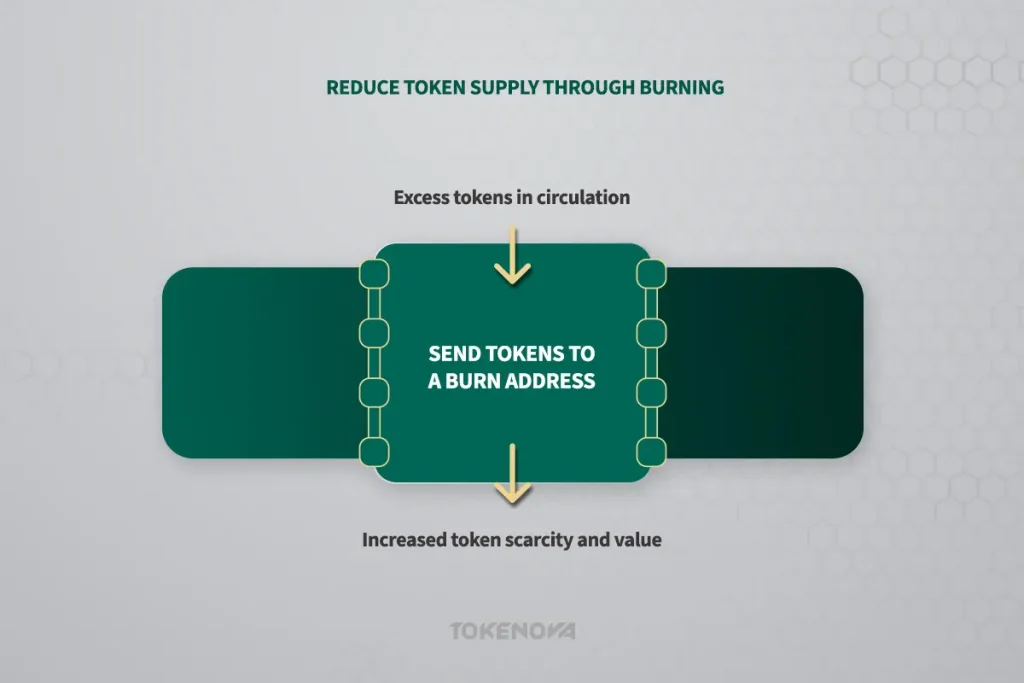

At its core, the concept of token burning is relatively simple to grasp: it’s about permanently reducing the number of cryptocurrency tokens available in the market. The execution of this concept, however, relies on a critical technological element: the burn address. Think of a burn address as a digital dead-end for cryptocurrency tokens. Once tokens are sent to this address, they become irretrievable and unusable, effectively taken out of the circulating supply forever. This action directly influences the scarcity of the remaining tokens, a key factor in their potential value.

The Indispensable Role of Burn Addresses

The legitimacy and effectiveness of token burning are linked to the security and verifiability of the burn address. These addresses are specifically engineered to be unspendable, guaranteeing that no individual, including the project’s founders or developers, can ever access or recover the tokens sent there. A defining characteristic of a legitimate burn address is that the private key associated with it is either demonstrably non-existent, intentionally destroyed, or generated through a process that makes its discovery computationally infeasible.

Furthermore, and crucially for transparency, transactions directed to these burn addresses are permanently recorded on the blockchain, providing an immutable and publicly accessible record of the burn event. Anyone can independently verify on the blockchain that the specified number of tokens has indeed been sent to the designated burn address and are therefore no longer part of the circulating supply. This transparency is vital for maintaining community trust and preventing accusations of hidden agendas or fraudulent activities.

