The renewable energy sector is experiencing a financial revolution. While traditional energy projects struggle with lengthy funding cycles and limited investor access, tokenized energy initiatives are raising capital in weeks rather than years. Yet behind every successful sustainable energy token lies a carefully crafted economic model that balances environmental impact with financial sustainability.

If you’re building a sustainable energy project on blockchain, your tokenomics design will determine whether you attract committed long-term stakeholders or speculative traders who abandon ship at the first market downturn. The difference lies in understanding how to align economic incentives with environmental goals.

Why Sustainable Energy Projects Need Strategic Tokenomics Design

Sustainable energy projects face unique economic challenges that traditional tokenomics models often fail to address. Unlike typical crypto projects focused on speculation, energy initiatives must balance real-world asset performance with digital token value.

According to industry research, blockchain transforms renewable energy through faster payments, peer-to-peer trading, and real-time tracking of power and carbon credits. However, the success of these innovations depends heavily on well-designed token economics that sustain both environmental and financial objectives.

The challenge becomes even more complex when you consider the long-term nature of energy infrastructure. Solar panels and wind turbines generate returns over 20-25 years, while crypto markets often operate on much shorter cycles. Your tokenomics must bridge this gap between infrastructure longevity and market expectations.

Understanding Token Utility in Energy Ecosystems

Token utility in sustainable energy projects extends far beyond simple payment mechanisms. Effective energy tokens serve multiple interconnected functions that create genuine value within the ecosystem.

As decentralized energy models gain momentum, real-world use cases show how blockchain-enabled peer-to-peer trading is already reshaping power markets. As noted by Alastair Caithness, a Strategic Business Development Leader with over 15 years of experience in fintech and energy sectors, “homeowners and businesses with renewable energy sources like solar and wind can seamlessly trade excess electricity with their neighbors through smart contracts, creating a more resilient and cost-effective energy network.”

The most successful energy tokenomics models incorporate utility tokens that facilitate energy trading, governance participation, and staking rewards. Power Ledger and Energy Web Foundation have pioneered approaches where tokens enable peer-to-peer energy trading while providing holders with governance rights over network upgrades and energy distribution policies.

Consider designing your token with layered utility functions. Primary utilities might include paying for energy services or accessing platform features, while secondary utilities could involve governance voting or earning staking rewards from energy production. This multi-layered approach creates multiple demand drivers for your token beyond pure speculation.

Read More: Utility Tokenomics: An Introduction to Its Concepts and Applications

Designing Incentive Mechanisms for Green Energy Participation

Incentive alignment represents the cornerstone of sustainable energy tokenomics. Your economic model must reward behaviors that advance both project sustainability and environmental goals.

A blockchain developer working on renewable energy projects shared their approach on Reddit: “The core idea: Tokenising solar energy production so people can stake in renewable projects and earn yield based on actual energy generation”. This approach directly ties token rewards to real-world environmental impact.

Caithness also mentions that blockchain’s integration into EV charging stations within smart grids is already facilitating decentralized networks that support transparent, energy-efficient infrastructure—a trend gaining traction in 2025.

Effective incentive mechanisms often include staking rewards for long-term token holders, bonus distributions for early adopters of green energy solutions, and governance rewards for active community participation. The key is ensuring that your incentive structure promotes sustained engagement rather than quick exits.

Token Distribution Models for Energy Project Stakeholders

Token distribution in sustainable energy projects must account for diverse stakeholder groups, each with different risk profiles and contribution timelines.

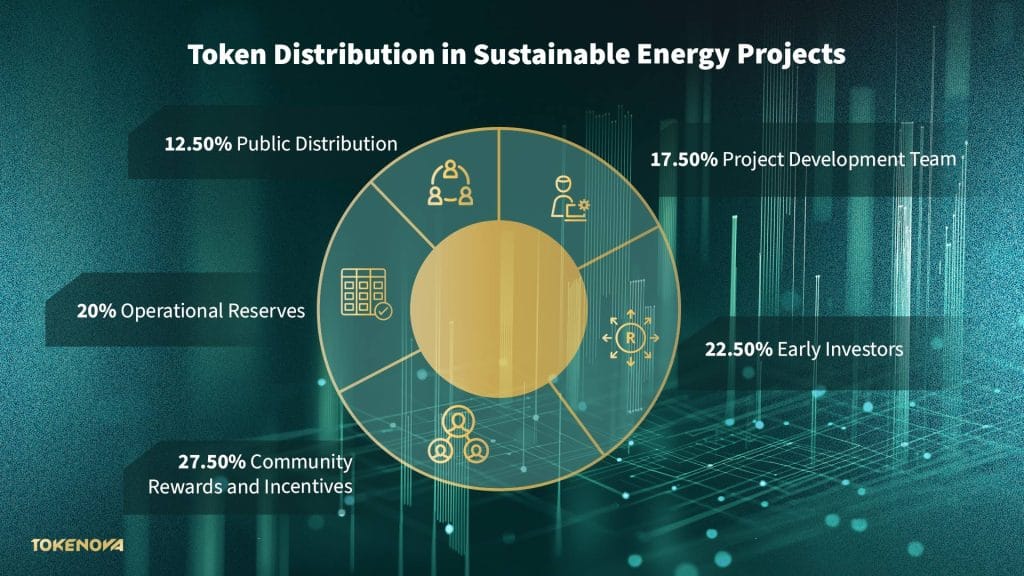

A balanced distribution model typically allocates tokens across five key categories: project development team (15-20%), early investors (20-25%), community rewards and incentives (25-30%), operational reserves (15-20%), and public distribution (15-20%). However, energy projects often require higher allocations for operational reserves due to infrastructure maintenance needs.

