Did you know that upwards of 70% of smart contract disputes arise from coding errors or ambiguously defined terms? As blockchain technology continues its relentless march across industries, transforming everything from supply chains to financial transactions, the need for robust and effective Dispute Resolution in Smart Contracts has never been more crucial. Imagine building a state-of-the-art skyscraper, only to discover that the emergency protocols are missing this is the dilemma many face when navigating the complexities of smart contract disagreements without a clear resolution strategy.

This article provides an in-depth exploration of the landscape of smart contract dispute resolution, examining the inherent challenges in detail, spotlighting innovative solutions that are reshaping the field, and forecasting future trends that will define its evolution. We will also dissect real-world case studies, analyze cutting-edge technological advancements, and deliver actionable insights designed to empower you to navigate this intricate domain with confidence and clarity.

By the conclusion of this comprehensive guide in Tokenova, you will possess a thorough understanding of how to proactively prevent disputes from arising, efficiently resolve those that do, and maintain a competitive edge in the burgeoning blockchain-powered future.

What Are Smart Contracts and Why Do Disputes Happen?

Before diving into dispute resolution, let’s take a step back to understand smart contracts and why disputes occur.

What Are Smart Contracts?

Smart contracts are programs stored on a blockchain that execute predefined actions when specific conditions are met. They eliminate intermediaries, reduce transaction costs, and enhance transparency. For example, in a global supply chain, payments can be automatically released to a supplier once delivery is recorded on the blockchain. This showcases the transformative power of smart contracts, streamlining operations and fostering trust through verifiable execution.

Read More: Future of Decentralized Finance: The Upcoming Financial Revolution

Why Disputes Arise

Despite their automation and security, smart contracts are not immune to disputes. Several factors contribute to disagreements:

Coding Errors and Bugs: Smart contracts, like any software, are prone to coding errors. Even minor flaws can lead to significant financial losses or breaches of contractual obligations. In 2023, over $1.95 billion (de.fi) was lost due to coding errors and vulnerabilities in DeFi smart contracts.

Ambiguous Language: While the code is precise, the natural language agreement it represents can be subjective. Misunderstandings about intended outcomes or specific clauses can lead to disputes. This is akin to solving a riddle where the solution remains elusive despite careful consideration.

Oracle Failures: Many smart contracts rely on external data feeds (oracles) to trigger execution. If an oracle provides inaccurate or manipulated data, it can lead to unfair or incorrect contract execution. For instance, price oracle manipulation has been a critical vulnerability that caused significant losses in DeFi protocols.

External Events: Unforeseen real-world events, or “black swan” events, can disrupt smart contract execution. While the contract may be executed correctly, the outcome may no longer be equitable or desirable for all parties involved.

Exploits and Hacks: Despite blockchain’s robust security, vulnerabilities in smart contract code can be exploited. In 2023 alone, $4 billion worth of assets were compromised due to smart contract vulnerabilities, underscoring the need for better security measures.

The Importance of Dispute Resolution Mechanisms

The lack of clear dispute resolution pathways can hinder the adoption of smart contract technology. According to a 2024 Deloitte report, 40% of businesses using smart contracts encountered disputes due to ambiguous terms or coding errors. Establishing robust mechanisms is critical to fostering trust and ensuring the widespread adoption of smart contracts.

Read More: Future of Decentralized Finance: The Upcoming Financial Revolution

How Blockchain Powers Smart Contracts

To fully grasp the complexities of resolving disputes in smart contracts, it’s essential to understand the foundational blockchain technology that enables their operation. Blockchain acts as the backbone of smart contracts, providing the infrastructure for these self-executing digital agreements.

Blockchain Technology: The Foundation

Smart contracts operate on a blockchain a decentralized and distributed digital ledger. This architecture ensures that the smart contract’s code and transaction history are replicated across a vast network of computers. This decentralization makes the data highly resistant to tampering, as altering information on one node would require simultaneous changes across the majority of the network a near-impossible task.

