Unlock unparalleled business opportunities with Company Formation in Sharjah your strategic gateway to the Middle East, Africa, and Asia.

Did you know that Sharjah’s economy has been growing at an impressive rate of 15% annually over the past five years, making it a hotspot for new businesses? If you’re an entrepreneur or an established company looking to expand, company formation in Sharjah offers a wealth of opportunities. This comprehensive guide will walk you through everything you need to know about setting up a business in this thriving emirate.

Sharjah, the third-largest emirate in the United Arab Emirates (UAE), is renowned for its rich cultural heritage and dynamic economy. With pro-business policies, strategic location, and robust infrastructure, Sharjah has become a magnet for entrepreneurs and multinational corporations alike. The government’s commitment to economic diversification and investor-friendly regulations makes it an ideal destination for your business venture.

Strategic Location Advantages

Situated at the crossroads of Europe, Asia, and Africa, Sharjah serves as a pivotal gateway connecting the Middle East, Africa, and Asia markets. The emirate boasts:

- Three Modern Seaports: Providing access to over 2 billion consumers.

- An International Airport: Facilitating swift global connectivity.

- Proximity to Dubai: Just a short drive away, offering additional business opportunities.

Setting up a company in Sharjah positions your business at the heart of global trade routes, enhancing your reach and potential for exponential growth.

Read More: Fujairah Company Registration: Launch Your Global Success

Why Choose Sharjah for Company Formation?

Overview of Tax Incentives and Government Support

- Zero Corporate and Personal Income Tax: Sharjah offers a tax-free environment, significantly boosting your profit margins.

- Full Repatriation of Capital and Profits: Investors can repatriate 100% of their capital and profits without restrictions.

- Government Initiatives: The Sharjah government provides extensive support, including streamlined company registration in Sharjah and various business incentives like grants and subsidies.

These financial advantages make company setup in Sharjah a cost-effective and lucrative option.

Access to Middle East, Africa, and Asia Markets

- Strategic Trade Routes: Sharjah’s ports and airports connect you to major global markets.

- Free Trade Agreements: Benefit from the UAE’s multiple trade agreements, reducing tariffs and trade barriers.

- Multilingual Workforce: Access to a diverse talent pool fluent in English, Arabic, Hindi, and other Asian languages.

By forming a company in Sharjah, you gain a competitive edge in accessing emerging markets and expanding your global footprint.

Read More: Company Formation in Abu Dhabi

Steps to Company Formation in Sharjah

Initial Consultation and Business Activity Selection

- Consult a Business Advisor:

- Expert Guidance: Engage with local experts to understand legal requirements and market opportunities.

- Feasibility Study: Assess the viability of your business idea in the Sharjah market.

- Select Business Activities:

- Permitted Activities: Choose from over 1,500 permitted activities listed by the Sharjah Economic Development Department (SEDD).

- Alignment with Goals: Ensure the activities align with your business objectives.

Proper planning is crucial for a successful company setup in Sharjah.

