Imagine transforming your investment process to complete transactions in mere minutes instead of days and reducing your investment fees by over 50%. This isn’t a futuristic concept but a tangible reality with token-based investments. As blockchain technology revolutionizes the financial landscape, token-based investments are emerging as a powerful alternative to traditional methods.

In this comprehensive guide, we delve deep into the efficiency gains of token-based investments compared to traditional methods, uncovering why savvy investors are making the switch. From enhanced transparency and security to unprecedented accessibility and cost reductions, discover how tokenization is transforming the investment world and why it might be the game-changer your portfolio needs.

The investment landscape is undergoing a seismic shift, driven by rapid advancements in blockchain technology and the rise of token-based investments. Traditional investment methods, while time-tested, are increasingly seen as cumbersome, expensive, and less transparent. Token-based investments are a modern, efficient alternative that leverages blockchain to offer superior speed, cost-efficiency, and security.

This article explores the efficiency gains of token-based investments compared to traditional methods, providing a detailed analysis of how tokenization is reshaping the future of investing. Whether you’re a seasoned investor or new to the game, understanding these efficiency gains is crucial for making informed investment decisions in today’s dynamic financial environment.

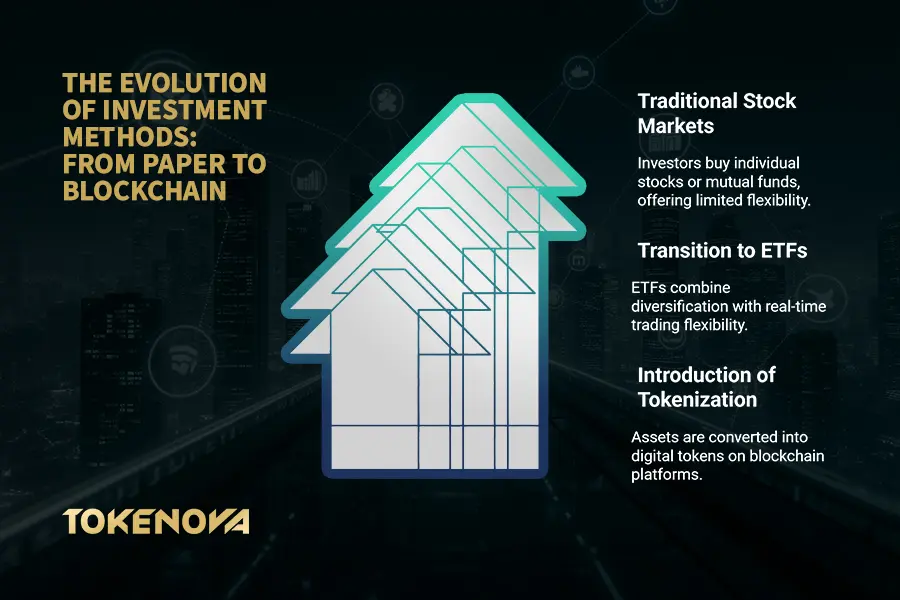

Evolution of Investment Methods

Investment strategies have evolved dramatically over the decades, adapting to technological advancements and shifting market dynamics. From the traditional stock exchanges of the early 20th century to the rise of mutual funds and ETFs, the primary goal has always been to maximize returns and mitigate risks. However, these traditional methods come with inherent limitations, including high transaction costs, limited accessibility, and slower transaction times.

Historical Perspective

Historically, investments were limited to those who had substantial capital and access to financial intermediaries. The stock market, real estate, and other investment avenues required navigating complex regulatory frameworks and dealing with multiple layers of intermediaries, each adding to the cost and time of transactions. Over the years, innovations like mutual funds and ETFs aimed to democratize investments by allowing individuals to invest smaller amounts and diversify their portfolios. However, these instruments still relied heavily on traditional financial infrastructures, which often led to inefficiencies.

Technological Advancements

The advent of the internet and digital technologies brought about significant changes in how investments are managed and traded. Online trading platforms made it easier for individuals to buy and sell securities, reducing some of the barriers to entry. However, issues like high transaction fees, limited transparency, and the need for intermediaries persisted. Blockchain technology emerged as a solution to these persistent challenges, offering a decentralized and transparent ledger system that could revolutionize investment processes.

Emergence of Token-Based Investments

Token-based investments utilize blockchain technology to represent ownership of assets through digital tokens. These tokens can encapsulate a wide array of assets, including real estate, equities, commodities, and even intellectual property. The tokenization process involves converting these assets into digital tokens that can be seamlessly traded, transferred and managed on a blockchain platform.

