Financial systems often rely on cumbersome processes, geographic barriers, and exclusive networks that hinder broader participation. These limitations restrict investor access to high-value assets, elevate transaction costs, and slow overall market efficiency. As a result, growth opportunities remain out of reach for many businesses and investors, perpetuating a cycle of unequal access and opaque practices.

This entrenched complexity stifles innovation and erodes trust in conventional markets, creating urgency for a transformative approach. This shift not only expands investor inclusivity through fractional ownership but also streamlines operations and raises global liquidity.

While tokenization has the potential to promote democratization, fractional ownership, and 24/7 markets, a more troubling narrative is emerging: the largest financial players are using this technology to solidify their dominance. For example, BlackRock’s tokenized money market funds, valued at over $1 billion, and Euroclear’s gold-backed tokens are not genuine innovations for the general public; rather, they are strategic moves aimed at capturing the projected $2 trillion tokenized asset market by 2030. Larry Fink’s vision of having “every stock, every bond on one general ledger” may sound idealistic, but it’s important to recognize that this ledger could ultimately be controlled by today’s financial oligarchs.

These Are Our Explosive Speculations:

- By 2035, traditional stock exchanges may become obsolete, as security tokens traded on decentralized platforms are expected to surpass the trading volumes of the NYSE and Nasdaq.

- Central banks could lose 30% of their control over monetary policy due to the rise of algorithmically stabilized tokenized assets, which are not limited by geographic boundaries.

- Corporate balance sheets may face significant challenges as tokenized real estate and commodities—projected to represent a market value of $1.4 trillion—will necessitate radical changes in accounting practices.

In the sections ahead, key tokenization trends and evolving regulations will be examined, along with the Future of tokenization – concerns and opportunities that come with digitizing high-value assets. By addressing challenges such as security, compliance, and interoperability, the Future of asset tokenization promises to deliver greater transparency, efficiency, and financial inclusivity across markets worldwide.

Understanding Tokenization

Tokenization is the process of taking a real-world asset—whether tangible (like real estate or gold) or intangible (like patents or digital content)—and converting it into digital tokens that represent ownership or rights to that asset. Recorded on a blockchain, these tokens can be created and exchanged in a way that’s transparent, secure, and accessible to parties worldwide. The most important benefits it brings are:

- Fractional Ownership: Investors can hold fractional shares in high-value assets, significantly lowering entry barriers.

- Improved Liquidity: Tokenization transforms illiquid assets into tradable tokens that can be bought or sold in seconds on digital marketplaces.

- Transparency and Security: Blockchain’s auditability prevents fraud and ensures clear records of transaction history.

- Global Access: Once an asset is tokenized, virtually anyone with internet access can become an investor, expanding markets beyond geographic boundaries.

Underpinning these benefits is blockchain technology, which ensures the legitimacy of transactions without relying on a central authority. Smart contracts further automate processes—like dividend distribution or buy-back policies—reducing the time and costs typically associated with intermediaries.

Early Foundations

The first wave of digital tokens was largely limited to cryptocurrencies like Bitcoin, followed by Ethereum and other altcoins. While these assets demonstrated blockchain’s potential to store and transfer digital value, they did not tackle real-world assets.

Between 2016 and 2018, ICOs became a popular fundraising method for blockchain-based projects, though many offerings faced regulatory scrutiny. Despite the controversies, ICOs ignited global awareness of the future of tokenization – concerns and opportunities lurking in this emerging space.

As regulatory standards advanced, more projects shifted toward Security Token Offerings (STOs) and asset-backed tokens. This phase focused on translating tangible assets—ranging from real estate to fine art—into blockchain-compatible formats that could be traded similarly to stocks or commodities.

Read More: How to Launch an ICO

The Future & What Lies Ahead

The Future of Tokenization is more than a trend—it represents a profound shift in how we relate to value, hold assets, and engage in global markets. Rather than delivering mere incremental gains, tokenization promises an upheaval that redefines finance on a global scale. It extends beyond efficiency; it reshapes financial infrastructure to allow individuals, businesses, and entire industries to participate in a more accessible and transparent economic system. By exploring the market’s multi-trillion-dollar growth potential, examining which sectors are most likely to be disrupted, and highlighting how tokenization drives widespread inclusion, we gain a clear view of the future of asset tokenization—and by extension, the broader future of tokenization – concerns and opportunities that will guide us forward.

A Trillion-Dollar Opportunity

The Future of Tokenization is more than just a new financial trend—it’s a fundamental shift in how we represent and exchange value. Industry experts, including Boston Consulting Group (BCG), project that tokenized markets could exceed $16 trillion by 2030. This explosive growth stems from increased adoption, regulatory clarity, and ongoing technological innovation. As blockchain matures and more industries embrace tokenization, we’ll see new efficiencies, transparency, and access in global finance.

