In today’s digital-first world, tokenization in payments has become an indispensable strategy for safeguarding financial transactions. With cyber-attacks targeting payment systems more frequently than ever, businesses must adopt robust security measures to protect sensitive customer data. Payment tokenization involves replacing confidential payment information, such as credit card numbers, with unique, non-sensitive tokens that are meaningless to unauthorized parties. This process not only enhances payment security but also streamlines secure payment processing, ensuring that transactions remain safe from potential breaches.

As the global digital payment market continues to expand, projected to reach over $15 trillion by 2030, understanding how payment tokenization works and the payment tokenization steps are crucial for businesses aiming to maintain trust and comply with industry regulations. This comprehensive guide delves into the intricacies of tokenization, exploring its benefits, types, real-world applications, challenges, and future trends, equipping you with the knowledge to implement secure and efficient payment systems in the digital economy.

“Tokenization has revolutionized the way we handle payment data, providing an additional layer of security that our customers trust,” says a tokenization expert at Tokenova 🪙.

How Tokenization Works

Process of Generating Payment Tokens from Sensitive Data

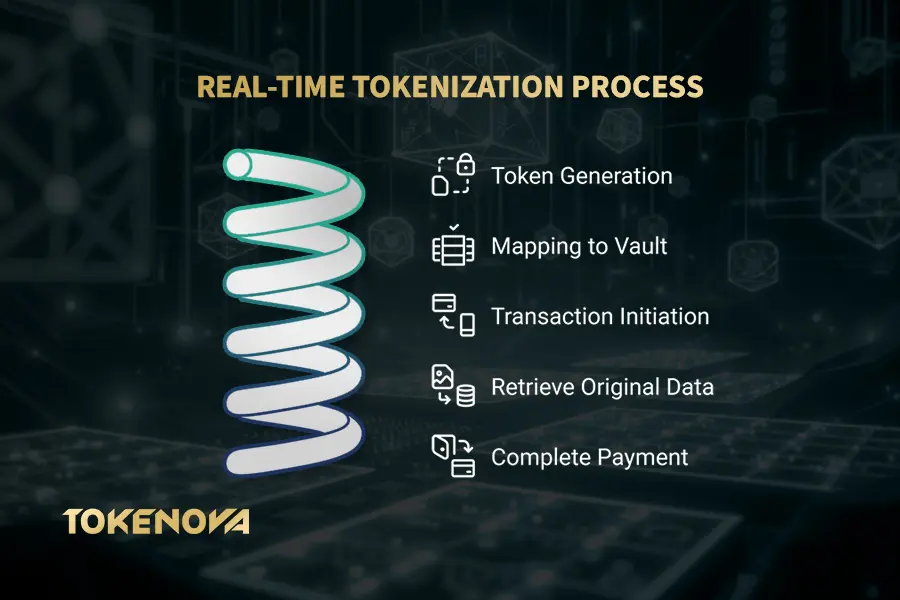

Payment Tokenization begins with the capture of sensitive payment information during a transaction. When a customer makes a purchase, their payment details are securely transmitted through a payment gateway. This data is then sent to a tokenization system, where it is replaced with a unique token. This token serves as a stand-in for the actual payment data, rendering it useless to unauthorized parties.

Real-Time Token Generation and Mapping Back to Original Data

Once the token is generated, it is mapped back to the original sensitive data in a secure token vault. This mapping ensures that the token can be used to process transactions without exposing the actual payment information. The tokenization process occurs in real-time, allowing seamless transaction processing while maintaining data security. When a transaction is initiated using a token, the system retrieves the original payment data from the token vault to complete the payment.

Use of Tokens in Various Transaction Types

Tokens can be utilized across different types of transactions, including:

- Online Purchases: Facilitating secure e-commerce transactions by storing tokens instead of actual credit card numbers.

- Recurring Payments: Enabling subscription services to process recurring billing without repeatedly exposing sensitive data.

- In-Store Transactions: Securing point-of-sale systems by using tokens for in-person payments.

- Mobile Payments: Supporting digital wallets and contactless payments through tokenized data.