Tokenization not only simplifies the investment process but also introduces a new level of flexibility and innovation. By fractionalizing assets, token-based investments allow for greater diversification and inclusivity, enabling investors with smaller capital to participate in markets that were previously inaccessible. This democratization of investment opportunities is one of the key factors driving the growing popularity of token-based investments.

Advantages Over Traditional Methods

- Fractional Ownership: Tokenization allows for the division of assets into smaller, more affordable units, enabling broader participation.

- Global Accessibility: Investors from around the world can participate in token-based investments without geographical restrictions.

- Enhanced Liquidity: Digital tokens can be traded 24/7 on various platforms, increasing the liquidity of traditionally illiquid assets.

- Transparency: Every transaction is recorded on a blockchain, providing an immutable and transparent ledger that enhances trust and accountability.

- Reduced Intermediaries: The use of smart contracts automates many processes, reducing the need for intermediaries and lowering costs.

These advantages collectively contribute to the superior efficiency and appeal of token-based investments over traditional methods, making them an attractive option for modern investors.

Traditional Investment Methods

Traditional investment methods have long been the backbone of personal and institutional portfolios. These methods, while reliable, come with their own set of challenges that can impede efficiency and accessibility.

Overview of Conventional Processes

Traditional investment methods typically involve purchasing shares, bonds, or other securities through intermediaries such as brokers, banks, or investment firms. These transactions often require extensive paperwork, compliance checks, and time-consuming processes. Additionally, traditional investments are usually limited by geographical boundaries and accessibility, restricting participation to accredited or institutional investors.

The reliance on intermediaries not only adds to the complexity but also increases the costs associated with investments. For instance, broker fees, administrative costs, and other hidden charges can significantly erode the returns on investment. Moreover, the lack of transparency in traditional investment processes often leaves investors in the dark about the exact breakdown of these costs and the overall performance of their investments.

Limitations and Challenges

Traditional investment methods face several challenges that hinder efficiency:

- High Transaction Costs: Fees charged by intermediaries can significantly erode investment returns.

- Slow Transaction Times: Settling trades can take days, delaying access to funds.

- Limited Transparency: Investors may lack visibility into the underlying processes and fees.

- Accessibility Barriers: High minimum investment requirements exclude many potential investors.

These limitations not only reduce the overall efficiency of traditional investments but also create barriers for new and smaller investors looking to enter the market. The cumbersome nature of these processes often discourages potential investors, limiting the growth and diversification of investment portfolios.

Traditional real estate investment firms often set high entry barriers, requiring substantial minimum investments and involving complex, time-consuming processes. For instance, Paradyme Companies’ Secured Income Fund mandates a minimum investment of $100,000, with a rigorous due diligence process to ensure asset quality.

Similarly, Origin Investments offers various real estate funds with minimum investments starting at $50,000, catering primarily to accredited investors. Their strict due diligence process and personalized service aim to provide investors with stable returns and long-term capital appreciation.

These high entry thresholds and extensive procedures can deter smaller investors, limiting access to lucrative real estate opportunities. The substantial capital requirements and complex due diligence processes often restrict participation to those with significant financial resources, thereby excluding a broader investor base.

Token-Based Investment Mechanisms

Token-based investments address many of the limitations associated with traditional methods by leveraging the inherent advantages of blockchain technology. By digitizing assets and using smart contracts, tokenization streamlines the investment process, making it more efficient, transparent, and accessible.

How Token Investments Work

In a token-based investment model, assets are digitized and represented as tokens on a blockchain. These tokens can be bought, sold, and traded on digital investment platforms, providing a seamless and efficient way to manage investments. Smart contracts, which are self-executing contracts with terms directly written into code, automate many processes, reducing the need for intermediaries and enhancing transaction speed and security.

The tokenization process begins with the creation of a digital representation of the asset, which is then issued as tokens on a blockchain platform. Investors can purchase these tokens, gaining fractional ownership of the underlying asset. The blockchain ensures that all transactions are recorded transparently and immutably, providing a secure and verifiable record of ownership and transaction history.

Types of Investment Tokens

There are several types of investment tokens, each serving different purposes:

- Security Tokens: Represent ownership in an asset and are subject to regulatory compliance.

- Utility Tokens: Provide access to a product or service within a platform.

- Equity Tokens: Grant ownership stakes in a company, similar to traditional shares.

