Ras Al Khaimah International Corporate Centre (RAK ICC) is a corporate registry that enables the formation of International Business Companies (IBCs) off-shore in the UAE. Located in the Ras Al Khaimah emirate, RAK ICC has earned a global reputation because of its adherence to local and international regulations, easy firm setup process, and excellent professional services.

RAK has shifted its focus from traditional industries to sectors like tourism, real estate, and commerce. It is one of the most company-friendly jurisdictions and is known for its efficient incorporation processes, allowing companies to be registered in as little as one day.

In this article, we will find out how to get established there, and why. In between, we will show you what the Tokenova team can do to help with this process.

The Benefits and Advantages of RAK ICC Company Formation

Home to over 30,000 companies from 160 countries, RAK ICC is showing no signs of slowing down. Forming an offshore company in the UAE offers numerous advantages for businesses seeking a strategic, tax-efficient, and confidential international presence. And RAK ICC is no exception.

1. No Corporate or Personal Income Tax: Offshore companies in the UAE benefit from zero corporate taxes and no value-added tax (VAT). The only entities subject to taxation are oil and gas exploration companies and branches of foreign banks.

2. Quick Incorporation Process: Registering an offshore company in the UAE is a fast process, enabling businesses to commence operations without delay.

3. No Requirement for a Local Office or Employees: There is no need to establish a local office or hire local staff, which helps reduce overhead costs.

4. 100% Foreign Ownership: Offshore companies can be fully owned by foreigners, providing complete control over the business.

5. No Import or Export Duties: There are no duties on imports or exports, which streamlines international trade.

6. No Requirement to File Annual Accounts: Offshore companies are not obligated to file annual accounts, making compliance simpler.

7. Stable Jurisdiction with Excellent Reputation: The UAE is recognized as a stable jurisdiction, attracting businesses from around the globe.

8. Maximum Privacy and Secrecy: Offshore companies enjoy high levels of privacy and confidentiality, ensuring protection for assets and information.

9. No Currency Exchange Restrictions: There are no limits on currency exchange, allowing for the free movement of capital.

10. Ownership of Real Estate: Offshore companies can own real estate in the UAE, including properties in free zones.

11. Facilitated Bank Account Opening: Offshore companies can easily open bank accounts in the UAE, supporting financial transactions and international trade.

Governing Authority of the RAK ICC

RAK ICC is the result of merging two company registries in Ras Al Khaimah: RAK International Companies (previously part of the RAK Free Trade Zone) and RAK Offshore (formerly associated with the RAK Investment Authority). This consolidation was established under Decree No. 12 of 2015, which was amended by Decree No. 4 of 2016.

Legal Framework

- Common Law Basis: The legal framework of RAK ICC is founded on common law principles, much like other jurisdictions such as the Dubai International Financial Centre (DIFC). This alignment enables companies registered under RAK ICC to access the courts of both DIFC and Abu Dhabi Global Market (ADGM) for any legal matters.

- Business Companies Regulations: The operations of RAK ICC are regulated by the RAK ICC Business Companies Regulations 2016, which detail the requirements for company formation, governance, and compliance.

- Economic Substance Requirements: Companies registered with RAK ICC must show sufficient management and economic activities within the UAE to meet international standards, especially if they undertake relevant activities.

