Looking to launch or expand your business in the UAE? Imagine a location where favorable tax policies, a prime geographic position, and a supportive business ecosystem converge all at an accessible cost. Ajman is quickly becoming one of the UAE’s most sought-after hubs for entrepreneurs and established companies alike, thanks to its streamlined registration process, robust infrastructure, and strategic incentives for growth.

This guide is your go-to resource for company registration in Ajman. Whether you’re a seasoned business owner or a first-time founder, we’ll walk you through the steps of setting up your business, explain the types of companies you can form, and highlight the unique advantages that make Ajman stand out. By the end, you’ll have the practical insights and actionable steps you need to set up successfully in one of the UAE’s fastest-growing business landscapes. Ready to transform your vision into reality? Let’s dive into the essentials of establishing a thriving business in Ajman.

Overview of Ajman as a Business Hub

Ajman has rapidly emerged as a prominent business hub in the UAE, attracting investors with its strategic location, robust infrastructure, and business-friendly policies. Situated along the Persian Gulf, Ajman offers seamless connectivity to major markets in the Middle East, Africa, and Asia. The emirate’s free zones are specifically designed to cater to international businesses, providing a flexible and efficient environment for company registration in Ajman.

Strategic Location

Ajman’s geographical position makes it an ideal gateway for businesses aiming to expand into the GCC region. Its proximity to Dubai, one of the world’s leading business centers, enhances its appeal by providing easy access to a vast network of suppliers, customers, and partners.

Robust Infrastructure

Ajman boasts state-of-the-art infrastructure, including modern office spaces, reliable utilities, and advanced telecommunications. The emirate continuously invests in improving its infrastructure to support the growing needs of businesses, ensuring a smooth operational flow.

Business-Friendly Policies

The government of Ajman is committed to creating a business-friendly environment. Simplified registration processes, transparent regulations, and supportive government initiatives make it easier for companies to establish and grow their operations in the emirate.

Ajman Free Zone

Ajman Free Zone (AFZ) is a standout feature that attracts numerous international businesses. AFZ offers 100% foreign ownership, no personal or corporate taxes, and easy repatriation of profits, making it a preferred choice for company formation in Ajman.

Importance of Registering a Company in Ajman

Registering a company in Ajman is crucial for businesses seeking to capitalize on the emirate’s economic growth. Company formation in Ajman not only provides legal recognition but also unlocks numerous benefits that can significantly enhance your business operations and profitability.

Legal Recognition

Establishing your business in Ajman grants you legal recognition, allowing you to operate within the UAE’s robust legal framework. This ensures that your business activities are protected and regulated, fostering trust among clients and partners.

Tax Advantages

One of the primary benefits of registering in Ajman, especially within its free zone, is the tax advantages. Businesses enjoy zero corporate tax, no personal income tax, and no import or export duties, which can lead to substantial cost savings and higher profit margins.

Access to World-Class Infrastructure

Ajman’s investment in infrastructure provides businesses with access to modern facilities, reliable utilities, and advanced telecommunications, ensuring that your operations run smoothly and efficiently.

Supportive Business Environment

Ajman offers a supportive business environment with various government initiatives aimed at fostering entrepreneurship and innovation. This includes business support services, training programs, and financial incentives designed to help businesses thrive.

Strategic Location for Market Access

Ajman’s strategic location allows businesses to easily access international markets, facilitating global trade and expansion. Whether you’re targeting the Middle East, Africa, or Asia, Ajman provides the perfect launchpad for your business ambitions.

Enhanced Credibility

Having your company registered in Ajman enhances your business’s credibility and reputation, making it easier to attract investors, partners, and customers. It demonstrates your commitment to operating within a reputable and stable economic environment.

