Imagine owning a fraction of a skyscraper in New York, a coveted piece of digital art, or even a share in a renewable energy project all through a simple digital token. This isn’t a scene from a futuristic novel but the tangible reality of asset tokenization today. As blockchain technology continues to revolutionize various industries, the question, “What assets can be tokenized?” becomes increasingly pertinent. Asset tokenization transforms traditional and digital assets into blockchain-based tokens, democratizing access to investments, enhancing liquidity, and redefining ownership paradigms in the modern financial landscape.

Asset tokenization is the process of converting the rights to an asset into a digital token on a blockchain. This innovation not only offers unparalleled liquidity and fractional ownership but also ensures transparency and security through immutable blockchain records. From real estate and financial instruments to digital assets and renewable energy projects, the spectrum of tokenizable assets is vast and continually expanding, paving the way for a more inclusive and efficient financial ecosystem.

In this comprehensive guide, we will explore the myriad of assets eligible for tokenization, delve into the benefits and challenges associated with this technology, and examine real-world case studies that highlight its transformative potential. Whether you’re an investor seeking to diversify your portfolio, a business leader exploring new funding avenues, or simply intrigued by the future of finance, this article will equip you with the essential knowledge to navigate and leverage the tokenized economy.

Types of Assets Eligible for Tokenization

Asset tokenization transcends traditional boundaries, encompassing a diverse range of assets that can be digitized and traded on blockchain platforms. Below, we delve into ten prominent categories of assets that are ripe for tokenization, supported by market insights and illustrative case studies.

1. Real Estate

The real estate sector stands as a cornerstone of the tokenization revolution, projected to reach $1.4 trillion by 2026, growing at an impressive CAGR of 59.6% from 2022 to 2026.

Transforming Property Ownership

Tokenizing real estate involves converting ownership rights of properties into digital tokens on a blockchain. Each token signifies a fractional ownership stake in the property, enabling investors to buy, sell, or trade these tokens akin to stocks. This process transforms the traditionally illiquid real estate market into a more dynamic and accessible investment environment.

Advantages for Investors and Property Owners

Asset tokenization significantly enhances liquidity, potentially increasing real estate liquidity by 20-30%. Investors gain the ability to own fractions of high-value properties without the need for substantial capital outlay, thereby democratizing access to premium real estate assets. Additionally, the streamlined transaction process reduces the time and costs associated with traditional real estate dealings, making property investment more efficient and attractive.

How the St. Regis Aspen Resort Revolutionized Real Estate Investment

In 2018, the St. Regis Aspen Resort made headlines by becoming one of the first major U.S. real estate properties to undergo tokenization. This innovative approach allowed investors to purchase digital tokens representing ownership shares in the luxury hotel, effectively democratizing access to high-end real estate investments. By issuing $18 million worth of digital tokens, each priced at $1, the resort enabled a broader range of investors to participate in its ownership. This move not only enhanced liquidity but also set a precedent for how blockchain technology can be applied to physical assets, making property investment more accessible to individuals beyond the traditional wealthy elite.

The success of the St. Regis Aspen’s tokenization underscores the potential for blockchain to transform real estate investment, offering greater inclusivity and flexibility in the market.

Market Growth and Future Prospects

The exponential growth in the tokenized real estate market is driven by the increasing adoption of blockchain technology and the rising demand for more liquid and accessible investment opportunities. As regulatory frameworks become more defined and technological advancements continue, the real estate tokenization market is poised for sustained expansion, fostering greater investor confidence and participation.

2. Financial Instruments

The tokenization of financial instruments is fundamentally altering the landscape of securities trading and management, with the tokenized securities market expected to surge to $4.1 trillion by 2030.

Digitizing Stocks, Bonds, and Securities

Tokenizing financial instruments involves creating digital tokens that represent shares in stocks, bonds, or other securities. These tokens can be traded on blockchain platforms, offering a more efficient and transparent trading process. This innovation simplifies the issuance, distribution, and transfer of securities, making them more accessible and manageable.

Impact on Liquidity and Trading Efficiency

Tokenization drastically reduces trade settlement times from the traditional T+2 (two days after the transaction) to near real-time, enhancing the speed and efficiency of transactions. Unlike traditional markets, tokenized securities facilitate 24/7 trading, providing investors with greater flexibility and access. Moreover, by enabling trading in smaller denominations, tokenization significantly boosts overall market liquidity, attracting a wider range of investors.

Regulatory Considerations

Ensuring compliance with securities laws and regulations is paramount to maintaining legality and investor trust. Regulatory bodies are actively developing guidelines to accommodate tokenized securities, balancing innovation with investor protection. Additionally, the standardization of protocols for tokenized securities is essential to facilitate wider adoption and interoperability across various platforms.

BlackRock’s Tokenized Fund: A Game-Changer in Asset Management

In March 2024, BlackRock launched its first tokenized fund, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), on the Ethereum blockchain (source). This innovative move aimed to enhance transparency, reduce costs, and improve efficiency in fund management.

