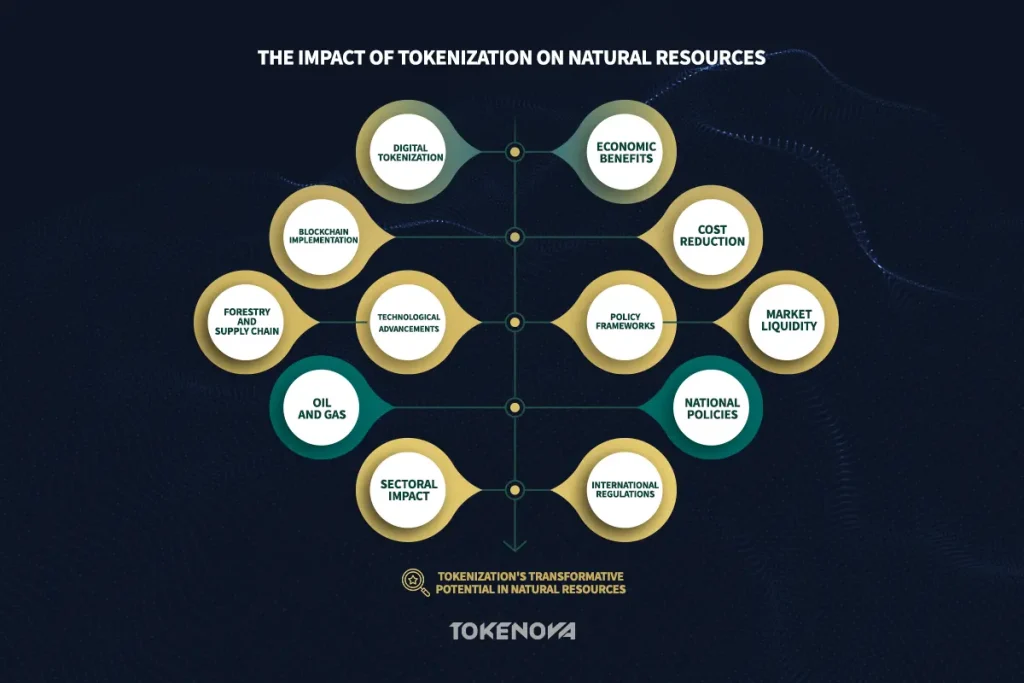

The concept of tokenization is revolutionizing finance and the management of natural resources. At its core, tokenization involves converting physical assets or data into digital tokens on a blockchain, thereby enhancing transparency, efficiency, and accessibility. This innovative approach, aptly named the tokenization of natural resources, holds immense promise for improving asset management, increasing liquidity, and promoting sustainability across various sectors. In today’s article, we’re going through the subject at hand, analyzing it thoroughly, and learning all there is about it like its benefits, challenges, etc. Stay with us through the rest.

Tokenization of Natural Resources: A New Frontier in Environmental Management

Real-world applications vividly illustrate tokenization’s advantages. For instance, in the timber supply chain, tokenization tracks timber’s journey from forest to end-user, providing verifiable proof of sustainable practices and origins. In the realm of groundwater management, it enables effective monitoring of consumption and recharge rates to ensure sustainable usage. This multifaceted approach not only contributes to environmental conservation but also fosters economic efficiencies by optimizing resource allocations and enhancing investor confidence.

Leading companies, such as Powerledger and Parley for the Oceans, are at the forefront of this movement, harnessing blockchain technology for sustainable natural resource management. Their initiatives underscore the transformative potential of tokenization, highlighting the necessity for broader adoption across various sectors.

Another key example of a successful application is the MyPower Platform, developed by Riddle & Code Energy Solutions in partnership with Wien Energie. This platform tokenizes solar panel assets, allowing customers to invest directly in Austria’s solar energy sector. By facilitating public participation in renewable energy projects, the initiative exemplifies how tokenization can democratize access to investments in sustainable energy solutions.