- Asset-Backed Tokens: Linked to tangible assets like real estate or commodities.

Each type of token offers unique benefits and caters to different investment needs. Security tokens, for example, are ideal for investors seeking regulated and compliant investment opportunities, while utility tokens are suited for those looking to participate in specific platforms or ecosystems.

Tokenization Process

- Asset Identification: Determine the asset to be tokenized, ensuring it is suitable for digitization.

- Legal Structuring: Ensure compliance with relevant regulations and legal frameworks.

- Token Creation: Use blockchain technology to create digital tokens representing ownership shares.

- Smart Contract Deployment: Develop and deploy smart contracts to automate investment processes.

- Distribution and Trading: Offer the tokens on digital investment platforms for investors to purchase and trade.

Technological Infrastructure

The backbone of token-based investments is blockchain technology. Platforms like Ethereum, Binance Smart Chain, and Polkadot provide the necessary infrastructure for creating and managing investment tokens. These platforms offer robust security features, scalability, and interoperability, ensuring that token-based investments can operate smoothly and securely.

For example, Ethereum has become a cornerstone in the realm of token creation, largely due to its robust smart contract capabilities. A prime example is the ERC-20 token standard, which has emerged as the technical standard for fungible tokens on the Ethereum blockchain. This standard defines a common set of rules that all fungible Ethereum tokens should adhere to, simplifying the process for developers and ensuring compatibility across the ecosystem. (Ethereum)

In parallel, Polkadot addresses the challenge of interoperability in the blockchain space. Its unique multi-chain architecture is designed to facilitate interoperability and scalability across different blockchain networks. This design allows various blockchains to communicate and share information and transactions without sacrificing their autonomy, effectively enabling tokens and data to operate seamlessly across multiple blockchains. (Rapid Innovation)

Efficiency Gains through Tokenization

Tokenization introduces multiple efficiency gains that set it apart from traditional investment methods. These gains can be broadly categorized into transaction speed, cost reduction, and improved transparency and security.

Speeding Up Transactions

One of the most significant advantages of token-based investments is the speed of transactions. Traditional investments often involve multiple intermediaries, each adding time to the process. In contrast, token-based transactions can be executed directly between parties on a blockchain, reducing settlement times from days to minutes or even seconds.

Cost Reduction Benefits

Tokenization eliminates many of the intermediaries required in traditional investments, such as brokers, clearinghouses, and custodians. By removing these middlemen, transaction costs are significantly reduced. Additionally, smart contracts automate various processes, further lowering administrative expenses. According to a report by Forbes, token-based investments have the potential to significantly reduce transaction fees, thereby enhancing net returns for investors. By leveraging blockchain technology, these investments streamline processes and minimize the need for intermediaries, leading to cost savings. For instance, in the context of digital payments, fees can be less than $0.50 per transaction, offering a more economical solution compared to traditional methods.(Forbes)

Lower costs not only enhance the overall efficiency of investments but also make them more accessible to a broader range of investors. Reduced fees mean that even small-scale investors can benefit from investment opportunities that were previously cost-prohibitive. This democratization of investment opportunities is a key factor driving the widespread adoption of token-based investments.

Improved Transparency and Security

Blockchain technology ensures that all transactions are recorded on a transparent and immutable ledger. This transparency allows investors to verify the authenticity and ownership of their assets, reducing the risk of fraud and enhancing trust. Moreover, the decentralized nature of blockchain enhances security by eliminating single points of failure and making it more resistant to cyberattacks.

For example Artory, a blockchain-based art registry, provides immutable records of art ownership, significantly reducing fraud in art investments. These features provide investors with greater confidence in the integrity and safety of their investments. Enhanced transparency and security not only protect investors but also foster a more trustworthy investment environment, attracting more participants to token-based investment platforms.

Real-World Impact

The efficiency gains from tokenization are not just theoretical. Real-world applications demonstrate tangible benefits that enhance the overall investment experience. For instance, Platforms like Lofty enable fractional ownership in real estate, allowing investors to purchase tokens representing shares in properties. This approach reduces transaction times and lowers minimum investment thresholds, democratizing access to real estate markets. (Financial Times)

Similarly, Masterworks allows investors to buy shares in high-value artworks, making art investment more accessible. By securitizing artworks, Masterworks enables fractional ownership, allowing a broader range of investors to participate in the art market. (Estate Protocol)

These platforms exemplify how tokenization is broadening investment opportunities, increasing market participation, and enhancing liquidity across various asset classes.

