Did you know that Abu Dhabi ranks among the top cities globally for ease of doing business and investor-friendly policies? If you’re considering expanding your business horizons, company formation in Abu Dhabi offers a gateway to a thriving market, strategic location, and a host of economic benefits.

Abu Dhabi, the capital of the United Arab Emirates (UAE), is not just a city of soaring skyscrapers and luxurious lifestyles; it’s a burgeoning hub for global commerce and innovation. Over the past few decades, Abu Dhabi has strategically diversified its economy beyond oil, investing heavily in sectors like tourism, renewable energy, technology, and finance. Understanding local regulations is crucial for a successful venture, and this comprehensive guide will walk you through every aspect of setting up a business in Abu Dhabi, ensuring you are well-equipped to navigate the opportunities and challenges that lie ahead.

Why Choose Abu Dhabi for Business?

- Economic Diversification: The government’s Vision 2030 plan focuses on creating a sustainable, knowledge-based economy.

- Stable Political Climate: Abu Dhabi offers a secure environment with strong legal frameworks protecting investors.

- High Standard of Living: Attracts a talented and diverse workforce, enhancing the talent pool available to businesses.

- World-Class Infrastructure: State-of-the-art facilities in transportation, communication, and utilities support business operations.

💡Legal Expert Guide: By choosing company setup in Abu Dhabi, you’re positioning your business in a city that’s geared toward future growth and innovation.

Types of Company Formation in Abu Dhabi

Abu Dhabi offers diverse options for company formation, each tailored to different business activities, ownership preferences, and operational scopes. Understanding these options is essential to choose the structure that best aligns with your business goals.

Mainland Companies

Definition and Characteristics

Mainland companies, also known as onshore companies, are licensed by the Department of Economic Development (DED) of Abu Dhabi. They allow businesses to operate within the entire UAE market without any territorial restrictions, enabling direct trade with both local and international clients. This unrestricted access makes mainland companies ideal for businesses aiming for rapid expansion and a broad customer base.

Legal Requirements and Ownership Structure

Historically, mainland company registration in Abu Dhabi required a UAE national to hold a minimum of 51% ownership, with the foreign investor holding the remaining 49%. However, recent legal reforms under the UAE Commercial Companies Law have revolutionized this landscape, permitting 100% foreign ownership in over 1,000 business activities across various sectors such as manufacturing, agriculture, and services.

Key Aspects:

- Types of Licenses:

- Commercial License: For trading and commercial activities.

- Professional License: For service-oriented professions like consultancy.

- Industrial License: For manufacturing and industrial operations.

- Local Service Agent: Required for professional licenses, acting as a liaison without owning shares.

- Office Space Requirement: Must have a physical office space ranging from small offices to large warehouses.

💡Legal Expert Guide: Engaging with a local sponsor or service agent can facilitate compliance and streamline the company setup in Abu Dhabi, especially for activities still requiring local participation.

Advantages of Mainland Companies

- No Trade Restrictions: Ability to trade anywhere in the UAE and internationally.

- Government Contracts: Eligibility to bid on lucrative government projects.

- Multiple Branches: Flexibility to open multiple branches across the UAE.

- Wide Business Scope: Freedom to engage in a broader range of business activities compared to free zones.

💡Legal Expert Guide: Mainland company formation in Abu Dhabi provides the versatility and reach needed for businesses aiming for significant market penetration.

Free Zone Companies

Overview of Abu Dhabi’s Free Zones

Abu Dhabi hosts several free zones designed to attract foreign investment by offering tax incentives, full foreign ownership, and simplified business procedures. Free zones provide 100% foreign ownership and exemption from import and export taxes. They are strategically developed to cater to specific industries, fostering sector-specific growth.

Prominent Free Zones Include:

- Khalifa Industrial Zone Abu Dhabi (KIZAD): Focused on logistics, manufacturing, and industry, offering seamless connectivity through Khalifa Port.

- Masdar City Free Zone: Dedicated to renewable energy, clean technology, and sustainability industries, providing a hub for innovation and research.

- twofour54: A hub for media, entertainment, and creative industries, offering state-of-the-art production facilities and support services.

- Abu Dhabi Global Market (ADGM): An international financial center offering a business-friendly ecosystem for financial services.

Types of Entities

- Free Zone Limited Liability Company (FZ-LLC): An independent legal entity with its own shareholders. Ideal for small to medium-sized businesses.

