Tokenizing real-world assets—real estate, commodities, even invoices—opens up new models for ownership and transfer. But it’s not just about code or market access. Legal classification, technical stability, and asset behavior all carry risks that can derail a project.

This article breaks down where those risks come from, how to assess them before launch, and what to do about them, especially if you’re setting up in a jurisdiction like the UAE.

Key Risk Areas in RWA Tokenization

RWA tokenization risk assessment challenges are spread across three domains: law, code, and market structure. These aren’t hypothetical. They’ve already caused projects to stall, break, or get shut down. Here’s where the trouble usually starts:

Legal and Regulatory Risks

- Token Classification

Mislabel the asset, and you’re in trouble before anything’s launched. If your token gives access to future profit, shared revenue, or fractional ownership, it probably counts as a security. The U.S. uses the Howey Test. In the UAE, you’ll deal with frameworks inside DIFC or ADGM. Each one has its own definitions, and they don’t overlap neatly.

- Jurisdictional Gaps

Legal strategies built for one country rarely transfer cleanly to another. For example, tokenization methods acceptable in Europe often require amendments or licensing in the UAE. Fail to map this out properly, and you’ll lose months—or worse, attract regulatory heat.

- KYC / AML Structures

Lightweight checks aren’t enough. UAE regulators expect strong onboarding controls. If your process skips due diligence—or doesn’t retain the right records—you’ll hit compliance walls quickly, especially when moving fiat into or out of tokenized systems.

Technical Risks

- Smart Contract Vulnerabilities

If your token logic relies on smart contracts, it’s only as safe as the code. Reentrancy bugs, broken permission structures, and unchecked inputs have already drained millions from token ecosystems. Projects that skipped independent audits often paid the price.

- Oracle Reliability

Off-chain data powers most RWA tokens, including asset values, rent flows, supply chain events, etc. If your Oracle goes offline, sends corrupted data, or gets manipulated, your entire contract behavior can skew pricing, ownership, and even rights distributions.

- Chain Limitations

Some projects start on Ethereum without accounting for congestion or gas costs. Others try to run on sidechains with weak finality guarantees. If your asset requires fast or frequent transactions (like tokenized receivables), the wrong network can turn into a bottleneck.

Market Risks

- Illiquidity

A token isn’t useful if no one trades it. This is especially true for niche RWAs like tokenized luxury goods or agricultural contracts. With low secondary market demand, investors can’t exit easily, so the value they assign to the token drops.

- Valuation Drift

RWAs don’t reprice themselves. If you rely on quarterly appraisals or outdated external inputs, your token’s listed price might not match the asset’s real worth. That mismatch creates arbitrage risk and erodes trust among investors.

- Redemption Shock

Some assets can’t be sold fast. When too many token holders try to cash out at once, the underlying system can lock up. Without structured withdrawal mechanisms—like timed redemptions or max cap per cycle—these events can spiral into wider liquidity issues.Don’t wing it if you’re putting money, time, or reputation into an RWA tokenization. These risks have shut down deals that looked airtight on the surface. Tokenova works on this daily, especially inside the UAE’s regulatory setup. Start with the right structure if you’d rather not deal with the aftermath.

