Imagine diversifying your investment portfolio by owning fractional shares of prime real estate, rare art, or even precious commodities all without the traditional barriers to entry. This isn’t a futuristic fantasy; it’s the reality of tokenized assets reshaping the financial landscape today. Tokenization leverages blockchain technology to convert physical and intangible assets into digital tokens, making investing more accessible, liquid, and diversified than ever before.

If you’re curious about how to invest in tokenized assets, you’re about to discover a transformative approach that blends traditional investing with cutting-edge technology. This guide delves deep into investing in digital securities, explores effective tokenized asset investment strategies, highlights the benefits of asset tokenization, and equips you with the knowledge to navigate this dynamic market confidently. Whether you’re a seasoned investor seeking to expand your horizons or a newcomer eager to explore innovative opportunities, understanding tokenized assets is essential in today’s rapidly evolving financial ecosystem.

Understanding Tokenized Assets

What Exactly Are Tokenized Assets?

At its core, tokenization is the process of converting ownership rights of an asset into digital tokens on a blockchain. These tokens represent a stake in the underlying asset, enabling seamless trading and transfer. Tokenized assets bridge the gap between traditional investments and the digital economy, offering a new paradigm for asset ownership and management.

Types of Tokenized Assets:

- Real Estate: Tokenizing real estate allows investors to purchase fractional shares of properties, making high-value real estate accessible to a broader audience.

- Commodities: Precious metals like gold and silver, as well as other commodities like oil, can be tokenized, providing a digital means to invest in these traditionally tangible assets.

- Art and Collectibles: High-value artworks and rare collectibles can be tokenized, enabling fractional ownership and easier trading of these unique items.

- Financial Instruments: Stocks, bonds, and venture capital investments can be tokenized, offering enhanced liquidity and accessibility to these financial assets.

By transforming traditionally illiquid assets into tradable tokens, tokenization democratizes access and increases liquidity, making investing more inclusive and efficient.

The Mechanics Behind Tokenization

Tokenization leverages blockchain technology to create a secure, transparent, and immutable ledger of asset ownership. Each token on the blockchain is unique and can be bought, sold, or traded independently of the physical asset. This digital representation ensures that ownership is easily transferable and verifiable without the need for intermediaries, reducing costs and increasing transaction speed.

Key Components:

- Blockchain Technology: The decentralized backbone that records all transactions securely and transparently.

- Smart Contracts: Self-executing contracts with the terms of the agreement directly written into code, automating processes like dividend distribution and ownership transfers.

- Digital Wallets: Secure storage solutions for holding and managing digital tokens, essential for participating in the tokenized asset market.

Understanding these components is crucial for comprehending how tokenized assets function and their potential impact on the investment landscape.

The Evolution of Tokenization in Finance

Tokenization isn’t just a buzzword; it’s a fundamental shift in how assets are managed and traded. Traditional asset management involves significant intermediaries, high transaction costs, and limited accessibility. Tokenization addresses these challenges by leveraging blockchain’s decentralized nature, reducing reliance on intermediaries, and enabling direct peer-to-peer transactions. This evolution not only streamlines the investment process but also opens up new avenues for asset diversification and portfolio optimization.

Benefits of Investing in Tokenized Assets

Investing in tokenized assets offers a multitude of advantages that traditional investment avenues may not provide. Here’s why tokenized assets are gaining traction among savvy investors:

- Increased Liquidity: Tokenized assets can be easily traded on digital platforms, providing liquidity to markets that were once considered illiquid. This means you can buy and sell your investments more freely and at your convenience.

- Fractional Ownership: Tokenization allows for the division of high-value assets into smaller, more affordable units. This enables investors to diversify their portfolios by owning fractions of expensive assets like real estate or fine art without requiring significant capital.

- Portfolio Diversification: With access to a broader range of asset classes, including commodities, real estate, and collectibles, tokenized assets offer unparalleled diversification opportunities, reducing overall investment risk.

- Lower Transaction Costs: By eliminating intermediaries such as brokers and reducing administrative overhead, tokenization can significantly lower transaction fees, maximizing your investment returns.

- Global Accessibility: Tokenized assets can be accessed by investors worldwide, breaking down geographical barriers and expanding investment opportunities beyond local markets.