This combination of transparency and immutability is the cornerstone of trust in smart contract execution. For example, the infamous DAO hack of 2016, where a coding error led to the theft of over $50 million in cryptocurrency, highlighted the challenges of reversing transactions once recorded on the blockchain. The incident resulted in a controversial hard fork of Ethereum, underscoring the irreversible nature of blockchain transactions.

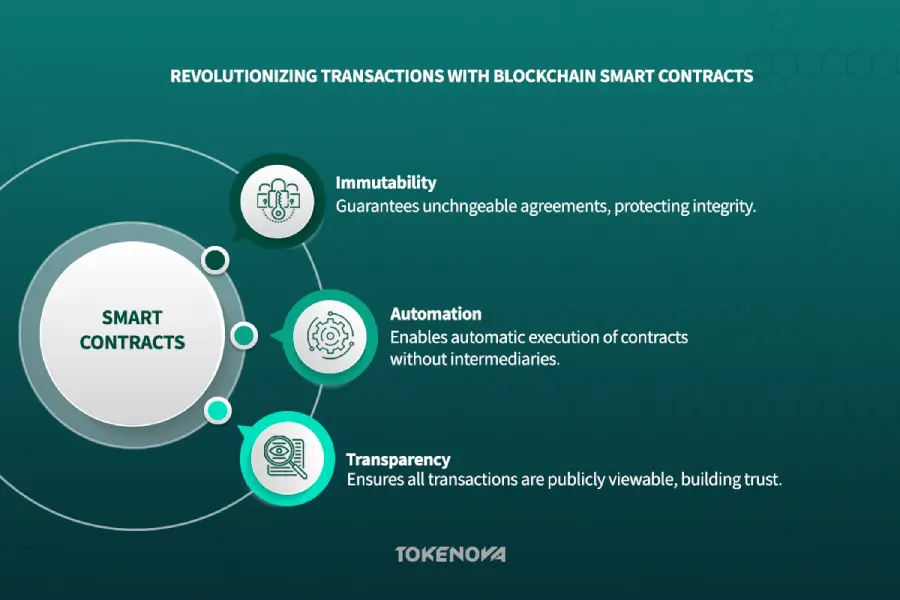

Key Features of Blockchain-Powered Smart Contracts

- Automation: .In 2024, the syndicated loans market reached a value of $1.2 trillion, driven by growing demand for large-scale financing and technological innovations. Industry players increasingly focused on enhancing efficiency through advanced digital platforms that offer real-time data, trading protocols, and analytics. While smart contract adoption in this space is still emerging, these developments signal a broader trend toward automation and transparency in high-value syndicated loan transactions.

- Transparency: Every transaction and line of code in a smart contract is publicly viewable on the blockchain. This transparency builds trust, as seen in DeFi platforms, where smart contracts processed over $150 billion in transactions in 2024, ensuring trustless trading.

- Immutability: Once deployed, smart contracts cannot be altered, ensuring the integrity of agreements. This feature is critical in industries like real estate, where $85 billion in assets were tokenized using smart contracts in 2024, reducing fraud and speeding up transactions.