- Branch Office: An extension of a parent company, allowing for 100% control by the parent entity.

- Freelance Permit: Allows individuals to offer professional services under their own name, suitable for freelancers and sole practitioners.

💡Legal Expert Guide: Each entity type offers unique advantages tailored to specific business needs, providing flexibility in how you structure your company setup in Abu Dhabi.

Benefits of Free Zone Companies

- 100% Foreign Ownership: No need for a local sponsor or partner.

- Tax Exemptions: Exemption from corporate and personal income taxes, and customs duties.

- Simplified Company Registration in Abu Dhabi: Streamlined registration and licensing procedures.

- Repatriation of Capital and Profits: Full repatriation allowed without restrictions.

- Modern Infrastructure: Access to high-quality facilities and support services.

💡Legal Expert Guide: Free zones are designed to make the company formation in Abu Dhabi as smooth as possible, reducing administrative burdens and operational costs.

Offshore Companies

Definition and Benefits

Offshore companies are established to facilitate international business without a physical presence in the UAE. They are ideal for activities like asset management, international trading, holding intellectual property, and maintaining bank accounts. Offshore companies are not permitted to conduct business within the UAE but offer several advantages for global operations.

Benefits Include:

- Confidentiality: Shareholder and director information is not publicly disclosed, ensuring privacy.

- Tax Optimization: No corporate taxes, VAT, or income taxes, facilitating efficient tax planning.

- Asset Protection: Secure wealth management and estate planning through a stable legal framework.

- Ease of International Transactions: Simplified processes for global business dealings.

Regulatory Considerations

While offering numerous advantages, offshore companies have specific limitations:

- No Business Within UAE: Cannot trade within the UAE market or have physical office space.

- Residency Visas Not Available: Cannot sponsor residency visas for shareholders or employees.

- Compliance Requirements: Must adhere to international regulations, including Anti-Money Laundering (AML) laws and Economic Substance Regulations (ESR).

- Registered Agent Requirement: Must appoint a registered agent approved by the relevant authority.

💡Legal Expert Guide: Understanding these limitations is essential for leveraging offshore company formation in Abu Dhabi effectively and ensuring compliance with all legal requirements.

Ideal Uses for Offshore Companies

- Holding Company: For owning shares in other companies or real estate assets.

- Intellectual Property Holding: Managing patents, trademarks, and copyrights.

- International Trading: Facilitating trade without the complexities of operating within a domestic market.

- Financial Planning: Estate planning and wealth management for high-net-worth individuals.

💡Legal Expert Guide: Offshore companies serve as a strategic tool for international business expansion and financial efficiency.

Benefits of Setting Up a Business in Abu Dhabi

Strategic Location and Economic Stability

- Gateway to Global Markets: Abu Dhabi’s strategic location bridges Asia, Europe, and Africa, providing access to over 4 billion consumers within an eight-hour flight radius.

- Robust Economy: Supported by substantial oil reserves and a commitment to economic diversification, Abu Dhabi boasts one of the highest GDPs per capita globally.

- Political Stability: A secure and transparent legal framework protects investments and enforces contracts.

💡Legal Expert Guide: Setting up a company in Abu Dhabi positions your business at the crossroads of global trade, offering unparalleled market access.

Access to Local and International Markets

- Advanced Infrastructure: World-class airports, including Abu Dhabi International Airport, and seaports like Khalifa Port facilitate efficient logistics.

- Free Trade Agreements: The UAE has multiple agreements, enhancing trade opportunities within the Gulf Cooperation Council (GCC) and beyond.

- Multinational Workforce: A diverse talent pool from over 200 nationalities brings varied skills and perspectives, driving innovation.

💡Legal Expert Guide: Your company setup in Abu Dhabi can tap into both burgeoning local markets and established international trade routes, maximizing growth potential.

Tax Advantages and Incentives

- Zero Corporate and Personal Income Taxes: Enhances profit margins and attracts top talent.

- Customs Duty Exemptions: Particularly beneficial within free zones, reducing import/export costs.

- Full Repatriation of Capital and Profits: Ensures financial flexibility and ease of international operations.

- Government Incentives: Initiatives like “Ghadan 21” offer funding and support for startups and SMEs, fostering a pro-business environment.

💡Legal Expert Guide: These financial benefits significantly enhance your company’s bottom line and long-term sustainability.

Quality of Life and Business Environment

- High Living Standards: Excellent healthcare, education, and recreational facilities attract a skilled workforce.

