In today’s fast-evolving financial landscape, digital assets and blockchain technology have given rise to a novel breed of financial institutions. But what is a Crypto Bank? Simply put, a crypto bank is a financial institution that merges traditional banking services with the innovative world of cryptocurrencies and blockchain technology. In this article, we delve into the details to cover crypto banks’ features, benefits, risks, and future prospects while exploring the underlying principles that make them unique.

The Emergence of Crypto Banks

The rise of cryptocurrencies such as Bitcoin and Ethereum has challenged traditional banking, paving the way for new models of financial services. Crypto banks have emerged to provide services similar to those of conventional banks—like deposits, loans, and payments—while harnessing the power of decentralized finance (DeFi) and blockchain technology. As more people invest in digital assets, understanding Crypto Banks becomes essential for anyone exploring new financial opportunities.

Read More: Tokenization in DeFi

How do crypto banks work?

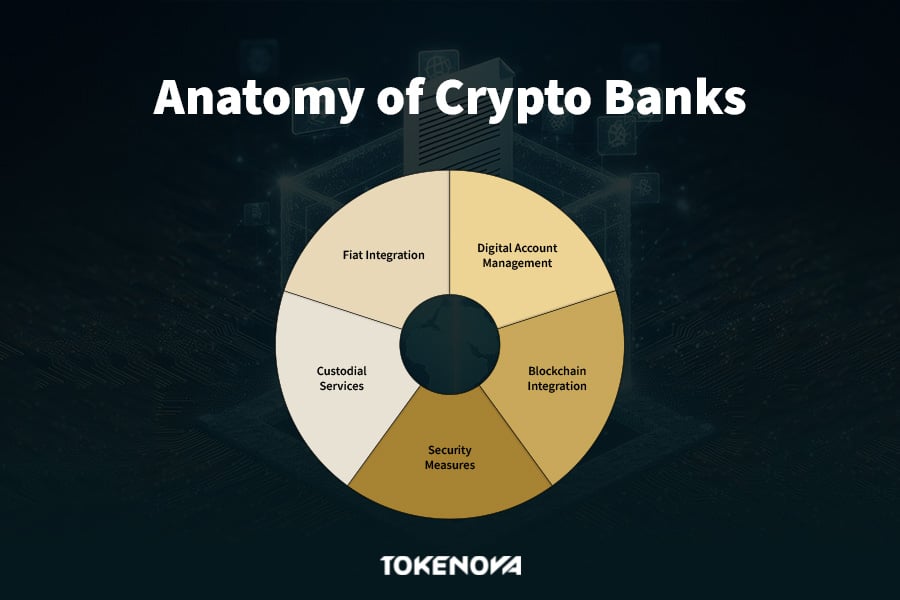

At their core, crypto banks integrate blockchain technology with traditional banking frameworks. Here is an overview of their underlying mechanics:

Digital Account Management

Just like traditional banks, crypto banks maintain digital accounts for customers. These accounts are designed to hold both cryptocurrencies and fiat money, providing users with a unified platform for managing their assets. The goal is to make it as simple as possible for users to view their holdings, execute transactions, and monitor account activity through user-friendly interfaces.

Integration of Blockchain Technology

Blockchain is the backbone of crypto banks. Every transaction is recorded on a decentralized ledger, ensuring transparency and security. By eliminating multiple intermediaries, blockchain technology allows for faster and more cost-effective transactions. Users can track their transactions on a public ledger, fostering trust and transparency in the process.

Read More: Blockchain Governance: Building Trust and Transparency

Security Measures

Security is a top priority for crypto banks. These institutions employ advanced measures such as multi-factor authentication, encryption, and cold storage for digital assets. Many of these banks also enforce identity verification protocols (KYC/AML), which help maintain compliance with global regulations. This rigorous approach to security reassures users that their digital assets are safeguarded against potential cyber threats.

Read More: Tokenization in Cyber Security: A Comprehensive Guide

Custodial and Non-Custodial Services

Crypto banks may offer both custodial and non-custodial solutions. In a custodial model, the bank holds the private keys for users, simplifying asset management and reducing the technical burden on the customer. In contrast, non-custodial services allow users to maintain control of their private keys, offering greater autonomy at the expense of convenience. Each method has its advantages, and users can choose based on their comfort level with managing security personally.

Fiat Integration

One major challenge in the digital asset space has been the seamless integration of fiat currency. Crypto banks address this by enabling easy conversion between digital assets and traditional money. Whether buying, selling, or trading cryptocurrencies, these institutions provide integrated exchange platforms that answer the question, how do crypto banks work with both asset classes.

Features and Services Offered

To fully grasp what a Crypto Bank is, it is important to explore the array of services they provide. These institutions often offer a blend of traditional and innovative products, including:

Interest-Bearing Savings Accounts

One of the attractive features of these banks is the ability to open savings accounts that earn interest on digital assets. Unlike traditional savings accounts that often yield minimal interest, these platforms may offer significantly higher returns through mechanisms such as staking, lending, or participation in decentralized finance (DeFi) projects. This service is particularly appealing for investors looking to grow their wealth passively while holding on to their digital assets.

🔥 Note: Current crypto savings accounts typically offer interest rates ranging from 0.5% to 15% APY, with some platforms like Nexo offering up to 14% APY and Coinbase offering up to 4.10% APY. The rates vary significantly based on the cryptocurrency and platform used.

Crypto-Backed Loans

For those seeking liquidity without having to sell their digital assets, crypto-backed loans provide a viable solution. Customers can secure loans by using their cryptocurrencies as collateral. The process is similar to taking out a conventional loan, but it leverages the value of digital assets. This allows users to access cash while still retaining their investment positions, an option that has gained popularity among crypto enthusiasts.