Common Applications of Smart Contracts

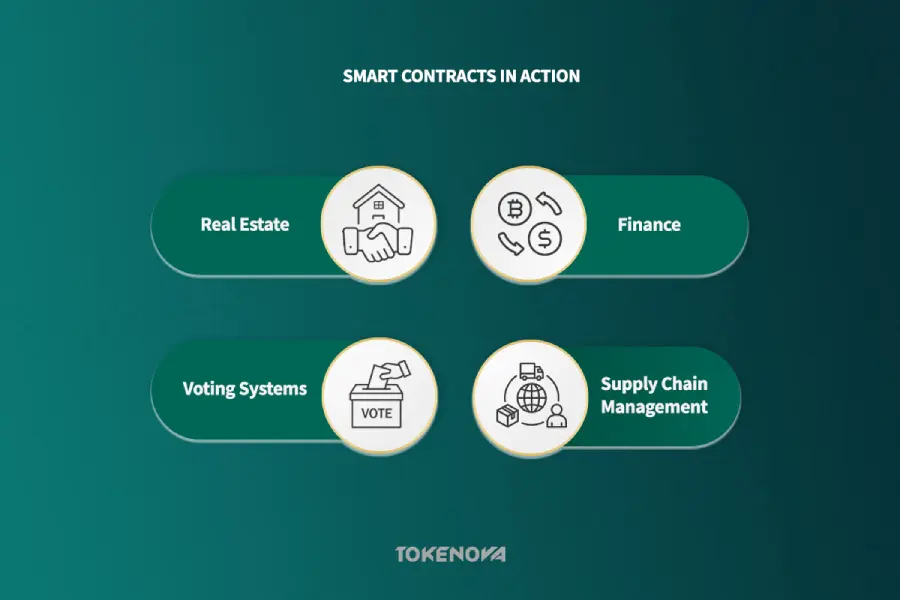

- Finance:

Decentralized Finance (DeFi): Smart contracts power peer-to-peer lending, borrowing, and trading platforms. In 2024, DeFi platforms attracted $245 billion in total value locked (TVL) (defillama), a 40% year-over-year increase.

Cross-Border Payments: Smart contracts reduced processing times by 80%, enabling near-instant settlements.

- Supply Chain Management:

Companies like Walmart use blockchain to track goods from origin to consumer, ensuring transparency and reducing inefficiencies. In 2024, $230 billion in supply chain finance contracts (thebusinessresearchcompany) were executed on blockchains, doubling from the previous year.

- Real Estate:

Smart contracts automate property transfers and escrow management. In 2024, $3.5 billion in property tokenization was facilitated by smart contracts, enabling fractional ownership and reducing fraud.

- Voting Systems:

Blockchain-based voting systems ensure tamper-proof elections. For example, Estonia has pioneered blockchain voting, enhancing trust in electoral processes.

Read More: Future of Decentralized Finance: The Upcoming Financial Revolution

Top Challenges in Smart Contract Dispute Resolution

Resolving disputes in smart contracts presents unique challenges that diverge sharply from traditional contract law. These challenges arise from the intricate interplay of technological and legal complexities inherent in blockchain-based agreements. Below, we delve into the key hurdles in smart contract dispute resolution, bolstered by the latest data and insights.

The Irreversibility Factor

The immutability of blockchain, which ensures security and trust, can become a double-edged sword during disputes. Once a smart contract executes a transaction, reversing it is nearly impossible, unlike traditional contracts where courts can mandate reversals. This irreversibility complicates dispute resolution, as parties cannot easily undo unintended or erroneous transactions.

To tackle this issue, on-chain dispute resolution platforms like Kleros and Aragon Court have emerged, offering decentralized arbitration mechanisms. These platforms facilitate dispute resolution within the blockchain ecosystem, leveraging community-driven decision-making to ensure fair outcomes.

Coding Errors: A Double-Edged Sword

Smart contracts depend on precise code; however, even minor errors can lead to substantial financial losses. In 2024, vulnerabilities in DeFi smart contracts resulted in over $1.48 billion (hackread) in losses across various protocols, highlighting the critical need for rigorous code audits and formal verification processes.

To mitigate these risks, developers increasingly utilize tools like Certora for formal verification and OpenZeppelin for secure smart contract templates. These resources help identify vulnerabilities before deployment, significantly reducing the likelihood of costly errors.

Lack of Human Discretion

Smart contracts operate on rigid, pre-programmed logic that lacks the flexibility of human judgment. This automation can lead to unfair outcomes when unforeseen circumstances arise. For instance, a smart contract might automatically execute a penalty clause due to a delayed payment caused by external factors like a natural disaster.

To address this challenge, hybrid dispute resolution mechanisms are gaining traction. These combine automated smart contract execution with human arbitration for complex cases. Platforms like Jur allow parties to escalate disputes to human arbitrators when automated systems cannot resolve them fairly.