- Safety and Security: Low crime rates and effective law enforcement contribute to a secure environment.

- Cultural Diversity: A cosmopolitan society fosters an inclusive business culture.

💡Legal Expert Guide: An attractive living environment complements the business ecosystem, aiding in talent retention and employee satisfaction.

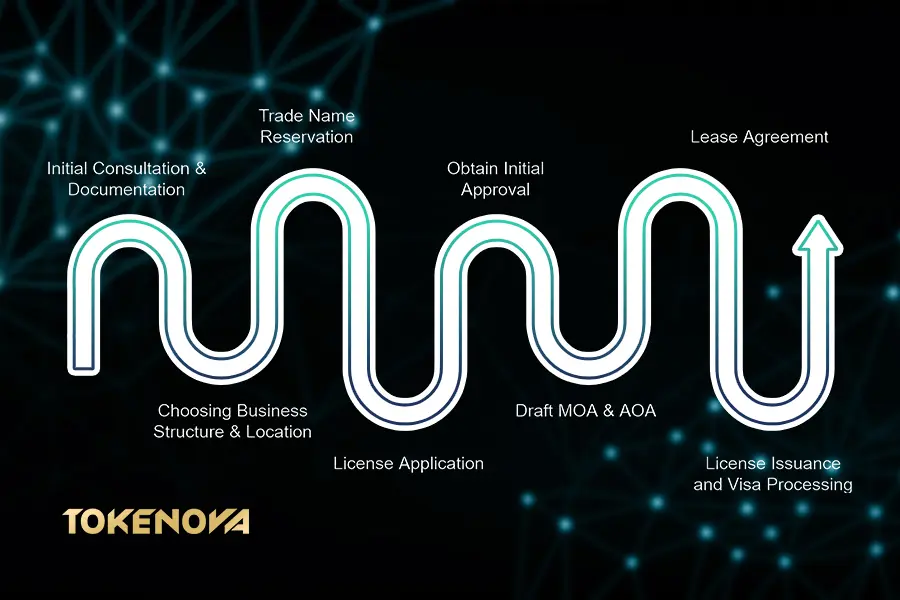

Company Registration Process in Abu Dhabi

Steps for Registration in Mainland and Free Zones

Embarking on the journey of company formation in Abu Dhabi involves several critical steps:

1. Initial Consultation and Documentation

- Engage a Business Consultant: Provides expertise on legal requirements, market conditions, and optimal company structure.

- Feasibility Study: Assess the viability of your business idea in the Abu Dhabi market.

- Prepare Documentation: Collect necessary documents, including passport copies, proposed business activities, and shareholder information.

💡Legal Expert Guide: Proper guidance ensures compliance and expedites the company registration in Abu Dhabi, minimizing potential setbacks.

2. Choosing Business Structure and Location

- Evaluate Business Activities: Determine the nature of your business to select the appropriate license and jurisdiction.

- Select Location: Choose between mainland, specific free zones, or offshore jurisdictions based on operational needs and strategic goals.

💡Legal Expert Guide: Your choice affects operational scope, costs, and regulatory obligations, so careful consideration is crucial for successful company setup in Abu Dhabi.

3. Trade Name Reservation

- Unique and Compliant Name: Reserve a trade name that adheres to UAE naming conventions, avoiding any prohibited terms or trademarks.

- Name Approval: Submit the proposed name to the relevant authority for approval.

💡Legal Expert Guide: An approved trade name is mandatory before proceeding with the license application for company registration in Abu Dhabi.

4. License Application

- Submit Application: Provide all required documents to the DED for mainland companies or the relevant free zone authority for free zone entities.

- Pay Fees: Include application, initial approval, and license fees as per the jurisdiction’s fee schedule.

💡Legal Expert Guide: Accurate and complete applications reduce delays and rejections, ensuring a smoother company formation in Abu Dhabi.

5. Obtain Initial Approval

- Verification Process: Authorities review your application to ensure compliance with legal and regulatory standards.

- Receive Approval: Proceed once initial approval is granted, which may include specific conditions to be met.

💡Legal Expert Guide: This step confirms that you can legally establish the company, subject to fulfilling all requirements.

6. Draft Memorandum of Association (MOA) and Articles of Association (AOA)

- Legal Documentation: Outline company structure, ownership percentages, management responsibilities, and business activities.

