Blockchain innovations have sparked intense debates on consensus models, with discussions centering on proof of stake vs proof of work vs proof of history. In this article, we explore the evolution, technical intricacies, and practical impacts of these mechanisms. By examining their unique strengths and trade-offs, readers can better understand how blockchain networks achieve security, scalability, and efficiency.

This guide offers detailed insights backed by data and industry trends, ensuring a clear and informed overview of these pivotal technologies.

The Evolution of Blockchain Consensus Mechanisms

Blockchain technology began as a groundbreaking solution for decentralized record-keeping, relying on a single consensus approach. Over time, increasing demands for scalability, energy efficiency, and enhanced security have driven the development of multiple consensus mechanisms. This evolution has led to a diversified ecosystem where different methods are tailored to specific network requirements and applications.

Read More: Blockchain Scalability Challenges: Top Solutions for 2025

Historical Background

The journey started with Bitcoin’s introduction of Proof of Work (PoW), which established the foundation for a trustless system without central authorities. Early blockchain pioneers focused on securing the network through computational puzzles, setting the stage for future innovations. This initial model highlighted both the potential and limitations of decentralized consensus.

Developmental Milestones

Subsequent advancements saw the emergence of Proof of Stake (PoS) and later Proof of History (PoH). PoS was developed to address the massive energy consumption inherent in PoW systems, while PoH introduced a novel way to timestamp transactions, dramatically boosting network performance. Each step in this evolution reflects a response to the increasing complexity and varied demands of blockchain applications.

- Proof of Work: The Pioneer Consensus Mechanism

Proof of Work (PoW) is the original consensus method that underpins Bitcoin and many other early blockchains. Its design relies on computational puzzles to secure the network and has been a benchmark for decentralization and security despite inherent challenges.

Before diving into the technical details, it is important to understand that PoW was initially designed to solve the double-spending problem in digital currencies. The approach establishes trust by making it computationally expensive to alter historical records, which has ensured Bitcoin’s resilience over time.

Technical Foundation and Energy Consumption

In PoW systems, miners compete to solve complex cryptographic puzzles, with the winner earning the right to add a new block to the blockchain. This competitive process makes it economically unfeasible for an attacker to control the network. However, the trade-off is an enormous energy requirement. For instance, Bitcoin’s energy consumption has been compared to that of entire nations like Australia and the Netherlands. Such comparisons highlight the environmental concerns that have spurred ongoing debates about PoW’s sustainability.

Market Position and Network Security

Despite energy concerns, PoW’s security model remains one of its strongest assets. Bitcoin’s self-adjusting mining difficulty ensures that even as the total computational power fluctuates, the network maintains its robustness. The geographic distribution of mining operations has evolved due to regulatory shifts, with regions such as the United States emerging as major hubs. This distributed model further reinforces Bitcoin’s integrity and resilience against centralized control.

Real-World Applications

PoW’s primary applications revolve around systems where immutability and security are paramount. Bitcoin, often dubbed “digital gold,” serves as a store of value and a medium of exchange. Other cryptocurrencies such as Litecoin and Monero have adapted PoW to suit their unique objectives—Litecoin offers faster transaction times, while Monero focuses on privacy by making transactions difficult to trace. In each case, PoW’s design choices continue to influence blockchain implementations where the highest level of security is a critical requirement.

2. Proof of Stake: The Energy-Efficient Alternative

Proof of Stake (PoS) emerged as a transformative alternative to PoW, designed to drastically reduce energy consumption while maintaining network security. PoS selects validators based on the amount of cryptocurrency they lock up as collateral rather than relying on computational power, which makes it far more environmentally friendly.

Before exploring PoS in detail, it is crucial to note that this mechanism also introduces economic incentives that encourage honest behavior. By staking tokens, validators risk losing their investment if they act maliciously, which helps secure the network while reducing the need for energy-intensive computations.

Mechanics of PoS and Economic Incentives

In PoS systems, validators are chosen to propose and validate new blocks based on their stake in the network. This method eliminates the need for large-scale computational efforts. For example, Ethereum’s transition to PoS reportedly reduced its energy consumption by approximately 99.95% compared to its PoW model. In 2025, Ethereum’s network has over 33 million ETH staked, representing around 27.57% of its total supply. These figures underscore how PoS not only conserves energy but also drives a strong economic security model through participant commitment.

