The difference between a thriving blockchain project and a failed one often comes down to one critical factor: tokenomics.

The actual difficulty is in creating tokenomics that support the technology of your enterprise, promote involvement, and guarantee long-term viability. Even the most modern blockchain initiatives could fail without a robust tokenomics system.

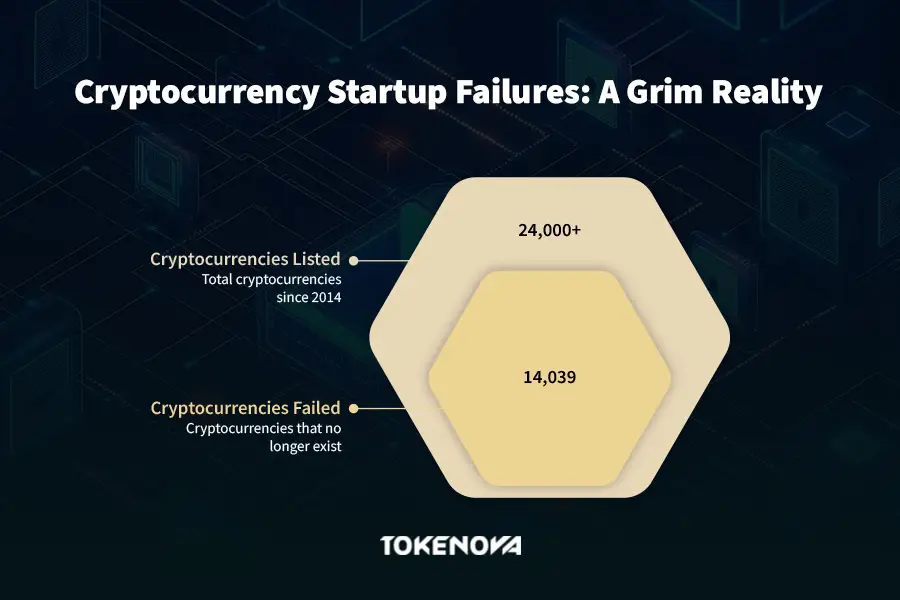

The statistics don’t lie:

- Over 50% of crypto startups collapse within 3 years, often due to poorly designed token models or lack of strategic planning. Of the over 24,000 cryptocurrencies listed on CoinGecko since 2014, 14,039 have died.

- Regulatory fines for non-compliant token sales have exceeded $2.5 billion since 2020, and projects have been penalized for issues related to token distribution and liquidity planning.

These numbers highlight exactly how vital it is to start off with correct tokenomics. Tokenova focuses on avoiding these expensive errors even before they can happen. Our multidisciplinary team builds token economies that are not only creative but also legally compliant and financially viable by combining legal knowledge, financial modeling, and blockchain development.

If you’re planning to launch a token, this information could be the difference between success and failure.

What Is Tokenomics Consulting?

Tokenomics is the financial mechanics and economic framework supporting a blockchain initiative. Simply put, it’s the unseen architecture controlling how a project’s tokens are generated, spread, and used inside the ecosystem.

Whether your token is fixed (a set maximum supply) or inflationary (new tokens are routinely produced), this choice influences both its scarcity and long-term value. A stable token economy depends on effective supply control.

Your token’s value and community involvement can be greatly affected by how tokens are allocated at launch—e.g., fair launches, pre-sales, airdrops—and over time via vesting schedules. Errors in this area could result in market manipulation or centralised management.

Your token’s use defines its usefulness. Within the platform, tokens could be transaction fees, staking rewards (earning interest), or governance rights (voting on proposals). Demand is driven by utility; without obvious utility, tokens may be left behind.

A weak tokenomics strategy may cause anything from price collapses to legal obstacles or community abandonment for your initiative. Tokenomics is the basis of your project’s success, not only a side issue.

Why “Copy-Paste Tokenomics” Fails

Many new blockchain initiatives make the mistake of simply copying tokenomics models from successful projects like Bitcoin or Ethereum, without considering their own needs or background. Here are some typical errors that cause failure:

Blindly copying successful projects: A model that worked for Bitcoin or Ethereum does not automatically apply to you. Every blockchain project has its particular use cases and market circumstances. Many unsuccessful ICOs show that copying their tokenomics without modification can produce negative results.

