An airdrop marketing campaign is a sharp and deliberate strategy where blockchain projects throw out free tokens to wallets. But it isn’t some magic crypto rain falling from the sky; you need to know how to create a successful airdrop marketing campaign in order to properly gain attention and pull users in early.

A token airdrop campaign is about building an initial base and blasting a token into as many hands as possible. The chief goal here is to pull people into the project’s orbit so more wallets hold the tokens. That means more chatter, more experiments on your dApp, and more folks checking your updates.

You’ll often see projects asking for simple things: sign up, register a wallet, maybe follow on social media, or complete a few other tasks. Once verified, tokens land in the wallets. Think back to 2017’s ICO boom as a prime example when airdrops were everywhere.

But here’s the catch: free token distribution is more of a tactical marketing strategy instead of just tossing free coins into the void. Airdrops aim to spread token ownership, prevent a few whales from hoarding, and invite real user interaction. So, if you’re cooking up an airdrop marketing campaign in 2025, you have to be aware you’re playing in a space that’s gotten sharper, faster, and more competitive.

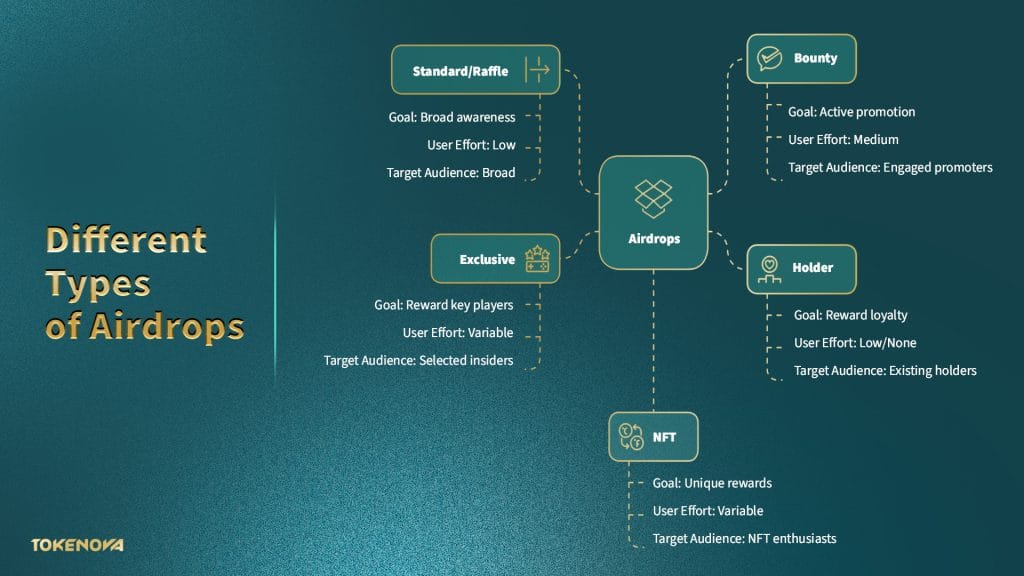

The 5 Types of Crypto Airdrops for Marketing

Not all airdrops are made equal. You’ve got to pick the right type to match your crypto airdrop strategy. Some types spark short-term excitement, while others are crafted to drive deep, lasting engagement. Each type has strengths and weaknesses depending on your goals, your audience, and how much effort you’re ready to throw behind filtering, verifying, and rewarding the right participants.

Standard Airdrop (aka Raffle Airdrop)

Raffle Airdrop is a classic Airdrop marketing campaign. Users toss in a wallet address or sign up, maybe cross fingers if there’s a raffle involved. It doesn’t require heavy lifting, and you can get in with a quick sign-up. It’s also great for building numbers fast because anyone can join without effort.

That said, you should be warned that this type of blockchain Airdrop marketing can attract freebie hunters with no long-term interest. Bots also love this, so you’ll definitely need filters.

