Are you ready to establish a business in a strategic UAE location that combines cost-effectiveness with growth potential? Umm Al Quwain (UAQ) offers an attractive environment for both startups and established enterprises looking for a streamlined setup, affordable operational costs, and access to a thriving business ecosystem. Known for its business-friendly regulations and strategic position close to major markets, UAQ provides entrepreneurs with everything needed to succeed in a competitive market.

In this comprehensive guide, we’ll walk you through the essentials of company registration in Umm Al Quwain, from understanding licensing options in the UAQ Free Zone to navigating the key registration steps. Whether you’re a first-time entrepreneur or expanding your existing business, this guide offers actionable steps, practical tips, and insights to help you launch your business confidently in UAQ. Ready to take your business to the next level in one of the UAE’s most promising business hubs? Let’s dive into the process of setting up and thriving in Umm Al Quwain.

Overview of Umm Al Quwain (UAQ) Business Environment

Understanding the business environment in Umm Al Quwain is crucial for making informed decisions about your company’s future. UAQ stands out not just for its picturesque landscapes but also for its robust economic framework that fosters business growth and innovation.

Introduction to UAQ as a Business Hub

Umm Al Quwain has rapidly emerged as a prime business hub in the UAE, attracting investors with its strategic location and robust infrastructure. UAQ’s thriving economy provides a fertile ground for diverse industries, making it an ideal choice for both startups and established enterprises. The emirate boasts a balanced mix of traditional and modern industries, ranging from manufacturing and logistics to tourism and technology. This diversity ensures that businesses across various sectors can find a conducive environment to flourish.

Advantages of Setting Up in UAQ

Choosing UAQ for your business setup comes with numerous advantages, including:

- Strategic Location: Positioned close to major markets and ports, UAQ offers excellent connectivity, facilitating seamless trade and logistics operations. Its proximity to Dubai and other key Emirates ensures easy access to a vast customer base and business networks.

- Cost-Effectiveness: UAQ is known for its competitive setup and operational costs compared to other emirates like Dubai and Abu Dhabi. Lower rental rates, affordable labor costs, and reduced utility expenses make UAQ an economically viable option for businesses of all sizes.

- Business-Friendly Regulations: UAQ boasts streamlined processes and supportive government policies that simplify the business setup journey. The emirate has implemented investor-friendly regulations that minimize bureaucratic hurdles, allowing businesses to focus on growth and innovation.

- Quality Infrastructure: With state-of-the-art facilities, reliable utilities, and modern office spaces, UAQ ensures that businesses have access to the necessary infrastructure to operate efficiently. High-speed internet, advanced telecommunications, and well-maintained transportation networks further enhance the business environment.

Real-Life Example:

TechWave Solutions, a technology startup, successfully established its presence in UAQ by leveraging the cost-effective infrastructure and business-friendly regulations. “Setting up in UAQ allowed us to reduce our initial costs significantly while enjoying the benefits of a strategic location,” says Ahmed Al Mansoori, CEO of TechWave Solutions.

Umm Al Quwain Free Zone (UAQ FTZ)

One of the standout features of Umm Al Quwain company registration is the Umm Al Quwain Free Zone (UAQ FTZ), which offers a range of incentives designed to attract foreign investors and promote business growth.

Benefits of UAQ FTZ

The Umm Al Quwain Free Zone (UAQ FTZ) offers a plethora of benefits tailored to enhance your business operations:

- 100% Foreign Ownership: One of the most attractive features of UAQ FTZ is the allowance for 100% foreign ownership. This means you can have complete control over your business without the need for a local partner, simplifying decision-making processes and enhancing operational efficiency.

- No Corporate or Personal Taxes: UAQ FTZ provides significant financial advantages by exempting businesses from corporate and personal taxes. This tax-free environment maximizes your profits and provides a competitive edge in the market.

- Exemption from Import/Export Taxes: Facilitating smooth international trade, UAQ FTZ exempts businesses from import and export taxes. This benefit reduces the overall cost of goods and services, making your offerings more competitive in global markets.

- Simple Registration Process: Setting up a business in UAQ FTZ is hassle-free, thanks to a streamlined registration process. Minimal paperwork and efficient procedures ensure that your company can be up and running in a short timeframe, allowing you to focus on your core business activities.