Staking Dynamics and Institutional Participation

The PoS landscape is characterized by a diverse array of participants—from individual validators to large institutional investors. Liquid staking solutions have emerged as a significant trend, allowing stakers to retain liquidity while participating in network security. Recent data shows that liquid staking accounts for over 31% of staked ETH, followed by contributions from centralized exchanges and staking pools. Institutional involvement has grown as regulatory clarity has improved, prompting organizations to see PoS as a sustainable long-term strategy. Initiatives like the Ethereum Foundation’s strategic staking allocations further illustrate the market’s growing confidence in this consensus method.

Use Cases and Ecosystem Growth

Proof of Stake is particularly well-suited for ecosystems that demand both high throughput and low energy consumption. Ethereum’s extensive network, which hosts decentralized finance (DeFi) projects, non-fungible tokens (NFTs), and decentralized autonomous organizations (DAOs), is a prime example of PoS’s versatility. Other blockchain platforms like Cardano, Polkadot, and Tezos have also adopted PoS or its variants to support specialized applications such as digital identity verification, cross-chain interoperability, and on-chain governance. These diverse implementations highlight how PoS is fueling growth in the blockchain ecosystem by providing a balance between efficiency and robust security.

Read More: Future of Decentralized Finance: The Upcoming Financial Revolution

3. Proof of History: The High-Performance Innovation

Proof of History (PoH) represents a significant innovation in blockchain consensus mechanisms. It introduces a verifiable timeline to the network by using cryptographic proofs, thereby allowing for extremely high transaction throughput. PoH is typically integrated with PoS to combine the benefits of both systems, making it a pivotal topic in the comparison of our big three.

Before delving into the specifics, it’s important to understand that PoH does not replace PoS or PoW; rather, it complements them by addressing the challenge of establishing time in a decentralized environment. This integration enhances the overall efficiency and performance of the network.

Mechanics and Time-Stamping with VDF

Proof of History relies on a Verifiable Delay Function (VDF) to create a cryptographic timestamp for each transaction. This function performs a series of sequential hash computations, establishing a historical record that is both verifiable and tamper-resistant. By doing so, PoH eliminates the need for validators to coordinate on transaction ordering, which significantly speeds up the overall process. Networks such as Solana leverage this mechanism to achieve processing speeds of over 65,000 transactions per second, with some days recording as many as 66.9 million transactions.

Integration with PoS and Network Performance

In practice, PoH is most effective when combined with a PoS model, as seen on the Solana blockchain. This hybrid approach allows Solana to maintain the energy efficiency of PoS while reaping the benefits of PoH’s rapid transaction sequencing. The resulting network is capable of handling exceptionally high volumes of transactions, making it attractive for applications that require low latency and high throughput, such as decentralized finance and high-frequency trading.

Emerging Applications and Market Impact

The performance improvements enabled by PoH are driving its adoption in a variety of sectors. Beyond traditional financial services, PoH’s capabilities are being leveraged in blockchain gaming, real-time data processing, and enterprise payment systems. Solana’s recent collaboration with major financial institutions—for example, a pilot project with Visa to test stablecoin settlement systems—demonstrates the growing market confidence in PoH’s potential. Such initiatives reshape the competitive landscape and reinforce PoH’s role as a cornerstone for next-generation blockchain applications.

Comparative Analysis: Security, Efficiency, and Scalability

A direct comparison of consensus mechanisms provides insights into their respective strengths and limitations. Analyzing security, energy efficiency, and scalability is essential to understand how proof of stake vs proof of work vs proof of history address different aspects of the blockchain trilemma.

Before examining specific dimensions, consider that each mechanism is designed with a different set of priorities. PoW focuses on computational difficulty, PoS emphasizes economic security, and PoH prioritizes transaction speed through innovative time sequencing. This section breaks down these attributes to illustrate where each mechanism excels.

Energy Efficiency and Environmental Impact

⬜Proof of Work: PoW secures the network by requiring significant computational power, which in turn leads to high energy consumption. For example, Bitcoin’s energy use has been compared to that of entire countries, raising concerns about its environmental footprint. This model, while secure, is increasingly scrutinized for its sustainability.

⭕Proof of Stake: PoS dramatically reduces energy demands by replacing computational work with token-based validation. Ethereum’s shift to PoS reportedly cut its energy consumption by around 99.95%, making it an attractive alternative for eco-conscious projects.

🔼Proof of History: PoH maintains the low-energy benefits of PoS while boosting throughput by creating an efficient, verifiable timeline for transactions. Its reliance on cryptographic proofs rather than heavy computation results in a system that is both energy-efficient and highly scalable.

Transaction Throughput and Scalability

⬜Proof of Work: PoW networks like Bitcoin are designed for maximum security rather than speed, processing roughly 7 transactions per second. This limitation is intentional, as the focus is on decentralization and trustlessness rather than high-volume processing.

