Is the stock market about to be revolutionized? It just might be, thanks to tokenization of stocks. But what is this process really? Forget outdated systems imagine owning and trading equity in a more accessible, secure, and efficient digital ecosystem. This is the future of investing, and it’s closer than you think.

Imagine investment possibilities previously out of reach now becoming accessible. Tokenization achieves precisely this by transforming real-world assets (RWAs) into divisible digital tokens on the blockchain. This breakthrough democratizes market access, boosts efficiency, and unlocks exciting new opportunities for investors at every level.

In this guide, we’ll demystify the core ideas behind tokenization, reveal the power of blockchain driving this financial evolution, and assess both the real advantages and potential challenges of tokenized stocks. Critically, we will also guide you on where to buy these stocks and explore compelling real-world examples that demonstrate its transformative potential. Prepare to discover actionable insights and position yourself at the leading edge of the digital economy.

Understanding Stock Tokenization

When we delve into the tokenized stocks meaning, we’re uncovering a modern digital evolution of traditional equity. These digital tokens are not merely electronic records; they are a fundamental reimagining of ownership. Unlike traditional paper stock certificates or even electronic records managed by centralized institutions, tokenized stocks operate on decentralized platforms.

This decentralization is key, offering transaction capabilities that are near-instantaneous and far more efficient than legacy systems. This enhanced efficiency not only streamlines the trading process but also significantly broadens access to investment opportunities, especially those that were once the exclusive domain of institutional investors and high-net-worth individuals. By making investments more accessible, tokenization is paving the way for a more democratic and inclusive financial future.

In fact, the tokenized asset market is projected to reach $10.9 trillion by 2030, highlighting the growing confidence in this technology.

Furthermore, digitizing ownership through tokenization unlocks innovative features like fractional ownership. This is a game-changer, especially for investing in high-value stocks. Fractional ownership allows investors to purchase portions of a single share, dramatically lowering the barrier to entry. This innovation broadens market participation to a wider spectrum of investors, making it feasible to invest in companies with high stock values, previously requiring substantial capital, even with limited funds, thanks to tokenized stocks. This increased accessibility is a key driver in the expanding appeal of tokenization of stocks and bonds.

The Mechanics of Stock Tokenization

For anyone considering venturing into this innovative financial space, understanding the mechanics of tokenization is essential. The process of transforming traditional stocks into digital tokens, ready for trading on modern platforms, is underpinned by robust blockchain technology. This section breaks down the key components and steps involved in making traditional assets tradeable in the digital realm.

Blockchain and Smart Contracts Powering Tokenization

Blockchain is the bedrock of tokenization, providing a revolutionary infrastructure for secure and transparent transactions. It functions as a distributed ledger technology, meticulously recording every transaction across a decentralized network of computers. This eliminates the need for a central authority, enhancing security and reducing points of failure.

Crucially, each tokenized stock is governed by smart contracts. These are not just legal agreements; they are self-executing contracts where the terms of agreement are directly written into code. Smart contracts are designed to automatically execute transactions and rigorously enforce compliance with predefined rules. This automation and enforcement are pivotal in ensuring that all operations related to tokenized stocks are not only transparent but also inherently tamper-proof.

The use of blockchain technology ensures that once a tokenized stock is issued, its ownership and transaction history are immutably recorded. This provides a level of security and trust that significantly surpasses traditional systems, where records can be more vulnerable to alteration or loss. This inherent security and transparency are among the most compelling advantages of tokenization in the financial markets.

The Tokenization Process

The journey of tokenization, from initial valuation to market listing, encompasses several well-defined stages, each vital to the ultimate digital transformation of stocks. For a more detailed overview, you can refer to this comprehensive guide: Asset Tokenization Process: Transforming Finance for the Future.