The BUIDL fund allows investors to earn U.S. dollar yields through blockchain technology, showcasing the potential for tokenized financial instruments to revolutionize traditional markets. BlackRock’s adoption of tokenization highlights its commitment to innovation and positions blockchain as a cornerstone of modern asset management.

Market Size and Future Outlook

With the tokenized securities market projected to reach $4.1 trillion by 2030, the sector is attracting significant interest from both institutional and retail investors. The growth is fueled by the need for more efficient trading mechanisms, reduced costs, and enhanced accessibility, positioning tokenized financial instruments as a pivotal component of the future financial ecosystem.

3. Art and Collectibles

The art and collectibles market is undergoing a renaissance through tokenization, with the tokenized art market projected to ascend to $5.6 billion by 2026.

Tokenizing Artwork, Rare Items, and Collectibles

Tokenizing art and collectibles involves creating digital tokens that represent ownership of physical or digital art pieces, rare items, and other collectibles. This process facilitates fractional ownership and easier trading of high-value assets. Blockchain technology ensures that each token is uniquely identifiable and verifiable, safeguarding the authenticity and provenance of the asset.

Enhancing Accessibility and Ownership Transparency

Asset tokenization democratizes art investment by enabling multiple investors to own shares of expensive artworks or collectibles, thereby lowering the investment barrier. Blockchain’s immutable ledger ensures the authenticity and provenance of art pieces, mitigating the risk of fraud and counterfeit items. Furthermore, tokenization broadens the investor base by making art and collectibles accessible to a global audience, enhancing market liquidity and participation.

Maecenas: Transforming Art Ownership Through Tokenization

In a groundbreaking move, Maecenas revolutionized the art world by tokenizing Andy Warhol’s iconic painting, 14 Small Electric Chairs, valued at $5.6 million. Through blockchain technology, the platform enabled fractional ownership of the artwork, allowing art enthusiasts and investors worldwide to purchase shares.

This initiative not only enhanced liquidity in the traditionally illiquid art market but also democratized access to valuable art assets. By purchasing fractional shares, a broader spectrum of investors could participate in the ownership of high-value art, an opportunity once reserved for the ultra-wealthy.

The success of this venture underscores a shift in the art market. Tokenization breaks down barriers, making prestigious art ownership accessible to anyone with an interest in investing. As Maecenas demonstrated, art is no longer just for billionaires it’s for everyone.

Market Potential and Future Prospects

The tokenized art market’s growth is propelled by the increasing acceptance of digital ownership and the burgeoning popularity of NFTs (Non-Fungible Tokens). Digital platforms facilitating art tokenization have significantly contributed to market expansion, enabling artists and collectors to monetize and trade their works more efficiently. As technological advancements continue, the integration of augmented reality (AR) and virtual reality (VR) with tokenized art will further enhance the digital art experience, driving continued growth and innovation in the sector.

4. Intellectual Property

Intellectual Property (IP) tokenization is unlocking innovative avenues for creators and investors, with the IP tokenization market anticipated to grow at a CAGR of 25% from 2023 to 2028.

Tokenizing Patents, Copyrights, and Trademarks

Tokenizing IP involves creating digital tokens that represent ownership or rights to patents, copyrights, trademarks, and other intellectual properties. These tokens can be traded, licensed, or used as collateral, providing a new layer of liquidity and investment potential for IP assets. This process facilitates the efficient monetization and management of intellectual properties, enabling creators to capitalize on their innovations more effectively.

Benefits for Creators and Investors

For creators, tokenization offers a streamlined method to monetize their IP by selling tokens that represent ownership or usage rights. This opens up new revenue streams and investment opportunities. For investors, tokenized IP assets provide diversification options, allowing them to invest in a variety of intellectual properties across different industries. Additionally, blockchain’s transparency ensures fair and automated royalty distribution, enhancing trust and efficiency in financial transactions related to IP.

Implementation Challenges

Tokenizing IP presents several challenges, including the establishment of clear legal frameworks to protect rights and ensure enforceability. Accurately valuing IP assets is another significant hurdle, necessitating standardized valuation methods to ensure fair token pricing. Moreover, adoption barriers such as skepticism and lack of understanding among creators and investors must be addressed through education and demonstration of clear benefits.

Sony Music Japan: Revolutionizing Royalties with Blockchain

Sony Music Entertainment Japan is changing the game for artists by using blockchain technology to manage music rights and royalties. Through this innovative approach, Sony ensures faster, more transparent, and more accurate royalty distribution, empowering creators and revolutionizing how the music industry operates.

With blockchain, Sony streamlined the process of tracking music rights, providing tamper-proof records and automating royalty payments. This not only guarantees that artists are paid on time but also enhances operational efficiency, freeing artists to focus on their craft instead of worrying about delayed payments.