Legal Structure Options

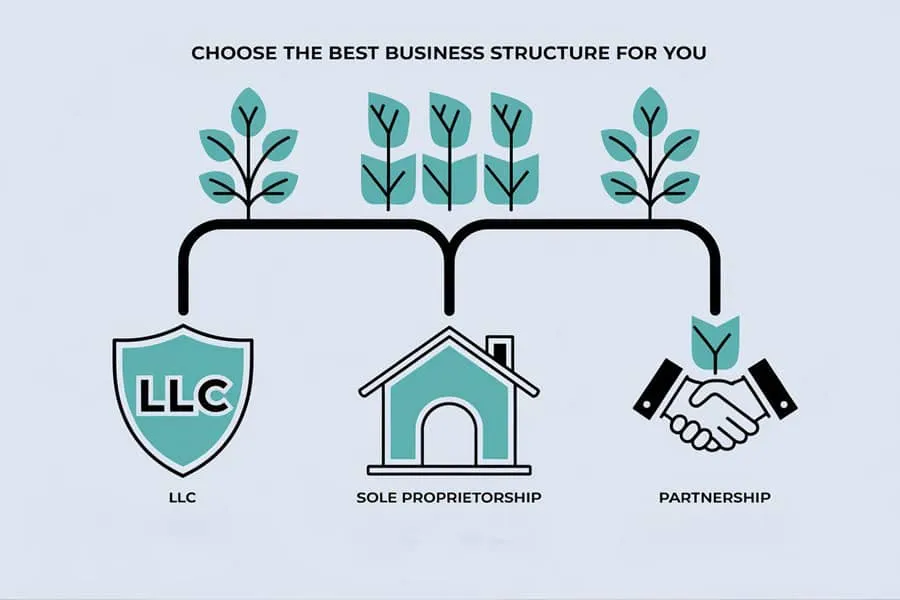

Choosing the right legal structure is pivotal for legal compliance and operational efficiency, ensuring that your business aligns with your strategic objectives and risk management preferences. Below is a detailed comparison of the primary legal structures available for company registration in Sharjah.

Legal Structure Comparison Table

| Structure | Ownership | Liability | Ideal For | Advantages | Disadvantages |

| Sole Proprietorship | 100% ownership by a single individual | Unlimited liability | Small businesses, freelancers, startups | Full control, simple setup, minimal costs | Unlimited liability, difficult to raise capital |

| Partnership | Shared ownership among two or more partners | Unlimited or limited liability | Businesses requiring shared capital and expertise | Shared responsibilities, pooled resources, diverse skill set | Joint liability, potential for disputes |

| Limited Liability Company (LLC) | Up to 100% foreign ownership in Free Zones; typically 51% local ownership required in mainland | Limited to shareholders’ capital | Medium to large enterprises seeking liability protection | Limited liability, broader capital base, credibility, easier to raise capital | More regulations, possible need for a local partner in mainland |

Documentation Requirements

- Passport Copies: For all shareholders and managers.

- Proof of Address: Recent utility bills or bank statements.

- No Objection Certificate (NOC): If the shareholder is a UAE resident employed elsewhere.

- Business Plan: Detailed plan outlining objectives, strategies, and financial projections.

- Specimen Signatures: For all authorized signatories.

- Professional Qualifications: Attested educational certificates for professional licenses.

- Bank Reference Letter: Demonstrating financial stability.

Accurate and complete documentation expedites the company registration in Sharjah.

Registration Process with the Department of Economic Development (DED)

- Trade Name Reservation:

- Unique Name: Choose a unique company name compliant with UAE regulations, avoiding any offensive or religious terms.

- Approval: Submit to DED for approval.

- Initial Approval:

- Application Submission: Provide details about shareholders, business activities, and legal structure.

- Security Clearance: Undergo background checks as required.

- MOA and AOA Drafting:

- Memorandum of Association (MOA): Outlines the company’s structure and shareholder responsibilities.

- Articles of Association (AOA): Details internal regulations and governance.

- Lease Agreement:

- Physical Office Space: Secure office space as per regulatory requirements.

- Tenancy Contract: Provide a registered lease agreement.

- Final Submission:

- Document Compilation: Submit all documents to the DED.

- Fee Payment: Pay the required registration and licensing fees.

- License Issuance:

- Trade License: Receive your trade license upon approval.

- Registration Certificate: Obtain the certificate of incorporation.

Following these steps ensures a smooth company formation in Sharjah.

Read More: Establishing a Company in DIFC: 2025 Full Guide

Obtaining Necessary Licenses and Permits

- Commercial License: For trading and commercial activities.

- Industrial License: For manufacturing and industrial operations.

- Professional License: For service-oriented businesses.

- Tourism License: For travel agencies and hospitality services.

- E-commerce License: For online businesses.

Securing the appropriate license is essential for legal operation and avoiding penalties.

Opening a Corporate Bank Account

- Choose a Bank:

- Local Banks: Emirates NBD, Sharjah Islamic Bank.

- International Banks: HSBC, Standard Chartered.

