Business leader or investor hunting for a smarter way to raise cash or get your hands on valuable assets? Is that you? Security Token Offerings (STOs) are changing the game in finance. They’re basically taking the best parts of blockchain tech and combining them with the rules and regulations you need. Forget the old ways of fundraising STOs offer transparency and efficiency, and you can reach investors anywhere in the world. That makes them a seriously powerful option for both businesses and investors.

This guide will break down what STOs are all about, how they work, and why they’re becoming a key part of the modern financial landscape. Whether you’re looking to raise capital or invest in these tokenized assets, STOs offer a secure and efficient route to reach your goals. So, let’s get started!

Why STOs are a Big Deal

STOs let you break down assets like real estate, patents, or even future earnings into smaller, investable pieces. Think of it like owning a slice of something big. This opens up investment to a much wider group of people. And get this: the market for tokenized assets is predicted to explode, growing by over 18.8% each year from 2024 to 2032, hitting a massive $13.2 billion by then. Just last year, in 2024, STOs pulled in over $3.32 billion, with real estate and venture capital leading the charge.

One of the best things about STOs is that they use blockchain. Every transaction is recorded on this super secure, unchangeable record. This means less chance of dodgy dealings and more trust for investors. For instance, platforms like Tokenova are letting people own fractions of fancy stuff, and some are seeing massive returns.

Understanding the Fundamentals of Security Token Offerings

To really understand what makes Security Token Offerings (STOs) a big deal, we need to start with the basics. Think of this as laying the foundation for understanding how they fit into the bigger picture of how companies raise money. Getting this fundamental understanding is key to seeing just how impactful STOs could be.

| Aspect | ICO | STO | IPO |

| Regulation | Minimal (utility tokens) | Strict (securities laws) | Heavy (SEC oversight) |

| Asset Type | Utility tokens | Security tokens (backed assets) | Equity shares |

| Investor Rights | None (speculative value) | Ownership rights (dividends, etc.) | Equity + voting rights |

| Costs | Lower (initially) | Higher than ICOs | Highest (compliance fees) |

| Use Case | New crypto projects | Regulated assets | Established companies |

What is a Security Token Offering (STO)?

Simply put, a Security Token Offering (STO) is a formal and regulated way for companies to raise money by issuing digital tokens using blockchain technology. These aren’t just random cryptocurrencies; security tokens are special because they represent actual ownership or rights to something real and valuable. Imagine them as digital versions of traditional investments like stocks, bonds, or even a share in a property. This direct connection to a real-world asset is what makes them unique.

How STOs Differ from ICOs and IPOs

Knowing how STOs are different from other ways companies raise funds is super important for both companies looking to raise money and people thinking about investing. Understanding these differences helps everyone make smarter choices.

This connection to something tangible is the main thing that sets STOs apart from Initial Coin Offerings (ICOs). ICOs often sell “utility tokens” that promise access to a future product or service kind of like buying a voucher. Security tokens, on the other hand, give you a claim on something real and valuable, which means they’re subject to the same rules and regulations that protect investors in traditional markets. Compared to traditional Initial Public Offerings (IPOs), STOs use blockchain to make things more efficient and accessible. This can potentially lower costs and open up investment opportunities to a wider range of people.

The Role of Blockchain in STOs

Blockchain technology is the engine that makes STOs work smoothly and securely. It provides the underlying system for transactions to happen in a transparent and trustworthy way. This technology is the reason STOs offer so many advantages, ensuring that ownership is clear and can’t be tampered with.

Essentially, an STO is like a modern, tech-savvy version of familiar fundraising methods like IPOs or private placements. But it uses the power of blockchain to make things much more transparent, efficient, and globally accessible. The blockchain acts like a permanent, shared record book that everyone can see, meticulously tracking all transactions and who owns what. This builds a lot of trust and significantly reduces the chances of things going wrong.