This initiative reflects a broader shift in the industry: putting power back into the hands of creators. By eliminating inefficiencies and fostering trust, Sony is setting a new standard for fairness and transparency, ensuring that artists are rewarded for their talent and hard work. Blockchain isn’t just a buzzword for Sony it’s a tool for empowerment and progress.

Market Growth and Future Prospects

The IP tokenization market is set to flourish, driven by the increasing recognition of intellectual property as a valuable asset class and the need for more efficient monetization mechanisms. As the digital economy expands, the importance of intellectual property grows, positioning tokenization as a crucial tool for enabling creators to capitalize on their innovations and fostering a more dynamic and accessible IP market.

5. Commodities

Tokenizing commodities like gold, oil, and silver is gaining significant traction, with the tokenized commodities market projected to reach $20 billion by 2025.

Digitizing Physical Commodities

Tokenizing commodities involves creating digital tokens that represent physical assets such as gold bars, oil reserves, or silver. These tokens are backed by the actual commodity, providing a secure and tradable digital representation. Each token typically corresponds to a specific quantity of the commodity, ensuring that the digital token retains its value relative to the physical asset.

Advantages for Trading and Storage

Asset tokenization offers numerous advantages, including cost reduction, improved liquidity, and simplified storage. By tokenizing commodities, trading costs can be reduced by up to 30%, making it more economical for investors. Digital tokens can be traded more easily and quickly than physical commodities, enhancing market liquidity and allowing for more flexible investment strategies. Additionally, tokenization eliminates the need for physical storage, as ownership is tracked digitally on the blockchain, reducing logistical challenges and associated costs.

Market Implications

Tokenization increases accessibility, making commodities accessible to a broader range of investors, including those who may not have the means to invest in large quantities. Blockchain’s immutable ledger enhances price transparency and reduces the risk of market manipulation, ensuring fair pricing and reducing information asymmetry in the commodity markets.

Royal Mint Gold (RMG): Turning Heavy Gold into Digital Wealth

Imagine owning gold without the hassle of vaults, security, or logistics. That’s exactly what the Royal Mint set out to achieve with Royal Mint Gold (RMG). By tokenizing gold reserves, the UK’s Royal Mint offered a revolutionary way to own and trade physical gold securely, transparently, and digitally.

Each RMG token represented one gram of physical gold stored in the Royal Mint’s highly secure vaults. Investors could seamlessly buy, sell, or trade their holdings on blockchain platforms, enjoying the age-old value of gold without the burdens of physical storage. This move brought a fresh wave of liquidity to the gold market, making it accessible to global investors at the click of a button.

While the project faced regulatory and partnership challenges that eventually led to its closure, RMG left a lasting mark on the financial world. It demonstrated how digital tokens could unlock the potential of traditional assets, inspiring similar ventures worldwide.

Gold bars may be heavy, but their digital tokens are weightless, global, and a glimpse into the future of asset investment. The RMG case proves that innovation, even when met with obstacles, sparks ideas that continue to transform industries.

Market Size and Future Prospects

With the tokenized commodities market expected to reach $20 billion by 2025, the sector is attracting considerable attention from both institutional and retail investors. The growth is driven by the need for more efficient and accessible trading mechanisms and the increasing acceptance of digital assets as legitimate investment vehicles.

Future Outlook

The future of commodity tokenization is promising, with continuous advancements in blockchain technology and increased regulatory clarity supporting market expansion. Innovations such as automated compliance and enhanced security measures will further bolster investor confidence and drive widespread adoption, positioning tokenized commodities as a vital component of the modern financial ecosystem.

6. Digital Assets

The tokenization of digital assets is a rapidly burgeoning sector, with the NFT market size expected to soar to $211.72 billion by 2030, growing at a CAGR of 34.2% from 2022 to 2030.

Tokenizing Digital Goods Such as Software Licenses and Digital Art (NFTs)

Digital asset tokenization involves creating digital tokens that represent ownership or usage rights of digital goods, including software licenses, digital art, and non-fungible tokens (NFTs). These tokens can be bought, sold, and traded on various blockchain platforms, providing a secure and verifiable means of transferring ownership and usage rights. This process enhances the value and marketability of digital assets by ensuring their uniqueness and authenticity.

Growth of the Digital Asset Market

The digital asset market, particularly NFTs, is experiencing explosive growth. The NFT market alone generated a trading volume of $17.7 billion in 2022, reflecting the massive demand for digital ownership. Beyond art, digital asset tokenization is expanding into gaming, virtual real estate, and other virtual experiences, enhancing user engagement and creating new revenue streams for creators and developers.

Security and Authenticity Benefits

Blockchain technology provides immutable proof of ownership, preventing unauthorized duplication and fraud. Each token is uniquely identifiable, ensuring that the owner’s rights are verifiable and protected. This transparency and security significantly enhance the value of digital assets in the market, making them more attractive to collectors and investors alike.

NBA Top Shot: Revolutionizing Fan Engagement Through Tokenization

In the world of sports, NBA Top Shot stands as a shining example of how tokenization can redefine fan experiences and create lucrative new markets. By turning iconic basketball highlights into collectible NFTs, NBA Top Shot tapped into the power of blockchain technology to transform sports memorabilia.

