In today’s fast-paced digital environment, governance tokens have emerged as a pivotal innovation in blockchain and decentralized finance (DeFi). These tokens fundamentally alter how decisions are made within blockchain ecosystems, shifting control away from centralized authorities and redistributing power to a broader community of stakeholders. By enabling token holders to vote on protocol upgrades, resource allocation, and other strategic choices, governance tokens lay the groundwork for transparent, democratic, and collaborative networks. This article delves into the foundational aspects of governance tokens, examines how they transform user roles—especially through the conversion of utility tokens into governance instruments—and explores their real-world applications and future prospects.

Understanding Governance Tokens

Before diving into the mechanics of decentralized governance, it’s essential to grasp what governance tokens truly are and why they stand apart in the blockchain world. This section lays the conceptual groundwork, exploring the evolution, core functions, and distinctive features of these tokens.

What Are Governance Tokens?

Governance tokens are specialized digital assets that grant holders the power to influence and shape a protocol’s direction. They are not primarily designed for simple value transfer, like Bitcoin, or for granting access to a platform’s features, like standard utility tokens. Instead, governance tokens function as instruments of collective control. By holding them, users gain the right to propose, debate, and vote on decisions that can range from minor technical adjustments to substantial strategy pivots.

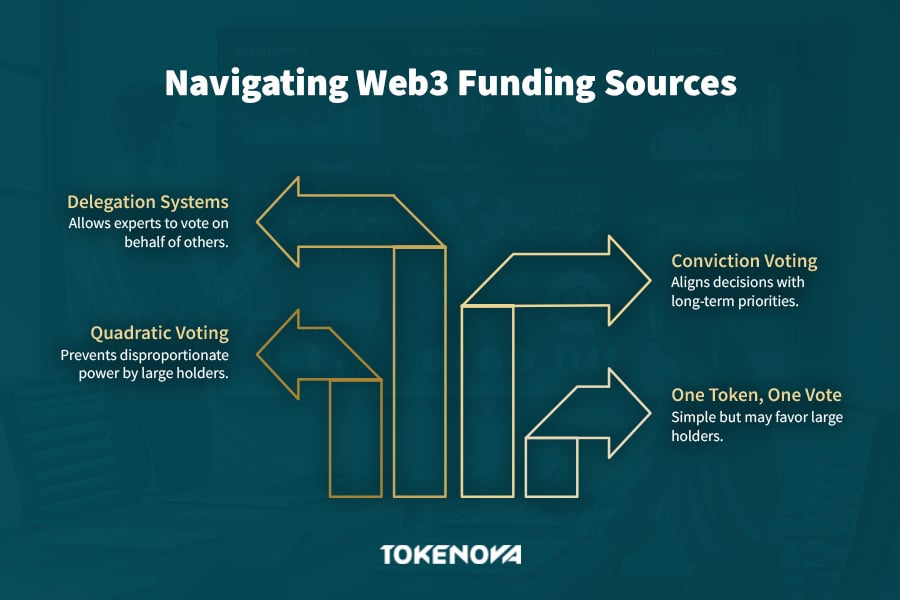

In many cases, governance tokens follow a “one token, one vote” principle, aligning voting power with the quantity of tokens held. However, alternative voting mechanisms—like quadratic voting—aim to prevent large holders from dominating outcomes. This flexibility in design enables protocols to craft governance models suited to their unique goals, risk profiles, and community values.

Core Functions and Mechanisms

At the heart of governance tokens lies their voting mechanism. These tokens often reside in smart contracts that define how proposals are submitted, reviewed, voted upon, and enacted. Beyond their voting functionality, some governance tokens also offer economic incentives. For example, holding or staking governance tokens might yield rewards derived from protocol fees, buybacks, or newly minted tokens.

Moreover, delegation systems allow individuals to transfer their voting power to other participants—often those who possess domain-specific knowledge. This balance between direct participation and delegated voting gives communities a democratic way to refine and execute decisions.

Historical Emergence

The rise of governance tokens gained momentum during the DeFi summer of 2020. Protocols like Compound, MakerDAO, and Uniswap pioneered community-oriented governance by distributing tokens that conferred real decision-making authority. This strategy was revolutionary: instead of restricting control to founding teams, it elevated users, developers, and even passive investors into co-creators. Over time, this paradigm spread across multiple blockchain projects, cementing governance tokens as a key mechanism for decentralized coordination.

