Here’s the thing – you’re probably excited about the potential of asset tokenization. Maybe you’ve seen those impressive returns from real estate tokens or heard about fractional ownership of art and precious metals.

But here’s what keeps me up at night: most investors jump into tokenization projects without proper due diligence.

And guess what? That’s exactly how people lose money in this space.

Look, I get it. Traditional due diligence feels outdated when you’re dealing with blockchain technology. But skipping this step is like buying a house without an inspection – you might get lucky, or you might discover expensive problems later.

The good news? You don’t need to figure this out alone. Let me walk you through the exact framework that professional investors use to evaluate tokenization projects.

What is Asset Tokenization Due Diligence?

Think of asset tokenization due diligence as your safety net.

You’re not just buying a token – you’re investing in a complex system that includes the underlying asset, blockchain technology, legal structures, and ongoing management.

Here’s where it gets tricky: blockchain transactions are usually permanent. If something goes wrong, you can’t just call customer service to reverse the trade.

That’s why a thorough upfront evaluation is critical.

The Real Challenge:

Traditional investment due diligence doesn’t cover blockchain-specific risks. You need to evaluate smart contract security, token economics, regulatory compliance, and operational frameworks that simply don’t exist in conventional investments.

What I’ve found is that most tokenization failures happen not because the underlying asset was bad, but because of problems in the technology or legal structure.

Read More: Top Asset Tokenization Challenges & How to Overcome Them

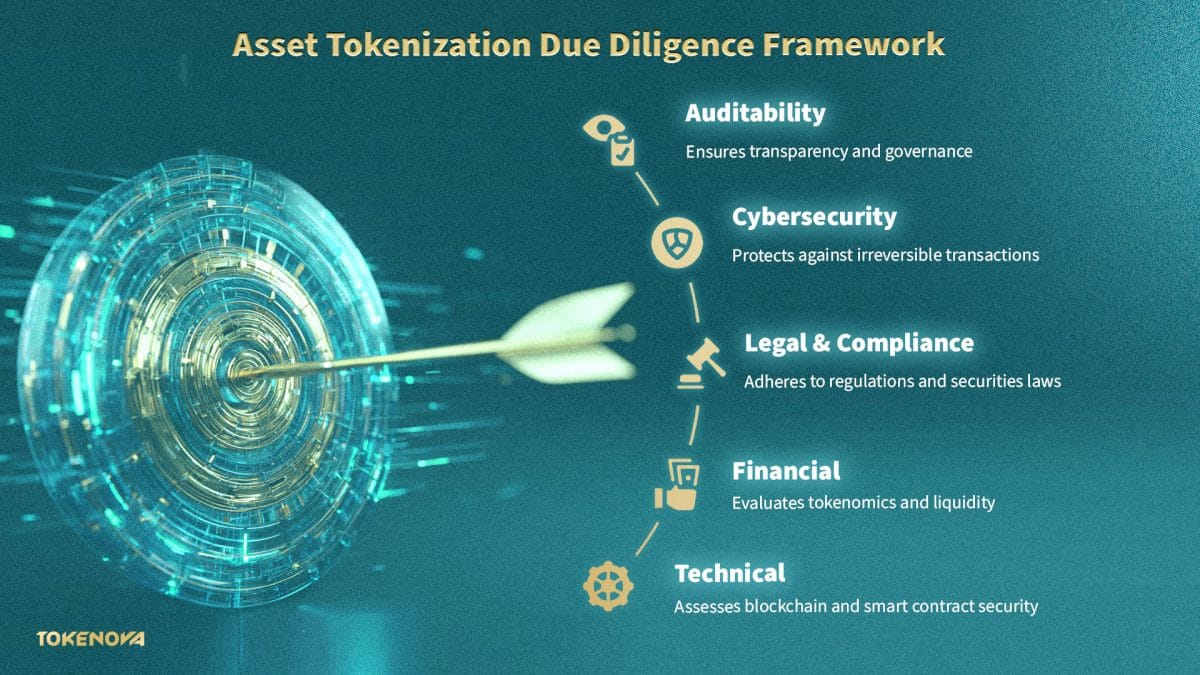

The 6-Pillar Due Diligence Framework

Here’s the comprehensive framework that works. Based on EY’s industry research, this approach has been tested across thousands of digital asset evaluations.

| Risk Pillar | Key Focus Areas | Why It Matters |

| Reputational & Strategic | Team credibility, accountability, track record | Anonymous teams create accountability risks |

| Technical | Blockchain infrastructure, smart contract security | Most hacks happen through technical vulnerabilities |

| Financial | Tokenomics, revenue models, liquidity | Unsustainable economics lead to project failure |

| Legal & Compliance | Regulatory adherence, securities status | Regulatory violations can kill entire projects |

| Cybersecurity | Key management, operational security | Blockchain transactions are irreversible |

| Auditability | Transparency, governance, verification | Lack of transparency indicates hidden problems |

Why This Approach Works:

Each pillar catches different types of problems. You might find a project with excellent technology but terrible legal compliance. Or great assets, but anonymous teams with no accountability.

