Blockchain trends are spearheading a revolution that redefines trust, security, and data ownership. This article examines the transformative power behind the latest blockchain trends—from decentralized identity systems to the tokenization of real-world assets. Discover how these innovations not only address longstanding challenges but also pave the way for more efficient, transparent, and secure systems. Dive in to learn why understanding these trends is crucial for staying competitive in an increasingly interconnected landscape.

Decentralized Identity (DID) and Self-Sovereign Identity Systems

One of the most compelling blockchain trends for 2025 is the emergence of decentralized identity (DID) frameworks. The global decentralized identity market is expected to grow from $1.15 billion in 2024 to $89.6 billion by 2033, representing a compound annual growth rate (CAGR) of 62.2%. Traditional identity management is rapidly being replaced by self-sovereign identity (SSI) systems, which give individuals full control over their digital credentials. By leveraging blockchain’s inherent security and immutability, DID systems utilize decentralized identifiers—unique cryptographic tokens stored securely in digital wallets—to verify identity without reliance on centralized authorities.

Innovative projects are now integrating zero-knowledge proofs and biometric verification methods, ensuring that personal data is shared selectively and securely. For example, platforms like LUKSO’s Universal Profiles and blockchain voting tools powered by zero-knowledge technologies demonstrate how the latest blockchain trends are transforming the way we interact online. These advancements not only enhance privacy and reduce fraud risks but also create a more resilient infrastructure that aligns with regulatory demands for secure data sharing.

Data Sovereignty Through Blockchain

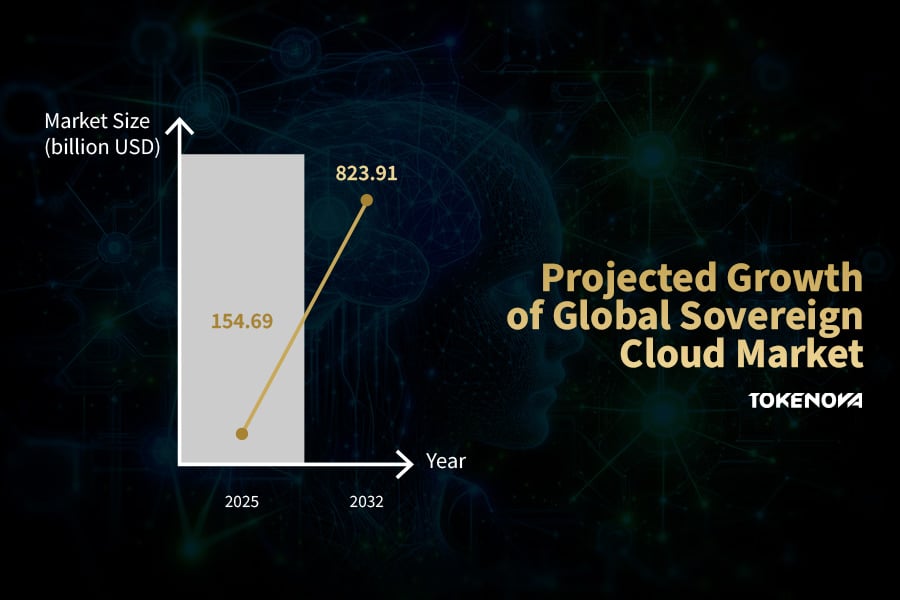

Data sovereignty—the right to control one’s data—has become critical as regulations tighten globally and individuals demand greater accountability from organizations. Blockchain’s decentralized ledger provides immutable records that ensure data integrity and compliance with laws such as the GDPR. The global sovereign cloud market, which addresses data sovereignty and compliance, is projected to grow from $154.69 billion in 2025 to $823.91 billion by 2032, at a CAGR of 27%.

By combining blockchain with artificial intelligence, companies can securely analyze data without compromising ownership. Smart contracts automate data-sharing protocols, ensuring that access permissions are enforced without human intervention. This innovation has been pivotal for industries like healthcare, finance, and government, where regulatory compliance and transparent data usage are non-negotiable. The convergence of blockchain technology with modern data governance practices underscores the latest blockchain trends by fostering environments where data remains secure, traceable, and accessible only to authorized parties.

