NFT ticketing replaces printouts and QR codes with smart contract tickets that live on-chain. This shift isn’t just about better tech, but rather about flipping control back to the organizer and the attendee.

Each ticket, minted as an NFT (ERC-721 or ERC-1155), holds its own metadata, including seat info, event name, transfer rules, and resale limits. This lives on a decentralized ledger, meaning you can’t tamper with it, and you can’t fake it. When you purchase a ticket through an official NFT ticketing platform, the smart contract executes the transfer instantly, moving the ticket directly into your crypto wallet. There’s no waiting for email confirmations, no files to download, and no third-party delays. Just clean, automatic delivery through the blockchain itself.

Organizers can hardcode logic like royalties or anti-scalping rules right into the NFT. So if someone flips it on a secondary market, the system auto-distributes a cut or blocks the trade altogether. That’s the upside of programmable access.

At the door, scanning wallet ownership replaces barcode scans. On-chain proof replaces human guesswork. After the event ends, your NFT ticket doesn’t just vanish like a paper stub. It can stay in your wallet as a verified collectible that may unlock perks like discount codes, behind-the-scenes content, or early access to future events. That’s NFT ticketing doing what old tickets couldn’t.

NFT Ticketing vs Traditional Ticketing: A Complete Comparison

Traditional tickets, such as paper stubs and scannable QR codes, sit on centralized servers and carry zero permanence. Anyone with Photoshop or access to the backend can replicate or reroute them. That’s the crack NFT ticketing seals.

With NFT event tickets, the whole lifecycle, from minting to transfers to resales, gets recorded on-chain. Everyone sees the same ledger. There’s no way to alter records behind the scenes or manipulate transfers. Anyone with a wallet can view a ticket’s full transaction history and confirm its legitimacy without third-party help. This moves past basic digitization and delivers fully decentralized ticketing with on-chain verification and built-in control.

Smart contract tickets lock in more than access. They enforce the rules. Resale caps, royalties for creators, and anti-bot protections are all enforceable at the contract level. These mechanisms operate without manual oversight, baked directly into the ticket logic. That kind of control was never feasible with older, centralized systems.On top of this, since the ticket lives on-chain, organizers tap into real-time data, like resale hotspots, user geos, and transfer rates, without ever prying into private info. That’s blockchain event access with analytics baked in. Then there’s the market. While the digital ticketing platform space will hit $91.1B by 2033 at a 4.03% CAGR, NFT ticketing is scaling faster, with a projected 30% CAGR from 2025. Moreover, research on Global Market Estimates (GME) shows that the broader NFT in the ticketing market is projected at a 14.5% CAGR from 2023 to 2028.