Token Burning Methods

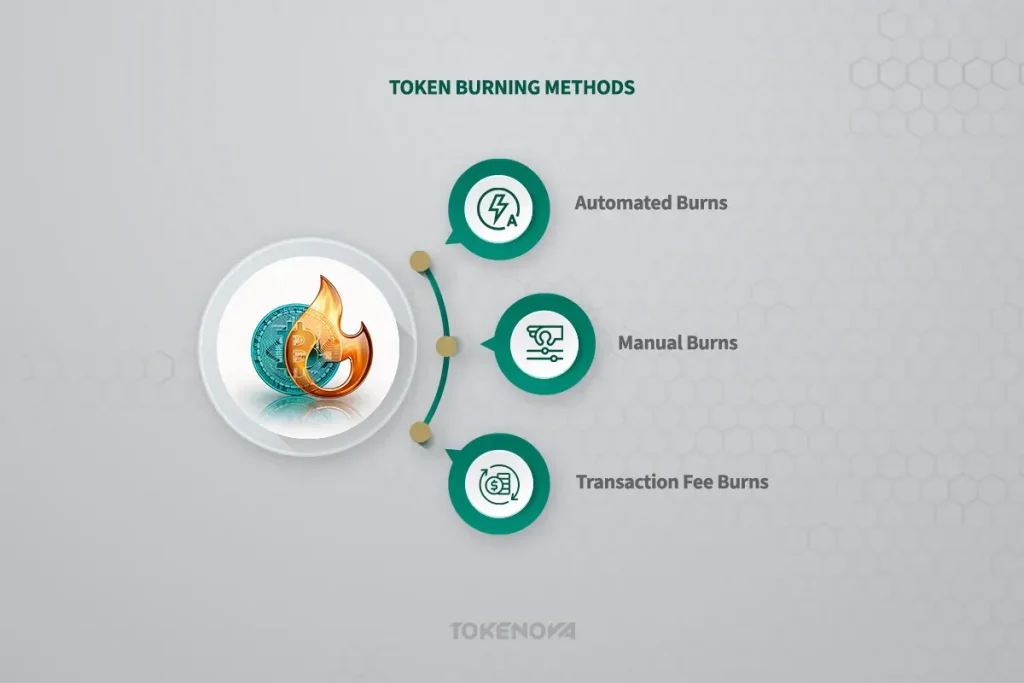

The methods by which projects implement token burning can vary considerably, reflecting their unique strategic objectives, technological infrastructure, and community engagement models. Let’s explore some of the most prevalent approaches employed in the cryptocurrency space.

Manual Token Burns

One of the most straightforward methods is the manual burn, where the project team intentionally and directly initiates the burning process. These burns are often pre-announced to the community and may occur at predetermined intervals, such as quarterly burns, or be triggered by specific, pre-defined events, like achieving a certain trading volume milestone or reaching a significant development benchmark. For example, Binance Coin (BNB) has become well-known for its consistent quarterly burns.

Binance publicly announces these burns in advance, typically providing detailed information about the exact amount of BNB to be burned and the specific rationale behind the decision. This scheduled and transparent approach is designed to foster trust within the community and allows investors to anticipate these events, potentially influencing market sentiment. Recent trends indicate that projects are increasingly adopting community-driven manual burns to enhance transparency and engage token holders in decision-making processes.

Automated Token Burns

The advancements in blockchain technology have facilitated the automation of token burning through the use of smart contracts. These self-executing contracts are programmed with specific conditions that, when met, automatically trigger a burn event without the need for manual intervention. For instance, a smart contract could be designed to automatically burn a fixed percentage of tokens each time a new user successfully registers on the platform or when the total trading volume on a decentralized exchange surpasses a predefined threshold.

This method not only eliminates the need for manual execution but also enhances transparency and predictability. The rules governing the burn process are immutably encoded within the smart contract’s code and are publicly auditable on the blockchain, ensuring that no hidden changes or manipulations can occur without being detected by the community. Notably, automated burns are becoming more prevalent as they are perceived as fairer and more efficient compared to manual methods.

Transaction Fee Burning

A particularly innovative and increasingly popular application of token burning is the mechanism of burning transaction fees. In this model, a predetermined portion of the fees paid by users for conducting transactions on the network is automatically sent to a burn address, effectively and permanently removing those tokens from the circulating supply. Ethereum’s implementation of EIP-1559 serves as a prominent example of this approach.

With each transaction processed on the Ethereum network, a base fee is algorithmically determined and subsequently burned. This creates a direct and dynamic relationship between the level of network activity and the deflationary nature of the token. During periods of high network congestion and increased transaction volume, a greater quantity of ETH is burned, leading to a faster reduction in the overall supply. This mechanism has profound implications for Ethereum’s long-term tokenomics and its potential as a store of value

Reasons Behind Token Burns

Cryptocurrency projects implement token burning for a variety of strategic reasons, often with the overarching goal of enhancing the value proposition of their token and fostering the long-term health and sustainability of their ecosystem. Let’s examine some of the primary motivations driving this practice.