The Role of Governance Tokens in Decentralized Ecosystems

Step into the realm where decentralized technology reshapes collective power. In this section, we explore how governance tokens dissolve traditional hierarchies and enable a more inclusive, transparent, and equitable decision-making process across global blockchain ecosystems.

Decentralizing Control

In traditional systems, decision-making powers are concentrated in hierarchical structures. By contrast, governance tokens distribute these powers across a broad community. Protocols relying on governance tokens no longer depend on an exclusive leadership body. Instead, token holders—who may span the globe—collectively vote on proposals, parameter changes, or treasury allocations. This ensures that critical decisions reflect the community’s collective insight and interest, mitigating single points of failure or overt manipulation.

Alignment of Incentives

Governance tokens typically incentivize holders to maintain the protocol’s long-term health. When decisions that benefit the protocol are made, they often result in positive outcomes for the token’s value or yield. For instance, MakerDAO’s MKR token holders adjust risk parameters for the DAI stablecoin; if they manage these parameters well, both DAI and MKR remain stable and valuable. This direct correlation between decision-making and token performance encourages thoughtful governance, as the community’s collective wealth is on the line.

Transparency and Accountability

Every governance action—proposal submissions, votes cast, and final decisions—is logged on a publicly accessible blockchain. This transparency fosters accountability because each participant’s governance activity is visible to all. Furthermore, the immutable nature of blockchains ensures these records remain permanently available. This open record of discussions, debates, and votes helps both new and existing stakeholders understand the context of previous governance decisions, learn from successes and failures, and plan future proposals more effectively.

Inclusivity and Global Participation

Blockchain technology transcends geographic and political barriers. As a result, anyone with access to the internet can acquire governance tokens and help steer a protocol’s evolution. This inclusivity ensures that projects benefit from diverse perspectives and expertise. Unlike legacy models that require formal board appointments or specialized credentials, governance tokens invite a global user base—often spanning various cultural, technical, and financial backgrounds—to have a say in how protocols operate and grow.

How Governance Tokens Work: Processes and Mechanisms

Imagine a finely tuned machine where every cog has a role in driving innovation. This section reveals the step-by-step processes behind governance tokens—from the spark of a proposal to its ultimate execution—illustrating the structured and community-driven mechanics of decentralized governance.

Proposal Submission and Discussion

A governance process typically begins with a community member drafting a proposal. Proposers usually must meet a minimum token holding threshold or gather enough delegated votes, ensuring only stakeholders with genuine interest can initiate changes. After submission, the proposal enters a public discussion phase, where participants analyze potential benefits, drawbacks, and technical details. This stage is vital for refining ideas and building consensus among community members.

Voting Mechanisms

Once the discussion has matured, the proposal progresses to a formal voting phase. Depending on the protocol, token holders cast votes by locking their tokens in a voting contract or using an off-chain signaling tool. Systems can vary widely:

- Direct Voting (One Token, One Vote): Straightforward but can lead to concentration of power.

- Quadratic Voting: Aims to distribute influence more evenly by weakening the voting power of large holders.

- Time-Weighted Voting: Rewards longer-term commitment by granting more voting power the longer tokens are locked or staked.

Quorum requirements may also apply, ensuring that a certain percentage of the total token supply participates to validate the vote’s legitimacy.

Execution of Approved Proposals

Approved proposals typically move to an implementation stage. In fully on-chain governance models, smart contracts automatically enact the changes once a proposal passes. In off-chain or hybrid models, core developers or an appointed multisig wallet may need to manually implement changes. This final phase ensures the protocol aligns its operational code or parameters with the democratic will expressed during the vote.

Voting Mechanisms and Decision-Making Processes

Every decision within a decentralized network is the result of intricate voting processes that balance simplicity with sophistication. In this section, we explore the diverse models of voting and how they collectively steer the direction of blockchain protocols.

Diverse Voting Models

Governance tokens enable a variety of voting models, each tailored to a protocol’s specific goals and community dynamics:

- One Token, One Vote: Most common and simplest, but may favor large holders.

- Quadratic Voting: A mathematical approach designed to prevent whales from wielding disproportionate power.

