Are you a business leader, a forward-thinking innovator, or a savvy investor seeking to harness the transformative power of digital assets? The allure of increased liquidity, the potential for fractional ownership, and the promise of streamlined processes through the magic of tokenization are undeniably compelling. However, the pivotal question that demands a well-informed answer remains: What is the best blockchain for tokenization to effectively translate your ambitious vision into a tangible reality?

Selecting the appropriate foundational technology is of paramount importance, akin to choosing the right building materials for a skyscraper. This comprehensive and meticulously crafted guide is specifically designed to expertly navigate you through the often-intricate complexities of this burgeoning field. We aim to cut through the pervasive industry jargon and provide you with a crystal-clear understanding of the critical factors involved in selecting the optimal platform for tokenization, ultimately ensuring your project is not only launched successfully but is also strategically positioned for sustained growth and long-term viability.

Prepare yourself to gain actionable and immediately applicable insights, embark on an in-depth exploration of the leading blockchain contenders in the space, and, most importantly, equip yourself with the essential knowledge and understanding necessary to make truly informed decisions that will undoubtedly shape the future trajectory of your valuable assets.

Understanding Tokenization: Digitizing Value in the Blockchain Era

Tokenizationis the process of converting proprietary rights of physical or digital assets into unique digital tokens on a blockchain. These tokens act as secure, transferable certificates of ownership, enabling seamless trading and management. This innovation is transforming how we interact with value, allowing fractional ownership of assets like fine art, real estate, or private equity. For example, a high-value painting can be divided into digital tokens, making it accessible to a broader range of investors.

Key Benefits of Tokenization

- Unlocking Liquidity: Tokenization makes illiquid assets like real estate and collectibles easier to trade by breaking them into smaller, tradable tokens. For instance, RealT allows fractional ownership of real estate, opening the market to smaller investors.

- Democratizing Investments: Tokenization lowers barriers to entry, enabling retail investors to access opportunities once reserved for institutions. Platforms like CurioInvest let users invest in luxury assets like cars and watches.

- Improving Efficiency: Blockchain automates processes like ownership transfers and compliance through smart contracts, reducing costs and eliminating intermediaries.

- Enabling Fractional Ownership: High-value assets can be divided into affordable tokens, allowing multiple investors to co-own a single asset. For example, Tokeny Solutions provides tools for compliant fractional ownership.

- Enhancing Transparency and Security: Blockchain’s immutable ledger ensures tamper-proof records of ownership and transactions, reducing fraud and disputes.

- Creating New Revenue Streams: Tokenization enables innovative business models, such as staking rewards, DeFi lending, and exclusive access tokens. Platforms like Polymath help businesses tokenize securities and explore new revenue opportunities.

Blockchain: The Foundation of Tokenization

Blockchain’s decentralized, secure, and transparent nature makes tokenization possible. Key features include:

- Decentralization: No single entity controls the network, enhancing security and trust. Platforms like ConsenSys Codefi leverage Ethereum’s decentralized infrastructure for tokenization.

- Immutability: Once recorded, transactions cannot be altered, ensuring the integrity of ownership records.

- Transparency: All transactions are publicly viewable, fostering accountability. Companies like Securitize ensure compliance and transparency in tokenized assets.

- Cryptographic Security: Advanced encryption protects against unauthorized access and data manipulation.

- Smart Contracts: Self-executing contracts automate processes, reducing the need for intermediaries. Platforms like Antier Solutions use smart contracts for cross-chain tokenization.

