Imagine a world where investing in real estate, renowned artworks, or government bonds is as easy as buying stock on your smartphone. This is the reality brought about by asset and government bond tokenization, which uses digital bonds and blockchain technology to simplify investments.

Tokenization represents a fundamental shift in financial markets, allowing investors to buy, sell, and trade fractions of both tangible and intangible assets with unprecedented ease. This article explores the technology behind tokenization, its application to assets and bonds, regulatory aspects, market adoption, and future prospects. Whether you’re an investor or just curious about finance’s future, this guide will reveal the transformative potential of tokenization.

The Evolution of Asset Tokenization in Financial Markets

The financial landscape is undergoing a seismic shift, driven by the tokenization of assets and government bonds. This transformation is rooted in the broader movement towards digitization, where traditional financial instruments are being reimagined through the lens of blockchain technology.

A New Era of Ownership

Traditionally, investing in high-value assets like real estate, fine art, or government bonds required substantial capital, limiting participation to affluent individuals and institutional investors. Tokenization of assets democratizes access by breaking down these high-value assets into smaller, more affordable units tokens. This fractional ownership model allows a broader spectrum of investors to participate in markets that were previously inaccessible.

For instance, instead of needing millions to invest in prime real estate, an investor can now purchase tokens representing a fraction of the property. This not only lowers the entry barrier but also diversifies investment portfolios, spreading risk across multiple assets.

The Mechanics Behind Tokenization

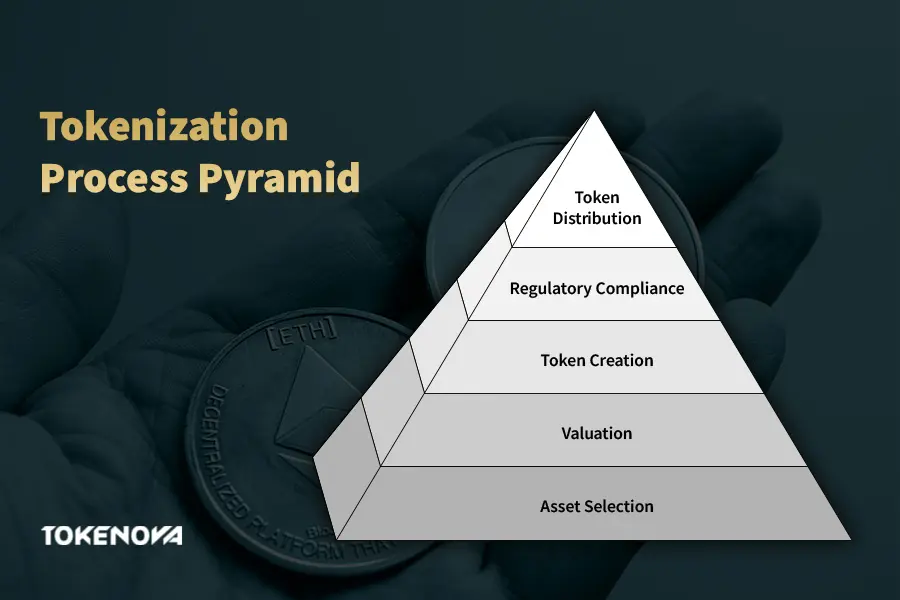

At its core, asset tokenization involves converting the ownership rights of an asset into digital tokens on a blockchain. Each token represents a specific share of the underlying asset, ensuring that ownership is transparent, immutable, and easily transferable. Here’s how the process typically unfolds:

- Asset Selection: Identify the asset to be tokenized be it real estate, artwork, or government bonds.

- Valuation: Determine the asset’s market value to establish the basis for token issuance.

- Token Creation: Generate digital tokens representing fractional ownership of the asset using blockchain technology.

- Regulatory Compliance: Ensure that the tokenization process adheres to relevant legal and regulatory frameworks.

- Token Distribution: Distribute the tokens to investors through a secure platform or exchange.

This seamless process not only enhances liquidity but also fosters a more inclusive investment environment.

Why It Matters Now More Than Ever

In today’s digital age, investors demand flexibility, security, and efficiency. Tokenization of assets and government bonds addresses these needs by leveraging blockchain technology, which offers decentralized ledgers, smart contracts, and enhanced security protocols. This technological synergy is particularly transformative for tokenized government securities, making them more accessible and efficient.

Moreover, the global financial crisis underscored the need for more resilient and transparent financial systems. Tokenization offers a solution by providing real-time tracking of transactions and reducing reliance on intermediaries, thus enhancing the overall stability and transparency of financial markets.