Types of Licenses Available in UAQ FTZ

UAQ FTZ provides various licensing options to cater to different business needs, ensuring that every entrepreneur can find a suitable framework for their operations:

- Commercial License: Ideal for businesses engaged in trading and commercial activities. Whether you’re dealing in goods, services, or both, a Commercial License provides the necessary authorization to operate within UAQ FTZ.

- Consultancy License: Designed for advisory and consultancy services, this license is perfect for professionals offering expertise in fields such as management, IT, finance, and more. It allows you to provide specialized services to clients within and outside the free zone.

- Industrial License: Suited for manufacturing and industrial enterprises, the Industrial License enables businesses to set up production facilities, engage in manufacturing processes, and distribute industrial products. This license supports a wide range of industrial activities, from light manufacturing to heavy industries.

Detailed Description of Each License Type:

| License Type | Permitted Activities | Sector-Specific Requirements | Limitations |

| Commercial | Trading, import/export, retail, wholesale | Must align with free zone regulations for trade | Restricted to commercial activities only |

| Consultancy | Business advisory, IT consulting, financial services | Professionals must have relevant qualifications | Limited to consultancy services |

| Industrial | Manufacturing, production, assembly | Compliance with environmental and safety standards | Requires specific industrial permits |

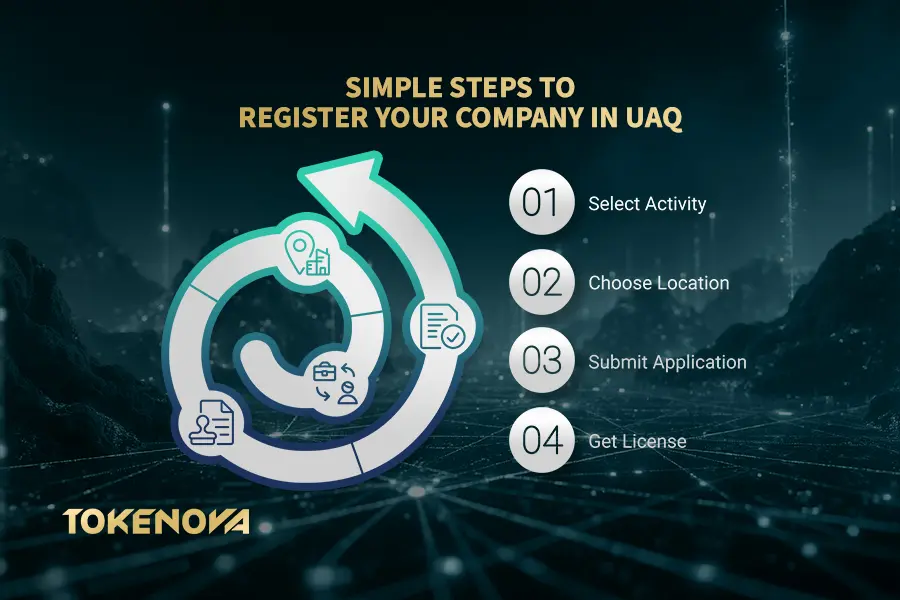

Steps for Company Registration in UAQ

Navigating the company registration in Umm Al Quwain involves a series of well-defined steps. Understanding each phase ensures a smooth and efficient setup process.

Selecting a Business Activity

Identifying the right business activity is crucial as it determines the type of license and permits required. UAQ FTZ categorizes business activities into various sectors, each with specific regulations and compliance requirements. Ensure your chosen activity aligns with UAQ FTZ regulations by thoroughly researching permissible activities and consulting with business setup experts if necessary.

Actionable Tips:

- Research Permissible Activities: Visit the official UAQ FTZ website or consult with a business advisor to understand which activities are allowed.

- Assess Market Demand: Choose an activity that aligns with market needs and your expertise.

- Future-Proof Your Choice: Consider the scalability and future growth potential of your chosen activity.

Choosing an Office Location

Selecting a strategic office location within UAQ FTZ is essential for your business operations. Consider factors such as proximity to suppliers, accessibility for employees, and the nature of your business when choosing a location. UAQ FTZ offers a range of office solutions, from flexi-desks and co-working spaces to fully furnished offices, catering to different business sizes and budgets.