Legal and Jurisdictional Uncertainty

The global nature of blockchain introduces jurisdictional challenges in resolving disputes. Smart contracts often involve parties from multiple countries, complicating the determination of which legal framework applies. For example, a dispute between a U.S.-based developer and a Singaporean investor might require navigating conflicting regulations in both jurisdictions.

In 2024, the European Union’s Markets in Crypto-Assets (MiCA) regulation introduced guidelines for cross-border smart contract disputes; however, gaps remain. Only 12% of global regulatory bodies have specific guidelines for smart contracts, leaving many disputes in a legal gray area.To navigate this uncertainty, parties are increasingly incorporating arbitration clauses into smart contracts that specify governing law and jurisdiction. For instance, the International Chamber of Commerce (ICC) has developed specialized arbitration rules for blockchain disputes, providing a clearer framework for resolution.

Read More: Future of Decentralized Finance: The Upcoming Financial Revolution

4 Key Dispute Resolution Mechanisms for Smart Contracts

Resolving disputes in smart contracts presents unique challenges, but innovative mechanisms are emerging to address these complexities. These Smart Contract Dispute Resolution methods offer diverse approaches to achieving fair and efficient outcomes.

1. Traditional Arbitration

Traditional arbitration, where a neutral third party (the arbitrator) hears evidence and makes a binding decision, remains a viable option for smart contract disputes. Parties can embed arbitration clauses directly into the smart contract’s code, specifying the arbitration process, governing rules, and the chosen arbitral institution.

Prominent institutions like the International Chamber of Commerce (ICC) are refining frameworks to handle blockchain-related disputes. For example, the ICC’s 2024 report on blockchain dispute resolution provides guidelines for adapting arbitration to the unique characteristics of smart contracts. These frameworks emphasize clarity in arbitration agreements and the use of technology to streamline proceedings.

2. Blockchain Arbitration

Blockchain Arbitration leverages the same technology behind smart contracts to resolve disputes. Decentralized platforms like Kleros use on-chain mechanisms to select arbitrators and record the entire dispute resolution process transparently on the blockchain. This approach reduces costs, increases efficiency, and enhances trust by eliminating intermediaries.

For instance, Kleros allows parties to submit evidence and receive binding decisions directly on the blockchain, ensuring that the process is tamper-proof and accessible globally. This method is particularly effective for disputes involving cryptocurrency transactions or decentralized applications (dApps).

3. Hybrid Approaches

Hybrid models combine traditional arbitration with blockchain-based solutions to create a more adaptable framework. For example, a smart contract might include an arbitration clause that first resolves disputes through traditional arbitration. Once a decision is reached, it is automatically enforced via a separate smart contract, ensuring seamless execution.

This approach is gaining traction in industries like real estate and supply chain management, where disputes often require both legal expertise and automated enforcement. By blending human judgment with blockchain’s efficiency, hybrid models offer a balanced solution for complex disputes.

4. Mediation and Negotiation

Mediation and negotiation provide less formal but equally effective ways to resolve smart contract disputes. These methods involve facilitated discussions between parties, often with the help of a neutral mediator, to reach a mutually agreeable solution.

For example, platforms like Modria and Smartsettle use AI-driven tools to assist in mediation, making the process faster and more cost-effective. These tools are particularly useful for disputes involving ambiguous contract terms or external events not accounted for in the code.

Read More: Future of Decentralized Finance: The Upcoming Financial Revolution

Smart Courts and Online Dispute Resolution (ODR)

The integration of advanced technologies like blockchain and artificial intelligence (AI) into legal systems is revolutionizing dispute resolution. Smart courts and Online Dispute Resolution (ODR) platforms are at the forefront of this transformation, offering efficient, scalable, and accessible solutions for resolving disputes, particularly in the digital realm.

Smart Courts Explained

Smart courts represent a leap forward in the administration of justice, leveraging technology to streamline legal processes. These courts are designed to handle disputes involving blockchain-based evidence and smart contracts, providing a platform for the efficient submission of digital evidence, secure virtual hearings, and transparent enforcement of rulings.

