The Dubai World Trade Centre (DWTC) Free Zone is widely regarded as one of the most prestigious business locations in the UAE. Positioned in the heart of Dubai’s central business district, it offers unparalleled access to government entities, international events, and a thriving corporate ecosystem. As a part of the iconic DWTC complex, the Free Zone is especially appealing to businesses that value proximity to key institutions, premium office infrastructure, and a professional brand image.

However, this level of prestige comes at a price. According to user feedback on platforms like Reddit, DWTC is generally considered pricier than other free zones in the UAE. Entrepreneurs frequently weigh the higher costs against the benefits of being based in such a central and reputable location. For companies that prioritize credibility, accessibility, and access to co-working and event spaces, DWTC remains a strong contender—particularly for consultants, international firms, and businesses with government-facing operations.

The Benefits of Dubai World Trade Centre

The Dubai World Trade Centre Free Zone offers a range of strategic benefits that make it an attractive choice for businesses aiming to establish a presence in Dubai. While the zone is positioned at the higher end of the cost spectrum, many entrepreneurs consider the advantages worth the investment.

Key advantages include:

- 100% foreign ownership: This eliminates the necessity for a local partner or sponsor, thereby granting investors complete control over their business.

- Full repatriation of capital and profits: Businesses can transfer earnings back to their home country without restrictions.

- Zero personal and corporate income tax: One of the most compelling incentives for entrepreneurs seeking tax-efficient operations.

- Prime central location: Positioned near Dubai International Airport and within the city’s commercial and government hubs.

- Access to a thriving business ecosystem: Close proximity to international exhibitions, events, and business services hosted within the DWTC complex.

- Modern infrastructure: High-quality office spaces, co-working environments, and premium business facilities.

User discussions on Reddit highlight that while DWTC is pricier than other free zones, it offers unmatched credibility and location benefits. Some users recommend checking whether DWTC runs promotional offers during Ramadan, Expo seasons, or other key periods, which can reduce setup costs.

DWTC Free Zone delivers significant value for businesses that prioritize long-term credibility, access to key decision-makers, and a central position in Dubai’s business landscape.

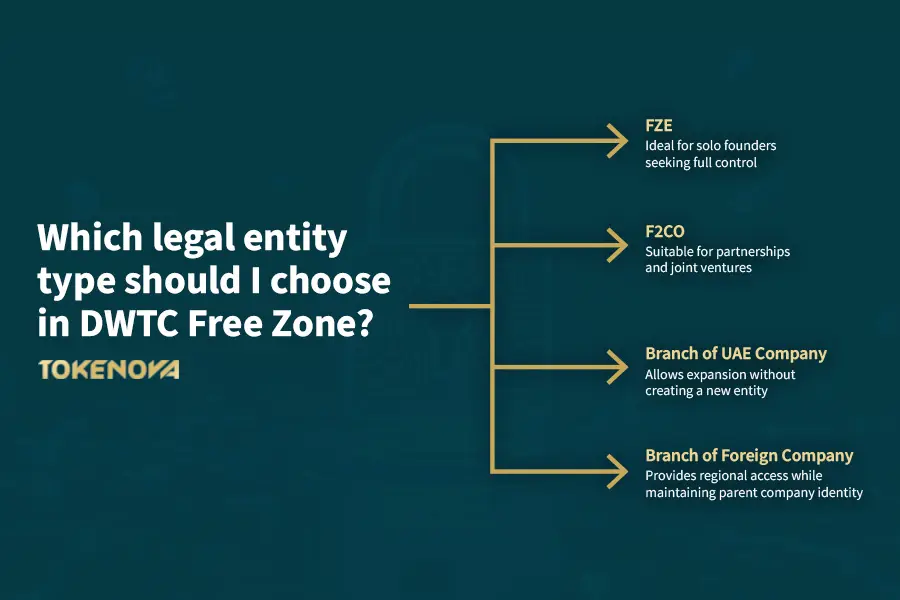

Types of Legal Entities in DWTC Free Zone

The DWTC Free Zone offers multiple legal structures to accommodate various business models and ownership setups. Whether you’re an individual entrepreneur, a group of partners, or an existing company expanding into Dubai, there’s an entity type suited to your needs.