Tokenization of natural resources is indeed on the rise

Understanding tokenization’s impact through data can be enlightening. A recent study demonstrated that employing blockchain and tokenization in the supply chain could reduce paperwork and administrative costs by as much as 30%. In the forestry sector, a pilot project reported a 20% increase in traceability and transparency when utilizing tokenized solutions.

in 2023, The Central African Republic (CAR) established a comprehensive framework for tokenizing its natural resources, including gold, uranium, and diamonds. This allows both citizens and foreign investors to participate in these markets through digital tokens such as the Sango coin.

Another interesting and promising insight comes from a study that suggests fully tokenizing real-world assets (RWAs), such as natural resources, could result in gross economic savings of up to $2.4 trillion per year. Realistically, it is projected that the annual economic benefits from tokenization could range between $31 billion and $130 billion by 2030.

Moreover, The World Economic Forum estimates that tokenizing oil and gas could significantly boost market liquidity by $1.6 trillion, expanding the total market size by $2.5 trillion. Such substantial financial potential motivates companies within non-renewable sectors to embrace tokenization.

Challenges and Considerations: A Deeper Look

| Challenge | Description | Considerations |

| Data Noise and Ambiguity | Natural resource datasets often contain variations that lead to misunderstandings. | Robust tokenization processes are essential to handle discrepancies and maintain high data fidelity. |

| Computational Complexity | Advanced tokenization techniques require substantial processing power, increasing energy consumption. | Developers must optimize algorithms to balance computational demands with environmental impacts. |

| Validation and Verification | Ensuring the quality and reliability of tokenized data requires rigorous validation mechanisms, including consistency checks. | Feedback loops from real-world applications and continuous algorithm improvements are necessary for accurate data. |

The journey toward effective tokenization is fraught with challenges. Managing noise, ambiguity, and inconsistencies within natural resource datasets adds significant complexity. These datasets frequently contain variations that can lead to misunderstandings; thus, robust tokenization processes capable of handling these discrepancies are essential to maintain high data fidelity.

Moreover, computational complexity associated with advanced tokenization techniques presents a significant hurdle. Implementing these systems can require substantial processing power, leading to increased energy consumption an important consideration within sustainability discussions. Developers need to optimize algorithms for a balance between computational demands and environmental impacts.

To sustain the quality and reliability of tokenized data, rigorous validation and verification mechanisms are vital. This includes consistency checks, leveraging feedback loops from real-world applications, and continuously improving algorithms. Such strategies ensure that decision-makers can rely on accurate, tokenized data streams for effective resource management.

Applications in Natural Resource Management: Expanded Insights

Tokenization’s influence extends to text mining and sentiment analysis. For instance, analyzing public sentiment can help organizations gauge the success of environmental policies and adjust strategies as needed. A positive sentiment might validate the success of a green initiative, while overwhelming negative feedback could indicate the need for a strategic pivot.

Predictive Modelling and Anomaly Detection

Tokenization plays a critical role in predictive modeling and anomaly detection. As data becomes more structured through tokenization, accuracy improves, enabling nuanced predictions about resource availability, consumption patterns, and potential shortages. Anomaly detection is crucial for spotting unusual patterns, indicating issues such as illegal logging or unexpected groundwater depletion, and facilitating preemptive actions to safeguard these resources.

Natural Language Interfaces: Engaging the Stakeholder

The development of intuitive natural language interfaces can democratize access to resource management data. By allowing non-specialists to engage with complex datasets via user-friendly interfaces, these tools empower varying stakeholders from local communities to policymakers to actively participate in resource management discussions.

Leading Countries in Offering Energy and Natural Resource Tokenization

Countries like the United Arab Emirates and Luxembourg are actively embracing the tokenization of natural resources. The UAE, for example, has established a blockchain strategy aiming to integrate tokenization within its energy market, streamlining processes from exploration to distribution. Such strategic foresight encourages innovation while maintaining safeguards against misuse.