Bounty Airdrop

Bounty Airdrop is a bit of a hustle for users. They complete tasks such as following an X account, retweeting, writing a blog, or joining a Telegram channel. In return, they get tokens. It’s a trade of reward for promotion. Although this Airdrop marketing strategy gets higher-quality engagement, but verifying all those tasks can eat up resources.

Holder Airdrop

In the Holder Airdrop strategy, tokens drop into wallets that already hold a specific asset, like a token or a related chain like ETH or ATOM, usually based on a snapshot (a record taken at a set date/time). It’s automatic and fair, and it reinforces loyalty among your base.

Exclusive Airdrop

As the name suggests, exclusive Airdrop is a VIP kind of Airdrop marketing strategy. Tokens go only to handpicked addresses, such as early supporters, top community contributors, and high-impact influencers. In plain terms, it’s the project giving a clear nod to the people who stuck around and gave real value. If done right, an exclusive Airdrop can build massive goodwill and loyalty that sticks. But the trick is making sure the selection feels fair, clear, and transparent, rather than like backroom favoritism or secret deals that alienate the rest of the community.

NFT Airdrop

NFT Airdrops give out collectibles, access passes, or utility-based tokens. You can base eligibility on holdings or tasks, just like with fungible tokens. Perceived value is more important than anything else, and if the NFT feels cheap or pointless, the campaign will likely flop.

| Feature | Standard/Raffle | Bounty | Holder | Exclusive | NFT |

| Goal | Broad awareness | Active promotion | Reward loyalty | Reward key players | Unique rewards |

| User Effort | Low | Medium | Low/None | Variable | Variable |

| Target Audience | Broad | Engaged promoters | Existing holders | Selected insiders | NFT enthusiasts |

| Pros | Fast, big numbers | Boosts visibility | Builds loyalty | Creates goodwill | Adds uniqueness |

| Cons | Low retention | Needs verification | Needs prior holders | Small reach, exclusive | Niche appeal |

Airdrop Marketing Campaign Best Practices: Step-by-Step Guide

Tossing free tokens around without a plan is like lighting money on fire. That’s why a successful Airdrop marketing campaign in 2025 needs a sharp, step-by-step approach, not just the hype. And crypto consultancies like Tokenova can stand by your side as your strategic partner for launching a successful airdrop.

But for now, let’s dissect the steps for a cohesive blockchain Airdrop marketing.

1. Define Your Objectives

First up, figure out what you actually want to achieve. You need to know if you want to chase brand awareness, grow your user base, reward early diehards, or drive people onto your dApp? Clear, specific objectives are a prerequisite to anchoring every other decision.

2. Identify Your Target Audience

The next step is to know who you’re trying to reach. Your target audience could be DeFi nerds, NFT collectors, hardcore devs, or casual newcomers. You should define them, understand their habits, and know where they hang out online. Without this, your campaign’s aimless.

3. Choose the Right Blockchain

Tokenization in blockchain doesn’t get you success singlehandedly. You’d want your Airdrop marketing campaign to have low fees, solid scalability, an active user base, and reliable smart contract support. Ethereum, Solana, BNB Chain, and Polygon are some of the go-to choices, and each comes with trade-offs. For instance, Solana’s reputation for high throughput and low fees makes it a go-to choice for an Airdrop project.

4. Select the Airdrop Type

Each airdrop type serves a different goal, so it’s important to align your choice with what you’re trying to achieve:

- Standard Airdrop: They might pull in large numbers, but often lack commitment.

- Bounty-Based Airdrops: They require more user effort and often lead to deeper engagement.

- Holder and Exclusive Types: They reward loyalty or contribution, helping you grow a core community.

- NFT Airdrops: They can stir up unique excitement among collectors or fans of gamified rewards.

If you pick the wrong type of Airdrop and consequently a mismatched Airdrop marketing campaign, you might attract users who are only interested in quick rewards and disappear after claiming their tokens. And no one wants to build a dedicated community, but end up with inactive wallets, bot activity, or users who dump the tokens immediately.