Countries like China and the United Arab Emirates are leading the charge in implementing smart courts. For instance, China has established a network of internet courts specifically designed to handle online disputes, including those involving blockchain and smart contracts. These courts use AI to analyze evidence and automate parts of the judicial process, significantly reducing delays and costs3.

Online Dispute Resolution (ODR)

ODR platforms are taking dispute resolution to the next level by integrating smart contracts and AI to automate and expedite the resolution process. These platforms can analyze disputed smart contracts, identify inconsistencies, and even suggest resolutions based on legal precedents and past cases.

The global blockchain market is projected to reach $39.7 billion by 2025, driving the need for scalable and efficient dispute resolution mechanisms1. ODR platforms are well-positioned to meet this demand, offering faster, cheaper, and more accessible alternatives to traditional litigation.

Benefits of ODR

- Cost-Effectiveness: ODR platforms eliminate the need for physical court appearances and reduce administrative overhead, cutting costs for both parties. For example, the APEC Collaborative Framework for ODR has helped small businesses resolve cross-border disputes at a fraction of traditional legal costs10.

- Speed: Automation and online communication channels enable ODR platforms to resolve disputes in days or weeks, compared to months or years in traditional courts.

- Accessibility: ODR removes geographical barriers, allowing parties in different jurisdictions to resolve disputes online. This is particularly beneficial for micro, small, and medium enterprises (MSMEs), which often lack the resources for cross-border litigation10.

The Future of ODR and Smart Courts

The integration of generative AI and large language models (LLMs) into ODR platforms is expected to further enhance their ability to analyze complex disputes and provide fair resolutions.

Smart courts and ODR platforms are transforming the way disputes are resolved in the digital age. By leveraging blockchain, AI, and automation, these systems offer cost-effective, fast, and accessible solutions for handling smart contract disputes. As the blockchain market continues to grow, the adoption of these technologies will be crucial for ensuring fair and efficient dispute resolution in the digital economy.

Read More: Future of Decentralized Finance: The Upcoming Financial Revolution

Legal and Regulatory Challenges in Smart Contracts

The legal and regulatory landscape surrounding smart contracts is still evolving, presenting unique challenges for businesses and individuals operating in this space. As of 2025, the rapid adoption of blockchain technology has outpaced the development of comprehensive legal frameworks, leaving many questions unanswered.

Validity and Enforceability

A fundamental challenge is determining the legal validity and enforceability of smart contracts under existing contract law frameworks. While jurisdictions like the United States and the European Union have begun to recognize electronic agreements as legally binding, the unique characteristics of smart contracts such as self-execution and immutability complicate their legal treatment. Courts in these regions have upheld smart contracts as legally binding, provided they meet traditional contract law requirements like offer, acceptance, and consideration.

For example, in 2024, a U.S. court (mayerbrown) ruled in favor of enforcing a smart contract for a real estate transaction, emphasizing that the code clearly reflected the parties’ intent. However, cases involving ambiguous code or unforeseen circumstances continue to test the limits of enforceability.

KYC/AML in Dispute Resolution

Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations play a critical role in ensuring the legitimacy of parties involved in smart contract transactions. As of 2025, the rise of Decentralized Finance (DeFi) platforms has made it easier for bad actors to exploit smart contracts for illicit activities, such as money laundering and fraud.

To combat this, regulators are pushing for stricter compliance measures. The Financial Action Task Force (FATF) has updated its guidelines to include Virtual Asset Service Providers (VASPs), requiring them to implement robust KYC and AML protocols. Platforms like Chainlink are also integrating decentralized oracles to verify real-world data, enhancing the security and transparency of smart contract transactions.