Ignoring local rules: Tokenomics consulting is not only about economics; it’s also about compliance. Regulatory agencies include the U.S. The SEC has particular policies on governance, liquidity, and token issuance. Ignoring these rules could lead to legal issues, fines, or perhaps project closure.

Not planning for liquidity could cause your token to be worthless or see significant price fluctuation. Tokenomics is about making sure a token can be purchased, sold, and exchanged with sufficient demand to preserve its value over time, not just about generating one.

Expert advice is a kind of risk management, not only a luxury. A tokenomics consultant provides the appropriate knowledge to guide your project towards long-term success and prevent these errors.

The High Costs of Poor Token Design

Though the blockchain and crypto sectors are still somewhat young, bad tokenomics can have terrible effects, even though the benefits of success might be great. The past of token design tells a story filled with cautionary tales of failed ventures, regulatory fines, and market collapses—all directly related to poor tokenomics practices. Let’s look at a few of the more remarkable cases:

Luna/UST Crash (2022): Failure of Algorithmic Stablecoin

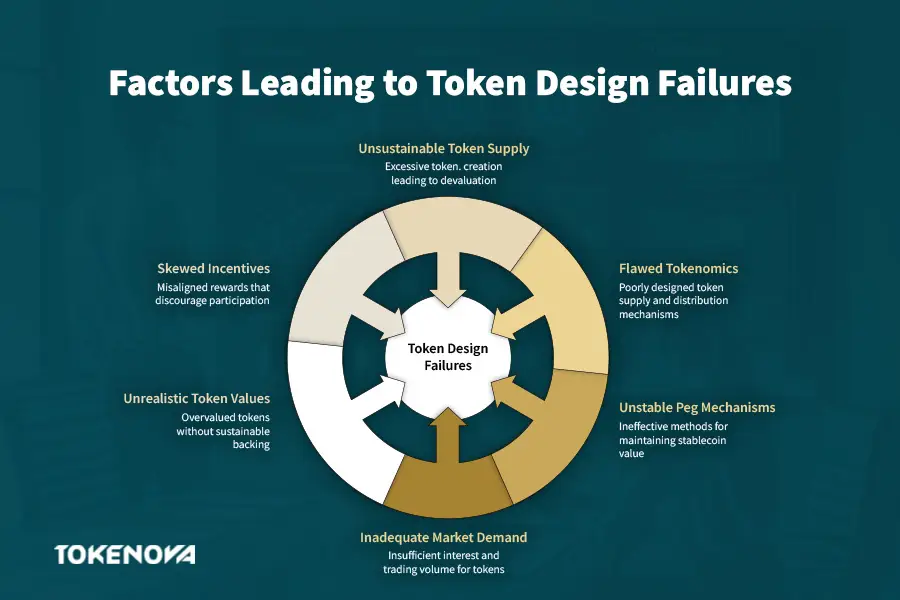

Designed to preserve its value via intricate tokenomics, the Luna/UST ecosystem, an algorithmic stablecoin, fell dramatically in 2022, erasing more than $40 billion in value. Flawed design choices—including badly designed token supply management, unstable peg mechanisms, and inadequate market demand—underpinned the disaster.

The Luna meltdown highlighted how even the most ambitious and well-funded initiatives can collapse when tokenomics is not well considered, sending ripples across the crypto industry. Especially for tokens intended to function as stablecoins, this event served as a significant wake-up call that stability in token design is not something to take lightly.

ICO Era Failures: 80% of 2017-2018 ICOs Failed or Were Scams

The ICO (Initial Coin Offering) period of 2017–18 is yet another clear illustration. Though an astonishing 80% either failed or proved fraudulent, hundreds of blockchain projects generated billions of dollars during this time. Many of these initiatives had badly implemented tokenomics, including unrealistic token values, skewed incentives, and unsustainable token supply. Investors lost confidence as a consequence, initiatives failed, and token owners ended up with useless assets.