5. Develop Clear Eligibility Criteria

You should be very specific about who qualifies to receive tokens. This could include:

Snapshot dates to capture wallet holdings at a specific point in time,

Mandatory task lists that must be completed

Minimum token holdings that show user commitment.

Confusion kills trust fast. That’s why these rules should be clearly communicated on all relevant platforms, so users don’t feel blindsided or frustrated. It’s best to use simple, direct language and make sure the criteria are easy to follow. And yes, don’t skip the anti-bot (Sybil) filters; it’s not optional to weed out fake accounts and wallet farms trying to game your drop. Without safeguards like CAPTCHAs, wallet behavior analysis, or identity verification tools, you can keep things clean and fair.

6. Plan Token Allocation and Distribution Mechanics

Token allocation is another notable stage in devising a token Airdrop campaign. Start by deciding the total number of tokens you plan to distribute. Then, determine the distribution per user. It should be transparent if it’s going to be equal for everyone, or based on tiers like activity level, referral count, or past engagement with your ecosystem.

Next, think about vesting. Will the tokens be available immediately, or should they unlock over time to discourage instant sell-offs? Vesting schedules can help control token flow and maintain price stability. These choices influence more than just token distribution as they affect long-term commitment, token price pressure, and overall community trust.

7. Design a Marketing and Promotion Strategy

After setting up your token allocation, you need to decide how users will actually receive their tokens. There are three main delivery options, each with its own strengths and drawbacks:

Manual Distribution

Manual drops give you more control over who receives what, allowing for highly customized rewards. On the flip side, it demands significant time and labor, and it’s prone to human error.

Automated Smart Contracts

Smart contracts can streamline the process by automating distributions based on predefined rules. They reduce manual work and eliminate mistakes, but only if the code is secure and thoroughly audited. A single flaw in the contract could lead to major losses or loopholes.

Claim Portals

Claim portals require users to manually retrieve their tokens, which can reduce spam and prevent tokens from going to inactive wallets. However, they introduce an extra step for the user, which could reduce participation if not handled warily.

8. Ensure Legal and Regulatory Compliance

You should ensure your airdrop doesn’t accidentally violate any laws before it’s too late. Work with lawyers and consultants like Tokenova who understand crypto and token regulations, especially the tricky overlap between tokens and securities.

You’ll need to cover a few bases:

- Does your token pass the Howey Test in the U.S.? If not, you might be on the hook for securities violations.

- Are you following KYC (Know Your Customer) and AML (Anti-Money Laundering) rules if your region or user base requires them?

- Have you considered taxes for both your team and those receiving the tokens?

- If you’re collecting any kind of user data, do you comply with privacy laws like GDPR in Europe or CCPA in California?

Even if your project is decentralized, these legal concerns can come back to bite you. Handle them early.

9. Technical Implementation and Security

- Smart Contract Development: Your smart contracts are the foundation of your airdrops, and thus, they must be secure and efficient. Even a small coding oversight could result in major financial loss or exploitation. This makes it a must-do to have some independent, professional auditors testing and reviewing the functions.

- Claim Portal Security: Treat your claim portal as seriously as you would a vault. It needs layers of protection against phishing, distributed denial-of-service (DDoS) attacks, and common exploit attempts. Weak portal security compromises user trust and can tank your campaign before it starts.

- Testing: Nothing should go live untested. Deploy your setup on a testnet first and run through all critical flows, such as eligibility checks, token distribution, and UI/UX. Having real users simulate the process can reduce the chance of technical issues once you’re on the mainnet.

- Anti-Sybil Measures: To prevent abuse, implement safeguards against Sybil attacks. CAPTCHAs, social media verifications, IP tracking, and behavioral analytics help flag fake or duplicate accounts. For large token amounts, requiring KYC (Know Your Customer) processes might be necessary, even if unpopular, to protect your community and campaign integrity.

