Did you know that over 560 million people worldwide now engage with cryptocurrencies? As the digital asset revolution accelerates, the pivotal choice of where to legally establish your crypto company can be the defining factor between unprecedented success and unforeseen setbacks in this fiercely competitive arena. This decision isn’t merely about paperwork; it’s about strategically positioning your burgeoning venture for exponential growth, adeptly navigating the intricate regulatory labyrinth, and cultivating unwavering trust with your discerning users and astute investors.

For ambitious crypto startups, visionary blockchain developers, and forward-thinking investors, this comprehensive guide serves as your strategic compass, illuminating the path towards selecting the best country to register crypto company. This isn’t just a procedural formality; it’s a foundational decision that will significantly impact your business’s trajectory The global cryptocurrency market size was USD 0.94 billion in 2023 and the market is projected to touch USD 1.29 billion by 2032 at a CAGR of 3.5% during the forecast period.

This in-depth exploration will navigate you through the leading contenders for the coveted title of best country to register a crypto company, providing a meticulously detailed roadmap to help you establish your crypto empire on a bedrock of solid legal and financial principles. We’ll delve into the nuances of the best countries for crypto business registration, meticulously highlighting the top crypto-friendly countries for company setup, and ultimately serve as your definitive guide to discovering the best jurisdictions for crypto company registration. Prepare to unlock the closely-guarded secrets to achieving unparalleled global crypto success!

❗Disclaimer:

The following article is for informational purposes only and does not constitute professional legal advice. The content is based on general principles and may not apply to specific legal situations. Readers are strongly encouraged to seek the guidance of a qualified legal professional to address any particular legal concerns or to obtain tailored advice.

Why Your Crypto Company’s Location Matters?

Think of where you register your crypto company as its launchpad the very ground from which it will take flight. It’s more than just ticking a legal box; it’s about strategically choosing the environment where your venture can truly thrive. Just like picking the right neighborhood can shape a person’s opportunities, your company’s jurisdiction will fundamentally influence the rules of the game you play by. This decision isn’t a mere formality; it’s a core strategic move that will ripple through your business, impacting everything from your legal footing to your long-term growth potential.

Building Crypto Trust: Location’s Role

In the still-evolving world of crypto, where trust is the ultimate currency, choosing a location known for its clear and robust oversight is like earning your stripes. Imagine two crypto platforms vying for users: one operating in a jurisdiction with a reputation for being the Wild West, and the other firmly rooted in a country with established financial regulations and a commitment to protecting users. Which one instantly feels more secure and reliable? Exactly. Registering in a reputable and well-regulated country isn’t just about playing by the rules; it’s a powerful signal to potential customers and investors that you’re serious, transparent, and in it for the long haul.

Take a company like Coinbase, for example. While it operates globally, its foundation in the US, with its established financial framework, has undoubtedly played a role in building its reputation and attracting a broad user base. It’s a clear demonstration of how location can significantly impact a crypto company’s perceived legitimacy and ability to build lasting relationships.

Crypto Legal & Finance: Choosing Wisely

The global map of crypto regulation is a patchwork quilt, with each country stitching together its own approach. Some are rolling out the welcome mat for blockchain innovation with forward-thinking rules, while others are treading cautiously, prioritizing consumer protection. Choosing a country with a transparent, well-defined, and supportive legal framework is like finding a safe harbor in potentially stormy seas. It significantly reduces the risk of future legal headaches, hefty fines, or being blindsided by sudden regulatory shifts. Consider smaller, agile startups too.

For instance, a DeFi project might choose a jurisdiction known for its clarity on smart contract legality, allowing them to innovate without constantly looking over their shoulder. To navigate these waters effectively, entrepreneurs should dig deep: research specific regulations, consult with legal experts familiar with the jurisdiction and even connect with other crypto businesses operating there to get the inside scoop. Furthermore, access to reliable banking is the lifeblood of any business. Financial institutions are far more likely to partner with crypto companies registered in jurisdictions with strong anti-money laundering (AML) and know-your-customer (KYC) protocols. This unlocks essential financial services crucial for smooth operations and future growth.

Smart Crypto Tax Strategies by Location

Let’s be frank: taxes matter. The tax landscape for crypto gains, corporate income, and VAT varies wildly across the globe. Strategically choosing a jurisdiction with favorable tax laws isn’t about dodging responsibilities; it’s about making your money work smarter and giving your company a financial edge. Think of it as finding the right financial climate to help your business flourish. For example, companies setting up shop in places like Portugal have benefited from its historically lenient approach to taxing crypto gains, allowing them to reinvest more capital back into their ventures. It’s about smart financial planning, not tax evasion. However, it’s crucial to balance tax optimization with ethical considerations and long-term sustainability. Transparency and compliance should always be paramount.