Read More: Launch an ICO: Your Step-by-Step Guide

Regulatory Pitfalls: The Legal Landmine

The regulatory landscape around tokenomics and cryptocurrency is constantly changing and somewhat complicated. Ignoring compliance while designing tokens could cause major legal problems, including large penalties and litigation.

SEC Lawsuits Against Projects Including Ripple (XRP) and Telegram (TONNE)

Consider Ripple (XRP), where the SEC went after the project, asserting its token sale was an unregistered securities sale. Years of the case have created major market uncertainty. The government’s intervention forced Telegram’s TONNE project to close due to issues with its tokenomics and legal compliance.

Apart from millions in legal expenses, these actions have harmed the standing of the projects concerned. For any blockchain enterprise hoping to generate money or issue tokens without knowledge of the legal criteria in their area, they are a cautionary story.

UAE’s VARA Penalties for Non-Compliant Asset Tokenization

Asset tokenization is governed by the Virtual Assets Regulatory Authority (VARA) in the UAE under rigorous policies; noncompliance might lead to significant fines and sanctions. VARA has really started acting against initiatives failing to comply with its criteria, hence indicating the severity of the regulatory climate in the MENA area. Tokenova’s legal team keeps a close eye on these changes to make sure our customers are constantly in compliance with rules.

Tokenova closely monitors these risks to guarantee our clients are not just creating successful tokenomics but also doing so legally.

Liquidity Crises: The Silent Project Killer

Liquidity, often overlooked yet essential, frequently influences the performance of a tokenomics design. Insufficient liquidity planning may cause your token’s value to fluctuate and eventually cause the whole enterprise to fail. To achieve this, follow these steps:

Whales Control Prices: A tiny group of investors (whales) can distort token prices by buying or selling significant amounts under insufficient liquidity. Extreme volatility results from such scenarios and panics smaller investors.

Exchanges Delist Tokens: Major exchanges could delist a token if it lacks enough liquidity, hence restricting user access and complicating holders’ ability to sell or trade their tokens.

Lack of liquidity causes investors to rapidly lose faith in the long-term viability of the enterprise. This could lead to a mass exodus as individuals sell off their assets, thereby further depreciating the token’s value.

Tokenova has created certain market-making techniques to reduce these dangers, so guaranteeing that your token can manage demand changes and stay robust in unstable market circumstances.

Why Tokenova: Our Methodology

Tokenova knows that tokenomics is not a universal remedy. Our multi-disciplinary, all-encompassing strategy guarantees that every facet of your token’s design is suited to the aims of your project, legal environment, and market requirements.

Expertise from End to End

Our group offers thorough tokenomics consulting by combining the greatest brains from several disciplines, so guaranteeing that your idea is not only creative but also legally compliant and financially sustainable.

Using best practices in token standards like ERC-20 or BEP-20, we offer smart contract audits and guarantee your token meets the maximum requirements of security and functionality.

Financial Modellers: We conduct a thorough supply and demand analysis to ensure the optimisation of your tokenomics for enduring value. This includes deciding on the appropriate token supply, distribution channels, and incentive plans.

Legal Experts: Everything we do revolves around following guidelines. Our legal team has significant expertise in negotiating the intricate regulatory terrain in many nations, from UAE’s VARA and ADGM (Abu Dhabi Global Market) to U.S. SEC rules. to guarantee your token issue is legally sound and complies with worldwide standards, our legal team has considerable experience negotiating the complicated regulatory environments in several jurisdictions, including UAE’s VARA, ADGM (Abu Dhabi Global Market), and the U.S.

UAE Regulatory Advantage

Dubai’s VARA has become a major force in controlling virtual assets as the blockchain sector in the MENA area fast expands. With a workforce well-versed in MENA crypto legislation, Tokenova has a special benefit here. We assist you in organising legally viable token offers following VARA’s rules, guaranteeing seamless market entry and operational compliance.

Our extensive local knowledge gives your project a major advantage in the UAE’s changing environment, as this country is setting itself as a hub for virtual assets and blockchain.