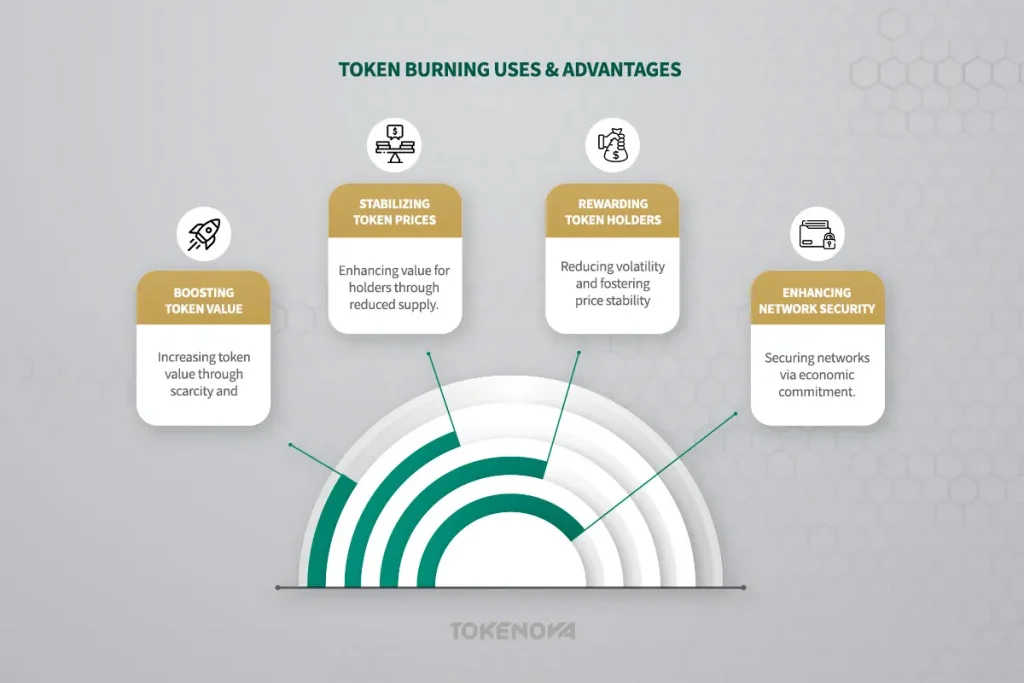

Boosting Token Value

Perhaps the most frequently cited reason for implementing token burning is the potential to drive an increase in the value of the remaining tokens. By permanently reducing the total number of tokens in circulation, the fundamental economic principle of scarcity comes into play. If the demand for the token remains constant or, ideally, increases while the available supply diminishes, the price of each individual token is likely to rise. This is a direct application of basic supply and demand dynamics. Consider the example of rare collectibles – their value is often significantly higher due to their limited availability. Token burning aims to replicate this effect in the digital realm, creating artificial scarcity to potentially boost value.

Stabilizing Token Prices

The cryptocurrency market is well-known for its inherent volatility, which can be a significant barrier to wider adoption. Token burning can be strategically employed as a tool to manage the token’s supply and potentially mitigate drastic and unpredictable price fluctuations. By strategically burning tokens, projects can attempt to counteract inflationary pressures or dampen excessive price swings, thereby fostering a more stable and predictable trading environment for investors. This can be particularly important for projects seeking mainstream adoption or those whose tokens are intended for use in stable economic systems.

Rewarding Token Holders

Token burning can be perceived as a mechanism to directly reward the existing holders of the token. As the total supply of the token decreases, each remaining token represents a proportionally larger share of the overall network or project. This increased scarcity can translate directly into price appreciation, thus benefiting those who have chosen to hold the token. It serves as a way for projects to incentivize long-term holding and demonstrate their commitment to their early supporters and the overall community. The underlying principle is that by reducing the total “pie,” each individual “slice” becomes larger and more valuable.

Enhancing Network Security

While less common than other applications, token burning plays a foundational role in the Proof-of-Burn (PoB) consensus mechanism. In PoB, instead of relying on energy-intensive computational power as in Proof-of-Work (PoW) systems, participants “burn” a certain amount of their tokens to demonstrate their commitment to the network and earn the right to validate transactions and create new blocks. The act of burning tokens represents an economic cost incurred by the validators, thereby incentivizing honest behavior and contributing to the overall security and integrity of the network. This “skin in the game” approach aligns the financial interests of the validators with the long-term health and stability of the blockchain.