Different Areas Within UAQ FTZ:

| Area | Benefits | Suitable For |

| Business Bay | Central location, high visibility | Trading and commercial businesses |

| Industrial Park | Proximity to manufacturing facilities, large spaces | Industrial and manufacturing enterprises |

| Tech Hub | Advanced infrastructure, high-speed internet | IT and consultancy firms |

Actionable Tips:

- Evaluate Accessibility: Ensure your office is easily accessible for employees and clients.

- Consider Future Expansion: Choose a location that allows for potential expansion as your business grows.

- Assess Facilities: Ensure the office space meets your operational needs, including meeting rooms, storage, and technological infrastructure.

Filling Out the Application Form

Completing the application form accurately is a critical step in the registration process. Provide all necessary details about your business, including the company name, business activity, shareholder information, and contact details. Ensure that all information is correct and consistent with your supporting documents to avoid delays in the approval process.

Actionable Tips:

- Double-Check Information: Verify all details before submission to prevent errors.

- Use Clear Descriptions: Clearly describe your business activities to align with license requirements.

- Seek Professional Assistance: Consider hiring a business setup consultant to ensure completeness and accuracy.

Submitting the Application for a License

Once the application form is filled, submit it along with the required documents to the UAQ FTZ authorities for approval. The submission can be done online or in person, depending on the free zone’s procedures. After submission, the authorities will review your application, and upon approval, you will receive your business license, officially authorizing you to operate within UAQ FTZ.

Actionable Tips:

- Prepare All Documents: Ensure all required documents are complete and correctly formatted.

- Follow Up: Regularly check the status of your application and respond promptly to any additional requests.

- Understand Timelines: Be aware of the expected processing times to plan your business launch accordingly.

Documents Required for Company Registration

To ensure a smooth registration process, prepare the following documents meticulously:

- Passport Copies of Shareholders and Managers: Provide valid identification for all key individuals involved in the business. Ensure that the passports are up-to-date and include clear, readable copies.

- Proof of Address for All Stakeholders: Submit utility bills or bank statements that confirm the residency of all stakeholders. This proof is necessary to establish the legitimacy of the individuals involved in the business.

- Memorandum and Articles of Association: These legal documents outline the company’s structure, governance, and operational framework. They must be drafted in accordance with UAQ FTZ regulations and signed by all shareholders.

- Business Plan: Although not always mandatory, a comprehensive business plan can support your application by demonstrating the viability and strategic approach of your business.

- Shareholder Resolution: If applicable, provide a resolution from the shareholders approving the establishment of the company and appointing the managers or directors.

- Bank Reference Letters: Some free zones may require reference letters from your bank to attest to your financial credibility and business integrity.

- Additional Documents: Depending on your business activity, additional documents such as professional licenses, certifications, or permits may be required.

Pro Tip: Organize all documents in both digital and physical formats to ensure easy access and submission.

Umm Al Quwain Mainland Business Setup

While UAQ FTZ offers numerous advantages, setting up a mainland business in Umm Al Quwain also presents unique opportunities and benefits.

Overview of Mainland Business Opportunities

Setting up a mainland business in UAQ opens doors to a wider market, including direct access to the UAE’s domestic market without restrictions. Unlike free zones, mainland businesses can operate freely across the UAE, engage in government contracts, and establish a physical presence outside the free zone boundaries. This broader market access can significantly enhance your business’s growth potential and revenue streams.

Market Opportunity:

Global Traders LLC, a trading company, expanded its operations to mainland UAQ to tap into the UAE’s vast domestic market. “The mainland setup allowed us to bid for government contracts and reach customers beyond the free zone,” explains Fatima Al Zahra, Managing Director of Global Traders LLC.

Types of Business Structures Available

Choose from various business structures to suit your operational needs, each offering different levels of liability, ownership, and management flexibility:

- LLC (Limited Liability Company): Offers limited liability protection to its shareholders, meaning their personal assets are protected from business debts and liabilities. An LLC can have up to 50 shareholders, and it requires a local sponsor who holds at least 51% ownership unless you opt for specific sectors that allow 100% foreign ownership.

- Partnership: Ideal for businesses with multiple partners who wish to share profits, losses, and management responsibilities. Partnerships can be general or limited, depending on the level of liability each partner is willing to assume.

- Joint Venture: Suitable for collaborative projects with other entities, both local and international. Joint ventures allow businesses to pool resources, expertise, and market access to achieve common objectives while sharing risks and rewards.