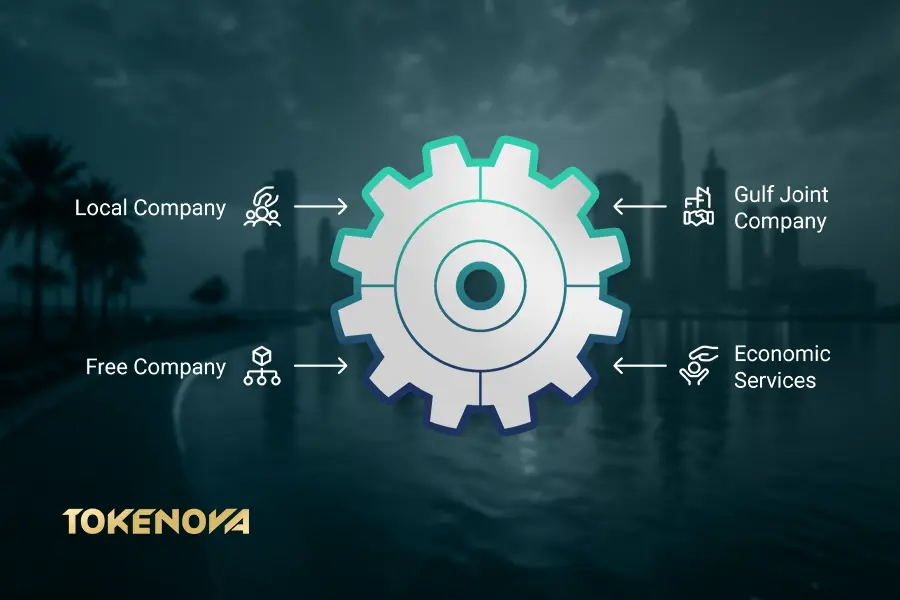

Types of Companies in Ajman

Understanding the types of companies in Ajman is essential for selecting the right structure for your business. Each company type offers unique advantages and caters to different business needs and objectives. Here are the primary options available:

Local Company

A Local Company is ideal for businesses that wish to operate within the mainland of Ajman. This structure requires a local sponsor who holds a majority share, fostering strong local partnerships.

Key Features:

- Requires a local sponsor holding at least 51% of the shares.

- Suitable for businesses targeting the UAE mainland market.

- No restrictions on the types of business activities.

Sole Proprietorship

For individual entrepreneurs, a Sole Proprietorship offers a straightforward setup with full ownership and control, perfect for small-scale operations. This structure is suitable for professionals such as consultants, freelancers, and small business owners.

Key Features:

- Owned entirely by one individual.

- Simple registration process with minimal documentation.

- Owner has complete control over business decisions and profits.

Gulf Joint Company

A Gulf Joint Company is designed for partnerships between Gulf nationals and foreign investors, promoting regional collaboration and business expansion. This structure is beneficial for businesses looking to leverage local expertise and networks while maintaining international standards.

Key Features:

- Requires a partnership between Gulf nationals and foreign investors.

- Combines local knowledge with international business practices.

- Suitable for medium to large-scale enterprises seeking regional growth.

Free Company

A Free Company registered in Ajman Free Zone provides 100% foreign ownership, tax exemptions, and easy repatriation of profits, making it a preferred choice for international businesses. Free companies benefit from streamlined administrative processes and access to a global business community.

Key Features:

- 100% foreign ownership without the need for a local sponsor.

- No personal or corporate taxes.

- Flexible office solutions and access to free zone facilities.

Economic Services Company

An Economic Services Company caters to specialized services, offering flexibility and tailored solutions to meet specific business needs. This structure is ideal for businesses in sectors such as consultancy, IT services, and financial services.

Key Features:

- Focuses on providing specialized economic services.

- Flexible licensing options to suit various business models.

- Access to a network of professional services and support.