Proactive Security Policies

We not only create tokenomics; we also make sure your initiative is protected from possible hazards. Apart from creating robust economic models, we advise reliable companies like MythX and CertiK to conduct third-party security audits. These audits guarantee the security of your smart contracts and blockchain infrastructure before launch throughby means of removing vulnerabilities.

Our proactive strategy lowers the possibility of hacks, exploits, or breaches by handling possible problems before they might interfere with your project.

Our Tokenomics Consulting Process

Tokenova has developed a methodical, outcomes-orientated approach to tokenomics consultancy that guarantees your blockchain initiative not only survives but flourishes. Focussing on risk reduction while maximising the possibilities for development, our approach is thorough and open. Here is a breakdown of how we direct you along the road:

Step 1: Risk Assessment & Discovery

The initial stage of our approach is to grasp the whole range of your project and its particular requirements. We begin by examining the following important factors:

Project Goals: Are you concentrated on DeFi (Decentralised Finance), GameFi, Security Token Offerings (STOs), or another use case? The particular sector and project objectives will determine your tokenomics.

Target Market Regulations: Knowing the regulatory environment is absolutely vital. We evaluate the legal needs particular to your area—especially important areas like the UAE, where VARA (Virtual Assets Regulatory Authority) and ADGM (Abu Dhabi Global Market) rules are vital.

We study your rivals to see what succeeds in the market and where others have failed. By using proven techniques and steering clear of traps, we can create unique tokenomics.

Step 2: Custom Token Model Design

Our team starts creating a custom token model suited to your project once we have collected all the pertinent data. Our solutions comprise:

Supply Control: We create burning and minting systems to guarantee the stability of your token’s supply and its alignment with your long-term objectives. Your project will guide us in also assisting you in planning for token inflation or deflation.

Demand Drivers: We’ll provide incentives that promote demand and involvement, whether your token will be used for staking, fee-sharing, or as part of an NFT ecosystem, hence guaranteeing its value and utility.

A key component of tokenomics design is making sure your token follows the rules. Depending on its functionality and jurisdiction, we will categorise your token as either a security or a utility. This action is crucial to avoid expensive regulatory problems later on.

Step 3: Assistance with Implementation

Designing tokenomics is only the start. We provide continuous assistance in the following fields to help your project start successfully:

We examine and audit your smart contracts to guarantee their security, functionality, and efficiency. We will also make sure they fit your unique tokenomics system.

Avoiding the liquidity crises that frequently affect new projects, we assist you in designing and managing liquidity pools to guarantee your token stays trading and stable.

Post-launch Monitoring: Tokenomics is not a one-and-done approach. After launch, we will keep an eye on your token’s performance and change tactics as required to preserve long-term stability and expansion.

How We Compare to Competitors

When choosing a tokenomics consultant, it’s essential to understand what sets us apart. Here’s how Tokenova stacks up against other consulting services:

| Factor | Tokenova | Other Consultants |

| UAE Compliance Focus | ✅ Specialized in VARA/ADGM | ❌ Often lack regional expertise |

| Holistic Approach | ✅ Legal + Tech + Finance integrated | ❌ Siloed services (e.g., only tech or legal) |

| Transparency | ✅ No hidden fees, clear deliverables | ❌ Vague pricing models, unclear deliverables |

Tokenova specialises in negotiating UAE rules, particularly VARA and ADGM, hence guaranteeing compliance from day one. Many generic consultants lack this area-specific knowledge, which can expose your project to expensive legal problems.

Unlike other consultants who could concentrate on only one area—legal or technical, for example—Tokenova combines legal, technical, and financial knowledge in one unified team. This guarantees that every essential element is fully understood when your tokenomics are created.

We take pleasure in open pricing and no concealed charges. With well-defined deliverables at every level, you will know precisely what to expect during the course of the project. Other consultants can offer unclear pricing schemes that could cause doubt and unanticipated expenses.

Final Note

In the fast-changing crypto industry, foresight trumps retrospect. Avoiding the errors that have led to the failure of numerous projects depends on your careful planning and design of your tokenomics. Together, let’s create expanding, rather than crashing, tokenomics.

Tokenova allows you to create a sustainable future rather than merely issuing a token.