NFTs Beyond Collectibles: Utility and Real-World Applications

Non-fungible tokens (NFTs) have matured significantly, marking a shift from mere digital collectibles to assets with real-world utility. The global NFT market is projected to grow from $27.3 billion in 2023 to $264.6 billion by 2032, representing a compound annual growth rate (CAGR) of 28.7%. This significant increase is driven by the adoption of NFTs in various real-world applications, including gaming, event ticketing, and real estate. This expansion showcases the growing usefulness of NFTs beyond just digital collectibles.

This evolution is a key aspect of blockchain trends as NFTs expand into domains such as gaming, event ticketing, real estate, and governance. Utility NFTs are powered by smart contracts that embed ownership rights, usage details, and metadata directly on the blockchain, providing a secure and transparent record of transactions.

In the gaming sector, utility NFTs grant players genuine ownership of in-game assets, facilitating cross-platform interoperability and a thriving secondary market. Likewise, digital ticketing systems utilizing NFTs offer enhanced security and fraud prevention for large-scale events. In real estate, tokenized assets enable fractional ownership, lowering investment barriers and democratizing access to traditionally illiquid markets. Additionally, decentralized autonomous organizations (DAOs) are incorporating NFTs for governance purposes, allowing token holders to vote and influence project direction.

AI and Blockchain Convergence

The convergence of artificial intelligence (AI) and blockchain technology is rapidly emerging as one of the most influential blockchain trends in 2025. This integration offers transformative benefits by combining AI’s analytical power with blockchain’s decentralized security. As blockchain networks become more sophisticated, AI algorithms are increasingly used to optimize consensus mechanisms, detect fraudulent activities, and automate complex processes.

One striking example is the AI-driven enhancement of smart contracts, where conditional logic is refined using real-time data inputs. This not only boosts operational efficiency but also minimizes human error, paving the way for more reliable and transparent transactions. Furthermore, AI applications in predictive analytics and risk management are set to revolutionize financial services by providing deeper insights into market trends and consumer behavior.

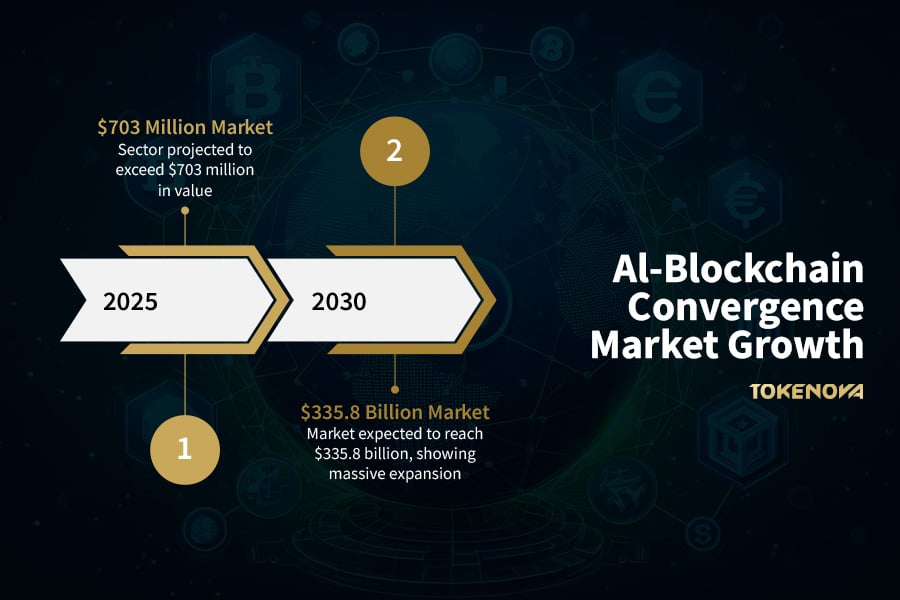

The market for AI-blockchain convergence is expected to be robust, with projections indicating that the sector could exceed $703 million in 2025 and $335.8 billion by 2030. This convergence addresses many of the “black box” issues associated with AI, enabling more transparent and accountable decision-making processes. As such, these latest blockchain trends are laying the groundwork for a new era of technological innovation, where AI and blockchain collaboratively enhance efficiency, security, and data integrity across diverse sectors.