- Submit Documents:

- Company Formation Documents: Trade license, MOA, AOA.

- Identification: Passports and visas of shareholders and signatories.

- Business Plan: Some banks may require detailed business activities.

- Board Resolution: Authorizing account opening and signatories.

- Minimum Balance:

- Requirement: Maintain the required minimum balance, which can range from AED 20,000 to AED 150,000.

An operational bank account is vital for financial transactions and establishing credibility.

Visa Processing

- Employment Visas: For shareholders and employees.

- Medical Fitness Test: Mandatory health check-ups.

- Emirates ID Registration: Required for all residents.

- Family Sponsorship: Possibility to sponsor family members based on eligibility.

Completing visa processes ensures legal residency and work authorization in the UAE.

Types of Business Structures in Sharjah

Detailed Explanation of Each Structure

Sole Proprietorship

- Control: Full control and decision-making authority by the owner.

- Taxation: Profits taxed as personal income (though currently, there is no personal income tax in the UAE).

- Liability: Owner is personally liable for all debts and obligations.

- Flexibility: Easy to set up and dissolve.

Partnership

- General Partnership:

- Ownership: Equal responsibility among partners.

- Liability: Unlimited liability shared equally.

- Management: All partners participate in management.

- Limited Partnership:

- Ownership: Combination of general and limited partners.

- Liability: Limited partners’ liability is restricted to their capital contribution.

- Management: Only general partners manage the business.

Limited Liability Company (LLC)

- Shareholders: Minimum of two, maximum of 50.

- Capital Requirements: No minimum capital requirement in most cases.

- Management: Managed by appointed directors or managers.

- Liability: Shareholders’ liability is limited to their shares in the capital.

- Ownership Structure: In mainland Sharjah, 51% local ownership is typically required unless exemptions apply.

Advantages and Disadvantages

| Structure | Advantages | Disadvantages |

| Sole Proprietorship | – Full control – Simple setup – Minimal costs | – Unlimited liability – Difficult to raise capital |

| Partnership | – Shared capital and expertise – Simple structure | – Joint liability – Potential for partner disputes |

| LLC | – Limited liability – Broader capital base – Credibility | – More regulations – Possible need for local partner |

Choose the structure that best aligns with your business needs and risk appetite.

Costs Associated with Company Formation

Design an Infographic showing costs involved in setting up a company in Sharjah.

Breakdown of Registration and Licensing Fees

- Trade Name Reservation: Approximately AED 620.

- Initial Approval: Around AED 1,000.

- License Fees:

- Commercial License: AED 9,000 – AED 15,000.

- Industrial License: AED 15,000 – AED 25,000.

- Professional License: AED 7,000 – AED 12,000.

- Notarization and Legal Fees: Approximately AED 2,000 – AED 5,000.

- Administrative Fees: May include service agent fees, document translation, and attestation.

- Visa Fees: Approximately AED 3,000 – AED 5,000 per visa.

Understanding the cost of company setup in Sharjah helps in effective budgeting and financial planning.

Office Space Leasing Costs

- Free Zones:

- Flexi-Desk Options: Starting from AED 15,000 annually.

- Office Units: AED 20,000 – AED 50,000 annually, depending on size and location.

- Warehouses: Available for industrial activities, costs vary based on size.

- Mainland:

- Office Rent: Varies based on location, starting from AED 20,000 to over AED 100,000 annually.

- Retail Spaces: Costs depend on foot traffic and location.

Consider virtual office options if physical space is not immediately necessary.

Operational Expenses

- Utilities:

- Electricity and Water: Approximately AED 1,500 – AED 3,000 monthly.

- Internet and Telecommunications: Around AED 500 – AED 1,000 monthly.

- Salaries:

- Minimum Wage Laws: No official minimum wage, but market rates apply.

- Additional Costs: Health insurance, end-of-service benefits.

- Other Expenses:

- Marketing and Advertising: Budget according to business needs.

- Insurance: General liability, property, and other relevant insurances.