Successful projects often emerge from strong collaborations among technology firms, government entities, and academic institutions. This integrated approach blends technological advancement with practical applications, although challenges such as regulatory clarity and international cooperation on transboundary environmental issues remain pertinent.

Case Studies and Examples

In Canada, blockchain technology is utilized in mineral resource management, improving supply chain transparency for cobalt extraction. This initiative allows for the verification of ethically sourced materials, aligning with global sustainability objectives.

Moreover, initiatives like Toucan and KlimaDAO leverage blockchain technology to create transparent and easily tradable carbon credits, enhancing market accessibility and encouraging participation in sustainability efforts.

These projects exemplify how tokenization facilitates investment opportunities and raises public engagement in sustainability initiatives.

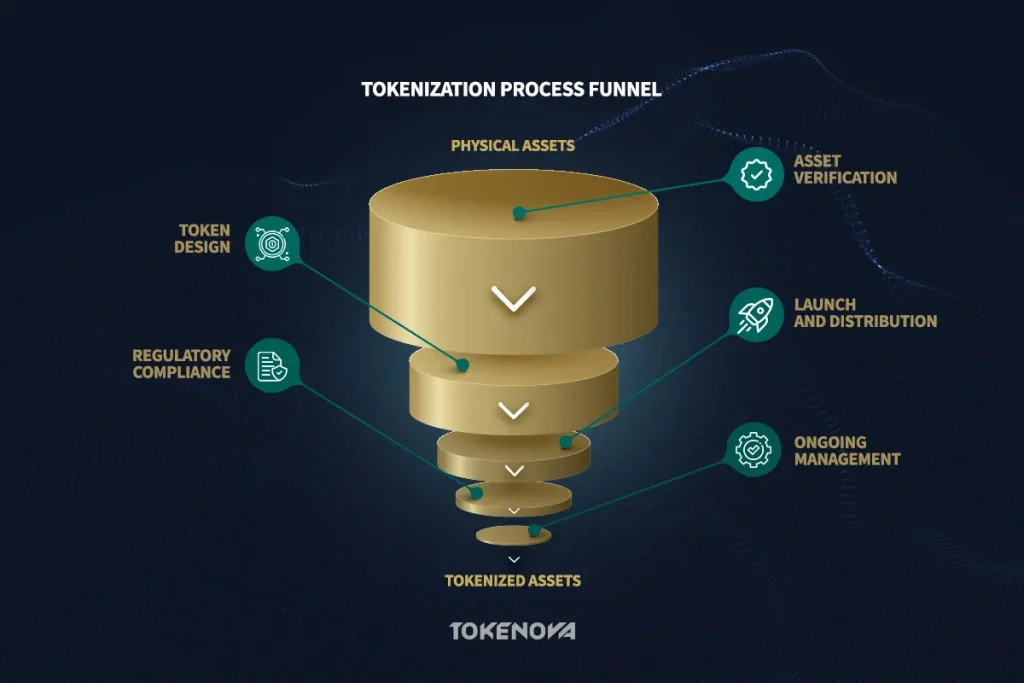

How to Tokenize Your Assets

Tokenizing assets, such as gold or other physical commodities, involves converting the value of real-world assets into digital tokens on a blockchain. Tokenova simplifies and streamlines this process by offering end-to-end solutions for businesses and investors looking to enter the digital asset space.

Step 1: Asset Verification and Valuation

Before tokenization begins, Tokenova works closely with clients to verify and accurately value the physical assets, ensuring their legitimacy and compliance with regulatory standards. For instance, in the case of gold, this would involve assessing the quantity, quality, and source of the gold reserves.

Step 2: Token Design and Blockchain Integration

Tokenova then designs the token structure according to the specific requirements of the asset and its intended market use. They leverage blockchain technology to create a secure, immutable digital ledger that transparently records ownership and transactions related to the tokens. These tokens represent a fractional ownership of the physical assets, making them easily tradable across digital platforms.