Tokenization: The Future of Investment in Numbers

Tokenization is revolutionizing the financial sector, converting real-world assets into digital tokens on blockchain platforms. Here are the latest statistics showcasing its transformative potential:

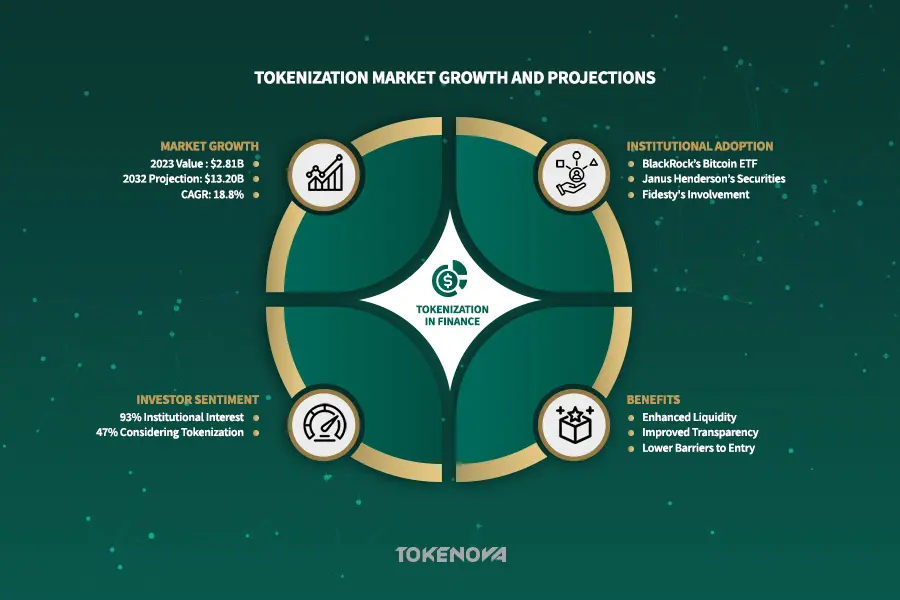

Market Growth

The tokenization market is witnessing explosive growth. Valued at approximately $2.81 billion in 2023, it is projected to reach $13.20 billion by 2032, growing at a CAGR of 18.8%.

Institutional Adoption

Major financial institutions are increasingly adopting tokenization:

- BlackRock’s spot Bitcoin ETF has already accumulated $16.7 billion in assets, nearing the market leader’s position (source).

- Janus Henderson is tokenizing securities, starting with the $11 million Anemoy Liquid Treasury Fund, aligning with industry leaders like BlackRock and Fidelity.

Investor Sentiment

The interest in tokenized assets is growing rapidly. A survey found that 93% of institutional investors see long-term value in blockchain technology and digital assets, with 47% actively considering tokenizing their own assets.

Adoption Rates

Adoption of tokenized assets is accelerating, with approximately $85.12 billion worth of assets tokenized to date. This number is expected to grow as regulatory frameworks evolve and institutional interest deepens.

Why This Matters

These numbers highlight the transformative impact of tokenization on the investment landscape. It enhances liquidity, improves transparency, and reduces barriers to entry for investors worldwide. As the market continues to evolve, tokenization is set to redefine the future of finance.

Enhanced Portfolio Performance

Investors leveraging tokenized assets often experience enhanced portfolio performance due to the ability to diversify across previously inaccessible markets. By incorporating a variety of tokenized assets, investors can mitigate risks associated with market volatility in any single asset class, leading to more stable and potentially higher returns over time.

Democratization of Investment Opportunities

Tokenization democratizes investment opportunities by lowering the barriers to entry. Traditionally, high-value investments like commercial real estate or rare art were only accessible to institutional investors or individuals with substantial capital. Tokenization makes these opportunities available to a broader audience, fostering financial inclusion and empowering individual investors to participate in lucrative markets.

Risks and Considerations

While the benefits of investing in tokenized assets are substantial, it’s crucial to be aware of the associated risks to make informed investment decisions. Understanding these challenges will help you mitigate potential downsides and safeguard your investments.

- Regulatory Uncertainty:

- Diverse Regulations: Tokenized assets often fall into a gray area of financial regulation, with different jurisdictions having varying rules. This lack of standardized regulation can pose legal risks and uncertainties for investors.

- Compliance Requirements: Staying compliant with evolving regulations requires continuous monitoring and adaptation, which can be resource-intensive.

- Market Volatility:

- Crypto Market Fluctuations: The value of tokenized assets can be highly volatile, influenced by broader cryptocurrency market dynamics. Sudden price swings can impact the value of your investments significantly.

- Speculative Nature: Many tokenized assets are still emerging, and their long-term stability is not yet proven, adding to investment risk.

- Security Risks:

- Platform Vulnerabilities: While blockchain itself is secure, the platforms that facilitate token trading can be susceptible to hacks, fraud, and technical glitches.

- Digital Wallet Security: Improper management of digital wallets can lead to loss or theft of tokens, emphasizing the need for robust security measures.

- Technology Risks:

- Smart Contract Bugs: Flaws in smart contract code can lead to unintended consequences, including financial losses or exploitation by malicious actors.

- Network Issues: Blockchain networks can experience downtime or slow transaction processing, affecting the reliability of token transactions.