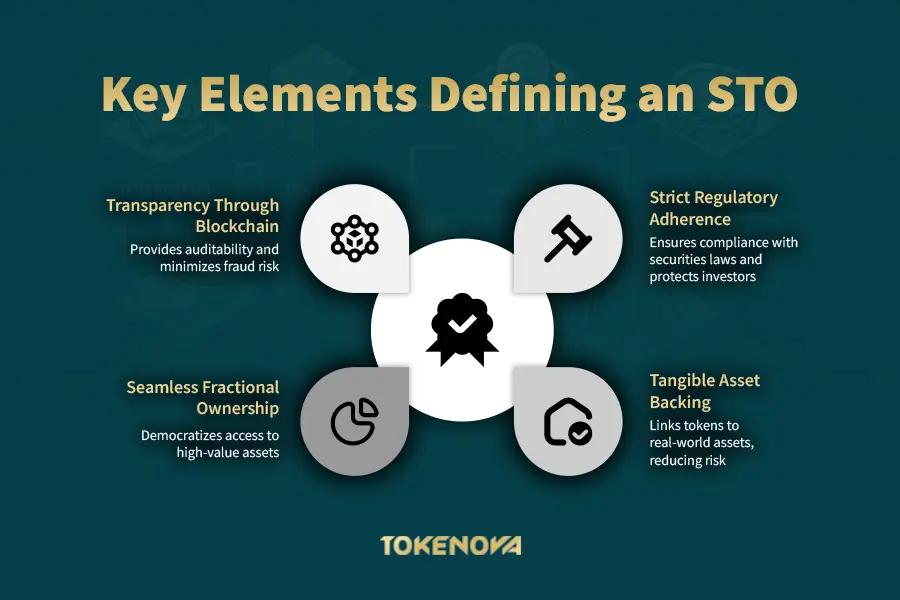

Key Elements Defining an STO

Several key elements distinguish STOs from other digital assets and traditional securities. These defining characteristics underscore the unique nature of STOs and their position within the financial ecosystem.

Strict Regulatory Adherence

A major differentiator for STOs is their commitment to following securities laws wherever they operate. This focus on regulation is a big plus for investors, offering a level of protection often missing in the more freewheeling world of Initial Coin Offerings (ICOs). For instance, in the US, STOs often utilize exemptions like Regulation D or Regulation A+ under the Securities Act of 1933. Across the pond in the EU, they need to adhere to regulations like the Prospectus Regulation and MiFID II.

The regulatory landscape for STOs is actively developing. The EU’s Markets in Crypto-Assets (MiCA) regulation, which kicked in during 2024, provides a comprehensive framework for digital assets, including STOs, boosting transparency and investor confidence. Looking ahead, the Digital Operational Resilience Act (DORA), starting in January 2025, will enforce strong operational standards for financial services, further solidifying the regulatory foundation for STOs. These advancements help ensure STOs are a secure and compliant investment avenue, appealing to both individual and institutional investors.

Tangible Asset Backing

Unlike many digital assets that can feel a bit abstract, security tokens are typically linked to real-world assets. This tangible backing provides inherent value and reduces investment risk. Each token essentially represents a claim on something concrete, like shares in a company, debt, property, or even intellectual property.

Platforms like RealT and Harbor have successfully tokenized real estate, allowing investors to buy fractions of properties. Similarly, LumiShare has tokenized renewable energy projects, enabling investment in sustainable initiatives. This asset-backed approach not only offers security but also opens doors to diversification, allowing investors to access valuable assets that were previously out of reach.

Seamless Fractional Ownership

One of the game-changing aspects of STOs is their ability to enable fractional ownership, democratizing access to high-value assets. By dividing assets into smaller, more affordable units, STOs allow a wider range of investors to participate in markets traditionally dominated by big players.

For example, 22X Fund has tokenized venture capital investments, enabling individuals to invest in promising startups with smaller amounts of capital. This fractional ownership model not only levels the playing field but also improves liquidity, as investors can trade their tokenized assets on secondary markets.