10. Execute the Airdrop

This is the point where your airdrop goes live. Follow the steps you’ve planned and keep everything running smoothly. Make sure your distribution tools are functioning, your team is ready to respond to questions, and your communication channels are open in case anything goes wrong.

11. Post-Airdrop Engagement and Analysis

The drop isn’t the end. Once the tokens are out, your work shifts into keeping the momentum going. Start by managing your new community; make sure holders know what to do next, where to go, and how to stay involved.

Measuring airdrop marketing campaign success is another continuous task in your post-airdrop phase. You should measure how well your campaign did by comparing the actual results with the KPIs you set at the beginning. Look at user activity, engagement, and growth to gauge success. Also, don’t forget to collect honest feedback from your participants about what they liked and what confused them; that input helps to make future campaigns smoother and more effective. And lastly, continue promoting your project, and stay active in your communities to maintain the buzz you’ve built.

This checklist summarizes the key actions needed before launching your airdrop:

| Category | Task | Status (Done/In Progress/To Do) | Notes |

| Strategy | Define clear, measurable objectives (e.g., user growth, awareness) | Aligned with overall project goals? | |

| Identify and segment target audience (personas, behaviors) | Who are we trying to reach? | ||

| Choose the appropriate airdrop type (Standard, Bounty, Holder, Exclusive, NFT) | Matches objectives and audience? | ||

| Select the optimal blockchain (fees, scalability, ecosystem) | Where is our audience? Can it handle the load? | ||

| Tokenomics | Determine total token allocation for the airdrop | Aligned with overall token supply & project goals? 2 | |

| Define token distribution per participant/tier | Fair and incentivizing? | ||

| Plan for potential vesting schedules, if any | To mitigate sell pressure? | ||

| Eligibility | Establish clear, verifiable eligibility criteria (snapshot date, tasks, etc.) | Easy to understand and implement? | |

| Implement anti-Sybil attack measures | How will we prevent fraud? | ||

| Technical | Develop/select secure token distribution mechanism (smart contract, multisender) | Audited? Reliable? | |

| Design and develop a secure claim portal/landing page (if applicable) | User-friendly? Secure against attacks? | ||

| Conduct thorough end-to-end testing on a testnet | All scenarios covered? | ||

| Marketing | Develop a multi-channel promotion plan (social, influencers, content, PR) | Channels selected? Content ready? | |

| Prepare announcement copy for all channels (Twitter, Telegram, Blog) | Clear, engaging, includes all key info? | ||

| Create a landing page or registration form with clear instructions | Simple, secure, user-friendly? | ||

| Legal | Consult with legal counsel regarding securities laws, KYC/AML, tax | Compliance in key jurisdictions confirmed? | |

| Prepare necessary disclaimers (tax liability, risks) | Communicated to users? | ||

| Ensure data privacy compliance if collecting user information | GDPR/CCPA considered? | ||

| Operations | Set a clear timeline (start/end dates, snapshot, distribution) | Realistic and communicated? | |

| Prepare community support channels and FAQs | Ready to handle queries? | ||

| Allocate budget for marketing, gas fees, tools, legal, etc. | All costs accounted for? | ||

| Post-Airdrop | Plan for post-airdrop community engagement and onboarding | How will we retain new holders? | |

| Define Key Performance Indicators (KPIs) for measuring success | How will we track ROI? |