Read More: Exploring Tokenization in Blockchain: A New Era of Assets

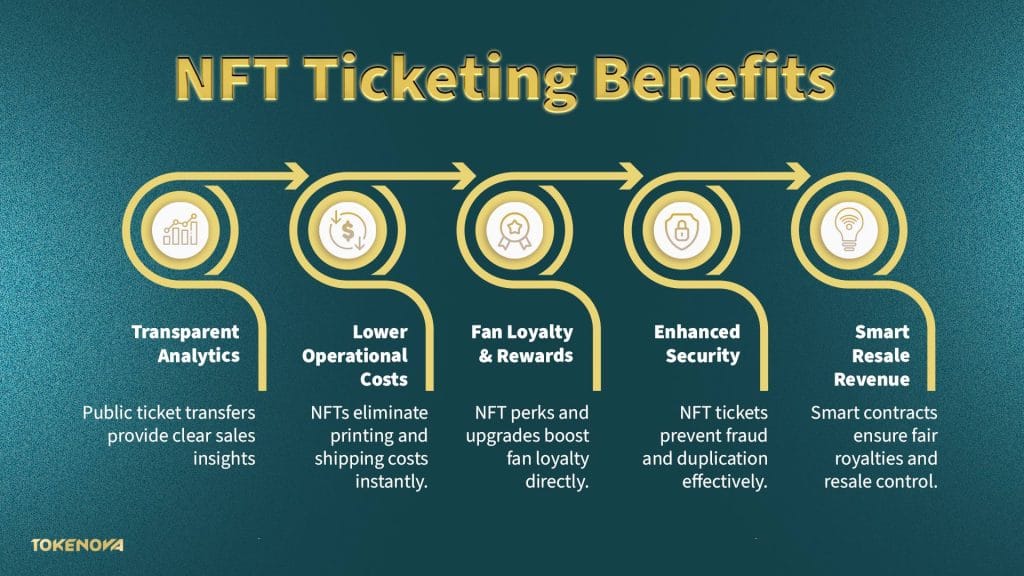

Key Benefits of NFT Ticketing for Event Organizers and Attendees

NFT ticketing has matured over the past few years and is running live at concerts, conferences, and stadiums. This shift goes beyond surface-level upgrades, directly tackling the long-standing flaws in traditional ticketing infrastructure. NFT ticketing improves how events are organized, how money flows, and how fans stay connected after the gates close.

Enhanced Security and Anti-Fraud Measures

Blockchain ticketing wipes out common scam vectors. Each NFT ticket carries a unique on-chain identity tied to a verifiable wallet. That makes duplication or tampering nearly impossible. This way, event teams no longer rely on barcode scans or third-party systems, as each entry gets validated right on the chain.

Built-in Revenue Sharing from Resales

With smart contract tickets, resale rules are enforceable by code. Organizers can define royalty structures, place limits on resale prices, and restrict known bot activity, all hardcoded into the ticket logic through smart contracts. A platform like GET Protocol proves how NFT ticketing fraud prevention and fair monetization can coexist. Artists and organizers earn from every resale without chasing it.

Streamlined Operations and Cost Savings

With NFT ticketing, printed tickets and shipping logistics are cut out entirely. NFT event tickets are distributed instantly to wallets across the world. This turns ticketing into a low-overhead, digital-first channel, one that cuts middlemen and slashes logistics.

Intelligent Fan Engagement and Loyalty

NFT ticketing becomes a loyalty rail. Organizers can reward long-term fans by sending exclusive content or VIP upgrades directly to wallets that hold previous tickets. NFTs can continue delivering value after the event by enabling organizers to drop rewards, updates, or perks straight to the ticket holders’ wallets.

Data Insights and Analytics

Every transaction, resale, and transfer is public. Organizers get insight into fan movement and demand, with full visibility into what’s happening and without any reliance on private dashboards or vague reports.

Read More: Build an NFT Marketplace from Scratch: A Step-by-Step Guide

Challenges and Limitations of NFT Ticketing

NFT ticketing solves major legacy issues, but it’s not frictionless. The ecosystem still carries onboarding hurdles, technical limits, and unclear regulations. These challenges don’t discredit the model, but they shape how and where it works best. Here’s what event teams and users should expect.

Onboarding and Usability Friction

Managing wallets, securing private keys, and covering transaction fees can overwhelm everyday users unfamiliar with crypto systems. For non-crypto audiences, this creates real friction. Until wallet UX improves and fiat onramps become seamless, NFT ticketing may stay niche for mainstream crowds.

Network Congestion and Transaction Costs

Blockchains like Ethereum often choke under high demand. Ticket drops can trigger gas spikes, purchase failures, or stalled confirmations. Even with Layer-2s helping, their extra steps and ecosystem fragmentation can make the process messier, not smoother.

Legal and Regulatory Ambiguity

NFTs used for access or resale profit can trigger financial scrutiny. Without standardized frameworks for how NFT ticketing fits into existing laws, organizers risk compliance issues, from royalties to consumer protection to tax obligations.

Peripheral Security Threats

Blockchains are secure. Wallets, contracts, and marketplaces are less so. Sloppy smart contract code, phishing links, or compromised secondary markets can still expose user assets.

Crypto Volatility and Pricing Pressure

NFT ticket pricing tied to volatile crypto tokens can confuse or repel buyers. Price swings mess with perceived value, and organizers must weigh the risk of pricing in ETH or other unstable tokens.

Privacy Gaps in Public Chains

On-chain transparency helps organizers, but it also reveals behavioral patterns. Without optional privacy layers, wallet addresses and ticket histories are fully visible, potentially exposing users in ways they never consented to.

Read More: Top Asset Tokenization Challenges & How to Overcome Them

Top NFT Ticketing Platforms to Know in 2025

A few platforms have gone far beyond experimenting with NFT ticketing. In 2025, certain players lead the space with operational scale, strong user experience, and practical features that serve both organizers and audiences.