⭕Proof of Stake: PoS networks typically support higher transaction rates. Ethereum, for instance, can process between 15 to 30 transactions per second at the base layer, with additional throughput provided by Layer 2 solutions. This makes PoS a viable option for applications that need a balance between security and performance.

🔼Proof of History: Networks employing PoH, such as Solana, demonstrate exceptional scalability, handling over 65,000 transactions per second. This capability makes PoH particularly well-suited for applications requiring high-speed data processing and minimal latency.

Security Models and Trade-Offs

⬜Proof of Work: The security of PoW is rooted in its requirement for massive computational effort. Altering historical records is economically unfeasible without controlling the majority of the network’s mining power. However, the concentration of mining power in regions with low electricity costs poses potential centralization risks.

⭕Proof of Stake: PoS secures the network through economic incentives; validators are penalized if they act maliciously by losing a portion of their staked tokens. While this model reduces energy use, critics point out that it can lead to wealth concentration, potentially centralizing control among large stakeholders.

🔼Proof of History: PoH enhances security by creating a tamper-resistant chronological record, making it difficult to manipulate transaction sequences. Although it is a newer technology compared to PoW and PoS, its integration with PoS creates a robust hybrid model that leverages the strengths of both systems.

Comparative Analysis Overview

Below is a table summarizing the key comparisons between Proof of Work, Proof of Stake, and Proof of History:

| Feature | Proof of Work (PoW) | Proof of Stake (PoS) | Proof of History (PoH) |

| Energy Efficiency | High energy consumption due to computational puzzles. | Significantly lower energy use by relying on staked tokens rather than extensive computations. | Maintains PoS energy benefits while adding a cryptographic timestamping mechanism that minimally increases energy demand. |

| Transaction Throughput | Low throughput (around 7 transactions/sec) as the process is intentionally slow for security. | Moderate throughput (15–30 transactions/sec on the base layer, with scalability improvements via Layer 2 solutions). | Extremely high throughput (over 65,000 transactions/sec, e.g., as seen in Solana) enables processing of high-volume, low-latency apps. |

| Scalability | Limited scalability due to energy and processing constraints. | Scalable through additional Layer 2 protocols and network upgrades that boost transaction capacity. | Highly scalable and optimized for speed, making it ideal for applications that require rapid, high-volume processing. |

| Security Model | Relies on computational difficulty to deter attacks, though centralized mining power can be a concern. | Uses economic incentives (staking and slashing) to secure the network, which may risk wealth concentration over time. | Enhances security by combining PoS’s incentives with a verifiable timeline, creating a robust framework that’s still evolving with use. |

| Environmental Impact | Significant environmental footprint due to large-scale energy usage. | Minimal environmental impact compared to PoW, aligning with sustainability goals. | Similar to PoS in environmental efficiency while delivering high performance, ensuring low additional environmental cost. |

The table above highlights the fundamental differences between Proof of Work (PoW), Proof of Stake (PoS), and Proof of History (PoH) across key criteria such as energy efficiency, transaction throughput, scalability, security, and environmental impact. While PoW offers unmatched security through computational difficulty, it comes at the cost of high energy consumption and limited scalability. PoS improves energy efficiency and scalability by replacing mining with staking, making it a more sustainable alternative. PoH, on the other hand, takes scalability to the next level by introducing a verifiable timestamping mechanism that drastically increases transaction throughput while maintaining PoS-like efficiency.