Crypto Talent & Resources: Location Advantages

Certain countries have become magnets for crypto innovation, creating vibrant ecosystems brimming with talent, collaborative opportunities, and cutting-edge infrastructure. Registering your company in such a hub is like plugging into a powerful grid, giving you access to the resources you need to fuel growth and innovation. Imagine the cross-pollination of ideas and expertise happening in places like Singapore, where a concentration of fintech companies, developers, and investors creates a dynamic environment for progress. However, it’s also worth noting that in highly competitive hubs like Switzerland’s Crypto Valley, securing top talent can be a challenge due to high demand. To find the right fit, explore online platforms specializing in crypto and blockchain talent, attend industry events in your target jurisdiction, and leverage local networking opportunities.

In short, choosing the right location for your crypto company is a multifaceted decision with significant implications. It’s about building trust, navigating legal complexities with confidence, optimizing your financial strategy, and tapping into the resources needed to thrive. This foundational choice sets the stage for your company’s long-term success and ability to make a real impact in the world of digital assets.

Key Considerations for Your Crypto Hub

Choosing the right place to set up your crypto company is a big deal. It’s not just about ticking boxes; it’s about finding a jurisdiction that truly fuels your growth. Before you jump in and pick a spot, you need to really dig into what makes each country tick. Think of it like scouting the perfect location for your next big venture you need to know the lay of the land. This means getting down to brass tacks on a few key areas to make sure your chosen hub isn’t just a good idea on paper, but a springboard for real success.

Crypto Regulations: The Binance Lesson

Let’s face it, navigating crypto regulations can feel like walking through a maze. But understanding the legal landscape is absolutely non-negotiable. You need to know the specific laws, rules, and guidelines like the back of your hand. Are the licensing requirements clear? How strict are the anti-money laundering (AML) and know-your-customer (KYC) checks? Are there solid protections for your users? Steer clear of places with vague or overly strict rules that could stifle innovation or land you in hot water.

Think of Malta’s early embrace of crypto with its Virtual Financial Assets (VFA) Act. This clear framework initially attracted major players like Binance, providing them with the legal certainty they needed to operate and scale. While Binance’s operational base has evolved, their initial move to Malta highlights the power of clear and supportive regulations in attracting significant crypto businesses.

💡Operating in a place where the rules are constantly changing or poorly defined is like building your house on shifting sands it’s a recipe for headaches and potential legal battles.

Smart Crypto Tax: Estonia’s Advantage

Taxes. Nobody loves them, but they’re a reality. A deep dive into the tax policies of each potential location is crucial for your bottom line. We’re talking corporate income tax rates, capital gains tax on crypto, VAT the whole shebang. And don’t forget to look for any sweet deals or special tax breaks for crypto businesses. Take Estonia, for example. Their unique tax system, where corporate income is only taxed when it’s distributed as dividends, has been a major draw for tech companies, including those in the crypto space. This allows businesses to reinvest profits back into growth without immediate tax burdens, a strategy many find incredibly attractive. Imagine the difference between constantly paying out a chunk of your earnings versus having that capital readily available to fuel your next innovation.

💡Choosing a jurisdiction with high taxes or unfavorable crypto policies can seriously eat into your profits.

Banking on Crypto: Singapore’s Financial Edge

Despite the decentralized nature of crypto, having reliable access to traditional banking services is often a make-or-break factor. You need to know if banks in your chosen country are open to working with crypto companies. Are there plenty of banks willing to provide services? How robust is the overall financial infrastructure, including payment processors? Singapore, with its well-established and globally connected financial sector, has become a hub for many crypto businesses. Companies like Coinbase have established a significant presence there, leveraging the country’s openness to fintech innovation and its strong banking infrastructure to facilitate global operations.

💡Trying to run a crypto business in a place where banks are hesitant to touch you is like trying to swim with your feet tied it’s going to be a struggle.

Stability Matters: Switzerland’s Secure Base

Think long-term. The political and economic stability of your chosen jurisdiction is a key ingredient for sustainable growth. You want a place with a solid political system, good governance, and a stable economy. This provides a predictable environment where your business can thrive. Look at Switzerland, renowned for its political neutrality and economic stability. The Cardano Foundation, a major player in the blockchain space, is based in Switzerland, benefiting from the country’s secure and predictable environment.

💡Choosing a location with political turmoil or economic instability is a gamble you might not want to take.

Smooth Sailing Setup: Estonia’s Digital Efficiency

The ease and speed of setting up your company can have a real impact on your resources and how quickly you can get to market. Look for countries with clear, streamlined processes, minimal red tape, and ideally, online registration options. Again, Estonia shines here with its pioneering e-Residency program. Entrepreneurs can register a company remotely, saving significant time and resources. This efficiency has attracted countless startups, including those in the crypto sector, looking for a hassle-free setup.

💡Dealing with a complicated and bureaucratic registration process can be a major drain on your time and energy.