GET Protocol

GET Protocol links blockchain rails to traditional event systems. It processes over 200 events per month and enforces resale limits, price caps, and revenue splits directly through smart contract tickets. For organizers, it means scalable tokenized blockchain event access without alienating mainstream users.

GUTS Tickets

GUTS has issued more than 600,000 NFT tickets worldwide. Its focus is on eliminating scalping by embedding resale rules directly into each ticket, making unauthorized resales both traceable and unprofitable. Resale conditions are embedded into every ticket, making hoarding unprofitable and manual enforcement unnecessary.

YellowHeart

YellowHeart builds collectible NFT event tickets in collaboration with top-tier artists. Smart contract enforcement ensures fans (not bots) benefit from any resales. It combines audience engagement with verifiable blockchain ticketing mechanics.

SeatlabNFT, NFT Tix, and WICKET

These platforms push experimental features like dynamic NFTs, multichain issuance, and integrations with metaverse events. All three offer flexible rule-setting and support for cross-chain activity, a growing need as blockchain ticketing expands.

Tixbase (formerly NFT-TIX)

Tixbase runs a white-label NFT ticketing platform on Avalanche. It partnered with Pollso, Turkey’s national ticketing brand, to handle over 25 million tickets a year. Its focus is B2B scalability, not hype.

Aventus Protocol

Built on Ethereum, Aventus has been around since the 2018 FIFA World Cup. Its open-source framework centers on traceable ownership, resale controls, and public on-chain auditability, which are ideal for projects demanding transparency at scale.