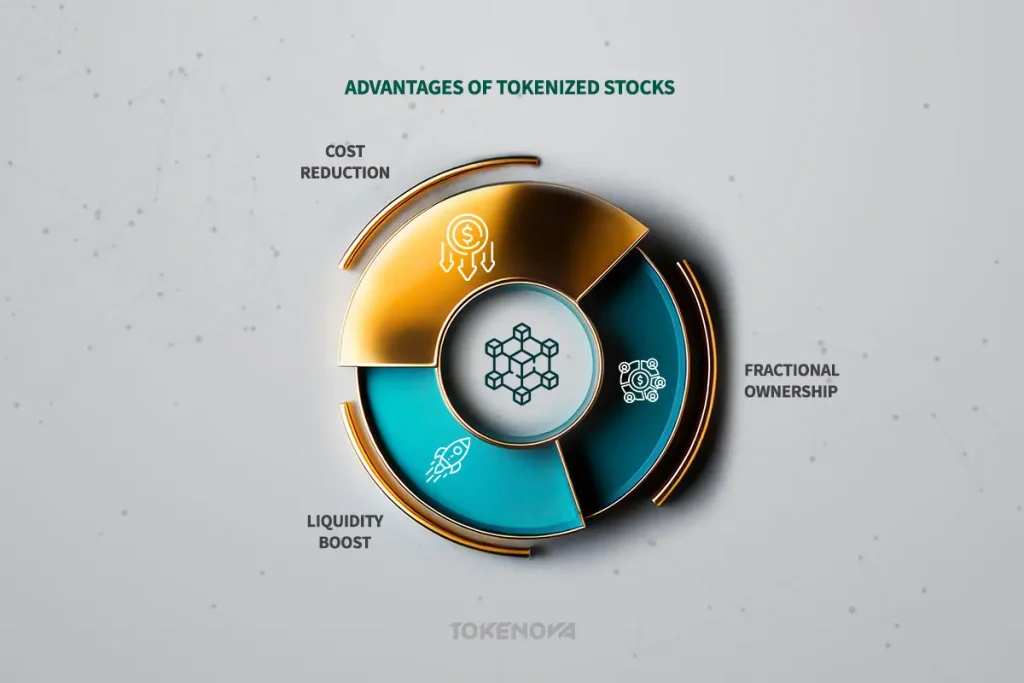

Key Advantages of Tokenized Stocks

Tokenized stocks are not just a digital version of traditional stocks; they represent a significant upgrade and offer a plethora of advantages that appeal to the modern investor. These benefits extend beyond mere digital convenience, fundamentally reshaping the landscape of investment opportunities and offering tangible improvements in market dynamics.

Fractional Ownership and Enhanced Market Entry

One of the most compelling features of tokenized stocks is the concept of fractional ownership. Traditionally, investing in high-growth or blue-chip companies often required a substantial capital outlay, effectively creating a barrier to entry for many potential investors.

Tokenization of stocks shatters this barrier by enabling fractional ownership. Investors can now purchase just a fraction of a share, making it possible to invest in premium assets with significantly less capital. This democratization of investment access is profound, particularly for younger investors or those with limited funds, allowing them to enter markets previously considered out of reach.

This increased accessibility is not just about lower costs; it’s about strategic portfolio diversification. With tokenized stocks, investors can more effectively spread their investments across various companies and sectors, reducing risk and optimizing returns. For instance, instead of needing thousands of dollars to buy a single share of a high-value stock, investors can allocate smaller amounts across a range of tokenized assets, creating a more balanced and resilient investment portfolio.

Liquidity Boost and 24/7 Global Trading

Tokenized stocks operate on digital platforms that are active 24 hours a day, 7 days a week. This always-on trading environment represents a stark contrast to traditional stock exchanges, which are bound by geographical locations and operating hours. This continuous availability of trading opportunities is a game-changer for liquidity. Enhanced liquidity means that investors can execute trades faster and more efficiently, at any time, from anywhere in the world. This is particularly beneficial in volatile markets, where the ability to react quickly to market changes is crucial.