The main legal entity options include

- Free Zone Establishment (FZE)

Designed for a single shareholder, this structure is ideal for solo founders or independent professionals who want full control over their business. - Free Zone Company (FZCO)

This structure is suitable for two or more shareholders, whether they are individuals, corporate entities, or a combination of both. This structure supports joint ventures and partnerships. - Branch of a UAE Company

Allows an already established UAE mainland company to expand its operations within the DWTC Free Zone without creating a new legal entity. - Branch of a Foreign Company

Enables international businesses to set up a branch office in Dubai, providing regional access while maintaining the legal identity of the parent company.

Community feedback, particularly from Quora, indicates that new businesses commonly choose FZE and FZCO structures due to their simplicity and flexibility. For larger or multinational firms, the branch option is often the most strategic route, allowing them to operate in Dubai while remaining legally tied to their parent company.

Each structure comes with its own regulatory and documentation requirements, so selecting the right one depends on your ownership model, investment strategy, and long-term business goals.

Types of Business Licenses in DWTC Free Zone

DWTC Free Zone offers a wide range of business licenses to accommodate diverse sectors and operational needs. Choosing the right license is essential not only for compliance but also for banking, visa eligibility, and long-term scalability.

Available license types include:

- Professional License

This is particularly relevant for service-oriented businesses such as consulting, IT services, legal advisory, design, and other specialized professional activities. - E-Commerce License

This license is specifically designed for companies that engage in online sales of products or services. This license is suitable for digital entrepreneurs, dropshipping companies, and platform-based startups.

Read More: Tokenization in E-commerce: Enhancing Security in the Digital Marketplace

- General Trading License

It offers extensive trading rights for a wide range of product categories. It’s often chosen by import-export firms that deal in varied goods. - Commercial License

A more focused version of the trading license, allowing businesses to trade specific goods or product lines. - Event Management License

Ideal for companies involved in planning, organizing, or managing events, exhibitions, and conferences—particularly relevant given DWTC’s position as a major events hub. - Virtual Asset License

The program is designed for blockchain, crypto, and digital asset firms looking for regulatory legitimacy and access to Dubai’s growing fintech ecosystem. - Family Office License

Enables the setup of single-family offices for wealth and asset management, often used by high-net-worth individuals and family groups.

According to user feedback on Reddit and Quora, e-commerce, professional, and general trading licenses are among the most commonly selected. One recurring tip from experienced business owners is to align your license choice with your banking strategy—some banks are more receptive to certain licenses, particularly those associated with well-defined and regulated activities.

When selecting a license, it’s wise to consider both your current business model and future plans. Choosing a license with broader or more flexible terms can help avoid the need for costly amendments later on.

Business Activities Permitted in DWTC Free Zone

The DWTC Free Zone supports a wide variety of business activities—more than 1,200 in total—across multiple sectors. This flexibility allows entrepreneurs to tailor their license to match their exact business model, whether it’s product-based, service-driven, or digital-first.

Some of the most commonly permitted business sectors include

- Trading and Import/Export

Includes everything from consumer goods and electronics to raw materials and industrial equipment. - Consulting and Professional Services

Covers legal, financial, management, HR, IT, marketing, and design consultancy services. - Information Technology and Software Development

Ideal for startups and established firms offering software products, SaaS solutions, app development, and IT support. - Event Management and Media

A strong fit for Dubai-based businesses managing exhibitions, corporate events, or media production. - E-Commerce and Logistics

Supports businesses that operate online stores, delivery services, and fulfillment operations. - Blockchain, Fintech, and Virtual Assets

With the introduction of the Virtual Asset License, DWTC supports a growing number of businesses in emerging tech sectors.

Read More: Top Web3 Business Ideas

Community insights suggest that when selecting your business activities, it’s wise to:

- Choose broader activity categories when possible to allow for flexibility in service or product offerings.