The versatility of tokens ensures that payment security is maintained across all transaction platforms.

Expert Tip: “Tokenization has transformed payment security. It not only protects sensitive data but also simplifies the payment process, making transactions faster and more efficient for both businesses and consumers.”

Read More: Tokenization in Banking: Transforming the Financial Landscape

Benefits of Payment Tokenization

Implementing payment tokenization offers a multitude of benefits that enhance both security and user experience.

1. Enhanced Data Protection and Security

Payment tokenization significantly reduces the risk of data breaches by eliminating the storage of sensitive payment information. Tokens are meaningless to cybercriminals, ensuring that intercepted data cannot be used for fraudulent activities. This enhanced protection is vital in maintaining customer trust and safeguarding business reputations.

2. Compliance with PCI DSS Standards

Compliance with the Payment Card Industry Data Security Standard (PCI DSS) is mandatory for businesses handling payment card information. Tokenization simplifies this process by reducing the scope of PCI DSS compliance. By minimizing the amount of sensitive data that needs to be protected, businesses can achieve compliance more efficiently and cost-effectively.

3. Reduction in Fraud and Chargebacks

By ensuring that sensitive payment data is never exposed, tokenization drastically reduces the risk of fraudulent transactions. This leads to fewer chargebacks, which can be costly and damaging to a business’s reputation. Lower fraud rates not only save businesses money but also enhance customer confidence in the payment system.

According to Juniper Research, the total volume of tokenized payment transactions worldwide is projected to exceed 1 trillion by 2026, up from 680 billion in 2022.This significant growth underscores the critical role of tokenization in enhancing payment security and reducing fraud.

4. Facilitation of One-Click and Zero-Click Payments

Tokenization enables advanced payment features such as one-click and zero-click payments, enhancing the overall customer experience. These features make transactions faster and more convenient, encouraging repeat business and increasing customer loyalty.

Amazon’s One-Click Checkout feature revolutionized online shopping by allowing customers to make purchases swiftly without repeatedly entering payment details. This seamless experience is powered by tokenization, a technology that replaces sensitive payment information with unique identifiers, or tokens. These tokens facilitate transactions without exposing actual card details, significantly enhancing security. By implementing tokenization, Amazon not only streamlines the purchasing process but also ensures that customers’ payment information remains protected, fostering trust and convenience in the e-commerce environment.

5. Future-Proofing Payment Systems

As payment technologies evolve, tokenization provides a flexible framework that can adapt to new payment methods, including mobile wallets and emerging digital currencies. Businesses that implement tokenization are better prepared to integrate future payment innovations, staying ahead in a competitive market.

Types of Tokenization

Understanding the various types of tokenization is essential for selecting the appropriate solution for your business needs.

1. Payment Tokenization vs. Network Tokenization

| Feature | Payment Tokenization | Network Tokenization |

| Definition | Replaces payment data with a token specific to a merchant’s environment. | Replaces card details with a token issued by major payment networks. |

| Management | Managed internally by the merchant or their payment processor. | Managed by payment networks like Visa and Mastercard. |

| Use Cases | Best for businesses with proprietary systems and internal token management. | Ideal for businesses operating across multiple platforms needing seamless integration. |

| Versatility | Limited to specific merchant environments. | Allows tokens to be used across multiple merchants, enhancing interoperability. |

| Security Features | Provides basic security by obscuring card details within a closed system. | Offers enhanced security with automatic card updates and reduced fraud risk. |

| Transaction Approval Rates | Dependent on the merchant’s system and practices. | Typically results in improved transaction approval rates (up to 2% increase). |

| Adaptability for New Payments | Less adaptable to emerging payment methods. | Highly adaptable, securing transactions for cryptocurrencies and real-time payments. |

| User Experience | May require users to re-enter payment information for each transaction. | Seamless user experience with automatic updates for lost or stolen cards. |

| Expert Opinion | Focused on internal management; may lack broader security features. | Digital wallets are leveraging tokenization to offer secure and convenient payment options. |

Differences Between the Two Methods

- Payment Tokenization: This method replaces payment data with a token used within a specific merchant environment. It is ideal for closed-loop systems managed by the merchant or their payment processor.

