Did you know that blockchain technology is projected to boost global GDP by a staggering $1.76 trillion by 2030?

If you’re an entrepreneur with a vision for leveraging this transformative technology, or an established business leader looking to innovate, the potential is immense. But before you can truly tap into this revolution, there’s a critical first step: you need to register a blockchain-based business.

The question of how to register a blockchain-based company might seem like a traditional formality in the decentralized world of blockchain. However, it’s the cornerstone of building a legitimate, sustainable, and fundable venture. Navigating the blockchain business registration process might seem complex, but this comprehensive guide will break down the essential steps to start a blockchain business, providing you with the knowledge and confidence to transform your blockchain vision into a legal reality.

Understanding Blockchain as a Business

Before diving into the registration process, let’s clarify what exactly constitutes a blockchain-based business. It’s more than just accepting cryptocurrency payments; it’s about fundamentally integrating blockchain technology into your core operations and value proposition.

A blockchain business leverages the inherent properties of distributed ledger technology to offer unique solutions. This can manifest in various forms, from creating decentralized applications (dApps) that offer services without intermediaries to building transparent and immutable supply chain management systems or developing secure digital identity solutions that empower individuals with control over their data.

As of January 2025, VeChain has partnered with over 1,000 global brands, including Walmart China and Porsche, to enhance supply chain transparency and efficiency.

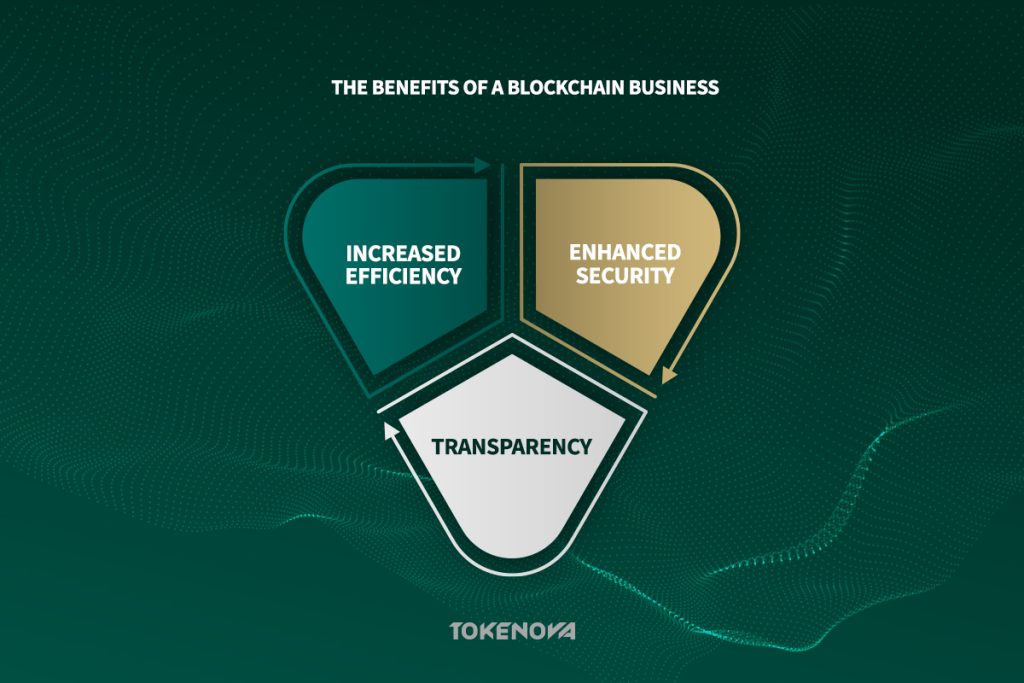

Advantages of a Blockchain Venture

Operating a blockchain-based business offers a compelling array of advantages. Enhanced security is a primary benefit, thanks to the cryptographic hashing and distributed nature of the technology, making it incredibly difficult to tamper with data. Blockchain’s decentralized architecture ensures that sensitive information is stored securely, significantly reducing the risk of unauthorized access and fraud.