- Confirm if multiple activities can be combined under one license—some users mention this is permitted depending on compatibility and license type.

- Consult directly with DWTC to ensure your chosen activities align with regulatory requirements and future scalability.

This flexibility in approved activities makes DWTC suitable not just for established industries, but also for innovative or niche ventures looking to operate from a globally connected hub.

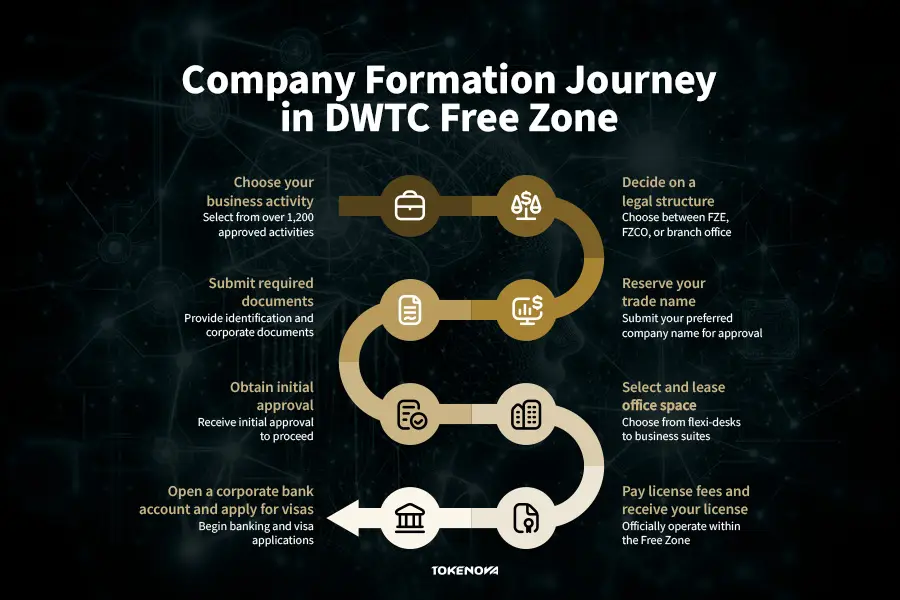

Step-by-Step Company Formation Process in DWTC Free Zone

Setting up a company in the DWTC Free Zone is designed to be efficient and business-friendly. Most users who’ve gone through the process report that it’s relatively smooth—especially when handled directly with DWTC, rather than through third-party agents.

Here’s a typical step-by-step breakdown:

- Choose your business activity

Select from over 1,200 approved activities, ensuring alignment with your business model and long-term plans. - Decide on a legal structure

Choose between a Free Zone Establishment (FZE), Free Zone Company (FZCO), or branch office depending on your ownership and scale. - Reserve your trade name

Submit your preferred company name for approval. The name must comply with UAE naming conventions and be unique within the Free Zone. - Submit required documents

Provide identification, corporate documents, and supporting materials depending on whether you’re applying as an individual or corporate entity. - Obtain initial approval

Once the documents are verified, you’ll receive initial approval to proceed with office selection and payment. - Select and lease office space

Choose from flexi-desks, executive offices, or dedicated business suites within DWTC’s facilities. - Pay license fees and receive your license

Upon payment, your trade license will be issued, officially allowing you to operate within the Free Zone. - Open a corporate bank account and apply for visas

With your license and lease in hand, you can begin the banking process and apply for residency or employee visas as needed.

Read More: Your Essential Guide to register a blockchain-based business

Based on user feedback from Reddit, the process is straightforward when managed directly with DWTC. Many users caution against using intermediary agents, who can inflate costs or introduce unnecessary delays. Going direct often results in more transparent pricing and better control over timelines.

That said, for first-time entrepreneurs or international investors unfamiliar with UAE business setup requirements, it’s often a smart move to have your documentation and structure reviewed by a qualified business consultant. Firms like Tokenova can help you avoid errors, select the right license type, and ensure compliance with banking and visa regulations—without overcomplicating the process or adding unnecessary fees.