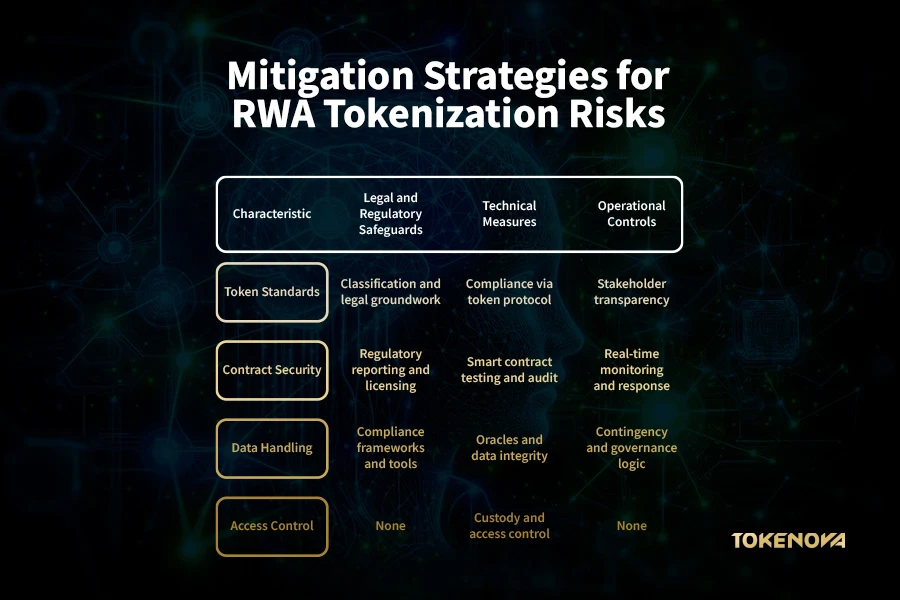

Mitigation Strategies for RWA Tokenization Risks

Identifying risks is only half the job. How you deal with them matters more before the asset goes on-chain. Legal setups must be precise, contract logic needs to hold under stress, and operational control systems should be able to catch issues without delay.

Here’s what a real mitigation plan looks like when the stakes are high.

Legal and Regulatory Safeguards

- Token Classification and Legal Groundwork

Start with what the token represents—economic rights, asset ownership, dividends, or access. Then pin it to the correct classification. If it’s security, you’re looking at compliance with legal frameworks for RWA tokens, like the UAE’s FSRA regulations (ADGM), DFSA rules (DIFC), or the UAE’s Central Bank rulebook.

In the U.S., expect to face Howey, Reves, and even the SEC’s DAO report standards. Some firms use a legal wrapper (SPV or trust) to define rights between token holders and the underlying asset clearly. It’s not a shortcut. It’s a requirement if you want a model that won’t collapse under scrutiny.

- Regulatory Reporting and Licensing Protocols

Depending on the asset and offer type, projects operating in the UAE might require a Financial Services Permission (FSP) from ADGM or DFSA licenses.

The setup must include investor categorization (professional vs. retail), ongoing disclosure mechanics, legal opinions per jurisdiction, and cross-border offering constraints. Missing any of these can lead to blacklisting or fines.

- Compliance Frameworks: Tools and Standards

Don’t guess compliance. Use frameworks like ISO/TC 307 (for blockchain governance), FATF’s Travel Rule implementation via tools like TRISA or Notabene, and Rule Engine automation that checks user risk scoring, transaction history, and blacklist matching.

Reports should be audit-ready, scheduled, and event-triggered. And yes, that includes off-chain recordkeeping that mirrors smart contract actions.

Technical Measures

- Smart Contract Testing and Audit Standards

Every line of smart contract code is part of your legal execution layer. Run unit tests (Truffle, Hardhat), fuzzing (Echidna, Foundry), and formal verification (Certora, K Framework) to catch logic holes.

For audits, go external. OpenZeppelin, Trail of Bits, Halborn, and Certik are not just names—they have track records. Internal review doesn’t cut it.

- Standard Compliance: Use the Right Token Protocol

Use token standards that enforce on-chain permissioning and investor restrictions. ERC-3643 is a top pick for RWA tokenization on blockchain—it supports compliance checks directly in the transfer function.

Others include ERC-1400 (modular securities) or ERC-3475 for structured products. If you’re on non-EVM chains, find the equivalent: Polymesh (native compliance), Tezos FA2, or Avalanche’s Subnet custom VM logic.

- Oracles and Data Integrity

Asset pricing, rental income, appraisal values—many of these rely on oracles. Use decentralized options like Chainlink OCR, Witnet, or RedStone. Always design for failure: stale data, timestamp drift, malicious inputs. Add multiple oracles. Weight them. Set deviation thresholds. If the data’s wrong, the contract shouldn’t be executed.

- Custody and Access Control

Don’t store token admin keys in a MetaMask wallet. Use MPC (Fireblocks, Qredo), HSMs (Ledger Vault, Anchorage), or multisig setups (Gnosis Safe) for treasury and administrative functions—Automate key rotation policies. Maintain tamper logs and session recording for any admin action. These are expected in regulated environments.