Comparative Analysis

To understand the efficiency gains of token-based investments, it’s essential to compare them directly with traditional investment methods across various performance metrics.

Performance Metrics: Traditional vs Token-Based

| Metric | Traditional Investments | Token-Based Investments |

| Transaction Speed | Days | Minutes or seconds |

| Transaction Costs | High (intermediary fees) | Low (minimal intermediaries) |

| Transparency | Limited | High (blockchain ledger) |

| Accessibility | Restricted to accredited investors | Open to a broader investor base |

| Liquidity | Lower, especially for illiquid assets | Higher, due to fractional ownership |

| Security | Vulnerable to fraud and intermediaries’ risks | Enhanced through blockchain’s security |

| Operational Efficiency | Slower due to manual processes | Faster with automated smart contracts |

This comparative analysis highlights the clear advantages of token-based investments over traditional methods. The speed and cost efficiency, combined with enhanced transparency and security, make token-based investments a compelling choice for modern investors seeking to optimize their investment strategies.

Comparative Case Studies

To further illustrate the efficiency gains of token-based investments, let’s explore diverse case studies across different industries, including healthcare and energy.

How Tokenization is Revolutionizing Real Estate Investments

A prominent real estate firm, RealT, tokenized a commercial property, allowing investors to purchase fractional ownership through tokens. Before tokenization, investing in such real estate required significant capital and involved lengthy legal and administrative processes. However, the token-based approach reduced the minimum investment threshold by 80%, accelerated transaction times from weeks to minutes, and minimized costs associated with property management and ownership transfer. As a result, RealT saw a 150% increase in investor participation and a 200% rise in liquidity within the first six months of tokenization.

Bringing Art Investments to Everyone with Tokenization

Masterworks, an art investment platform, leveraged tokenization to allow investors to buy shares in high-value artworks. Traditionally, investing in art requires substantial funds and poses challenges in verifying authenticity and ownership. By issuing tokens backed by verified artworks on a blockchain, Masterworks enhanced transparency, reduced transaction costs by 60%, and facilitated easier buying and selling of art shares. This innovation attracted a wider range of investors and increased the overall market efficiency, with assets under management growing by 300% within a year.

Transforming Healthcare Investments Through Tokenization

In the healthcare sector, tokenization is being used to invest in medical research and biotech startups. Healthereum, a blockchain-based platform, tokenizes investments in healthcare projects, enabling investors to support cutting-edge medical research and biotechnology developments. By tokenizing these investments, Healthereum reduces the barriers to entry, allowing smaller investors to participate in high-impact projects.

This not only accelerates funding for critical medical advancements but also provides investors with the opportunity to contribute to meaningful healthcare innovations. According to Healthereum, tokenization has increased investment participation by 120% and reduced funding acquisition time by 60%, significantly enhancing the efficiency of healthcare investments.

Powering the Energy Sector with Tokenization

The energy sector has seen significant advancements through token-based investments, particularly in renewable energy projects. WePower, a blockchain-based green energy trading platform, tokenizes investments in renewable energy projects such as wind and solar farms. By issuing tokens representing shares in these projects, WePower enables investors to directly fund and benefit from renewable energy production. This approach not only accelerates the deployment of renewable energy infrastructure but also provides investors with a transparent and secure way to support sustainable energy initiatives. As a result, WePower has successfully raised over $10 million through tokenized investments, reducing the time and cost associated with traditional energy project financing by 40%.

These diverse case studies across different industries demonstrate the versatile and transformative potential of token-based investments. Whether in real estate, art, healthcare, or energy, tokenization is driving significant efficiency gains, making investments more accessible, transparent, and cost-effective.