Tokenization of Government Bonds: A Serious Game Changer

Government bonds have long been a cornerstone of the global financial system, serving as a low-risk investment vehicle backed by sovereign credit. However, traditional government bonds come with limitations high entry barriers, lengthy settlement processes, and limited accessibility for retail investors. Tokenization of government bonds addresses these challenges, revolutionizing how these securities are issued, traded, and managed.

Understanding Government Bonds

Government bonds are debt securities issued by governments to finance public spending and manage national debt. Investors purchase these bonds, effectively lending money to the government in exchange for periodic interest payments and the return of the principal amount at maturity. Due to their low-risk nature, government bonds are favored by conservative investors seeking stable returns.

The Shift to Digital Bonds and Blockchain Technology

The advent of digital bonds and blockchain technology has opened new avenues for government bond issuance and trading. Tokenizing government bonds involves creating digital representations of these securities on a blockchain platform. This process offers several significant advantages:

- Enhanced Efficiency: Traditional bond issuance involves multiple intermediaries, extensive paperwork, and prolonged settlement times. Digital bonds streamline these processes, reducing settlement times from days to minutes and cutting operational costs.

- Broader Investor Access: Tokenization democratizes access by allowing retail investors to participate in government bond markets. Fractional ownership lowers the investment threshold, enabling a wider range of investors to diversify their portfolios.

- Improved Transparency: Blockchain’s immutable ledger ensures that all transactions are recorded transparently and securely. Investors can track the ownership and movement of bonds in real-time, fostering greater trust and accountability.

- Increased Liquidity: Digital bonds can be traded on secondary markets 24/7, enhancing liquidity and providing investors with more flexibility in managing their investments.

The Reserve Bank of India’s Digital Rupee: Transforming Government Securities

The Reserve Bank of India (RBI) has been proactive in exploring the potential of tokenized government securities. In a groundbreaking pilot program, the RBI tested a blockchain-based platform for issuing and managing government bonds. The initiative aimed to:

- Reduce Settlement Times: Traditional bond settlement can take up to three days. The RBI’s pilot demonstrated the ability to settle transactions in minutes, significantly enhancing efficiency.

- Cut Costs: By eliminating intermediaries and reducing administrative overhead, the RBI was able to lower the costs associated with bond issuance and trading.

- Boost Financial Inclusion: Tokenization made government bonds accessible to a broader audience, including retail investors who previously couldn’t participate due to high entry barriers.

The RBI’s initiative underscores the tangible benefits of tokenization in improving the efficiency and accessibility of government securities.

The Technological Framework Powering Tokenization

At the heart of any asset tokenziation lies blockchain technology a decentralized, secure, and transparent ledger system. Blockchain serves as the backbone for tokenization, enabling the creation, management, and trading of digital tokens representing various assets.

Blockchain: The Backbone of Asset Tokenization in Financial Markets

Blockchain technology offers several key features that make it ideal for asset tokenization:

- Decentralization: Unlike traditional centralized databases, blockchain operates on a decentralized network of nodes. This eliminates the need for a central authority, reducing the risk of single points of failure and enhancing system resilience.

- Immutability: Once data is recorded on the blockchain, it cannot be altered or deleted. This ensures the integrity and permanence of transaction records, fostering trust among participants.

- Transparency: All transactions on a public blockchain are visible to participants, promoting transparency and reducing the likelihood of fraud.

- Programmability: Blockchain platforms like Ethereum allow the creation of smart contracts self-executing agreements with terms directly written into code. These smart contracts automate processes, ensuring that predefined conditions are met without human intervention.

Smart Contracts: Automating Digital Bonds and Blockchain Transactions

Smart contracts play a pivotal role in the tokenization process by automating the execution of agreements when specific conditions are met. In the context of digital bonds and blockchain technology, smart contracts facilitate:

- Automated Interest Payments: Smart contracts can automatically distribute interest payments to bondholders at predetermined intervals, ensuring timely and accurate disbursements.

- Asset Transfers: Ownership of tokenized bonds can be transferred seamlessly between parties without the need for intermediaries, reducing transaction costs and settlement times.

- Compliance Enforcement: Smart contracts can enforce regulatory compliance by ensuring that only eligible investors can purchase tokens and that transactions adhere to relevant laws.

By automating these processes, smart contracts enhance the efficiency, accuracy, and security of tokenized bond transactions.