Step 3: Regulatory Compliance

Regulatory compliance is a key challenge in tokenization, but Tokenova’s legal experts ensure that the process aligns with both local and international regulations. This involves determining whether the tokens should be classified as utility, security, or another type of asset, thus ensuring the tokenized assets avoid legal complications.

Step 4: Launch and Distribution

Once the tokens are created, Tokenova assists in launching the tokens on relevant exchanges or platforms. The distribution process is carefully managed to ensure a fair and transparent rollout, with mechanisms to enhance liquidity such as partnering with liquidity providers or establishing smart contracts that enable liquidity pools.

Step 5: Ongoing Management and Support

After token launch, Tokenova continues to support projects by providing liquidity management, market analysis, and regulatory updates. Token holders can trade or redeem their tokens based on predefined conditions, and Tokenova ensures the assets remain securely managed and fully backed by their underlying real-world assets.

Tokenova’s comprehensive approach allows businesses to navigate the complexities of tokenization with confidence, unlocking liquidity and market opportunities while minimizing risks.

Master Tokenization Process with Tokenova

The Tokenova approach to tokenization includes several crucial stages:

- Securitization: Developing a framework to convert physical assets into secure digital tokens.

- Tokenization: Creating tokens that represent ownership and rights associated with these assets.

- Offering: Providing these tokens to investors through efficient platforms and systems.

- Marketing: Promoting tokenized assets effectively to reach appropriate audiences while ensuring compliance and transparency.

Future Directions and Trends Explored

The future of tokenization within the realm of natural resources and energy appears promising due to several emerging trends:

- Increased Market Participation: Heightened awareness regarding renewable energy benefits will likely attract more investors to tokenized assets, especially those aligned with sustainability goals.

- Integration with Decentralized Finance (DeFi): Tokenized natural resources could serve as collateral for loans or be traded on decentralized exchanges, fostering an interconnected investment ecosystem.

- Sustainable Practices: By providing transparent tracking of ownership and usage, tokenization encourages responsible management of natural resources, promoting sustainable practices in extraction and consumption.

Ethical Considerations Revisited

While tokenization presents numerous advantages, ethical considerations regarding data privacy and equitable access must remain at the forefront. Protecting sensitive data while ensuring the benefits of tokenization are accessible to all especially marginalized communities will be critical.

Moreover, it is crucial to address the digital divide. Ensuring that advancements in technology do not inadvertently widen gaps between those with easy access and those without is vital for fostering equitable practices in resource management.

conclution

The tokenization of natural resources represents not only a technological advancement but a paradigm shift in our perception and management of the world’s finite resources. It champions transparency, accountability, and efficiency qualities indispensable for sustainable development.

At Tokenova, we embrace the transformative power of tokenization to modernize and enhance your resource management strategies. Be part of the sustainable future by advocating for tokenization initiatives in your community. Together, let us foster a transparent and efficient resource management system. By actively engaging with this dynamic technology, we can cultivate a balanced relationship with nature, addressing contemporary challenges while paving the way for a sustainable future.

What is a digital token in the context of natural resources?

A digital token embodies a specific asset or data point on a blockchain, enhancing resource tracking and management capabilities.

How does tokenization benefit the economy specifically?

By enhancing transparency and curtailing administrative expenses, tokenization fuels efficiency, leading to substantial economic savings and new investment opportunities.

Are there environmental risks associated with blockchain technology?

While blockchain technologies present environmental challenges, such as excessive energy consumption, newer innovations are focusing on sustainable practices to mitigate these impacts.

What types of resources can be tokenized?

Almost any natural resource from water to timber to minerals can be tokenized, each presenting distinct advantages and challenges.

How do I start implementing tokenization in my organization?

Start by evaluating your resource management needs, consulting with blockchain specialists, and exploring existing solutions that align with your objectives.

By tapping into the potential of tokenization, Tokenova lays the foundation for a more sustainable and equitable future in natural resource management.