The beauty of this framework? It helps you spot mismatches before they become expensive lessons.

For example, I’ve seen tokenized real estate projects with solid property portfolios but completely unaudited smart contracts. That’s a recipe for disaster, even if the buildings are worth millions.

Legal & Regulatory Compliance Checklist

This is where most projects stumble – and where you can save yourself serious headaches.

The Howey Test Reality Check:

Every token needs to pass this four-part test. You’re looking at whether it’s an investment of money in a common enterprise with the expectation of profits derived from others’ efforts. If all four boxes get checked, you’re dealing with a security that needs proper registration and compliance.

Jurisdiction and Licensing Assessment:

Here’s what I always investigate: Where is the project legally based, and which regulations apply? Many projects try to “jurisdiction shop” by incorporating in crypto-friendly places while targeting investors elsewhere. This creates regulatory time bombs that could explode later.

Understanding asset tokenization regulation is crucial for making informed investment decisions. Don’t just take their word about licenses – verify that platform operators, custodians, transfer agents, and intermediaries all have proper authorization. According to InvestaX’s detailed analysis, licensing requirements change dramatically based on token structure and target markets.

Critical Warning Signs:

Teams that wave away regulatory concerns should terrify you. The same goes for projects targeting retail investors without proper exemptions, unclear legal structures with sketchy offshore setups, or marketing that promises guaranteed returns. The bottom line? Regulatory enforcement is ramping up fast. Projects that seemed fine in 2022 are facing serious enforcement actions today.

Read More: Tokenization & Tax Regulation: A Strategic Guide

Technical Security Assessment Process

This is where tokenization gets vulnerable. Here’s your systematic technical evaluation approach:

Smart Contract Security Deep Dive:

Start with audit verification from reputable firms like Trail of Bits, Consensys Diligence, or OpenZeppelin. But don’t stop there – check if they fixed the problems auditors found. Watch out for new code added after audits, because that’s where fresh vulnerabilities sneak in.

Professional smart contract development includes comprehensive security testing and audit procedures, but not all projects follow these standards.

Blockchain Architecture Analysis:

Every blockchain choice involves trade-offs that affect your security. Ethereum offers maximum security but high gas fees. Polygon provides scalability with some centralization risks. Other chains have their own unique risk profiles. Recent security research shows that blockchain selection significantly impacts your overall security risk.

The upgrade question is crucial, too. How can smart contracts be updated? Immutable contracts are secure, but can’t fix bugs. Upgradeable contracts are flexible but create centralization risks. The best projects use time-locked upgrades with community governance.

Infrastructure Integration Risks:

Pay special attention to how platforms connect with external systems like oracles, bridges, and DeFi protocols. Here’s what I’ve learned from years of analysis: most technical failures happen not from single components breaking, but from complex interactions between different systems going wrong.

Key management deserves serious scrutiny. Multi-signature wallets are standard, but who holds the keys? What happens if key holders disappear? Look for detailed operational security procedures, not just vague promises.

Read More: Audit Smart Contracts: Secure Your Investment

Financial Analysis & Risk Evaluation

Now let’s talk money. You need to analyze both traditional metrics and blockchain-specific tokenomics.

Tokenomics and Revenue Model Assessment:

Look at the complete token supply picture: total tokens, release schedules, and team token lock-ups. Projects with high fully diluted valuations compared to circulating supply create massive sell pressure when tokens unlock.

Here’s the key question that separates winners from losers: How does this project make sustainable money? Does token value depend purely on price appreciation, or are there real income streams like rent, dividends, or transaction fees? EY’s research shows that projects with clear revenue models have much lower failure rates.

Liquidity and Financial Metrics:

Understanding how to invest in tokenized assets helps you make better liquidity decisions. Where can you sell these tokens? What’s the typical spread between buy and sell prices? Low liquidity creates exit problems, especially when markets get stressed.

| Key Financial Ratio | What It Measures | Red Flag Threshold |

| TVL to Market Cap | Asset backing vs. valuation | Ratio below 0.5 |

| Revenue per Token | Actual earnings generation | No measurable revenue |

| FDV to TVL | Dilution vs. utility | Ratio above 10x |

| Circulating Supply % | Token release pressure | Below 20% circulating |

Treasury management transparency indicates professional operations. Are project funds held in stable assets or volatile crypto? How are spending decisions made? These operational details matter way more than flashy marketing suggests.