Operational Controls

- Real-Time Monitoring and Response Systems

Every contract interaction should feed into monitoring systems—on-chain event watchers (Tenderly, Forta), log aggregators (Datadog, Sumo Logic), and security alerts (Sentinel, BlockSec Guard). If something breaks, you want a timestamped audit trail, not a black box.

- Contingency and Governance Logic

Deploy upgradeable contracts with explicit delay windows. Set up emergency pause functions (Circuit Breakers). Governance should be clearly defined: who can vote, what quorum is needed, and how emergency actions are triggered. Snapshot votes, Tally integrations, and hardcoded time locks add real protection.

- Stakeholder Transparency

Set expectations early. Publish smart contract audits, legal reviews, and Oracle configs. Provide investors with redemption rules, lock-up logic, and valuation methods. This isn’t just about trust—it prevents legal claims later when things don’t perform as expected.

Why Early-Stage Advice Matters

An audit won’t fix a flawed foundation. That’s the part too many teams overlook. The token might pass technical review, but if the legal structure is off—or the permissions logic doesn’t reflect regulatory reality—it doesn’t matter. You’ll be rebuilding, not scaling.

Common Missteps in UAE-Based Tokenization

Plenty of projects in the region start with good intentions and solid tech, but stumble because they miss early legal realities.

- Skipping or misreading licensing rules

It’s easy to assume that ADGM or DIFC gives you a green light by default. They don’t. If your token carries profit rights, fractional ownership, or resembles a financial product, you may need a Financial Services Permission (FSP) or similar approval. Some founders only learn this after they’ve onboarded investors, and the damage is done by then.

- No legal wrapper, or the wrong one

Without an SPV, foundation, or trust to hold the underlying asset, what exactly is the token backed by? If it’s not pinned to a real legal claim, it’s just software pretending to be finance. That might work in a sandbox, but not when someone asks for redemption—or in court.

- Weak onboarding protocols

One KYC form won’t cover it. UAE regulators expect more:

- ID verification

- PEP checks

- Source of funds documentation

- ongoing monitoring

Projects that try to do the bare minimum here often get flagged by compliance teams at partner banks. That’s not just inconvenient. It can freeze capital.

Audit vs. Upfront Design: Not the Same Thing

Audits receive a lot of attention, and they should. But they only tell you whether the contract does what it says it will do, not whether it should exist in the first place.

Design comes before that. It means deciding what rights the token gives, who gets them, how they’re exercised, and how those rights interact with actual asset ownership and regulatory boundaries. Once that’s clear, then—and only then—does it make sense to build the contract.

Audits check the structure for cracks. But if you built the wrong structure to begin with? That’s not the auditor’s job.

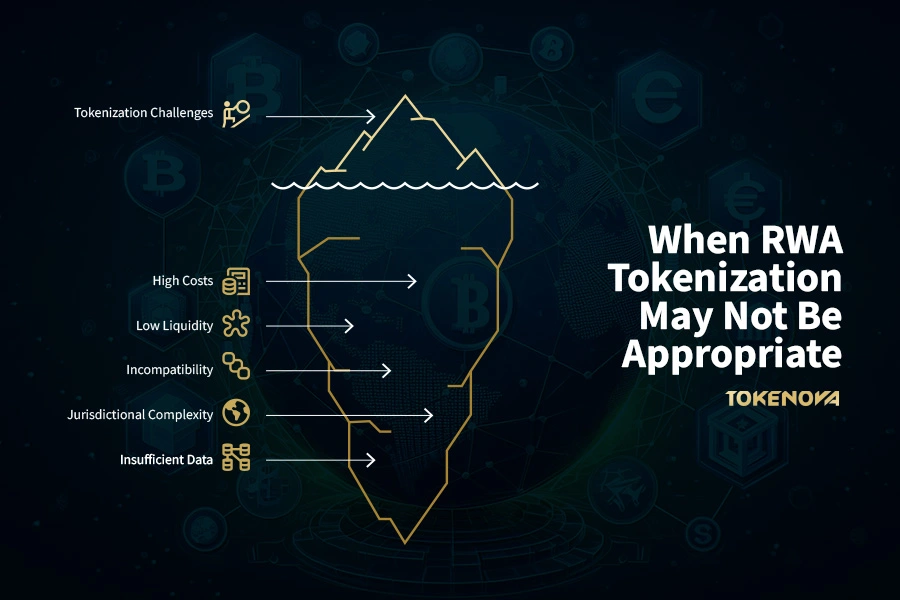

When RWA Tokenization May Not Be Appropriate

While RWA tokenization can offer new access pathways to traditionally illiquid assets, several scenarios may introduce more problems than it solves.