Types of Companies in Ajman

| Company Type | Ownership Structure | Tax Benefits | Ideal For |

| Local Company | 51% local sponsor | Varies by activity | Businesses targeting mainland UAE |

| Sole Proprietorship | 100% owned by individual | Standard tax regime | Freelancers, small businesses |

| Gulf Joint Company | Partnership with Gulf nationals | Varies by activity | Regional collaborations |

| Free Company | 100% foreign ownership | Tax exemptions | International businesses |

| Economic Services Company | Varies | Varies by activity | Specialized service providers |

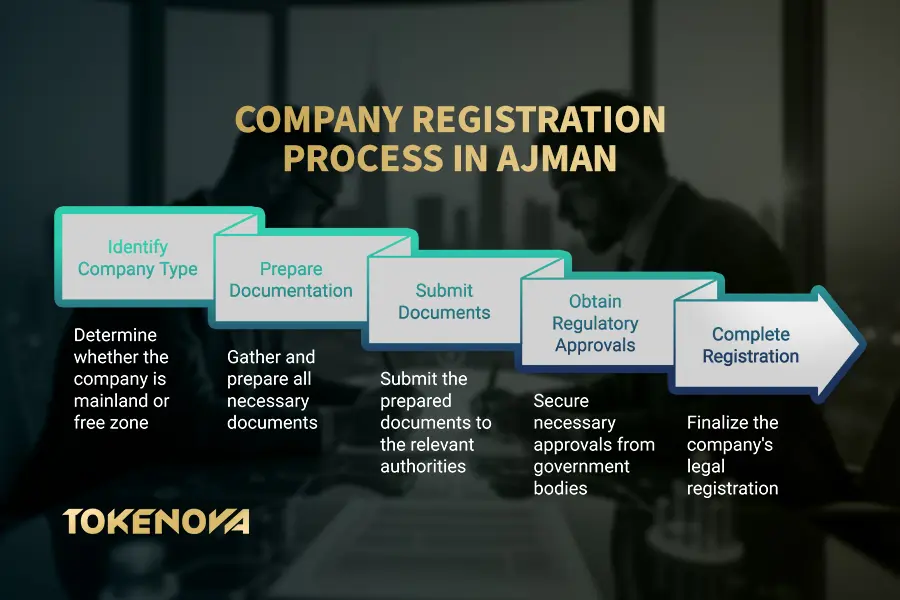

Steps to Register a Company in Ajman

Registering a company in Ajman involves several key steps to ensure compliance and successful establishment. Each step requires careful planning and adherence to local regulations to facilitate a smooth registration process.

Determine the Business Activity

Identify the core activities your business will engage in, as this determines the licenses and permits required. The UAE classifies business activities into different categories, each with specific regulations and requirements. Accurately defining your business activity ensures that you obtain the correct licenses and avoid legal complications.

Key Considerations:

- Define your primary business activities.

- Check the permitted activities in your chosen free zone or mainland.

- Ensure compliance with any industry-specific regulations.

Choose the Appropriate Legal Structure

Select the legal structure that best fits your business model, whether it’s a local company, free zone entity, or sole proprietorship. The legal structure impacts ownership, liability, taxation, and operational flexibility.

Factors to Consider:

- Ownership requirements (local sponsor vs. 100% foreign ownership).

- Liability and risk management.

- Business scope and expansion plans.

Select a Unique Company Name

Ensure your company name is unique and compliant with Ajman’s naming regulations to avoid conflicts and ensure brand identity. The name should reflect your business activities and adhere to cultural and legal standards.

Naming Guidelines:

- Avoid offensive or prohibited words.

- Ensure the name is not already registered by another entity.

- Reflect on the nature of your business.

Prepare Necessary Documentation

Gather essential documents such as the No Objection Certificate (NOC) and a detailed business plan to support your application. Proper documentation is crucial for a successful registration process and helps expedite approvals.

Required Documents:

- Passport copies of all shareholders and directors.

- Visa copies (if applicable).

- Proof of address.

- NOC from current sponsor (if applicable).

- Detailed business plan outlining your business objectives and strategies.