This approach offers a balance: take advantage of DWTC’s direct setup channels while having expert support to navigate complex decisions and paperwork.

Required Documents for Company Setup in DWTC Free Zone

Preparing the right documentation is a critical step in setting up your company in the DWTC Free Zone. While the list is relatively standard, missing or incomplete paperwork can lead to delays—especially when it comes to opening a bank account or applying for visas.

Here’s a general breakdown based on the type of shareholder:

For individual shareholders:

- Passport copy (valid for at least 6 months)

- Recent proof of residential address (utility bill or bank statement)

- Business plan or activity description

- CV or resume detailing relevant experience

For corporate shareholders:

- Certificate of Incorporation

- Memorandum and Articles of Association (MOA/AOA)

- Board resolution approving the setup of the new entity

- Passport copy of the authorized signatory

- Company profile and business license (if applicable)

Practical advice from users: Several Reddit contributors point out that banks in the UAE often request additional documents such as a signed office lease (Ejari) and a valid residency visa before proceeding with account opening. It’s wise to prepare for these kinds of documents even if not initially requested during license issuance.

Double-checking your documents before submission with a reliable business consultant can save valuable time. While DWTC provides clear guidance, working with a consultant or advisor to review everything—especially if you’re unfamiliar with UAE requirements—can help avoid unnecessary back-and-forth with authorities and banks.

Read More: Web3 Legal: Startup Regulatory Framework

Office Space Options in DWTC Free Zone

One of the key attractions of setting up in the DWTC Free Zone is access to high-quality office infrastructure in a central Dubai location. Whether you’re a solo founder, a growing startup, or a branch of an international company, DWTC offers a range of workspace solutions to suit different operational needs and budgets.

Available office types include:

- Flexi-desks

Cost-effective, shared desk spaces are ideal for solo entrepreneurs, freelancers, or remote-based teams needing a business address and occasional physical presence. - Executive offices

Fully equipped private offices suitable for small to medium-sized teams. These offer more privacy and can accommodate in-person meetings and staff expansion. - Co-working spaces

Modern shared environments that foster collaboration and networking. Ideal for creative, tech, or consulting businesses that value flexibility and interaction. - Business centers

Located in iconic buildings such as One Central, Convention Tower, and Sheikh Rashid Tower, these spaces offer scalable office solutions with premium amenities and a professional corporate setting.

User feedback on Reddit suggests that many entrepreneurs choose to start with a flexi-desk or co-working plan to minimize overhead, then upgrade to a dedicated office as the business grows. This staged approach allows founders to keep costs low during the early months without sacrificing the benefits of a DWTC business address.

Regardless of which option you choose, all office types come with the infrastructure needed for licensing, banking, and visa eligibility, ensuring compliance while maintaining flexibility.

Costs and Packages in DWTC Free Zone

While the DWTC Free Zone is known for its premium location and infrastructure, it’s important for prospective business owners to understand the associated costs. Compared to other free zones in the UAE, DWTC sits in the mid-to-high range in terms of pricing—but many entrepreneurs find the credibility and strategic advantages worth the investment.

Setting up a business in the DWTC Free Zone involves various costs, which can vary based on the type of license, office space, and visa requirements. Below is a breakdown of the typical expenses:

License Fees:

- Standard Licenses: The cost for a standard license ranges from AED 12,000 to AED 30,000, depending on the business activity and license type.

- General Trading License: This license requires an executive office and incurs an additional annual deposit of AED 12,000.

Office Space:

- Flexi-Desks: Ideal for solo entrepreneurs, flexi-desks are available starting at AED 12,000 per year.

- Executive Offices: For businesses requiring dedicated space, executive offices start from AED 51,300 per year.

Visa Fees:

- Investor/Partner Visas: The cost for investor or partner visas varies, with some packages including one visa. For instance, a package with a license, flexi-desk, and one visa is priced at AED 17,800.

- Additional Visas: Each additional visa incurs extra charges, which can vary based on the specific requirements and services chosen.

