Entrepreneurs and tech professionals often struggle with the complexities of launching a secure and efficient digital marketplace. Many are left wondering how a crypto exchange is built. with uncertainties about integrating the right features of a cryptocurrency exchange that can attract users while ensuring robust security and compliance.

The challenges are immense. Without a deep understanding of how to build a crypto exchange platform that balances speed, security, and user experience, you risk launching a platform that fails to gain traction or, worse, becomes vulnerable to security breaches. Every misstep—from inadequate liquidity solutions to poor user interface design—can result in lost investments, diminished trust, and a competitive disadvantage in a market where even minor flaws can be exploited. It begs the question: How can you possibly know how to make a crypto exchange platform that stands out amid fierce competition and evolving regulatory demands?

This guide is designed to dispel those uncertainties by providing a step-by-step roadmap on how to build a crypto exchange that not only meets industry standards but also leverages innovative features of cryptocurrency exchange to deliver an exceptional user experience. Whether you are exploring how to build a crypto exchange platform from scratch or seeking insights into how to make a crypto exchange platform that is both secure and scalable, this article offers actionable strategies and expert insights that can turn your vision into a reality.

Essential Features of a Cryptocurrency Exchange

A successful cryptocurrency exchange is built on a set of core features that cater to both novice traders and seasoned investors. Below, we outline these features along with actionable insights on how to implement them.

Core Trading Engine

At the heart of every successful crypto exchange is a robust trading engine. This critical component is responsible for matching buy and sell orders seamlessly and maintaining real-time order book functionality. Speed and efficiency are non-negotiable, as high-frequency trading demands that orders are processed within milliseconds. Leveraging a microservices architecture can further enhance performance and scalability, setting your platform apart in the competitive market.

User-Friendly Interface (UI/UX)

A clean, intuitive, and responsive user interface is essential for engaging both novice traders and seasoned investors. An organized trading dashboard displaying real-time data, charts, and trading pairs, coupled with easy account management and clear navigation, significantly enhances the user experience. By investing in superior UI/UX design, you can drive user engagement and retention, ensuring that your platform not only attracts visitors but also keeps them coming back.

Robust Security Measures

Security is a cornerstone of any crypto exchange. Implementing multi-factor authentication (MFA) fortifies user identity verification, while cold storage solutions secure the bulk of funds offline, minimizing hacking risks. In addition, state-of-the-art encryption and DDoS protection protocols safeguard the exchange against cyber threats. Prioritizing security from the outset and conducting regular audits and penetration tests are essential steps to prevent breaches that could damage your platform’s reputation.

Payment Gateway Integration

A successful exchange must offer seamless payment gateway integration for both fiat and cryptocurrency transactions. Fast and secure processing of deposits and withdrawals builds trust with users, making it easier for them to engage with your platform. Partnering with reputable payment processors and financial institutions further ensures that your exchange maintains high standards of security and operational efficiency.

KYC/AML Compliance

Ensuring compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations is critical. Implementing robust user verification processes and adhering to regulatory standards protects your exchange from legal complications. A strong compliance framework not only safeguards user information but also enhances your platform’s credibility in a market where trust is essential.

Customer Support System

Effective customer support can be a game-changer in the crypto exchange arena. Providing responsive support channels, including chat, email, and ticket systems, along with a comprehensive FAQ and knowledge base, helps address user queries promptly. A well-trained, accessible support team builds trust and fosters a positive user experience, ensuring that your exchange stands out in a crowded market.

Admin Panel & Management Tools

An intuitive admin panel is crucial for smooth platform management. This tool offers complete control over operations, including monitoring transactions, managing user accounts, and accessing real-time reporting and analytics. Effective user management and policy enforcement through the admin panel provide the data and insights necessary for making informed decisions swiftly.