Token Burning in Practice

To gain a deeper understanding of the practical implications of token burning, let’s examine several prominent examples of cryptocurrency projects that have successfully integrated this mechanism into their tokenomics.

Binance Coin (BNB)

Binance Coin (BNB), the native utility token of the world’s largest cryptocurrency exchange, Binance, offers a compelling and well-documented case study in the application of token burning. Binance has made a long-term commitment to burning BNB tokens on a quarterly basis. They utilize a portion of their profits generated from trading fees and other services to buy back BNB from the open market and subsequently and permanently remove these tokens from circulation. Their publicly stated long-term objective is to reduce the total supply of BNB by 50% from its initial issuance. This consistent, pre-announced, and transparent approach to token burning has been widely recognized as a significant contributing factor to the sustained appreciation of BNB’s value over time.

- BNB Auto-Burn Mechanism: As of December 2021, Binance introduced the BNB Auto-burn mechanism, which automatically adjusts the burn amount based on BNB’s price and supply-demand dynamics. This system aims to provide greater transaction transparency and predictability using on-chain information from Binance Smart Chain (BSC) to calculate the amount needed to burn BNB.

- Quarterly Token Burns: The exchange has burned billions of dollars worth of BNB, pursuing its goal of reducing the token’s total supply by 50%. The latest burn occurred in October 2024, eliminating approximately 1.07 billion BNB.

- Real-Time Burning Mechanism: Additionally, since November 2021, Binance implemented the BEP-95 mechanism, which allows for real-time burning of a portion of gas fees collected by validators from each block produced on average every three seconds. This mechanism continues even after reaching the target of 100 million tokens.

- Transparency and Auditability: The auto-burn process is designed to be independently auditable and objective, ensuring that figures are reported quarterly and are independent of revenues generated on Binance’s centralized exchange.

Ethereum (ETH)

Ethereum’s implementation of EIP-1559 as part of the London Hard Fork on August 5, 2021, marked a significant evolution in its tokenomics. Prior to this upgrade, transaction fees paid by users on the Ethereum network were entirely awarded to the miners who validated transactions. EIP-1559 introduced a fundamental change by establishing a base fee for transactions, which is algorithmically determined based on network congestion. This base fee is then automatically burned, effectively removing it from the circulating supply of ETH.

This mechanism establishes a direct and dynamic correlation between the level of activity on the Ethereum network and the rate at which ETH is burned. During periods of high demand and increased transaction volume, a greater amount of ETH is burned, potentially leading to situations where more ETH is burned than is created through block rewards, making ETH a deflationary asset. Data on the total amount of ETH burned can be tracked through various on-chain analytics platforms.

Shiba Inu (SHIB)

Shiba Inu (SHIB), a popular meme-inspired cryptocurrency, provides an interesting example of token burning with significant contributions from its vibrant and active community. While the official Shiba Inu development team also conducts token burns, a substantial portion of the total SHIB burned has been initiated and executed by members of the SHIB community. These community-led burns often involve individuals or groups purchasing SHIB tokens from the open market and then voluntarily sending those tokens to publicly known burn addresses, effectively removing them from circulation.

Recently, over 1.7 billion SHIB tokens were burned in late 2024, significantly reducing its circulating supply and reigniting market optimism for 2025. These burn events are often publicized across social media platforms, demonstrating the community’s commitment to reducing the token’s massive initial supply. News outlets like CoinDesk frequently report on the burn rates and community initiatives surrounding SHIB, emphasizing that the burn rate surged by 1500%, with over 30 million tokens burned in just 24 hours. This highlights the potential for decentralized and community-driven efforts to influence a cryptocurrency’s tokenomics.

Potential Downsides

While token burning can offer several potential benefits to cryptocurrency projects and their communities, it’s crucial to acknowledge and critically examine the potential risks and criticisms associated with this practice to gain a balanced and informed perspective.

Concerns About Market Manipulation

One of the primary concerns surrounding the practice of token burning is the potential for it to be used as a tool for market manipulation. Unscrupulous projects or individuals could strategically time burn events to coincide with aggressive marketing campaigns, positive news announcements (whether genuine or fabricated), or other promotional activities, creating an artificial and potentially unsustainable surge in the token’s price.

This can mislead unsuspecting investors into believing that there is strong organic demand for the token, potentially leading to classic “pump and dump” schemes where early participants profit significantly at the expense of those who buy in later at inflated prices. Maintaining a high degree of transparency and consistent communication regarding burn plans and their rationale is absolutely essential to mitigate these risks and maintain investor confidence.