Other Costs:

- Establishment Card: An establishment card is required for visa processing and costs approximately AED 2,000.

- Registration Fees: Initial registration fees can start from AED 5,000, depending on the business structure and services selected.

It’s important to note that while DWTC Free Zone offers premium facilities and a strategic location, the costs are higher compared to other free zones like IFZA or RAKEZ. However, the added value in terms of prestige, infrastructure, and proximity to key business hubs often justifies the investment for many businesses.

When considering setting up in DWTC, it’s advisable to consult business setup experts to understand the full scope of costs and to ensure compliance with all regulatory requirements.

| Cost Category | Item | Cost (AED) | Notes |

| License Fees | Standard Licenses | 12,000 – 30,000 | Depending on business activity and license type. |

| General Trading License | 12,000 (deposit) | Requires an executive office; additional annual deposit. | |

| Office Space | Flexi-Desks | 12,000+ per year | Ideal for solo entrepreneurs. |

| Executive Offices | 51,300+ per year | For businesses needing dedicated space. | |

| Visa Fees | Investor/Partner Visa (package) | 17,800 | Package includes license, flexi-desk, and one visa. Cost varies. |

| Additional Visas | Varies | Additional charges based on requirements and services. | |

| Other Costs | Establishment Card | 2,000 (approx.) | Required for visa processing. |

| Initial Registration Fees | 5,000+ | Depending on business structure and services selected. |

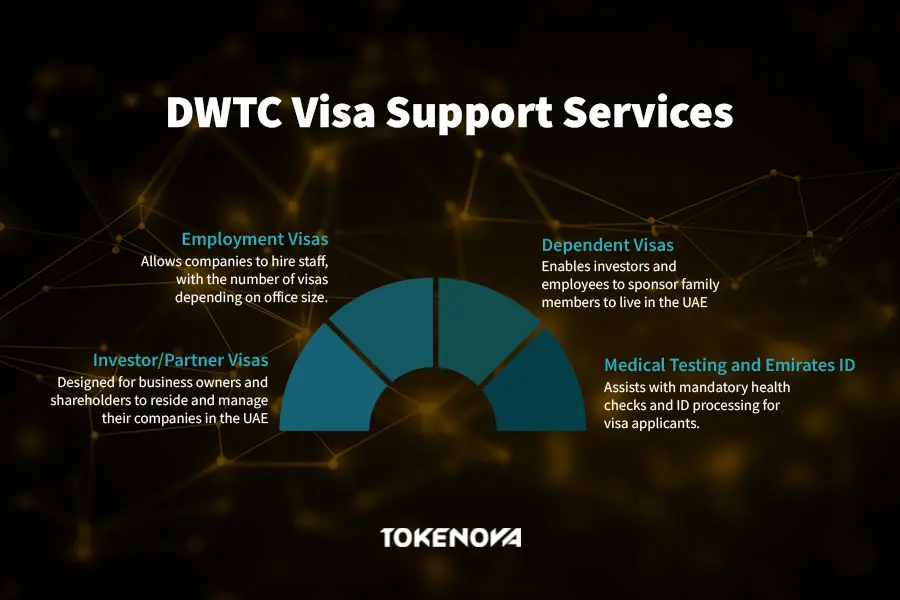

Visa and Immigration Support in DWTC Free Zone

One of the key services offered by the DWTC Free Zone is streamlined visa and immigration support for business owners, employees, and their families. Once a company is licensed, it becomes eligible to sponsor visas based on the size of the office space and the business activity.

Visa services offered include:

- Investor/Partner Visas

This program is designed for business owners and shareholders who wish to reside in the UAE and actively manage the company. - Employment Visas

For staff hired under the company. The number of visas allowed typically depends on the type and size of the leased office. - Dependent Visas

Enables investors and employees to sponsor family members, including spouses, children, and, in some cases, parents.

Medical Testing and Emirates ID

DWTC assists with the standard UAE immigration steps, including medical fitness tests, biometric capture, and Emirates ID processing.

