Choosing the appropriate nation for your blockchain enterprise in 2025 is not just a legal choice but also a strategic one.

Founders and investors are coming to understand that jurisdiction influences everything—tax burden, licensing speed, banking access, and even long-term viability—as global regulation becomes stricter and the crypto ecosystem develops.

However, there is no single method to achieve crypto-friendliness. While some nations shine in tax policy, others shine in innovation incentives or regulatory clarity. Your objectives will determine the appropriate environment—whether you are running a crypto fund, starting a token, or developing a DeFi protocol.

Top Crypto-Friendly Countries in 2025: Where Regulation, Tax, and Innovation Align

For startups, investors, and enterprises, navigating the global blockchain landscape means finding a jurisdiction where clarity, cost-efficiency, and opportunity converge.

The countries listed below aren’t just popular—they’ve earned their place by offering real advantages: clear regulatory frameworks, supportive tax policies, and infrastructure that enables both experimentation and scale.

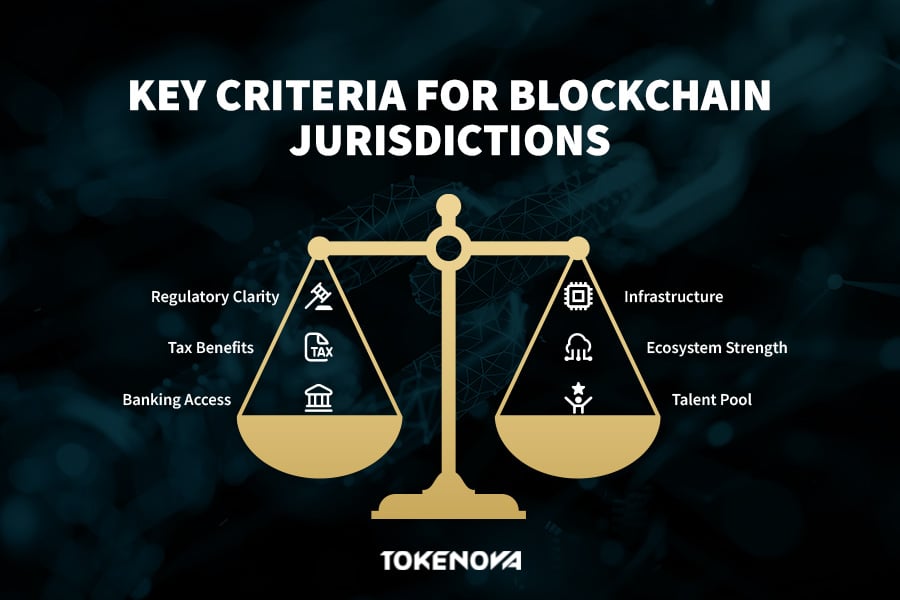

We’ve ranked them based on overall friendliness, which means a combination of

- Transparent and forward-thinking regulation

- Competitive tax treatment for individuals and businesses

- Banking and licensing support for crypto operations

- A mature ecosystem of service providers, exchanges, and legal talent

These are the countries where blockchain isn’t just allowed—it’s understood, supported, and integrated into the economy. Let’s take a closer look at the leaders shaping the future of crypto in 2025.

Switzerland: Where Legal Clarity Meets Financial Sophistication

Switzerland has established itself as the global leader in blockchain regulation. With its landmark DLT Act and the supportive oversight of FINMA (Swiss Financial Market Supervisory Authority), the country offers unparalleled regulatory certainty for blockchain ventures.

But what truly sets Switzerland apart is its integration of crypto into its traditional financial sector. In Crypto Valley (Zug), startups work alongside established players and crypto-native banks like Sygnum and SEBA, both of which offer licensed services including custody, trading, and asset tokenization.

From a tax perspective, Switzerland is highly attractive—individuals pay no capital gains tax on crypto, and corporate rates vary by canton, with several offering generous incentives for tech and blockchain businesses.

Ideal for: Asset management, token issuance, DeFi, and DAO foundations

Biggest advantage: Legal maturity and financial-grade infrastructure

Watch out: Costs are high, and regulation—though clear—is strict

Singapore: Asia’s Blockchain Launchpad

Singapore continues to be a favorite for Web3 companies expanding into Asia, thanks to its progressive regulatory environment, world-class financial system, and global connectivity.