Transparency Through Blockchain

Blockchain technology is the bedrock of STOs, providing unparalleled transparency and auditability. Every transaction and ownership change is recorded on a secure, publicly accessible ledger, ensuring accountability and minimizing the risk of fraud.

Smart contracts, which automatically execute processes like dividend payouts and token transfers, further enhance efficiency and security. Platforms like Polymath and Securitize utilize smart contracts to manage compliance, ensuring only verified investors can participate in STOs. This transparency builds trust among investors, as they can track their investments in real-time and verify the legitimacy of the underlying assets.

How Does a Security Token Offering Work?

Understanding how a Security Token Offering (STO) works is key for both companies launching them and individuals looking to invest. Let’s break down the process, revealing the mechanics and the important rules involved, making it easier to grasp and encouraging wider participation.

Peeling Back the Layers: How an STO Works

The journey of an STO, from the initial idea to when tokens can be traded, involves several crucial stages. Each step is designed to ensure everything is above board legally and that investors are protected, all while leveraging the efficiency of blockchain tech. Knowing these steps is vital whether you’re a business considering an STO or an investor exploring this new market.

Tokenization: Laying the Legal and Technical Foundation

The very first step, and arguably the most important, is tokenization. This isn’t just about the technical side of creating digital tokens on a blockchain. Crucially, it’s about legally structuring the ownership rights to the real-world asset those tokens represent. Think of it as creating a digital wrapper with legally binding ownership attached. This requires careful legal planning to ensure it ticks all the boxes with relevant securities regulations.

For example, in the US, this often means navigating specific exemptions under the Securities Act. In the EU, it involves sticking to directives like the Prospectus Regulation. This unwavering focus on legal compliance is what separates legitimate STOs from the riskier world of ICOs. Companies often bring in legal eagles specializing in both securities law and blockchain to navigate this complex area and avoid any legal missteps. They need to be meticulous and ensure every detail is correct.

Smart Contracts: Putting Automation to Work

Once the legal framework is solid, smart contracts step in to automate many STO processes. This boosts efficiency and cuts out the need for many middlemen, streamlining operations and potentially lowering costs.

Imagine smart contracts as self-executing digital agreements. The terms are written directly into the code and automatically enforced by the blockchain network. These contracts are carefully programmed with the specific rules for the tokens. This includes how they can be transferred between owners, what rights token holders have (like voting on company decisions or receiving dividends), and any limitations on their use or transfer.

Smart contracts automate tasks that were traditionally handled manually by intermediaries, such as distributing dividends or executing trades. This leads to significant efficiency gains and lower operating costs. Think of them as incorruptible digital rule enforcers, making sure all token actions follow the pre-defined terms precisely.

Opening the Doors: Offering and Trading Tokens

The final stages involve offering the tokens to investors and then enabling trading on secondary markets. This provides liquidity, allowing investors to manage their investments and creating a more dynamic and accessible market.

After the secure creation and thorough testing of these smart contracts, the tokens are offered to potential investors through a carefully planned and legally compliant offering process. Finally, once the initial offering period is over, the security tokens can be listed and actively traded on specialized trading platforms designed and regulated specifically for digital securities.

These regulated exchanges provide a vital secondary market where investors can easily buy and sell their security tokens. This provides much-needed liquidity to the market and helps determine the price through supply and demand. This ability to trade on the secondary market is crucial for the long-term success and appeal of security tokens as an investment.

Your Roadmap: Launching an STO Step-by-Step

For businesses considering an STO, a clear plan is essential. This step-by-step guide outlines the key stages involved in launching a successful STO, providing a practical framework to follow.

- Define Your Offering: Clearly define the asset you plan to tokenize whether it’s equity, debt, or a physical asset. Outline the specifics of your offering, including the number of tokens, the rights attached to them, and your fundraising goals. A well-defined offering is crucial for attracting investors and ensuring you’re on the right side of the law. This requires a deep dive into your assets and financial objectives.