Navigating the Regulatory Landscape for Tokenization of Assets and Government Bonds

The regulatory environment for the tokenization of assets and government bonds is evolving rapidly, with significant variations across jurisdictions. Understanding these frameworks is essential for legally issuing and trading tokenized government securities, ensuring compliance while fostering market trust.

Current Regulations Governing Tokenized Assets

Governments and financial regulators are actively crafting policies to address the unique challenges posed by asset tokenization in financial markets. Key regulatory aspects include:

Securities Laws

Many tokenized assets are classified as securities, meaning they fall under existing securities regulations. For instance, the U.S. Securities and Exchange Commission (SEC) mandates strict disclosure and compliance standards to protect investors and ensure market integrity.

Anti-Money Laundering (AML) and Know Your Customer (KYC)

Platforms issuing digital bonds on blockchain technology must implement robust AML and KYC protocols to prevent illicit activities. These measures ensure that only verified investors participate, aligning with global anti-fraud initiatives outlined by FATF.

Licensing Requirements

In many jurisdictions, specific licenses are required for platforms to operate legally. For example, the Monetary Authority of Singapore (MAS) regulates tokenized assets under its Payment Services Act, ensuring financial transparency and accountability.

Data Protection Laws

Compliance with data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe, is critical. These laws safeguard sensitive investor information and establish guidelines for handling digital identities.

Comparative Analysis Across Jurisdictions

The regulatory approaches for tokenized government securities vary, shaping how these assets are issued and traded globally.

Switzerland

Switzerland leads with progressive regulations, creating a conducive environment for blockchain innovation. The Swiss Financial Market Supervisory Authority (FINMA) has established clear guidelines for tokenized securities, striking a balance between innovation and investor protection.

United States

The U.S. takes a conservative stance. The SEC requires that tokenized assets comply with traditional securities laws, prioritizing investor protection and market integrity. However, this cautious approach can hinder innovation and slow adoption.

Singapore

Singapore has emerged as a hub for digital bonds and blockchain-based financial markets, thanks to the MAS’s proactive policies. Its clear regulatory guidelines foster innovation while maintaining strict oversight, making it a model for other nations.

Estonia and Malta

These smaller nations have embraced blockchain technology with favorable regulations. Their flexible yet structured policies have attracted a wave of tokenization ventures, bolstering their status as leaders in digital asset innovation.

Future Outlook and Regulatory Developments

As asset tokenization in financial markets grows, regulators are expected to adapt their frameworks to encourage innovation while maintaining safeguards. Emerging trends include:

- Harmonized Regulations Across Jurisdictions

Global bodies like the International Organization of Securities Commissions (IOSCO) are advocating for standardization. Harmonized regulations could reduce compliance burdens and enable seamless cross-border trading of tokenized assets. - Enhanced Investor Protections

Future frameworks are likely to include stricter disclosure rules and risk mitigation measures, particularly for retail investors. Initiatives like mandatory risk assessments could ensure a safer investment environment. - Support for Innovation through Sandboxes

Regulatory sandboxes, such as those offered by UK FCA, allow innovators to test new models under regulatory supervision. This approach encourages experimentation while mitigating risks. - Clear Taxation Policies

Tax authorities worldwide are working to clarify how gains from tokenized government securities will be taxed. For example, the OECD is developing frameworks to address the complexities of taxing blockchain transactions. - Comprehensive Asset Classifications

Establishing clear definitions for different types of tokenized assets will provide legal certainty and guide issuers, helping them navigate the regulatory landscape effectively.

Proactive collaboration between industry stakeholders and regulators is crucial to shaping a supportive regulatory environment for the tokenization of assets and government bonds. With harmonized rules, enhanced investor protections, and clear frameworks, tokenization can thrive as a transformative force in global financial markets.

Market Adoption and Notable Case Studies in Tokenization of Assets and Government Bonds

The tokenization of assets and government bonds is gaining momentum globally, with governments and leading financial institutions taking significant steps to implement this transformative technology. From operational efficiency to enhanced liquidity, tokenization is proving its potential to reshape financial markets.

Leading Financial Institutions Embracing Tokenization

Several major financial institutions are spearheading initiatives to integrate digital bonds and blockchain technology into traditional finance.

Citi Bank

Citi has emerged as a frontrunner in the tokenization space, conducting successful pilots for tokenized bonds. These initiatives showcase the advantages of reduced settlement times and enhanced operational efficiency. Citi’s efforts are setting industry benchmarks for leveraging blockchain in bond issuance.

JPMorgan Chase

JPMorgan Chase is making waves with its JPM Coin, a digital token designed for instantaneous institutional payments. The bank is also exploring tokenization for government bonds, highlighting its potential to improve liquidity and streamline operations.