Furthermore, global market access inherent in tokenized stocks breaks down geographical barriers that have historically restricted investment opportunities. Anyone with an internet connection can participate in these markets, fostering a more inclusive and globally interconnected investment ecosystem.

Cost Reduction and Rapid Settlements

The traditional stock trading ecosystem involves a complex web of intermediaries, including brokers, clearinghouses, and depositories. Each intermediary adds to the overall transaction costs and extends settlement times. The tokenization of stocks fundamentally alters this landscape by removing many of these intermediaries. Blockchain-based transactions operate on a peer-to-peer basis, significantly reducing the need for middlemen.

This disintermediation directly translates to lower transaction fees for investors. Moreover, the settlement process for tokenized stocks is dramatically faster. Traditional stock trades can take several days to settle, whereas blockchain-based trades often settle in near-real-time, typically within minutes. This efficiency not only reduces costs but also minimizes the risks associated with settlement delays and potential errors, making the entire trading process more streamlined and cost-effective.

Navigating the Tokenized Stock Market

As the concept of tokenization moves from theoretical to practical application, numerous platforms are now available that facilitate the trading of tokenized stocks. These platforms are specifically engineered to be user-centric, highly secure, and fully compliant with evolving regulatory standards. This makes them increasingly accessible to a diverse spectrum of investors, from seasoned traders to those new to the digital asset space.

Leading Platforms for Tokenized Stock Trading

For investors specifically seeking platforms dedicated to tokenized stocks, focusing on tokenized equities and security tokens, a few specialized platforms stand out. These platforms often prioritize regulatory compliance and offer a more focused environment for trading tokenized securities:

tZERO: tZERO is a technology firm that focuses on the innovation and trading of security tokens. Their platform, the tZERO ATS, is an SEC-registered broker-dealer and Alternative Trading System (ATS) specifically designed for trading security tokens, including tokenized stocks. tZERO emphasizes regulatory compliance and aims to provide a transparent and regulated marketplace for these assets.They offer trading in a select number of tokenized securities, primarily focused on private company stocks and real estate-backed security tokens.

Securitize Markets: Securitize operates a registered ATS, Securitize Markets, which is designed for trading security tokens. While Securitize is known for its tokenization services across various asset classes, their trading platform, Securitize Markets, does facilitate the secondary trading of tokenized stocks and bonds that have been issued through their platform or are compliant with their standards. They focus on providing liquidity and a regulated trading environment for security tokens.

MERJ Exchange: MERJ Exchange is a regulated securities exchange based in Seychelles that lists and facilitates the trading of tokenized securities, including tokenized stocks. MERJ operates under a securities exchange license and focuses on international listings and trading of tokenized assets. MERJ Exchange is a regulated exchange for security tokens. They offer a platform for companies to issue and list tokenized equities and other securities in a regulated environment, catering to a global investor base.

ADDX (formerly iSTOX): ADDX, formerly known as iSTOX, is a Singapore-based platform that focuses on offering private market investments, including tokenized stocks of private companies, as well as other asset classes like bonds and funds. ADDX operates under regulatory supervision from the Monetary Authority of Singapore (MAS). They provide access to fractional ownership in private equity, venture capital, and other alternative investments through tokenization, including shares of private companies.

Important Considerations for Specialized Platforms:

- Liquidity: Liquidity on specialized security token platforms may be lower compared to large general crypto exchanges.

- Regulatory Compliance: These platforms generally prioritize regulatory compliance, offering a more secure and regulated environment.

- Asset Selection: The range of tokenized stocks available might be more limited, focusing on specific types like private company equities or regulated security tokens.

- Investor Eligibility: Some platforms may have stricter investor eligibility requirements due to security token regulations.