According to Quora discussions, while DWTC provides comprehensive support, many users choose to handle visa applications independently through government portals or typing centers to save on service charges. The process is relatively straightforward, especially for those familiar with UAE procedures.

However, for new investors or businesses bringing in multiple employees, using DWTC’s support services can reduce administrative overhead and ensure compliance with immigration regulations. It’s also worth noting that office space selection directly impacts your visa quota, so this should be considered early during setup planning.

Whether you handle the process yourself or engage support, the DWTC Free Zone offers the infrastructure and authorization needed to manage all essential visa and residency matters efficiently.

Dual Licensing and Mainland Access

One of the notable benefits of setting up in the DWTC Free Zone is the ability to apply for a dual license, which allows companies to operate both within the Free Zone and in Dubai’s mainland under specific conditions.

What is dual licensing?

Dual licensing allows a Free Zone company to legally extend certain business activities to the mainland by obtaining an additional license from the Dubai Department of Economy and Tourism (DET). This is particularly useful for businesses that want to:

- Offer services directly to clients located in the mainland UAE

- Bid on government or semi-government contracts

- Open mainland bank accounts and sign local client agreements

- Operate showrooms, branches, or retail outlets in Dubai city

User insights from Reddit clarify that while dual licensing does provide access to the mainland, it still requires DET approval and may not be available for all business activities. It’s important to confirm eligibility with the DWTC Authority and ensure your license type and office space are aligned with DET requirements.

Important considerations:

- Only certain activities are eligible for dual licensing; not all Free Zone licenses qualify

- You may still need to maintain a physical office or presence in both jurisdictions, depending on your activity

- Costs for DET licenses are additional and subject to mainland regulations

For businesses that need the flexibility to operate in both free zone and mainland markets, particularly in sectors such as consulting, services, or retail, dual licensing provides a practical and compliant method to broaden their reach without the need to establish a separate mainland entity.

Before proceeding, it’s essential to have a clear discussion with DWTC or a trusted advisor to understand the exact scope, conditions, and documentation involved. This process ensures there are no surprises down the line, especially with compliance and renewals.

Why Choose DWTC Free Zone Over Other Free Zones

With over 40 free zones in the UAE, choosing the right one depends on your business goals, industry, and budget. DWTC Free Zone positions itself at the higher end of the spectrum, offering premium infrastructure, a central location, and access to high-profile networks. It’s particularly suited for businesses that need a credible, visible presence in Dubai’s core commercial district.

Here’s how DWTC compares to other free zones:

| Criteria | DWTC (Dubai World Trade Centre) | Other Free Zones (e.g., RAKEZ, UAQ FTZ, IFZA, SHAMS) |

| Location Advantage | Central Dubai; close to business, government, events, and regulators. | Often in outer-city locations; less access to central business and government districts. |

| Brand Credibility | High prestige; signals professionalism and stability—ideal for high-end clients and institutions. | Lower prestige; may not convey the same level of professionalism to discerning clients. |

| Sector Focus | Strong for consulting, event management, IT, media, financial services, virtual assets, and family offices. | General focus; may not offer specialized infrastructure for advanced sectors. |

| Startup-Friendliness | Higher costs, but greater benefits for established or growth-oriented businesses. | Lower setup costs and simpler procedures—ideal for startups or solo consultants on a budget. |

| Client Perception | Positive, especially among government and institutional partners. | May lack the same positive perception or prestige as DWTC. |

Conclusion

DWTC Free Zone is not the lowest-cost option in the UAE, but for many businesses, it offers exceptional value. The combination of regulatory clarity, business support, visa flexibility, and geographic positioning makes it an ideal choice for entrepreneurs and firms that prioritize brand strength, access, and professionalism.If you’re confident in navigating the process, DWTC offers direct and efficient company formation. That said, reviewing your documents and setup plan with a consultant like Tokenova can help you avoid costly missteps and ensure you get the most out of your investment. Whether you’re launching a new venture or expanding into Dubai, DWTC Free Zone offers a robust platform for long-term growth.