Launched by Dapper Labs in partnership with the NBA, Top Shot generated over $700 million in sales, showcasing the immense potential of tokenized digital assets. These NFTs offered fans a chance to own, trade, and cherish moments like legendary dunks and game-winning shots, all through a secure and transparent blockchain platform.

More than just a marketplace, NBA Top Shot revolutionized fan engagement. It blurred the lines between sports and technology, making digital collectibles mainstream while creating a new revenue stream for leagues and players. Fans didn’t just buy memorabilia they became part of a digital ecosystem, engaging with the sport in an entirely new way.

The success of NBA Top Shot highlights how tokenized digital assets are reshaping industries, proving that content can be more than just consumable it can be collectible, tradable, and timeless. It’s a clear signal that the future of fan interaction lies in the digital realm, powered by blockchain.

Market Growth and Future Prospects

With the NFT market projected to reach $211.72 billion by 2030, the digital asset sector is set to dominate the digital economy. The integration of tokenization with emerging technologies like augmented reality (AR), virtual reality (VR), and the metaverse will further enhance the utility and appeal of digital assets, fostering a more immersive and interactive digital experience.

Future Outlook

As technology evolves, digital asset tokenization will continue to integrate with other digital innovations, driving the expansion of virtual economies and digital marketplaces. The continued adoption of blockchain technology and the development of new use cases will sustain the growth trajectory of the digital asset market, positioning tokenized digital assets as a fundamental component of the future digital landscape.

7. Venture Capital and Private Equity

Tokenizing venture capital (VC) and private equity (PE) investments is democratizing access to high-growth opportunities, with the tokenized VC market projected to reach $1.5 trillion by 2025.

Tokenizing Investment Funds and Equity Stakes

Tokenizing VC and PE involves creating digital tokens that represent shares in investment funds or equity stakes in startups. These tokens can be traded on blockchain platforms, providing liquidity and fractional ownership. This innovation lowers the barriers to entry, allowing a broader range of investors to participate in high-growth investments that were previously accessible only to institutional investors and high-net-worth individuals.

Increased Accessibility for Smaller Investors

By lowering minimum investment amounts from millions to as little as thousands, tokenization makes VC and PE investments accessible to a wider audience. This inclusivity enables smaller investors to diversify their portfolios by holding tokens from multiple funds or startups, spreading their risk and increasing their potential returns.

Potential for Fractional Ownership

Fractional ownership allows investors to buy and sell smaller shares of high-value assets, enhancing market liquidity and making it easier for investors to enter and exit positions. This democratization attracts a larger pool of investors, including retail investors who were previously excluded from high-entry-barrier investments, fostering a more inclusive investment environment.

SPiCE VC: Pioneering Tokenized Venture Capital

SPiCE VC broke new ground by launching one of the first tokenized venture capital (VC) funds, proving that innovation isn’t just for startups it’s for the way we fund them, too. By leveraging blockchain technology, SPiCE VC opened the exclusive world of venture capital to smaller investors, making it more accessible and inclusive.

This tokenized fund allowed investors to hold digital tokens representing their stake, creating liquidity in a traditionally illiquid market. It not only broadened the investor base but also provided startups with an innovative avenue for raising capital. With tokenization, SPiCE VC showcased how blockchain could transform venture capital and private equity markets, offering greater transparency and efficiency.

SPiCE VC’s success highlights a major shift in venture funding: decentralization. By lowering barriers to entry, tokenized VC funds empower smaller investors to participate in high-growth opportunities once reserved for a select few. It’s a step toward a more inclusive financial future, where anyone can back the next big idea.

The future of venture funding isn’t just digital it’s decentralized, transparent, and built for everyone. SPiCE VC is leading the charge, proving that tokenization is more than a trend; it’s a revolution.

Market Size and Future Prospects

With the tokenized VC market projected to reach $1.5 trillion by 2025, the sector is poised for rapid expansion. The increased accessibility and liquidity offered by tokenization are key drivers of this growth, attracting both institutional and retail investors and positioning tokenized VC and PE as pivotal elements of the future investment landscape.

Future Outlook

The future of venture capital and private equity tokenization looks promising, with continued advancements in blockchain technology and supportive regulatory frameworks facilitating market growth. Innovations such as decentralized investment platforms and automated fund management will further enhance the efficiency and appeal of tokenized VC and PE investments, driving their adoption and integration into mainstream financial practices.

8. Infrastructure and Utilities

Tokenizing infrastructure projects and utility services is creating new funding and investment opportunities, with the tokenized infrastructure market expected to reach $544 billion by 2026.

Tokenizing Infrastructure Projects and Utility Services

This involves creating digital tokens that represent ownership or investment in large-scale infrastructure projects such as highways, ports, and utilities. These tokens can be used to raise funds, manage ownership, and distribute returns, facilitating the efficient allocation of capital towards essential infrastructure developments.