- Legal and Regulatory Compliance: This is a make-or-break step. Make sure you understand and comply with all relevant securities laws in the countries you’re targeting. This includes following regulations like Regulation D or Regulation A+ in the US, or the Prospectus Regulation in the EU, as well as implementing strong Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. Bringing in legal experts is highly recommended to navigate this complex and ever-changing landscape.

- Tokenization Process: This involves the technical creation of your security tokens. This includes developing secure smart contracts that govern how the tokens work and choosing the right blockchain platform. Ensure your tech team has the necessary skills in blockchain development and security to build a robust and reliable system.

- Marketing and Investor Outreach: Develop a compelling story around your investment and create a professional website and whitepaper. Use social media and public relations to build awareness and connect with potential investors. Consider partnering with STO launch platforms and advisors to broaden your reach and connect with the right people.

- Post-STO Management: Once your STO is complete, focus on listing your tokens on regulated exchanges to provide liquidity. Maintain open communication with your investors and ensure you continue to comply with all regulatory requirements. This long-term commitment is crucial for building trust and maintaining the value of your tokens.

Exploring the Diverse Types of Security Tokens

Forget the one-size-fits-all approach of traditional investments. Security tokens (STOs) open up a world of possibilities, offering different flavors to match various investment goals and the types of assets involved. Think of it like choosing from a menu there’s something for everyone. This flexibility is a game-changer for both companies looking for funding and individuals wanting to invest. Let’s break down the main types of security tokens to help you understand this evolving landscape: Equity Tokens, Debt Tokens, and Asset-Backed Tokens. Knowing these categories is key to navigating the exciting world of STOs.

Equity Tokens: Owning a Piece of the Pie

Equity tokens are essentially digital shares in a company. When you hold one, you own a piece of the action, with potential perks and financial upside.

How They Work: Owning equity tokens often means you get a say in important company decisions through voting rights. Plus, as the company does well, you might receive dividends a share of the profits based on how many tokens you hold. If the company really takes off, the value of your tokens can increase significantly, leading to strong returns. For instance, in 2024, equity tokens from new blockchain companies saw impressive growth, sometimes doing better than traditional stocks in certain areas.

What’s in it for Companies: Issuing equity tokens lets companies raise money without giving up too much control. It also allows them to tap into a global pool of investors, meaning a startup in one country can easily attract funding from across the globe.

Why Investors Like Them: Investors get to directly benefit from a company’s success, meaning their interests are aligned with the company’s growth. Unlike traditional private investments, these tokens can often be traded on special exchanges, making it easier to buy or sell them when you need to.

Imagine a cool new tech startup using equity tokens to fund their next big project. As they become profitable, they can share those profits with the token holders through regular dividend payments.

Debt Tokens: Lending a Hand, Earning Returns

Debt tokens work similarly to traditional bonds. You’re essentially lending money to a company and getting regular interest payments in return.

How They Work: If you hold debt tokens, you’ll receive regular interest payments over a set period. Once that period is up, the company pays back the original amount you lent. Sometimes, these tokens are even backed by something valuable as security, offering extra peace of mind. For example, in 2024, we saw a big jump in the number of companies issuing tokenized corporate bonds, as they appeal to investors who prefer a more stable approach.

Why Companies Choose Them: Debt tokens are a cost-effective way for companies, especially those with a good track record, to raise funds. They offer flexibility in setting interest rates and repayment schedules, making them appealing to both the company and the investors.

What Makes Them Attractive to Investors: Debt tokens provide a predictable stream of income, making them a good choice for investors who prefer lower-risk options. The fixed interest payments and the potential for security through collateral make them even more appealing.

Think of a company building a new apartment complex. They might issue debt tokens to finance the construction. Investors would receive interest payments while the building is being built and then get their initial investment back once the project starts generating income.

Asset-Backed Tokens: Owning a Slice of Something Real

Asset-backed tokens represent ownership in physical or digital assets, like real estate, artwork, or even valuable commodities. These tokens make it possible for more people to invest in high-value assets that were previously out of reach for the average investor.