- Due Diligence Importance:

- Thorough Research: Investors must conduct comprehensive research on the underlying assets, the tokenization platform, and the legal framework to ensure informed decision-making.

- Evaluating Asset Value: Assessing the true value and potential appreciation of tokenized assets requires a deep understanding of the asset class and market conditions.

By acknowledging and addressing these risks, investors can develop strategies to protect their investments and navigate the tokenized asset market more effectively.

Mitigating Risks Through Informed Investing

To mitigate the inherent risks associated with tokenized assets, investors should adopt a proactive approach:

- Conduct Comprehensive Research: Before investing, thoroughly investigate the asset, the issuing platform, and the underlying technology. Understanding the fundamentals can help you make informed decisions and avoid potential pitfalls.

- Diversify Your Investments: Spread your investments across various tokenized assets and sectors to reduce exposure to any single asset’s performance.

- Stay Updated on Regulatory Changes: Keep abreast of the latest regulatory developments in the tokenized asset space to ensure compliance and adapt to new rules as they emerge.

- Implement Robust Security Measures: Use secure digital wallets, enable two-factor authentication, and follow best practices for online security to protect your investments from cyber threats.

Long-Term Sustainability and Market Maturity

As the tokenized asset market matures, regulatory frameworks will likely become more standardized, and security measures will improve. Investors should stay informed about these developments and adjust their investment strategies accordingly to align with the evolving market landscape.

How to Invest in Tokenized Assets

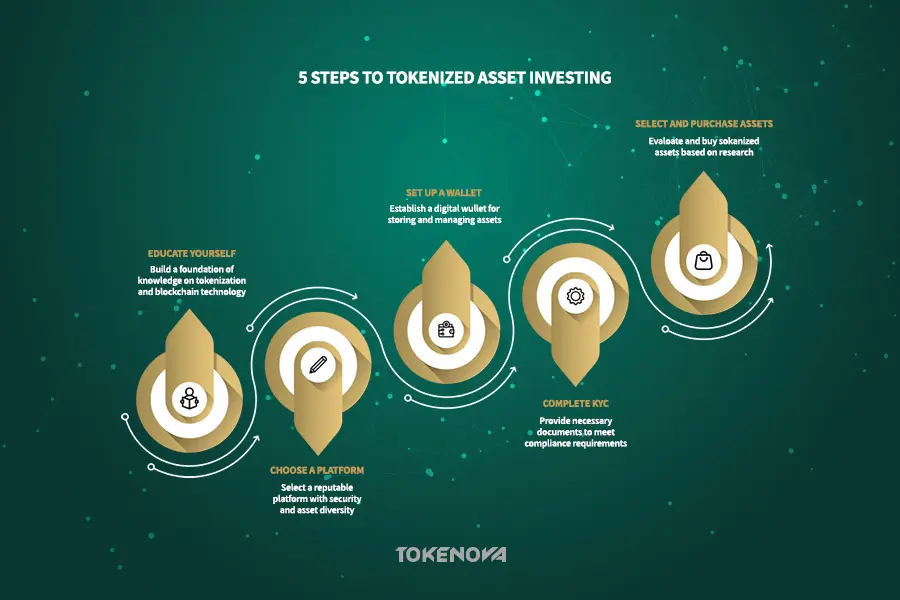

Step 1: Educate Yourself on Tokenization

Before diving into the world of tokenized assets, it’s essential to build a solid foundation of knowledge. Understanding the principles of tokenization, blockchain technology, and the specific mechanics of digital securities will empower you to make informed investment decisions.

Leverage Trusted Resources

Building knowledge is key. Start by exploring resources that offer structured, reliable, and practical insights:

- Online Courses: Platforms like Coursera, Udemy, and edX have courses on blockchain, tokenization, and digital securities tailored for all levels.

- Webinars and Workshops: Many industry experts host webinars and workshops that delve into practical aspects of tokenized investing. These are excellent for real-world insights.

- Whitepapers and Research Reports: For a deeper dive, read whitepapers from reputable blockchain projects or studies from established research institutions.

Stay Updated on Trends

The tokenization market evolves rapidly, so keeping up with the latest trends is crucial:

- Industry News: Regularly check websites like CoinDesk, CoinTelegraph, and Blockchain News for updates on new developments and projects.

- Social Media and Forums: Join conversations on platforms like LinkedIn or Reddit, where investors and enthusiasts share news, insights, and experiences. Specialized forums also offer a wealth of peer-to-peer learning opportunities.

Join Investor Communities

Connecting with others who share your interest in tokenization can provide valuable perspectives and guidance:

- Networking: Building relationships with fellow investors allows you to exchange strategies, stay informed about market movements, and identify promising opportunities.