- Notarization: MOA and AOA must be notarized by a public notary or attested by the free zone authority.

💡Legal Expert Guide: These documents serve as the legal foundation of your company, defining its governance and operational framework.

7. Lease Agreement

- Physical Office Space: Secure an office as per regulatory requirements. For mainland companies, a physical office is mandatory.

- Provide Tenancy Contract: Submit the Ejari (tenancy contract) for mainland companies or office lease agreement for free zone entities.

💡Legal Expert Guide: Some free zones offer flexible office solutions like virtual offices or shared workspaces, providing cost-effective options for company setup in Abu Dhabi.

8. License Issuance and Visa Processing

- Final Approval: Upon meeting all requirements and submitting necessary documents, the business license is issued.

- Residency Visas: Apply for visas for shareholders, employees, and family members through the immigration and labor departments.

💡Legal Expert Guide: Licensing grants legal authority to commence business operations, while visas allow you and your staff to reside and work in the UAE.

9. Opening a Corporate Bank Account

- Choose a Bank: Select from local or international banks operating in the UAE.

- Provide Required Documents: Submit company documents, personal identification, and business plans as requested.

💡Legal Expert Guide: Having a corporate bank account is essential for conducting business transactions and managing finances after company formation in Abu Dhabi.

Additional Considerations

- Regulatory Approvals: Certain business activities may require additional approvals from specialized authorities (e.g., health, education, finance).

- Employee Registration: Register employees with the Ministry of Human Resources and Emiratisation and arrange for health insurance.

💡Legal Expert Guide: Compliance with all regulatory requirements ensures smooth and lawful business operations.

Costs Associated with Company Formation in Abu Dhabi

Breakdown of Costs for Different Types of Companies

Understanding the financial commitments is essential for planning and budgeting the cost of company formation in Abu Dhabi:

- Mainland Companies:

- Trade Name Reservation: Approx. AED 620.

- Initial Approval Fees: Around AED 1,000.

- License Fees: Ranges from AED 10,000 to AED 15,000, depending on business activity.

- Office Rent: Varies based on location and size; can range from AED 15,000 to AED 100,000 annually.

- Local Sponsor Fees: Negotiable, often starting from AED 10,000 to AED 25,000 annually.

- Municipality Fees: Additional charges for office registration.

- Free Zone Companies:

- Registration Fees: Between AED 9,000 to AED 15,000.

- License Fees: Approximately AED 15,000 to AED 50,000, depending on the free zone and license type.

- Office Packages: Flexi-desk options starting from AED 15,000; physical offices cost more.

- Visa Fees: Around AED 3,000 to AED 5,000 per visa, including medical and Emirates ID.

- Miscellaneous Fees: Such as document attestation and translation.

- Offshore Companies:

- Registration Fees: Approximately AED 10,000 to AED 15,000.

- Annual Renewal Fees: Around AED 8,000 to AED 12,000.

- Agent Fees: Varies by service provider; essential for compliance.

- Bank Account Opening Fees: May include additional charges.

💡Legal Expert Guide: Prices are approximate and subject to change; consult with authorities or professional consultants for current rates and personalized quotes on the cost of company formation in Abu Dhabi.

Factors Influencing the Cost

- Business Activity Type: High-risk or specialized industries may incur higher fees due to additional regulatory requirements.

- Number of Shareholders: Additional costs for processing documents and visas.

- Office Space Requirements: Premium locations and larger spaces increase expenses; consider cost-effective solutions if appropriate.

- Special Approvals and Permits: Activities requiring extra approvals (e.g., medical, legal, financial services) may involve higher costs.

- Number of Visas: More employees mean higher visa and processing fees.

💡Legal Expert Guide: Budgeting accurately ensures financial preparedness and sustainability, avoiding unexpected financial strains in your company setup in Abu Dhabi.

Cost-Saving Tips

- Choose the Right Free Zone: Some free zones offer competitive packages and lower fees.

- Flexible Office Solutions: Opt for virtual offices or shared workspaces if physical presence isn’t critical.

- Consolidate Services: Use business setup packages that include multiple services at a discounted rate.

- Negotiate Sponsor Fees: If a local sponsor is required, negotiate terms to suit your budget.

💡Legal Expert Guide: Strategic planning can significantly reduce the cost of company formation in Abu Dhabi and ongoing expenses.

Required Documentation for Company Setup in Abu Dhabi

General Documents Needed

- Passport Copies: Clear, color copies for all shareholders, directors, and managers.