The Monetary Authority of Singapore (MAS) has developed a licensing regime for crypto businesses that emphasizes compliance without stifling innovation. In return, licensed firms benefit from banking support and international credibility.

Singapore also offers 0% capital gains tax, generous R&D rebates, and is home to a fast-growing community in sectors like DeFi, gaming, and digital identity. Its support for blockchain in public sectors (e.g., trade, healthcare) makes it more than just a financial hub—it’s an innovation testbed.

Ideal for: DeFi, NFT platforms, payment and trading infrastructure

Biggest advantage: Pro-business government and low tax burden

Watch-out: Licensing can be slow; MAS is strict on consumer protections

Germany: Regulated, Respected, and Ready

Germany may not be the flashiest jurisdiction, but it’s one of the most robust and respected. With BaFin (Federal Financial Supervisory Authority) regulating crypto businesses and full alignment with MiCA, Germany offers the clearest path for compliant growth within the EU.

One of Germany’s most compelling features is its tax stance: crypto held for more than one year is tax-free for individuals, making it ideal for long-term investors. The country also supports a growing ecosystem of regulated crypto banks and licensed custody providers.

Germany is especially attractive for institutional investors and fintechs looking to bridge traditional finance with blockchain.

Read More: Tokenization in Banking

Ideal for: Institutional DeFi, custody services, stablecoins, fintech integration

Biggest advantage: Legal certainty, strong investor trust

Watch out: Regulation is detailed and requires good legal support; startup costs are mid-to-high

United States: Innovation Powerhouse With Legal Complexity

The U.S. remains a cornerstone of blockchain development, especially in terms of technology innovation, venture capital, and institutional adoption. Major developments like Bitcoin ETFs, tokenization of real-world assets, and layer-2 infrastructure all have deep roots in the American crypto ecosystem.

However, regulatory fragmentation is a real challenge. The SEC, CFTC, IRS, FinCEN, and state-level regulators all play roles—often with conflicting views. Obtaining licenses, such as Money Transmitter Licenses (MTLs), can be costly and time-consuming; however, states like Wyoming and Delaware provide crypto-friendly policies for DAOs and LLCs.

Despite this, the U.S. remains a leader in blockchain R&D, financial markets, and global influence. Startups that manage compliance well can tap into unparalleled capital, developer talent, and institutional partnerships.

Ideal for: Tokenized assets, Web3 infrastructure, crypto funds, AI/DeSci projects

Biggest advantage: Global investor trust and deep capital markets

Watch-out: Regulatory uncertainty and high compliance costs

China: Government-Led Blockchain Innovation

China maintains a unique role in the blockchain world. While public crypto trading and mining are restricted, the country is pushing forward with state-backed blockchain systems like the Digital Currency Electronic Payment (DCEP)—its central bank digital currency—and enterprise blockchain networks under BSN (Blockchain-based Service Network).

China’s strength lies in its top-down support for blockchain use in trade, logistics, digital identity, and governance. It’s not a haven for Web3 entrepreneurs or DeFi builders, but it’s a global pioneer in enterprise blockchain and CBDCs.

Ideal for: Enterprise blockchain, supply chain systems, national infrastructure projects

Biggest advantage: Scale and state investment

Watch-out: No legal space for public DeFi, NFTs, or crypto exchanges

United Kingdom: Bridging Law and Innovation

Post-Brexit, the UK has accelerated efforts to become a regulated yet competitive home for crypto assets. In 2023, it introduced legislation that recognizes crypto and NFTs as personal property, giving holders greater legal protection under English common law.

The UK is working on clear regulatory frameworks for stablecoins and crypto trading, and the FCA (Financial Conduct Authority) is actively licensing and monitoring digital asset businesses.

London remains a global finance and fintech capital, and the legal infrastructure is highly attractive to institutional players and high-net-worth individuals.

Read More: Blockchain Governance: Building Trust and Transparency

Ideal for: Digital asset funds, custody providers, Web3 law and governance firms

Biggest advantage: Strong legal tradition and regulatory momentum

Watch-out: FCA licensing can be strict and resource-intensive

United Arab Emirates: The Zero-Tax Crypto Sandbox

The UAE—especially Dubai and Abu Dhabi—has positioned itself as one of the world’s most ambitious crypto jurisdictions. Backed by zero income and capital gains taxes and tailored free zones like ADGM and DMCC, the UAE offers a unique combination of tax efficiency, licensing flexibility, and lifestyle appeal.