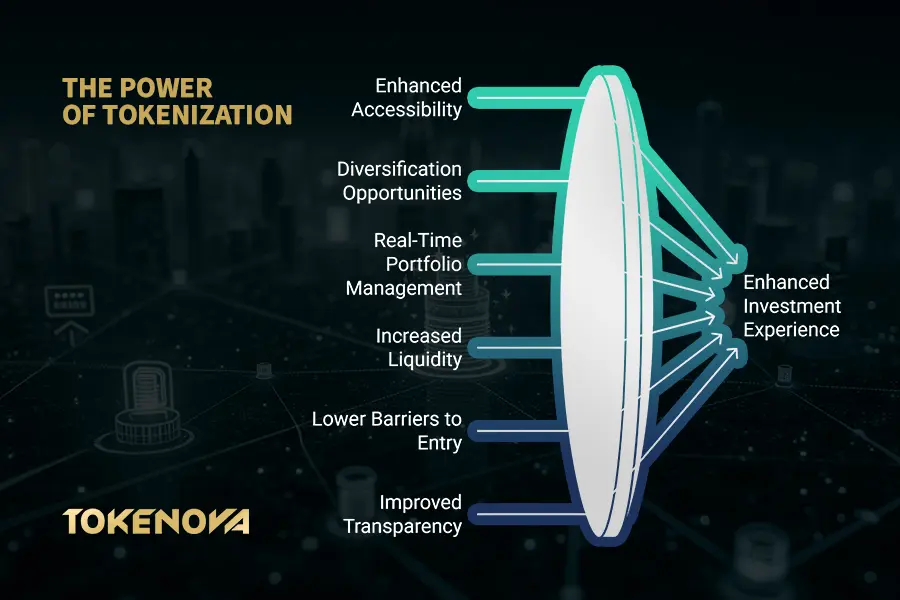

Investor Benefits

Token-based investments offer a myriad of benefits to investors, making them an attractive alternative to traditional investment methods. These benefits not only enhance the investment experience but also provide tangible advantages that can lead to higher returns and greater financial security.

Enhanced Accessibility

Tokenization democratizes access to investment opportunities by lowering the barriers to entry. Investors can purchase fractional shares of high-value assets, enabling participation with smaller capital investments. This inclusivity opens up markets to a broader audience, fostering greater diversity in investment portfolios.

Enhanced accessibility not only broadens the investor base but also promotes financial inclusion. By enabling participation from a wider range of investors, tokenization fosters a more diverse and resilient investment ecosystem, benefiting both investors and the underlying asset markets.

Diversification Opportunities

With token-based investments, investors can easily diversify their portfolios across various asset classes, geographies, and industries. The ability to invest in fractional shares of different assets allows for more granular diversification, which can mitigate risks and enhance overall portfolio performance.

Diversification is a fundamental principle of sound investing, and token-based investments make it easier than ever to achieve. By allowing investment in a variety of asset types and sectors, tokenization helps investors build balanced portfolios that can withstand market volatility and economic downturns.

Real-Time Portfolio Management

Blockchain technology provides investors with real-time visibility into their investment portfolios. Automated tracking and reporting through digital platforms enable investors to monitor their holdings, assess performance, and make informed decisions promptly. This real-time management capability enhances responsiveness to market changes and optimizes investment strategies.

Real-time portfolio management empowers investors with the information they need to make timely and strategic decisions. The ability to instantly track and analyze investment performance helps investors stay agile and responsive to market dynamics, improving overall investment outcomes.

Increased Liquidity

Traditional investments, especially in sectors like real estate and art, often suffer from low liquidity. Selling such assets can take weeks or even months, limiting investors’ ability to quickly access their funds. Token-based investments, however, offer enhanced liquidity by enabling 24/7 trading on digital platforms. Fractional ownership allows investors to sell smaller portions of their investments as needed, making it easier to liquidate assets without waiting for a buyer to come along

Lower Barriers to Entry

Token-based investments significantly lower the barriers to entry, making it possible for a broader range of investors to participate in high-value markets. Traditional investments often require substantial initial capital, making them inaccessible to many potential investors. Tokenization reduces these barriers by allowing investments in smaller increments, making it feasible for individuals with limited funds to participate in lucrative markets.

This democratization of investment opportunities not only benefits individual investors but also contributes to a more diversified and robust investment ecosystem. By enabling participation from a wider range of investors, tokenization fosters greater market stability and resilience.

Improved Transparency

Blockchain technology provides an immutable and transparent ledger that records all transactions related to token-based investments. This transparency allows investors to independently verify the ownership and history of their investments, reducing the risk of fraud and enhancing trust in the investment process.

For example, Artory maintains a transparent record of art ownership and transaction history on the blockchain, allowing investors to verify the authenticity and provenance of the artworks they invest in. This level of transparency is difficult to achieve with traditional investment methods, where information is often siloed and controlled by intermediaries.

Greater Security

The decentralized nature of blockchain technology enhances the security of token-based investments. Each transaction is encrypted and recorded on a distributed ledger, making it resistant to tampering and cyberattacks. Additionally, the use of smart contracts ensures that investment terms are automatically enforced, reducing the risk of human error and fraud.

Challenges and Solutions

While token-based investments offer significant efficiency gains, they also come with their own set of challenges. Addressing these challenges is crucial for the widespread adoption and success of token-based investment platforms.

