Tokenized real estate sits at the messy intersection of blockchain tech and tax codes. Understanding tokenized real estate tax treatment starts with how the IRS classifies digital assets like tokenized properties as property, not currency. That means capital gains rules apply when you sell your stake. You’re not dodging traditional tax logic here; you’re just swapping paper shares for blockchain ones.

The structure behind these deals matters. Most tokenized real estate offerings route through securities models. A property gets dropped into an SPV, usually an LLC, which then issues tokens as membership shares. When you grab a token, you’re holding a slice of the LLC that holds the real-world title. This affects the income tax side of things, so that any profits or losses flow straight through to holders. So, you’ll need to account for those in your annual filings.

The tax implications of tokenized real estate properties aren’t just about capital gains. Property tax on tokenized assets, income distributions, and even how you handle crypto-based purchases can all trigger different rules. Smart tax planning for tokenized property means understanding how real estate token securities regulation overlaps with cryptocurrency tax rules.

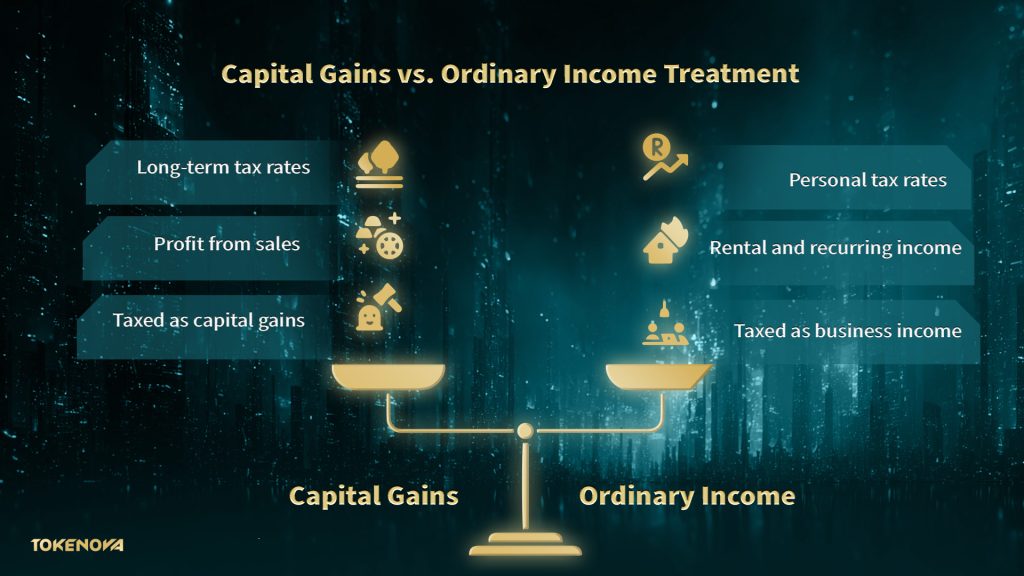

Capital Gains vs. Ordinary Income Treatment

Tax implications of tokenized real estate properties hinge heavily on how the IRS classifies your earnings, capital gains, or ordinary income.

Capital Gains

If you sell tokenized real estate for more than what you originally paid (including any transaction fees), the profit is classified as a capital gain. So, when you sell at a profit, capital gains on tokenized property are triggered just as they are for any other asset.

If you held it over a year, the profit likely qualifies for long-term capital gains tax, which comes in at 0%, 15%, or 20%, depending on your income level. If you sell within one year of buying the token, the IRS treats the profit as a short-term capital gain, meaning it gets taxed the same way as your regular wages or salary.

IRS rules treat any disposition, including sale, swap, and even conversion to another token, as a taxable event. Your gain or loss is the difference between your basis (purchase price plus fees) and what you sold it for. Classic property tax math, just applied to digital slices.

Ordinary Income

Tokenized real estate doesn’t just live in buy-sell cycles. Rental income flows through these digital structures and creates income tax tokenized real estate obligations on the amounts you receive. Academic work backs this up: these setups are built to push periodic income to holders.

Platforms like Lofty not only distribute rental income to investors but also allow for depreciation expenses to be passed through. These depreciation deductions create paper losses, which can offset your rental income and reduce the total taxes you owe.

If you’re flipping tokens fast or turning it into a full-time gig, the IRS might tag you as a trader. That shifts everything, and your gains may get taxed as business income, not capital gains. Tokenized real estate tax treatment depends on how you play the game.

Read More: Fractional Investment in Tokenized Real Estate Assets

Property Tax Implications and Assessments

Even though tokens live on-chain, the physical properties behind them stay in the real world, and local property tax on tokenized assets still applies. The legal owner, typically an SPV structured as an LLC, is the one who gets the tax bill and pays it using rental income.

As a token holder, you don’t pay this tax directly. Instead, it’s treated as an operating cost that reduces the property’s net income before anything is distributed to you. Platforms like Lofty and RealT handle all this behind the scenes, covering taxes, insurance, and maintenance.

That makes investing simpler, but it also means your returns are already net of these costs. On the upside, you may benefit from tax deductions passed through the LLC, covering things like property taxes, mortgage interest, and depreciation. These are less visible, but still part of the broader tax implications of tokenized real estate properties.

