Businesses throughout the globe are shifting to fiat-to-crypto payment gateways by 2025 to grow internationally, reduce costs, and serve crypto-savvy clients. These solutions enable you to take cash (such as USD or EUR) and turn it into crypto right away, which makes payments quicker and more flexible.

This guide has everything you need to choose the best solution for your company, including a list of the best gateways, their most important features, how to integrate them, compliance guidelines, and future trends.

What Is a Fiat-to-Crypto Payment Gateway?

A fiat-to-crypto payment gateway is a financial service that enables businesses to accept fiat currencies — like USD, EUR, and GBP — and seamlessly convert them into cryptocurrencies such as Bitcoin, Ethereum, or stablecoins. This allows merchants to tap into the global crypto market without the complexity of managing crypto wallets, exchanges, or blockchain infrastructure themselves.

For example, Stripe Crypto Onramp provides a smooth integration where e-commerce sites or apps can offer users the ability to purchase crypto directly using their credit card or bank account. Stripe manages the payment process, conducts compliance checks such as KYC/AML, and facilitates the delivery of cryptocurrency, offering a ready-to-use solution for platforms seeking to incorporate crypto functionality without the need for in-depth development.

Similarly, Simplex offers a robust fiat-to-crypto onramp used by exchanges and wallets, allowing end users to buy crypto with fiat in real time. Simplex takes care of fraud prevention, regulatory compliance, and chargeback protection, providing businesses with a secure, scalable payment backbone.

Aggregator platforms such as Onramper, which combine multiple gateways such as Simplex, MoonPay, and Wyre into a single API, offer businesses access to the most competitive rates, currencies, and global coverage, eliminating the need for individual integration with each provider.

These gateways are critical for any company operating in the Web3, fintech, or digital commerce space — they remove the technical and regulatory barriers that traditionally separated fiat payments from crypto assets.

Read More: Tokenization in Payments: A Comprehensive Guide for Secure Transactions

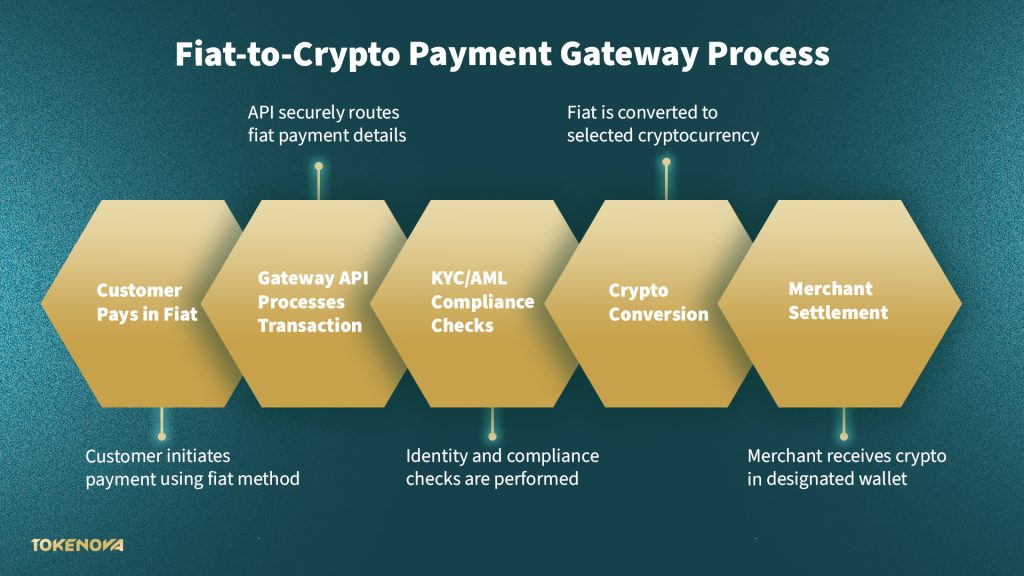

How Do Fiat-to-Crypto Payment Gateways Work?