Transparency is another key advantage, as transactions are typically recorded on a public ledger, fostering trust and accountability. This transparency allows all network participants to view transaction details, which can help in verifying authenticity and preventing double-spending. However, the level of transparency can depend on the blockchain’s privacy features.

Increased efficiency can be achieved through the use of smart contracts, which automate processes and eliminate the need for intermediaries, thereby reducing costs and streamlining operations. For instance, Walmart employs blockchain technology for food traceability, allowing it to trace the origin of products in seconds rather than days. Furthermore, blockchain can enable new business models and foster greater trust and collaboration among participants.

OpenSea, a leading NFT marketplace built on blockchain, allows creators to directly connect with buyers, offering a transparent and efficient platform for trading digital assets. The platform exemplifies how blockchain can facilitate direct transactions without intermediaries, enhancing user experience and trust in digital asset trading.

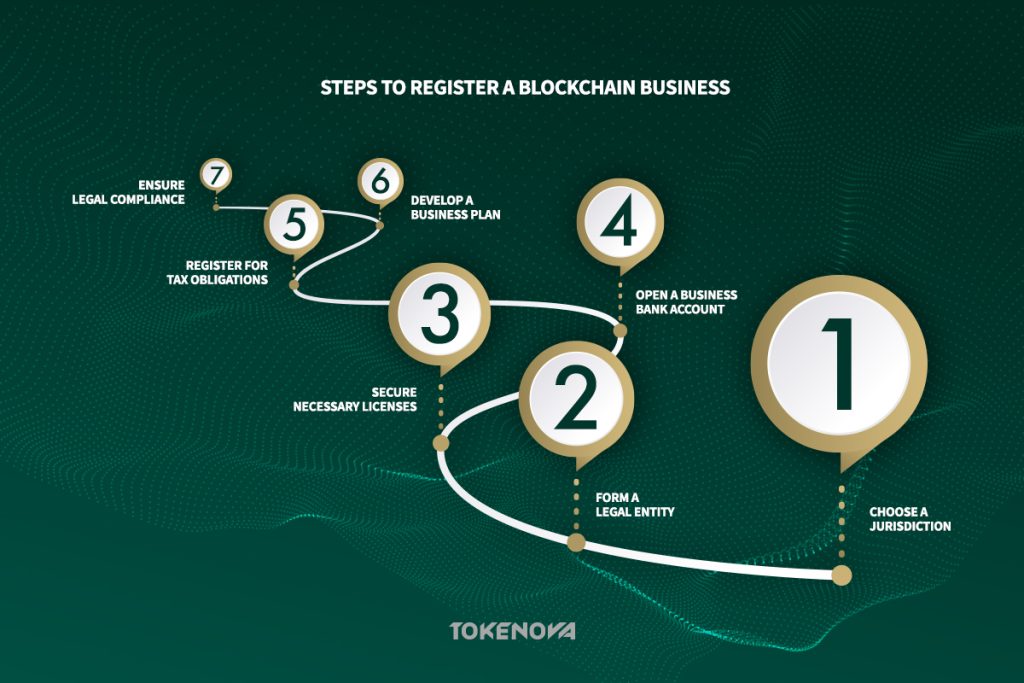

Key Steps to Register a Business on Blockchain

The journey to register a blockchain-based business involves several crucial steps. Each stage requires careful planning and execution to ensure your venture is established on a solid legal foundation.

Choose the Right Location

Selecting the appropriate jurisdiction is a foundational decision that can significantly impact the trajectory of your blockchain business. The regulatory landscape for blockchain technology varies considerably across the globe, making this a strategic choice.

Why Jurisdiction Matters

The jurisdiction you choose will determine the legal and regulatory framework governing your business operations. This encompasses crucial aspects such as taxation policies, licensing requirements for specific blockchain activities, and the legal recognition and enforceability of smart contracts and digital assets. A supportive jurisdiction can foster innovation, attract investment, and provide legal clarity, while a less favorable one can create significant obstacles and compliance burdens.