- Network Tokenization: Managed by major payment networks like Visa and Mastercard, network tokenization allows tokens to be used across multiple merchants. It offers additional benefits such as automatic card updates and improved transaction approval rates.

Network tokenization provides greater versatility and interoperability, enhancing security across the entire payment ecosystem.

Use Cases for Each Type

- Payment Tokenization: Best suited for businesses with proprietary payment systems and those seeking to manage tokens internally.

- Network Tokenization: Ideal for businesses operating across multiple platforms and seeking seamless integration with various payment networks.

Read More: Top Web3 Business Ideas

2. Digital Wallet Tokenization

Digital wallets such as Apple Pay, Google Pay, and Samsung Pay utilize tokenization to secure payment information on mobile devices. When a card is added to a digital wallet, the actual card data is replaced with a token. This ensures that even if a device is lost or stolen, the user’s actual payment details remain protected.

“Digital wallets use tokenization to deliver secure and seamless payment options,” explains one of Tokenova’s chief consultants. “This approach enhances user experience while dramatically reducing the risk of data breaches, making it a cornerstone of modern digital payments.”

3. Tokenization for Emerging Payment Methods

As new payment methods like cryptocurrencies and real-time payments gain traction, tokenization is expanding to secure these transactions as well. Tokenization’s adaptability makes it a crucial component in securing the future of digital payments, ensuring that new technologies can be integrated without compromising security.

Use Cases for Tokenization

Tokenization is versatile and applicable across various industries, enhancing security and efficiency in multiple contexts.

1. E-Commerce Transactions

Online retailers leverage tokenization to securely store customer payment information, enabling features like one-click checkout while protecting against data breaches. Enhanced security combined with convenience improves customer trust and boosts sales. According to Statista, global e-commerce sales are expected to surpass $6.3 trillion by 2024, making secure payment processing essential.

How Shopify Uses Tokenization

Shopify, one of the biggest names in e-commerce, has embraced tokenization to keep payment data safe and secure. By implementing this technology, Shopify not only protects sensitive information but also meets important compliance standards, showing how businesses can build trust through advanced security measures.

Shopify’s approach replaces sensitive payment data with tokens, ensuring that customer and merchant information stays protected. This method allows Shopify to comply with PCI DSS standards while maintaining smooth and secure transactions.

The result? Shopify has solidified its reputation as a trusted e-commerce platform, giving both merchants and customers peace of mind when it comes to online transactions. It’s a clear example of how tokenization can enhance both security and user confidence.

2. Subscription-Based Services

Services such as streaming platforms and SaaS providers rely on tokenization to manage recurring payments securely. Tokenization ensures seamless billing cycles without repeatedly exposing sensitive payment data, enhancing both security and customer convenience.

How Netflix Secures Billing

Netflix uses the Visa Token Service to secure subscription payments by replacing sensitive card details with digital tokens. This approach enhances security, prevents fraud, and ensures seamless recurring transactions, even if card details change.

By leveraging tokenization, Netflix processes millions of payments globally, maintaining trust and providing a secure, hassle-free billing experience for its users.

3. Brick-and-Mortar Retail Integration

Physical retailers implement tokenization at point-of-sale systems to protect in-person transactions. This integration strengthens payment security without compromising transaction speed, enhancing the in-store customer experience.

Walmart’s Approach to Secure Checkouts

Walmart incorporates tokenization into its checkout systems to enhance security and speed. By using tokens instead of storing sensitive payment information, Walmart protects customer data from breaches while ensuring compliance with industry standards. This strategy supports faster, more secure transactions, improving the overall shopping experience.

4. Platforms and Marketplaces

Marketplaces that process payments for multiple vendors use tokenization to manage transactions securely without exposing sensitive data to all parties involved. This approach ensures that each transaction is secure, fostering a trustworthy environment for both vendors and customers.