Regulatory Compliance Issues

The regulatory landscape for token-based investments is still evolving, with varying requirements across different jurisdictions. Ensuring compliance with securities laws, anti-money laundering (AML) regulations, and know-your-customer (KYC) protocols is essential. Collaboration with legal experts and proactive engagement with regulatory bodies can help navigate these complexities and ensure adherence to necessary standards. Coinbase, one of the largest cryptocurrency exchanges, has invested heavily in compliance infrastructure to meet regulatory requirements, setting a benchmark for the industry. Learn about Coinbase’s compliance.

Staying compliant not only avoids legal pitfalls but also builds trust with investors. Platforms that prioritize regulatory compliance are more likely to gain investor confidence and achieve long-term sustainability in the market.

Technological Barriers

Implementing blockchain technology requires robust infrastructure, technical expertise, and continuous innovation. Security vulnerabilities, scalability issues, and interoperability challenges can impede the effectiveness of token-based investment platforms. Investing in cutting-edge technology, fostering skilled development teams, and prioritizing security measures can mitigate these technological barriers. A great example is Ethereum 2.0, which addresses scalability and security issues, enhancing the platform’s capability to support large-scale token-based investments.

By transitioning to a proof-of-stake consensus mechanism and implementing sharding, Ethereum 2.0 aims to significantly increase transaction throughput and network efficiency. These improvements are designed to make Ethereum more scalable, secure, and sustainable, thereby facilitating the growth of decentralized applications and large-scale investments on the platform.

Overcoming technological barriers is essential for ensuring the reliability and efficiency of token-based investment platforms. Continuous advancements in blockchain technology and strategic investments in infrastructure are key to maintaining a competitive edge and delivering seamless investment experiences.

Market Volatility Management

The cryptocurrency and blockchain markets are known for their volatility, which can impact the stability of token-based investments. Implementing risk management strategies, such as diversification, hedging, and leveraging stablecoins, can help manage market volatility and protect investor interests. Effective risk management is crucial for maintaining investor confidence and ensuring the long-term success of token-based investments. By adopting robust risk mitigation strategies, platforms can offer more stable and reliable investment opportunities, attracting a wider range of investors.

Technological Education and Adoption

Another challenge is the learning curve associated with blockchain technology and token-based investments. Many potential investors may not fully understand how tokenization works or the benefits it offers. Providing comprehensive educational resources and user-friendly platforms can help bridge this knowledge gap and encourage wider adoption.

Platforms like Coinbase and Binance have invested in educational initiatives to help users understand blockchain technology and token-based investments. By simplifying the user experience and offering clear, accessible information, these platforms make it easier for individuals to participate in token-based investment opportunities.

Scalability Issues

As the number of token-based investments grows, scalability becomes a critical concern. Blockchain networks can experience congestion and increased transaction fees as demand rises. Addressing scalability issues through technological advancements and optimized network protocols is essential to ensure that token-based investment platforms can handle increased volumes without compromising performance.

Polkadot is addressing scalability by enabling multiple parallel blockchains to operate simultaneously, increasing the overall capacity of the network. This multi-chain approach allows token-based investment platforms to scale effectively, accommodating growing numbers of transactions and users.

User Trust and Security

Building and maintaining user trust is paramount for the success of token-based investments. Ensuring the security of investments, safeguarding against cyber threats, and maintaining transparent and fair processes are essential for fostering trust among investors. Platforms must prioritize security measures, conduct regular audits, and maintain open communication with users to build and sustain trust.