For instance, Estonia has been proactive in embracing digital technologies and offers an “e-Residency” program, making it attractive for blockchain entrepreneurs seeking a business-friendly environment within the EU. Estonia’s e-Residency program allows global citizens to establish and manage a location-independent business online, which continues to enhance its reputation as a leading jurisdiction for digital innovation

Factors to Evaluate

So, what should you keep in mind when weighing potential jurisdictions? Here are some key factors that deserve your attention:

Regulatory Environment: First and foremost, you want to look for jurisdictions with clear, supportive regulations that are ahead of the curve when it comes to blockchain businesses. For instance, the UK Jurisdiction Taskforce has made it clear that cryptoassets can be treated as property under English law. That’s a solid foundation for anyone looking to build something great!

Taxation Policies: Don’t forget about taxes! Understanding the tax implications for cryptocurrency transactions, token sales, and other blockchain activities is crucial. Countries like Singapore have set up favorable tax regimes that are like gold dust for innovators, providing clarity and encouragement for those diving into the world of digital assets.

Legal Framework: The legal landscape surrounding digital assets, smart contracts, and data privacy is another piece of the puzzle. The UK has taken significant steps in recognizing smart contracts as binding agreements under English law. As they say, “A stitch in time saves nine” getting this right from the start can save you a lot of trouble down the road!

Talent and Funding Availability: You’ll also want to consider whether there’s a pool of talent and funding available in your chosen jurisdiction. A thriving blockchain ecosystem can be a goldmine for skilled professionals and potential investors. Singapore has become a hotspot for blockchain innovation thanks to its clear regulations and pro-business environment it’s no wonder so many companies are setting up shop there!

Political and Economic Stability: Last but not least, think about the overall political and economic stability of the region. A stable government is like a sturdy ship in choppy waters; it provides a consistent regulatory framework that supports long-term business operations.

In short, jurisdictions like Estonia, Singapore and UAE shine bright as beacons of opportunity for blockchain development. With their supportive regulations and vibrant ecosystems, they’re paving the way for entrepreneurs ready to take the plunge!

Form Your Legal Structure

Once you’ve identified the optimal jurisdiction for your blockchain venture, the next essential step is to formalize your business by selecting and establishing an appropriate legal entity. This crucial step provides legal protection and defines the organizational structure of your company.

Selecting the Right Entity

The legal structure you choose will have significant implications for liability, taxation, administrative requirements, and your ability to raise capital. Common legal structures for blockchain businesses include Limited Liability Companies (LLCs), Corporations (both public and private), and, in some cases, Foundations, particularly for non-profit or community-driven blockchain initiatives. An LLC offers a balance of liability protection and flexibility in management and taxation, making it a popular choice for many startups. Corporations provide more robust liability protection and are often preferred when seeking significant investment or planning for an IPO; however, they come with more stringent regulatory and compliance requirements.

Consider the example of Block.one, the company behind the EOSIO blockchain protocol, which is incorporated in the Cayman Islands as an exempted company. This choice allows them to navigate a favorable regulatory environment while attracting global investors. Recent developments indicate that jurisdictions like Germany are tightening regulations around crypto businesses, requiring compliance with laws such as Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols to ensure legitimacy in operations.

Incorporation Process

The process of legally incorporating your business involves several key steps that vary slightly depending on the jurisdiction. First, you’ll need to choose a unique and compliant business name that adheres to the naming conventions of your chosen jurisdiction. Next, you’ll typically be required to appoint a registered agent (also known as a resident agent or agent for service of process), who will be responsible for receiving official and legal documents on behalf of your business.

You will then need to prepare and file the necessary incorporation documents with the relevant government agency. These documents typically include articles of incorporation (for corporations) or articles of organization (for LLCs), which outline the basic structure and purpose of your business. Depending on your chosen structure and jurisdiction, you may also need to draft an operating agreement (for LLCs) or bylaws (for corporations), which detail the internal rules, governance, and operating procedures of your business.