Liquidity Solutions

Without adequate liquidity, even the most sophisticated trading platform can struggle to execute orders effectively. Integrating with liquidity providers ensures that your exchange can consistently match orders while employing market-making strategies helps stabilize the market. Automated liquidity solutions can bridge gaps and ensure a continuous, efficient trading process, reinforcing the strength of your platform.

Cryptocurrency & Trading Pair Support

Diversity in asset offerings is key to attracting a wide user base. Supporting a broad range of cryptocurrencies and trading pairs not only enhances the appeal of your platform but also positions it as a comprehensive solution for crypto trading. Designing the system with scalability in mind ensures that new assets can be added seamlessly as market demands evolve.

Reporting and Analytics

Data-driven insights are indispensable in optimizing your crypto exchange. Detailed transaction histories, user behavior data, and performance metrics enable continuous improvement and strategic decision-making. Advanced analytics help monitor the health of your platform, ensuring that every feature—from the trading engine to customer support—is performing at its best.

By focusing on these features of a cryptocurrency exchange, you’re better equipped to answer the question of how to build a crypto exchange that not only meets market demands but also offers a competitive edge. Whether you’re determining how to build a crypto exchange platform or figuring out how to make a crypto exchange platform more secure and user-friendly, these core elements provide the framework for success.

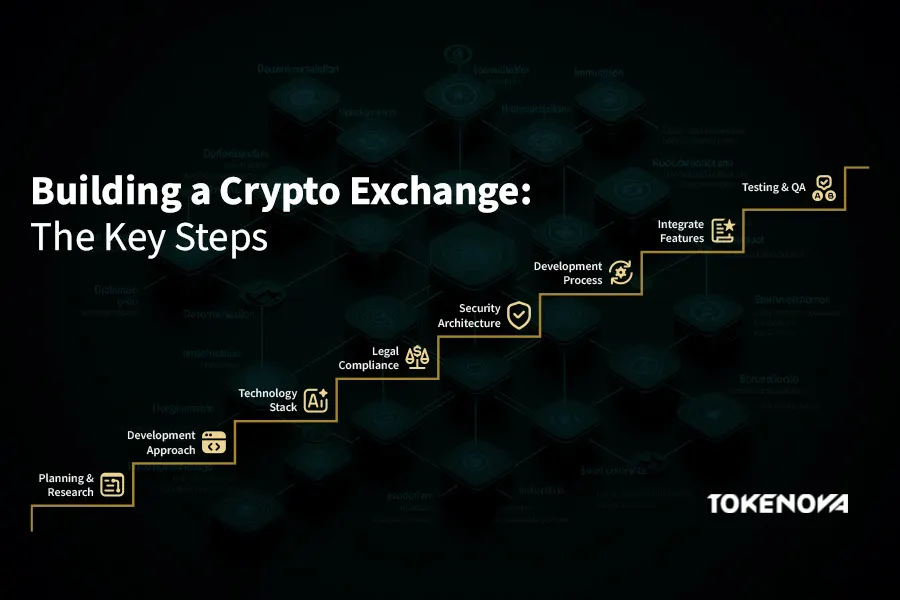

Step-by-Step Guide: How to Build Your Crypto Exchange Platform

Building a crypto exchange is a journey that involves meticulous planning, technological prowess, and a deep understanding of the regulatory landscape. Whether you’re exploring how to build a crypto exchange or seeking insights on how to make a crypto exchange platform more secure and user-friendly, this comprehensive guide walks you through each crucial step.

Read More: How to Build an NFT Marketplace from Scratch

1. Planning & Market Research

Start by defining your niche. Identify a unique value proposition—perhaps by specializing in a particular asset or by offering enhanced security features. It is essential to understand your target audience, which may include entrepreneurs, tech professionals, investors, and financial industry professionals. Conduct thorough market research and competitive analysis to pinpoint gaps and opportunities. Solid planning and market surveys will lay the groundwork for a successful exchange, ensuring that you address your audience’s key pain points.