Tokenization of Real-World Assets

Tokenization is revolutionizing the way traditional assets are owned and traded. This process involves converting physical and conventional financial assets into digital tokens that can be traded on blockchain networks. The result is an increase in liquidity, transparency, and accessibility that benefits both individual investors and large institutions.

Through tokenization, assets such as real estate, art, commodities, and even securities can be fractionally owned, lowering the barriers to entry for many investors. This fractional ownership model not only democratizes investment but also enables more efficient market participation by reducing capital requirements. Major financial institutions and startups alike are embracing this model, leading to an anticipated surge in market size. The market size for tokenization of real-world assets (RWA) is projected to reach $30 trillion by 2030.

DeFi Expansion and TradFi Integration

Decentralized Finance (DeFi) is rapidly evolving, bridging the gap between decentralized networks and traditional financial systems—a dynamic that stands out among 2025 blockchain trends. DeFi platforms are now offering sophisticated financial products, including lending, borrowing, and insurance services, all without the need for conventional intermediaries. This shift has led to significantly lower transaction costs, faster processing times, and enhanced transparency.

The integration of DeFi with traditional finance (TradFi) is creating a hybrid ecosystem that leverages the strengths of both worlds. Institutional investors are increasingly participating in DeFi markets, attracted by the efficiency and reduced friction offered by blockchain-based solutions. According to market projections, the global DeFi market could reach $231 billion by 2030, highlighting the rapid growth and mainstream acceptance of these technologies.

Smart contracts remain at the heart of this integration, automating complex financial transactions and enforcing regulatory compliance. This technological synergy not only enhances financial inclusion but also improves the reliability and scalability of financial services. As traditional banks experiment with blockchain-enabled platforms, the latest blockchain trends in DeFi and TradFi integration are poised to transform how we perceive and engage with financial systems in 2025 and beyond.

Enhanced Blockchain Interoperability

Historically, blockchain networks operated in isolation, limiting asset and data transfer. Now, cross-chain bridges, multi-chain protocols, and Layer 2 solutions are enhancing interoperability, enabling efficient communication and value sharing.

These advancements lead to faster asset transfers and integrated data flows, crucial for both enterprise applications and everyday transactions. For example, Layer 2 solutions like those on Polygon boost transaction speeds and lower fees while ensuring Layer 1 security.

Interoperability protocols empower developers to build versatile applications that leverage multiple blockchains, improving user experiences and breaking down technological silos. As these solutions evolve, they will be essential in transforming isolated networks into a unified digital ecosystem by 2025.