Getting Started with Tokenized Stocks: Essential Steps

Embarking on the journey of investing in tokenized stocks involves a series of straightforward steps, designed to ensure a secure and compliant entry into this exciting market:

- Setting Up a Digital Wallet: The first essential step is to establish a secure digital wallet. This wallet will serve as your personal vault for storing and managing your tokenized stocks. When choosing a digital wallet, prioritize those that offer robust security features. Key features to look for include multi-factor authentication (MFA), which adds an extra layer of security beyond just a password, and encryption, which protects your digital assets from unauthorized access. A secure digital wallet is the cornerstone of safely participating in the tokenized stock market.

- Completing KYC/AML Verification: Regulatory compliance is paramount in the world of digital assets. Most reputable platforms that offer tokenized stocks trading require new users to complete Know Your Customer (KYC) and Anti-Money Laundering (AML) verification processes. These procedures are designed to ensure that all participants on the platform are verified and meet regulatory requirements. The primary goals of KYC/AML are to prevent fraud, ensure platform integrity, and comply with international financial regulations. While this process may require some initial effort in terms of providing identification and personal information, it is a critical step towards ensuring a secure and legally compliant trading environment for everyone.

- Funding Your Account: Once your digital wallet is securely set up and your identity is verified through the KYC/AML process, the next step is to fund your trading account. You can typically do this using traditional fiat currencies (like USD or EUR) or through cryptocurrencies, depending on the platform’s capabilities and your preferences. The specific funding process can vary from platform to platform, but generally, it is designed to be user-friendly and straightforward. You will usually find options for bank transfers, credit/debit card payments, or cryptocurrency deposits. Choose the method that best suits your needs and financial setup to begin your investment journey in tokenized stocks.

- Purchasing Tokenized stocks: With your account successfully funded, you are now ready to navigate to the tokenized stocks section of your chosen platform. This is where you will find a list of available tokenized stocks for trading. Take your time to thoroughly review the available options. For each tokenized stock, carefully assess its valuation, understand the underlying asset it represents, and consider your investment goals and risk tolerance. Once you have made your selections, you can confidently execute your trades. The platform will provide tools and interfaces to facilitate buying and selling, making the process as seamless as possible. This final step marks your active participation in the tokenized stocks market, allowing you to leverage the benefits of digital asset trading.

By diligently following these steps, you can ensure a seamless and secure transition into the innovative world of tokenized stocks. This approach not only equips you with the necessary tools and knowledge but also provides a solid foundation for tapping into the numerous benefits of digital asset trading, setting you on a path to potentially lucrative investment opportunities in the digital economy.

Challenges and Risk Factors

While the landscape of tokenized stocks is brimming with opportunities and advantages, it’s crucial to acknowledge that this innovative financi

al frontier is not without its challenges and inherent risks. A comprehensive understanding of these potential pitfalls is essential for anyone considering investing in this emerging field.

❌Regulatory Uncertainty: The evolving regulatory landscape is a primary concern. Regulations for tokenized real-world assets, including tokenized equities, are still being developed globally, creating compliance hurdles and legal risks for platforms and investors. The lack of consistent global frameworks for crypto-assets, including tokenized securities, adds further complexity.

❌Cybersecurity Threats: Tokenized equities are vulnerable to cybersecurity risks. Hacking attempts, smart contract flaws, and phishing attacks can lead to loss of assets. Robust security measures and investor vigilance are essential.

❌Market Immaturity and Illiquidity: The markets for tokenized equities are still developing and lack the breadth and liquidity of traditional markets. This can result in higher price volatility, liquidity issues, and price slippage.

❌Limited Integration with Traditional Finance: Integration with traditional financial systems is limited. Hesitancy from established institutions can hinder interoperability between digital and conventional markets, potentially restricting market growth.

❌Market Manipulation and Lack of Oversight: Tokenized equity markets are susceptible to market manipulation and insider trading. The decentralized nature of some blockchain systems can create challenges for regulatory oversight, potentially increasing the risk of fraud and illicit activities.