- Passport-Sized Photos: Recent photographs with a white background, meeting UAE specifications.

- Proof of Residence: Recent utility bills or bank statements showing the residential address of shareholders.

- No Objection Certificate (NOC): For UAE residents employed elsewhere, a NOC from the current employer may be required.

- Curriculum Vitae (CV): Detailing professional experience, especially for professional licenses.

💡Legal Expert Guide: Having all documents in order accelerates the company registration in Abu Dhabi and minimizes delays.

Specific Requirements for Mainland vs. Free Zone Companies

Mainland Companies:

- Emirates ID Copies: For UAE nationals involved as local sponsors or service agents.

- Memorandum of Association (MOA): Outlining ownership structure and business activities.

- Local Service Agent Agreement (if applicable): Legal document specifying the agent’s role and compensation.

- Lease Agreement (Ejari): Official tenancy contract registered with the relevant municipality.

- Professional Qualifications: Attested educational certificates for professional licenses.

Free Zone Companies:

- Business Plan: Detailed plan required for certain activities or when applying for multiple visas.

- Bank Reference Letter: Proof of financial stability from a recognized bank.

- Board Resolution: For corporate shareholders, authorizing the establishment of the new company.

- Additional Approvals: From relevant authorities for regulated sectors (e.g., healthcare, education, finance).

- Specimen Signatures: For all authorized signatories.

💡Legal Expert Guide: Compliance with specific documentation requirements is crucial for approval and demonstrates credibility to authorities during company registration in Abu Dhabi.

Document Attestation and Legalization

- Attestation: Documents issued outside the UAE may need to be attested by the UAE embassy in the country of origin and the Ministry of Foreign Affairs in the UAE.

- Translation: Non-English documents must be translated into Arabic by a certified legal translator.

💡Legal Expert Guide: Ensuring documents are correctly attested and translated prevents legal complications and processing delays in your company setup in Abu Dhabi.

Post-Formation Obligations

Compliance Requirements After Company Registration in Abu Dhabi

- Annual License Renewal: Mandatory to maintain legal status, involving payment of renewal fees and submission of required documents.

- Audit Reports: Some entities, especially in free zones like ADGM, must submit annual audited financial statements by approved auditors.

- Tax Registration and Compliance:

- Value Added Tax (VAT): Register with the Federal Tax Authority if annual revenue exceeds AED 375,000.

- Economic Substance Regulations (ESR): File annual ESR notifications and reports if conducting relevant activities.

- Employee Welfare:

- Wage Protection System (WPS): Comply with regulations ensuring timely salary payments to employees.

- Health Insurance: Mandatory health insurance coverage for all employees and their dependents.

- Labor Law Compliance: Adhere to UAE labor laws regarding contracts, working hours, leave entitlements, and termination procedures.

💡Legal Expert Guide: Regular compliance after company formation in Abu Dhabi avoids legal issues, financial penalties, and protects your company’s reputation.

Importance of Maintaining Licenses and Permits

- Avoid Penalties and Fines: Non-compliance can result in substantial fines, legal action, or business closure.

- Legal Protection: Ensures operations are within the legal framework, protecting against disputes and liabilities.

- Business Continuity: Uninterrupted operations build client trust and facilitate long-term planning.

- Reputation Management: Maintains a positive image with authorities, customers, and business partners.

💡Legal Expert Guide: Proactive management of obligations safeguards your investment and promotes sustainable growth after your company setup in Abu Dhabi.

Ongoing Obligations

- Statutory Record Keeping: Maintain accurate records of meetings, resolutions, and company changes.

- Update Authorities on Changes: Notify relevant authorities of changes in ownership, management, or business activities.

- Renewal of Employee Visas: Monitor visa expiry dates and process renewals in a timely manner.

- Stay Informed on Regulatory Changes: Laws and regulations can change; staying updated ensures ongoing compliance.

💡Legal Expert Guide: Effective governance and administrative practices contribute to operational efficiency and legal compliance in your company setup in Abu Dhabi.

Pro Tips for Seasoned Entrepreneurs

- Leverage Government Initiatives: Programs like “Ghadan 21” offer funding, grants, and support for innovation, technology, and SMEs. Staying informed about these programs can provide financial benefits and growth opportunities for your company setup in Abu Dhabi.