Key Features: Each token is linked to a real-world asset, giving it inherent value. Fractional ownership means you can own a small piece of something expensive without having to buy the whole thing. Many of these tokens also generate income, like rent from a property.

Benefits for Companies Issuing Them: Tokenizing assets unlocks their value by making them easier to trade and divide into smaller pieces. This provides a new and innovative way to raise capital while still maintaining ownership of the asset.

Why Investors Find Them Appealing: Investors gain access to valuable assets like luxury properties or fine art, which can help diversify their investment portfolio beyond traditional stocks and bonds. The potential for passive income from these assets adds another layer of attraction.

Imagine investing in a token that represents a share of a luxury apartment building. You would receive a portion of the rental income, and if the property’s value goes up, the value of your token also increases.

By understanding the different types of security tokens equity, debt, and asset-backed both investors and companies can leverage the power of STOs to participate in a more inclusive, efficient, and transparent global economy.

What are the Benefits of Security Token Offerings?

Security Token Offerings (STOs) are rapidly gaining traction as a modern and innovative way to raise capital and invest in assets. They offer a range of advantages over traditional fundraising methods, making them an attractive option for both issuers and investors. Below, we explore the key benefits of STOs in detail, highlighting why they are becoming a preferred choice in the financial world.

1. Enhanced Liquidity

One of the most significant advantages of STOs is enhanced liquidity. Traditional assets like real estate, private equity, or fine art are often illiquid, meaning they cannot be easily bought or sold without significant time, effort, and cost. STOs address this challenge by fractionalizing ownership of these assets, allowing them to be divided into smaller, more affordable units represented by digital tokens.

This fractionalization enables investors to buy and sell their stakes in these assets on secondary markets, which are specifically designed for trading security tokens. As a result, previously illiquid assets become more tradable, providing investors with greater flexibility and control over their investments. For example, an investor who owns a fraction of a tokenized commercial property can sell their stake on a regulated exchange without waiting for the entire property to be sold.

2. Transparency and Security

Blockchain technology, the foundation of STOs, provides unparalleled transparency and security. Every transaction involving security tokens is recorded on a distributed ledger, which is immutable and publicly accessible. This means that once a transaction is recorded, it cannot be altered or tampered with, ensuring a high level of data integrity.

For investors, this transparency means they can verify ownership and track the history of their investments with ease. For issuers, it builds trust and credibility, as all transactions and ownership details are open to scrutiny. Additionally, the use of smart contracts automates processes like dividend distribution or token transfers, reducing the risk of human error or fraud.

3. Global Access to Capital

STOs unlock global access to capital, allowing companies to reach a wider pool of investors beyond geographical limitations. Traditional fundraising methods, such as IPOs or private placements, are often restricted by regulatory and logistical barriers that limit the pool of potential investors to specific regions or countries.

With STOs, companies can tap into a global investor base, as blockchain technology enables seamless cross-border transactions. This global reach not only increases the potential for successful fundraising but also diversifies the investor base, reducing reliance on local markets.

4. Cost Efficiency

Compared to traditional fundraising methods like Initial Public Offerings (IPOs), STOs offer greater cost efficiency. IPOs are notoriously expensive, involving high fees for underwriters, legal advisors, and regulatory compliance. They also require significant time and resources to execute, often taking months or even years to complete.

STOs, on the other hand, leverage blockchain technology and smart contracts to automate many of the processes involved in issuing and managing securities. This reduces the need for intermediaries, such as brokers or custodians, and lowers the overall issuance and management costs. Additionally, the streamlined nature of STOs allows companies to raise capital more quickly, further reducing costs.

5. Regulatory Compliance and Investor Protection

Unlike Initial Coin Offerings (ICOs), which often operate in a regulatory gray area, STOs are designed to comply with existing securities laws and regulations. This commitment to regulatory compliance provides a critical layer of investor protection, ensuring that issuers adhere to strict standards and that investors have legal recourse in case of disputes.