Detailed Comparison of Business Structures:

| Structure | Ownership | Liability | Management | Pros | Cons |

| LLC | 51% local sponsor, 49% foreign | Limited to investment | Managed by appointed directors | Limited liability, access to local market | Requires local sponsor |

| Partnership | Shared among partners | Unlimited or limited | Shared management responsibilities | Shared resources, simple setup | Shared liability (for general partners) |

| Joint Venture | Shared with partner(s) | Shared liability | Jointly managed | Combined expertise, shared risks | Potential for conflicts |

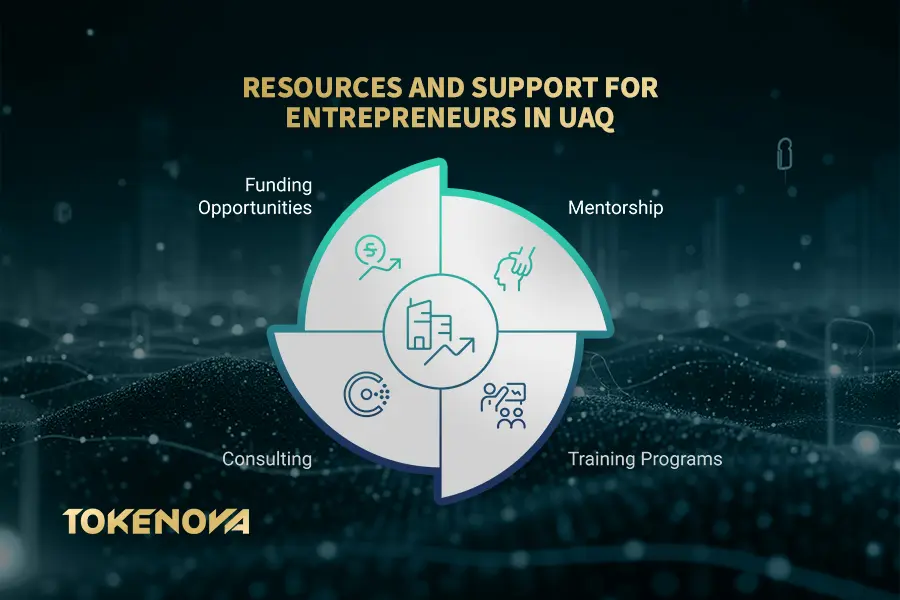

Support and Resources for Entrepreneurs

Umm Al Quwain is committed to fostering a thriving entrepreneurial ecosystem by providing extensive support and resources to businesses.

Government Support for SMEs and Startups

The UAQ government provides extensive support for SMEs and startups, recognizing their crucial role in economic diversification and job creation. Support initiatives include:

- Funding Opportunities: Access to grants, loans, and investment programs designed to help startups secure the necessary capital for growth.

- Training Programs: Comprehensive training and development programs that equip entrepreneurs with the skills and knowledge needed to succeed in a competitive market.

- Mentorship Initiatives: Experienced mentors and industry experts are available to provide guidance, advice, and strategic insights to budding entrepreneurs.

- Business Incubators and Accelerators: Facilities that offer workspace, resources, and support services to help startups develop and scale their operations efficiently.

Testimonial:

“The government support programs in UAQ were instrumental in our early stages. The mentorship we received helped us navigate challenges and scale effectively,” says Sara Ahmed, founder of InnovateX.

Availability of Infrastructure and Facilities

Benefit from state-of-the-art infrastructure and facilities that facilitate smooth business operations and growth. UAQ boasts:

- Modern Office Spaces: Equipped with the latest technology and amenities to support various business activities.

- Reliable Utilities: Consistent and high-quality utility services, including electricity, water, and internet, ensuring uninterrupted business operations.

- Transportation Networks: Well-developed transportation infrastructure, including roads, ports, and airports, enhancing connectivity and logistics efficiency.

- Recreational Facilities: A range of recreational amenities, such as parks, shopping centers, and dining options, contribute to a high quality of life for employees and business owners.

Market Analysis

Current Market Landscape in UAQ

Umm Al Quwain’s market landscape is characterized by steady economic growth, driven by key industries such as manufacturing, logistics, tourism, and technology. The emirate has witnessed a GDP growth rate of 3.5% in the last fiscal year, reflecting its robust economic health and resilience.

Potential Opportunities

- Manufacturing and Industrial Growth: With the availability of industrial zones and modern facilities, there is significant potential for manufacturing enterprises.

