For seasoned business owners exploring the crypto space, Initial Coin Offerings (ICOs) present an opportunity for disruptive innovation and early-stage investment in high-growth ventures. One of the most crucial—yet often overlooked—aspects of any successful ICO is token distribution.

Understanding how tokens are created and allocated offers vital information regarding a project’s structure, sustainability, and long-term value. Here’s what every high-net-worth investor should know about ICO token distribution before entering this emerging market.

What Is Token Distribution?

Token distribution refers to how a cryptocurrency project’s tokens are allocated among stakeholders during or after an ICO. These tokens may serve various purposes—such as accessing services within a platform, participating in governance, or functioning as digital assets with potential resale value.

The distribution process typically includes

- Token Issuance: Tokens are created on blockchain platforms like Ethereum or Binance Smart Chain.

- Allocation: Tokens are distributed to investors, founders, advisors, and the broader community according to a predefined structure.

Why Token Distribution Matters for Investors

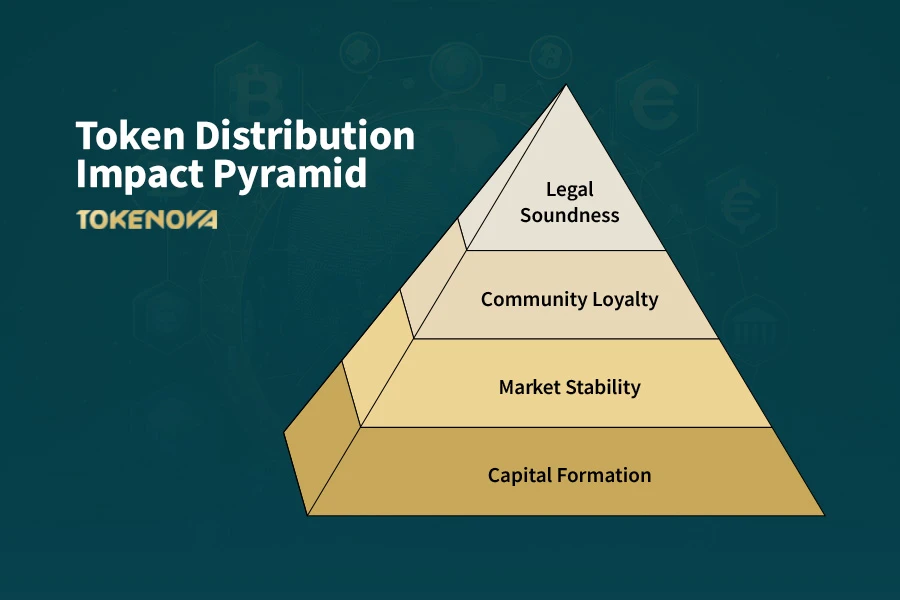

Token distribution isn’t just technical minutiae—it directly influences the long-term viability and profitability of a project. Here’s why it’s vital:

- Capital Formation: Effective token sales raise essential funds for development, scaling, and operations.

- Market Stability: Smart allocation strategies help avoid token oversupply and reduce volatility.

- Community Loyalty: Strategic distribution to users and contributors fosters engagement and long-term adoption.

- Legal Soundness: Compliance with KYC/AML protocols and securities laws protects both the project and its investors.

For affluent investors, understanding these factors is key to mitigating risk and identifying projects with long-term growth potential.

Read More: Efficiency Gains: Token vs Traditional Investments

Common Token Distribution Models

A well-structured token distribution strategy is a cornerstone of a successful ICO. It influences governance, incentivizes participation, ensures long-term sustainability, and builds investor confidence. Below are the most common categories of token allocation, each explained with examples from real projects and insights into what business owners should pay attention to.

1. Public Sale

Tokens are sold directly to the general public, usually in one or more stages. Early-stage pricing may be discounted to reward early supporters.

Typical Allocation: 30–50% of total supply

Examples & Insights:

- Ethereum (2014): Coindesk says that Ethereum has sold ~83% of its initial supply (60M ETH) to the public. The phenomenon created strong grassroots support and wide decentralization.

Lesson: Broad participation builds long-term community trust and reduces governance centralization. - Tezos (2017): Tezos has sold ~57% of XTZ to the public in an uncapped sale. Despite post-sale challenges, the large public share reinforced legitimacy.

Lesson: High public allocations build legitimacy but must be balanced with responsible capital management.

Read More: Launch an ICO: Your Step-by-Step Guide

2. Private Sale / SAFT (Simple Agreement for Future Tokens)

Tokens are sold at discounted prices to early investors, often institutions, before the public sale. These allocations usually come with lock-up periods.

Typical Allocation: 10–30%

Examples & Insights:

- Polkadot: Based on Crypto-finance, Polkadot conducted multiple private rounds (2017–2020) alongside public sales. Early investors received discounted DOT, but tokens were vested.

Lesson: Smart structuring of private rounds can bring in capital without risking early dumps. - VeChain: Sold 9% of its tokens in a private sale to strategic partners and institutional investors.

Lesson: Private sales can attract not just money but also strategic value—like corporate adoption. - 0x (2017): Strategic investors participated early, but the structure emphasized fairness by capping insider allocations and including vesting schedules.

Lesson: Balance discounted access with long-term alignment to avoid market manipulation.

3. Team & Advisors

A portion of tokens is allocated to founders, developers, and advisors to reward their contributions and ensure their continued commitment.