Operational Due Diligence Requirements

This often gets overlooked, but operational failures kill more projects than technical problems.

Team and Governance Evaluation:

Does the core team have experience with both traditional finance AND blockchain technology? Anonymous teams create accountability risks that might work for some projects, but probably not for your serious investment.

Governance structure determines everything. How are decisions actually made – centralized with founders or distributed among token holders? Good governance prevents projects from getting paralyzed or dominated by single parties.

Asset Management and Business Continuity:

For real-world asset tokens, who physically holds the assets, and how are they insured? What happens if the custodian fails? These operational details matter way more than most people realize.

Many projects obsess over token launches but completely underestimate ongoing operational needs. Who handles investor relations, regulatory reporting, and asset maintenance? What’s the plan if key team members leave or regulatory environments change?

Working with experienced tokenization consultants can help ensure proper operational planning from the start. Robust projects plan for multiple scenarios rather than assuming everything goes smoothly.

The reality check? Operational failures often cause project deaths, even when the technology and underlying assets are solid.

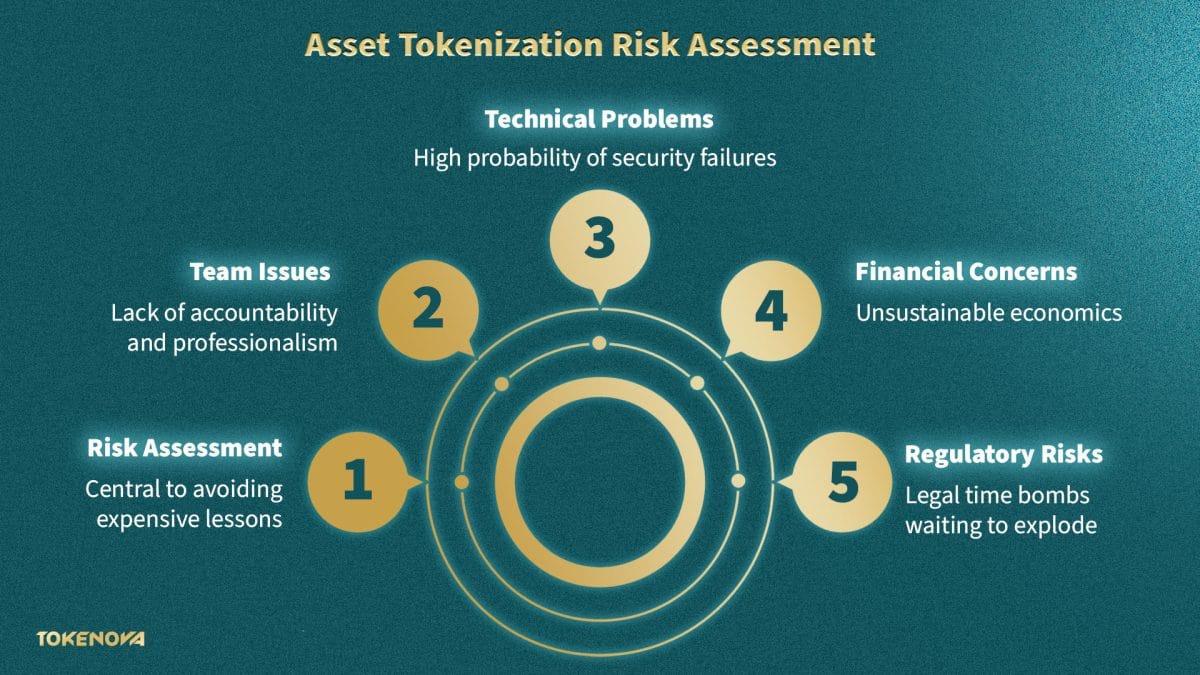

Red Flags and Warning Signs to Avoid

Here are the warning signs, organized by category, that should make you run:

| Risk Category | Major Red Flags | What This Means |

| Team Issues | Anonymous teams, aggressive marketing, pressure tactics | Lack of accountability and professionalism |

| Technical Problems | Unaudited contracts, experimental networks, no testing | High probability of security failures |

| Financial Concerns | Insider-heavy distribution, unclear revenue, hidden fees | Unsustainable economics |

| Regulatory Risks | “Not securities” claims, hostile jurisdictions, no compliance | Legal time bombs waiting to explode |

| Operational Gaps | Unclear custody, no insurance, unrealistic timelines | Management incompetence |

The most dangerous projects often look sophisticated on the surface but have fundamental flaws hiding underneath. Your systematic evaluation using this framework helps you spot these problems before they become expensive lessons.