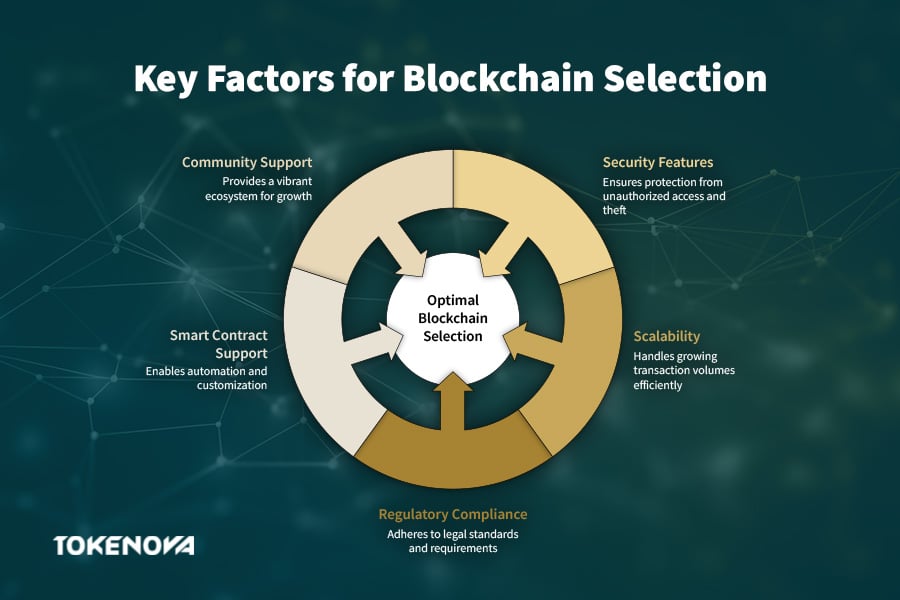

Key Considerations for Choosing a Blockchain for Tokenization

Selecting the right blockchain platform to underpin your tokenization project is not merely a technical decision; it is a critical strategic imperative that can profoundly impact the ultimate success, long-term longevity, and overall viability of your endeavor. Think of this crucial choice as meticulously selecting the very foundation upon which you intend to construct your entire digital asset ecosystem.

Read More: Exploring Tokenization in Blockchain: A New Era of Assets

Several truly crucial factors warrant careful consideration and thorough evaluation, and a diligent assessment of each of these elements will ultimately guide you towards the optimal platform that best aligns with your specific needs and objectives. These key considerations serve as the foundational pillars that will steadfastly support your tokenization endeavor and ensure its inherent resilience in the face of evolving market conditions and technological advancements.

Security Features and Protocols

Security stands as an absolute paramount concern when dealing with valuable assets, irrespective of whether they exist in the physical realm or as digital representations. Therefore, you necessitate a blockchain platform that boasts robust and well-established security features and meticulously designed protocols to effectively protect your valuable tokens and the underlying assets they faithfully represent from a wide range of potential threats, including unauthorized access, theft by malicious actors, and sophisticated manipulation attempts. Consider these absolutely critical aspects when evaluating the security of a blockchain:

When rigorously evaluating the security of a blockchain, it is imperative to delve into the intricate specifics of its underlying consensus mechanism. For instance, Ethereum’s transition to Proof-of-Stake (PoS) in September 2022, known as ‘The Merge,’ has continued to evolve, with further enhancements in scalability and security.

As of 2025, Ethereum’s Layer-2 solutions, including Arbitrum and Optimism, have further improved scalability, with transaction throughput now exceeding 10,000 TPS and gas fees consistently below $0.005 per transaction due to advancements in rollup technology and sharding implementations. A deep and nuanced understanding of each blockchain’s unique approach to achieving consensus and securing its network is absolutely crucial for making an informed decision about its suitability for your tokenization project.

Scalability and Transaction Throughput

Scalability, in the context of blockchain technology, refers to the network’s inherent ability to efficiently handle a continuously growing number of transactions without experiencing any compromise in speed, a significant increase in transaction costs, or a noticeable degradation in overall performance.

Transaction throughput, often measured in transactions per second (TPS), serves as a key metric for gauging a blockchain’s capacity. Therefore, it is essential to carefully consider your project’s realistically anticipated transaction volume, both at launch and in the future as adoption grows, as well as your long-term growth projections:

The landscape of Layer-2 scaling solutions is characterized by rapid innovation and continuous development. For example, Arbitrum and Optimism have emerged as highly popular and effective Ethereum Layer-2 rollups that ingeniously bundle multiple transactions into a single, compressed transaction on the main chain, thereby significantly increasing overall throughput capacity and dramatically reducing the gas fees associated with individual transactions. Staying abreast of the latest advancements and emerging trends in this dynamic area of blockchain technology is crucial for making informed decisions about scalability solutions.