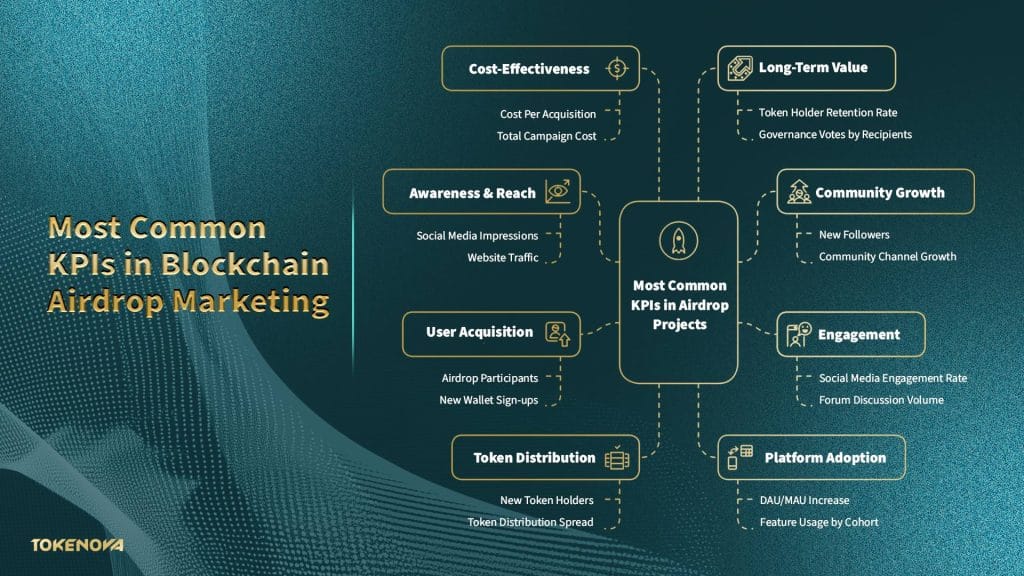

Setting Clear Objectives and KPIs for Your Airdrop

Without defined objectives and Key Performance Indicators (KPIs), your Airdrop marketing campaign will be just throwing tokens into the void and hoping something sticks. That’s why setting SMART objectives is a must, namely Specific, Measurable, Achievable, Relevant, Time-bound. To give an example, “grow the community” or “boost engagement” aren’t precise KPIs, and instead, you should set KPIs like “add 5,000 new Telegram members in 60 days” or “increase daily active users by 30% in 90 days.”

Your KPIs should match your goals:

- Awareness: track social media shares and landing page visits.

- Community growth: monitor Telegram, Discord, and X follower numbers.

- User acquisition: count new wallets and dApp interactions.

- Token spread: check how many unique holders you gained.

- Loyalty: measure how many airdrop recipients stay active after 30, 60, and 90 days.

Tools like Nansen, Dune Analytics, and web metrics can facilitate the process of pulling the right data for your crypto Airdrop strategy.. And remember that your KPIs have different meanings in various phases of your Airdrop launch, and you need to constantly track what has worked, where users dropped off, or where costs spiked.

Check out the following table to get familiar with the most common KPIs in Airdrop projects?

| Objective Category | Potential KPIs | Data Source Examples |

| Awareness & Reach | Social media impressions & reach, website traffic (landing page), number of airdrop announcement shares, PR mentions | Social media analytics, web analytics (GA4, Plausible) |

| Community Growth | New followers/members (Twitter, Discord, Telegram), growth rate of community channels | Social media platform analytics, community management tools |

| Engagement | Social media engagement rate (likes, comments, shares), participation in AMAs/contests, forum discussion volume | Social media analytics, community platform data |

| User Acquisition | Number of airdrop participants/claimants, new wallet sign-ups, new dApp users from airdrop cohort | Airdrop platform data, on-chain analytics, dApp analytics |

| Token Distribution | Number of new token holders, token distribution spread (e.g., Herfindahl-Hirschman Index), claim rate | Blockchain explorer, on-chain analytics (Nansen, Dune) |

| Platform Adoption | DAU/MAU increase, number of transactions by new users, TVL contribution from new users, feature usage by cohort | dApp analytics, on-chain analytics |

| Cost-Effectiveness | Cost Per Acquisition (CPA) of new holder/user, total campaign cost vs. tokens distributed value | Internal financial tracking, campaign data |

| Long-Term Value | Token holder retention rate (30/60/90 days), ongoing platform engagement by airdrop recipients, governance votes by recipients | On-chain analytics, dApp analytics, DAO voting data |

Whether you’re looking to navigate token compliance, structure your tokenomics, or legally set up in jurisdictions like ADGM or DIFC, Tokenova provides end-to-end support tailored for airdrop campaigns. We help you define fair eligibility criteria, draft the legal framework, implement secure distribution mechanics, and ensure full regulatory alignment.