Funding and Investment Opportunities

Tokenization streamlines the fundraising process, reducing the time and costs associated with traditional methods. Smart contracts automate fund collection and distribution, enhancing efficiency and transparency. Additionally, tokenization enables infrastructure projects to attract investment from a global pool of investors, increasing funding sources and diversifying the investor base.

Long-Term Benefits

Blockchain technology ensures transparent and automatic distribution of revenues or profits to token holders, building trust and accountability among investors. Moreover, tokenization facilitates better tracking and management of project milestones and financials, enhancing oversight and operational efficiency in infrastructure projects.

Power Ledger: Tokenizing Renewable Energy for a Sustainable Tomorrow

Power Ledger is revolutionizing clean energy investment by tokenizing renewable energy assets like solar farms. This innovative approach allows fractional ownership, giving investors a transparent and accessible way to fund green initiatives while earning financial returns.

By leveraging blockchain technology, Power Ledger merges environmental impact with financial opportunity, democratizing access to renewable energy projects. It’s not just about profits it’s about empowering communities and promoting a sustainable future.

Investing in tomorrow’s cities has never been easier or more impactful. Power Ledger is leading the charge toward a greener, more inclusive energy market.

Market Size and Future Prospects

The tokenized infrastructure market is expected to reach $544 billion by 2026, driven by the increasing need for efficient funding mechanisms and the growing adoption of blockchain technology in large-scale projects. The integration of tokenization with infrastructure development is set to revolutionize how projects are financed, managed, and executed, fostering greater innovation and sustainability.

Future Outlook

As urbanization continues and the demand for infrastructure grows, tokenization will play a crucial role in financing and managing infrastructure projects. Innovations in smart contracts and decentralized finance (DeFi) will further enhance the efficiency and scalability of tokenized infrastructure investments, positioning blockchain technology as a fundamental tool in the modernization of global infrastructure.

9. Renewable Energy Assets

The tokenization of renewable energy projects is promoting sustainable investments, with the tokenized renewable energy market projected to reach $24 billion by 2025.

Tokenizing Renewable Energy Projects Like Solar Farms and Wind Turbines

This involves creating digital tokens that represent ownership or investment stakes in renewable energy projects such as solar farms, wind turbines, and other green initiatives. These tokens can be traded, providing liquidity and investment opportunities in the renewable energy sector, thereby supporting the growth and scalability of sustainable energy projects.

Promoting Sustainable Investments

Tokenization facilitates investment in clean energy, contributing to environmental sustainability and the fight against climate change. By enabling fractional ownership, it allows a broader range of investors to support and benefit from renewable energy projects. Additionally, tokenization offers investors the potential for stable returns from energy projects, backed by tangible assets and consistent revenue streams generated from energy production and sales.

Benefits for Investors and Projects

Tokenization lowers entry barriers for green energy participation, allowing smaller investments and broader investor participation. This provides renewable energy projects with a new avenue for raising capital, ensuring that they receive the necessary funding to scale and innovate. Moreover, blockchain’s transparency ensures clear tracking of energy production and revenue distribution, fostering trust and accountability among investors and stakeholders.

SolarCoin: Profiting from Renewable Energy, One Token at a Time

SolarCoin is redefining how we incentivize renewable energy by rewarding solar energy producers with digital tokens. These tokens, which are tradable on blockchain platforms, serve as both a financial incentive and a recognition of their contribution to a greener planet.

For every megawatt-hour of solar energy produced, participants earn SolarCoins, creating a dual benefit: supporting renewable energy initiatives while providing tangible rewards for producers. This approach promotes the adoption of solar infrastructure and accelerates the transition to clean energy.

With SolarCoin, profiting from solar energy doesn’t just benefit producers it benefits the planet. It’s a win-win model, proving that saving the environment and financial gain can go hand in hand.

Market Growth and Future Prospects

With the tokenized renewable energy market expected to reach $24 billion by 2025, the sector is set to benefit from the global push towards sustainability and the increasing attractiveness of renewable energy investments. The integration of tokenization with renewable energy projects enhances their scalability and impact, driving continued growth and innovation in the green energy sector.

Future Outlook

The future of renewable energy asset tokenization is bright, with ongoing advancements in blockchain technology and increasing regulatory support for green investments. Tokenization will play a pivotal role in accelerating the transition to renewable energy by providing efficient funding mechanisms and fostering greater investor participation, thereby driving the global shift towards sustainable energy solutions.

10. Personal Assets

Tokenizing personal assets such as vehicles, jewelry, and luxury goods is creating new liquidity options, with the tokenized luxury goods market expected to reach $4 billion by 2025.

Tokenizing Personal Assets

This process involves creating digital tokens that represent ownership or shares in personal assets like luxury cars, high-end jewelry, and designer goods. These tokens can be traded, providing liquidity and ownership transfer capabilities. By tokenizing personal assets, owners can unlock the value of their possessions without having to sell them outright, offering a flexible and efficient method to manage and monetize high-value personal items.