Wave-like Adoption Patterns

Tokenization’s impact will not be uniform across asset classes. Experts anticipate a wave-like pattern of adoption, with certain sectors embracing the technology more rapidly than others.

This variation stems from differences in expected benefits, technical feasibility, regulatory considerations, and market participants’ risk appetites.

Asset classes with larger market values, higher friction in current value chains, less mature traditional infrastructure, or lower liquidity are positioned to achieve outsized benefits from tokenization.

McKinsey identifies mutual funds, bonds and ETNs, loans and securitization, and alternative funds as likely early adopters, with each potentially reaching meaningful adoption (defined as over $100 billion in tokenized market capitalization) by decade’s end.

Institutional and Governmental Adoption

Perhaps the most significant indicator of the future importance of tokenization is its growing adoption by established institutions and governments. After years of investment and testing, the tokenization of financial assets is “finally happening at an institutional and governmental level.” This marks a pivotal shift that “will forever change the way nations trade and promote more inclusive financial participation.”

Major financial infrastructures, including the World Bank, Euroclear, the US Depository Trust & Clearing Corporation (DTCC), and the European Investment Bank, are actively developing technology to manage tokenized assets. Additionally, central banks are beginning to explore this area, with the Bank of England indicating its intention to advance a central bank digital currency.

Changes in Regulations

The regulatory landscape for tokenized assets is experiencing significant changes. By 2025, it is expected that over 80% of jurisdictions will have implemented comprehensive regulations for digital assets, which will provide clearer guidelines for digital securities. This improved regulatory clarity is likely to enhance cross-border trading and reduce legal uncertainties. As a result, institutional participation could increase by 30% to 40% as compliance tools and regulatory adherence become more streamlined.

Asset Classes Poised for Disruption

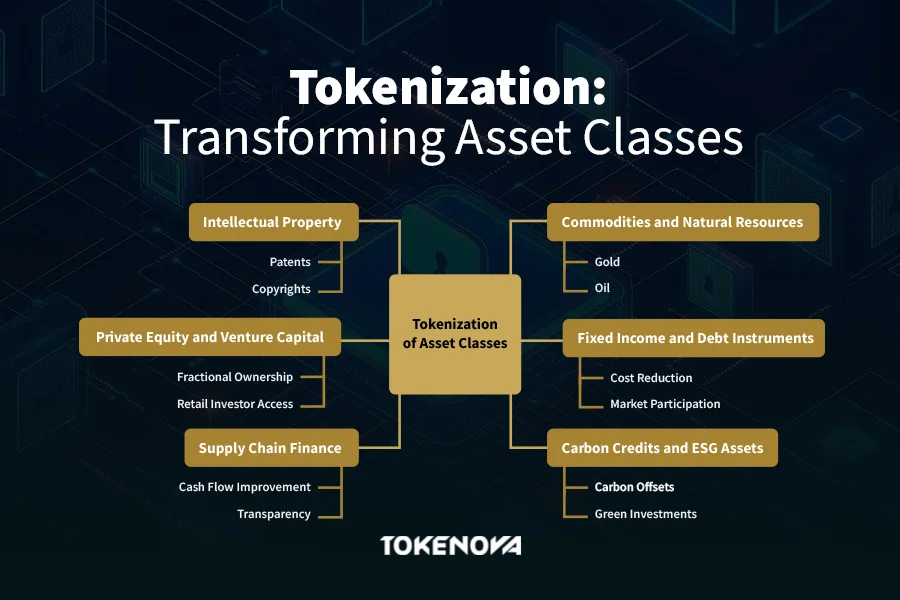

Tokenization is no longer limited to real estate or art. A broad range of assets stands ready for transformation, demonstrating the diverse tokenization trends defining the Future of tokenization – concerns and opportunities:

- Private Equity and Venture Capital

Tokenizing shares in private funds and startups democratizes access, allowing retail investors to own fractional stakes in high-growth ventures. - Fixed Income and Debt Instruments

Tokenized bonds and loans streamline issuance, trading, and settlement, reducing costs and expanding market participation for both issuers and investors. - Supply Chain Finance

Invoices and trade documents become tradable tokens, improving cash flow for businesses and enhancing overall transparency and speed in supply chains. - Carbon Credits and ESG Assets

Sustainability-linked tokens provide clarity around carbon offsets and green investments, helping companies and individuals invest responsibly. - Intellectual Property

Tokenizing patents and copyrights enables fractional ownership and unlocks new revenue channels for creators.

Commodities and Natural Resources

Converting assets like gold or oil into digital tokens opens more efficient market access, improves liquidity, and increases price transparency.