- Conviction Voting: Weighs votes based on the duration of support for a proposal, aligning decisions with long-term priorities.

These models reflect a desire for balance: they aim to encourage broad participation while ensuring decisions represent a consensus across the community.

Delegation Systems

Not every token holder is well-versed in the technical nuances of governance. Delegation systems help mitigate this issue by allowing holders to transfer their voting power to knowledgeable representatives. This setup is particularly beneficial for complex proposals—such as upgrades requiring advanced blockchain know-how—where designated experts can vote on behalf of less technical community members. Compound’s delegation feature, for instance, ensures that even smaller or newer users can have a meaningful impact through trusted proxies.

Proposal Lifecycle

Every governance protocol establishes a lifecycle for proposals:

- Ideation: Community brainstorming in forums or social channels.

- Formal Submission: Meeting thresholds for token holdings or delegated votes.

- Discussion Phase: Public debate and refinement of proposal details.

- Voting: A designated period (often days to weeks) for casting on-chain or off-chain votes.

- Execution: Automatic or developer-led implementation of successful proposals.

This structured approach ensures that each proposal receives thorough vetting and that decisions are made according to well-defined rules established by the protocol’s governance framework.

Transforming Utility Tokens into Governance Tokens

A revolution is underway as utility tokens evolve from simple transactional tools to instruments of governance. In this section, we examine how this transformation empowers users by turning passive consumption into proactive participation, thereby reshaping the very nature of digital ecosystems.

Changing User Roles and Enhancing Engagement

Historically, utility tokens have served straightforward purposes—granting access to decentralized applications (dApps) or fueling transactions. However, converting these utility tokens into governance tokens shifts the dynamic drastically. Users who previously only consumed services can now propose protocol changes, vote on upgrades, and manage treasuries. This metamorphosis deepens user engagement, as token holders become co-creators and co-owners of the platform’s future.

Case Study: World Computer | Internet Computer

A compelling example of this transition is the Internet Computer (often referred to as the World Computer). Initially, ICP tokens were used for computational needs—covering resource costs and facilitating dApp operations. Over time, the Internet Computer introduced a staking mechanism called “neurons,” allowing ICP holders to transform their utility tokens into governance tokens. When staked, ICP tokens gain voting power proportional to both the staked amount and the duration for which they remain locked.

By adopting this model, the Internet Computer revolutionized user participation. Instead of being mere users, participants became integral decision-makers, holding influence over everything from network upgrades to resource distribution. This dual-function mechanism—utility and governance—exemplifies how protocols can cultivate vibrant, long-lasting communities invested in a network’s development.

Benefits of Converting Utility to Governance

- Enhanced Engagement: Converting utility tokens to governance tokens motivates more active participation in discussions and votes.

- Dynamic Role Transformation: Users transition from passive consumers to active stakeholders, shaping network priorities and future directions.

- Economic Incentives: Many governance tokens offer staking rewards, tying financial returns to the health of the ecosystem.

- Flexibility in Participation: Users can decide how much of their tokens they devote to governance, allowing them to tailor their involvement based on expertise, risk tolerance, or personal interest.

Real-World Examples and Case Studies

To truly appreciate the impact of governance tokens, it’s instructive to examine their real-world implementations. This section spotlights several pioneering projects where governance tokens have reshaped decision-making and fostered community empowerment.

MakerDAO (MKR)

MakerDAO stands at the forefront of decentralized stablecoins, governing DAI—a digital asset pegged to the U.S. dollar. MKR holders vote on critical risk parameters, including collateralization ratios and stability fees. These governance choices directly impact DAI’s stability and MakerDAO’s resilience during market volatility. The March 2020 “Black Thursday” event showcased the power of decentralized governance when MKR holders swiftly enacted measures to preserve DAI’s peg amid extreme price drops.

Compound (COMP)

Compound introduced COMP tokens to transform traditional lending into a community-driven service. COMP holders propose and vote on changes to interest rate models, collateral types, and protocol parameters. A unique feature is the ability to delegate COMP voting power, ensuring that those with technical expertise—rather than merely the largest investors—can exert significant influence when shaping Compound’s direction.