Global Regulatory Frameworks

The absence of a universally harmonized regulatory framework for smart contracts creates significant challenges, especially for cross-border disputes. Different jurisdictions have adopted varying approaches:

In the United States, states like Wyoming and Texas have passed laws recognizing smart contracts as legally enforceable, while the SEC continues to scrutinize their use in securities transactions. In the European Union, the Markets in Crypto-Assets (MiCA) regulation, set to take full effect in 2025, aims to create a unified framework for crypto assets and smart contracts across EU member states. Meanwhile, in Asia, countries like Singapore and Japan have embraced progressive regulations, while China maintains strict controls on cryptocurrency-related activities.

These divergent approaches create complexities for businesses operating globally, as they must navigate a patchwork of regulations to ensure compliance.

Aligning with International Standards

Efforts are underway to align smart contracts with established international legal standards, such as the United Nations Convention on Contracts for the International Sale of Goods (CISG). The CISG, which governs international trade, has been interpreted to support the validity of smart contracts, provided they meet the Convention’s formation requirements.

For example, a 2024 analysis (uchicago) argued that smart contracts can satisfy the CISG’s requirements for offer, acceptance, and consideration, making them a viable tool for international trade. However, challenges remain in addressing issues like jurisdictional disputes and code interpretation, which are not explicitly covered by the CISG.

The legal and regulatory challenges surrounding smart contracts are significant but not insurmountable. As of 2025, courts and regulators are gradually adapting to the unique characteristics of blockchain-based agreements, with jurisdictions like the EU and U.S. leading the way in creating clearer frameworks. However, the lack of global harmonization and the rapid pace of technological innovation continue to pose challenges. Businesses must stay informed and proactive in navigating this evolving landscape to ensure compliance and mitigate risks.

Read More: Future of Decentralized Finance: The Upcoming Financial Revolution

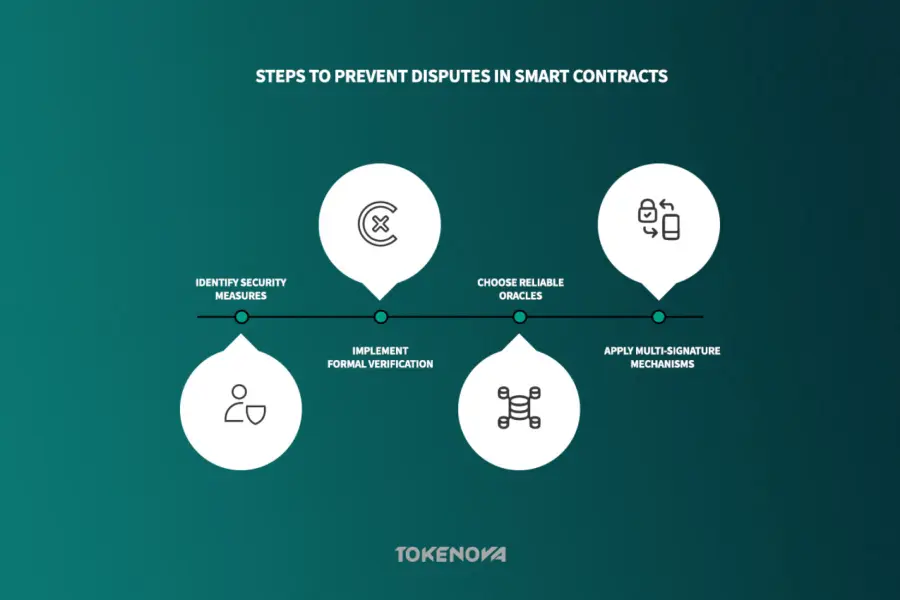

How to Prevent Disputes in Smart Contracts

Preventing disputes in smart contracts is far more efficient and cost-effective than dealing with them after they arise. By taking proactive steps, you can significantly reduce the chances of disagreements. Here’s how to build a solid foundation for dispute-free smart contracts:

Formal Verification: Ensuring Code Accuracy

Formal verification is a must for any serious smart contract project. It uses mathematical methods to prove the correctness of the code, reducing the risk of bugs or unintended behaviors. Tools like Certora and PropertyGPT (an LLM-driven tool) are leading the way, helping developers automate the verification process and catch vulnerabilities early. For example, PropertyGPT has identified 26 CVEs/attack incidents (ui.adsabs.harvard.edu) and uncovered 12 zero-day vulnerabilities, earning over $8,256 in bug bounties.