Submit Application for Licenses and Permits

Complete the application process by submitting all required licenses and permits to the relevant authorities. This step involves filling out application forms, paying necessary fees, and providing supporting documents.

Application Process:

- Complete the online or physical application forms.

- Submit all required documentation.

- Pay the applicable licensing and registration fees.

- Await approval from the relevant authorities.

Register in the Commercial Registry

Finally, register your company in Ajman’s Commercial Registry to obtain legal recognition and commence operations. This step formalizes your business entity and allows you to operate legally within the emirate.

Registration Steps:

- Submit the final approval and all required documents to the Commercial Registry.

- Receive your commercial license.

- Register for necessary taxes and social security (if applicable).

Requirements for Company Registration

Meeting the requirements for company registration in Ajman is crucial for a smooth setup process. Different types of companies and free zones may have specific criteria, so understanding these requirements helps in preparing a successful application.

Documentation Needed

Proper documentation is essential for company registration. Below is a list of standard documents required:

- No Objection Certificate (NOC): Required from your current sponsor if you are an existing resident or transferring business.

- Business Plan: A detailed plan outlining your business objectives, strategies, and financial projections.

- Passport Copies of Shareholders: Clear copies of passports for all shareholders and directors.

- Proof of Address: Utility bills or tenancy contracts as proof of your business address.

- Additional Documents: Depending on the business activity, additional documents such as professional licenses or certifications may be required.

Specific Requirements for Different Types of Companies

Different types of companies and free zones have unique requirements. It’s essential to understand these specifics to ensure compliance and avoid delays.

Mainland Companies

- Local Sponsor: Requires a UAE national to hold at least 51% of the shares.

- Office Space: Must have a physical office space in Ajman.

- Licensing: Specific licenses based on business activities.

Free Zone Companies

- 100% Foreign Ownership: No need for a local sponsor.

- Flexibility: Various office solutions, including flexi-desks and dedicated offices.

- Sector-Specific Requirements: Certain industries may have additional licensing requirements.

Requirements for Different Company Types

| Company Type | Local Sponsor Required | Ownership Structure | Office Space Requirement | Additional Licensing Needs |

| Mainland Company | Yes | 51% local, 49% foreign | Mandatory | Based on activity |

| Free Zone Company | No | 100% foreign | Depends on office type | Sector-specific |

| Sole Proprietorship | No (owned by individual) | 100% owned | Minimal (home-based or small office) | Professional licenses |

| Gulf Joint Company | Yes | Partnership with Gulf nationals | Mandatory | Based on activity |

| Economic Services Company | Varies | Varies | Flexible | Specialized licenses |