Factor in all expenses to ensure financial sustainability and avoid cash flow issues.

Cost-Saving Tips

- Choose the Right Free Zone: Some offer more competitive rates and packages.

- Negotiate Lease Terms: Long-term leases may offer better rates.

- Utilize Shared Services: Co-working spaces and shared facilities can reduce costs.

- Government Incentives: Look out for discounts or incentives for certain industries.

Strategic planning can significantly reduce the cost of company setup in Sharjah and ongoing expenses.

Benefits of Company Formation in Free Zones

Overview of Sharjah Free Zones

Sharjah Airport International Free Zone (SAIF Zone)

- Ideal For: Logistics, aviation, manufacturing, and trading companies.

- Facilities: Offers warehouses, offices, and land for development.

- Advantages: Quick setup process, modern infrastructure.

Sharjah Media City (SHAMS)

- Focused On: Media, digital marketing, and creative industries.

- Benefits: Cost-effective license packages, 100% foreign ownership.

- Flexibility: Allows for multiple business activities under one license.

Hamriyah Free Zone

- Ideal For: Industrial and commercial activities.

- Facilities: Deepwater port, pre-built warehouses, and office spaces.

- Advantages: Competitive energy costs, land availability.

Advantages of Foreign Ownership and Tax Exemptions

- 100% Foreign Ownership: No need for a local sponsor or partner.

- Tax Benefits:

- Corporate Tax Exemption: Zero corporate tax.

- Import and Export Duties: Exemption within the Free Zone.

- Repatriation of Profits: Full repatriation of capital and profits without restrictions.

- Simplified Company Registration in Sharjah: Streamlined processes in Free Zones.

Free Zones simplify the company registration in Sharjah for foreign investors, offering a hassle-free environment.

Types of Licenses Available in Free Zones

- Trading License: For import, export, and trading activities.

- Industrial License: For manufacturing and production.

- Service License: For service-oriented businesses like consultancy.

- E-commerce License: For online trading activities.

- Media License: Specific to media and creative sectors in SHAMS.

Choose a license that aligns with your business activities to ensure compliance and operational efficiency.

Case Study: Successful Free Zone Company

ABC Trading LLC

- Industry: Electronics Trading

- Free Zone: SAIF Zone

- Success Factors:

- Quick Setup: Completed company formation in Sharjah within two weeks.

- Cost Savings: Benefited from tax exemptions and lower operational costs.

- Market Access: Leveraged strategic location to expand into African markets.

This example illustrates the advantages of Free Zone company setup in Sharjah.

Key Industries for Company Formation in Sharjah

Overview of Thriving Sectors

Logistics and Transportation

- Why Sharjah?: Strategic location with access to major ports and airports.

- Opportunities: Warehousing, freight forwarding, and supply chain management.

Manufacturing

- Supportive Policies: Government incentives for industrial development.

- Sectors: Plastics, textiles, machinery, and equipment manufacturing.

- Competitive Edge: Lower energy costs and availability of skilled labor.

Services

- Growing Demand: Increasing need for IT services, healthcare, education, and professional consultancy.

- Advantages: Diverse market with opportunities for niche services.

- Digital Transformation: High demand for cybersecurity, AI, and fintech solutions.

Tourism and Hospitality

- Cultural Hub: Rich heritage attracts tourists, boosting hospitality services.

- Opportunities: Hotels, travel agencies, and event management.

- Government Support: Initiatives to promote Sharjah as a tourist destination.

Identifying the right industry enhances your chances of success in company setup in Sharjah.

Emerging Industries

- Renewable Energy: Government focus on sustainability creates opportunities.

- Technology and Innovation: Support for startups in AI, fintech, and IoT.

- Education and Training: Growing population increases demand for educational institutions.

Staying ahead of industry trends can give your business a competitive edge.

Common Challenges in Company Formation

Regulatory Hurdles

- Complex Procedures: Navigating the legal requirements can be daunting for newcomers.

- Documentation: Strict adherence to documentation standards is mandatory.

- Language Barrier: Official documents may require translation into Arabic.