Finally, you’ll need to obtain an Employer Identification Number (EIN) from the relevant tax authority (like the IRS in the US) if you plan to hire employees or operate as a corporation or partnership. In Canada, the process of incorporation is handled at both the federal and provincial/territorial levels. Recent trends show that countries are increasingly focused on creating clear regulatory frameworks for crypto companies; thus, staying informed about local laws is paramount to avoid falling into a legal quagmire.

Secure Necessary Licenses

Depending on the specific activities your blockchain-based business will undertake, securing the necessary licenses and permits is a critical step to ensure legal operation and avoid potential penalties. The specific requirements can vary significantly based on your business model and the jurisdiction in which you operate.

Identifying Required Permits

Determining the precise licenses required for your blockchain business can be a complex undertaking, akin to navigating a maze. It necessitates a careful analysis of your business activities and the regulatory landscape of your chosen jurisdiction. If your business involves financial services such as operating a cryptocurrency exchange, providing lending or borrowing services using digital assets, or managing digital asset portfolios you will likely need to obtain specific financial licenses. These licenses often come with stringent compliance obligations related to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations to prevent illicit financial activities.

Businesses that facilitate the transmission of funds, even in cryptocurrency form, may be required to obtain money transmitter licenses. If your blockchain venture includes online gaming or gambling elements, securing the appropriate gaming licenses from relevant authorities is essential. Furthermore, compliance with data protection regulations like GDPR or CCPA is crucial if your business handles personal data, possibly necessitating specific data processing licenses or registrations. For instance, in Japan, operating a cryptocurrency exchange requires registration with the Financial Services Agency (FSA).

Navigating Varied Requirements

Licensing requirements are not standardized globally; they can vary considerably not only between countries but also between states or provinces within a single country. Conducting thorough research and consulting with legal experts who specialize in blockchain regulations is absolutely essential to accurately identify the specific licenses and permits required for your particular business activities in your chosen jurisdiction. Failing to obtain the necessary licenses can lead to significant financial penalties, legal repercussions, and even the forced shutdown of your business operations.

It’s crucial to proactively engage with regulatory bodies and seek clarification on any ambiguous requirements. In the European Union, the Markets in Crypto-Assets (MiCA) regulation is being implemented to create a harmonized regulatory framework for crypto-assets . This regulation aims to provide clarity and consistency across member states, making it easier for businesses to comply while fostering innovation.

Addressing regulatory requirements early on can save businesses from future headaches. In 2025, understanding these nuances will be vital for success in an increasingly regulated environment

Open a Business Bank Account

Establishing a dedicated business bank account is a fundamental step for any business, and it’s particularly important for blockchain ventures to maintain financial transparency and streamline operations.

Why a Separate Account Matters

Commingling personal and business finances can create significant complications in accounting, tax reporting, and legal liability. A dedicated business bank account simplifies financial management by providing a clear separation of income and expenses, making it easier to track your business’s financial performance and prepare accurate financial statements. It also enhances your business’s credibility in the eyes of clients, partners, and investors, and it can be a prerequisite for obtaining certain licenses and permits. Furthermore, maintaining separate accounts provides a layer of legal protection by reinforcing the distinction between your personal assets and the liabilities of your business.

Finding Crypto-Friendly Banks

While traditional banks are increasingly becoming more open to working with blockchain businesses, some institutions still exhibit caution due to regulatory uncertainties and perceived risks associated with the industry. Therefore, it’s often advisable to seek out banks that are known to be crypto-friendly and possess a solid understanding of blockchain technology and its applications.

When choosing a bank, consider factors such as their willingness to accept deposits from cryptocurrency-related activities, their understanding of the specific nuances of blockchain business models, their expertise in complying with AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations relevant to the blockchain space, as well as their fee structures and the range of services they offer. Some financial institutions actively focus on serving the cryptocurrency industry, offering specialized accounts and services tailored to the needs of blockchain businesses.

For instance, The Kingdom Bank has emerged as a leading option for businesses seeking crypto-friendly banking solutions. As a fully licensed and regulated digital bank, The Kingdom Bank offers multi-currency wallets that support both fiat currencies and cryptocurrencies. They provide advanced crypto trading, lending, custody, and staking capabilities while ensuring compliance with global AML/KYC standards. This makes them an ideal partner for businesses navigating the complexities of the crypto landscape.