Regulators like VARA (Dubai) and FSRA (Abu Dhabi) have rolled out comprehensive licensing frameworks for VASPs, stablecoins, and even metaverse businesses. Dubai aims to transition all government services to blockchain and hosts a rapidly growing community of founders, funds, and crypto family offices.

Ideal for: Token launches, exchanges, family offices, metaverse/AI ventures

Biggest advantage: 0% tax and fast-track licensing in free zones

Watch-out: Still maturing in regulatory enforcement; legal complexity varies by emirate

Nigeria: Grassroots Adoption Meets National Blockchain Strategy

Nigeria has emerged as a global leader in grassroots crypto adoption, with millions using crypto for remittances, savings, and entrepreneurship. In fact, it ranks among the highest in P2P trading volume and developer activity in Africa.

Recognizing this organic growth, the Nigerian government launched a National Blockchain Policy, aiming to integrate blockchain into public services, identity systems, and financial inclusion. While regulatory clarity is still evolving, recent moves indicate a more open and structured approach to virtual asset regulation.

Nigeria also offers low operating costs, a fast-growing talent pool, and increasing investor interest in African Web3 ecosystems.

Ideal for: Fintech, remittances, Web3 dev hiring, DeFi for underbanked populations

Biggest advantage: Massive user base and developer affordability

Watch-out: Regulatory environment is still maturing; financial infrastructure remains uneven

Vietnam: Agile, Young, and Rapidly Growing

Vietnam is one of the fastest-growing crypto markets in Southeast Asia, thanks to its young, tech-native population and growing demand for digital financial services. With over 20 million users and a strong gaming culture, the country has become a hotspot for Web3 gaming, NFT projects, and mobile-first DeFi platforms.

While the legal framework is still developing, the government has signaled interest in blockchain for public administration and digital identity. Startups benefit from low overhead costs, a growing investor base, and strong developer communities in cities like Ho Chi Minh City and Hanoi.

Ideal for: Play-to-earn games, NFT marketplaces, DeFi wallets

Biggest advantage: Fast user adoption, low costs, high mobile penetration

Watch-out: Regulatory uncertainty and limited legal protection for investors

Estonia: Pioneering Digital Governance with Blockchain Roots

Estonia has long been a pioneer in digital identity, e-governance, and blockchain-backed infrastructure. Its e-Residency program, launched in 2014, laid the foundation for a digital-first nation that welcomes location-independent entrepreneurs.

The country offers a clear legal path for custodial wallets, crypto exchanges, and Web3 SaaS products and is part of the EU’s MiCA framework. Its streamlined business registration process, reliable tax system, and openness to tech innovation make it especially appealing for early-stage blockchain projects.Ideal for: Wallet services, SaaS/Web3 tools, global remote startups

Biggest advantage: Digital-first government and startup-friendly environment

Watch-out: Tighter VASP rules introduced recently; real substance requirements for licensing

Best Countries by Use Case: Matching Jurisdictions to Your Crypto Business

Not all crypto-friendly countries are ideal for every project. A DeFi protocol needs regulatory flexibility. A centralized exchange needs licensing clarity. A stablecoin issuer needs reserve rules and fiat on-ramps.

Choosing your jurisdiction based on your business model and compliance needs is critical—not just to get licensed, but to scale safely.

Here’s a breakdown of the best countries by category, based on legal frameworks, operational support, and regulatory nuance:

| Crypto Business Use Case | Best Countries | Why | Watch Out |

| Centralized Exchanges (CEXs) | United States, Estonia, Lithuania, UAE, Gibraltar | Clear VASP licensing frameworks, strong AML/KYC, maturing legal protections; Estonia & Lithuania (EU-wide services under MiCA); UAE (0% tax zones, streamlined onboarding) | U.S. (high compliance costs, fragmented regulations); EU MiCA (substance and transparency across borders) |

| DeFi & DEXs | Switzerland, Singapore, Cayman Islands, Marshall Islands | Support for decentralized governance (DAOs, token economies); flexible regulation, legal recognition of DAOs (Switzerland & Singapore); easier setup for TokenCo/DAO structures | Offshore structures (difficulty accessing fiat rails or institutional capital); VASP registration may still be required for token issuance |