This step is critical because even a small coding error can lead to significant financial losses or breaches of contract. By ensuring the code behaves as intended, you build trust with stakeholders and avoid costly disputes down the line.

Choosing Reliable Oracles: The Backbone of Smart Contracts

Many smart contracts rely on external data feeds, making the choice of oracles a key factor in preventing disputes. Decentralized oracle networks like Chainlink and API3 are trusted for their reliability and security. Chainlink, for instance, powers over 80% of DeFi applications and has processed $300 billion in transaction volume in 2024.

Using reputable oracles minimizes the risk of data manipulation or inaccuracies, which can trigger incorrect contract execution. This is especially important in industries like insurance or supply chain, where real-world data directly impacts contract outcomes.

Multi-Signature Mechanisms: Adding a Layer of Security

Multi-signature (multi-sig) mechanisms require multiple authorized parties to approve a transaction before it’s executed. This added layer of control prevents unilateral actions or unauthorized changes, reducing the risk of disputes. Platforms like Ethereum and Hyperledger Fabric have integrated multi-sig solutions, particularly in high-value sectors like real estate and supply chain management.

Multi-sig not only enhances security but also fosters collaboration among stakeholders, ensuring no single party can make decisions without consensus.

Read More: Future of Decentralized Finance: The Upcoming Financial Revolution

The Future of Smart Contract Dispute Resolution

The field of smart contract dispute resolution is rapidly evolving, driven by technological advancements and the growing adoption of blockchain technology. Several key trends are shaping its future, offering innovative solutions to address the unique challenges of decentralized agreements.

AI and Machine Learning in ODR

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into Online Dispute Resolution (ODR) platforms is revolutionizing how disputes are resolved. AI-powered systems can analyze vast amounts of evidence, predict dispute outcomes with greater accuracy, and even provide personalized recommendations to parties involved. For instance, AI can automate the review of smart contract code to identify potential vulnerabilities or discrepancies, reducing the need for manual intervention.

In 2025, platforms like Kleros and Aragon Court are leveraging AI to streamline arbitration processes, enabling faster and more efficient resolutions. AI is also being used to generate first drafts of legal documents and predict the likelihood of success in disputes, saving time and resources.

DAOs in Dispute Resolution

Decentralized Autonomous Organizations (DAOs) are emerging as a groundbreaking approach to dispute resolution. In this model, token holders participate in the resolution process by voting on outcomes or electing trusted arbitrators. DAOs like Aragon Court and Kleros are leading the charge, offering decentralized, transparent, and community-driven dispute resolution mechanisms.

By 2025, DAOs are expected to handle a significant portion of disputes in decentralized finance (DeFi) and other blockchain-based ecosystems. Their ability to operate without intermediaries and ensure transparency makes them an attractive option for resolving conflicts in a trustless environment.

Built-in Dispute Resolution Clauses

Future smart contracts are likely to include built-in dispute resolution clauses directly in their code. These clauses will outline specific procedures for resolving disagreements, such as arbitration or mediation, and automatically trigger these processes when disputes arise. This proactive approach reduces ambiguity and ensures that all parties are aware of the resolution mechanisms from the outset.

For example, platforms like Chainlink are exploring ways to integrate dispute resolution protocols into their smart contracts, ensuring that disputes are resolved efficiently and fairly.

Quantum Computing and Security

The rise of quantum computing poses a significant threat to the cryptographic security of blockchain technology. Quantum computers could potentially break current encryption methods, compromising the integrity of smart contracts. To address this, researchers are developing quantum-resistant cryptographic algorithms to safeguard blockchain systems.

In 2025, organizations like the National Institute of Standards and Technology (NIST) are leading efforts to standardize quantum-resistant encryption, ensuring that smart contracts remain secure in the face of future technological advancements.