SWIFT

SWIFT, the global financial messaging network, is trialing blockchain technology to facilitate cross-border digital currency transactions. These trials emphasize the importance of interoperability between different blockchain platforms and aim to make international transactions faster, more secure, and cost-effective.

SWIFT’s Trials and Their Industry Significance

SWIFT’s engagement with blockchain and digital currencies marks a pivotal moment for the integration of tokenization into mainstream financial systems.

- Improving Cross-Border Payments: By leveraging blockchain technology, SWIFT seeks to minimize delays and costs in international transactions, addressing long-standing inefficiencies.

- Enhancing Security: Blockchain’s robust cryptographic frameworks provide a secure method for recording and executing transactions, significantly reducing fraud and cyber risks.

- Establishing Industry Standards: SWIFT’s trials are crucial for creating interoperability standards, and ensuring seamless communication between different blockchain ecosystems.

These initiatives reflect the growing confidence in digital bonds and blockchain technology as practical alternatives to traditional financial systems, driving broader acceptance.

Future Prospects of Asset and Government Bond Tokenization

As the adoption of digital bonds and blockchain technology accelerates, financial institutions, governments, and investors are poised to unlock efficiencies and opportunities. However, the journey to mainstream adoption faces notable challenges that must be addressed.

The Expanding Reach of Tokenization

Increasing Adoption by Institutions

The adoption of tokenized assets has shifted from niche experiments to a cornerstone of financial innovation. Major institutions are driving this trend:

- BlackRock’s Vision: Larry Fink, CEO of BlackRock, has predicted a future where all stocks and bonds are recorded on a unified blockchain ledger. This vision underscores the long-term potential of tokenization to revolutionize efficiency and transparency across financial markets.

- State Street’s Initiatives: State Street has announced exploratory projects involving tokenized bonds and money market funds, aiming to incorporate blockchain technology into its services to streamline processes and enhance offerings.

Democratizing Access to Investments

Tokenization’s ability to enable fractional ownership is breaking traditional barriers to entry. Retail investors can now access markets previously reserved for institutional players or high-net-worth individuals. For instance, tokenized government bonds allow everyday investors to benefit from a stable and historically secure asset class.

Expanding Use Cases Beyond Bonds

While government bonds have garnered much attention, the tokenization frontier extends to real estate, commodities, private equity, and even intellectual property. Blockchain’s versatility and transparency make it an invaluable tool across diverse industries.

Innovations and Technological Developments

The Role of DeFi in Tokenization

Decentralized Finance (DeFi) is revolutionizing how tokenized assets are managed and traded. By removing intermediaries, DeFi platforms offer lower transaction costs and greater transparency, paving the way for innovations such as tokenized yield farming and peer-to-peer lending.

AI and Machine Learning Integration

Artificial Intelligence (AI) is poised to enhance tokenization by automating compliance checks and providing predictive analytics for informed investment decisions. For example, tools powered by AI algorithms can streamline due diligence processes and improve risk assessments.

Smart Contracts: The Next Frontier

Smart contracts are evolving to handle complex agreements, enabling automated asset management, multi-party settlements, and dispute resolution. Their integration into tokenized transactions ensures greater efficiency and reliability.

Market Predictions and Growth Trajectories

Global Market Growth

The global tokenized asset market is projected to reach $24 trillion by 2027, with a compound annual growth rate (CAGR) of approximately 20% (source). This growth will be driven by:

- Institutional Participation: Major players like BlackRock and State Street adopting tokenization to reduce costs and improve efficiency.

- Retail Accessibility: Fractional ownership models opening up investment opportunities for retail investors.

- Technological Advancements: Ongoing innovation in blockchain scalability and security.

Integration with Traditional Finance

Tokenized assets are expected to coexist with traditional financial instruments, creating a hybrid ecosystem. This integration will enable a gradual transition, offering investors the best of both worlds while expanding access to previously illiquid markets.

Tokenova: Your Trusted Advisor in Asset Tokenization

In the complex and evolving world of financial innovation, navigating the tokenization of assets and government bonds requires expertise and a strategic approach. Our trusted blockchain and legal experts help us be a leading consultancy in the field, and empower businesses to capitalize on the transformative potential of tokenization with tailored, efficient, and compliant solutions.

In a Nutshell: Why Choose Tokenova?

- Regulatory Expertise: Tokenova ensures your projects comply with the latest global regulations, mitigating legal risks and ensuring seamless execution.