Driving Financial Democratization

A standout benefit of the Future of tokenization is its democratizing power. By breaking assets into fractional units, retail investors can enter markets once reserved for high-net-worth or institutional participants. Decentralized exchanges and user-friendly platforms allow global access, while the blockchain’s transparency fosters greater trust. This inclusive approach to asset ownership is key to understanding why the Future of asset tokenization promises a fairer, more accessible financial system.

Impact on Global Capital Markets

The ripple effects of widespread tokenization extend well beyond any single sector:

Enhanced Liquidity and Efficiency

Asset fractionalization and instant settlement reduce barriers and costs, injecting liquidity into historically illiquid markets.

Read More: How to Make Illiquid Assets Tradeable

New Market Infrastructure

Specialized tokenization platforms, digital custodians, and decentralized marketplaces are reshaping financial ecosystems, and fostering innovation and competition.

Improved Price Discovery

Around-the-clock global trading and transparent ledgers provide more accurate asset valuations, encouraging broader participation.Innovative Financial Products

Tokenized derivatives, structured notes, and other advanced tools are expanding opportunities for investors of all sizes, showing how rapidly the Future of tokenization – concerns and opportunities can reshape traditional finance.

Key Tokenization Trends to Watch By 2025 And Beyond

Several tokenization trends are likely to shape how global markets evolve in the next few years. Among these are:

1. Tokenization of Intangible Assets

Tokenization is moving beyond physical assets like real estate and art to include intangible assets such as intellectual property (IP), data rights, and digital content. This shift allows creators, inventors, and businesses to unlock the value of their non-physical assets by turning them into tradable digital tokens.

By tokenizing intangible assets, businesses can create new revenue streams and democratize access to previously illiquid markets. For example, platforms like Tokenova are already tokenizing patents and copyrights, enabling fractional ownership and easier monetization. Similarly, OpenSea, a leading NFT marketplace, has tokenized digital art, with sales surpassing USD 14 billion in 2021 alone.

Despite its potential, tokenizing intangible assets comes with hurdles. Legal complexities around ownership rights and the subjective nature of valuing assets like data or IP can create barriers. Robust regulatory frameworks will be essential to ensure smooth adoption.

2. Sustainability-Linked Tokenization

Sustainability-linked tokenization focuses on creating tokens for environmentally friendly assets, such as green bonds, carbon credits, and ESG (Environmental, Social, Governance) funds. This trend aligns with global efforts to combat climate change and promote sustainable finance. the carbon credit market, which is closely related to sustainability-linked tokenization, is forecasted to expand from USD 933.23 billion in 2025 to approximately USD 16,379.53 billion by 2034, with an impressive CAGR of 37.68%.

Tokenization can make sustainable investments more accessible and transparent. For instance, ClimateTrade tokenizes carbon credits, allowing businesses and individuals to offset their carbon footprint efficiently. This not only supports environmental goals but also attracts socially conscious investors.

Ensuring the authenticity of green tokens and preventing “greenwashing” (misleading claims about environmental benefits) are critical challenges. Regulatory oversight will be necessary to maintain trust in this emerging market.

3. Integration with Decentralized Identity

Decentralized identity (DID) solutions, like those offered by the Sovrin Network, are being integrated with tokenization to enhance security and privacy. DID allows users to control their digital identities and manage tokenized assets without relying on centralized authorities.

By linking tokenized assets to decentralized identities, users can enjoy greater privacy and security. This integration reduces the risk of fraud and identity theft, as users manage their assets through secure, self-sovereign digital wallets. The blockchain identity management market is projected to reach USD 35.1 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 92.7%.

However, interoperability between different DID systems and user adoption remain significant hurdles. Educating users and ensuring seamless technical integration will be crucial for widespread adoption.

4. Advanced Financial Products through Tokenization

Tokenization enables the creation of complex financial instruments, such as tokenized derivatives, options, and structured products. Platforms like Synthetix already allow users to trade synthetic assets that mirror the value of real-world assets, from stocks to commodities.

These advanced financial products can increase market liquidity and democratize access to sophisticated investment tools. For example, tokenized derivatives lower the barriers to entry for retail investors, allowing them to participate in markets traditionally reserved for institutional players.

Regulatory compliance and the accuracy of smart contracts are critical concerns. Given the complexity of these financial instruments, ensuring that smart contracts are secure and legally sound will be essential for market stability.

5. Seamless Cross-Border Transactions

Tokenization is streamlining cross-border payments by reducing costs, delays, and intermediaries. Blockchain-based solutions like Ripple’s On-Demand Liquidity (ODL) enable near-instant international transfers, benefiting businesses and consumers alike.