| Crypto Wallets (Custodial) | Estonia, Malta, UAE | Strict AML and data custody rules, valuable VASP laws | Regulators viewing wallets with swap or staking features as VASPs; user location can trigger compliance obligations |

| Crypto Wallets (Non-Custodial) | Switzerland, British Virgin Islands, USA | Strong privacy protections, legal clarity (Switzerland); often avoid licensing | Regulators viewing wallets with swap or staking features as VASPs; user location can trigger compliance obligations |

| Play-to-Earn Games & NFT Platforms | Singapore, Hong Kong, Switzerland, Cayman Islands | Legal clarity around NFTs as digital property, IP protections, support for in-game token economies; Hong Kong (VASP regime with NFT-specific licensing) | GameFi models with financialized assets may face scrutiny as securities or gambling products |

| Stablecoin Issuance | Singapore, UAE, EU (Germany, Lithuania), El Salvador | MiCA (EU) and MAS (Singapore) (clear reserve, licensing, and reporting rules); UAE (VARA licensing, audit, and custody paths); El Salvador (Bitcoin-backed innovations) | EU stablecoins (mandatory reserve audits and volume caps under MiCA) |

| Decentralized AI & Data Projects | USA (Delaware), Liechtenstein, Costa Rica, Cayman Islands | Support for DAO foundations, IP structuring, TokenCo-DevCo separation; Delaware (capital raising under existing securities exemptions) | Compliance around data usage and AI models is fast-evolving; structure and governance are critical |

Most Tax-Friendly Countries for Crypto in 2025: Where Holding and Building Makes Financial Sense

Taxation is one of the most critical—and often misunderstood—factors when choosing a jurisdiction for crypto activity. While many countries claim to be “crypto tax-free,” the reality depends on specifics like the nature of the activity (trading, holding, staking, corporate income), residency status, and how long assets are held.

This section focuses on jurisdictions that offer meaningful, legally grounded tax advantages, not just informal gaps or temporary loopholes.

Read More: Tokenization & Tax Regulation: A Strategic Guide

Portugal: Still a Haven for Long-Term Holders

What makes it tax-friendly:

- 0% capital gains tax on crypto for individuals holding assets long-term

- No VAT applied to crypto transactions

- Crypto not considered income unless part of professional activity

Real-life scenario:

If you move to Portugal and hold Bitcoin or ETH for more than a year, you can cash out without paying any tax. Even casual trading is often ignored unless you’re operating as a business. However, if you start earning staking or DeFi rewards regularly, you may be classified as a professional investor—and taxed accordingly.

Best for: Passive holders, early retirees, and casual traders

Watch-out: Businesses and active traders may still be taxed under general income rules

Switzerland: Zero CGT + Canton-Based Perks

What makes it tax-friendly:

- No capital gains tax on crypto for individuals (if considered private wealth management)

- Low corporate taxes (typically 12–21%), depending on canton

- Tax relief for startups and blockchain R&D

Real-life scenario:

An Ethereum core developer residing in Zug who receives tokens as compensation and sells them after 1 year may qualify for no personal CGT—provided they are not classified as a professional trader. Meanwhile, their startup might pay just 12% corporate tax if incorporated in Zug with proper local substance.

Best for: Developers, investors, DAOs, and startups with Swiss substance

Watch-out: “Professional trading” status triggers income tax obligations; legal setup matters

Germany: Clear Benefits for Long-Term Holders

What makes it tax-friendly:

- 0% capital gains tax on crypto held over 12 months for individuals

- If assets are used in staking or lending, the tax-free window extends to 10 years

- Corporate tax at ~15% for blockchain startups

Real-life scenario:

A retail investor who bought Solana in 2022 and sells it in 2025 incurs no capital gains tax, assuming they haven’t used the assets in staking. If they have, the extended 10-year rule applies. Germany also offers advanced custody licensing under BaFin, making it a hub for crypto funds.

Best for: Investors with long holding horizons, DeFi startups with European ambitions

Watch-out: Frequent trading or staking shortens the tax benefits; must track usage history carefully

Singapore: No CGT + Business-Friendly

What makes it tax-friendly:

- 0% capital gains tax for individuals and companies

- Corporate income tax of 17%, with generous R&D rebates

- No tax on airdrops or token swaps unless tied to business activity

Real-life scenario:

A Web3 founder who moves their TokenCo to Singapore and raises funds via a token sale will not pay CGT on the token’s appreciation. If the token is sold through a business, corporate tax applies only on profits, not token value. Meanwhile, R&D costs (smart contract audits, legal fees) may qualify for up to 250% deductions.