Read More: DeFi Loan Mechanisms: Crypto Lending Explained

Integrated Trading Platforms

Many crypto banks include built-in trading platforms, allowing users to convert between cryptocurrencies and fiat currencies effortlessly. These platforms offer real-time market data and streamlined interfaces, enabling quick and efficient transactions. The convenience of having trading tools integrated directly into the banking platform is a major draw for those who regularly manage diverse asset portfolios.

Read More: How to Build a Crypto Exchange: The Ultimate 2025 Blueprint for Success

Payment Solutions and Debit Cards

Innovative payment solutions, such as crypto debit cards, bridge the gap between digital and physical economies. These cards enable users to spend cryptocurrencies at everyday merchants by converting crypto to fiat at the point of sale.

Read More: Tokenization in Payments: A Comprehensive Guide for Secure Transactions

Benefits of Crypto Banks

Crypto banks offer several advantages over traditional banking, making them an attractive option for a growing segment of users.

- Enhanced Financial Inclusion

Crypto banks provide global access to financial services, removing traditional geographical barriers. With only an internet connection, anyone can open an account and manage their assets, which is particularly beneficial in regions with underdeveloped banking infrastructure. This inclusivity helps empower individuals who may not have access to conventional financial services.

- Higher Yields

Traditional banks typically offer low interest rates on deposits, while crypto banks can generate higher yields by leveraging decentralized financial mechanisms. Through lending, staking, and other DeFi activities, these platforms often pass on higher returns to their customers. This advantage is especially attractive to investors who are looking to make the most out of their savings.

- Lower Transaction Costs

The efficiency of blockchain technology often translates into lower transaction fees. By eliminating many intermediaries, crypto banks can reduce the cost associated with transfers, especially cross-border payments. This cost reduction makes it easier for users to manage and move funds without the burden of high fees.

- Transparency and Security

Blockchain’s inherent transparency ensures that all transactions are recorded on a public ledger, which can be independently verified by users. Combined with robust security measures, this transparency builds a strong foundation of trust. Users have full visibility into how their transactions are processed, providing an added layer of security and accountability.

- 24/7 Accessibility

Unlike traditional banks with fixed operating hours, crypto banks operate around the clock. This continuous availability allows users to transact at any time, catering to a global audience. This flexibility reinforces Crypto Banks as modern, accessible financial institutions and illustrates how they work in a digital age where time zones and banking hours are no longer limitations.

Challenges and Risks

While crypto banks are promising, they also come with unique challenges that potential users must consider.

Regulatory Uncertainty

The legal framework for cryptocurrencies and crypto banks is still developing in many parts of the world. Regulatory environments can vary significantly between jurisdictions, creating uncertainty about long-term stability and compliance. As governments continue to adapt to the new digital economy, users should remain aware of potential regulatory changes that could impact these institutions.

Read More: Asset Tokenization Regulation: Navigating Compliance in 2025

Cybersecurity Threats

While robust security measures are in place, the digital nature of cryptocurrencies makes them an attractive target for cybercriminals. According to Chainalysis, crypto-related crimes reached significant levels in 2024, highlighting the importance of continuous vigilance and investment in cybersecurity. Users must remain informed about the security protocols of their chosen institution and adopt best practices to protect their personal information.

Market Volatility

The value of digital assets is known to fluctuate widely. While high returns are possible, significant losses can also occur during market downturns. The inherent volatility of cryptocurrencies means that the value of assets held within a crypto bank can change rapidly. Investors should carefully consider their risk tolerance and be prepared for the possibility of rapid market shifts.

Limited Consumer Protection

Unlike traditional banks that offer government-backed deposit insurance through institutions like the FDIC, many crypto banks do not provide the same level of consumer protection. This lack of insurance means that, in the event of a failure or breach, users may not be reimbursed.

Addressing Common Concerns

Despite their advantages, crypto banks often face skepticism. Here, we address several common concerns:

Regulatory Compliance

Critics often point to the lack of established regulations for digital assets. In practice, reputable crypto banks implement strict KYC/AML standards and work within existing legal frameworks to maintain compliance. This adherence to regulation is essential for building trust and ensuring that these institutions can operate in a stable environment.

Security and Risk Management

While cybersecurity is a major concern, many crypto banks invest heavily in advanced security protocols, such as cold storage, multi-factor authentication, and continuous monitoring. These measures help mitigate the risks associated with digital asset management, even though no system is entirely immune to threats.

Read More: Your Ultimate Guide to Smart Contract Security

User-Friendliness

Another concern is the perceived complexity of managing digital assets. However, many crypto banks have developed intuitive interfaces that simplify the user experience. By abstracting the technical details, they provide a smooth transition for those new to digital finance.

Broader Impact on the Financial Ecosystem

Crypto banks are not designed to replace traditional banks entirely. Instead, they serve as a complementary model that leverages blockchain technology to enhance financial services. By increasing competition, they encourage traditional banks to innovate and adapt.

The borderless nature of crypto banks also revolutionizes international transactions, significantly reducing fees and processing times. Their round-the-clock availability and digital-first approach make them attractive options in a globalized financial ecosystem.

Read More: Tokenization in Banking: Transforming the Financial Landscape

Conclusion

A Crypto Bank is a financial institution that combines traditional banking with blockchain technology, offering services like savings accounts, loans, trading platforms, and payment solutions. They enhance financial inclusion, provide higher yields, and offer lower transaction fees, accessible 24/7. However, challenges such as regulatory uncertainty, security risks, market volatility, and limited consumer protection remain. As regulations develop and technology advances, the future of crypto banking looks promising. Understanding what a Crypto Bank is and how it operates is crucial for navigating the evolving financial landscape.