2. Choosing a Development Approach

Deciding on the right development approach is critical. You have several options, such as a white-label solution for quick deployment using pre-built software, custom development for flexibility and scalability, or open-source platforms for cost-effective, community-supported frameworks. Your choice should reflect your budget, timeline, and the level of customization required. For those wondering how to build a crypto exchange platform, selecting the right approach can expedite market entry while providing long-term advantages.

3. Technology Stack Selection

The next step is to choose a robust technology stack that supports high performance, scalability, and security. Consider using strong programming languages like Python, Java, or C++ for backend development. Reliable databases such as PostgreSQL or MongoDB are essential to handle high volumes of data. Additionally, decide on blockchain integration protocols that align with your exchange’s objectives and incorporate security frameworks that ensure data integrity. The right tools will be the backbone of your platform’s efficiency and stability.

When building a crypto exchange, selecting the right programming languages is crucial for ensuring performance, scalability, and security. Here’s why the recommended languages are well-suited for this purpose:

- Python: Known for its simplicity and readability, Python is ideal for rapid development and prototyping. Its extensive libraries and frameworks (such as Django and Flask) make it a popular choice for backend development. However, it may not be the best choice for high-frequency trading due to its slower execution speed compared to compiled languages.

- Java: Renowned for its scalability and platform independence, Java is a strong choice for building large-scale, enterprise-grade applications. Its robust ecosystem, which includes frameworks like Spring Boot, ensures reliable performance and ease of maintenance. Java is particularly well-suited for exchanges that need to handle high transaction volumes.

- C++: A high-performance language that offers fine-grained control over system resources makes C++ ideal for building low-latency trading engines. Its efficiency and speed are critical for high-frequency trading platforms where milliseconds matter. However, C++ requires more expertise to manage memory and avoid vulnerabilities effectively.

Read More: Tokenization vs Encryption vs Hashing: Your Data Security Toolkit

4. Legal and Regulatory Compliance

Navigating the regulatory landscape is non-negotiable when building a crypto exchange. Start by identifying the licensing requirements in your target jurisdictions and conduct a thorough jurisdictional analysis. Engage legal counsel to ensure that every aspect of your platform meets local and international regulatory standards. Compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations will not only protect your exchange but also enhance its credibility in a highly competitive market.

5. Security Architecture Design & Implementation

Security is at the core of any successful cryptocurrency exchange. Develop a comprehensive security strategy that includes proactive measures such as firewalls, encryption, and regular vulnerability assessments. Conduct penetration testing to identify and mitigate potential threats before launching your platform, and implement continuous monitoring to respond swiftly to suspicious activities. Embracing a “defense-in-depth” approach is crucial for protecting your exchange from evolving cyber threats.

6. Development Process

Whether you choose Agile or Waterfall methodologies, a structured development process is key to success. Assemble a multidisciplinary team comprising developers, designers, security experts, and legal advisors. Establish clear milestones and deadlines, and incorporate iterative testing phases to ensure that each feature is functioning correctly. A well-planned development process not only streamlines the build but also enables iterative improvements, ensuring that your platform remains robust and reliable.

7. Integration of Key Features

Seamless integration of essential components is vital when considering the features of a cryptocurrency exchange. Focus on integrating a high-performance trading engine, secure wallet systems for deposits and withdrawals, reliable payment gateways for both fiat and crypto transactions, and robust KYC/AML systems. Using APIs and microservices can help ensure that each component interacts smoothly with the rest of your system, creating a cohesive and efficient trading environment.

8. Testing and Quality Assurance (QA)

A well-tested platform builds trust with users and minimizes the risk of post-launch failures. Engage in functional testing to verify that each feature performs as intended under varying conditions. In addition, conduct security audits with third-party experts and simulate high trading volumes during performance testing. Rigorous QA processes are essential for ensuring that your exchange not only operates flawlessly but also withstands high traffic and potential cyber threats.