Crypto onramps work by linking the customer’s fiat payment to the business’s crypto settlement in a series of steps. Using Stripe’s Crypto Onramp and Onramper as examples, here’s how it usually works:

Customer pays in fiat

A customer uses a credit card, debit card, bank transfer, or another fiat method (like Apple Pay) to make a purchase or top up their crypto wallet.

Gateway API processes the transaction

The gateway’s API integrates into the merchant’s platform (website, app, or exchange) and handles the payment routing, passing the fiat details securely through the system.

KYC/AML and compliance checks

Providers like Simplex and MoonPay apply mandatory Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, verifying user identity, screening for fraud, and ensuring compliance with international regulations.

Crypto conversion

Once the payment and checks are approved, the gateway converts the fiat into the selected cryptocurrency at the current exchange rate. For instance, Onramper routes the transaction through the best provider it aggregates, helping businesses get optimal rates and availability.

Merchant settlement

Finally, the merchant receives the crypto into their designated wallet or custodial account. Some gateways offer optional fiat settlement, depending on the business’s preference.

Behind the scenes, these steps are supported by a robust technical infrastructure:

– Secure APIs for smooth integration

– Automated payout systems for reliable settlements

– Compliance modules to handle regulatory requirements across regions

This entire process is designed to be quick, user-friendly, and scalable, letting businesses focus on growth without worrying about backend complexity.

Read More: How to Integrate Crypto Payments on Website

Benefits of Integrating a Fiat-to-Crypto Payment Gateway

Integrating a fiat-to-crypto payment gateway has several important benefits for firms that want to be competitive in 2025, both for how they run their company and how their customers feel about it. Vitalik Buterin, the co-founder of Ethereum, said that many people underestimate the advantages of crypto payments, which include convenience and resistance to censorship.

Drawing from providers like NowPayments and real-world industry cases, here’s why it matters:

Global Reach

By accepting fiat payments and instantly converting them to crypto, businesses can tap into a global customer base without being limited by local banking restrictions or currency barriers. Platforms like Simplex and Onramper provide coverage across multiple countries, letting businesses scale internationally.

Lower Transaction Fees

Traditional payment processors (like credit card companies) often charge high fees, especially for cross-border transactions. Fiat-to-crypto gateways can significantly reduce transaction costs, particularly for international payments, where crypto rails bypass expensive intermediaries.

Faster Settlements

Crypto transactions can settle much faster than bank wires or card settlements, often within minutes rather than days. Gateways like Stripe’s Crypto Onramp streamline this process so businesses can access funds quickly and improve cash flow.

Enhanced Customer Experience

From the customer’s side, using a fiat-to-crypto gateway means a smooth, familiar checkout process (credit card, Apple Pay, etc.) while gaining access to crypto. Reddit discussions highlight how developers prioritise user-friendly interfaces and smooth KYC flows, knowing that a clunky or slow checkout leads to cart abandonment.

Appeal to Crypto-Savvy Audiences

Younger, tech-forward customers are increasingly looking for businesses that offer crypto payments. By adding a gateway, businesses can stand out to this growing demographic and reinforce a forward-thinking brand image.

Fraud and Chargeback Protection

Providers like Simplex offer built-in fraud prevention and chargeback protection, reducing risk for merchants compared to traditional payment channels.

Overall, fiat-to-crypto payment gateways offer a strategic edge — combining operational efficiency with customer-centric benefits.