Web3 Content Creator Economy

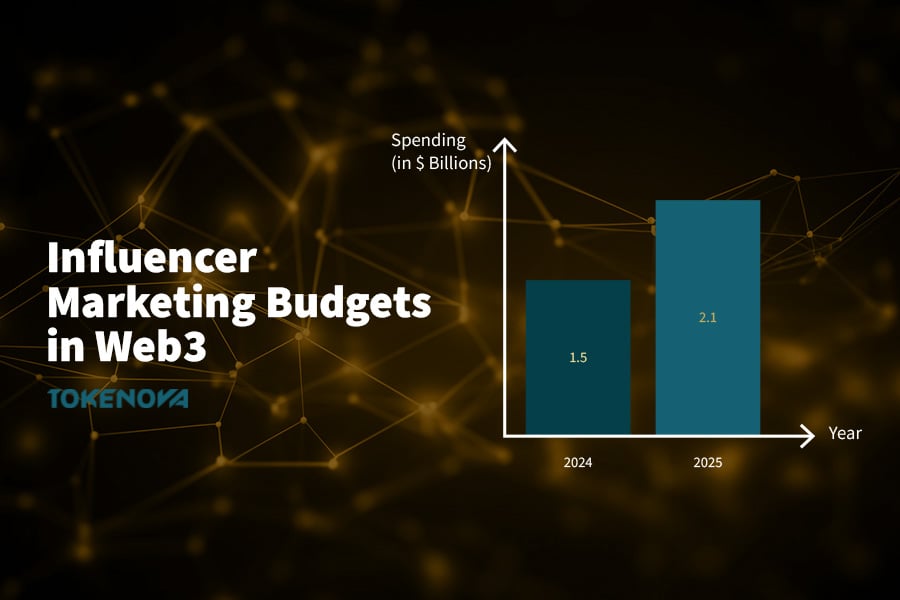

The rise of Web3 is redefining the content creator economy, marking a significant shift within blockchain trends 2025. Decentralized platforms are empowering creators by eliminating traditional gatekeepers and enabling direct, secure transactions with their audiences. Through blockchain, content creators can now leverage tokenized memberships, digital collectibles, and automated royalty systems to monetize their work more equitably.One notable development is the advent of token-gated content, where exclusive access to premium material is provided through blockchain-based tokens. This model has resulted in significantly higher engagement rates—some creators report increases of up to 65% compared to traditional subscription models. Influencer marketing budgets in the Web3 space have surged, with brands spending $1.5 billion in 2024 and expecting a 40% increase in 2025 as they tap into this emerging economy.

Moreover, smart contracts facilitate near-instant royalty payments and transparent revenue sharing, ensuring that creators receive fair compensation without the delays or deductions imposed by conventional platforms. This decentralized approach not only enhances creative freedom but also fosters a more collaborative and sustainable digital ecosystem. As the Web3 creator economy continues to evolve, it will remain a cornerstone of the latest blockchain trends, redefining how value is created, distributed, and sustained in the digital age.

Blockchain for Sustainable Development

Sustainability is now a key driver behind blockchain technology. Modern applications are designed to support environmental, social, and governance (ESG) goals, enhancing transparency in resource management. One innovative use is the digitization of carbon credits, where blockchain smart contracts streamline their minting, tracking, and retiring, improving market liquidity and trust. This transparency allows companies to accurately report their environmental impact and meet regulatory standards. The global carbon credit market, which increasingly leverages blockchain for secure tracking and trading, is forecast to soar from $933.23 billion in 2025 to $16.38 trillion by 2034, at a CAGR of 37.68%.

In sectors like maritime and energy, blockchain optimizes fuel consumption and reduces emissions. Additionally, its immutable record-keeping reduces paper waste and enhances efficiency, making sustainability initiatives central to emerging blockchain trends.

Challenges and Future Directions

Despite its transformative potential, blockchain technology faces several challenges. Scalability, energy consumption, and interoperability remain significant hurdles that must be addressed for mass adoption. Additionally, the rapid pace of technological change demands continuous innovation and regulatory adaptation.

Looking ahead, the future of blockchain trends appears promising as ongoing research and development aim to overcome these challenges. Efforts to improve consensus mechanisms, develop energy-efficient protocols, and enhance cross-chain communication are underway. Moreover, as industries increasingly recognize the value of decentralization, we can expect greater collaboration between the public and private sectors. These efforts, together with emerging latest blockchain trends, are set to unlock new possibilities and drive the evolution of a truly decentralized digital infrastructure.

Key Takeaways

- Decentralized Identity and Data Sovereignty: Empower users and secure data with blockchain’s immutable ledger.

- Utility NFTs and Tokenization: Revolutionize asset ownership and democratize investments across various sectors.

- AI Integration: Enhance operational efficiency and transparency through the convergence of AI and blockchain.

- Financial Innovation: Bridge DeFi and TradFi to create a more inclusive and efficient financial ecosystem.

- Interoperability and Regulation: Break down blockchain silos and align with regulatory frameworks for broader adoption.

- Sustainability: Leverage blockchain to support environmental initiatives and improve resource management.

Conclusion

Blockchain trends are what are reshaping industries by driving innovations in identity management, finance, interoperability, and sustainability. As we witness the convergence of technologies like AI and blockchain, the latest blockchain trends are setting the stage for a more secure, efficient, and decentralized future. Embracing these changes is key for businesses and individuals eager to lead in a dynamic digital ecosystem.