In addition to The Kingdom Bank, BankProv continues to be recognized for its commitment to serving the crypto industry by facilitating cryptocurrency exchanges and prioritizing compliance with relevant regulations.

Ultimately, choosing the right bank can be likened to selecting a sturdy ship before setting sail; it’s essential to ensure that your financial vessel is equipped to navigate the turbulent waters of the cryptocurrency market.

Register for Tax Obligations

Just like any other business, your blockchain-based venture will have tax obligations that need to be understood and fulfilled to ensure legal compliance and avoid potential penalties.

Understanding Tax Requirements

Navigating the tax landscape for blockchain businesses can be particularly complex due to the evolving nature of regulations surrounding cryptocurrencies and other digital assets. Your business will likely be subject to corporate income tax on its profits, similar to traditional businesses. Depending on your location and the nature of your services or products, you may be required to collect and remit sales tax or Value-Added Tax (VAT) on transactions. Profits generated from the sale or exchange of cryptocurrencies or other digital assets may be subject to capital gains tax.

If your business employs individuals, you will be responsible for withholding and remitting payroll taxes on their wages. The specific tax treatment of cryptocurrency transactions can vary significantly depending on the jurisdiction and the specific circumstances of the transaction. It’s crucial to stay informed about the latest tax regulations and seek professional advice to ensure compliance. For example, in Australia, the Australian Taxation Office (ATO) has issued guidance on the tax treatment of cryptocurrencies, which can be explored further through their official resources.

In the United States, recent updates from the IRS highlight significant changes for 2025, including the requirement for crypto brokers to file 1099 forms for customer sales and gains. This shift aims to enhance compliance and reduce tax evasion among high-income taxpayers. Additionally, taxpayers must now track crypto transactions by wallet or account under new regulations

Steps for Tax Registration

The first step in fulfilling your tax obligations is to obtain an Employer Identification Number (EIN) from the relevant tax authority if your business is not structured as a sole proprietorship. Next, you will need to register for state and federal taxes with the appropriate tax agencies in your jurisdiction. This registration process will provide you with the necessary tax identification numbers and establish your filing obligations and deadlines.

Given the complexities of tax laws related to blockchain and digital assets, it is highly recommended to consult with a tax professional who specializes in this specific area. A qualified tax advisor can provide tailored guidance based on your specific business activities, help you navigate the intricacies of cryptocurrency taxation, and ensure that you remain compliant with all applicable tax regulations.

In France, businesses dealing with crypto-assets need to adhere to guidelines provided by the Direction générale des Finances publiques (DGFiP) . As regulations continue to evolve like a river changing its course, staying informed is key to maintaining compliance

Develop a Robust Business Plan

A well-structured and comprehensive business plan is an essential tool for any startup, and it’s particularly crucial for blockchain-based businesses to articulate their innovative ideas and attract potential investors.

The Importance of Planning

A robust business plan is your North Star in the ever-shifting blockchain universe. It’s not just a roadmap; it’s a compass that guides your venture through uncharted territories. By forcing you to analyze your target market, identify competitive edges, and craft a scalable business model, it ensures you’re not just another drop in the blockchain ocean.

In 2025, with institutional adoption of blockchain skyrocketing and regulatory frameworks becoming clearer, a well-articulated business plan is more critical than ever. It’s your calling card to investors, showcasing your grasp of market opportunities, financial projections, and strategic growth plans. Whether you’re pitching to traditional financial institutions or crypto-native lenders, a compelling plan demonstrates your venture’s viability and long-term potential. As the saying goes, “Failing to plan is planning to fail.”

Key Elements of Your Plan

A comprehensive business plan for a blockchain-based business must be as dynamic as the technology itself. Here’s what it should include:

- Executive Summary: Begin with a concise overview of your business, its mission, and its key objectives. This section should grab attention and provide a snapshot of your venture’s potential.

