Real estate tokenization converts property ownership rights into blockchain-based digital tokens, opening fractional stakes and fresh liquidity in a market that normally locks up capital, and fueling a global real estate tokenization market that’s only just beginning to scale. According to Deloitte, the global market for tokenized real estate is set to surge from under US$300 billion in 2024 to US$4 trillion by 2035.

By slicing property rights into digital tokens, investors from Tokyo to Johannesburg can plug into U.S. or European deals. But rolling token offerings across borders stacks on regulatory, legal, tax, and operational hurdles that can stall transactions. In this guide, we’ll dive into those challenges and map out practical fixes for making international tokenized property investments work.

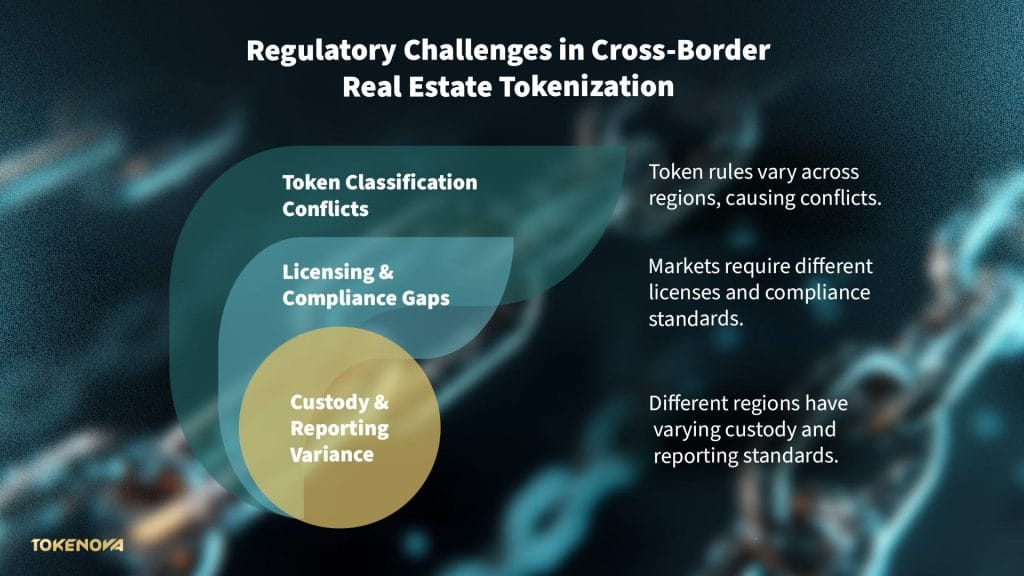

Major Regulatory Challenges Across Different Jurisdictions

Real estate tokenization faces a patchwork of rules that shift by market. Issuers can’t assume a token falls into the same category from New York to Berlin or Tokyo. Mapping each jurisdiction’s classification, licensing, and custody norms before launch is mission-critical to maneuver your path around challenges in asset tokenization.

Fragmented Token Classifications

Regulatory uncertainty in international real estate tokenization shows up as conflicting definitions and shifting rulebooks; case in point, what works for U.S. securities often clashes with EU MiFID regimes or bespoke Asian frameworks. Issuers wrestle with international real estate tokenization regulations before they even draft an offer.

| Jurisdiction | Regulatory Body | Token Classification | Licensing Requirement | Key Challenge |

| United Arab Emirates (UAE) | ADGM / DFSA / SCA | Asset-referenced & security | FSRA license (ADGM QIF) / DFSA license (DIFC CIF) / SCA approval | Multiple regulators and evolving DLT frameworks across free zones |

| United States | SEC | Security token | Broker-dealer / SEC filings | No clear “digital asset” safe harbor |

| European Union | ESMA / MiCA | Asset-referenced token | AIFM or MiFID authorization | MiCA implementation delayed until 2026 |

| Singapore | MAS | Securities under SFA | CMS license | Retail investor protection constraints |

Fragmented Token Classifications Across Jurisdictions

Licensing and Compliance Requirements

Each market tacks on its own license and reporting hurdles. For instance, a U.S. issuer needs broker‑dealer approval; Europe demands an AIFM license; and Singapore insists on a CMS license. Capital thresholds, audit cadences, organizational guardrails—they all vary. KYC/AML standards add another wrinkle: some territories require deep identity scans and continuous monitoring, while others barely scratch the surface.

Our experts at Tokenov know these markets inside out. Drop us a line today and we’ll map out a compliant, goal‑driven tokenization strategy that works for you and your business.

Custody and Reporting Discrepancies

Some regulators insist on a local, regulated custodian; others let investors self‑custody on‑chain. Ongoing disclosure requirements, everything from transaction reports to audit trails and risk assessments, differ in scope and frequency. So don’t miss any local mandate, or else you’ll be staring down fines or forced delisting.

Taming this regulatory jungle means breaking down each target market’s definitions, licensing gates, and custody norms before you go live.

Legal Compliance and Challenges in Cross-Border Real Estate Tokenization

Tokenized deals ride on a legal wrapper—usually an SPV or trust—that holds title for token holders. These vehicles must follow corporate, trust, or partnership rules where the property sits, tacking on entity formation, governance, and disclosure steps. Misalign the SPV’s corporate documents with token mechanics, and you risk voided transfers and lawsuits.