Read More: TradFi vs DeFi in 2025: 7 Revolutionary Changes

Top Fiat-to-Crypto Payment Gateways (2025 Comparison)

Choosing the right fiat-to-crypto payment gateway is critical — not all providers offer the same fees, supported currencies, or geographic reach. To help businesses make informed decisions, here’s a detailed comparison of some of the top players in 2025, using data from fiat2cryp.to, Simplex, Onramper, and NowPayments:

| Provider | Fees | Supported Fiat/Crypto | Regions | KYC Requirements | API & Tech Support |

| Simplex | ~3.5% per transaction | USD, EUR → BTC, ETH, LTC, +100 cryptos | Global | Mandatory KYC/AML | Strong API, fraud prevention |

| Onramper | Varies (aggregator model) | Aggregates Simplex, MoonPay, Wyre, etc. | Global (via partners) | Depends on underlying provider | Unified API, flexible integration |

| MoonPay | ~4.5% card, ~1% bank | USD, EUR, GBP → major cryptos + NFTs | 150+ countries | KYC required for most use | Clean API, developer-friendly |

| Ramp | ~2.9% | USD, EUR, GBP → ETH, stablecoins, more | Europe, US, expanding | KYC required | Strong UX, fast API setup |

| Transak | ~1–3% | USD, EUR, INR, more → BTC, ETH, altcoins | Global | KYC required | Developer-first API, flexible |

| Wyre | ~1–2% | USD, EUR → BTC, ETH, USDC | US, some international | KYC/AML compliant | Simple API, fiat on/off-ramp |

| NowPayments | ~0.5–1% | Crypto-to-crypto + fiat plug-ins | Global | Optional (depends on setup) | Easy plug-ins, no-KYC option |

This table gives businesses a quick snapshot of which gateway might fit their needs — whether they’re looking for the lowest fees, broadest currency support, strong KYC controls, or developer-friendly integration.

💰 Payment Gateway Cost Calculator

Key Features to Look For in a Fiat-to-Crypto Payment Gateway

When choosing a crypto onramps, businesses should look beyond just price. Drawing insights from Reddit developer discussions and industry trends, here are the essential features to prioritise:

Robust, Flexible API

A strong API is the backbone of smooth integration. Businesses should prioritise gateways with well-documented, developer-friendly APIs that allow for easy customisation, scalability, and connection with existing systems. Platforms like Onramper stand out because they aggregate multiple providers under one API, reducing integration headaches.

Regulatory Compliance (KYC/AML)

While “no-KYC” options may sound appealing for speed, businesses must ensure they’re working with gateways that comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, especially in the US, EU, and Asia. Providers like Simplex and Transak offer strong compliance frameworks that reduce legal risk.

Strong Security Measures

Security isn’t just about protecting funds — it’s about protecting customer trust. Gateways should offer encryption, fraud detection, and chargeback protection. For example, Simplex is known for its strong fraud prevention tools.

Smooth User Experience (UX)

Customers expect a quick, frictionless checkout — any slow KYC process, clunky interface, or failed transaction increases abandonment rates. Reddit feedback highlights how critical it is to have a well-designed, intuitive flow that balances security with convenience.

Fast and Cost-Efficient Transactions

Businesses should assess the transaction speed and fee structures carefully. High fees or slow processing can erode profit margins and frustrate customers. Gateways like Ramp and Wyre are often praised for their rapid settlement times and transparent pricing.

By focusing on these core features, businesses can select a gateway that meets technical and regulatory needs and enhances the customer experience — turning payments into a competitive advantage.

Read More: Top Asset Tokenization Challenges & How to Overcome Them

Implementation Guide: Setting Up Your Fiat-to-Crypto Payment Solution

Integrating a fiat-to-crypto payment gateway into your business can feel complex, but following a clear, structured process makes it much smoother. Based on best practices from Stripe and Simplex, here’s a step-by-step guide:

1. Assess Your Business Needs

Start by identifying what you need:

- Are you targeting global customers or specific regions?

- Do you need multiple fiat and crypto pairs?

- Do you require custodial services, or will you manage wallets yourself?

This assessment helps narrow down which gateway providers align with your goals.

2. Select the Right Gateway

Use the comparison table (above) to evaluate providers based on fees, features, KYC requirements, and supported currencies. For example, if you want an aggregator to simplify integrations, Onramper may be ideal; if you want strong fraud protection, Simplex is a solid choice.