Understanding Local Laws and Compliance

- Cultural Sensitivity: Business etiquette differs from Western practices; understanding local customs is crucial.

- Legal Changes: Regulations can evolve; staying updated is necessary to maintain compliance.

- Intellectual Property Rights: Ensuring protection of trademarks and patents.

Market Competition

- Saturated Markets: Certain industries may have high competition.

- Market Entry Strategy: Requires thorough market research and strategic planning.

- Consumer Behavior: Understanding local consumer preferences is essential.

Financial Management

- Currency Fluctuations: Impact on international transactions.

- Banking Regulations: Compliance with anti-money laundering (AML) laws.

Being aware of challenges prepares you for a smoother company formation in Sharjah and helps in risk mitigation.

Consultation Services for Business Setup

Importance of Professional Assistance

- Expert Guidance: Professionals help navigate legal complexities and regulatory requirements.

- Time Efficiency: Accelerates the registration process by handling paperwork and approvals.

- Cost Savings: Avoid costly mistakes due to non-compliance or procedural errors.

- Local Insights: Consultants offer valuable knowledge about market trends and opportunities.

Engaging consultants can be invaluable in your company setup in Sharjah, ensuring a hassle-free experience.

Overview of Services Offered by Business Setup Consultants

- Legal Advisory: Assistance with legal structure selection and compliance.

- Documentation Assistance: Preparing and submitting all required documents.

- PRO Services: Handling government relations, visa processing, and license renewals.

- Bank Account Setup: Facilitating corporate bank account opening.

- Office Solutions: Helping secure appropriate office spaces.

- Market Research: Providing insights into market conditions and competition.

- Accounting and Taxation Services: Setting up accounting systems and VAT registration.

Streamline Your Business Setup with Expert Guidance!”

Avoid costly mistakes and simplify your company formation process in Sharjah. Connect with our experienced consultants for tailored advice, regulatory support, and end-to-end assistance. Let us handle the complexities while you focus on your business goals.

Book Your Free Consultation Today!

Pro Tips for Seasoned Entrepreneurs

Leverage Government Incentives

- Stay Informed: Regularly check for government programs offering grants, subsidies, or reduced fees.

- Engage with Authorities: Build relationships with government agencies for smoother operations.

- Participate in Events: Attend business forums and exhibitions sponsored by the government.

Navigate Regulatory Environments

- Compliance Calendar: Maintain a calendar for license renewals, visa expirations, and tax filings.

- Legal Counsel: Retain a local legal advisor to stay updated on regulatory changes.

- Document Management: Keep digital copies of all important documents for easy access.

Cultural Nuances and Networking

- Business Etiquette: Understanding local customs enhances negotiations and relationships.

- Join Business Councils: Participate in organizations like the Sharjah Chamber of Commerce for networking opportunities.

- Language Skills: Learning basic Arabic phrases can go a long way in building rapport.

Industry-Specific Regulations

- Sector Regulations: Be aware of specific laws governing your industry, such as healthcare or finance.

- Quality Standards: Adhere to international and local standards to enhance credibility.

- Environmental Compliance: Ensure your business meets environmental regulations.

Strategic Partnerships

- Local Alliances: Partner with local businesses to enhance market penetration.

- Academic Collaborations: Engage with universities for research and development opportunities.

- Supply Chain Optimization: Build strong relationships with suppliers and distributors to ensure efficiency.

Applying these advanced strategies can significantly enhance the success of your company formation in Sharjah.

Conclusion

Unlock your business potential by setting up a company in Sharjah today! With its strategic location, business-friendly environment, and robust infrastructure, Sharjah offers unparalleled opportunities for entrepreneurs and established businesses alike. Don’t miss out on the chance to expand your horizons take the first step towards success now.

Sharjah stands as a testament to the UAE’s commitment to fostering a thriving business ecosystem. Whether you’re a startup looking to make your mark or an established enterprise aiming to penetrate new markets, company formation in Sharjah provides the foundation you need to achieve your goals. The emirate’s zero-tax policies, combined with full repatriation of profits and capital, ensure that your financial interests are well-protected and optimized for growth.