Read More: 5 Modern Solutions for Shared Ownership

International Tax Considerations

When real estate meets blockchain across borders, tax rules multiply. The tax implications of tokenized real estate properties for international investors hinge on both the property’s location and the investor’s country of residence.

Read More: Tokenization & Tax Regulation: A Strategic Guide

Foreign Investors in U.S. Real Estate

Non-U.S. investors in tokenized U.S. property face a 30% withholding tax on rental income, unless they elect to be taxed on net income (after property expenses like taxes and depreciation) at graduated rates. This requires filing a U.S. tax return and obtaining an individual taxpayer identification number (ITIN).

When it comes time to sell, the FIRPTA law kicks in. Foreign owners are hit with a 15% withholding on the gross sale amount, a placeholder for the capital gains tax that might apply later.

Global Reporting and Compliance

Tokenization platforms and their SPVs typically fall under FATCA and CRS rules. This makes them reportable financial institutions, obligated to collect and share data on foreign holders with relevant tax authorities. So expect KYC, AML, and data-sharing obligations on your end too.

Double Taxation Treaties

These treaties can reduce or eliminate double taxation across jurisdictions. For example, the 30% U.S. withholding might be lowered depending on your home country’s treaty with the U.S. But using that benefit usually means hiring a cross-border tax expert to sort the filings.

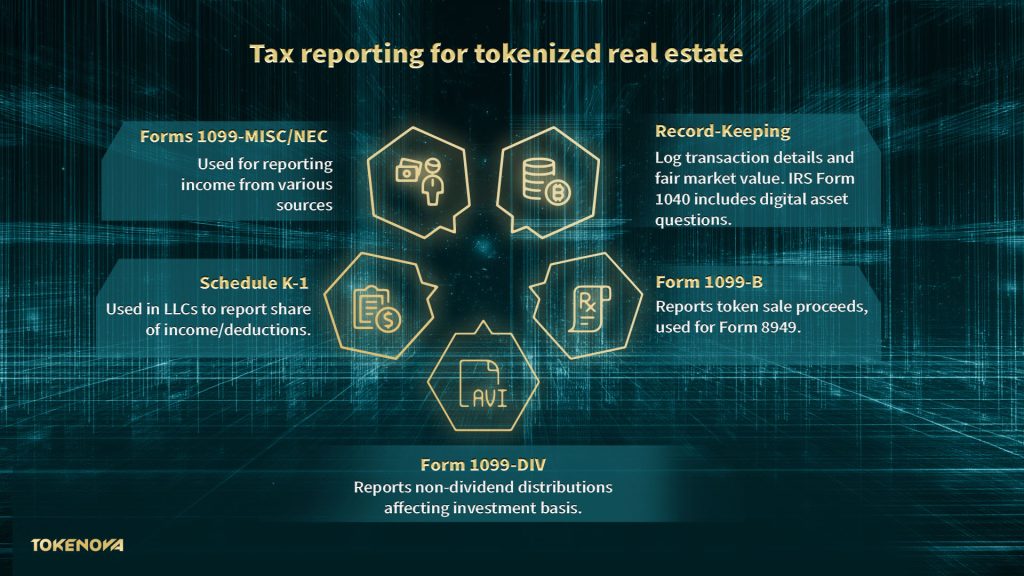

Tax Reporting and Compliance Requirements

Tax reporting for blockchain real estate isn’t plug-and-play. To handle the tax implications of tokenized real estate properties properly, you need a clear paper trail for every move you make. The IRS expects precision.

Record-Keeping for Investors

Every time you buy, sell, or earn from tokens, log the transaction date, fair market value in USD, your cost basis (including fees), and the transaction’s purpose. The IRS now includes digital asset activity questions on Form 1040, so omissions aren’t easy to hide.

Common Tax Forms

- Form 1099-B: If you sell tokens via a U.S. platform, expect a Form 1099-B, which reports the gross proceeds from the sales of your token. You’ll use this to calculate gains or losses on Form 8949 and Schedule D of your tax return.

- Form 1099-DIV: If the entity is a corporation, rental income might be labeled as non-dividend distributions, reducing your investment basis.

- Schedule K-1: For LLC-based setups, this is the standard. It shows your share of income, deductions, and depreciation from the property, and plugs into Schedule E on your return.

- Form 1099-MISC or 1099-NEC: Occasionally used for reporting income, especially if the platform structure varies.

Tax reporting for tokenized real estate demands discipline. As scrutiny around digital assets tightens, sloppy or late reporting can cost you, so be thorough with the reports.

Read More: How to Invest in Tokenized Assets: Your Comprehensive 2025 Guide

Final Thoughts

Tokenized real estate opens the door to new forms of ownership, but the tax responsibilities are very real. From capital gains to depreciation, from FIRPTA to FATCA, every piece has tax consequences. Whether you’re a domestic buyer or a cross-border investor, knowing where you stand on income, reporting, and compliance is key.

Tokenova works with investors to help them use real estate tokenization platforms, since they should structure deals smartly and make cross-border investing less opaque and more achievable. If you’re curious where to begin, Tokenova can walk you through how these platforms work and how to make them part of your real estate strategy. Contact our experts today!

Resources