Future Trends and Emerging Developments

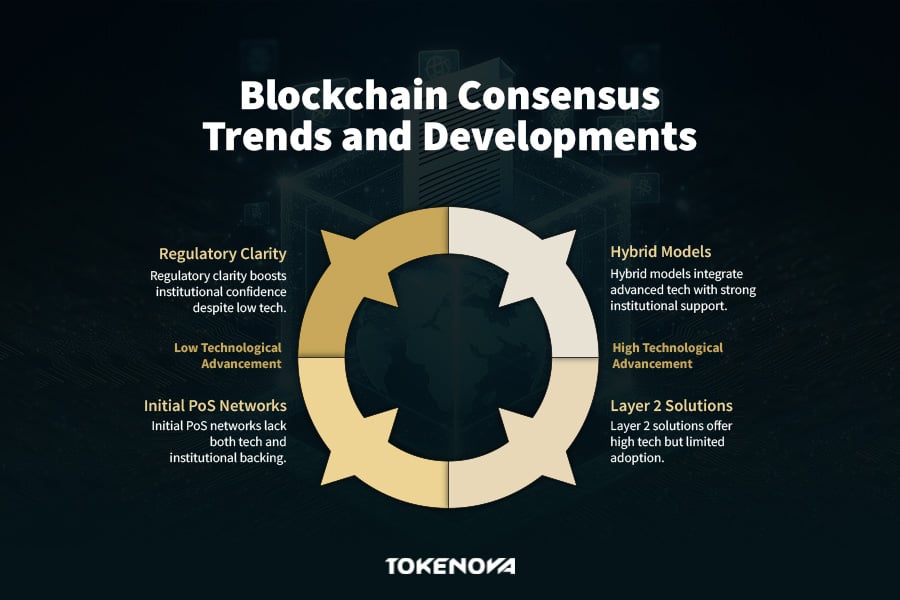

The landscape of blockchain consensus is continuously evolving, driven by technological advancements and shifting market dynamics. Future developments promise to integrate the strengths of various models, creating more efficient and adaptable networks.

Before diving into specific trends, it is important to recognize that institutional adoption, regulatory clarity, and technological innovations are all converging to reshape the blockchain ecosystem. Emerging hybrid models and specialized solutions are paving the way for a more resilient and scalable infrastructure.

Institutional Adoption and Regulatory Clarity

As regulatory frameworks mature and provide clearer guidelines for digital assets, institutional investors are increasingly drawn to blockchain projects with robust consensus mechanisms. The improved regulatory environment has led to higher confidence in PoS networks, as evidenced by strategic moves from major players such as the Ethereum Foundation. These developments signal a broader market shift toward systems that balance efficiency with compliance.

Hybrid Models and Specialized Solutions

The boundaries between consensus mechanisms are becoming increasingly fluid. Future blockchain networks are expected to adopt hybrid models that integrate the security of PoW, the energy efficiency of PoS, and the high throughput of PoH. These specialized solutions will be tailored to meet the unique requirements of various industries, from finance and healthcare to logistics and digital identity management.

Layer 2 Scaling and Cross-Chain Interoperability

Layer 2 solutions and cross-chain bridges are set to play a critical role in enhancing the performance of existing blockchain systems. By augmenting the capabilities of base-layer consensus mechanisms, these technologies will enable seamless interactions between different networks. This integration not only improves scalability but also fosters a more cohesive blockchain ecosystem where data and value flow freely across platforms.

Technological Advancements and Ecosystem Growth

Ongoing research in cryptographic proofs, validator incentives, and network protocols promises further refinements to consensus algorithms. These technological advancements will likely reduce latency, enhance security, and lower operational costs, making blockchain technology more accessible and practical for a wider range of applications. The continuous innovation in this space is expected to drive the long-term growth and adoption of decentralized systems.

Read More: Asset Tokenization Trends: Transforming the Financial Landscape

Partner with Tokenova: Your Trusted Blockchain Advisory Firm

Navigating the complexities of blockchain technology requires expert guidance. Tokenova is a premier consultancy specializing in blockchain strategy, tokenomics, and regulatory compliance. Whether you’re launching a new project, optimizing your existing blockchain infrastructure, or seeking investment insights, our experts provide tailored solutions to help you succeed in the evolving digital economy.

Why Choose Tokenova?

- Industry-Leading Expertise – Our team of blockchain professionals has deep experience across multiple sectors, from decentralized finance (DeFi) to enterprise blockchain solutions.

- Custom Blockchain Strategies – We develop tailored frameworks for consensus mechanisms, tokenomics, and smart contract deployment.

- Regulatory & Compliance Support – Stay ahead of legal challenges with our up-to-date regulatory advisory for global blockchain markets.

- Market Analysis & Investment Insights – Leverage our research-backed insights to make informed decisions in the rapidly evolving blockchain space.

- End-to-End Project Consulting – From whitepaper creation to project launch, we guide you through every stage of blockchain development.

Get Expert Blockchain Consulting Today

Maximize your blockchain potential with a trusted partner. Call us to schedule a consultation and take your project to the next level.

Conclusion

Comparing proof of stake with proof of work and proof of history reflects the dynamic and multifaceted evolution of blockchain technology. Each consensus mechanism—whether it is PoW’s robust security, PoS’s energy efficiency, or PoH’s exceptional transaction speed—offers distinct advantages that cater to specific application needs. As the industry advances, hybrid models and technological innovations are poised to integrate these strengths, forging a resilient and scalable ecosystem for the future.

Understanding these differences is essential for developers, investors, and policymakers as they navigate the complexities of decentralized systems. The ongoing evolution in consensus mechanisms not only drives technological progress but also shapes the broader adoption of blockchain in various industries.