The Imperative of Transparency

For token burning to be perceived as a legitimate and beneficial practice by the cryptocurrency community, a high degree of transparency is absolutely paramount. Projects must be fully transparent in communicating their burn strategies, including the specific reasons behind each burn, the exact quantity of tokens to be burned, the planned schedule for burns (if applicable), and the methodology used to determine the burn amount. Critically, projects must provide verifiable and auditable proof of each burn event by publicly sharing the transaction hashes of the tokens sent to the designated burn addresses on the blockchain. Any lack of transparency or ambiguity in the burn process can quickly erode community trust and fuel suspicions of hidden agendas or malicious intent.

Navigating Regulatory Scrutiny

As the cryptocurrency industry continues to mature and gain mainstream attention, regulatory bodies around the world are increasingly scrutinizing various practices within the space, including token burning. Regulators are primarily concerned with the potential for market manipulation and the need for robust investor protection. Depending on the specific jurisdiction and the characteristics of the token in question, token burning activities could potentially attract regulatory scrutiny. Projects operating in this space must remain vigilant and informed about the evolving regulatory landscape in their respective jurisdictions and ensure that their token burning practices comply with all applicable laws, rules, and guidelines to avoid potential legal and financial repercussions.

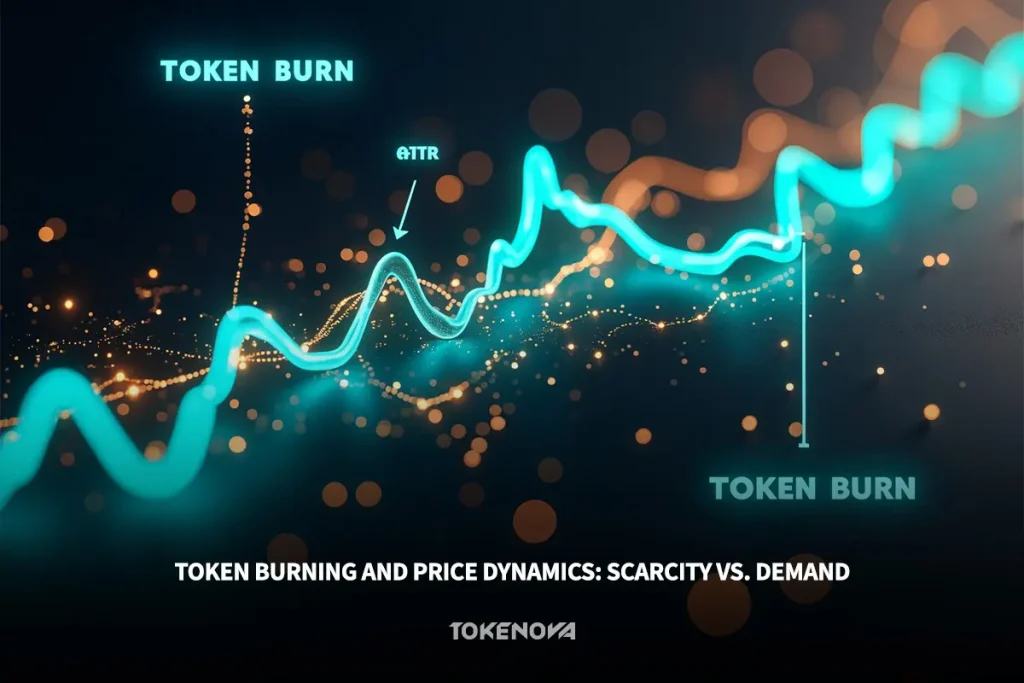

Impact on Pricing

The most immediate and direct consequence of token burning is its impact on the fundamental economic principle of supply and demand. By permanently removing tokens from circulation, burning tokens decreases the total supply of that cryptocurrency. Assuming that the demand for the token remains constant or, more ideally, increases, this reduction in the available supply can lead to upward pressure on the price of the remaining tokens. This is a core tenet of basic economics: when the supply of a desirable good decreases while demand stays the same or rises, the price tends to increase.