Top Countries Leading the Crypto Revolution

Choosing the right country to register your crypto company is a pivotal decision, akin to selecting the perfect launchpad for your venture. The global landscape is dotted with nations vying to become the go-to destination for crypto innovation, each offering a unique mix of advantages and potential hurdles. This section provides a comparative overview, cutting through the noise to highlight the key strengths and weaknesses of leading crypto-friendly jurisdictions, empowering you to make an informed choice that aligns perfectly with your business goals.

Malta: Regulatory Certainty

Malta, often dubbed “Blockchain Island,” has proactively rolled out the red carpet for crypto and blockchain ventures The introduction of the Markets in Crypto-Assets Regulation (MiCA), which came into full effect on December 30, 2024, enhances consumer protection and market integrity across the European Union, including Malta. This builds upon the existing Virtual Financial Assets (VFA) Act, which has laid a solid legal foundation for the cryptocurrency industry since its implementation in November 2018.

This regulatory foresight offers much-needed certainty, making Malta a magnet for crypto exchanges, virtual asset service providers, and blockchain startups seeking a stable operating environment. Think of it as a well-charted course, offering reassurance in a relatively new frontier. For instance, major players like OKX have strategically set up shop in Malta, citing its regulatory clarity as a major draw. This framework covers areas like licensing requirements, AML/KYC procedures, and investor protection, providing a solid foundation for compliant operations.

However, be prepared for a thorough licensing process while robust and focused on investor protection, it can be a bit of a marathon compared to some other locations. Expect detailed due diligence and potentially longer processing times. This reflects Malta’s commitment to maintaining a high standard within the crypto space.

Singapore: Tax & Fintech Hub

Singapore’s reputation as a global fintech powerhouse extends seamlessly into the crypto realm. A significant lure for crypto businesses is the absence of capital gains tax a considerable financial advantage when dealing with appreciating digital assets. Furthermore, the Monetary Authority of Singapore (MAS) has consistently adopted a forward-thinking and innovation-friendly approach to regulation, fostering a climate ripe for growth. MAS employs a “sandbox” approach, allowing innovative fintech companies, including crypto ventures, to test their products and services in a controlled environment.

Numerous prominent crypto players, including Crypto.com, have established significant operations in Singapore, drawn by its strategic location as a gateway to Asian markets and its supportive business ecosystem. In addition to the PSA, the Securities and Futures Act (SFA) plays a crucial role in regulating digital tokens that resemble securities. This dual regulatory framework ensures that entities involved in crypto activities comply with established financial market principles while promoting innovation.

Singapore boasts a highly skilled workforce and excellent infrastructure, making it attractive for scaling operations. Keep in mind, though, that the cost of living and doing business in Singapore can be on the higher side, a factor to weigh into your financial planning. Office space and talent acquisition can be more expensive compared to other jurisdictions.

Switzerland: Stable Crypto Valley

Switzerland, particularly the canton of Zug, known as “Crypto Valley,” maintains a long-standing reputation as a safe and stable haven for financial innovation. Its enduring political and economic stability, along with a predictable tax environment, continues to attract blockchain startups, decentralized autonomous organizations (DAOs), and established financial institutions exploring distributed ledger technology. Switzerland’s strong tradition of data privacy and financial security remains a significant draw for crypto businesses.

“Crypto Valley” serves as a vibrant hub, populated with numerous crypto companies, influential blockchain foundations (such as the Ethereum Foundation), and industry experts, creating a powerful network effect where ideas and resources flow freely. This concentration of talent and resources facilitates networking, partnerships, and access to funding. Notably, the Crypto Valley Conference 2025 is scheduled for June 5-6, 2025, in Rotkreuz, Switzerland, focusing on the latest developments in blockchain technology and the evolving regulatory landscape.

However, establishing a presence in Switzerland can involve higher initial costs and navigating a more intricate regulatory landscape, reflecting the country’s commitment to maintaining high standards. The recent expansion of zondacrypto, a European cryptocurrency exchange that opened an office in Zug’s Crypto Valley, highlights this trend. They are collaborating with Incore Bank to offer regulated cryptocurrency services while emphasizing compliance and security.

Expect a meticulous approach to compliance along with potentially higher legal and administrative fees as businesses adapt to Switzerland’s rigorous regulatory framework.

Estonia: Digital Efficiency

Estonia’s appeal lies in its pioneering digital infrastructure and groundbreaking e-Residency program. This innovative initiative allows entrepreneurs worldwide to establish and manage an EU-based company entirely remotely, leveraging Estonia’s advanced digital ecosystem. The e-Residency program, launched in December 2014, provides a government-issued digital identity that enables users to access Estonian services such as company formation, banking, and taxation, without needing to be physically present in the country. This offers unparalleled flexibility and reduces the need for physical presence.

One significant advantage of Estonia’s tax system is that it only taxes corporate income upon dividend distribution. This structure is particularly beneficial for businesses focusing on reinvestment and long-term growth, as it encourages companies to reinvest profits back into their operations. Numerous fintech and blockchain ventures have successfully leveraged Estonia’s digital prowess for operational efficiency, further enhancing the country’s reputation as a hub for innovation. Setting up a company can be done entirely online, saving time and resources.