- Logistics and Trade: UAQ’s strategic location near major ports and transportation hubs makes it an ideal center for logistics and trade businesses.

- Tourism Expansion: Investment in tourism infrastructure and attractions offers opportunities for hospitality and leisure businesses.

- Technology and Innovation: The growing tech ecosystem in UAQ presents opportunities for IT startups and tech-driven enterprises.

Challenges Businesses Might Face

- Market Competition: Increasing number of businesses setting up in UAQ can lead to heightened competition.

- Regulatory Compliance: Navigating the regulatory landscape requires thorough understanding and adherence to local laws and guidelines.

- Cultural Adaptation: Understanding and adapting to the local culture and business etiquette is essential for successful operations.

Market Trends:

- Sustainability Initiatives: Growing emphasis on sustainabl e and eco-friendly business practices.

- Digital Transformation: Increasing adoption of digital technologies and automation in business operations.

Legal Considerations

Compliance Requirements

Establishing a business in UAQ requires adherence to various compliance requirements to ensure legality and operational integrity:

- Licensing Compliance: Ensure that your business activities are in line with the license type and adhere to free zone regulations.

- Financial Reporting: Maintain accurate financial records and submit annual reports as required by UAQ FTZ authorities.

- Employment Laws: Comply with local labor laws, including employment contracts, working hours, and employee rights.

Intellectual Property Protection

Protecting your intellectual property (IP) is crucial for maintaining competitive advantage and safeguarding your innovations:

- Trademark Registration: Register your brand name and logo to prevent unauthorized use.

- Patent Protection: Secure patents for your inventions to ensure exclusive rights to your innovations.

- Copyrights: Protect original works, including software, designs, and creative content.

Pro Tip: Consult with an IP attorney to navigate the complexities of intellectual property laws in UAE.

Labor Laws Specific to UAQ

Understanding and complying with UAE labor laws is essential for managing your workforce effectively:

- Employment Contracts: Must be in writing and specify job roles, salaries, and other employment terms.

- Work Permits and Visas: Ensure all employees have valid work permits and visas as per UAE regulations.

- Employee Benefits: Provide mandatory benefits such as end-of-service gratuity, health insurance, and annual leave.

Legal Insight:

“Adhering to labor laws not only ensures legal compliance but also fosters a positive work environment,”

Cultural Insights

Local Culture and Business Etiquette

Understanding the local culture and business etiquette is pivotal for building strong relationships and ensuring smooth business operations in UAQ:

- Respect for Traditions: UAE has a rich cultural heritage, and respecting local traditions and customs is essential.

- Communication Style: Business communication is often formal and courteous. Building personal relationships is important for business success.

- Dress Code: Professional and conservative attire is recommended, especially during meetings and official events.

- Business Meetings: Punctuality is valued, and meetings often start with small talk to establish rapport before discussing business matters.

Navigating the Business Landscape

- Networking: Building a strong professional network through industry events, seminars, and business forums can open up new opportunities.

- Local Partnerships: Collaborating with local businesses can provide valuable insights and facilitate market entry.

- Adaptability: Being flexible and open to adapting your business practices to align with local preferences can enhance your business’s acceptance and success.

Cultural Tip: Taking the time to understand and appreciate the local culture can significantly impact your business relationships and overall success in UAQ.

Pro Tips for Advanced Traders

Maximize your business potential in UAQ with these expert strategies:

- Leverage Free Zone Incentives: Utilize the tax exemptions and 100% foreign ownership to optimize your business structure. By taking full advantage of these incentives, you can enhance profitability and streamline operations.

- Network Actively: Engage with local business communities and industry events to expand your reach. Building strong networks can lead to valuable partnerships, collaborations, and new business opportunities.

- Stay Compliant: Regularly update yourself with UAQ’s regulatory changes to ensure ongoing compliance. Staying informed helps you avoid legal issues and maintain your business’s good standing.

- Invest in Technology: Incorporate advanced technologies to enhance efficiency and competitiveness. From automation tools to data analytics, leveraging technology can drive innovation and improve business performance.

- Seek Professional Assistance: Consult with local experts to navigate the registration process and operational challenges effectively. Professional advisors can provide tailored solutions and ensure that your business adheres to all regulatory requirements.