Uniswap (UNI)

Uniswap revolutionized decentralized exchanges (DEXs) with automated market makers. Its UNI governance token extended control of protocol upgrades, fee changes, and treasury allocations to the community. UNI holders have funded developer grants, protocol enhancements, and expansions to new blockchain networks. This open governance approach has fueled Uniswap’s growth into one of the most prominent DEXs in DeFi.

Aave (AAVE)

Aave employs a hybrid governance structure, initiating proposal discussions off-chain in forums, then finalizing votes on-chain via AAVE tokens. This two-step model streamlines the democratic process: community members openly debate potential changes, which are later executed automatically if approved. Such a structure balances inclusivity, security, and agility, allowing Aave to adapt rapidly to shifts in the broader DeFi market.

Internet Computer (ICP) – World Computer Model

As noted earlier, the Internet Computer exemplifies the conversion of utility tokens into governance tokens. Through its neuron staking mechanism, ICP tokens gain voting power while also fulfilling functional roles in network operations. This model redefines user engagement, transforming everyday participants into pivotal decision-makers in the network’s future.

Sushiswap (xSUSHI)

Sushiswap applies a fee-sharing mechanism through its xSUSHI token. Users who stake SUSHI receive a portion of the platform’s trading fees while also holding governance rights. This dual benefit model has helped sustain user interest, linking financial incentives to active involvement in protocol upgrades and treasury management decisions.

Comparative Analysis of Governance Token Models

To understand the nuances of decentralized governance, it is useful to compare how different protocols implement their token models. The following table summarizes key aspects such as voting mechanisms, treasury management, and unique features that set each approach apart.

| Protocol | Token | Voting Mechanism | Treasury/Value Management | Distinctive Features |

| MakerDAO | MKR | Direct voting; emergency risk management | Stability fees, buybacks, and auctions | Votes on collateral ratios & stability fees; swift crisis response |

| Compound | COMP | One token, one vote; delegation enabled | Protocol fees & interest rate model adjustments | Minimum threshold for proposals; delegation ensures expert-driven governance |

| Uniswap | UNI | Direct voting with quorum requirements | Grants & liquidity mining programs | Broad-based community proposals; active treasury for ecosystem funding |

| Aave | AAVE | Hybrid model: off-chain discussion, on-chain execution | Dynamic risk parameters & liquidity incentives | Two-step governance process; responsiveness to market conditions |

| Internet Computer | ICP | Time-weighted voting via neuron staking | Staking rewards & network resource allocation | Converts utility tokens to governance; promotes long-term engagement |

| Sushiswap | xSUSHI | Direct voting with fee sharing | Fee distribution & token burn mechanisms | Users earn trading fees while holding governance power; fosters active participation |

This table compares popular governance token models, focusing on each protocol’s voting mechanism, treasury management, and standout features. It showcases how MakerDAO, Compound, Uniswap, Aave, Internet Computer, and Sushiswap each implement governance tokens in ways that suit their technical needs and community values. From fee-sharing arrangements to time-weighted voting, the approaches vary, but they all aim to democratize decision-making and incentivize user engagement.

Benefits and Challenges of Governance Tokens

No transformative technology comes without its trade-offs. This section weighs the significant advantages of governance tokens against the challenges they face. By examining these factors, stakeholders can better appreciate the complexities of decentralized governance.

Decentralized Control and Community Ownership

One of the biggest draws of governance tokens is how they dilute centralized power. By giving community members a direct stake in the decision-making process, protocols can better serve their user base’s diverse interests. This democratization often leads to innovative solutions and more resilient networks capable of withstanding external pressures.

Economic Incentives and Value Accrual

Governance tokens commonly incorporate financial rewards, whether through staking, revenue sharing, or token burns. These mechanisms tie protocol success to token value, motivating holders to vote in ways that enhance ecosystem growth and sustainability. When protocols thrive, so do the tokens, creating a mutually reinforcing cycle of active governance and value generation.

Enhanced Transparency and Accountability

Every vote and decision is recorded on a public blockchain, providing an immutable record that promotes accountability. This transparency not only builds trust among users but also creates an educational resource for new participants to learn from historical governance decisions.

Transforming User Roles

Converting utility tokens into governance instruments offers a significant shift in user dynamics. Instead of simply using a service, individuals actively shape its evolution. This transition fosters a sense of collective ownership, as participants recognize their pivotal role in driving innovation and ensuring long-term protocol success.