Etsy’s Secure Payment Processing

Etsy ensures secure and seamless transactions by using tokenization through its payment provider, Adyen. This system replaces sensitive card information with unique tokens, ensuring that no actual payment data is stored or transmitted during transactions.

By protecting sensitive information and streamlining the payment process, Etsy provides a safer and more efficient experience for both buyers and sellers, reinforcing trust in its marketplace.

Challenges and Considerations

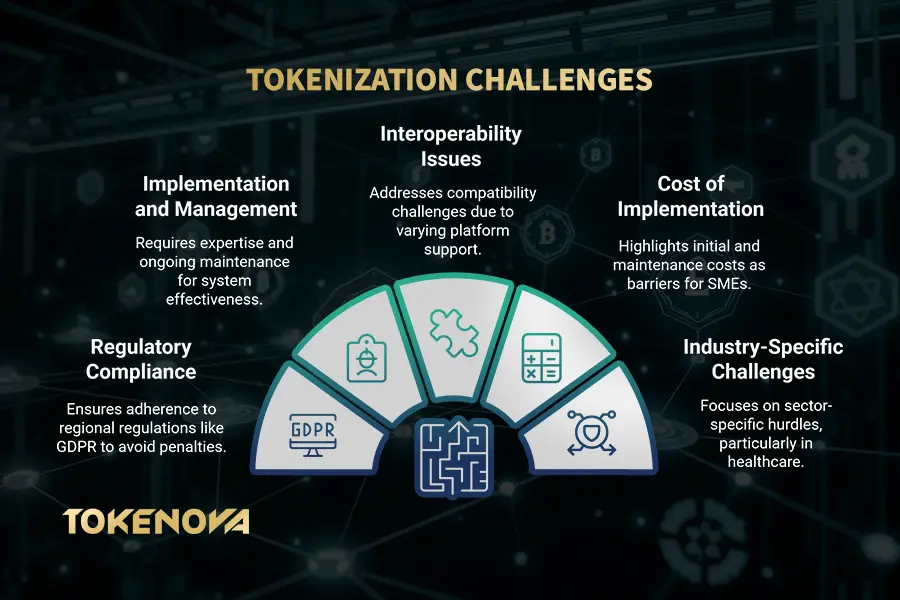

While tokenization offers significant benefits, businesses must navigate potential challenges to implement it effectively.

1. Limitations of Tokenization in Certain Industries

Some industries may face unique challenges when adopting tokenization, such as highly regulated sectors or those with complex payment systems. Understanding industry-specific requirements and limitations is crucial for successful implementation.

Healthcare Industry

The healthcare sector must comply with stringent regulations like HIPAA, which adds complexity to tokenization implementation. Ensuring that tokenization solutions meet both payment security and patient data protection standards is essential.

2. Need for Proper Implementation and Management

Implementing tokenization requires technical expertise and meticulous management to ensure its effectiveness. Proper integration and ongoing maintenance are essential to maximize the security benefits and prevent potential vulnerabilities.

Expert Tip: “Tokenization isn’t a one-and-done solution it requires continuous monitoring and adaptation to keep up with evolving security threats and maintain compliance; proactive management is essential to ensure its long-term effectiveness.”

3. Interoperability Issues

Different payment platforms may have varying support for tokenization, leading to interoperability challenges. Adopting network tokenization or working with providers offering broad compatibility can mitigate these issues.

Solution:

Choosing a tokenization provider that supports multiple payment platforms and networks can help businesses overcome interoperability challenges and ensure seamless transaction processing.

4. Cost of Implementation

Initial setup and ongoing maintenance costs can be a barrier for small and medium-sized enterprises (SMEs). Weighing the long-term benefits against the costs is essential, as tokenization can reduce fraud and compliance expenses over time.

5. Regulatory Compliance

While tokenization aids in compliance, businesses must ensure that their tokenization solution meets all relevant regulations, which may vary by region. Staying updated on regulatory changes is crucial for maintaining compliance and avoiding penalties.