- Mentorship: Seek out experienced investors who can guide you through the complexities of investing in tokenized assets, helping you avoid common pitfalls and refine your approach.

Investing in digital securities requires continuous learning and staying updated with the ever-evolving landscape of blockchain technology and market trends.

Step 2: Choose a Reputable Investment Platform

Selecting the right platform is crucial for a seamless and secure investment experience. A reputable investment platform offers robust security features, a diverse range of tokenized assets, and a user-friendly interface.

Start with Security

When it comes to investing, security is non-negotiable. A good platform should use advanced encryption to protect your information and funds. Two-factor authentication (2FA) is another must-have it adds an extra layer of protection, ensuring that only you can access your account.

Look at the Assets Offered

Diversity is key to a strong portfolio, and the same holds true for tokenized assets. The best platforms provide a variety of investment options across sectors like real estate, art, or commodities. But it’s not just about quantity make sure the assets are legitimate and of high quality. Doing a little homework on the platform’s offerings can save you from potential headaches down the line.

Reputation Matters

Choosing a platform with a solid reputation can make all the difference. Take time to read reviews and testimonials from other investors. These insights can reveal a lot about a platform’s reliability, customer service, and performance. Also, check if the platform complies with relevant regulations; transparency is a good sign that they’re operating above board.

Some Platforms to Consider

To help narrow down your options, here’s a look at three well-known platforms and what makes them stand out:

- Tokenova: This platform offers access to tokenized investments in areas like real estate, fine art, and commodities. Its intuitive design makes it suitable for both beginners and seasoned investors, and it places a strong emphasis on security.

- Securitize: Known for its wide range of digital securities, Securitize is great if you’re looking for compliance and scalability. It caters to individual and institutional investors, offering a professional and secure environment.

- RealT: If real estate is your focus, RealT specializes in tokenizing property investments. They’re transparent about their offerings, providing detailed metrics to help you make informed decisions.

Choosing the right investment platform is a pivotal step in your journey to investing in tokenized assets. Prioritize security, asset diversity, and platform reputation to ensure a positive investment experience.

Step 3: Set Up a Digital Wallet

A digital wallet is your gateway to the world of tokenized assets, allowing you to store, manage, and transact with your digital tokens securely. Selecting the right type of wallet and implementing robust security measures are essential for safeguarding your investments.

Hot vs. Cold Wallets: What’s the Difference?

Digital wallets fall into two main categories: hot wallets and cold wallets. Each has its strengths, depending on how you plan to manage your investments.

- Hot Wallets: These are connected to the internet, making them perfect for quick and easy transactions. If you plan to trade frequently or actively manage your investments, a hot wallet like MetaMask or Trust Wallet is a great choice. However, because they’re online, they’re more vulnerable to cyber threats, so you’ll need to prioritize security measures.

- Cold Wallets: These are offline, offering enhanced security by keeping your assets disconnected from the internet. Cold wallets like Ledger Nano S or Trezor are ideal for long-term storage of larger investments. While less convenient for frequent transactions, they provide peace of mind against hacking risks.

Why Wallet Security Is Essential

Your wallet’s security is as important as the assets it holds. Here are some key practices to protect your investments:

- Protect Your Private Keys: Think of your private key as the master password to your wallet. Never share it with anyone and ensure it’s stored securely, preferably offline.

- Backup Regularly: Losing access to your wallet due to a device failure can be devastating. Back up your wallet regularly and keep the backup in a secure location.

- Use Strong Passwords: A weak password is an open door for cybercriminals. Use a complex, unique password and update it periodically to stay ahead of potential threats.

Prioritizing wallet security is paramount to protecting your tokenized asset investments from potential threats and ensuring peace of mind.

Step 4: Complete KYC and Compliance Procedures

Know Your Customer (KYC) and compliance procedures are fundamental steps in the investment process, ensuring that both the platform and the investor adhere to legal and regulatory standards. Completing these procedures is essential for accessing a wide range of tokenized assets and maintaining a secure investment environment.

The Documents You’ll Need

When you sign up for a tokenized asset platform, you’ll typically need to provide several documents to verify your identity and meet legal requirements:

- Identification Proof: A government-issued ID, such as a passport or driver’s license, is essential for verifying who you are.

- Address Verification: You may need to submit a utility bill or a bank statement that confirms your residential address.

- Financial Information: Platforms might ask for details about your income, net worth, and investment experience to ensure compliance with financial regulations.

Having these documents ready in advance can streamline the onboarding process.

Understanding Legal Obligations

Compliance doesn’t stop at submitting documents. There are additional considerations depending on where you live and invest:

- Jurisdictional Regulations: Laws governing tokenized assets vary by country. Some regions have strict rules about who can invest and how assets are managed. It’s crucial to understand the specific regulations in your area.