The Psychological Impact of Scarcity

Beyond the straightforward mechanics of supply reduction, token burning can also exert a significant psychological influence on investors and the broader market sentiment. Announcing a planned or executed token burn can serve as a powerful signal to the market that the project team is genuinely committed to increasing the value of the remaining tokens for its holders. This positive signal can boost investor confidence, create a sense of scarcity and urgency (often referred to as FOMO, or Fear Of Missing Out), and potentially drive increased demand for the token. The perception of scarcity, even if artificially induced, can be a potent catalyst in the often emotionally driven cryptocurrency markets.

The Crucial Role of Demand

It is absolutely crucial to understand that token burning, in isolation, is not a guaranteed formula for price appreciation. While reducing the supply is one critical component of the equation, the other equally important factor is sustained or increasing demand for the token. If there is little to no genuine demand for a particular cryptocurrency, even a substantial and well-executed token burn may not result in a significant or sustained increase in its price. The project’s underlying utility, its real-world adoption rate, the strength and engagement of its community, and the overall sentiment of the broader cryptocurrency market all play vital roles in driving demand and ultimately determining the success of a token burning strategy.

Token Burning and Market Makers

When the total supply of a cryptocurrency decreases due to token burning, it can potentially have an impact on the market’s liquidity, which refers to the ease with which an asset can be bought or sold without significantly affecting its price. With fewer tokens available for trading, the spread between the highest price a buyer is willing to pay (the bid) and the lowest price a seller is willing to accept (the ask) might widen. This can make it more challenging and potentially more costly to execute large trades without causing significant price slippage.

Market makers, who are entities that provide liquidity to the market by placing buy and sell orders, play a crucial role in mitigating these potential liquidity issues. They help to ensure a smoother and more efficient trading environment, even in the face of supply reductions caused by token burning. Recent examples include Fetch AI’s plan to burn 5 million tokens on January 10, 2025, aimed at enhancing their value by creating scarcity in the market.

Strategies for Price Stability

Market makers employ a variety of sophisticated trading strategies to maintain price stability and ensure sufficient liquidity in the market when token burning occurs. They closely monitor publicly announced burn schedules and attempt to anticipate the potential impact on supply and demand. For instance, they might strategically increase their buy orders in anticipation of potential price increases resulting from the reduced supply.

Their primary objective is to facilitate continuous trading and prevent excessive price volatility, ensuring a more orderly and predictable market reaction to burn events. Their actions help to smooth out price fluctuations and provide a more stable trading environment for all participants. Market makers achieve this by continuously quoting buy and sell prices, which reduces the spread between bid and ask prices, ultimately making it easier for traders to execute orders efficiently.

Potential for Market Manipulation

The potential for market manipulation through token burning remains a significant concern that requires careful scrutiny and vigilance from both regulators and the cryptocurrency community. Unscrupulous actors could exploit this mechanism for illicit financial gain, as token burns can be used to create an illusion of scarcity, thereby influencing market dynamics without genuine demand. Without transparency and a solid rationale, these burns may appear as tactics to artificially inflate prices, leading to potential exploitation by influential players.

The Risk of Artificial Price Inflation

In 2024, several projects have been accused of using token burns as tools for pump-and-dump schemes. For instance, the SEC charged Minerco Inc. with conducting a large token burn while simultaneously promoting the token on social media, resulting in a 300% price increase followed by a crash. This incident has intensified calls for stricter regulations and transparency in token burning practices. Insiders with privileged information about these planned events could capitalize on this artificial price inflation by selling their holdings at inflated prices before the market corrects, leaving unsuspecting investors who bought at the peak with significant losses. This situation underscores the inherent danger of artificial price inflation driven by manipulative token burning practices and highlights the need for robust oversight and investor education.

Regulatory Scrutiny

Regulatory authorities worldwide are increasingly focusing on how token burns are utilized by cryptocurrency projects and whether these practices fall under market manipulation definitions. The overarching objective of this increased scrutiny is to protect retail investors from deceptive practices and ensure the overall integrity and transparency of cryptocurrency markets. As the industry matures and attracts greater mainstream participation, increased regulatory oversight and clear guidelines regarding token burning are anticipated to emerge.

Regulation M: A Potential Framework

While Regulation M was initially designed to govern traditional securities offerings, its core principles offer valuable insights into how regulatory bodies might approach the oversight of token burning in the cryptocurrency space to prevent manipulative activities and protect investors.