While these tokenization processes can seem complex, determining which approach fits your specific investment goals requires careful analysis. Our advisory team has helped dozens of investors evaluate tokenization opportunities and choose the right path forward.

For comprehensive guidance on navigating tokenization compliance and implementation, consider our legal consultation services to ensure your due diligence process meets all regulatory requirements.

Conclusion

Asset tokenization due diligence isn’t just traditional investment analysis with some tech sprinkled on top. It’s a completely new approach for a new asset class.

The six-pillar framework gives you the systematic process to identify both risks and opportunities in this rapidly evolving space. The key insight? Tokenization creates entirely new risk vectors while offering new transparency and efficiency opportunities.

Success means balancing innovation with thorough risk assessment.

Ready to dive deeper into tokenization investment strategies? Drop your questions in the comments below – our team reads and responds to every one.

Don’t miss our weekly insights on blockchain investments and tokenization trends. Join our newsletter community for actionable advice delivered straight to your inbox.

FAQ

What’s the most important part of tokenization due diligence? Legal and regulatory compliance typically ranks highest because regulatory violations can kill projects regardless of other strengths. But all six pillars connect – you need to check everything.

How long should proper due diligence take? For serious investments, plan on 4-8 weeks depending on project complexity. Rushed due diligence is the biggest risk factor I see in tokenization investments.

Do I need to be a tech expert to evaluate these projects? While technical knowledge helps, this framework gives you specific checkpoints that work for non-technical investors. For significant investments, consulting blockchain experts is smart.

What’s the biggest mistake tokenization investors make? Focusing only on the underlying asset value while ignoring technology, legal structure, and operational risks. Tokenization adds completely new risk layers that need systematic evaluation.

How do I verify what projects tell me? Cross-reference everything with independent sources. Check team credentials through professional networks. Verify smart contract audits directly with auditing firms. Consult legal experts about regulatory claims.

Insert Meta Data

Meta Title: Asset Tokenization Due Diligence Checklist: 6 Risk Frameworks 2025

Meta Description: Complete due diligence checklist for asset tokenization with 6 critical risk assessment frameworks. Protect your investments with expert evaluation strategies.

URL Slug: asset-tokenization-due-diligence-checklist

Related Long-tail Keywords:

- “asset tokenization compliance checklist framework”

- “tokenization due diligence risk assessment guide”

- “how to evaluate tokenization investment opportunities”

Related Topics: Security & Compliance

Insert Image Descriptions

Suggested Images for Article

Featured Image (Before Main Title)

- Placement: Before article title/introduction

- Image Description: Professional business meeting scene with diverse team reviewing documents and digital screens showing blockchain analytics, tokenization charts, and compliance checklists. Modern office setting with laptops, tablets, and financial data visualizations.

- Text Overlay: “Master Tokenization Due Diligence”

- Why This Placement: Captures the essence of professional due diligence evaluation and establishes credibility for the comprehensive guide.

Internal Image 1

- Section: The 6-Pillar Due Diligence Framework

- Image Description: Infographic-style visualization showing six interconnected pillars or columns, each representing a risk category (Legal, Technical, Financial, etc.), with icons and connecting lines showing their relationships. Clean, professional design with blockchain-inspired elements.

- Text Overlay: “6 Critical Risk Assessment Pillars”

- Why This Section: Visual representation helps readers understand the comprehensive framework structure and how different risk areas connect.

Internal Image 2

- Section: Technical Security Assessment Process

- Image Description: Close-up of computer screens showing smart contract code, security audit reports, and blockchain network visualizations. Hands typing on keyboard with multiple monitors displaying technical analysis tools and security dashboards.

- Text Overlay: “Smart Contract Security Deep Dive”

- Why This Section: Reinforces the technical complexity and importance of security evaluation, making the technical concepts more accessible.

Internal Image 3

- Section: Red Flags and Warning Signs to Avoid

- Image Description: Conceptual image of warning signs and red flags against a digital/blockchain background. Could include caution symbols, alert icons, and danger indicators overlaid on cryptocurrency and tokenization imagery.

- Text Overlay: “Avoid These Critical Mistakes”

- Why This Section: Visual warning system helps readers remember and identify dangerous situations in their evaluations.

Note: Total word count analyzed: ~1850 words | Recommended images: 1 featured + 3 internal images