SPV Structuring and Governance

An SPV issues tokens representing equity or debt interests. Its articles of association and shareholder agreements must explicitly recognize tokens as the transfer mechanism. Without that, on-chain swaps won’t hold up in court.

Title Registration and Conveyancing

Blockchain swaps don’t auto‑update land registries. Issuers need notaries or land offices to record beneficial ownership after a token trade. Civil‑law countries demand notarial deeds; common‑law relies on title insurance. Each model calls for bespoke processes.

Due Diligence and Enforcement

Investors lean on issuer‑led title checks, zoning compliance, and encumbrance audits before buying tokens. Varying standards for land surveys, environmental assessments, and title insurance across borders can leave gaps in enforcement if problems surface later.

Tax Implications and Currency Fluctuation Challenges

Cross-border real estate tokenization tax regulations add another headache. It’s because cross-border token deals trigger tax liabilities in both the issuer’s home and the investor’s residence, often glitching into double taxation without a treaty play. Investors must untangle capital gains and income tax rules, track residency definitions, and sift through withholding rates for each jurisdiction. Treaty analysis and bespoke tax structuring become non-negotiable.

What’s more, double taxation treaties can ease the burden, but only if you map beneficial ownership rules against local tax codes. Missteps on residency or entity classification can leave you on the hook for unexpected tax bills.

| Jurisdiction | Capital Gains Tax Rate | Withholding Tax | Reporting Obligations |

| United Arab Emirates (UAE) | Exempt (0% capital gains tax, except on depreciable assets) | None (exempt on dividends, interest, and gains) | Annual FATCA/CRS reporting by UAE Reporting Financial Institutions to UAE Ministry of Finance (deadline 30 June) |

| United States | 0–20% for long-term gains under IRC §1(h) | 30% on distributions to non-resident aliens under FIRPTA | Form 1040-NR and annual 1099-B filings |

| Germany (EU) | 25% flat rate + 5.5% solidarity surcharge on gains | Up to 15% for foreign investors per AStG | Annual disclosures under CRS/AEOI |

| United Kingdom | 18–28% for residential property gains | 20% on overseas investors under ATED | Annual self-assessment returns |

Tax Regimes and Reporting Obligations in Key Markets

Sources 1, 2, 3, and 4

Currency Fluctuation and Hedging

Returns stream in local fiat, exposing investors to FX swings that can significantly erode net gains over time; hedging with forward contracts, options, or stablecoin settlements can dampen volatility, but these strategies introduce counterparty exposure, collateral requirements, and extra liquidity and operational costs

Practical Solutions for Cross-Border Implementation

These real estate tokenization barrier solutions hinge on aligned legal frameworks across markets, standardized token protocols that ensure interoperability, and partnership networks covering global compliance requirements for real estate tokens. Reliable operational partners streamline custody, settlement, and compliance behind the scenes, so issuers can move from sandbox pilots to scalable international offerings.

Regulatory Harmonization and Licensing

In the UAE, setting up a multi‑jurisdictional SPV in a free zone, like ADGM’s Qualified Investor Fund (QIF) regime or DIFC (Dubai International Financial Centre)’s Collective Investment Fund (CIF) framework, gives you a single governance and disclosure rule set across the wider GCC. Choosing a fund structure built for professional and institutional investors cuts down on duplicative licensing or repeated registrations in each MENA market.

At the same time, the UAE has three sandboxes, namely ADGM (Abu Dhabi Global Market)’s RegLab, DFSA (Dubai Financial Services Authority)’s Tokenization Sandbox in DIFC, and VARA’s Innovation Testing Licence in Dubai. They create controlled environments to pilot tokenized real estate under tailored waivers and direct regulator feedback. Early runs here de-risk full-scale rollouts and feed real‑world data on investor protections, tech governance, and risk monitoring that regulators across MENA are watching closely.

Standardized Technical Frameworks

Around the Gulf, platforms are already leaning on ERC-3643 to power compliant RWA setups in ADGM’s RegLab and beyond. That token standard bakes in permission layers and legal logic, so transfers automatically enforce compliance rules. You should also pair this with a modular KYC/AML stack tuned to ADGM’s AML/CFT Rulebook and UAE federal AML laws, with global watchlist screening, risk-based due diligence, and continuous monitoring, to smooth investor onboarding and tick both VASP and FATF boxes.

Operational Partnerships and Custody

Team up with regulated custodians offering multi‑currency wallets and built‑in fiat rails. That streamlines settlement, custody, and hedging in one package.

Combine these pillars and keep them aligned with legal wrappers, shared tech protocols, and solid custody partners, so you can scale compliant cross‑border tokenized real estate offerings. And if you’re still unsure how to stitch together ERC-3643 integration, KYC/AML flows, and other steps, you can team up with us to receive professional guidance and build end-to-end solutions across MENA and Europe; it’s time to map your road.

Final Words

Tokenization can open doors to global property markets, weaving liquidity into a traditionally locked‑down asset class. Yet the promise risks falling short if you ignore the legal mazes, tax traps, and technical mismatches that spring up between borders. A measured blend of harmonized legal structures, proven token standards, and deep operational partnerships is how you turn that promise into real‑world deals. Get the foundation right, and cross‑border tokenized real estate shifts from concept to capital flow.