9. Deployment and Infrastructure Setup

Choosing the right infrastructure is crucial for scalability. Opt for reliable servers and cloud solutions, such as AWS, Google Cloud, or Azure, that can support rapid growth and high trading volumes. Your deployment strategy should include considerations for scalability and a robust disaster recovery plan. This ensures that your platform remains operational even under unforeseen circumstances, providing continuous and reliable service to your users.

10. Post-Launch Maintenance & Updates

Launching your platform is just the beginning. Ongoing maintenance is critical to ensuring long-term success and user satisfaction. Regularly apply security patches to address vulnerabilities, and continuously improve your platform based on user feedback and market trends. A dedicated customer support team should be available to handle inquiries and technical issues. Keeping your platform updated and secure will foster trust and encourage sustained user engagement.

How to Have a Crypto Exchange Platform?

Business owners and crypto enthusiasts can choose one of these two options for their platform:

Existing Crypto Exchanges: Platforms like Coinbase, Kraken, Binance, and Gemini, where you can buy, sell, and trade cryptocurrencies.

Service Providers for Building Crypto Exchanges: Companies that offer the technology and infrastructure to create your own crypto exchange platform.

Read this breakdown to help you with our choice:

1. Existing Crypto Exchanges:

These are platforms where users go to trade cryptocurrencies. Some of the most well-known include:

Coinbase:

✔️User-friendly, and popular with beginners.

✔️Offers a wide range of cryptocurrencies.

Kraken:

✔️Known for its security and advanced trading features.

✔️Appeals to more experienced traders.

Binance:

✔️One of the largest exchanges globally, with a vast selection of cryptocurrencies.

✔️Offers various trading options.

Crypto.com:

✔️Offers a very wide range of crypto services, and has a very large user base.

2. Service Providers for Building Crypto Exchanges:

If you’re looking to create your own crypto exchange, you’ll need to work with technology providers that offer:

- White-label exchange software: Pre-built exchange platforms that can be customized and branded.

- API solutions: Tools that allow you to integrate trading functionalities into your own applications.

- Security infrastructure: Essential for protecting user funds and data.

- Compliance solutions: To navigate the complex regulatory landscape.

Finding these service providers will often require in-depth online research, and contacting companies that specialize in blockchain and exchange software development.

Key Considerations and Challenges

Building a crypto exchange comes with its own set of challenges. Being aware of these and planning accordingly can save you from potential pitfalls.

Security Risks and Vulnerabilities

When learning how to build a crypto exchange, prioritizing robust security is essential. Protect your platform from cyberattacks such as hacking, DDoS, and phishing scams. Data breaches pose a major risk, so safeguarding sensitive user information is crucial. Employ advanced cybersecurity measures and conduct regular audits to mitigate threats effectively.

Regulatory Landscape and Compliance Hurdles

Understanding global regulations is vital when exploring how to build a crypto exchange platform. Navigating different regulatory environments can be complex, and securing the necessary licenses often demands significant legal investment.

Stay updated on regulatory changes and adapt your policies accordingly to ensure compliance and enhance your platform’s credibility. Here are some jurisdictions known for their clear and favorable crypto regulations:

🚩Malta: Often referred to as the “Blockchain Island,” Malta has established a comprehensive regulatory framework for cryptocurrencies and blockchain technology. The Malta Digital Innovation Authority (MDIA) and the Virtual Financial Assets (VFA) Act provide clear guidelines for crypto businesses.

🚩Singapore: The Monetary Authority of Singapore (MAS) has implemented a progressive regulatory framework under the Payment Services Act (PSA). Singapore is known for its supportive environment for fintech innovation while ensuring robust consumer protection.

🚩Switzerland: Switzerland’s Crypto Valley in Zug is a global hub for blockchain innovation. The Swiss Financial Market Supervisory Authority (FINMA) provides clear guidelines for crypto businesses, emphasizing anti-money laundering (AML) and know-your-customer (KYC) compliance.