Meeting GDPR Requirements with Tokenization

Tokenization is a prime example of how businesses can comply with GDPR. By replacing sensitive customer data with secure tokens, companies reduce the risk of breaches and align with GDPR’s data minimization principles. This approach not only protects privacy but also simplifies compliance with strict regulatory standards.

Future Trends in Payment Tokenization

| Trend | Description | Benefits |

| AI-Driven Tokenization | Utilizes AI to enhance token generation efficiency and fraud detection capabilities. | Increases fraud detection rates by up to 40%, improving transaction security and reliability. |

| Blockchain and Tokenization | Employs blockchain for a decentralized approach, eliminating centralized token vaults. | Enhances transparency and security through immutable ledgers and decentralized verification processes. |

| Tokenization in IoT | Secures payments made through IoT devices, protecting consumer data in connected environments. | Vital for securing transactions across various smart devices, ensuring sensitive information remains protected. |

| Expansion into New Industries | Industries like real estate and automotive are adopting tokenization for secure, high-value transactions. | Facilitates secure property transactions and vehicle sales without exposing sensitive financial information. |

| Increased Adoption of Zero-Click Payments | Promotes seamless transactions without additional authentication steps, necessitating robust tokenization solutions. | Enhances customer satisfaction by streamlining payment processes while maintaining security. |

| Integration with Emerging Technologies | Combines tokenization with biometric authentication and advanced encryption methods to boost security. | Provides multi-layered security for fast, convenient, and highly secure transactions. |

The field of payment tokenization is continuously evolving, driven by technological advancements and changing market demands.

1. AI-Driven Tokenization

Artificial Intelligence (AI) is enhancing tokenization by improving token generation efficiency and fraud detection capabilities. AI enables smarter, real-time analysis of transaction patterns, boosting security measures and providing predictive insights to prevent fraud before it occurs.

According to the Journal of Accountancy, integrating AI into tokenization systems can significantly enhance fraud detection. AI analyzes vast amounts of transaction data in real time, identifying patterns and anomalies that may indicate fraudulent activity. This proactive approach helps businesses detect and prevent fraud more effectively, ensuring more secure and reliable transactions.

2. Blockchain and Tokenization

Blockchain technology offers a decentralized approach to tokenization, potentially eliminating the need for centralized token vaults. Blockchain could revolutionize tokenization, making transactions more transparent and secure by leveraging immutable ledgers and decentralized verification processes.

“Integrating blockchain with tokenization enhances transparency and security, creating a tamper-proof system for managing payment tokens,” explains a Tokenova specialist. “This combination is particularly effective for ensuring data integrity and trust in digital transactions.”

3. Tokenization in the Internet of Things (IoT)

As IoT devices become more prevalent, tokenization will play a key role in securing payments made through these devices. Securing IoT transactions is vital for protecting consumer data in an increasingly connected world, where devices range from smart home gadgets to wearable technology.

How Smart Appliances Use Tokenization for Secure Payments

Smart appliances, such as refrigerators, utilize tokenization to securely process payments for services or products. This method replaces sensitive payment data with unique tokens, ensuring that personal information remains protected even within interconnected environments. By implementing tokenization, these devices enhance security and reduce the risk of fraud during transactions.

4. Expansion into New Industries

Industries like real estate and automotive are exploring tokenization to facilitate secure, high-value transactions. Tokenization’s adaptability means it’s poised to transform payment security across various sectors, enabling secure property transactions, vehicle sales, and more.

Case Study: Real Estate Tokenization

Tokenization is transforming real estate by digitizing property assets, allowing secure transactions without exposing sensitive financial details. Platforms like Propy streamline processes, reducing costs and transaction times while enhancing transparency and security.

5. Increased Adoption of Zero-Click Payments

The rise of zero-click payments where transactions are completed without additional authentication steps will drive the need for robust tokenization solutions to ensure security without compromising user experience. This trend emphasizes the importance of seamless and secure payment processes in enhancing customer satisfaction.

6. Integration with Emerging Technologies

Future tokenization systems will increasingly integrate with technologies such as biometric authentication and advanced encryption methods to further enhance security and streamline payment processes. These integrations will provide multi-layered security, ensuring that transactions are not only fast and convenient but also highly secure.