Purpose and Scope

The fundamental purpose of Regulation M is to prevent market manipulation during securities offerings by establishing restrictions on the activities of individuals and entities involved in the distribution process. Although not directly applicable to all instances of token burning in the cryptocurrency market, its underlying principles of preventing artificial price inflation and ensuring a fair and transparent market for all participants are highly relevant and could inform future regulations in the crypto space. Cryptocurrency burning involves removing tokens from circulation, which can theoretically increase demand and price by limiting supply.

Key Provisions

Here are some key provisions of Regulation M and how their underlying principles could potentially be applied to the context of token burning in the cryptocurrency ecosystem:

- Rule 101: This rule restricts underwriters and broker-dealers involved in a securities distribution from bidding for or purchasing the security during a specific period before the offering is complete. Applying this principle to token burning could mean restricting project developers or their affiliated entities from buying back their own tokens in the open market shortly before or after a planned burn event, as this could artificially inflate the price and mislead investors.

- Rule 102: This rule governs the activities of the issuers of securities and any selling security holders, imposing similar restrictions to those outlined in Rule 101. In the context of token burning, this could translate to restrictions on promotional activities or sales of tokens by the issuing entity or its insiders around the time of a burn event, preventing them from profiting from potentially artificial price increases.

- Rule 104: This rule pertains to stabilization activities, which are actions taken to prevent or retard a decline in the market price of a security. While token burning is not precisely a stabilization activity, the principle of transparency and providing public information about activities that could significantly influence the price of a token is relevant. Applying this to token burning could mean requiring projects to disclose detailed information about their burn plans well in advance.

Relevance to Token Burning

While Regulation M is not currently directly enforceable for most cryptocurrencies, its core tenets of preventing artificial price manipulation, ensuring fair and equal access to information for all market participants, and promoting overall market integrity are highly relevant to the practice of token burning. As regulatory frameworks for the cryptocurrency industry continue to develop and mature, the fundamental principles embodied in Regulation M are likely to inform the approach taken by regulatory authorities in overseeing practices like token burning.

Understanding these principles can guide cryptocurrency projects in implementing token burning strategies in a responsible, ethical, and transparent manner, minimizing the risk of manipulation and fostering greater trust and confidence within the community.

Expert Perspectives

To gain a more comprehensive and nuanced understanding of the complexities surrounding token burning, it’s valuable to consider the perspectives of respected analysts and thought leaders within the cryptocurrency industry. For instance, Willy Woo, a well-known on-chain analyst, has frequently discussed the impact of supply shocks on cryptocurrency prices, particularly in relation to Bitcoin. His insights suggest that supply dynamics play a crucial role in price fluctuations, which is directly relevant to the effects of token burning. Recently, Woo has emphasized that the current market dynamics are significantly different from previous cycles, reflecting on how retail investor behavior impacts overall market supply and demand.

Furthermore, reports and analyses from blockchain analytics firms like Glassnode provide empirical evidence regarding token burns and their effects on various metrics. These firms often highlight how token burns can lead to reduced supply, potentially driving up demand and influencing price movements. For example, as of Q3 2024, the WOO token ecosystem has burned approximately 772 million tokens, which accounts for about 26% of its total supply. This strategic reduction in supply is aimed at enhancing the token’s value proposition and aligning with decentralized governance goals.

Pro Tips for Investors

When evaluating cryptocurrency projects that utilize token burning as part of their tokenomics, consider these actionable insights and due diligence steps to make more informed investment decisions and mitigate potential risks:

1️⃣Independently Verify the Burn Transaction: Always take the time to independently verify that the claimed token burn has actually occurred by checking the relevant blockchain explorer. Look for the transaction hash (a unique identifier for the transaction) and confirm that the tokens were indeed sent to a publicly known and verifiable burn address (an address with no known private key).

2️⃣Thoroughly Assess the Level of Transparency: Carefully evaluate how transparent the project is regarding its token burning plans and execution. Are the burns announced well in advance? Is the rationale behind the burns clearly and logically explained? Does the project provide verifiable proof of the burns on the blockchain? Lack of transparency should be a significant red flag.

3️⃣Consider the Broader Context of the Burn: Analyze whether the token burning strategy appears to be a well-integrated part of a broader, sustainable growth strategy for the project, or if it seems like an isolated event primarily aimed at generating short-term price speculation. A holistic and strategic approach is generally more indicative of a healthy project.

4️⃣Don’t Solely Focus on Token Burns: While token burning can be a positive factor, it should not be the sole basis for your investment decision. Conduct thorough research into the project’s underlying fundamentals, including its technology, team, use case, adoption rate, and the strength of its community. A strong project with solid fundamentals is more likely to succeed in the long run, regardless of its token burning strategy.