- Tax Implications: Tokenized investments often come with tax obligations that can vary based on the type of asset and your location. Working with a tax advisor can help you navigate these complexities and optimize your strategy.

Best Practices for Staying Compliant

To ensure you meet all compliance requirements and protect your investments, follow these best practices:

- Stay Informed: Regulations around tokenized assets are constantly evolving. Keep up with changes to avoid any surprises.

- Maintain Detailed Records: Keep thorough records of your transactions, account information, and any compliance documents. These can be invaluable for audits or future reference.

- Engage Legal Counsel: Consulting with a legal professional who specializes in blockchain or financial regulations can help you navigate complex legal landscapes with confidence.

Completing KYC and compliance procedures not only legitimizes your investment activities but also fosters a secure and trustworthy investment environment.

Step 5: Select and Purchase Tokenized Assets

With a solid foundation of knowledge, a reputable platform, a secure digital wallet, and compliance in place, you’re ready to embark on the exciting journey of selecting and purchasing tokenized assets. This step involves evaluating asset options, understanding the transaction process, and making informed investment decisions.

Evaluating Asset Options

Selecting the right assets begins with thorough research and analysis. Consider these key factors:

- Assess Asset Performance: Historical performance data and current market trends can provide valuable insights. For example, a tokenized real estate project’s past rental yields or an art token’s auction history might indicate future returns.

- Understand the Underlying Value: Every tokenized asset has an intrinsic value tied to its real-world counterpart. For real estate, this might include location and amenities. For commodities, market demand and rarity are crucial.

- Verify Issuer Credibility: The credibility of the asset issuer matters greatly. Research their history, reputation, and track record to ensure they are trustworthy and reliable.

Looking for Expert Guidance?

If you’re unsure where to start, Tokenova can help. Their experienced team specializes in tokenized investments, providing personalized advice to match your goals. Whether you’re interested in real estate, fine art, or alternative assets, Tokenova’s expertise can guide you through the decision-making process, offering insights into performance, value, and issuer credibility.

Completing the Transaction

Once you’ve chosen an asset, the purchase process is straightforward but requires attention to detail:

- Browse Assets: Use the platform’s catalog to explore available tokenized options. Platforms like Tokenova allow you to filter assets by type, size, and performance metrics for tailored results.

- Select Your Asset: Choose an asset that fits your goals and risk tolerance. Double-check all metrics and details to ensure it aligns with your strategy.

- Initiate the Purchase: Transfer funds from your digital wallet to the platform following their secure instructions.

- Confirm the Transaction: Carefully review all transaction details before finalizing. Your tokens will then be credited to your wallet.

- Monitor Your Investment: Keep an eye on your asset’s performance through the platform’s dashboard. Regular updates can help you decide when to hold, reinvest, or sell.

Selecting and purchasing tokenized assets is a streamlined process that combines thorough research with user-friendly platform features, enabling you to invest with confidence and ease.

Unlock Exclusive Tokenized Assets with Tokenova

Revolutionize your investment strategy with Tokenova, the trusted partner for accessing premium tokenized asset opportunities. Tokenova specializes in providing the knowledge, tools, and insights you need to confidently navigate the rapidly evolving world of tokenized investments. Whether you’re exploring new markets or enhancing your current portfolio, Tokenova ensures you stay ahead in this competitive space.

Why Tokenova Stands Out

- Expert Guidance at Every Step: Tokenova empowers investors with the latest insights, detailed asset analyses, and actionable strategies tailored to your financial goals.

- Exclusive Access to Top-Tier Assets: Unlock tokenized opportunities in real estate, fine art, commodities, and more. Tokenova connects you with unique, high-value investments traditionally reserved for institutional players.

- In-Depth Market Research: Benefit from cutting-edge data, industry trends, and performance metrics that allow you to make informed, confident investment decisions.

- Global Opportunities with Local Insights: Explore tokenized assets across international markets while staying informed about regional nuances and potential risks.

- Streamlined, Secure Process: Tokenova offers a seamless experience, from evaluating assets to executing trades, with an emphasis on security and transparency throughout.

Elevate Your Portfolio with Tokenova

Invest smarter and bolder with Tokenova. By combining innovative solutions with exclusive access to premium tokenized assets, Tokenova equips you to thrive in the next generation of investing.

Take the leap today join Tokenova and redefine what’s possible in your investment journey.

Investing in Tokenized Real Estate

Real estate has long been a cornerstone of investment portfolios, offering steady returns and tangible asset value. Tokenized real estate amplifies these benefits, making property investment more accessible and efficient.

Key Advantages:

- Accessibility: Tokenization lowers the entry barrier, allowing investors to purchase fractional shares of high-value properties with smaller capital investments.

- Steady Returns: Investors can benefit from rental income and property appreciation without the complexities of managing physical real estate.