- Company Description: Elaborate on your business model, its unique value proposition, and the specific problem it aims to solve using blockchain technology. Highlight how your solution aligns with current trends, such as the rise of decentralized finance (DeFi) or the tokenization of real-world assets.

- Market Analysis: Conduct a thorough analysis of your target audience, key competitors, and prevailing trends in the blockchain industry. For example, the global blockchain market is projected to grow at a CAGR of 52.9%, reaching $1.87 trillion by 2034, driven by innovations in AI integration and sustainable blockchain solutions.

- Products and Services: Provide a detailed explanation of how your blockchain-based solutions work and the benefits they offer to users. For instance, if your business leverages smart contracts, explain how they automate processes and reduce costs.

- Technology and Development Roadmap: Specify the blockchain platforms or protocols you plan to utilize, such as Ethereum, Polkadot, or Solana. Outline your plans for future development, including scalability improvements and interoperability solutions.

- Marketing and Sales Strategy: Detail how you intend to reach your target market, acquire customers, and generate revenue. Consider leveraging Web3 marketing strategies, such as NFT-based campaigns or decentralized advertising platforms.

- Management Team: Highlight the relevant experience, expertise, and track record of your team. Investors often bet on the jockey, not just the horse, so showcasing your team’s capabilities is crucial.

- Financial Projections: Forecast your revenue, expenses, profitability, and key financial metrics over a specific period. Be transparent about your assumptions and include scenarios for best-case, worst-case, and most-likely outcomes.

- Funding Request: If seeking external funding, clearly outline the amount of capital you need and how you intend to utilize it. For example, specify whether the funds will be used for product development, marketing, or scaling operations.

Consider the example of the Ethereum whitepaper, which clearly laid out the vision for a world computer, attracting developers and investors alike. While the Ethereum whitepaper remains a classic reference, newer frameworks like Polkadot’s interoperability solutions or Solana’s high-speed transactions are also worth studying.

Ensure Legal and Regulatory Compliance

Maintaining ongoing compliance with the ever-evolving legal and regulatory landscape is not a one-time task but a continuous process that is absolutely crucial for the long-term viability and success of your blockchain-based business.

Navigating the Regulatory Maze

The regulatory landscape for blockchain businesses is in a constant state of flux, making it imperative to stay informed and proactively adapt your business practices to remain compliant. Key regulations that frequently impact blockchain businesses include Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, which are designed to prevent illicit financial activities and require businesses to verify the identity of their customers and monitor transactions for suspicious behavior.

In 2025, the Financial Action Task Force (FATF) has continued to refine its global standards, particularly with the implementation of the Travel Rule for crypto transactions, which mandates that virtual asset service providers (VASPs) share transaction information to combat money laundering and terrorist financing. Additionally, the European Union’s Markets in Crypto-Assets (MiCA) regulation, which came into full effect in 2024, has set a comprehensive framework for crypto assets, enhancing consumer protection and market integrity.

Data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in California, dictate how businesses collect, use, and protect personal data. These regulations have been further strengthened in 2025, with stricter enforcement and higher penalties for non-compliance.

Depending on the nature of your token offerings or the financial products you offer, you may also need to comply with securities laws, which can be particularly complex and often require careful legal interpretation. For instance, the U.S. Securities and Exchange Commission (SEC) has continued its enforcement actions against unregistered securities offerings, while also providing clearer guidance on the classification of digital assets.

Failure to comply with these regulations can result in substantial financial penalties, legal action, damage to your reputation, and even the potential shutdown of your business. The stakes are high, and as the proverb goes, “Better safe than sorry.”

Strategies for Compliance

To ensure ongoing compliance, implement robust AML and KYC procedures that align with the regulatory requirements of your operating jurisdictions. This includes establishing clear protocols for verifying customer identities, monitoring transactions for suspicious activity, and reporting any suspicious transactions to the relevant authorities. In 2025, the use of AI-driven AML solutions has become increasingly prevalent, with financial institutions leveraging machine learning to detect complex patterns in financial transactions and reduce false positives by up to 40%.