🚩United States: While the U.S. regulatory environment is complex due to its federal structure, states like Wyoming have enacted crypto-friendly laws. The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) provide regulatory oversight for crypto assets.

🚩European Union: The EU’s Markets in Crypto-Assets (MiCA) regulation, expected to be fully implemented by 2024, aims to create a harmonized regulatory framework for crypto assets across member states.

Read More: Best Countries to Register Your Crypto Company

| Jurisdiction | Regulatory Body | Notable Features |

| Malta | Malta Digital Innovation Authority (MDIA) | Comprehensive framework for cryptocurrencies and blockchain technology |

| Singapore | Monetary Authority of Singapore (MAS) | Progressive regulatory framework, supports fintech innovation while ensuring consumer protection |

| Switzerland | Swiss Financial Market Supervisory Authority (FINMA) | Clear guidelines for crypto businesses, emphasis on AML and KYC compliance |

| United States | Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC) | Complex due to federal structure, some states (e.g., Wyoming) have crypto-friendly laws |

| European Union | – | Harmonized framework across member states, expected full implementation by 2024 |

Building Trust and User Acquisition

In a competitive market, building trust is paramount. Focus on establishing user confidence by implementing the right features of a cryptocurrency exchange, such as transparent operations and robust security measures. Leverage effective digital marketing and community engagement strategies to attract and retain users, and consider partnering with trusted entities in the crypto and financial sectors.

Scalability and Performance Under High Trading Volumes

Design your platform to handle exponential growth in trading volumes by monitoring performance metrics and optimizing system architecture. Embrace cloud solutions and modular systems to future-proof your exchange. A scalable design ensures that your crypto exchange platform can maintain high performance even during peak trading periods.

Cost and Time Investment for Development and Launch

Developing a crypto exchange is capital-intensive, with expenses spanning development, legal, marketing, and operational costs. Set realistic timelines and milestones, as launching a platform can take months or even years. Evaluating the long-term return on investment against upfront costs is crucial for determining the overall viability of your project.

Conclusion

The path to launching a successful crypto exchange platform is paved with challenges, from navigating complex regulations and mitigating security risks to building trust and ensuring scalability. However, armed with the insights in this guide, you can learn how to build a crypto exchange platform and are well-equipped to overcome these hurdles. Success in this dynamic market hinges on prioritizing user experience, security, and compliance and having the key features of a cryptocurrency exchange while maintaining a commitment to innovation.

Key Takeaways for Aspiring Crypto Exchange Platform Owners:

- Plan Meticulously: Conduct thorough market research and define your niche to tailor your platform for success.

- Prioritize Security: Invest in multi-layered security measures and regular audits to protect user funds and data.

- Focus on Compliance: Understand and meet the regulatory requirements in your target jurisdictions.

- Enhance User Experience: Build an intuitive interface with real-time data and responsive customer support.

- Be Ready for Growth: Design a scalable architecture that can handle high trading volumes and rapid user growth.

Continually Innovate: Stay ahead of market trends by regularly updating your platform and integrating new features.

What are the biggest challenges in how to build a crypto exchange?

Building a crypto exchange comes with challenges like regulatory compliance, liquidity management, security risks, and user acquisition. Without proper security and compliance, your platform may face legal issues or cyber threats. Ensuring liquidity and a seamless user experience is key to long-term success.

How much does it cost to build a crypto exchange platform?

The cost of how to build a crypto exchange platform varies based on features, security, and development approach. A basic white-label solution can start at $30,000, while a fully custom-built platform may exceed $500,000. Additional costs include security upgrades, liquidity solutions, and regulatory compliance.

How can a new exchange stand out among competitors?

To compete, focus on unique features of cryptocurrency exchange, enhanced security, and seamless user experience. Offering low fees, fast transactions, and niche trading pairs can attract traders. Strong marketing, regulatory compliance, and innovative features like DeFi integrations help establish credibility in a competitive market.