Best for: Early-stage startups, DAOs, token launches, R&D-heavy projects

Watch-out: Revenue-generating protocols may be taxed as corporate income if not structured carefully

United Arab Emirates: 0% Personal & Corporate Tax in Free Zones

What makes it tax-friendly:

- 0% tax on capital gains and income for individuals

- 0% corporate tax in certain free zones (like DMCC, ADGM, and DIFC)

- Tailored tax rulings and clear crypto licensing under VARA and FSRA

Real-life scenario:

A crypto exchange licensed in Dubai’s VARA-regulated free zone can operate globally without paying corporate tax—provided it doesn’t earn UAE-source income. A founder relocating to Dubai who doesn’t have UAE-source employment pays no income tax and can sell personal crypto tax-free.

Best for: Token launches, family offices, global DAOs, exchanges

Watch-out: Must comply with economic substance rules to retain 0% tax status; advisory is key

Crypto Adoption & Infrastructure Highlights: Where Blockchain Is Thriving on the Ground

Crypto-friendliness on paper means little without real users, working banks, and institutional-grade infrastructure. This section highlights where blockchain isn’t just regulated, but used and supported at scale—with metrics to back it up.

We break this down into four areas:

- Ownership & Adoption Rates

- Banking Access & Crypto-Integrated Institutions

- Licensing Trends for VASPs

- Ecosystem Strength & Developer Community

Ownership & Usage: Where People Actually Use Crypto

Crypto ownership is a leading indicator of ecosystem strength, product-market fit, and long-term adoption. These countries have standout penetration:

| Country | Ownership Rate (% of population) | Highlights |

| UAE | ~25% | High adoption for remittances and investing |

| Singapore | ~20–22% | Active users in DeFi, NFTs, and trading |

| Nigeria | ~30%+ (active users) | Heavy usage for savings, P2P payments |

| Vietnam | ~20% | High GameFi engagement and mobile usage |

| Germany | ~33% interested; 15% holders | Strong institutional and retail engagement |

Insight:

The UAE and Nigeria lead in active usage, while Germany and Singapore show high levels of financial-sector integration and product diversity.

Banking Access & Institutional Support

Without banking access, even the most innovative crypto company will struggle to operate. These countries support crypto-native firms through integrated financial institutions:

| Country | Banking Highlights |

| Switzerland | Crypto-native banks (Sygnum, SEBA), fiat accounts for blockchain companies |

| Germany | Multiple licensed custodians + fintech/crypto-friendly banks like Solarisbank |

| Singapore | MAS-approved banks serving licensed crypto firms; strong FinTech–TradFi bridge |

| UAE | Banks aligned with VARA/FSRA guidelines, with dedicated on/off-ramp services |

| Estonia | Smaller but functional crypto payment providers; legacy banking still cautious |

Insight:

Switzerland and Germany lead with deep, institutional-grade crypto-finance integration. Singapore and the UAE follow with policy-aligned banking partners.

VASP Licensing Trends: Where Rules Are Clear

Clear licensing frameworks give crypto companies legal certainty and the ability to scale globally. Here’s where regulators are setting the pace:

| Jurisdiction | Framework | Known For |

| EU (Germany, Estonia, Lithuania) | MiCA (2024–2025) | Unified passporting for all crypto services |

| Singapore | MAS Payment Services Act | Structured approach to wallets, exchanges, stablecoins |

| UAE (Dubai/Abu Dhabi) | VARA, FSRA | Specialized free zones, tiered licensing |

| Switzerland | FINMA DLT Act | DAO recognition, token classification |

| United Kingdom | FCA + Digital Asset Laws | Legal recognition of crypto/NFTs as property |

Insight:

MiCA will set the tone for global compliance in 2025. VARA (UAE) and MAS (Singapore) remain the best examples of localized but progressive frameworks.