While Estonia offers a remarkably streamlined setup and a favorable tax regime, its specific crypto regulatory framework is still evolving and may not yet have the same depth as more established hubs like Malta. As regulations develop, it is crucial for businesses to stay informed about the latest updates and ensure compliance with any changes in the legal landscape.

El Salvador: Bitcoin Pioneer (Opportunities & Risks)

El Salvador’s groundbreaking decision to adopt Bitcoin as legal tender has undeniably thrown it into the global crypto spotlight. This bold move presents unique opportunities, particularly for businesses focused on Bitcoin and its underlying technology. The government is actively promoting cryptocurrency adoption within the country, including initiatives like the Chivo wallet and infrastructure development to support Bitcoin transactions. This creates a unique environment for Bitcoin-centric businesses. However, this pioneering approach also comes with inherent uncertainties.

The long-term implications of this decision and the broader regulatory landscape for cryptocurrencies beyond Bitcoin are still developing. Recently, El Salvador reached a $1.4 billion loan agreement with the International Monetary Fund (IMF), which stipulates that while Bitcoin remains legal tender, its use in the private sector will be voluntary, and engagement in Bitcoin-related economic activities by the public sector will be limited. Consequently, this evolving environment presents both significant opportunities for early movers and potential challenges related to regulatory clarity and market volatility.

Businesses need to be prepared for potential fluctuations in Bitcoin’s value and the evolving regulatory landscape. As of Early 2025, a survey indicated that approximately 92% of Salvadorans did not utilize Bitcoin, highlighting a disconnect between government policy and public adoption. Think of it as venturing into uncharted territory high risk, potentially high reward, but requiring careful navigation.

Poland: Rising EU Fintech Hub

Poland is rapidly gaining traction as a dynamic player in the European fintech scene. It offers a compelling combination of relatively lower operating costs, a highly skilled and educated workforce, and seamless access to the vast European Union market. Poland boasts a strong pool of tech talent, particularly in software development, at competitive rates. Company registration in Poland is generally straightforward, and a vibrant fintech community is fostering collaboration and innovation. Numerous fintech events and co-working spaces are supporting the growth of the sector.

The Polish fintech sector is experiencing impressive growth, with the number of fintech companies increasing from 167 in 2018 to 368 in 2024. This growth is underpinned by Poland’s strategic location within Europe, which enhances its appeal as a hub for financial technology companies seeking to access broader markets while benefiting from lower operational costs.

While Poland’s specific crypto regulations are still being refined, its strategic location and growing tech sector make it an increasingly attractive option for certain segments of the crypto industry. It’s a market that’s gaining momentum, offering a blend of affordability and access. Businesses should monitor the development of specific crypto regulations to ensure compliance as the sector continues to evolve.

Overall, Poland’s fintech landscape is characterized by an upward trajectory, promising significant opportunities for innovation and investment in the coming years.

UAE: Strategic Middle East Gateway

The UAE, particularly its specialized free zones such as the Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM), is increasingly recognized as a pivotal hub for crypto businesses aiming to establish a presence in the Middle East and beyond. These zones provide significant advantages, including the potential for 100% foreign ownership, attractive tax regimes with exemptions for certain activities, and a business-friendly environment that encourages international investment. Each free zone has its own regulatory body and framework tailored for financial services and digital assets, enhancing their appeal to crypto enterprises.

The UAE government is actively working on comprehensive regulations to foster sustainable growth in the digital asset sector, demonstrating its commitment to becoming a leading center for blockchain innovation. The Securities and Commodities Authority (SCA) plays a crucial role in shaping this regulatory landscape, which has seen recent developments aimed at creating a safe and innovative environment for digital asset activities. For instance, effective November 15, 2024, most transactions involving virtual assets are exempt from the standard 5% VAT, further incentivizing crypto operations.

A growing number of crypto exchanges and blockchain technology providers are establishing themselves in the UAE’s free zones, attracted by the region’s strategic location and proactive regulatory approach. The UAE’s status as a global trade hub offers access to markets across Asia, Africa, and Europe. However, businesses must understand that specific regulations and requirements vary between each free zone; thus, thorough research into the DIFC or ADGM’s distinct legal and regulatory frameworks is essential.

Recent initiatives include the establishment of the Virtual Assets Regulatory Authority (VARA) in Dubai, which has introduced detailed rules governing virtual assets under the Law on the Regulation of Virtual Assets. This framework aims to protect consumers while promoting innovation within the market. Furthermore, the SCA has taken full responsibility for overseeing the cryptocurrency sector, ensuring that all crypto businesses comply with stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) measure.

In summary, while the UAE presents a promising environment for cryptocurrency ventures due to its favorable regulations and strategic advantages, companies must navigate the specific requirements of each free zone to fully capitalize on these opportunities.