❌Technological and Custodial Risks: Technological risks include smart contract vulnerabilities and private key leaks, which can lead to asset loss. Firms may lack adequate infrastructure to securely manage blockchain keys, creating custodial risks.

❌Redemption and Corporate Action Risks: Investors face risks related to the redemption of tokens for underlying assets and may not receive equitable treatment regarding corporate actions, depending on smart contract terms and platform procedures.

Understanding these challenges and risks is crucial for anyone considering tokenized stocks. Thorough due diligence, platform selection based on security and compliance, and a cautious approach are essential in this evolving landscape.

Real-World Examples of Stock Tokenization

Several real-world examples demonstrate the diverse ways tokenized stocks are being implemented across the financial landscape.

Beesfund’s TokenBridge Initiative offers another compelling illustration of stock tokenization in practice. Beesfund launched TokenBridge specifically to tokenize traditional securities, with a key focus on stocks traded on public markets. TokenBridge operates by taking physical shares directly from established stock markets and converting them into digital tokens. These tokens typically adhere to the widely recognized ERC-20 standard, ensuring interoperability within the blockchain ecosystem.

The tokenization process involves a rigorous audit of the underlying physical shares, followed by the issuance of corresponding digital tokens. These tokens are then made available for trading on various blockchain-based platforms. The primary benefit of TokenBridge is that it provides global investors with a novel avenue to trade public stocks that were previously considered illiquid or difficult to access. This is achieved through fractionalization, making high-value equities more attainable, and by enhancing both the transparency and efficiency of the secondary market for these tokenized assets.

Swarm, a blockchain investment platform, champions the concept of public stock tokenization. Swarm’s model centers on the conversion of traditional public stock ownership into easily transferable digital tokens. These tokens then serve as the foundation for creating new and innovative investment opportunities, particularly in areas like retail lending and borrowing, primarily by leveraging the power of fractional ownership. The key advantage of Swarm’s approach is its ability to open up investment in high-value public companies to a significantly broader base of retail investors. Moreover, it dramatically improves liquidity by enabling these tokenized shares to be traded on decentralized platforms around the clock, 24 hours a day, 7 days a week.

Even major asset managers, such as BlackRock, are actively exploring the potential of tokenized equity funds. While not directly tokenizing individual stocks, these initiatives represent a significant hybrid model where a diversified basket of equities is digitized and traded as unified tokens. In this model, a fund that holds a collection of diverse stocks is represented on a blockchain network. Each token issued then effectively represents a fractional share in the fund’s entire portfolio.

This approach offers investors exposure to a well-diversified mix of stocks while simultaneously harnessing the inherent advantages of blockchain technology, such as faster transaction settlement and enhanced transparency across the investment lifecycle. While not a direct example of individual stock tokenization, this approach clearly illustrates how tokenization is being strategically applied to provide broader and more efficient access to equity exposure.

These collectively demonstrate the multiple and evolving pathways through which traditional stocks are being converted into tokenized stocks. Each approach brings a unique set of advantages to the financial landscape, such as increased accessibility for investors, improved liquidity within markets, significantly faster settlement times for trades, and a general enhancement of transparency. These combined benefits are the core drivers behind the rapidly growing interest in tokenization of stocks and bonds and its wider application across the entire financial industry.

Future Outlook for Stock Tokenization

The future of tokenized stocks is exceptionally promising, with a convergence of key trends and developments poised to fundamentally reshape the landscape of equity issuance, trading, and management. Experts and recent industry advancements suggest a significant transformation in how we interact with equity in the coming years.

Increased Institutional Adoption is a primary driver of this future growth. Major asset managers and custodians, including prominent names like BlackRock, Fidelity International, and Janus Henderson, are increasingly exploring tokenization. These institutions recognize tokenization’s potential to substantially reduce operational costs, improve market liquidity, and significantly broaden investor access to equity markets. They are actively testing innovative models where fund units, and even individual stocks, are converted into digital tokens.