Enhancing Liquidity and Ownership Transfer

Tokenization facilitates easy collateralization, allowing personal assets to be used as collateral for loans by leveraging their tokenized versions. This provides owners with access to funds without relinquishing ownership. Additionally, tokenization streamlines the resale process, making it easier for owners to sell their assets without extensive paperwork. Smart contracts automate the transfer of ownership, reducing transaction times and costs.

Practical Applications

Fractional ownership allows multiple individuals to own shares of a single asset, reducing the cost burden and increasing accessibility. This is particularly beneficial for high-value personal assets like luxury cars and high-end jewelry, enabling more individuals to invest in and enjoy these items. Moreover, blockchain ensures the authenticity and provenance of luxury goods, significantly reducing the risk of counterfeit products and enhancing trust among buyers and sellers.

Breitling’s Blockchain Revolution: Digital Passports for Luxury Watches

In October 2020, Swiss watchmaker Breitling partnered with Arianee to introduce blockchain-based digital passports for all its new timepieces. This innovation allows owners to verify authenticity, track ownership, and access detailed information about their watches through a secure digital platform.

Each digital passport is linked to the watch’s serial number and warranty activation date, providing a tamper-proof record of its history. Owners can easily transfer this digital certificate during resale, ensuring transparency and trust in the secondary market.

By leveraging blockchain technology, Breitling enhances customer engagement and offers a seamless, secure experience for luxury watch enthusiasts. This move sets a new standard in the industry, combining traditional craftsmanship with cutting-edge digital solutions.

Your luxury watch now comes with a blockchain-backed digital passport, merging timeless elegance with modern innovation.

Market Size and Future Prospects

With the tokenized luxury goods market expected to reach $4 billion by 2025, the sector is gaining momentum as consumers seek more secure and efficient ways to manage and trade their high-value personal assets. The increasing adoption of blockchain technology for authenticity verification and ownership tracking is driving market growth, positioning tokenized personal assets as a significant segment in the digital asset ecosystem.

Future Outlook

As consumer trust in blockchain technology grows, the tokenization of personal assets will become more prevalent. Innovations in digital identity verification and enhanced smart contract functionalities will further streamline the process, making it easier for individuals to tokenize and manage their personal assets. The integration of augmented reality (AR) and virtual reality (VR) with tokenized personal assets will also enhance the user experience, driving continued adoption and market expansion.

Benefits of Asset Tokenization

Asset tokenization offers a plethora of benefits that are fundamentally transforming the financial landscape. These advantages not only enhance the efficiency and accessibility of investments but also democratize ownership across various asset classes.

Enhanced Liquidity

By converting assets into digital tokens, traditionally illiquid assets become more liquid, allowing for easier buying and selling. This liquidity unlocks value that was previously trapped in long-term investments, providing investors with the flexibility to enter and exit positions with greater ease.

Fractional Ownership

Tokenization enables investors to own a fraction of high-value assets, democratizing access to investments that were previously out of reach. Fractional ownership allows for greater diversification within investment portfolios, reducing risk and increasing potential returns.

Transparency and Security

Blockchain technology ensures that all transactions are transparent, immutable, and secure, reducing fraud and enhancing trust among market participants. Each token’s history is recorded on the blockchain, providing a clear and verifiable ownership trail that enhances accountability and integrity.

Cost Efficiency

By eliminating the need for intermediaries, asset tokenization significantly lowers transaction fees, making trading more cost-effective. Smart contracts automate processes, reducing the reliance on traditional financial institutions and streamlining operations.

Global Accessibility

Tokenized assets can be accessed and traded by a global audience, breaking down geographical barriers and expanding market reach. This global accessibility increases the potential investor base and enhances market efficiency, fostering a more inclusive financial ecosystem.

Rapid Settlement Times

Transactions can be settled in near real-time, enhancing the efficiency of trading and reducing the time between investment and returns. Faster settlement times improve liquidity and investor satisfaction, making asset tokenization a more attractive investment vehicle.

Improved Portfolio Diversification

Investors can diversify their portfolios more easily by accessing a wider range of asset classes and investment opportunities. Tokenization enables seamless investment across different sectors and geographic regions, leading to a more robust and resilient investment strategy.

Automated Compliance

Smart contracts can be programmed to automatically enforce regulatory compliance, ensuring that all transactions adhere to relevant laws and standards. This automation reduces the risk of non-compliance and enhances regulatory oversight, providing a secure and trustworthy investment environment.

Market Efficiency

By leveraging blockchain technology, asset tokenization streamlines the trading process, reducing delays and inefficiencies inherent in traditional markets. This leads to a more dynamic and responsive financial ecosystem, capable of adapting to the evolving needs of investors and market conditions.

Asset tokenization transforms assets into universally accessible financial opportunities, fostering a more inclusive and efficient financial landscape.

Challenges and Considerations

While asset tokenization presents numerous benefits, it also comes with its own set of challenges that must be addressed to ensure successful implementation and widespread adoption.