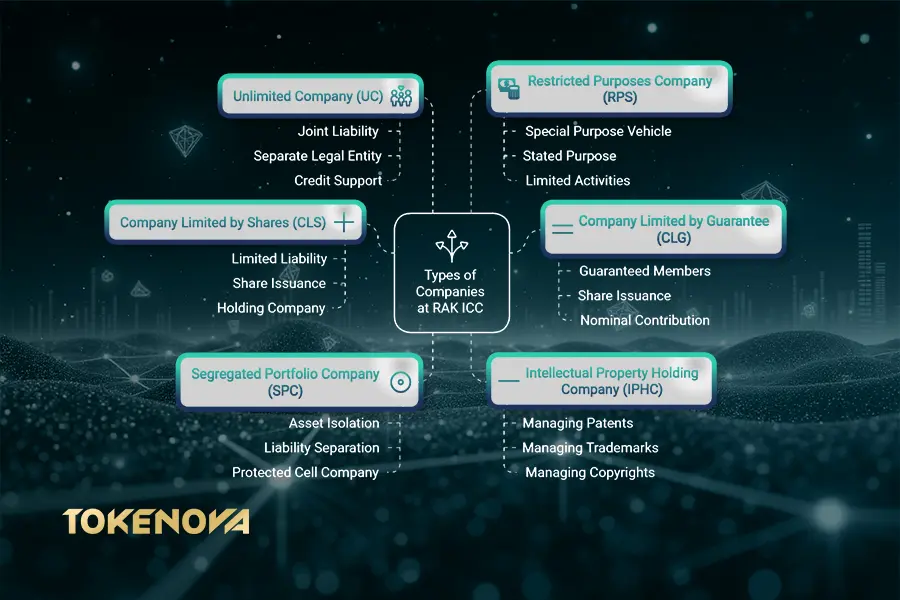

Types of Companies You Can Establish in RAK ICC

RAK ICC offers various types of companies to cater to diverse business needs, each with unique features and benefits. For someone who wishes to start operating there, it is mandatory to choose between these options.

1. Company Limited by Shares (CLS)

A Company Limited by Shares (CLS) limits shareholders’ liability to their initial capital investment (nominal value of shares and any premiums). Its name must end with “Limited,” “Incorporated,” “Ltd,” or “Inc” and it’s usually a Holding Company, Special Purpose Vehicle, or family office.

Different companies have different features. So make sure you understand the terms before starting your establishment process.

Key Features of a CLS:

- Requires at least one shareholder and one director.

- Can issue bonus, partly paid, or nil paid shares.

- Shares may be held jointly for succession.

- Share certificates must be signed by a director, with issuing conditions in the company’s articles.

2. Company Limited by Guarantee (CLG)

A Company Limited by Guarantee (CLG) can be established with RAK ICC as either a company authorized to issue shares or one that is not authorized to issue shares. Again, the company’s name must end with “Limited,” “Incorporated,” “Ltd,” or “Inc.”

In a CLG, there must be at least one member who is a guaranteed member. If the company is authorized to issue shares, the member can also hold shares. Guarantee members agree to contribute a nominal amount in the event the company is wound up. Their liability is limited to the amount specified in the memorandum, articles of association, and any other liabilities outlined in these documents.

CLGs are good options for various purposes such as managing real estate developments and granting membership rights to apartment owners.

3. Segregated Portfolio Company (SPC)

A Segregated Portfolio Company (SPC) is a type of company limited by shares that can create up to ten segregated portfolios. This structure allows the company to isolate its assets and liabilities, ensuring that the assets and liabilities of each segregated portfolio are kept separate from those of the other portfolios and the company as a whole.

An SPC, which is sometimes referred to as a protected cell company, includes various segregated portfolio assets such as share capital, retained earnings, capital reserves, share premiums, and other associated assets.

4. Intellectual Property Holding Company (IPHC)

An Intellectual Property Holding Company (IPHC) at RAK ICC serves as a subsidiary or sister company of global corporations, specifically created to manage the company’s intellectual property (IP). This includes patents, trademarks, and copyrights.

The intellectual property tied to a business name or system can be one of its most valuable assets. Therefore, it is crucial to protect this IP properly in order to maintain its value.

5. Unlimited Company (UC)

An Unlimited Company (UC) is a company where the liability of its members is not limited. Members have joint, several, and unlimited obligations to cover any shortfall in the company’s assets if liquidated. Unlike a general partnership, a UC is a separate legal entity that can own assets. It is usually used for Credit Support, Liability Pass-Through, and International Tax Planning.