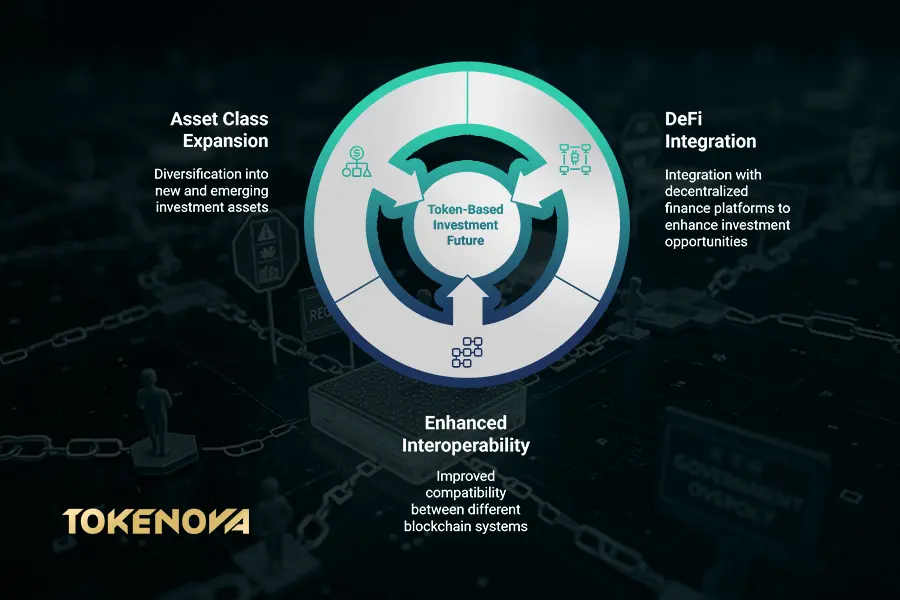

Future Trends in Token-Based Investments

The future of token-based investments is promising, with several trends poised to drive further efficiency gains and broader adoption. These trends reflect the ongoing innovation and evolution within the blockchain and investment sectors, shaping the future landscape of investing.

Integration with DeFi (Decentralized Finance)

Decentralized Finance (DeFi) is revolutionizing the financial sector by offering decentralized alternatives to traditional financial services. The integration of token-based investments with DeFi platforms can enhance liquidity, provide innovative financial products, and enable seamless interoperability between different investment ecosystems. Aave, a leading DeFi platform, allows users to lend and borrow tokenized assets, creating a more dynamic and liquid investment environment.

The convergence of token-based investments and DeFi opens up new avenues for financial innovation. By leveraging the decentralized nature of DeFi, token-based investments can offer more flexible and accessible financial products, further enhancing the efficiency and appeal of these investment opportunities.

Advancements in Smart Contracts

Smart contracts are continually evolving, offering more sophisticated functionalities and automation capabilities. Advancements in smart contracts will enable more complex investment structures, enhanced security protocols, and greater customization of investment terms, further increasing the efficiency and appeal of token-based investments.

Enhanced Interoperability

As the blockchain ecosystem matures, enhanced interoperability between different blockchain platforms will become crucial. Cross-chain solutions will allow token-based investments to operate seamlessly across multiple blockchains, increasing flexibility and expanding investment opportunities.

Regulatory Evolution and Standardization

As token-based investments gain popularity, regulatory frameworks are evolving to accommodate and regulate this new form of investment. Governments and regulatory bodies are developing standardized guidelines to ensure compliance, protect investors, and maintain market integrity. The establishment of clear regulatory standards will provide a more predictable and secure environment for token-based investments, encouraging more institutional investors to participate.

Organizations like the Financial Action Task Force (FATF) are working on international standards for blockchain and cryptocurrency regulations, aiming to harmonize regulatory approaches and facilitate cross-border investments. This regulatory evolution will play a critical role in mainstreaming token-based investments and ensuring their long-term sustainability.

Integration with Traditional Financial Systems

The integration of token-based investments with traditional financial systems is expected to accelerate, bridging the gap between conventional and digital finance. Traditional financial institutions are increasingly exploring blockchain technology and tokenization to enhance their service offerings and improve operational efficiency. JPMorgan Chase, for example, has developed its own blockchain network, JPM Coin, to facilitate faster and more secure transactions for its clients.

This integration will create a more seamless and cohesive financial ecosystem, where token-based investments coexist with traditional financial instruments. By leveraging the strengths of both systems, investors will benefit from enhanced efficiency, greater flexibility, and a broader range of investment opportunities.

Expansion into New Asset Classes

Token-based investments are expanding beyond traditional asset classes, venturing into new and emerging sectors. This expansion includes areas like intellectual property, gaming assets, and environmental credits. Tokenizing these diverse asset classes provides investors with unique opportunities to participate in innovative and high-growth industries.

Enhanced User Experience and Accessibility

Future developments in token-based investments will focus on enhancing user experience and accessibility. User-friendly platforms, intuitive interfaces, and seamless integration with existing financial tools will make token-based investments more accessible to a broader audience.

Strategic Insights: Maximizing Your Investment Efficiency

Navigating the world of token-based investments requires strategic planning and informed decision-making. Here are some exclusive strategies to help you maximize your investment efficiency:

- Conduct Thorough Research: Understand the underlying technology, regulatory environment, and specific assets represented by tokens. Knowledge is power in making informed investment decisions.