The United States: An Ascending Jurisdiction for Cryptocurrency Ventures

The United States is rapidly solidifying its position as a prominent jurisdiction for cryptocurrency enterprises, leveraging its established foundations in innovation alongside a developing regulatory framework.

The nation boasts a formidable concentration of blockchain developers, engineers, and entrepreneurial talent, nurtured by leading academic institutions and research centers. This robust ecosystem serves as a cornerstone of advancement within the financial technology and distributed ledger technology sectors, fostering a fertile ground for continuous breakthroughs.

With its mature and deeply integrated financial markets and institutions, the U.S. offers cryptocurrency businesses unparalleled access to traditional financial systems. This interconnectedness facilitates seamless integration, thereby bolstering operational stability and enabling sustainable growth trajectories.

Evolving Regulatory Landscape

Recent developments indicate a discernible shift towards a more supportive regulatory environment:

Executive Branch Initiatives: Plans are underway within the executive branch to issue directives aimed at streamlining regulatory processes for cryptocurrency companies and fostering broader digital asset adoption. These initiatives include the potential formation of a cryptocurrency advisory council and a directive for the Securities and Exchange Commission (SEC) to re-evaluate existing accounting guidelines perceived as burdensome for cryptocurrency holdings.

Leadership Appointments: The prospective appointment of Paul Atkins, an individual with a demonstrated understanding of the digital asset space, as SEC Chair, suggests a potential pivot towards more accommodating policies concerning digital assets

Sub-National Legislative Progress: Individual states, such as Wyoming, have enacted progressive legislation that formally recognizes digital assets and provides specialized charters for cryptocurrency banks. These state-level initiatives foster innovation and offer a degree of regulatory certainty within their respective jurisdictions.

The United States represents a significant consumer base for cryptocurrency users, investors, and project development. Furthermore, the increasing engagement of institutional players lends further credence and legitimacy to cryptocurrency operations within the nation’s economic framework.

Despite these positive advancements, the U.S. regulatory landscape remains multifaceted. The historical absence of a unified federal framework has resulted in a patchwork of regulations across different states, potentially presenting operational complexities for businesses seeking nationwide reach. However, recent legislative efforts and administrative changes indicate a concerted movement towards greater harmonization and clarity in this domain.

In conclusion, the United States is strategically positioned to become an increasingly compelling destination for cryptocurrency enterprises. The synergy between its inherent strengths in innovation and finance, coupled with an increasingly conducive regulatory environment, presents a significant opportunity for ventures in this dynamic sector.

Comparing Crypto Hubs: A Side-by-Side Look

To facilitate a more informed decision-making process, the following table provides a comparative overview of these leading jurisdictions across several key factors:

| Feature | Malta | Singapore | Switzerland | Estonia |

| Regulatory Clarity | High | High | High | Medium |

| Tax Environment | Favorable | Very Favorable | Favorable | Competitive |

| Banking Access | Improving | Good | Good | Moderate |

| Political Stability | High | High | High | High |

| Ease of Setup | Moderate | Moderate | Moderate | Easy |

| Cost of Operations | Moderate | High | High | Low to Moderate |

| Feature | El Salvador | Poland | UAE (Free Zones) | United States |

| Regulatory Clarity | Developing | Developing | Medium to High | Medium |

| Tax Environment | Potentially Very Favorable | Competitive | Very Favorable | Competitive |

| Banking Access | Limited | Moderate | Improving | Good |

| Political Stability | Moderate | High | High | High |

| Ease of Setup | Moderate | Easy | Moderate | Moderate |

| Cost of Operations | Low | Low to Moderate | Moderate to High | High |

This comparative analysis underscores the inherent trade-offs involved in selecting a jurisdiction for your cryptocurrency business. For instance, while El Salvador presents potentially significant tax advantages for Bitcoin-centric ventures, accessing reliable banking services within the country remains a notable challenge. Similarly, Estonia offers a remarkably streamlined and efficient company setup process, but its regulatory framework for cryptocurrency activities may not yet possess the same level of comprehensive detail as Malta’s. Ultimately, the selection of the best jurisdictions for crypto company registration is a highly individualized decision that must be carefully aligned with your specific business priorities, your appetite for risk, and your overarching strategic objectives.

Navigating the Hurdles: Challenges in Crypto Registration

While the crypto world brims with opportunity, officially launching your company involves navigating some real-world hurdles. Understanding these challenges upfront empowers you to plan strategically and build a resilient, thriving venture.

Navigating Regulatory Uncertainty: Staying Ahead

The global crypto regulatory landscape is a moving target. This constant evolution can be a significant burden, especially for resource-strapped startups. Continuously adapting to new rules and ensuring compliance demands specialized legal expertise, dedicated teams, and sophisticated technology. Consider the EU’s Markets in Crypto-Assets (MiCA) regulation, requiring substantial adjustments for companies operating within or targeting the EU. This ongoing adaptation isn’t just a cost; it’s a core operational reality.