Challenges to Overcome

Despite these advantages, governance tokens face several hurdles:

- Concentration of Voting Power: Large token holders can disproportionately influence outcomes, prompting many protocols to explore voting methods that mitigate whale dominance.

- Low Voter Turnout: Even with incentives, many token holders remain passive, placing decision-making in the hands of a small fraction of the community.

- Technical Complexity: Understanding complex proposals, especially in areas like blockchain security or financial risk parameters, can be daunting for non-experts.

- Security Vulnerabilities: Decentralized governance can be susceptible to coordinated attacks, requiring robust safety measures like time locks, multi-signature wallets, or built-in circuit breakers.

- Regulatory Ambiguity: The legal status of governance tokens in many jurisdictions is still evolving, which can introduce uncertainty for projects and participants.

Future Prospects for Governance Tokens

As blockchain technology continues to mature, governance tokens are poised to evolve in new and exciting ways. In this forward-looking section, we explore the innovations and trends that could define the next generation of decentralized governance.

Innovative Voting Mechanisms

Expect the emergence of new models like conviction voting and further refinements of quadratic voting. These evolving mechanisms aim to prevent wealthy stakeholders from monopolizing influence while encouraging sustained engagement from all holders. Successful innovation in this area can lead to more equitable governance outcomes and higher community satisfaction.

Integration with Traditional Finance

As decentralized finance (DeFi) continues to mature, bridging the gap with traditional financial institutions becomes increasingly plausible. Governance tokens might serve as a blueprint for more transparent corporate governance, offering real-time insights and distributed decision-making that can coexist with conventional regulatory frameworks.

Cross-Chain Governance and Interoperability

The rise of multi-chain ecosystems necessitates interoperability. Projects like Polkadot and Cosmos lay the groundwork for seamless cross-chain functionality, which could extend to governance. A future in which governance tokens operate across different blockchains would encourage collaborative decision-making that transcends individual platforms.

Increased Community Education and Engagement

Continuous education is vital for effective governance. Protocols and community leaders are likely to invest heavily in user-friendly interfaces, explainer content, and mentorship programs. These initiatives can help reduce voter apathy, simplify complex proposals, and empower a wider range of participants to become active governors.

Regulatory Evolution

As authorities worldwide gain deeper understanding of blockchain technologies, new regulations could clarify the standing of governance tokens. Clearer legal frameworks would likely bolster institutional participation, thereby injecting more liquidity and expertise into decentralized governance while maintaining adherence to compliance standards.

Tokenova: Your Trusted Blockchain & Web3 Advisory Partner

At Tokenova, we provide expert consulting services to help businesses navigate the complexities of blockchain, Web3, and decentralized finance (DeFi). Whether you’re launching a governance token, optimizing your tokenomics, or designing a decentralized ecosystem, our team of specialists ensures your project is built for long-term success.

Why Choose Tokenova?

- Strategic Advisory – Tailored solutions for token launches, governance structures, and regulatory compliance.

- Tokenomics Optimization – Build a sustainable, high-value token economy that incentivizes participation and growth.

- Decentralized Governance Consulting – Design voting mechanisms and governance models that empower your community.

- DeFi & Web3 Integration – Implement cutting-edge blockchain solutions for seamless user experiences.

- Risk & Compliance Guidance – Navigate evolving regulations and mitigate security threats effectively.

Ready to Scale Your Blockchain Project?

Partner with Tokenova to unlock the full potential of decentralized innovation. Schedule a consultation today with our experts.

Conclusion

In conclusion, governance tokens represent a critical leap forward in the democratization of digital ecosystems. By empowering communities to shape protocol development—through mechanisms that transform utility tokens into instruments of active governance—these tokens pave the way for a more transparent, inclusive, and economically aligned future.

As protocols refine their voting mechanisms and address challenges like voter apathy and security risks, governance tokens will continue to expand their influence beyond DeFi, potentially reshaping corporate governance, social media platforms, and global digital communities. Their ability to balance decentralization, transparency, and incentive alignment may well be the key to sustained, large-scale blockchain adoption. The future of governance is digital, dynamic, and driven by the collective power of community participation.