5️⃣Be Wary of Red Flags and Potential Manipulation: Exercise caution and be skeptical of projects that heavily promote token burns without providing clear and logical justification or verifiable evidence. Be particularly wary of projects where the timing of burns seems suspiciously correlated with marketing pushes or other promotional activities, as this could be an indication of potential market manipulation.

Elevate Your Crypto Strategy with Tokenova

Navigating the crypto landscape can be complex, but you don’t have to do it alone. At Tokenova, we’re here to help you unlock the full potential of your project.

- Optimize Tokenomics: From token burns to supply management, we help design strategies that drive value and sustainability.

- Stay Compliant: Keep up with evolving regulations and implement transparent practices to build trust.

- Maximize Impact: Leverage data-driven insights to enhance market performance and investor confidence.

Whether you’re refining your token model or exploring innovative mechanisms, Tokenova provides the expertise and tools to help you succeed.

Visit Tokenova.co to learn more and take your project to the next level.

Conclusion

In conclusion, token burning is a multifaceted and influential mechanism within the cryptocurrency ecosystem, possessing the potential to significantly impact a cryptocurrency’s value and overall market dynamics. By strategically reducing the circulating supply of tokens, projects can create artificial scarcity, potentially driving up prices and rewarding token holders. However, the inherent risk of market manipulation remains a significant concern, underscoring the critical importance of transparency, clear and consistent communication, and responsible implementation by project development teams.

The ultimate effectiveness and legitimacy of token burning are not solely determined by the act of burning itself but rather by a complex interplay of factors, including the project’s underlying fundamentals, the strength and engagement of its community, the prevailing market conditions, and the ethical considerations guiding its implementation. As the cryptocurrency landscape continues to evolve and mature, a thorough and nuanced understanding of token burning is absolutely essential for both project creators seeking to build sustainable ecosystems and discerning investors aiming to navigate this dynamic and often unpredictable space effectively.

Key Takeaways

- Token burning is the permanent removal of cryptocurrency tokens from circulation, effectively reducing the total supply.

- Common methods of token burning include manual burns initiated by the project team, automated burns executed via smart contracts, and the burning of transaction fees generated by network activity.

- Cryptocurrency projects implement token burning for various strategic reasons, including potentially increasing token value through scarcity, stabilizing prices to reduce volatility, rewarding long-term token holders, and as a core component of consensus mechanisms like Proof-of-Burn.

- Potential risks and criticisms associated with token burning include concerns about market manipulation, the imperative of transparency in the burn process, and the need to navigate the evolving regulatory landscape.

- The impact of token burning on a cryptocurrency’s price is determined by the interplay of supply reduction and the level of sustained or increasing demand for the token. Reducing supply alone does not guarantee price appreciation.

- Transparency, strong project fundamentals, a supportive community, and responsible implementation are crucial for ensuring that token burning is perceived as a legitimate and effective mechanism rather than a manipulative tactic.

How does token burning compare to stock buybacks in traditional finance, and what are the key differences?

While both token burning and stock buybacks reduce the circulating supply of an asset, potentially increasing its value per unit, key differences lie in the regulatory frameworks and the level of transparency. Token burning, due to the nature of blockchain technology, is often more transparent, with burn transactions publicly verifiable on the blockchain. However, stock buybacks are subject to established securities regulations, whereas the regulatory landscape for token burning is still evolving.

Are there any technical limitations or potential vulnerabilities associated with the process of sending tokens to a burn address?

The security of token burning largely relies on the cryptographic security of the burn address itself. If a burn address were somehow compromised (which is highly improbable with properly generated burn addresses), there would be a theoretical risk. However, the primary risk is not technical vulnerability but rather the potential for a project to falsely claim a burn without actually sending the tokens to a provably unspendable address. This underscores the importance of verifying burn transactions on the blockchain.

What are some key indicators or on-chain metrics that investors can monitor to assess the effectiveness and legitimacy of a project’s token burning strategy?

Investors can monitor several on-chain metrics, including the burn rate (the frequency and amount of tokens being burned), the circulating supply of the token over time, and the transaction history of the burn address to verify the burns. Additionally, analyzing the token’s price action and trading volume around burn events can provide insights, although it’s crucial to consider these metrics in conjunction with other fundamental analysis of the project