☑️Solutions: Crafting Your Compliance Narrative

- Embrace Agility & Modular Design: Build your business with inherent flexibility. Opt for modular tech stacks and adaptable operational structures that can accommodate regulatory changes without requiring complete overhauls. Think microservices and API-first approaches.

- Invest Early in Specialized Legal Counsel: Don’t wait for a regulatory firestorm. Engage experienced legal professionals specializing in crypto regulations from the outset. Their proactive guidance can prevent costly mistakes and ensure compliance from day one. Look for firms with a proven track record in your target jurisdictions.

- Become a Proactive Regulatory Watchdog: Actively monitor regulatory developments in your target markets. Subscribe to industry-specific newsletters, participate in relevant forums and webinars, and engage with regulatory bodies where possible. Tools like Lexology or Coindesk Policy can be valuable resources.

- Explore Regulatory Sandboxes & Innovation Hubs: Seek opportunities to participate in regulatory sandboxes offered by jurisdictions like the UK’s FCA or Singapore’s MAS. This allows you to test your products in a controlled environment, engage with regulators, and potentially influence future policy. Consider innovation hubs that offer support and guidance for crypto startups.

Overcoming Banking Barriers: Building Financial Bridges

Securing reliable banking for crypto companies often feels like an uphill battle. Traditional financial institutions frequently express reluctance due to regulatory ambiguity, money laundering concerns, and market volatility. Stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements further complicate onboarding and ongoing compliance. Even established exchanges have faced sudden account closures or transaction limitations, highlighting the tension between traditional finance and the crypto ecosystem. Consider the difficulties faced by exchanges in establishing stable fiat on-ramps and off-ramps, crucial for mainstream adoption.

☑️Solutions: Forging Financial Partnerships

- Target Crypto-Friendly Financial Institutions: Research and prioritize banks and payment processors openly receptive to the crypto industry. These specialized institutions understand the sector’s nuances and are more likely to offer stable banking solutions. Examples include institutions in Switzerland, Liechtenstein, or certain Baltic states.

- Implement Robust AML/KYC Programs: Invest in comprehensive AML/KYC compliance programs exceeding minimum requirements. Utilize advanced KYC solutions with biometric verification and ongoing transaction monitoring. This demonstrates your commitment to security and transparency, making your business more attractive to potential banking partners.

- Explore Alternative Payment Solutions & Fintech Bridges: Consider integrating alternative payment processors specializing in crypto transactions. Explore partnerships with fintech companies that act as bridges between traditional finance and the crypto world, offering services like virtual IBANs or crypto-backed loans.

- Cultivate Relationships & Transparency: Actively engage with potential banking partners. Be transparent about your business model, compliance measures, and risk management strategies. Provide detailed documentation and be prepared to answer thorough due diligence questions. Building trust is paramount.

Mitigating Geopolitical & Market Risks: Charting a Stable Course

External factors significantly impact crypto ventures. Political instability can trigger sudden, unfavorable regulatory changes, potentially disrupting operations or leading to asset seizures. The inherent volatility of the cryptocurrency market can directly impact your company’s financial stability, investor confidence, and valuation. Consider the impact of regulatory crackdowns in countries like China on mining operations and exchanges. Choosing the right jurisdiction is about stability and predictability, not just taxes.

☑️Solutions: Weathering the External Elements

- Diversify Geographic Presence & Jurisdictional Strategy: Don’t concentrate all operations in a single location. Consider establishing subsidiaries or partnerships in multiple jurisdictions with stable political and economic environments and favorable crypto regulations.

- Develop Comprehensive Risk Management Frameworks: Implement robust risk management plans addressing both geopolitical and market volatility. This includes contingency planning for regulatory changes, hedging strategies using derivatives or stablecoins to mitigate market fluctuations, and robust cybersecurity protocols.

- Maintain Vigilant Monitoring & Adaptability: Continuously monitor global political and economic events that could impact your business. Subscribe to geopolitical risk analysis reports and be prepared to adapt your strategies and operations swiftly.

- Foster a Strong Community & Decentralized Elements: A loyal and engaged community can provide resilience against market volatility and external shocks. Explore decentralized governance models or community-driven initiatives to reduce reliance on centralized authorities and build a more robust ecosystem.

By proactively addressing these challenges with well-defined strategies and a forward-thinking mindset, entrepreneurs, developers, and investors can successfully navigate the crypto registration process and build thriving, sustainable ventures in this dynamic industry. It’s about preparation, adaptability, and ultimately, resilience in the face of evolving landscapes.