This conversion enables both fractional ownership, allowing smaller investments in high-value assets, and the possibility of 24/7 trading, breaking free from traditional market hours. This growing institutional interest and experimentation is widely expected to be a key factor in driving the broader acceptance and mainstream adoption of tokenized equities over the next 5 to 10 years.

Technological Maturation and Efficiency Gains are also critical to the future of stock tokenization. Ongoing advances in blockchain technology and the sophistication of smart contracts are paving the way for near-instantaneous settlement of trades. This technological progress will also reduce the current reliance on traditional financial intermediaries, streamlining processes and removing friction. This technological shift promises to deliver significantly lower transaction costs, much faster reconciliation processes, and enhanced transparency across the entire trading lifecycle.

These compelling factors will make tokenized stocks increasingly attractive to both companies issuing equity and investors seeking more efficient markets. As distributed ledger systems continue to mature and become more seamlessly interoperable with existing legacy financial infrastructure, the operational hurdles that currently exist will diminish, leading to accelerated adoption rates.

Regulatory Evolution and Standardization will serve as a major catalyst for the mainstream adoption of tokenized stocks. Regulatory bodies across the globe are progressively recognizing the importance of digital assets and are gradually offering clearer guidance and creating regulatory sandbox environments. These sandboxes are designed to help established financial institutions and innovative startups alike to test and refine tokenization solutions within a controlled and compliant framework. As these regulatory frameworks become more firmly established and globally harmonized, they will provide the essential legal certainty and investor protection needed for the tokenized equity market to truly flourish and gain widespread acceptance.

Market Democratization and Liquidity Enhancement are inherent benefits of tokenization that will shape the future of stock markets. Tokenization has the power to fundamentally democratize investment by breaking down traditionally expensive whole shares into smaller, more affordable units. This process of fractionalization dramatically lowers the barrier to entry for retail investors, allowing individuals with smaller capital amounts to participate in equity markets and build more diversified portfolios.

Furthermore, tokenization inherently enhances liquidity by enabling the potential for round-the-clock trading on decentralized platforms that operate beyond the constraints of traditional exchange hours. Over time, this significantly improved liquidity is expected to foster a more dynamic and efficient secondary market for stocks, potentially leading to a transformative impact on par with the revolutionary shift from traditional mutual funds to Exchange Traded Funds (ETFs).

Tokenova: Your Partner in Stock Tokenization

Navigating the evolving world of tokenized stocks requires expert guidance. Tokenova is a leading consulting and advisory firm ready to empower your business in the tokenization space.

Considering tokenized stocks for your company? Tokenova offers:

- Strategic Advice: Tailored strategies for tokenization implementation.

- Regulatory Expertise: Guidance on navigating complex legal frameworks.

- Technology Solutions: Support for seamless technology integration.

- End-to-End Services: From strategy to launch, Tokenova guides you every step.

Conclusion

Tokenization of stocks represents a significant leap forward in the evolution of financial markets. By transforming traditional stock shares into digital tokens on the blockchain, tokenization unlocks a new paradigm of accessibility, security, and efficiency in investing. From enabling fractional ownership and 24/7 global trading to reducing costs and streamlining settlements, the advantages of tokenized stocks are compelling for both investors and issuers.

While challenges such as regulatory uncertainty, cybersecurity risks, and market immaturity remain, the future outlook for stock tokenization is bright. Driven by increasing institutional adoption, technological advancements, and evolving regulatory frameworks, tokenized equities are poised to play a transformative role in the future of finance, democratizing investment and reshaping how we interact with equity markets. As this digital revolution unfolds, understanding the core concepts, mechanics, and potential of tokenized stocks is crucial for anyone seeking to navigate and capitalize on the future of investing.

Key Takeaways

- Tokenization Defined: Tokenization of stocks is the process of converting traditional stock shares into digital tokens on a blockchain, representing fractional or whole ownership.