The future of smart contract dispute resolution is being shaped by AI, DAOs, built-in clauses, and quantum-resistant technologies. These innovations promise to make dispute resolution faster, more transparent, and more secure, paving the way for broader adoption of blockchain technology. As the industry evolves, staying ahead of these trends will be crucial for businesses and developers alike.

Best Practices for Implementing Smart Contracts

- Write Clear Code: Prioritize writing clean, well-documented, and easily understandable smart contract code. Invest in thorough code audits conducted by independent security experts to identify and rectify potential vulnerabilities before deployment.

- Include Detailed Clauses: Incorporate comprehensive and unambiguous dispute resolution clauses directly within the smart contract’s code. Clearly specify the preferred dispute resolution mechanism, the governing law, and the designated jurisdiction for resolving any potential disagreements.

- Choose Oracles Carefully: Opt for reputable and decentralized Oracle networks with a proven track record of reliability and security to ensure the integrity of external data feeds.

- Keep Records: Maintain meticulous and comprehensive records of all interactions, transactions, and communications related to the smart contract. This documentation can prove invaluable in the event of a dispute.

- Get Legal Advice: Consult with legal professionals who possess specialized expertise in blockchain technology and smart contract law. Seeking expert legal counsel can help ensure compliance with relevant regulations and mitigate potential legal risks.

Navigate Smart Contract Disputes with Confidence – Partner with Tokenova

In the fast-evolving world of blockchain and smart contracts, disputes can arise unexpectedly, threatening the success of your projects. At Tokenova, we specialize in providing expert advisory and consulting services to help businesses navigate these complexities with ease.

Our team of seasoned blockchain and legal professionals offers comprehensive solutions, including:

- Smart Contract Auditing: Rigorous code reviews to identify and fix vulnerabilities.

- Strategic Consultation: Tailored advice to ensure your contracts are secure and compliant.

- Custom Dispute Resolution: Proven strategies to resolve conflicts efficiently.

- Access to Experts: A vetted network of arbitrators and mediators for fair resolutions.

Conclusion

In conclusion, dispute resolution in smart contracts is a critical factor driving the adoption and growth of blockchain technology. While the immutability of blockchain creates unique challenges, the industry is responding with innovative solutions, from traditional arbitration to advanced Online Dispute Resolution (ODR) platforms powered by Artificial Intelligence (AI). A proactive approach, focusing on prevention and a clear understanding of resolution options, is essential for navigating the complexities of decentralized agreements.

The global blockchain market is expected to grow to $39.7 billion by 2025, fueled by the increasing use of smart contracts in industries like finance, supply chain, and real estate. This growth highlights the need for effective dispute-resolution frameworks to ensure trust and reliability in digital agreements. For example, ODR platforms are becoming more popular, with 62% of traditional banks now using blockchain-based contracts for loan agreements and payment settlements.

Key Takeaways

- Disputes in Smart Contracts: Despite their automation and security, smart contracts can still face disputes due to coding errors, unclear terms, or oracle failures, which can lead to significant financial losses.

- Immutability Challenges: The irreversible nature of blockchain transactions makes dispute resolution more complex, requiring innovative solutions like on-chain arbitration and smart courts.

- Diverse Resolution Methods: A variety of solutions are available, from traditional arbitration to blockchain-native mechanisms like Kleros and Aragon, which use decentralized juries to resolve disputes.

- ODR and Smart Courts: Platforms like Modria and Smartsettle are using AI and blockchain to streamline dispute resolution, reducing processing times by up to 80% in cross-border payments.

- Preventative Measures: Proactive steps, such as formal verification of smart contract code, clear dispute resolution clauses, and reliable oracles like Chainlink, are essential for minimizing disputes.

By adopting these best practices, businesses can fully leverage the potential of smart contracts, ensuring that digital agreements are both reliable and enforceable in the rapidly evolving blockchain ecosystem.

References:

Dispute Resolution for Smart Contract-based

Two-Party Protocols