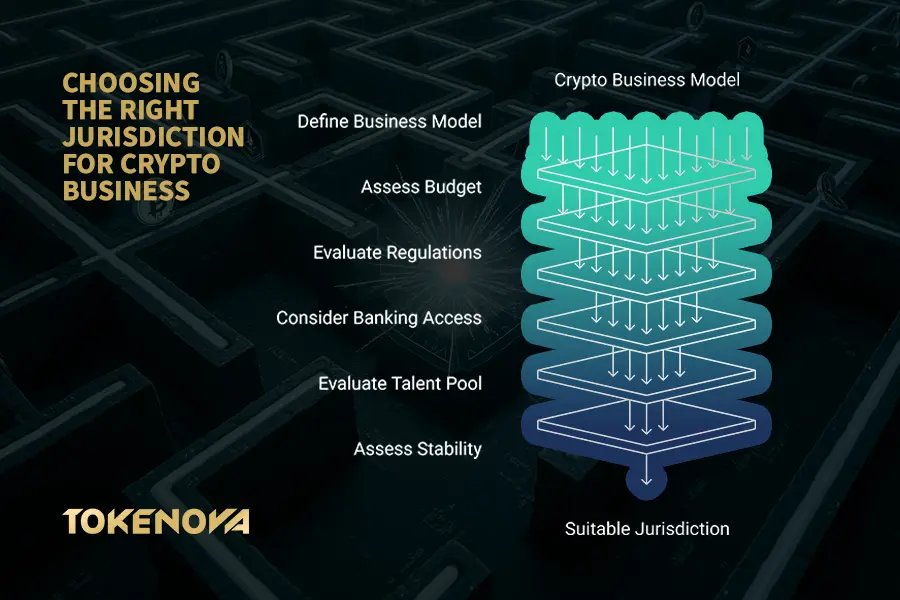

How to Choose Your Crypto Company’s Home: A Step-by-Step Guide

Selecting the optimal jurisdiction for your crypto company requires a thoughtful and systematic approach. Here’s a step-by-step guide to help you navigate this crucial decision:

- Define Your Business Model: Clearly articulate the nature of your crypto business. Are you launching a cryptocurrency exchange, developing a DeFi protocol, creating an NFT marketplace, or offering crypto payment solutions? Your business model will significantly influence the regulatory requirements and the types of jurisdictions that are most suitable.

- Assess Your Budget: Determine your financial capacity for registration, licensing, and ongoing compliance. Costs vary significantly between jurisdictions. Some, like Estonia, offer relatively lower setup costs, while others, like Switzerland, may require a more substantial initial investment.

- Evaluate Regulatory Environment and Tax Implications: Conduct a thorough analysis of the regulatory clarity, licensing requirements, and tax policies in your potential jurisdictions. Prioritize jurisdictions with well-defined regulations that align with your business model and offer a favorable tax environment.

- Consider Banking Access and Financial Infrastructure: Research the availability of banking services and the robustness of the financial infrastructure in your target jurisdictions. Access to banking is crucial for most crypto businesses, so prioritize jurisdictions where banks are more receptive to working with crypto companies.

- Evaluate Talent Pool and Infrastructure: Consider the availability of skilled professionals and the overall technological infrastructure in your potential jurisdictions. Hubs like Singapore and Switzerland offer access to a deep talent pool and a well-developed fintech ecosystem.

- Assess Political and Economic Stability: Prioritize jurisdictions with stable political and economic environments to minimize risks and ensure long-term security for your business.

- Risk Assessment and Long-Term Goals: Evaluate your risk tolerance and long-term strategic goals. Are you comfortable operating in a jurisdiction with evolving regulations, or do you prefer a more established and predictable environment?

- Seek Expert Advice: Consult with legal and compliance professionals specializing in cryptocurrency regulations in your target jurisdictions. Their expertise is invaluable in navigating the complexities and making informed decisions.

Unlock Your Crypto Business Potential with Tokenova

Navigating the complexities of cryptocurrency regulations and tokenization requires expert guidance. Tokenova offers comprehensive consulting services tailored to your unique business needs.

Why Choose Tokenova?

- Expert Advisory Services: We provide in-depth legal and corporate structuring within the UAE’s legal framework, ensuring optimal corporate structures considering ownership, liability, and taxation.

- Comprehensive Tokenization Solutions: Specializing in converting real-world assets into digital tokens, we offer end-to-end services from asset selection to token issuance, facilitating a seamless transition into the digital economy.

- Regulatory Compliance: With a deep understanding of global asset tokenization regulations, we help you navigate compliance requirements across various jurisdictions, keeping you ahead of regulatory changes.

Our Services Include:

- Legal & Corporate Structuring: Establishing proper legal entities within the UAE law framework and determining the best corporate structure, taking into account aspects like ownership, liability, and taxation.

- Tokenization Services: Providing comprehensive services in DIFC and ADGM, we assist in tokenizing businesses to unlock new opportunities across different industries.

- Regulatory Compliance: Ensuring adherence to complex legal and regulatory frameworks by obtaining the proper licenses and permits, and maintaining regulatory reporting.