Advanced Strategy: Implementing a robust digital marketing strategy can significantly boost your business visibility and customer engagement in UAQ.

Conclusion

Embarking on company registration in Umm Al Quwain opens the door to a multitude of opportunities within a vibrant and supportive business environment. UAQ’s strategic location, cost-effective setup options, and business-friendly regulations make it an ideal destination for both startups and established enterprises seeking growth and expansion in the UAE.

By leveraging the advantages of UAQ FTZ, understanding the comprehensive registration process, and utilizing the available support and resources, your business can thrive in this dynamic market. Whether you’re drawn by the promise of 100% foreign ownership, tax exemptions, or the seamless registration procedures, Umm Al Quwain provides a conducive foundation for your business aspirations.

Ready to take the next step? Contact our expert business setup consultants today to receive personalized guidance and streamline your company registration process in Umm Al Quwain. Alternatively, download our free Company Registration Checklist to ensure you have all the necessary documents and information prepared for a seamless setup experience. Stay ahead in your business journey by subscribing to our newsletter, where you’ll receive the latest insights, tips, and updates tailored to support your success in UAQ.

By choosing Umm Al Quwain, you’re not just registering a company; you’re investing in a prosperous future backed by robust infrastructure, government support, and a thriving business community. Let us help you navigate this journey with confidence and expertise.

Key Takeaways

- Umm Al Quwain offers a strategic and cost-effective environment for business setup, with a robust infrastructure and business-friendly regulations.

- UAQ FTZ provides significant benefits, including 100% foreign ownership, tax exemptions, and a simplified registration process, making it an attractive option for foreign investors.

- The registration process is straightforward, involving clear steps and required documentation that facilitate a smooth setup experience.

- Various business structures and licensing options are available to cater to different business needs, whether you’re establishing a startup or expanding an existing enterprise.

- Government support and robust infrastructure ensure that businesses have the necessary resources and facilities to grow and thrive in Umm Al Quwain.

- Market Analysis and Legal Considerations are essential for understanding the business landscape and ensuring compliance.

- Cultural Insights help foreign investors navigate the local business environment effectively.

- Pro Tips for advanced traders can significantly enhance business operations and growth.

What are the renewal requirements for a company registered in UAQ FTZ?

Renewing your company registration in UAQ FTZ involves submitting annual renewal applications, updating any changes in company information, and paying the applicable renewal fees. It is essential to adhere to the renewal deadlines to avoid penalties or suspension of your business license. Additionally, ensuring that all documentation is up-to-date and compliant with current regulations will facilitate a smooth renewal process.

Can I change my business activity after registration in UAQ FTZ?

Yes, you can change your business activity after registration in UAQ FTZ, provided it aligns with the free zone’s permissible activities. To do so, you must submit a modification request along with the required documentation and pay any associated fees. It is advisable to consult with UAQ FTZ authorities or a business setup consultant to ensure that the new business activity is permitted and to understand the specific requirements for the change.

What support services are available for companies newly registered in UAQ FTZ?

Newly registered companies in UAQ FTZ have access to a range of support services, including:

Business Advisory Services: Assistance with strategic planning, market analysis, and operational optimization.

Legal and Compliance Support: Guidance on regulatory requirements, contract drafting, and compliance management.

Accounting and Financial Services: Support with bookkeeping, financial reporting, and tax planning.

Human Resources Support: Help with recruitment, employee management, and payroll services.

IT and Technical Support: Access to technology solutions, cybersecurity measures, and technical assistance to ensure smooth business operations.

How can I expedite the company registration process in UAQ FTZ?

To expedite the registration process in UAQ FTZ, ensure that all required documents are complete and accurately prepared. Utilize professional business setup consultants who are familiar with the local procedures and can assist in promptly addressing any issues that may arise during the application process.

Are there any restrictions on the types of businesses that can be registered in UAQ FTZ?

UAQ FTZ has a list of permitted and restricted business activities. It is essential to verify that your intended business activity is allowed within the free zone. Certain industries may have specific requirements or limitations, so consulting with UAQ FTZ authorities or a business setup consultant is recommended.

What are the visa quotas for companies registered in UAQ FTZ?

Visa quotas in UAQ FTZ depend on the size of the office space and the type of license held. Typically, larger office spaces allow for more visas. It is advisable to discuss your visa needs with UAQ FTZ authorities or your business setup consultant to ensure compliance with the visa regulations.