Compliance with Regulatory Standards

The regulatory landscape surrounding the issuance, sale, and trading of tokenized assets is in a state of constant evolution and exhibits significant variations across different jurisdictions worldwide. Therefore, choosing a blockchain platform that inherently facilitates compliance with relevant regulations and offers readily available tools and functionalities to effectively meet evolving regulatory requirements is absolutely crucial for proactively avoiding potential legal hurdles, costly penalties, and significant reputational damage that could jeopardize your project’s future. A failure to adequately address regulatory considerations from the outset can have severe and potentially irreversible consequences for your project’s long-term viability and sustainability:

The forthcoming Markets in Crypto-Assets (MiCA) regulation in the European Union, which is anticipated to be fully implemented by 2024, represents a landmark piece of legislation that will have a profound and far-reaching impact on the regulation of digital assets within the EU and potentially beyond. Staying meticulously informed about such significant regulatory developments and proactively adapting your strategies to align with these evolving frameworks is absolutely essential for ensuring ongoing compliance and navigating the complex legal landscape effectively.

Read More: Asset Tokenization Regulation: Navigating Compliance in 2024

Support for Smart Contracts and Programmability

Smart contracts, as previously discussed, are self-executing agreements meticulously written in code and securely stored on the blockchain. They serve as an essential building block for automating a wide range of processes, transparently enforcing the terms of agreements, and creating sophisticated, customized, and highly efficient tokenized systems. The inherent flexibility and powerful capabilities of smart contracts are undeniably key to unlocking the full transformative potential of tokenization across diverse applications:

The specific choice of programming language utilized for smart contract development on a particular blockchain platform can have a significant impact on several factors, including the overall availability of skilled developers proficient in that language, the maturity and robustness of the available development tooling and resources, and the potential for interoperability with other systems. For instance, Solidity, the primary programming language for developing smart contracts on the Ethereum platform, benefits from a vast and active developer community, a wealth of readily available learning resources, and a mature ecosystem of supporting tools, largely due to Ethereum’s widespread adoption and established presence in the blockchain space.

Read More: Create Smart Contracts on Ethereum: Your Complete Guide

Community Support and Development Ecosystem

A vibrant, engaged, and actively contributing community of developers, enthusiastic users, and informed stakeholders serves as a strong and reliable indicator of a blockchain platform’s long-term viability, its inherent potential for future growth and innovation, and its overall ability to effectively adapt to emerging challenges and evolving technological landscapes. A robust and supportive community actively fosters innovation through collaborative development efforts, provides invaluable peer-to-peer support, and collectively contributes to the overall health, security, and resilience of the ecosystem:

When assessing the strength and vitality of a blockchain’s community, it is crucial to look beyond simply the raw number of members and delve deeper into the level of active engagement and the overall quality of discussions and contributions. Indicators such as active participation in governance proposals, a consistent stream of meaningful contributions to open-source projects related to the platform, and a healthy and constructive dialogue within community forums are all positive signs of a thriving and supportive ecosystem.

Top Blockchain Platforms for Tokenization

Numerous blockchain platforms present themselves as viable options for tokenization, each distinguished by its unique architectural design, inherent strengths, and specific weaknesses. A thorough understanding of these nuanced differences is absolutely crucial for making a well-informed decision that aligns perfectly with your project’s specific needs and objectives. Let’s embark on an in-depth exploration of some of the leading contenders in the tokenization space, providing a detailed comparative analysis to effectively help you narrow down your choices based on the specific and often complex requirements of your project.