For example, STOs often require issuers to implement Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, which help prevent fraud and illicit activities. Additionally, the asset-backed nature of security tokens provides investors with a tangible claim on an underlying asset, further reducing risk.

6. Democratization of Investment Opportunities

STOs have the potential to democratize investment opportunities, making high-value assets and exclusive markets accessible to a broader range of investors. Through fractional ownership, individuals can invest in assets like real estate, fine art, or venture capital portfolios that were previously reserved for institutional investors or high-net-worth individuals.

This democratization not only levels the playing field but also encourages financial inclusion, allowing more people to participate in wealth-building opportunities.

Navigating the Challenges and Risks of STOs

Security Token Offerings (STOs) offer a fresh way to raise money, but it’s not all smooth sailing. Both the companies launching STOs and the people investing in them need to understand the potential bumps in the road. Let’s break down the main challenges you’ll encounter with STOs:

Dealing with Shifting Rules

One of the biggest headaches with STOs is that the legal landscape is still being written. Different countries have different ideas about how to regulate them. This makes it tricky to operate across borders because you have to play by different rulebooks in each place. For example, the folks at the U.S. Securities and Exchange Commission (SEC) are keeping a close eye on anything crypto-related, which can create uncertainty for companies trying to launch an STO. We’ve even seen companies like Circle Internet Financial get investigated, highlighting why sticking to the rules is crucial.

Getting the Word Out and Getting People On Board

STOs are still pretty new to the financial scene. A lot of people, both companies looking to raise money and potential investors, don’t really get them yet. We need to do a better job of explaining what STOs are and why they matter to build trust and encourage participation. Otherwise, STOs might just stay a niche thing, limiting how much they can grow.

Tech Troubles

While the technology behind STOs (blockchain) is generally secure, it’s not completely safe. Things like cyberattacks, software glitches, or slow networks can still cause problems and threaten the security of STO platforms. To avoid these issues, companies launching STOs need to have strong security measures in place and regularly check their systems for weaknesses.

Figuring Out What They’re Actually Worth

Putting a price tag on security tokens can be tricky, especially if the asset they represent is unique or doesn’t fit into a standard box. Since there’s often no track record or easy way to compare them to other things, it’s harder to know what they’re truly worth. This lack of clear pricing can make investors hesitant. We need to develop better ways to value these assets to make the pricing fairer and more transparent.

Where Can You Actually Trade Them?

While STOs are supposed to make it easier to buy and sell assets, the places where you can actually trade them are still developing. There aren’t many established platforms, and the amount of buying and selling happening is often low. For STOs to truly deliver on their promise of easy trading, we need more robust and regulated marketplaces that can handle more activity.

Under the Regulatory Microscope

Because STOs involve digital assets, they often attract extra attention from regulators. Agencies like the SEC are watching closely, and this increased scrutiny can lead to lengthy legal battles and fines if companies don’t follow the rules to the letter. Companies launching STOs need to be sure they’re complying with all the relevant securities laws to avoid these headaches.

Comparing STOs with Other Fundraising Methods

To provide a clearer picture, let’s compare STOs with other common fundraising methods, highlighting their strengths and weaknesses in relation to each other.

| Feature | STOs | IPOs | ICOs |

| Regulation | Regulated under securities laws, providing transparency and protection. | Highly regulated, requiring extensive compliance and disclosures. | Largely unregulated, leading to increased risks of fraud and scams. |

| Investor Rights | Offers tokens backed by real-world assets, often with ownership rights. | Provides ownership rights through shares. | Typically offers utility tokens with no ownership or asset claims. |

| Accessibility | Open to global investors, with moderate entry barriers. | Limited to accredited or institutional investors initially. | Broad accessibility due to minimal regulatory requirements. |