Industry analysis shows that implementing vesting schedules prevents immediate sell-offs and builds community trust. For energy projects, consider longer vesting periods that align with energy production cycles—perhaps 24-36 months rather than the typical 12-24 months in other sectors.

Read More: Exploring Tokenization in Blockchain: A New Era of Assets

Governance Frameworks That Align Environmental and Financial Goals

Governance structures in sustainable energy tokenomics must balance technical expertise with community participation. Unlike pure DeFi projects, where financial metrics drive most decisions, energy projects require governance frameworks that can evaluate environmental impact alongside financial performance.

Implement tiered governance where token holders vote on operational decisions while technical advisory committees handle infrastructure-related choices. This hybrid approach ensures that complex energy decisions receive expert input while maintaining decentralized community oversight.

As Sasi Shekhar Kanuri notes, “energy tokens can embed carbon metadata, allowing organizations to automatically calculate emissions offsets.” This integration supports ESG reporting while aligning governance with measurable climate goals. Consider incorporating environmental impact metrics directly into your governance framework. Token holders might vote on energy efficiency targets, renewable source priorities, or carbon offset allocations. This creates a direct link between governance participation and environmental outcomes.

Managing Token Supply Dynamics in Sustainable Projects

Token supply management in energy projects requires a careful balance between rewarding participation and maintaining long-term value. Unlike inflationary models common in DeFi, sustainable energy tokens often benefit from deflationary or stable supply mechanisms.

According to tokenomics design principles, managed supply ensures scarcity while incentivizing adoption and sustaining ecosystem growth. For energy projects, consider implementing token burning mechanisms tied to energy production milestones or carbon credits generated.

A community member on Twitter noted: “Tokenization is revolutionizing green energy investments, enabling direct participation in renewable energy projects”. This revolution requires supply models that reflect the unique value proposition of sustainable energy assets.

Regulatory Considerations for Energy Token Projects

Regulatory compliance presents unique challenges for energy tokenomics, as these projects often straddle financial services, environmental regulations, and energy sector oversight.

Energy tokens may be classified as securities if they represent ownership in energy-producing assets or promise returns based on energy sales. Work with legal experts to structure your tokenomics in compliance with securities regulations while preserving the utility functions essential for your energy ecosystem.

Consider jurisdictional advantages when designing your regulatory approach. Some regions offer clearer regulatory frameworks for energy tokenization, which can influence both your business structure and tokenomics design.

If you’re feeling overwhelmed by the regulatory requirements we just discussed, you’re not alone. Many energy projects find navigating these complexities challenging without proper guidance. Speaking with a tokenization expert can help clarify your project’s specific regulatory situation and next steps.

Read More: Top Asset Tokenization Challenges & How to Overcome Them

Real-World Examples: Successful Energy Tokenomics Models

Several pioneering projects demonstrate effective tokenomics design for sustainable energy initiatives. Research shows that successful projects like Dogger Bank Wind Farm and Yellow Pine Solar Project have implemented tokenization strategies that align investor returns with environmental outcomes.

These projects typically feature token models where investors receive fractional ownership of energy assets through tokens, with returns distributed based on actual energy production. This direct correlation between environmental performance and financial returns creates sustainable incentive alignment.

The key lesson from successful implementations is the importance of transparent utility functions, clear governance structures, and realistic return expectations based on actual energy production rather than speculative token appreciation.

Building Your Sustainable Energy Tokenomics Strategy

Designing tokenomics for sustainable energy projects requires balancing environmental mission with financial sustainability. Start by clearly defining your token’s utility within the energy ecosystem, then build governance and incentive structures that reward long-term commitment over short-term speculation.

Remember that energy infrastructure operates on decades-long timelines while crypto markets move in much shorter cycles. Your tokenomics must bridge this gap by creating genuine utility that extends beyond market speculation while addressing common asset tokenization challenges.

As Sasi Shekhar Kanuri puts it, tokenizing electricity enables a new class of energy asset — one that’s digitally traceable, tradeable, and tied to real-world carbon impact. His vision underscores the growing importance of integrating blockchain with sustainable energy finance at every layer, from pricing to carbon accountability.

Success in energy tokenomics comes from understanding that you’re not just designing a financial instrument—you’re creating an economic system that can fund the transition to sustainable energy while providing meaningful returns to stakeholders who share your environmental vision. The integration of smart contracts can further enhance transparency and automate reward distribution based on verified energy production.

Have questions about implementing these tokenomics strategies in your sustainable energy project? Share them in the comments below—we read and respond to every one.

What makes energy tokenomics different from other crypto projects?

Energy tokenomics must align with real-world asset performance and long-term infrastructure cycles, requiring different incentive structures than typical crypto speculation models.

How do regulatory requirements affect energy token design?

Energy tokens may face securities regulations due to asset ownership components, requiring careful legal structuring to maintain utility while ensuring compliance.

What’s the ideal token distribution for sustainable energy projects?

A balanced approach typically allocates 15-20% to team, 20-25% to investors, 25-30% to community incentives, and 15-20% each to operations and public distribution.

Should energy tokens have inflationary or deflationary supply models?

Deflationary or stable supply models often work better for energy projects, with token burning tied to energy production milestones or environmental achievements.

How long should vesting periods be for energy token projects?

Consider 24-36 month vesting periods to align with energy production cycles, longer than typical 12-24 month periods in other sectors.