6. Restricted Purposes Company (RPS)

A Restricted Purposes Company (RPS) is a corporate entity designed to act as a special purpose vehicle. An RPS Company enjoys the additional layer of comfort that the company may not engage in any activity that is outside its stated purpose.It is a company limited by shares with a memorandum that states:

⚖️Note: RAK ICC companies are not permitted to conduct business within the UAE mainland or to hire local employees. They are primarily designed for international business activities and must generate their income from sources outside the UAE.

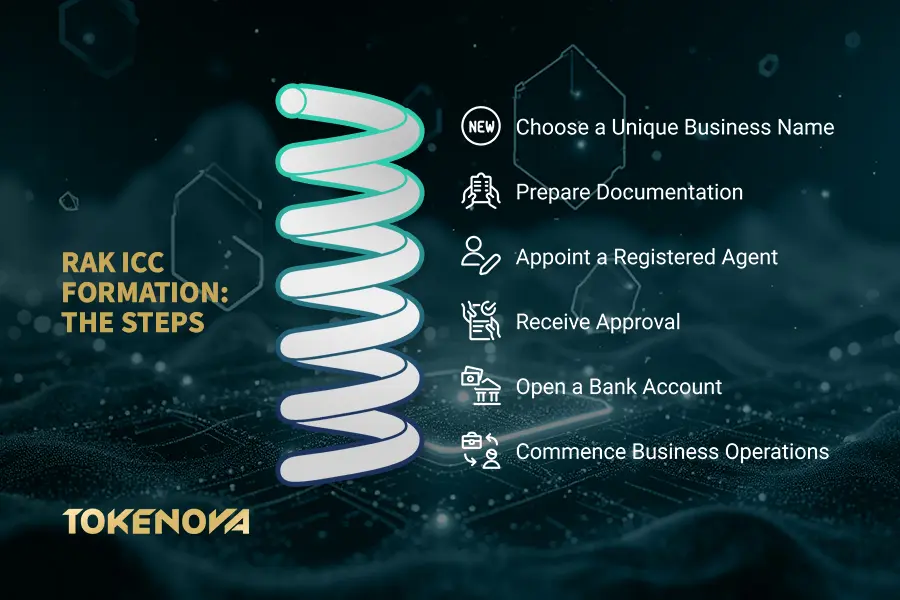

The Process of Getting Established in RAK ICC

Forming an offshore company in RAK ICC involves several detailed steps to ensure compliance and smooth operation.

1. Choose a Business Name: Make sure you select a unique business name that has not been used by any other company and complies with RAK ICC’s regulations. If you have a particular name in mind, reserve it to make sure it’s secured for you.

Ensure Uniqueness: Select a unique business name not already used by another entity.

2. Prepare Documentation: Passport copies, proof of address for all shareholders and directors, and documents that specify the structure, purpose, and nature and activity of your company are all required.

3. Appoint a Registered Agent: As we mentioned earlier, you are not obliged to be physically present or have an office when you opt for an offshore company establishment. But you do need a licensed agent, certified by RAK ICC, who can handle all the filings.

4. Receive Approval: RAK ICC will review the submitted application, memorandums, and documents for compliance. Once approved, it will issue the certificate of incorporation. This means you are officially established.

5. Open a Bank Account: Choose a bank and submit bank forms.

6. Commence Business Operations: Set up the necessary infrastructure and processes to begin business operations. Maintain compliance with RAK ICC requirements, including any annual filings and renewals.

Wrap-up

With constant investments in tourism infrastructure and real estate projects, the emirate of RAK is projected to see continued economic growth. Not only does it focus on tourism, but it aims to facilitate the establishment of foreign investment and company establishment.

It is important to get a consultation from a team of lawyers and legal experts (link be contact us) before submitting your application, as in your case, a different jurisdiction may be the best option for you.