| Cost Efficiency | More cost-effective due to blockchain-based processes and reduced intermediaries. | Expensive, involving underwriters, legal fees, and compliance costs. | Lower costs compared to IPOs but prone to inefficiency and misuse. |

| Liquidity | High liquidity through secondary markets for tokenized assets. | Limited liquidity; shares trade only on stock exchanges. | Potential for high liquidity on crypto exchanges but limited by market adoption. |

| Technology | Blockchain-based, ensuring transparency and security through immutable ledgers. | Traditional systems with limited technological integration. | Blockchain-based but with fewer regulatory safeguards. |

| Speed of Fundraising | Faster than IPOs due to streamlined processes using blockchain. | Time-intensive, often taking months to years to complete. | Very fast but without thorough vetting, increasing risk factors. |

| Risk of Fraud | Low, due to regulatory oversight and compliance. | Low, thanks to established regulations and investor protections. | High, owing to lack of oversight and regulatory ambiguities. |

This table highlights the unique advantages and trade-offs associated with each fundraising method, emphasizing STOs as a middle ground between the rigorous compliance of IPOs and the technological flexibility of ICOs.

Conclusion

Security Token Offerings are more than just a trend; they represent a fundamental shift in how capital is raised and assets are managed. Their potential to democratize finance and create new investment opportunities is immense. As the regulatory landscape becomes clearer and technology advances, STOs are poised to become an increasingly important part of the financial ecosystem.

For businesses seeking innovative funding solutions and investors looking for new avenues of growth, understanding and engaging with STOs is becoming essential. The future of finance is being shaped by these innovative digital securities, and the opportunities they present are vast and transformative. Embracing this evolution can unlock significant potential for growth and innovation in the financial world.

Why STOs Are a Game-Changer

Security Token Offerings are revolutionizing finance by offering a compliant, efficient, and transparent way to raise capital and trade assets. Their asset-backed nature and regulatory compliance provide a level of security and trust that is often lacking in other digital asset offerings.

The Growing Adoption of STOs

The increasing number of successful STOs and the growing interest from both businesses and investors indicate the strong potential and future growth of this market. This growing adoption signals a significant shift in the financial landscape.

How to Get Started with Your STO

If you’re considering launching an STO, the first step is to seek expert advice and develop a comprehensive plan that addresses both the legal and technical aspects of the offering. Partnering with experienced professionals can significantly increase your chances of success.

Key Takeaways

In summary, here are the essential points to remember about Security Token Offerings:

- STOs are regulated, asset-backed, and offer fractional ownership. This makes them a secure and accessible investment option, bridging the gap between traditional finance and the digital asset world.

- They provide enhanced liquidity, transparency, and global access. These benefits make STOs an attractive alternative to traditional fundraising methods, offering greater efficiency and broader reach.

- Legal compliance and technical expertise are critical for success. Navigating the regulatory landscape and ensuring the security of the technology are paramount for a successful STO launch and long-term viability.

- Real-world examples demonstrate the versatility of STOs across industries. From real estate to venture capital, STOs are proving their potential in various sectors, showcasing their adaptability and wide-ranging applications.

How do STOs ensure compliance with AML and KYC regulations?

STO platforms typically integrate robust AML and KYC procedures, similar to those used in traditional finance. This includes verifying the identity of investors and monitoring transactions for suspicious activity to prevent illicit financial flows, ensuring a secure and compliant environment.

Can non-accredited investors participate in STOs?

The eligibility criteria for participating in an STO depend on the specific regulations of the jurisdiction where the offering takes place. Generally, accredited investors (those meeting certain income or net worth thresholds) have fewer restrictions, while non-accredited investors may face limitations on the amount they can invest to mitigate risk. However, some STOs are structured to allow participation from non-accredited investors under specific exemptions.

What are the tax implications of investing in STOs?

The tax implications of investing in STOs can vary depending on the jurisdiction and the nature of the underlying asset. It is advisable to consult with a tax professional to understand the specific tax consequences in your situation, as tax laws surrounding digital assets can be complex and subject to change.