- Custom Solutions: Every business is unique, and Tokenova provides tailored strategies to meet your specific needs, whether you’re an institution or a smaller enterprise.

- Proven Results: With a track record of successful tokenization projects, Tokenova has become a trusted partner for businesses looking to stay ahead in the rapidly evolving financial landscape.

Contact Tokenova Today

If you’re ready to explore the benefits of tokenization and revolutionize how you approach asset management and investment, Tokenova is here to help. Partner with Tokenova to ensure your success in the dynamic world of digital finance.

Conclusion

The tokenization of assets and government bonds signifies a major shift in the financial landscape, leveraging digital bonds and blockchain technology to foster a more inclusive, efficient, and transparent market. This transformation redefines ownership, democratizes access, and enhances investment liquidity and security.

Tokenization offers several benefits, including fractional ownership, increased liquidity, and broader investor access. Institutions like the Reserve Bank of India are already demonstrating the advantages of tokenized government securities, indicating a promising future.

However, challenges such as technological integration, regulatory compliance, and market volatility must be addressed carefully. With the right strategies, these hurdles can lead to widespread adoption and success.

The prospects for tokenization are bright, with substantial market growth and innovation in blockchain technology and decentralized finance on the horizon. Tokenova offers solutions to navigate these complexities, helping investors and institutions seize new opportunities.

Embracing tokenization is essential for leveraging innovations that lead to greater financial prosperity and inclusion. The time to act is now the tokenized future awaits with immense potential.

Key Takeaways

- Revolutionizing Finance: The tokenization of assets and government bonds is transforming asset ownership and investment, making markets more accessible and efficient.

- Government Bonds Go Digital: Tokenizing government bonds enhances efficiency, transparency, and investor access, democratizing access to these traditionally low-risk investments.

- Technology as an Enabler: Digital bonds and blockchain technology are the pillars supporting this financial evolution, providing a secure and transparent framework for tokenization.

- Navigating Regulations: Understanding and complying with varying regulations is crucial for successful tokenization ventures, ensuring legal compliance and investor protection.

- Future is Bright: With continued innovation and market growth, tokenization is set to become a standard in financial markets, offering diverse investment opportunities and fostering financial inclusion.

How Does Tokenization Affect Asset Liquidity?

Tokenization enhances asset liquidity by allowing assets to be divided into smaller units (tokens), making it easier for investors to buy and sell portions of the asset. This fractional ownership lowers the investment threshold and increases market participation, resulting in higher liquidity. For example, a real estate property tokenized into 1,000 tokens allows investors to purchase as few as one or multiple tokens based on their investment capacity. This flexibility facilitates quicker buy and sell transactions, making the asset more liquid compared to traditional ownership models.

Are Tokenized Assets Secure?

Yes, tokenized assets are generally secure due to the underlying blockchain technology. Blockchain’s decentralized nature and cryptographic security measures protect against unauthorized alterations and fraud. Each transaction is verified by network participants, ensuring the integrity of the asset’s ownership record. Additionally, reputable tokenization platforms implement advanced security protocols, such as multi-factor authentication and regular security audits, to safeguard investor assets. However, it’s essential to use reputable platforms and remain vigilant against potential cyber threats to ensure the highest level of security for tokenized investments.

What Role Do Smart Contracts Play in Tokenization?

Smart contracts automate the execution of agreements when predefined conditions are met. In tokenization, they facilitate transactions, manage asset ownership, and enforce compliance automatically. For instance, in tokenized government bonds, smart contracts can automatically distribute interest payments to bondholders at specified intervals. They also ensure that transfers of tokens adhere to regulatory requirements, such as KYC and AML protocols. By eliminating the need for intermediaries, smart contracts reduce costs, increase transaction speed, and minimize the risk of human error, thereby enhancing the overall efficiency and reliability of the tokenization process.

How Can I Start Investing in Tokenized Government Securities?

To invest in tokenized government securities, you can follow these steps:

Choose a Platform: Select a reputable tokenization platform or exchange that offers government bonds.

Complete KYC/AML Requirements: Comply with regulatory requirements by providing necessary identification and documentation.

Fund Your Account: Deposit funds using accepted payment methods, such as bank transfers or cryptocurrencies.

Select Your Investment: Browse available tokenized bonds and choose the ones that align with your investment goals.

Purchase Tokens: Execute the purchase through the platform, acquiring the desired number of tokens representing the government bonds.

Monitor Your Investment: Use the platform’s tools to track the performance and manage your tokenized securities.

Always consult financial advisors and conduct thorough research before investing to ensure that your investments align with your financial objectives and risk tolerance.