Ecosystem Depth: Developers, Startups, and Community

Adoption without talent is unsustainable. These regions are seeing growth in crypto-native developers, builders, and events:

| Country | Ecosystem Highlights |

| India | Largest number of crypto users; massive Web3 developer talent |

| Germany | Active VC scene, hackathons, developer DAOs |

| Singapore | Hub for Web3 accelerators, venture studios, and protocol foundations |

| Nigeria | Fast-growing dev ecosystem; startups in identity, payments, and DeFi |

| Vietnam | GameFi talent base, design studios, strong youth adoption |

Insight:

India and Nigeria are developer goldmines, while Singapore and Germany offer more structured growth paths with funding and infrastructure.

Takeaway: Infrastructure Is Strategy

A favorable tax law or regulatory license means little without:

- A bank that will serve you

- Users to test and grow with

- Engineers to build your MVP

- Government agencies that understand your product

When choosing a base for your crypto business, infrastructure should weigh just as heavily as law or taxes.

Emerging Crypto Jurisdictions to Watch in 2025

While regulatory giants like Switzerland, Singapore, and Germany dominate headlines, some lesser-known jurisdictions are building quietly—and aggressively. These emerging markets offer regulatory experimentation, access to untapped user bases, and in many cases, lower setup costs or tax advantages.

Below are the countries and regions to keep an eye on, along with what’s making them rise in relevance.

Hong Kong: Regulated, Reopened, and Repositioned

What’s changing:

- Introduction of a new VASP regime with clear licensing pathways for exchanges and custodians

- Approval of spot Bitcoin and Ethereum ETFs in 2024

- Efforts to become Asia’s hub for Web3 finance separate from mainland China’s policies

Real-life signal:

Major exchanges like HashKey and OSL have obtained licenses. Venture capital is flowing back in. NFT, gaming, and token projects are relocating to take advantage of clarity and proximity to China.

Best for: Regulated trading platforms, Asia-facing Web3 startups

Watch-out: Still navigating political risks and banking conservatism

Kazakhstan: Green Mining and Tax Incentives

What’s changing:

- Government now supports regulated mining operations with green energy requirements

- Crypto exchanges can operate under Astana Financial Centre regulations

- Offers tax exemptions on crypto income for qualifying projects

Real-life signal:

Binance partnered with Kazakhstan to support compliance tools, and major miners relocated here after China’s 2021 crackdown.

Best for: Mining, crypto infrastructure, Layer 1 experimentation

Watch-out: Limited financial services and developer ecosystem; bureaucratic challenges

Panama: Quietly Tax-Free, Cautiously Open

What’s changing:

- No capital gains tax on crypto

- Passive regulatory stance—crypto not tightly regulated, but not banned

- Growing startup interest from Latin American founders

Real-life signal:

More DAOs and wallet startups are incorporating in Panama to access tax neutrality and avoid regulatory overreach. The country is especially attractive for projects targeting Spanish-speaking markets.

Best for: DAO foundations, protocol treasuries, Latin America-facing wallets

Watch-out: Lack of structured licensing can create gray zones for scaling

Nigeria: Building Africa’s Web3 Frontier

What’s changing:

- Released a National Blockchain Policy in 2023 focused on identity, payments, and education

- Central Bank softening its stance toward crypto services

- Massive grassroots adoption, particularly in stablecoins and P2P finance

Real-life signal:

Startups like Bundle, Kuda, and Yellow Card are gaining traction. Global projects are hiring remote Web3 devs and setting up local nodes in Nigeria.

Best for: Fintech, stablecoin apps, developer hiring, African DeFi

Watch-out: Regulatory policy is still catching up to real-world usage

Brazil: The Fintech–Crypto Bridge

What’s changing:

- Government is working on digital real (CBDC), integrating with crypto rails

- Exchanges like Mercado Bitcoin operating under clear tax reporting rules

- Growing investor and developer community supported by local VCs

Real-life signal:

Nubank launched a crypto product with over 1 million users in months. The central bank is piloting tokenized government bonds via blockchain.

Best for: Latin American expansion, stablecoin FX apps, compliant fintech bridges

Watch-out: Bureaucracy can delay licenses; tax system is complex for cross-border activity

Bonus: Other Fast-Moving Microjurisdictions

| Country/Region | Reason to Watch |

| Liechtenstein | EU-adjacent, progressive token law (TVTG), friendly to DAOs |

| Costa Rica | No CGT, easy business setup, growing DAO interest |

| El Salvador | Bitcoin as legal tender, zero CGT, government incentives |

| Bahamas | Digital assets bill (DARE), early mover on CBDCs |

Choosing the Right Country for Your Crypto Project

There’s no single “best” country for crypto—only the best one for your specific use case and risk profile.