- Diversify Your Portfolio: Spread investments across various token types and asset classes to mitigate risks. Diversification is key to optimizing returns while managing potential losses.

- Stay Informed: Keep abreast of market trends, technological advancements, and regulatory changes to make timely and informed investment decisions. Continuous learning ensures you stay ahead of the curve.

- Leverage Smart Contracts: Utilize smart contracts for automated and transparent investment processes, reducing the need for intermediaries and enhancing efficiency.

- Implement Risk Management: Adopt robust risk management strategies to safeguard against market volatility and other potential risks. Protecting your investments is as important as growing them.

- Utilize Advanced Analytics: Employ data analytics and AI tools to gain deeper insights into market trends and investment performance, enabling more strategic decision-making.

- Engage with the Community: Participate in blockchain and investment communities to share knowledge, gain insights, and stay updated on the latest developments and opportunities.

- Monitor Regulatory Developments: Stay informed about changes in regulations and compliance requirements to ensure your investments remain compliant and secure.

- Adopt a Long-Term Perspective: While token-based investments offer high liquidity, maintaining a long-term investment strategy can help capitalize on the full potential of these investments.

By adopting these strategic insights, investors can enhance the efficiency and effectiveness of their token-based investment strategies, ensuring better outcomes and greater returns.

Conclusion

Token-based investments represent a significant leap forward in the investment landscape, offering unparalleled efficiency gains compared to traditional methods. From faster transaction speeds and lower costs to enhanced transparency and accessibility, tokenization addresses many of the limitations that have long plagued conventional investment approaches. As blockchain technology continues to evolve and regulatory frameworks adapt, the adoption of token-based investments is set to accelerate, providing investors with more efficient, secure, and inclusive opportunities to grow their wealth. Embracing token-based investments could well be the strategic move that propels your investment portfolio into the future.

Key Takeaways

- Efficiency Gains: Token-based investments offer faster transactions, reduced costs, and improved transparency over traditional methods.

- Accessibility and Diversification: Lower barriers to entry and fractional ownership enable broader participation and enhanced portfolio diversification.

- Future Potential: Integration with DeFi and advancements in smart contracts will further drive the efficiency and adoption of token-based investments.

- Challenges to Address: Regulatory compliance, technological barriers, and market volatility are key challenges that need strategic solutions for widespread adoption.

- Diverse Applications: Tokenization is transforming various industries, including real estate, art, healthcare, and energy, demonstrating its versatile and impactful potential.

Exclusive Solutions for Token-Based Investments

Unlock the full potential of token-based investments with cutting-edge solutions designed to enhance your investment strategy. Whether you’re looking to tokenize assets, streamline your investment processes, or navigate the regulatory landscape, our specialized services provide the expertise and tools you need to achieve unparalleled efficiency and success in the digital investment space.

Our Offerings

- Asset Tokenization: Convert your assets into digital tokens, making them more accessible and tradable.

- Smart Contract Development: Implement secure and automated smart contracts to manage your investments efficiently.

- Regulatory Compliance: Navigate complex regulatory frameworks with our expert guidance and compliance solutions.

- Investment Platforms: Access state-of-the-art digital investment platforms that offer seamless trading and portfolio management.

- Consulting Services: Receive personalized consulting to optimize your token-based investment strategies and maximize returns.

How Do Token-Based Investments Enhance Portfolio Liquidity?

Token-based investments enhance portfolio liquidity by enabling fractional ownership and 24/7 trading on digital platforms. This allows investors to buy and sell tokens more easily compared to traditional assets, which often require longer settlement times and are limited to specific trading hours. Enhanced liquidity ensures that investors can quickly access their funds and adjust their portfolios in response to market changes.

What Are the Security Benefits of Blockchain in Token Investments?

Blockchain technology offers robust security features for token-based investments. Each transaction is encrypted and recorded on an immutable ledger, making it difficult for unauthorized parties to alter or manipulate data. Additionally, the decentralized nature of blockchain reduces the risk of single points of failure, enhancing overall security and protecting investor assets from cyber threats and fraud.

Can Token-Based Investments Be Integrated with Traditional Portfolios?

Yes, token-based investments can be seamlessly integrated with traditional portfolios to enhance diversification and optimize returns. Investors can allocate a portion of their portfolio to token-based assets, balancing them with traditional investments like stocks, bonds, and mutual funds. This hybrid approach leverages the strengths of both investment types, providing greater flexibility and resilience in varying market conditions.