- Enhanced Liquidity: Traditional real estate investments are often illiquid, but tokenization enables easier buying and selling of property shares, providing greater flexibility.

- Transparency: Blockchain technology ensures transparent and immutable records of ownership, reducing the risk of fraud and enhancing trust among investors.

Case Study: Sarah’s Success with Tokenized Real Estate

Meet Sarah, a mid-level professional who wanted to diversify her investment portfolio without committing large sums to real estate. Through a tokenized real estate platform, she invested $5,000 in a commercial property token. Over the next two years, she earned consistent rental dividends and witnessed a 15% appreciation in the property’s value. Sarah’s experience highlights how tokenized real estate can offer significant returns with manageable investment sizes, democratizing access to lucrative real estate markets.

Benefits Highlighted:

- Diversification: Sarah’s investment in commercial property tokens added a new asset class to her portfolio, reducing overall risk.

- Passive Income: The rental dividends provided her with a steady income stream without the need for active property management.

- Appreciation: The property’s value increase boosted her investment’s overall returns, showcasing the potential for capital gains.

Sarah’s story exemplifies the transformative potential of tokenized real estate, making property investment accessible, profitable, and hassle-free.

The Future of Tokenized Real Estate

As more investors recognize the benefits of tokenized real estate, the market is poised for exponential growth. Innovations such as smart leasing contracts and automated property management through blockchain will further enhance the attractiveness of tokenized real estate, offering even more streamlined and profitable investment opportunities.

Future Trends in Tokenized Asset Investing

What’s Next for Tokenized Investments?

The landscape of how to invest in tokenized assets is continuously evolving, driven by technological advancements and increasing market adoption. Understanding emerging trends can help investors stay ahead and capitalize on new opportunities.

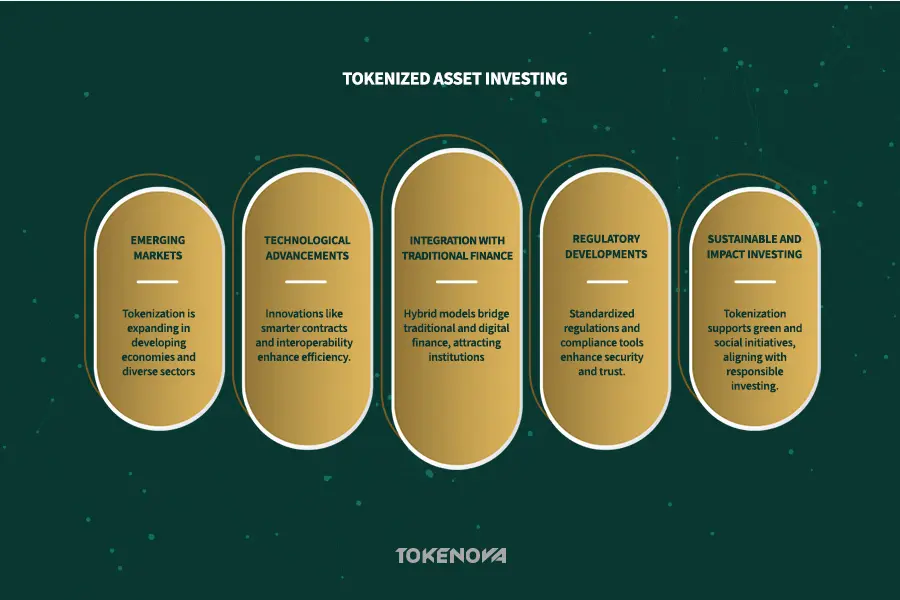

- Emerging Markets:

- Growing Popularity in Developing Economies: Tokenization is gaining traction in regions with emerging economies, providing access to local assets and expanding investment horizons.

- Expanding Asset Classes: Beyond real estate and commodities, tokenization is branching into sectors like healthcare, education, and infrastructure, offering diverse investment avenues.

- Technological Advancements:

- Smarter Contracts: Enhanced smart contract functionality enables more complex and automated investment processes, improving efficiency and reducing errors.

- Interoperability: Improved interoperability between different blockchain networks facilitates seamless asset transfers and cross-platform integrations.

- Integration with Traditional Finance:

- Hybrid Models: Combining traditional financial instruments with tokenized assets creates hybrid investment models, bridging the gap between conventional and digital finance.

- Institutional Adoption: Increased interest from institutional investors brings more credibility and liquidity to the tokenized asset market, driving mainstream acceptance.

- Regulatory Developments:

- Standardization of Regulations: Efforts to harmonize regulations across jurisdictions will provide clearer guidelines and enhance investor protection.

- Enhanced Compliance Tools: Advanced compliance technologies will streamline KYC/AML processes, making tokenized asset investments more accessible and secure.