Whether you’re launching a DAO, building a DeFi platform, issuing a stablecoin, or running a crypto exchange, your ideal jurisdiction will depend on three key dimensions:

- Legal flexibility: How adaptable is the law to your business structure?

- Tax burden: What are the capital gains and corporate tax implications?

- Operational viability: Can you get banking, licenses, and talent easily?

To help you decide, here’s a Crypto Jurisdiction Decision Matrix:

Crypto Jurisdiction Decision Matrix

| Business Model | Legal Flexibility | Tax Advantage | Best-Fit Countries |

| Token Issuance (ICO/IEO) | High (DAO/Foundation) | Often tax-neutral | Switzerland, Singapore, Cayman Islands |

| Centralized Exchange (CEX) | Regulated (VASP) | Mixed, jurisdiction-dependent | Estonia, UAE, USA (MTLs), Lithuania |

| DeFi Platform / Protocol | Needs structural freedom | Varies, often offshore | Switzerland, Marshall Islands, Cayman Islands |

| Stablecoin Issuance | Reserve compliance key | Corporate rates apply | Singapore, Germany/Lithuania, UAE |

| Play-to-Earn / NFT Gaming | IP + licensing focus | Typically 0% CGT | Singapore, Switzerland, Hong Kong |

| Crypto Fund / Asset Mgmt | High legal clarity | Tax treaties important | UK, Switzerland, Germany, Delaware |

| Developer DAO / Open Source | Foundation or DAO LLC | Tax-optimized tokens | Liechtenstein, Delaware, Costa Rica |

Read More: Decoding ICOs: A Simple Guide

Legal Structuring Essentials

Successful crypto businesses are often split into three entities for legal and operational efficiency:

- TokenCo – The company responsible for issuing or managing tokens (often offshore).

- DevCo – The R&D or engineering entity (often in a low-tax jurisdiction with talent).

- DAO/Foundation – The governance or community entity (common in Liechtenstein, Switzerland, Cayman Islands, or Panama).

Example setup:

- TokenCo in Cayman → Token sale

- DevCo in Portugal → Engineering, no CGT

- DAO Foundation in Liechtenstein → Governance and treasury holding

Read More: Web3 Legal: Startup Regulatory Framework

This structure helps minimize regulatory exposure while maintaining control and legal protection.

Legal Risks & Compliance Pitfalls to Avoid

Even in crypto-friendly countries, poor structuring can trigger problems. Here’s what to watch for:

- Substance requirements: Free zone companies (like in UAE) often require real offices or local employees

- AML/KYC triggers: Wallets and swaps may need VASP licenses—even if non-custodial

- Tax residency issues: Moving countries doesn’t automatically change your tax status

- DAO token issuance: Without proper legal wrap, you may face unintentional securities violations

Tip: Always consult crypto-native legal advisors familiar with VASP regimes, token law, and international structuring. To ensure you get confident, expert guidance, reach out to Tokenova today and ask about our consulting services.

Prioritize Based on Strategic Goals

| Your Goal | Prioritize… |

| Maximize legal clarity | Switzerland, Germany, UK |

| Minimize tax burden | UAE, Portugal, Singapore |

| Hire top Web3 developers | India, Nigeria, Vietnam |

| Raise capital from global funds | USA (Delaware), Switzerland |

| Operate an exchange or wallet | Estonia, UAE, Singapore |

| Launch with low cost | Costa Rica, Panama, Lithuania |

Conclusion: Choose Strategy Over Hype

In 2025, launching a crypto project is no longer just about tech—it’s about navigating regulation, tax law, banking infrastructure, and global jurisdictional nuance. The “crypto-friendly” label doesn’t mean much without legal clarity, banking access, and a stable environment to build and grow.

This guide has shown that

- Switzerland, Singapore, and Germany lead in mature, integrated ecosystems.

- The UAE and Portugal offer compelling tax advantages and operational flexibility.

- Emerging hubs like Hong Kong, Nigeria, and Panama are developing unique edges in talent, adoption, or governance.

- The right country depends on your project type, structure, compliance appetite, and where your users or investors are.

As tempting as 0% tax or offshore anonymity may seem, sustainability, banking access, and legal certainty are often worth far more over the long term.