Regulatory Compliance

Navigating the complex landscape of global regulations is crucial to ensure that tokenized assets comply with local and international laws. Different countries have varying regulations regarding digital assets, securities, and blockchain technology, necessitating a thorough understanding and adherence to these legal frameworks. Ensuring compliance with securities laws is paramount to protect investors and maintain market integrity. Developing clear legal frameworks for token ownership, transfer, and dispute resolution is essential to avoid legal ambiguities and foster trust among market participants.

Technological Infrastructure

A robust and secure blockchain infrastructure is necessary to support tokenization processes and ensure the integrity of transactions. Scalability issues must be addressed to ensure that blockchain platforms can handle high volumes of transactions without compromising speed or security. Additionally, seamlessly integrating tokenization platforms with existing financial and management systems can be technically challenging, requiring sophisticated technological solutions and expertise.

Market Acceptance

Educating investors, businesses, and regulators about the benefits and functionalities of tokenization is crucial for widespread adoption. Misconceptions and lack of understanding can hinder market growth, making awareness and education key components of successful tokenization initiatives. Building trust in the technology and its applications is necessary to encourage market participants to embrace tokenization, overcoming resistance to change and fostering a culture open to digital transformations in asset management.

Security Concerns

Protecting tokenized assets from hacking, theft, and other cyber threats is paramount to maintain investor confidence. Implementing robust cybersecurity measures and regularly auditing smart contracts to prevent vulnerabilities are essential steps in safeguarding digital tokens. Ensuring data privacy and compliance with data protection regulations is also critical to protect sensitive information related to tokenized assets and transactions, thereby maintaining the integrity and security of the tokenized ecosystem.

Overcoming these hurdles is key to unlocking the full potential of asset tokenization.

Expert Insights: Unlocking Opportunities in Tokenization

Navigating the tokenization landscape requires strategic planning, informed decision-making, and a solid understanding of the process. Below are key insights and actionable strategies to ensure success:

Start Small

Begin by tokenizing low-risk or straightforward assets to understand the process and overcome initial challenges. Starting on a smaller scale helps refine your strategy and build confidence for larger, more complex tokenization projects.

Educate Stakeholders

Inform stakeholders, including investors, partners, and regulators, about the benefits and mechanics of tokenization. Clear communication builds trust and ensures that all parties understand how the process works and how they can benefit.

Leverage Reliable Platforms

Collaborate with established blockchain platforms like Ethereum or Binance Smart Chain to ensure secure and seamless implementation. Trusted platforms bring the necessary technical expertise and infrastructure to support successful tokenization projects.

Prioritize Transparency and Security

Maintain transparency in all transactions by leveraging blockchain’s immutable ledger. Robust security measures, including regular audits and encrypted smart contracts, safeguard assets and ensure trust among stakeholders.

Stay Agile and Compliant

The regulatory landscape for tokenization is evolving rapidly. Staying informed and adaptable ensures compliance with current regulations and prepares for future changes. Agile strategies help businesses remain competitive in this fast-changing environment.

Partner with Experts

Working with experienced tokenization consultants like Tokenova can streamline the process, ensuring legal compliance and strategic alignment. Expertise in both finance and technology is crucial for navigating complex tokenization challenges effectively.

By implementing these insights, businesses can unlock the transformative potential of tokenization, positioning themselves as leaders in the digital economy.