Tokenova Services: Leading the Way in Payment Tokenization

At Tokenova, we do more than provide tokenization solutions we work with you to create a payment system that’s secure, seamless, and future-ready. Our services are tailored to businesses of all sizes, from startups to global enterprises, ensuring your payment processes are not just secure but also optimized for growth.

What We Offer:

- Secure Token Generation: Replace sensitive payment data with unique tokens to protect your customers and simplify compliance with PCI DSS.

- Advanced Token Vaults: Store sensitive information securely with multi-layered protection, accessible only to authorized parties.

- Real-Time Fraud Detection: Leverage AI-driven monitoring to detect and prevent fraudulent activities instantly.

- Digital Wallet Integration: Enable secure payments with platforms like Apple Pay and Google Pay using Tokenova’s easy-to-integrate APIs.

Why Choose Tokenova?

We don’t just deliver a product we provide expert guidance to ensure seamless implementation and ongoing success. With scalable solutions and a focus on emerging technologies like AI and blockchain, Tokenova is ready to future-proof your payment systems while enhancing customer trust.

Let’s Secure Your Payments Together

Looking to make your payments more secure and efficient? Contact Tokenova today for a personalized consultation. Together, we’ll build a tokenization strategy that protects your business and delights your customers.

Conclusion

In today’s digital economy, implementing tokenization in payments is not just a security measure it’s a business imperative. By replacing sensitive payment data with secure tokens, businesses can protect themselves and their customers from the ever-growing threat of cyber-attacks. Understanding how payment tokenization works and its benefits is crucial for any business that handles digital transactions.

The advantages of payment tokenization from enhanced data protection and reduced fraud to improved customer experiences make it a vital component of modern payment systems. As technologies like AI and blockchain continue to evolve, tokenization will play an even more significant role in securing transactions across various industries. Businesses that adopt tokenization now are not only safeguarding their present but also future-proofing their operations against emerging threats.

References: ACI, Mastercard, Stripe

What is tokenization in payments?

Tokenization in payments is the process of replacing sensitive payment information, such as credit card numbers, with unique, non-sensitive identifiers called tokens. This ensures that actual payment details remain secure during transactions.

How does payment tokenization work?

Payment tokenization works by capturing sensitive payment data, generating a unique token, storing the token securely, and using the token for processing future transactions without exposing the original payment information.

What are the benefits of payment tokenization?

The benefits include enhanced data protection, compliance with PCI DSS standards, reduction in fraud and chargebacks, and facilitation of convenient payment methods like one-click and zero-click payments.

What is the difference between payment tokenization and network tokenization?

Payment tokenization is used within a specific merchant environment, while network tokenization is managed by major payment networks and allows tokens to be used across multiple merchants, offering greater versatility and interoperability.

Can tokenization be used with digital wallets?

Yes, tokenization is integral to digital wallets like Apple Pay and Google Pay, replacing actual card data with tokens to secure mobile and contactless payments.

What challenges might businesses face when implementing tokenization?

Challenges include implementation complexity, interoperability issues, initial and ongoing costs, and ensuring regulatory compliance across different regions.

What are the future trends in payment tokenization?

Future trends include AI-driven tokenization, blockchain integration, tokenization in IoT devices, expansion into new industries, increased adoption of zero-click payments, and integration with emerging technologies.

How can Tokenova help with payment tokenization?

Tokenova offers comprehensive tokenization solutions, including secure token generation, advanced token vault management, seamless digital wallet integration, real-time fraud detection, and simplified PCI DSS compliance, tailored to meet the needs of businesses of all sizes.

Is tokenization enough to ensure payment security?

While tokenization significantly enhances payment security, it should be part of a broader security strategy that includes encryption, secure networks, and regular security assessments to provide comprehensive protection.

How does tokenization impact customer experience?

Tokenization improves the customer experience by enabling faster, more convenient payment methods like one-click and zero-click payments, while ensuring that their sensitive data remains secure.