Traditional cross-border payments are often slow and expensive, but tokenization can change that. Central Bank Digital Currencies (CBDCs), which are being explored by 93% of central banks according to the Bank for International Settlements (BIS), could further accelerate this trend. The global cross-border payment flows are expected to grow at a CAGR of 9%, reaching USD 290 trillion by 2030.

Harmonizing regulations across jurisdictions and ensuring the security of cross-border transactions are key concerns. Collaboration between governments and financial institutions will be necessary to address these issues.

Read More: Asset Tokenization Trends

Navigating the Challenges

Despite a positive outlook, experts recognize that tokenization encounters several challenges before it can achieve widespread adoption. McKinsey highlights that “further integration of these technologies into the mainstream in a robust, secure, and compliant manner will require cooperation and alignment among all involved stakeholders.”

Transitioning from pilot programs to full-scale implementation necessitates navigating complex technical, legal, and regulatory landscapes. The tokenization process involves selecting assets, developing compliant legal structures, integrating with trading platforms, and establishing governance mechanisms for ongoing asset management. Throughout this process, regular audits and technological upgrades are crucial to ensure security and transparency.

Regulatory Frameworks and Compliance

The evolving regulatory landscape for digital assets and tokenization remains a significant challenge. Clear and consistent regulatory frameworks are needed globally to provide legal certainty, protect investors, and foster innovation in the future of tokenization. Compliance with KYC/AML (Know Your Customer/Anti-Money Laundering) regulations is also paramount for the responsible future of asset tokenization.

Private vs. Public Blockchain Implementations

Choosing between private/permissioned blockchains and public blockchains involves trade-offs between control, transparency, and security. The optimal choice depends on the specific use case and industry requirements for the future of tokenization. Interoperability between different blockchain networks is also crucial for widespread adoption of asset tokenization trends.

Security Considerations in Asset Tokenization

Ensuring the security of tokenized assets and platforms is paramount for the future of asset tokenization. Smart contract vulnerabilities, cybersecurity threats, and custody risks need to be rigorously addressed through robust security protocols, audits, and best practices to maintain trust in the future of tokenization.

Scaling Solutions: The Role of ZK Technology

As tokenization adoption scales, blockchain networks need to handle increased transaction volumes and data processing demands. Zero-Knowledge (ZK) technology and other scaling solutions are crucial for enhancing blockchain scalability and privacy while maintaining security and supporting the expansive future of tokenization.

Cross-Border Tokenization and Interoperability

Facilitating seamless cross-border tokenization requires addressing regulatory fragmentation and ensuring interoperability between different tokenization platforms and jurisdictions. International collaboration and standardization efforts are essential for realizing the global potential of the future of tokenization and asset tokenization trends.

Permissioned vs. Permissionless Networks

The debate between permissioned and permissionless networks continues in the tokenization space. Permissioned networks offer greater control and compliance, while permissionless networks prioritize decentralization and accessibility. Finding the right balance for different use cases is crucial for the diverse applications of the future of tokenization.

Innovating the Future of Tokenization

If you’re ready to explore this rapidly emerging landscape, Tokenova stands at the forefront of tokenization services. Our mission is to harness the potential of blockchain technology and help individuals, enterprises, and institutions fully embrace the future of tokenization – concerns and opportunities in a secure, scalable manner.

- Comprehensive Solutions

Tokenova’s expertise spans advisory, design, and deployment of tokenized assets, ensuring compliance with evolving regulations and leveraging best-in-class technical tools. - Cutting-Edge Research

Our continuous research into tokenization trends and blockchain innovations guarantees that your project aligns with the latest industry standards and technologies. - Global Accessibility

We prioritize creating tokenization frameworks that serve both local and international markets, tapping into a worldwide audience eager to invest in new, exciting opportunities.

Ready to Unleash the Future of Asset Tokenization?

Partner with Tokenova to tap into an inclusive global market, unlock new revenue streams, and set the stage for long-term success.

Contact us to schedule a consultation and begin your tokenization journey today.

Conclusion

By digitizing virtually any form of value, tokenization democratizes ownership, slashes inefficiencies, and introduces new levels of transparency to previously siloed markets. This isn’t just an incremental improvement—it’s a wholesale revolution that challenges conventional norms of how capital is raised, traded, and held.

From the trillion-dollar projections fueling excitement to the varied asset classes ripe for innovation, we find ourselves at the cusp of an era defined by fluid markets and unprecedented access. Organizations like Tokenova are pioneering solutions that enable businesses and individuals to embrace the future of tokenization – concerns and opportunities, ensuring that the transformation is both responsible and profitable. As regulatory structures evolve and technology matures, it’s clear that the future of asset tokenization will reshape global finance for decades to come, offering a more equitable and dynamically responsive system for everyone involved.