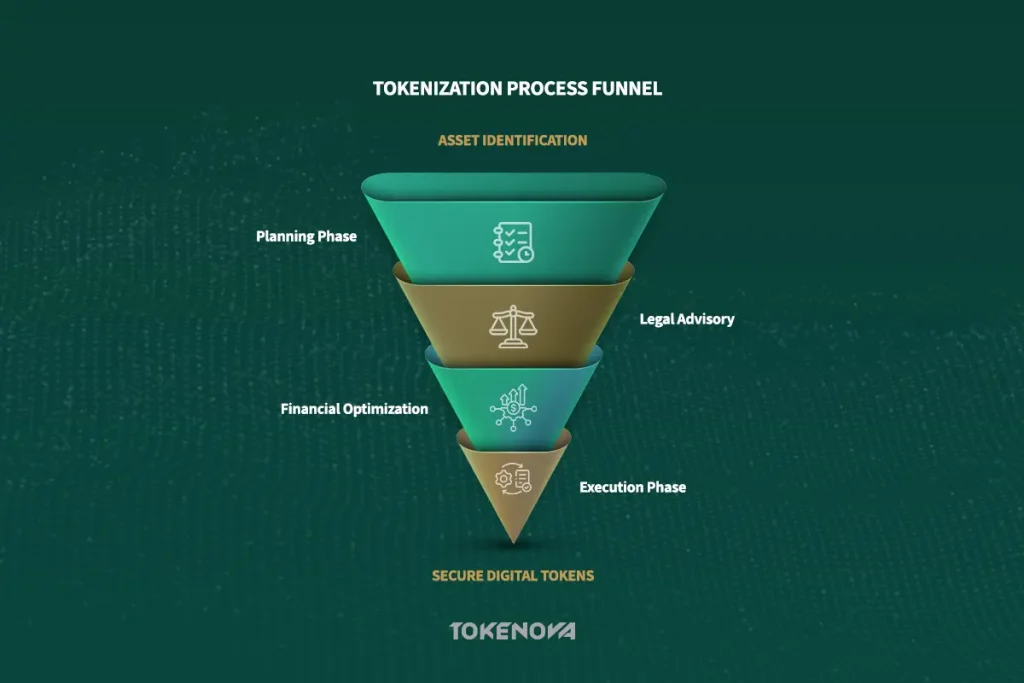

Tokenova Services: Your Trusted Tokenization Partner

Tokenova is a leading consultancy firm specializing in the tokenization of real-world assets. With expertise in both finance and blockchain technology, Tokenova provides tailored solutions to help businesses transform their assets into secure, tradable digital tokens.

Our Expertise

- Comprehensive Tokenization Solutions: From planning to execution, Tokenova ensures a seamless tokenization process.

- Legal and Financial Advisory: Expert guidance to navigate regulatory requirements and optimize financial outcomes.

- Industry-Specific Strategies: Customized approaches designed for industries such as real estate, art, and renewable energy.

Why Choose Tokenova

With a proven track record and commitment to client success, Tokenova delivers efficient, secure, and scalable tokenization services. Whether you’re new to tokenization or expanding your digital asset portfolio, Tokenova is your trusted partner.

Contact Tokenova today and unlock the future of finance through asset tokenization.

Conclusion

Asset tokenization is not merely a technological trend; it represents a fundamental shift in how we manage, invest in, and perceive ownership of assets. From real estate and financial instruments to art and renewable energy projects, the possibilities are vast and continuously expanding. The benefits of tokenization such as increased liquidity, fractional ownership, enhanced transparency, and reduced transaction costs are transforming traditional markets and democratizing access to investment opportunities.

As the financial landscape evolves, overcoming challenges like regulatory compliance, technological infrastructure, and market acceptance will be crucial for the widespread adoption of tokenization. However, the success stories of projects like St. Regis Aspen Resort, BlackRock’s tokenized fund, and NBA Top Shot demonstrate the immense potential and tangible benefits of this innovation.

Looking ahead, the future of asset tokenization appears bright, with emerging trends pointing towards greater integration with decentralized finance (DeFi), the expansion of digital asset ecosystems, and the continual evolution of regulatory frameworks to support this new paradigm. Businesses and investors who embrace tokenization now will be well-positioned to capitalize on the transformative opportunities it offers, driving the next wave of financial innovation.

Tokenization is revolutionizing the financial world, making investments more inclusive, transparent, and efficient.

Key Takeaways

- Real Estate, Financial Instruments, and Art are leading the tokenization wave, offering enhanced liquidity and accessibility.

- The benefits of asset tokenization include increased liquidity, fractional ownership, enhanced transparency, reduced transaction costs, and global accessibility.

- Case Studies like St. Regis Aspen Resort, BlackRock, and NBA Top Shot highlight real-world successes and the transformative potential of tokenization.

- Challenges such as regulatory compliance, technological infrastructure, market acceptance, and security concerns need to be addressed to fully unlock tokenization’s potential.

- Tokenova offers expert consultancy services, providing comprehensive tokenization solutions, legal and financial advisory, and industry-specific strategies to help businesses navigate the tokenized economy.

- Future Outlook suggests continued growth and integration of tokenization across various asset classes, driven by technological advancements and evolving regulatory landscapes.

What types of businesses benefit most from tokenization?

Industries such as real estate, art, renewable energy, and venture capital benefit significantly from tokenization by attracting a wider investor base and enhancing liquidity. Tokenization allows these sectors to access global markets, streamline transactions, and offer fractional ownership, making high-value assets more accessible to a broader range of investors. By democratizing access to investments, businesses in these industries can expand their funding sources and foster greater innovation and growth.

How does tokenization ensure security?

Tokenization leverages blockchain technology, which provides a decentralized and immutable ledger for transactions. This ensures that ownership records are tamper-proof and transparent, significantly reducing the risk of fraud. Additionally, advanced encryption techniques and secure smart contracts safeguard digital tokens from unauthorized access and cyber threats. Regular security audits and adherence to best practices in blockchain security further enhance the protection of tokenized assets, ensuring their integrity and reliability.

Is tokenization accessible to small investors?

Yes, tokenization lowers entry barriers, enabling smaller investors to participate in high-value markets like real estate and venture capital. By allowing fractional ownership, investors can buy smaller shares of assets that were previously inaccessible due to high costs, thus democratizing investment opportunities and fostering greater financial inclusion. This accessibility allows a more diverse range of investors to participate in various asset classes, promoting a more balanced and inclusive investment ecosystem.