Moreover, Sharjah’s diverse Free Zones, such as SAIF Zone and SHAMS, cater to a wide range of industries, offering tailored licenses and infrastructure that meet the specific needs of various business sectors. By choosing to set up a company in one of these Free Zones, you not only benefit from tax exemptions and 100% foreign ownership but also gain access to state-of-the-art facilities and a supportive community of like-minded entrepreneurs.

Navigating the company registration in Sharjah process is streamlined with the support of professional consultants who provide expert guidance, ensuring that every step from initial consultation to obtaining the final license is handled with precision and efficiency. These consultants are well-versed in local regulations and can help you avoid common pitfalls, saving you time and resources while ensuring compliance with all legal requirements.

Additionally, Sharjah’s commitment to economic diversification means that the emirate is continuously evolving, opening up new opportunities in emerging industries such as renewable energy, technology, and education. This forward-thinking approach not only makes Sharjah a resilient and stable business environment but also one that is ripe with opportunities for innovation and growth.

Take advantage of Sharjah’s booming economy and strategic location. Begin your company setup in Sharjah and join the ranks of successful businesses thriving in the UAE. Whether you’re eyeing the logistics sector, looking to establish a manufacturing base, or aiming to offer specialized services, Sharjah provides the perfect platform to launch and scale your business.

- Contact Us: Get in touch with our expert consultants to guide you through the company formation in Sharjah process.

- Explore Opportunities: Visit Sharjah and experience the vibrant business culture firsthand.

- Stay Informed: Subscribe to our newsletter for the latest updates on business opportunities in Sharjah.

Your journey to success starts here with company formation in Sharjah! Take the leap today and secure your place in one of the UAE’s most promising business environments.

Key Takeaways

- Business-Friendly Environment: Sharjah offers tax incentives and government support, making it an ideal location for company formation.

- Strategic Location: Access to major global markets enhances business opportunities and growth potential.

- Diverse Legal Structures: Various options like Sole Proprietorship, Partnership, and LLC cater to different business needs.

- Cost-Effective Setup: Understanding the cost of company setup in Sharjah helps in efficient budgeting and financial planning.

- Free Zone Benefits: Free Zones offer 100% foreign ownership, tax exemptions, and simplified registration processes.

- Professional Assistance: Engaging consultants can simplify the company setup in Sharjah, ensuring compliance and efficiency.

- Proactive Planning: Being aware of challenges and leveraging opportunities positions your business for success.

- Cultural Awareness: Understanding local customs and business etiquette enhances relationships and negotiations.

- Regulatory Compliance: Staying updated on laws and regulations avoids legal issues and fines.

- Market Research: Thorough understanding of the market ensures better decision-making and strategy formulation.

Embarking on company formation in Sharjah can be a transformative step for your business, unlocking new horizons and growth opportunities.

Can I operate my Free Zone company in the Sharjah mainland?

Generally, Free Zone companies are restricted to operating within their respective zones or internationally. To conduct business in the Sharjah mainland, you would need to appoint a local distributor or establish a branch office with the appropriate licenses.

Is it possible to change my company’s legal structure after registration?

Yes, you can change your company’s legal structure, but it involves legal procedures and approvals from the relevant authorities. It’s advisable to consult a legal advisor to understand the implications and process involved.

What are the auditing requirements for companies in Sharjah?

Certain companies, especially those in Free Zones, are required to submit annual audited financial statements. Compliance with auditing standards is crucial for license renewal and maintaining good standing with authorities.

Do I need a local sponsor for company setup in Sharjah?

In the mainland, certain business structures require a local Emirati sponsor holding 51% shares. However, Free Zones allow 100% foreign ownership without the need for a local sponsor.

How long does the company registration in Sharjah take?

The process typically takes between 7 to 14 working days, provided all documentation is in order and regulatory requirements are met.

These insights address common concerns and help you make informed decisions during your company formation in Sharjah.