Develop a comprehensive privacy policy that transparently outlines your data collection, usage, and protection practices, ensuring compliance with data privacy regulations like GDPR and CCPA. With the rise of privacy-enhancing technologies (PETs), such as zero-knowledge proofs and homomorphic encryption, businesses can now conduct necessary due diligence without compromising customer privacy.

Seek regular legal counsel from experienced attorneys who specialize in blockchain and regulatory compliance to ensure that your business practices are aligned with all applicable laws and regulations and to stay informed about any upcoming regulatory changes. Actively monitor regulatory updates and engage with industry associations to stay ahead of the curve.

Consider implementing blockchain analytics tools that can help you monitor transactions on the blockchain and identify potential compliance risks. These tools have become indispensable in 2025, with advancements in real-time transaction monitoring and predictive analytics enabling businesses to detect and respond to suspicious activities faster than ever before.

Taking a proactive and diligent approach to compliance will not only protect your business from legal and financial repercussions but also build trust and confidence with your users, partners, and regulators. Companies like Binance have significantly invested in their compliance programs to meet regulatory requirements globally, setting a benchmark for the industry.

Challenges in Registering a Blockchain Business

While the potential of blockchain technology is undeniable, the process of registering a blockchain-based business presents unique challenges that entrepreneurs need to be prepared to address.

Dealing with Regulatory Uncertainty

One of the most significant hurdles in the blockchain space is the ongoing regulatory uncertainty. Laws and regulations are still being developed and refined in many jurisdictions, leading to a lack of clear and consistent guidance for businesses. This ambiguity can make it challenging for entrepreneurs to navigate the legal landscape, understand their compliance obligations, and make informed decisions about their business operations.

The absence of a globally harmonized regulatory framework further complicates matters for businesses operating across multiple jurisdictions. This evolving environment necessitates a flexible and adaptable approach, requiring businesses to continuously monitor regulatory developments and be prepared to adjust their strategies as needed.

Managing Technical Complexity

Building and maintaining a secure, scalable, and functional blockchain solution demands specialized technical expertise. Finding and retaining qualified blockchain developers, cybersecurity experts, and other technical professionals can be a significant challenge, particularly given the high demand for these skills and the relatively nascent nature of the industry. The inherent complexity of blockchain technology itself can also pose hurdles, requiring businesses to invest heavily in research and development, explore partnerships with experienced technology providers, and potentially develop in-house expertise.

Navigating Market Competition

The blockchain industry is characterized by rapid innovation and a constantly evolving landscape, leading to intense competition. Numerous new projects and businesses are launched regularly, making it increasingly difficult for individual ventures to stand out and attract the attention of users, investors, and potential partners. Success in this competitive environment requires not only a strong technical foundation and a compelling value proposition but also effective marketing strategies, a strong community engagement plan, and a clear differentiation from existing solutions.

How to Navigate Regulatory Uncertainty

Navigating the complexities of regulatory uncertainty in the blockchain space requires a proactive and informed approach. Here are some key strategies:

- Stay Updated on Global Regulatory Trends: Continuously monitor regulatory developments in key jurisdictions relevant to your business. Subscribe to industry newsletters, follow regulatory bodies on social media, and participate in industry forums.

- Join Blockchain Industry Associations: Become a member of relevant blockchain industry associations. These organizations often provide valuable resources, updates on regulatory changes, and opportunities to engage with policymakers.

- Consult Legal Experts Specializing in Blockchain: Engage with legal professionals who have expertise in blockchain law and regulatory compliance. They can provide tailored advice based on your specific business model and the jurisdictions in which you operate.

Tokenova: Powering Your Blockchain Vision

Ready to bring your blockchain idea to life? Tokenova provides comprehensive services to help you navigate the complexities of the blockchain landscape. From tokenomics design and smart contract development to fundraising and community building, Tokenova offers the expertise and support you need to launch and scale your blockchain venture. Visit Tokenova.co to learn more and schedule a consultation.