Ethereum: The Established Leader and Ecosystem Powerhouse

Ethereum continues to hold its position as the most widely utilized blockchain platform for tokenization initiatives, boasting a remarkably large and exceptionally active community of developers, a mature and comprehensive ecosystem brimming with a vast array of tools and readily available services, and a well-established and proven track record of successfully hosting countless tokenization projects across diverse industries. As of late 2023, Ethereum proudly hosts the largest number of actively used decentralized applications (dApps) and remains a central hub for groundbreaking innovation and cutting-edge development within the broader blockchain space.

Read More: How to Create a Smart Contract on Ethereum

Polygon (Matic): Scaling Ethereum for Broader Adoption

Polygon , formerly known as Matic Network, has firmly established itself as a leading and highly effective Layer-2 scaling solution specifically designed for the Ethereum blockchain. Polygon’s ecosystem now hosts over 50,000 decentralized applications (dApps), with transaction speeds exceeding 7,000 TPS and fees consistently below $0.01 due to the adoption of zkEVM technology, all while maintaining seamless compatibility with the existing Ethereum ecosystem. The adoption rate of Polygon has experienced a significant surge in recent years, with thousands of decentralized applications (dApps) now actively built and deployed on its network, highlighting its growing importance in the blockchain landscape.

Read More: How to Create Smart Contracts on Polygon: Full Guide

BNB Chain (formerly Binance Smart Chain): A Cost-Effective and Fast Alternative

BNB Chain, has solidified its position as a leading blockchain for DeFi and NFTs, with over $35 billion in total value locked (TVL) and a transaction speed of 100 TPS, particularly recognized for its notably lower transaction fees and considerably faster block times when compared to the Ethereum network. BNB Chain boasts a thriving and rapidly expanding ecosystem, particularly within the realms of decentralized finance (DeFi) applications and the burgeoning market for Non-Fungible Tokens (NFTs).

Solana: High-Performance and Scalable for Demanding Applications

Solana has achieved a transaction speed of 65,000 TPS in real-world applications, with recent upgrades reducing network instability and improving reliability. Despite encountering some instances of network instability in the past, Solana remains a compelling and strong contender for applications that demand exceptionally high transaction throughput and minimal latency, making it a suitable choice for projects with demanding performance requirements.

Read More: How to Build a Smart Contract on Solana: A Developer’s Guide

Tezos: Formal Verification and On-Chain Governance for High-Assurance Applications

Tezos distinguishes itself as a blockchain platform with a pronounced emphasis on formal verification techniques and a robust on-chain governance mechanism. Its unique ability to seamlessly upgrade its protocol without requiring disruptive hard forks represents a significant advantage, particularly for projects that prioritize long-term stability, predictability, and a high degree of assurance in the underlying technology.

Avalanche: Customizable and Interoperable for Tailored Solutions

Avalanche offers high transaction throughput of up to 4,500 transactions per second (TPS) with an average block time of just 2 seconds, making it an attractive option for enterprise-grade tokenization projects. With a flexible subnet architecture and EVM compatibility, Avalanche enables businesses to create customizable blockchain environments tailored to specific regulatory, performance, or governance needs. Although average transaction fees are around $0.12, its performance, fast finality, and modular design continue to attract increasing interest from developers and enterprises seeking scalable and secure blockchain service.

Emerging Platforms to Consider

As the blockchain ecosystem expands, several emerging platforms are gaining attention for their potential in tokenization:

- zkSync (ZK): A Layer-2 scaling solution for Ethereum utilizing zero-knowledge rollups to enhance transaction speeds and reduce costs.

- Algorand: Focused on fast, low-cost transactions with a strong emphasis on security and scalability, making it suitable for various applications, including tokenization.

- Stellar: Specializes in cross-border transactions and operates on a consensus model that relies on trust between known institutions, facilitating immediate clearing and settlement.