Below are key considerations—supported by technical context and, where available, quantitative data—that help determine when tokenization may not be suitable:

High Transaction and Compliance Costs

Blockchain transaction fees (gas costs) on Ethereum fluctuate widely, from less than $1 to over $50 during periods of congestion. These costs can make frequent or small transactions uneconomical.

Legal and compliance costs can reach $5,000–$50,000+ per asset, depending on jurisdiction and the complexity of regulatory requirements (e.g., SEC exemptions, KYC/AML frameworks).

These overheads often outweigh any efficiency gained via tokenization for assets below a certain value (e.g., <$250,000).

Low Liquidity and Market Fragmentation

Many tokenized RWAs lack sufficient secondary market depth. For example, a 2024 Financial Times article notes that investors on platforms like RealT and Lofty have reported difficulties selling their tokens due to thin secondary market activity, sometimes accepting lower prices to exit positions.

Limited order books and wide bid-ask spreads make it difficult for holders to exit positions without taking a loss or waiting long periods.

Incompatibility with On-Chain Infrastructure

Real-world assets like fine art, collectibles, or niche private equity often have no reliable price oracle, making on-chain valuation mechanisms infeasible.

Assets with subjective or irregular cash flows (e.g., certain IP royalties) can be difficult to structure into automated smart contracts.

Jurisdictional and Custodial Complexity

In countries with non-digitized property registries, proving legal ownership or transferring rights through tokenized instruments is either impractical or outright impossible.

In multi-jurisdictional scenarios (e.g., foreign investors buying tokenized U.S. real estate), tax withholding and securities compliance add layers of operational risk.

Insufficient Asset Performance History

Historical data may be missing when tokenizing newer or experimental asset classes (e.g., carbon credits, startup royalties).Without at least 3–5 years of audited performance data, risk modeling and investor due diligence are significantly impaired.

Conclusion

Tokenizing assets, especially real-world assets, without a solid foundation leads to problems you can’t patch later. Misclassified tokens, missing legal wrappers, weak KYC systems—these don’t just stall projects, they break them. Most teams only find out after launch, when fixing things is expensive.

You don’t need perfection on day one, but the structure has to hold. If you’re unsure about compliance, rights mapping, or what local rules actually require, you can always count on us at Tokenova to help.

Reference: smartliquidity

How are dividends or income from tokenized assets distributed?

Dividends are paid automatically via smart contracts, based on ownership percentages. Income flows can be set for fixed intervals or triggered events.

What happens if the underlying real-world asset is damaged or destroyed?

Typically, insurance covers the asset. If a claim is paid out, proceeds are distributed to token holders according to their share.

Can tokenized assets be used as collateral for loans?

Yes. Some DeFi platforms and private lenders accept tokenized RWAs as collateral, depending on valuation and legal enforceability.

How is the value of a tokenized asset determined and updated?

Values are updated through price oracles, appraisals, or off-chain feeds linked to real-time market data or third-party evaluators.

Are there secondary markets for trading tokenized real-world assets?

Yes, but liquidity varies. Some platforms allow peer-to-peer trading; others operate regulated exchanges under specific asset classes.

What legal risks are associated with tokenizing real-world assets?

Jurisdictional differences, regulatory classification, and enforceability of smart contracts can introduce legal uncertainties.

How is ownership verified and protected on-chain?

Ownership is recorded on a blockchain, but legal backing often depends on off-chain agreements and regulatory frameworks.

What happens in the event of issuer default or fraud?

Investor protections depend on asset structure and jurisdiction. Legal recourse and insurance coverage may mitigate losses, but not eliminate them.

How are operational risks handled in tokenized asset platforms?

These include technical failures, key management errors, and custody risks. Risk mitigation depends on platform design and audit practices.

Are there transparency risks in RWA tokenization?

Yes. Incomplete or inaccurate asset performance reporting, valuation, or legal status can expose investors to unexpected outcomes.