- Stay Ahead of Regulatory Changes: Regularly consult legal advisors or subscribe to updates from government portals to remain compliant with new laws and regulations. This proactive approach prevents legal issues and positions your business favorably.

- Network Strategically: Join business councils, chambers of commerce, and industry associations like the Abu Dhabi Chamber of Commerce, American Chamber of Commerce in Abu Dhabi, or sector-specific groups. Networking can lead to partnerships, clients, and valuable market insights for your company in Abu Dhabi.

- Cultural Sensitivity: Understanding local customs, business etiquette, and cultural nuances enhances relationships and negotiations. Invest time in cultural training for yourself and your team to build trust and rapport with local partners.

- Utilize Professional Services: Hiring a Public Relations Officer (PRO) or using corporate service providers can streamline government-related processes like visa applications, license renewals, and document clearances. This allows you to focus on core business activities while ensuring compliance in your company setup in Abu Dhabi.

- Digital Presence: Establish a strong online presence through a professional website, social media, and local business directories. In a digitally connected market, this increases visibility and accessibility to potential clients and partners.

- Risk Management: Consider legal insurance, conduct regular compliance audits, and have contingency plans to mitigate risks. This proactive stance protects your business from unforeseen challenges after company formation in Abu Dhabi.

💡Legal Expert Guide: Maximizing local resources, knowledge, and strategic planning can give your business a competitive edge in the Abu Dhabi market.

Conclusion

Setting up a company in Abu Dhabi offers unparalleled access to a thriving market, extensive tax benefits, and a strategic location at the crossroads of global trade. Whether you’re interested in establishing a mainland, free zone, or offshore company, Abu Dhabi provides diverse options tailored to your business goals. With world-class infrastructure, a supportive business environment, and a commitment to innovation, this dynamic city is primed to support your growth and success.

Ready to take the first step in expanding your business in Abu Dhabi? Contact our expert consultants today to guide you through the entire setup process, ensuring a smooth and compliant transition into this vibrant business hub.

Start your journey in Abu Dhabi and unlock the potential for global success!

Key Takeaways

- Diverse Company Formation Options: Abu Dhabi offers multiple avenues for business setup, including mainland, free zone, and offshore companies, each with unique benefits and considerations.

- Strategic Advantages: The city’s strategic location, economic stability, tax incentives, and world-class infrastructure make it an attractive destination for global businesses.

- Understanding Legal Requirements: Comprehensive knowledge of legal and regulatory obligations is essential for successful company registration in Abu Dhabi and ongoing operations.

- Cost Management: Accurate budgeting and awareness of factors influencing costs ensure financial preparedness and sustainability during company formation in Abu Dhabi.

- Compliance is Crucial: Adhering to all legal requirements, maintaining licenses, and fulfilling post-formation obligations is vital for uninterrupted business operations and reputation management.

- Leverage Local Expertise: Engaging with local professionals, government initiatives, and business networks enhances opportunities for growth and success in your company setup in Abu Dhabi.

- Continuous Improvement: Stay informed, adapt to market changes, and proactively manage risks to maintain a competitive advantage.

💡Legal Expert Guide: By thoroughly understanding the landscape of company formation in Abu Dhabi, you’re well-positioned to make informed decisions that will contribute to the long-term success of your business.

Can I convert my free zone company to a mainland company in Abu Dhabi?

Yes, it’s possible to convert a free zone company to a mainland entity. This involves obtaining the necessary approvals, canceling the free zone license, and fulfilling mainland requirements such as securing a local sponsor (if required), registering with the DED, and establishing a physical office in the mainland.

What are the visa quotas for companies in Abu Dhabi?

Visa quotas depend on several factors:

Office Space Size: Generally, the larger your office space, the more visas you can obtain. For example, every 9 square meters may allow one visa.

Business Activity: Certain activities may have restrictions or allowances for visas.

Free Zone Policies: Each free zone has its own visa quota policies, with some offering packages that include a specific number of visas.

💡Legal Expert Guide: It’s advisable to plan your office space and understand the visa policies of your chosen jurisdiction to meet your staffing needs.

Do I need to deposit share capital when setting up a company?

For most free zones and mainland companies, the minimum share capital requirement is waived or minimal, and no actual capital deposit is required. However, certain activities or jurisdictions, especially in financial services or regulated industries, may require proof of capital deposit or minimum share capital to be reflected in the MOA.

Always check the specific requirements of your business activity and consult with the relevant authorities or a business setup consultant during your company registration in Abu Dhabi.