Conclusion

The journey to establishing a successful cryptocurrency company is paved with strategic decisions, and none is more pivotal than choosing the right jurisdiction. As this comprehensive guide has illuminated, the ideal location is not a one-size-fits-all answer but rather a carefully considered choice based on your unique business model, risk appetite, and long-term aspirations. From the regulatory clarity of Malta and Singapore to the digital efficiency of Estonia and the burgeoning fintech scene in Poland, each country offers a distinct blend of advantages and considerations.

The evolving landscape in the UAE’s free zones and the resurgent potential of the United States further underscore the dynamic nature of this decision. Ultimately, the most astute entrepreneurs, developers, and investors will recognize that selecting a home for their crypto venture is not merely a logistical step, but a foundational element that will significantly shape their trajectory in this exciting and rapidly evolving industry. By meticulously weighing the factors discussed, engaging in thorough due diligence, and seeking expert guidance, you can confidently chart a course towards building a thriving and impactful crypto enterprise.

Key Takeaways

- Location is Strategic: The jurisdiction you choose is not just about paperwork; it profoundly impacts your regulatory environment, tax obligations, access to banking, and overall business stability.

- Regulatory Clarity is Paramount: Prioritize jurisdictions with well-defined and supportive regulatory frameworks to minimize legal risks and foster trust with users and investors. Understanding nuances like MiCA in the EU is crucial.

- Tax Optimization Matters: Strategically select a location with favorable tax policies to enhance your financial efficiency and reinvest in growth. Consider the absence of capital gains tax in Singapore or Estonia’s unique corporate income tax structure.

- Banking Access Remains a Challenge: Be prepared to navigate banking complexities and seek out crypto-friendly financial institutions or explore alternative payment solutions.

- Stability Breeds Success: Favor jurisdictions with political and economic stability to ensure a predictable and secure environment for your long-term operations.

- Talent and Infrastructure are Key: Consider the availability of skilled professionals and robust technological infrastructure when making your decision. Hubs like Singapore and Switzerland offer significant advantages in this regard.

- Risk Management is Essential: Develop comprehensive risk management strategies to mitigate regulatory uncertainty, market volatility, and geopolitical risks. Diversification and adaptability are crucial.

- Expert Guidance is Invaluable: Consult with legal and compliance professionals specializing in cryptocurrency regulations to navigate the complexities and make informed decisions.

- The Landscape is Dynamic: Stay informed about evolving regulations and be prepared to adapt your strategies as the global crypto landscape continues to mature.

- Your Business Model Dictates Your Choice: The optimal jurisdiction is ultimately determined by the specific nature of your crypto business and your strategic objectives.

What are the ongoing compliance requirements after registering a crypto company?

Ongoing compliance is a critical aspect of operating a registered crypto company. Requirements vary by jurisdiction but typically include regular financial audits to ensure transparency and adherence to accounting standards. Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance are paramount, requiring continuous monitoring of transactions and customer due diligence. Data protection regulations, such as GDPR in Europe, necessitate robust data security measures and privacy policies. Depending on the jurisdiction and the nature of your business, you may also need to adhere to specific licensing conditions and reporting obligations. For instance, in Malta, licensed entities are subject to ongoing supervision by the Malta Financial Services Authority (MFSA) and must submit regular reports. Staying informed about evolving regulations and maintaining proactive compliance measures are essential for avoiding penalties and ensuring long-term operational stability.

How do I handle cross-border transactions in different jurisdictions?

Handling cross-border transactions requires careful consideration of the regulatory frameworks in both the originating and receiving jurisdictions. It’s crucial to ensure compliance with AML/KYC regulations in all relevant jurisdictions, which may involve enhanced due diligence for international transactions. Tax implications can be complex, as different countries have varying rules regarding the taxation of crypto transactions. Transfer pricing regulations may also apply if your company has subsidiaries or branches in multiple countries. Utilizing secure and compliant payment processors that operate within the legal frameworks of the involved jurisdictions is essential. Furthermore, staying informed about international sanctions and restrictions is crucial to avoid legal pitfalls. Consulting with legal and tax professionals who have expertise in cross-border crypto transactions is highly recommended to navigate these complexities effectively.

What are the risks of operating in a jurisdiction with evolving regulations?

Operating in a jurisdiction with evolving regulations presents both opportunities and risks. The primary risk is regulatory uncertainty, where future changes in the legal framework could impact your business model, require costly adjustments, or even render certain operations non-compliant. This uncertainty can also make it challenging to attract investment and secure long-term partnerships. There’s also the risk of “regulatory arbitrage,” where companies might choose jurisdictions with lax regulations, potentially leading to future crackdowns or reputational damage. However, operating in an evolving regulatory environment can also offer first-mover advantages if you can adapt quickly and proactively engage with regulators. It’s crucial to have a flexible business model, maintain open communication with regulatory bodies, and stay informed about potential regulatory changes to mitigate these risks effectively. Diversifying your operational presence across multiple jurisdictions with varying regulatory approaches can also be a strategy to manage this risk.