- Sustainable and Impact Investing:

- Green Tokenization: Tokenizing environmentally sustainable assets like renewable energy projects aligns with the growing demand for responsible investing.

- Social Impact Tokens: Investments in social initiatives and community projects through tokenization offer opportunities for impactful financial growth.

Staying informed about these trends will enable investors to anticipate market shifts, seize emerging opportunities, and navigate the future of tokenized asset investing with confidence.

The Role of Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are set to play pivotal roles in the future of tokenized asset investing. These technologies can enhance predictive analytics, risk assessment, and portfolio management, providing investors with deeper insights and more strategic decision-making capabilities. AI-driven platforms can analyze vast amounts of data to identify investment opportunities, optimize asset allocations, and automate trading strategies, thereby increasing efficiency and potentially boosting returns.

Decentralized Finance (DeFi) Integration

The integration of Decentralized Finance (DeFi) with tokenized assets is another emerging trend that promises to revolutionize the investment landscape. DeFi platforms enable peer-to-peer financial transactions without the need for traditional intermediaries, offering innovative financial products such as decentralized exchanges, lending platforms, and yield farming. This integration enhances the liquidity and functionality of tokenized assets, providing investors with more flexible and diverse investment options.

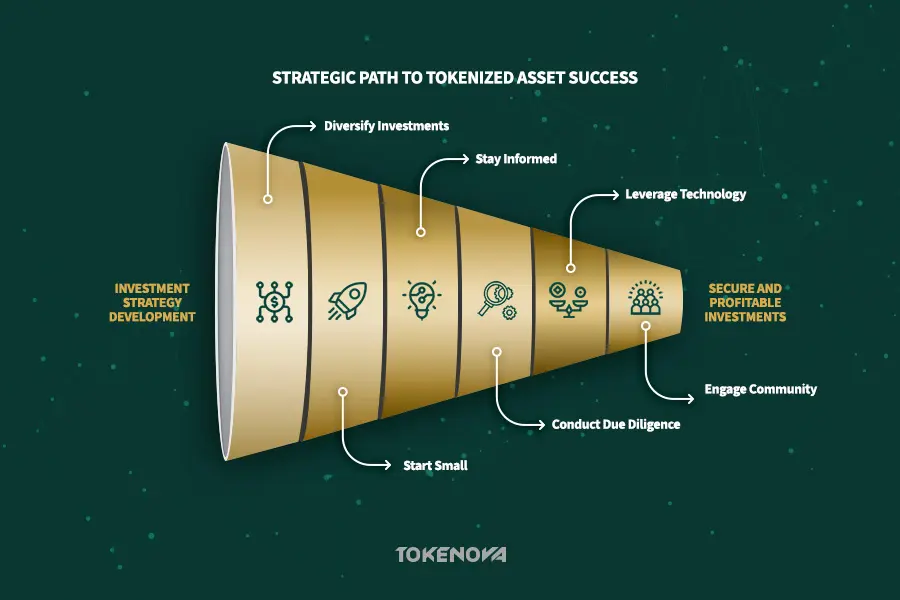

Mastering Tokenized Asset Investments: Expert Strategies

Pro Strategies for Excelling in Tokenized Asset Investing

Achieving success in how to invest in tokenized assets requires strategic planning, informed decision-making, and proactive management. Here are expert strategies to help you navigate this innovative investment landscape effectively:

- Diversify Wisely:

- Spread Your Investments: Allocate your funds across multiple asset classes and tokenized assets to mitigate risk and enhance portfolio resilience.

- Balance High and Low-Risk Assets: Combine high-potential, high-risk investments with more stable, low-risk assets to maintain a balanced portfolio.

- Start Small:

- Manageable Investments: Begin with smaller investments to understand the dynamics of tokenized asset markets without exposing yourself to significant risk.

- Gradual Scaling: As you gain experience and confidence, gradually increase your investment amounts to capitalize on growth opportunities.

- Stay Updated:

- Follow Industry News: Regularly monitor updates from reliable sources to stay informed about market trends, regulatory changes, and technological advancements.

- Engage in Continuous Learning: Participate in webinars, workshops, and courses to deepen your understanding of tokenization and blockchain technology.

- Conduct Thorough Due Diligence:

- Research the Asset: Assess the underlying value, market potential, and historical performance of the tokenized asset before investing.

- Evaluate the Platform: Ensure the investment platform is reputable, secure, and compliant with relevant regulations.

- Leverage Technology:

- Use Analytical Tools: Utilize blockchain analytics and investment tracking tools to monitor asset performance and make data-driven decisions.

- Automate Processes: Implement automation for tasks like portfolio rebalancing and dividend reinvestment to enhance efficiency.