Target Audience Identification and Segmentation

If you don’t know who you’re targeting, your campaign is sunk before it starts. You can start by sketching user personas by answering questions like the following:

- What’s their crypto experience?

- Are they traders, collectors, or builders?

- Where do they spend time, like on Ethereum, Solana, or Base?

- Are they privacy geeks, governance voters, or NFT flippers?

Once the basic questions are cleared out, you should break the audience into separate segments:

- Behavioral: who’s already using your dApp or similar products?

- Value-based: who’s contributed big value (liquidity, governance, dev work)?

- Community-based: which Discords, Telegrams, or forums do they live in?

- Geographic: where are they legally allowed to participate?

Audience segmentation gives you a wider insight into how to tailor your campaign to fit. If you target devs, for example, you can perhaps take advantage of airdrop rewards code contributions. Alternatively, if you target DeFi users, maybe eligibility is tied to staking or LP activity. A shotgun approach just fills your holder list with bots and dumpers.

Case Studies: Successful Airdrop Campaigns and Their Takeaways

Arbitrum’s $ARB Airdrop (March 2023)

In March 2023, Arbitrum handed out over 1.27 billion $ARB tokens to 625,000 wallet addresses. Huge numbers, but more than that, it was thoughtful. They didn’t just open the floodgates. Wallets had to have interacted with Arbitrum One or Arbitrum Nova before a certain snapshot date. That kind of gatekeeping rewarded real users and early believers. Plus, the claim process happened through a secure site, which cut down phishing risks.

Takeaway: Reward early usage with clarity and care. Snapshot eligibility + a secure claim process = trust and traction.

Optimism’s $OP Airdrops (Rounds 1 & 2)

Optimism didn’t go small either. Their first airdrop in May 2022 sent their $OP tokens to nearly 250,000 wallets. However, their second round targeted contributors, such as governance voters, builders, and active community members.

Takeaway: Airdrops can reward more than just users. They can empower your builders and glue people to your mission.

Uniswap’s $UNI Airdrop (September 2020)

You probably remember this one. September 2020 — 400 $UNI tokens went to anyone who’d used Uniswap before a certain date. That meant over 250,000 wallets got in. At $3 per token, that was roughly $1,200 dropped out of nowhere. It wasn’t just generous. It was iconic. Users felt seen, rewarded, and excited, and it sparked major word-of-mouth.

Takeaway: Surprise retroactive rewards work, especially when they’re tied to real usage and come with real value.

Blur’s $BLUR Airdrops (2022–2023)

Blur went full arcade mode. Users earned points for listing and bidding on NFTs, and those points later turned into tokens. It was sticky, addictive, and it worked so well that Blur managed to pull traders away from OpenSea.

Takeaway: If your goal is speed, engagement, and competition, gamified reward loops can fuel real traction.

Final Thoughts

The days of blind airdrops are over. Users have become more selective, more skeptical, and the competition for attention has never been fiercer. If you want your airdrop marketing campaign to reach real users and not just bots, you’ll need a proper Airdrop marketing campaign instead of random free token distribution.

This means knowing exactly what you want from the campaign. Are you chasing new users, community growth, and governance engagement? Setting sharp objectives and matching them with clear KPIs is step one. Then there’s designing eligibility rules that are fair, transparent, and tough enough to keep the bots out.

Ready to launch your airdrop marketing campaign? Schedule a free consultation with Tokenova’s airdrop strategy experts to discuss your project needs and how our platform can maximize your campaign’s success.

Resources: Binance, Investopedia, FasterCapital, FinPR