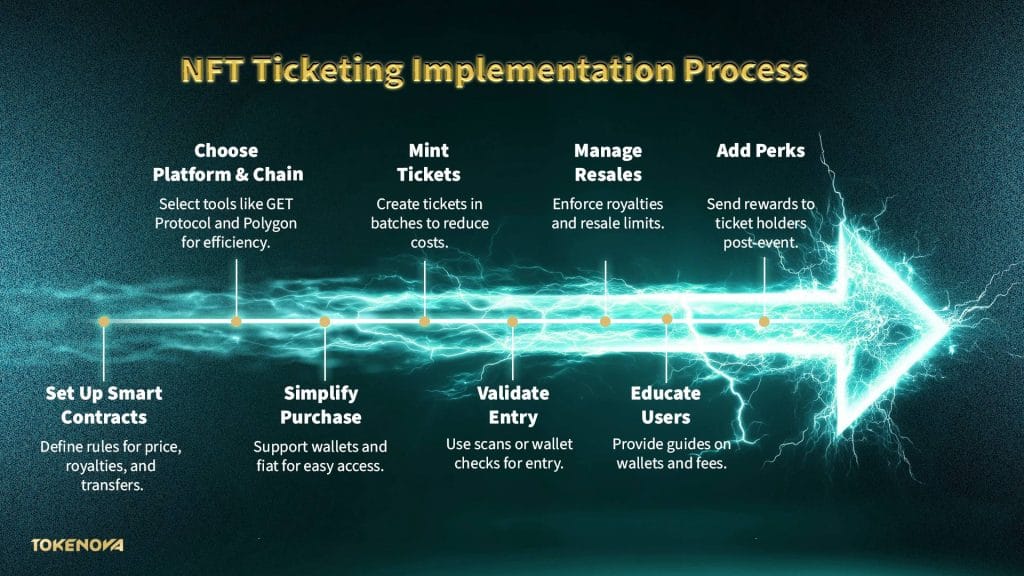

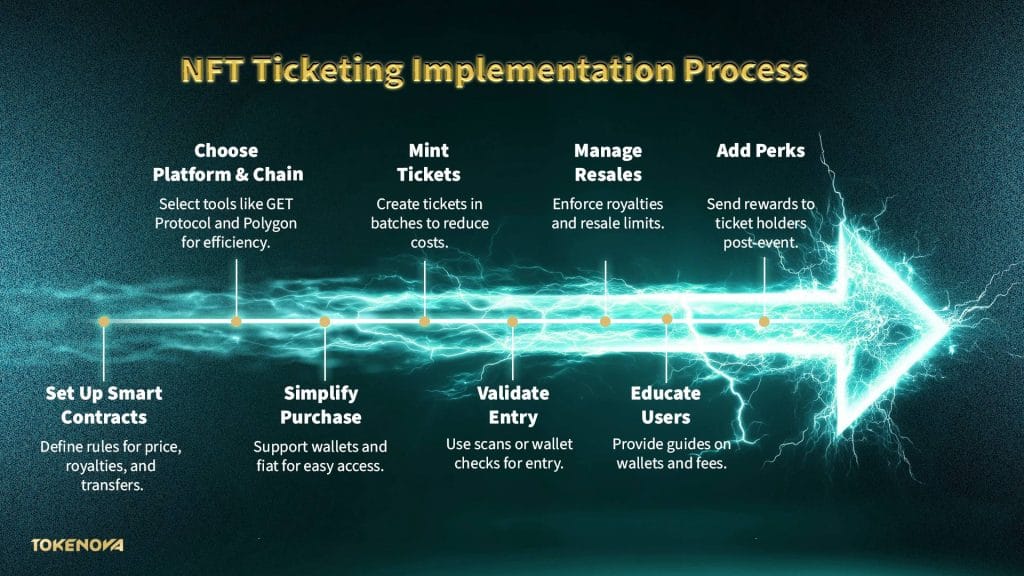

How to Implement NFT Ticketing for Your Events

Getting started with NFT ticketing isn’t about reinventing the wheel. If you’re clear on the tools and steps, setup can be fast, functional, and user-friendly.

1. Choose a Blockchain and Platform That Fits

Pick a platform aligned with your audience and event size. GET Protocol, GUTS, and YellowHeart are proven options. Chains like Polygon and Avalanche offer low fees and fast confirmations, useful when minting large ticket batches.

2. Set Up Smart Contracts

Smart contracts in tokenization are highly crucial for automating the rules and fostering transparency, and it’s the same story with NFT ticketing. You should define ticket parameters, including price, cap, royalty, and transfer permissions. Use audited templates like OpenZeppelin’s ERC-721 standards, or adapt existing tools provided by your NFT ticketing platform.

3. Mint the Tickets

Upload assets and metadata, including event details, seat info, and perks, to decentralized storage like IPFS. Then mint the tickets using your defined smart contracts. Batch or phased minting can reduce cost and avoid congestion.

4. Make the Buying Process Smooth

Build a clean interface where users can connect wallets and buy tickets. Support wallet options like MetaMask and Coinbase Wallet, and add fiat payment support to onboard non-crypto users.

5. Manage Resales and Royalties

Program secondary sale logic into the contract. You can cap resale prices, enforce royalty splits, or whitelist resale channels to limit scalping and automate payouts.

6. Enable Entry Validation

Integrate scanning or wallet-checking tools at the gate. Burn tokens or flag them after check-in to prevent reuse. Your NFT becomes a one-time verifiable pass.

7. Add Post-Event Utility

Attach perks to ownership to build loyalty. Drop discounts, access codes, or exclusive content into wallets that hold tickets.

8. Communicate Clearly

Promote the NFT ticketing benefits early. Walk users through wallets, fees, and storage basics. A few simple guides can lower drop-off.

If handled right, NFT ticketing builds credibility, unlocks new revenue, and turns events into ecosystems. Our Web3 experts at Tokenova can give you strategic guidance with your event ticketing pursuits and consultation on implementing cutting-edge ticketing technology. Contact us today to book your first consultation session.

Final Words

NFT ticketing has already crossed the threshold from concept to execution. Platforms like GET Protocol and GUTS have moved well beyond pilot stages, scaling NFT ticketing to more than 600,000 tickets issued across over 120 countries. For organizers, the upside is concrete: programmable revenue splits, fraud-resistant access, and post-event utility baked into each smart contract.

The friction points are real. Wallet onboarding still needs work. Regulatory frameworks are patchy. Gas fees can bite at the wrong time. But the direction is clear. The NFT ticketing market is projected to hit $3.4 billion by 2033, growing at nearly 15% CAGR.

If you’re organizing events in 2025 and still using legacy ticketing rails, you’re missing control, revenue, and data, while NFT ticketing can readily flip that script. Contact our team right now to explore various approaches you can use to enhance your business and event organization operations using NFT ticketing.

References: ND Labs, Seat Lab NFT, Business Research Insights