Comparative Analysis Table: A Side-by-Side View

To provide a clearer and more concise illustration of the key differences between these leading blockchain platforms, presented below is a comprehensive table summarizing their most salient features, incorporating the latest available data as of 2025:

| Feature | Ethereum | Polygon | BNB Chain | Solana | Tezos | Avalanche |

| Consensus Mechanism | PoS | PoS | PoSA | PoH & PoS | LPoS | Avalanche Protocol |

| Transaction Speed | ~15 TPS (Mainnet), 1k+ L2 | ~7,000 TPS | ~100 TPS | ~65,000 TPS | ~30 TPS | ~4,500 TPS |

| Transaction Fees | ~1−5(Mainnet),<1−5(Mainnet),<0.01 L2 | <$0.01 | <$0.10 | <$0.01 | ~$0.05 | <$0.10 |

| Smart Contract Language | Solidity | Solidity | Solidity | Rust, C, C++ | Michelson, SmartPy, LIGO | Solidity (C-Chain) |

| Active Developers | Highest | High | High | Medium | Medium | Medium |

| Decentralization Level | High | Moderate | Moderate | Moderate | High | Customizable |

| Market Cap (USD) | ~$300B | ~$10B | ~$40B | ~$10B | ~$1.5B | ~$5B |

| Scalability | Improving (L2) | High | High | Very High | Moderate | High |

Key Abbreviations:

- PoS: Proof-of-Stake

- PoSA: Proof-of-Staked Authority

- PoH: Proof-of-History

- LPoS: Liquid Proof-of-Stake

- L2: Layer-2 solutions (e.g., Arbitrum, Optimism)

- TPS: Transactions per second

This comparative table provides a valuable snapshot of the key characteristics of each platform. However, it is crucial to reiterate that the “best blockchain for tokenization” is not a one-size-fits-all solution and ultimately hinges on the specific and unique requirements of your individual project. Therefore, it is essential to carefully consider the various trade-offs between factors such as transaction speed, associated costs, the level of community support available, and the ease of integration with existing systems when making your final decision. Prioritize those factors that are most critically aligned with your tokenization project’s overarching goals and strategic objectives.

Conclusion

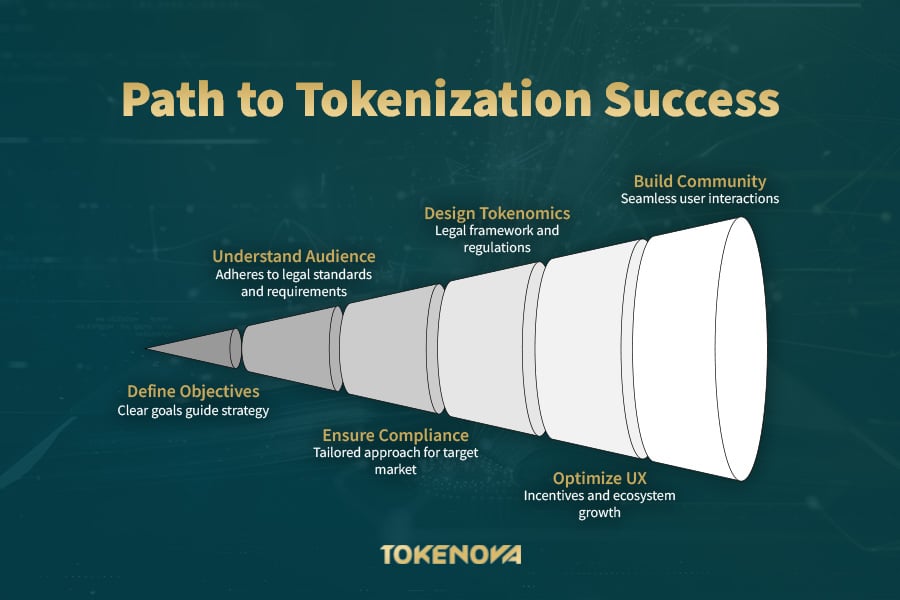

Choosing the best blockchain for tokenization is undeniably a pivotal decision that necessitates careful and comprehensive consideration of your project’s unique needs, specific objectives, and long-term aspirations. Throughout this comprehensive guide, we have diligently explored the fundamental principles underpinning tokenization, delved into the critical factors that should influence your blockchain selection process, and provided a detailed analysis of the inherent strengths and potential weaknesses of several leading blockchain platforms currently available in the market.