Typical Allocation: 10–20%

Examples & Insights:

- Chainlink: 30% of LINK reserved for the company and team, used for operations and incentives.

Lesson: While higher than average, long-term project success justified the allocation—transparent use is key. - Synthetix: allocates 20% of its tokens to the team and advisors, who will have lock-up periods of 12 to 24 months.

Lesson: Vesting prevents early dumping and aligns insiders with network growth. - Tezos: 10% each to the foundation and founder-controlled company DLS, with 4-year vesting.

Lesson: Transparency and vesting mechanisms build credibility, especially after large capital raises.

Read More: Utility Tokenomics

4. Community Rewards & Incentives

Tokens are reserved for incentivizing users, developers, and contributors. Such rewards may include staking, governance participation, liquidity mining, bug bounties, and user referrals.

Typical Allocation: 10–25%

Examples & Insights:

- Synthetix: Reserved 5% for partnerships and 3% for bounties—helped kickstart liquidity and integrations.

Lesson: Early ecosystem incentives create momentum for network effects. - Chainlink: 35% of tokens were reserved to reward node operators and developers.

Lesson: Directly funding network infrastructure leads to actual utility growth, not just speculation. - Decentraland: 20% allocated to reward creators and users building in its virtual world.

Lesson: In user-driven platforms, community tokens are critical to adoption and stickiness.

5. Reserves & Development Funds

Projects often hold a strategic reserve to support future development, operational costs, partnerships, or unforeseen expenses.

Typical Allocation: 10–30%

Examples & Insights:

- Polkadot: The Web3 Foundation holds ~30% of DOT to fund protocol development and ecosystem grants.

Lesson: A well-funded foundation can maintain project momentum and credibility across market cycles. - 0x: 15% allocated to a Developer Fund to support third-party applications and grant programs.

Lesson: Allocating funds specifically for ecosystem growth leads to sustained innovation. - VeChain: 12% reserved by the foundation for ongoing operations and development.

Lesson: Reserve allocations show strategic foresight and capacity for long-term project delivery.

6. Airdrops & Promotional Campaigns

Free token distributions are used as a marketing tool to generate awareness and incentivize onboarding new users, and rewarding early supporters is also a common use for free token distributions.

Typical Allocation: 1–5% (may vary)

Examples & Insights:

- Stellar Lumens (XLM): Distributed billions in free tokens via airdrops and partnership programs.

Lesson: Airdrops can massively boost awareness but need safeguards against abuse (e.g., bots, dumps). - Uniswap (UNI): Retroactively airdropped 400 UNI to users—instantly created goodwill and active governance.

Lesson: Targeted, value-based airdrops can solidify user loyalty and expand community governance. - Synthetix & Decentraland: Used smaller airdrops and bounties to engage the community and fix bugs.

Lesson: Small allocations, if used wisely, can build an active contributor base at low cost.

Read More: Token Burning: Is Your Crypto Going Up in Smoke?

Key Takeaways for Business Owners:

| Principle | Actionable Insight |

| Transparency Wins Trust | Publish exact allocations, use audited contracts, and communicate lockups clearly. |

| Balance Power and Access | Avoid highly centralized distributions—public and community allocations should have weight. |

| Long-Term Alignment | Use vesting, lock-ups, and milestone-based releases to keep insiders committed. |

| Fund the Future | Allocate for developer incentives, user growth, and ecosystem expansion—not just fundraising. |

| Match Incentives to Model | If your product depends on users or validators, ensure they’re compensated in tokens. |

Read More: What Assets Can Be Tokenized

Best Practices for Token Distribution

To protect your capital and align with high-performing projects, look for ICOs that implement the following best practices:

1. Transparent Allocation

Token allocation should be clearly outlined in the whitepaper, including how much goes to each group.

2. Vesting & Lock-Up Schedules

These measures prevent insiders from “dumping” tokens and help ensure price stability over time.

3. Regulatory Compliance

Projects should conduct KYC (Know Your Customer) and AML (Anti-Money Laundering) checks and operate within relevant legal jurisdictions.

4. Secure Smart Contracts

Token issuance and distribution should be governed by audited smart contracts to eliminate human error and enforce rules programmatically.

5. Community Focus

A well-funded and incentivized user base contributes to project traction and long-term ecosystem value.

Challenges and Risks to Consider

Even with the best planning, ICO token distribution carries inherent risks:

- Token Oversupply: Excess tokens can dilute value and crash prices post-ICO.

- Regulatory Pitfalls: Non-compliant projects risk fines or shutdowns.

- Scam Projects: The decentralized nature of ICOs makes them fertile ground for fraudulent schemes.

Due diligence is essential—verify the team, technology, legal standing, and tokenomics before committing capital.

For a more profound understanding of these risks, contact Tokenova experts to check project risks, assess tokenomics, and strengthen your due diligence before committing capital.

Conclusion

For high-net-worth individuals and business owners seeking to diversify into crypto, understanding ICO token distribution is foundational. It’s more than a technical detail—it’s a roadmap for how a project raises money, allocates power, and incentivizes stakeholders.

By prioritizing transparency, legal compliance, and investor-aligned tokenomics, you can identify promising ICOs with the potential to deliver outsized returns while mitigating risk.

Whether you’re planning to invest directly or structure your own tokenized project, mastering token distribution will give you a decisive edge in the rapidly evolving digital asset landscape.