3. Integrate via API

Once you’ve selected a gateway, work with your development team to integrate the gateway’s API into your platform (website, app, exchange). Stripe’s onramp integration, for example, offers embedded widgets and customisable flows to streamline setup.

4. Run Testing and Quality Assurance (QA)

Before going live, conduct thorough end-to-end testing:

- Test various payment methods (cards, bank transfers).

- Verify KYC workflows and approval times.

- Ensure crypto settlements are accurate and timely.

5. Review Compliance and Legal Requirements

Ensure you understand the KYC/AML obligations for your region and customer base. Consult legal advisors if needed to avoid regulatory pitfalls, especially if operating across multiple jurisdictions.

6. Launch and Monitor

Once live, continuously monitor transaction flows, customer feedback, and performance metrics. This helps catch issues early and optimise user experience over time.

By following this structured approach, businesses can ensure a smooth and compliant rollout of fiat-to-crypto payment solutions—positioning themselves to take full advantage of the growing crypto payments ecosystem.

Read More: AI and Blockchain Integration: A 2025 Framework

Regulatory Considerations for Fiat-to-Crypto Gateways

Integrating a fiat-to-crypto payment gateway isn’t just a technical task — it’s also a regulatory challenge. Businesses must understand the compliance landscape across the regions they operate in to avoid legal and financial risks.

Here’s what you need to know, pulling from insights across the US, EU, Asia, and user experiences shared on Reddit and Twitter:

KYC (Know Your Customer) and AML (Anti-Money Laundering)

Most reputable providers — like Simplex, MoonPay, and Transak — require customers to undergo KYC verification, providing identity documents before transactions are approved. This protects against money laundering and ensures regulatory compliance.

Some users have pointed out that trying to bypass KYC (using “no-KYC” services) comes with increased risk, especially as global regulators crack down on anonymous transactions.

Global Regulatory Differences

- In the United States, the Financial Crimes Enforcement Network (FinCEN) sets strict guidelines on crypto-related money transmission.

- In the EU, the Markets in Crypto-Assets (MiCA) regulation outlines detailed requirements for crypto service providers.

- In Asia, regulations vary sharply by country — Japan has a licensing framework, while some Southeast Asian countries are still developing crypto policies.

The Risks of No-KYC Gateways

While some platforms market themselves as “no-KYC”, businesses should be cautious. Engaging with such services can expose you to regulatory penalties, banking issues, or customer trust problems if anything goes wrong.

Vendor Responsibility

Good news: leading gateways like Stripe, Simplex, and Ramp handle most compliance processes on the backend, reducing the burden on your business. However, you should always review contracts, terms of service, and liability clauses carefully to understand what risks you retain.

In summary, businesses that anticipate compliance and select providers with robust regulatory frameworks can avert significant challenges in the future.

Before integrating any fiat-to-crypto gateway, take time to assess the provider’s regulatory track record, KYC/AML procedures, and regional licensing status. Reach out to vendors directly with legal or compliance-specific questions — especially if you’re operating across multiple jurisdictions.

Choosing a gateway isn’t just about ease of use or conversion rates — it’s about long-term stability, trust, and minimising risk exposure.

Read More: Best Countries to Register Your Crypto Company

Conclusion

As crypto adoption accelerates in 2025, integrating a fiat-to-crypto payment gateway has become a smart move for businesses looking to expand globally, improve cash flow, and appeal to a new generation of crypto-savvy customers.

By carefully selecting a provider—considering factors like fees, supported currencies, regulatory compliance, API flexibility, and security—businesses can turn crypto payments into a competitive advantage rather than a technical headache.

Real-world experiences, from developers integrating Stripe or Simplex to business leaders like Vitalik Buterin championing crypto’s convenience, highlight the demand for smooth, secure, and compliant payment solutions. With the right setup, businesses can confidently navigate this evolving space, future-proofing their payment systems and staying ahead in the digital economy.