It is crucial to remember that the ideal platform for tokenization is not a universally applicable solution; rather, it is the specific platform that most effectively and efficiently aligns with your project’s distinct requirements pertaining to security, scalability to accommodate future growth, adherence to relevant regulatory frameworks, and the desired functionalities offered by its smart contract capabilities.

As you embark on your own tokenization journey, we strongly encourage you to prioritize thorough and diligent research, actively engage with industry experts who possess practical experience in this domain, and remain continuously informed about the ever-evolving landscape of blockchain technology and digital assets. By making well-informed and strategically sound decisions, you can confidently harness the transformative power of blockchain technology to unlock new avenues for value creation, enhance the liquidity of your assets, and ultimately create exciting new opportunities for growth and innovation.

Key Takeaways

- Tokenization is the transformative process of representing real-world assets as digital tokens on a blockchain, offering compelling benefits such as increased liquidity, enhanced accessibility for a wider range of investors, and improved efficiency in asset management.

- Selecting the most appropriate blockchain platform for your tokenization project is a crucial decision that depends on a multitude of factors, including the robustness of its security features, its ability to scale to meet future demands, its compliance mechanisms with relevant regulations, and the versatility of its smart contract capabilities.

- Ethereum, Polygon, BNB Chain, Solana, Tezos, and Avalanche currently stand out as the leading blockchain platforms for tokenization initiatives, each offering a unique set of strengths and catering to different project requirements and priorities.

- When comparing different blockchain platforms, it is essential to carefully consider factors such as transaction processing speeds, the associated costs of transactions, the level of support offered by the platform’s community, and the ease with which it can be integrated with existing systems and infrastructure.

- Achieving success in tokenization requires a well-defined and clearly articulated strategy, the development of a robust and sustainable tokenomics model that incentivizes participation, and a relentless focus on creating a positive and intuitive user experience for all participants.

- The field of blockchain-based tokenization is characterized by continuous innovation and increasing regulatory clarity, both of which are shaping the future trajectory and widespread adoption of this transformative technology.

References:

Top 12 RWA Tokenization Platforms and Companies in 2025

Top 12 Asset Tokenization Platforms of 2025

Top 10 Blockchain Platforms to Explore in 2025

1. How does tokenization differ from traditional securitization?

While both tokenization and traditional securitization involve the process of representing ownership of an asset in a tradable form, tokenization leverages the inherent transparency, efficiency, and fractional ownership capabilities of blockchain technology to achieve this. Traditional securitization, in contrast, often involves more complex legal structures, a greater number of intermediaries, and can be less accessible to individual investors compared to the streamlined and democratized nature of tokenization.

2. What are the key legal considerations when launching a tokenized asset?

When launching a tokenized asset, several key legal considerations come into play, including compliance with applicable securities laws in relevant jurisdictions, adherence to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations to prevent illicit activities, ensuring compliance with data privacy laws to protect user information, and understanding the potential tax implications associated with the issuance and trading of the tokenized asset.

The specific regulations that apply will vary depending on the jurisdiction in which the token is offered and the specific nature of the underlying asset being tokenized. Therefore, seeking guidance from experienced legal experts is absolutely crucial to ensure full compliance and mitigate potential legal risks.

3. Can any asset be tokenized?

From a purely technical standpoint, the answer is yes – almost any asset, whether tangible or intangible, can be represented in a digital form through tokenization. However, the practical feasibility and the potential benefits of tokenization can vary significantly depending on the specific characteristics of the asset, its inherent value proposition, and the existing legal and regulatory framework surrounding that particular asset class.

Assets that typically derive the most significant benefits from tokenization are often those that are traditionally illiquid and difficult to trade, possess high intrinsic value, or can significantly benefit from the ability to be easily divided into fractional ownership units, thereby increasing accessibility and lowering the barrier to entry for potential investors.