Conclusion

The future of business is undeniably becoming more decentralized, transparent, and efficient, and your blockchain venture has the potential to be at the forefront of this revolution. Taking the crucial first step to register a blockchain-based business is not just about legal compliance; it’s about building a solid foundation for your vision and unlocking the immense potential of this transformative technology. Don’t let the complexities deter you. Start today by choosing the right jurisdiction, understanding the necessary steps, and building a legally sound foundation for your dream.

Key Takeaways

- Strategic jurisdiction selection is paramount for navigating the regulatory landscape.

- Choosing the appropriate legal entity provides essential liability protection and structure.

- Obtaining all necessary licenses and permits is mandatory for legal operation.

- Maintaining continuous compliance with evolving regulations is vital for long-term success.

- Developing a comprehensive business plan is your roadmap for growth and attracting investment.

What are the ongoing compliance requirements after registering a blockchain business?

initial registration, maintaining compliance is an ongoing process. This includes regularly monitoring for changes in regulations, submitting periodic reports to regulatory bodies (depending on your jurisdiction and the nature of your activities), and undergoing audits as required. You’ll also need to continuously update your Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures to align with evolving standards and ensure your data privacy practices adhere to applicable laws like GDPR or CCPA. Staying informed through legal counsel, industry publications, and regulatory updates is crucial for maintaining continuous compliance.

How long does the process of registering a blockchain business typically take?

The timeframe for registering a blockchain business can vary considerably depending on several factors. These include the specific jurisdiction you choose, the complexity of your business model and the services you offer, and the efficiency of the governmental agencies involved in the registration process. It can range from a few weeks for simpler business structures in jurisdictions with streamlined processes to several months for more complex businesses or in regions with more bureaucratic procedures. Ensuring you have all the necessary documentation prepared accurately and submitting it promptly can help expedite the process.

Are there specific legal considerations for businesses launching their own cryptocurrency or tokens?

Yes, launching your own cryptocurrency or tokens introduces a significant layer of legal considerations, primarily centered around securities laws. You’ll need to carefully analyze the nature of your token offering to determine if it qualifies as a security under the regulations of your target jurisdictions. If it does, you’ll need to comply with securities regulations, which may involve filing registration statements with securities regulators (like the SEC in the US), adhering to strict disclosure requirements, and potentially restricting who can participate in the token sale based on investor accreditation rules. Seeking specialized legal advice from securities lawyers is essential to navigate these complexities and avoid potential legal repercussions.

What are the costs involved in registering a blockchain business?

The costs associated with registering a blockchain business can vary widely depending on the jurisdiction, the legal structure you choose, and the complexity of your business operations. Typical costs can include government filing fees for incorporation, legal fees for drafting incorporation documents and obtaining legal advice, accounting fees for setting up your financial structure, and potential licensing fees depending on your business activities. Some jurisdictions may have higher fees than others, and the complexity of your business model can significantly impact legal and accounting costs. It’s advisable to research the specific costs associated with your chosen jurisdiction and consult with legal and financial professionals for a more accurate estimate.

Can I operate a blockchain business without registering it?

While it might be technically possible to operate a blockchain business without formal registration in some jurisdictions initially, it’s generally not advisable and can lead to significant legal and financial risks in the long run. Operating without proper registration can result in penalties, legal action, difficulty accessing banking services, and a lack of credibility with customers and partners. Registration provides legal legitimacy, protects your personal assets, and builds trust. While the specific requirements vary by jurisdiction, formal registration is generally considered a best practice for long-term sustainability and growth.

How do I choose between an LLC, Corporation, or Foundation for my blockchain venture?

The choice between an LLC, Corporation, or Foundation depends on several factors related to your specific business goals and structure. An LLC offers a good balance of liability protection and flexibility in management and taxation, making it suitable for many startups. A Corporation provides more robust liability protection and is often preferred for businesses seeking significant investment or planning for an IPO, but it comes with more complex regulatory requirements. A Foundation is typically used for non-profit or community-driven blockchain projects with a social mission. Consider factors like your liability tolerance, tax implications, administrative burden, and long-term goals when making this decision. Consulting with legal and financial professionals can help you determine the most appropriate structure for your specific needs.