- Engage with the Community:

- Join Forums and Groups: Participate in online communities to exchange insights, seek advice, and stay connected with other investors.

- Network with Experts: Build relationships with industry experts and mentors who can provide valuable guidance and support.

- Prioritize Security:

- Secure Your Wallet: Implement robust security measures for your digital wallet, including strong passwords and multi-factor authentication.

- Stay Vigilant: Be cautious of phishing attempts, scams, and fraudulent schemes targeting tokenized asset investors.

By implementing these expert strategies, you can maximize your returns while minimizing risks, ensuring a successful and rewarding experience in the realm of tokenized asset investing.

Long-Term Investment Horizon

Adopting a long-term investment horizon can help mitigate the impact of short-term market volatility. By focusing on the intrinsic value and growth potential of tokenized assets, investors can ride out market fluctuations and capitalize on sustained asset appreciation over time.

Utilizing Professional Services

While self-education is crucial, leveraging professional services such as financial advisors or investment consultants who specialize in tokenized assets can provide additional layers of expertise and personalized guidance, further enhancing your investment strategy.

Conclusion

Tokenized assets are undeniably transforming the investment landscape, offering a fusion of traditional asset classes with the innovation and efficiency of blockchain technology. By understanding how to invest in tokenized assets, you can unlock a world of opportunities that provide increased liquidity, fractional ownership, and diversified investment portfolios. While the market presents exciting prospects, it also comes with inherent risks such as regulatory uncertainties and market volatility. However, with thorough education, strategic planning, and the right investment platform, you can navigate these challenges and harness the potential of tokenized asset investing.

As the financial world continues to evolve, embracing tokenized assets can position you at the forefront of modern investing, enabling you to capitalize on emerging trends and technological advancements. Whether you’re looking to diversify your investments, reduce transaction costs, or access exclusive asset classes, tokenized assets offer a compelling avenue for growth and innovation. Embrace the opportunities presented by tokenization, conduct diligent research, and take confident steps towards a diversified and resilient investment portfolio.

Key Takeaways

- Tokenized Assets Defined: Tokenization converts physical or intangible assets into digital tokens on a blockchain, representing ownership and enabling easy trading.

- Significant Benefits: Investing in tokenized assets offers increased liquidity, fractional ownership, portfolio diversification, and lower transaction costs.

- Risk Awareness: Be mindful of regulatory uncertainties, market volatility, security risks, and technological challenges when investing in tokenized assets.

- Strategic Investment Steps: Educate yourself, choose reputable platforms, secure your digital wallet, complete necessary compliance procedures, and carefully select and purchase tokenized assets.

- Future Potential: The tokenized asset market is poised for substantial growth, with emerging trends in technology, market expansion, and integration with traditional finance shaping its trajectory.

- Expert Strategies: Diversify wisely, start with manageable investments, stay informed, conduct thorough due diligence, leverage technology, engage with the community, and prioritize security to maximize investment success.

By understanding these critical points, you can confidently navigate the world of tokenized asset investing and build a robust, diversified investment portfolio.

How Do Tokenized Assets Compare to Traditional Investments?

Tokenized assets offer several advantages over traditional investments, including increased liquidity, fractional ownership, and lower transaction costs. Unlike traditional investments, which often require substantial capital and involve complex transaction processes, tokenized assets can be purchased in smaller increments and traded easily on digital platforms. Additionally, the transparency and security provided by blockchain technology enhance trust and reduce the risk of fraud. However, it’s essential to consider the regulatory landscape and market volatility associated with tokenized assets, which can differ significantly from traditional investment environments.

Can Tokenized Assets Be Integrated into Retirement Portfolios?

Yes, tokenized assets can be integrated into retirement portfolios to enhance diversification and potentially increase returns. By including tokenized real estate, commodities, or other digital securities, investors can gain exposure to a wider range of asset classes that may not be easily accessible through traditional investment vehicles. However, it’s crucial to assess the risk profile of each tokenized asset and ensure that it aligns with your retirement goals and investment horizon. Consulting with a financial advisor who understands tokenized assets can help you make informed decisions about incorporating them into your retirement strategy.

What Are the Environmental Impacts of Tokenized Asset Investing?

The environmental impact of tokenized asset investing largely depends on the underlying blockchain technology used. Proof-of-Work (PoW) blockchains, like Bitcoin, are known for their high energy consumption, which can contribute to environmental concerns. However, many platforms are shifting towards more sustainable alternatives, such as Proof-of-Stake (PoS) and other energy-efficient consensus mechanisms. Additionally, tokenized asset platforms focused on sustainable investments, such as renewable energy projects, can have a positive environmental impact by directing capital towards eco-friendly initiatives. Investors should consider the environmental policies and technologies of the platforms they choose to ensure their investments align with their sustainability values.