- Blockchain Powered: Blockchain technology and smart contracts are the foundation of tokenization, ensuring secure, transparent, and efficient transactions.

- Fractional Ownership: Tokenization enables fractional ownership, democratizing access to high-value stocks for retail investors with smaller capital.

- Enhanced Liquidity & Global Access: Tokenized stocks facilitate 24/7 global trading, significantly boosting liquidity and breaking down geographical barriers to investment.

- Cost Reduction & Faster Settlements: By removing intermediaries, tokenization reduces transaction costs and dramatically speeds up trade settlements.

- Emerging Market with Challenges: While promising, the tokenized stock market faces challenges including regulatory uncertainty, cybersecurity threats, and market immaturity.

- Institutional Adoption is Key: Increased adoption by major financial institutions is expected to drive the mainstream growth of tokenized equities.

- Pioneering Platforms Exist: Specialized platforms like tZERO, Securitize Markets, MERJ Exchange, and ADDX are leading the way in providing regulated marketplaces for tokenized stocks.

- Expert Guidance Available: Firms like Tokenova offer expert consulting and advisory services to help businesses navigate the complexities of tokenization.

- Future is Bright: Despite current challenges, the future outlook for stock tokenization is highly promising, with the potential to revolutionize equity markets and democratize investment.

What are the tax implications of investing in tokenized stocks? Are they taxed differently from traditional stocks?

The tax implications of tokenized stocks are still evolving and can vary significantly depending on your jurisdiction. Generally, they are likely to be treated as capital assets, similar to traditional stocks, and subject to capital gains taxes on profits. However, the specific tax treatment can be complex and depend on local regulations regarding digital assets. It’s crucial to consult with a tax advisor in your specific location to understand the tax obligations related to tokenized stock investments.

If I buy tokenized stocks, how do I actually hold them securely? What are my custody options beyond just a digital wallet?

While a digital wallet is essential for accessing and managing your tokenized stocks, you have different custody options with varying levels of security and control. Beyond self-custody in your own wallet, you might consider using custodial services offered by exchanges or specialized custodians. These services hold your tokens on your behalf, which can be convenient but involves trusting a third party with your assets. Exploring different wallet types (hardware, software) and understanding the trade-offs between self-custody and custodial solutions is important for securing your tokenized stock holdings.

Are tokenized stocks regulated differently in different countries? If I’m investing internationally, what should I consider?

Yes, the regulation of tokenized stocks is far from uniform globally. Different countries are taking different approaches, ranging from adapting existing securities laws to creating entirely new frameworks for digital assets. If you are investing internationally, it’s crucial to understand the regulatory landscape of both your home country and the jurisdiction where the tokenized stock is issued and traded. Factors like investor protection rules, KYC/AML requirements, and securities laws can vary significantly and impact your investment.

Beyond stocks, what other types of assets are being tokenized, and how does stock tokenization compare?

Tokenization is being applied to a wide range of assets beyond stocks, including bonds, real estate, commodities, art, and even intellectual property. Compared to some other asset classes, stock tokenization is particularly focused on enhancing liquidity and accessibility in established equity markets. While real estate tokenization might focus on fractional ownership of property, and commodity tokenization on easier trading of raw materials, stock tokenization aims to modernize and democratize access to company ownership. Understanding the specific goals and benefits for each asset class is key to appreciating the broader tokenization trend.

What happens to my tokenized stocks if the platform I use to trade them shuts down or goes bankrupt? Are my assets protected?

The security of your tokenized stocks in the event of platform closure depends heavily on the platform’s custody practices and regulatory compliance. If you are using a custodial platform, your assets are subject to the platform’s solvency and security measures. It’s important to research the platform’s security protocols, insurance policies, and regulatory status. Some platforms may have measures in place to segregate client assets, but the legal frameworks for protecting tokenized assets in bankruptcy are still developing. Understanding the platform’s terms of service and custody arrangements is crucial for assessing this risk.