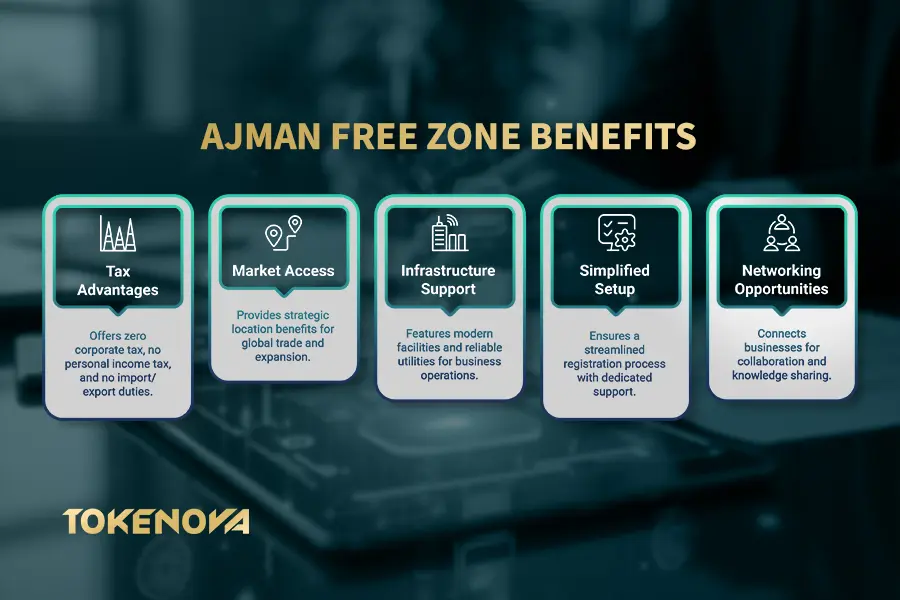

Benefits of Registering in Ajman Free Zone

Choosing to register your company in the Ajman Free Zone comes with numerous advantages that can significantly enhance your business operations and profitability. Ajman Free Zone is designed to cater to international businesses, providing a flexible and efficient environment for company formation.

Tax Advantages and Incentives

Ajman Free Zone offers tax exemptions and incentives that significantly reduce operational costs and enhance profitability. Businesses registered in the free zone benefit from:

- Zero Corporate Tax: No corporate taxes for up to 50 years, renewable.

- No Personal Income Tax: Employees enjoy tax-free salaries.

- No Import or Export Duties: Simplifies international trade and reduces costs.

Access to International Markets

Leverage Ajman’s strategic location to access international markets, facilitating global trade and expansion. The free zone’s excellent connectivity ensures that your business can easily engage with partners and customers worldwide.

Key Benefits:

- Proximity to major shipping routes and ports.

- Easy access to regional and global markets.

- Enhanced logistics and supply chain capabilities.

Infrastructure and Support Services

Benefit from state-of-the-art infrastructure and comprehensive support services that streamline business operations and growth. Ajman Free Zone provides:

- Modern Office Facilities: High-quality office spaces equipped with the latest technology.

- Reliable Utilities: Consistent and efficient utility services.

- Business Support Services: Access to legal, financial, and administrative support.

Simplified Business Setup

Ajman Free Zone offers a streamlined registration process, making it easier and faster to establish your business. The free zone authority provides:

- One-Stop-Shop Services: Handle all registration and licensing processes.

- Efficient Processing: Quick turnaround times for approvals and documentation.

- Dedicated Support: Professional assistance throughout the setup process.

Networking Opportunities

Being part of Ajman Free Zone connects you with a global community of businesses. This network provides opportunities for collaboration, partnerships, and knowledge sharing, fostering a dynamic business environment.

Networking Benefits:

- Access to industry events and seminars.

- Opportunities to collaborate with other businesses.

- Enhanced visibility within the international business community.

Costs Associated with Company Registration

Understanding the costs associated with company registration in Ajman is essential for budgeting and financial planning. Costs can vary based on the type of company, free zone, and business activities. Below is a detailed breakdown of the expenses involved.

Breakdown of Registration Fees

| Cost Component | Mainland Setup | Free Zone Setup |

| License Fees | Higher | Lower |

| Registration Fees | Higher | Lower |

| Office Space | Mandatory, higher cost | Flexible, various options |

| Local Sponsorship Fees | Yes, ongoing fees | No |

| Visa Fees | Standard | Included in some packages |

| Legal Fees | Higher | Lower |

| Tax Advantages | Limited | Significant |

| Total Estimated Cost | AED 50,000+ | AED 30,000+ |

License Fees

License fees vary based on the business activity and company type. Different licenses are required for different types of activities, such as trading, consultancy, or manufacturing.

- Commercial License: For trading activities.

- Professional License: For services and consultancy.

- Industrial License: For manufacturing and production.

Registration Fees

These include administrative charges and legal fees associated with the company registration process.

- Initial Registration Fee: One-time fee for registering the company.

- Annual Renewal Fee: Recurring fee for maintaining the company license.

- Office Setup Fees: Costs associated with leasing office space.

Office Space

The cost of office space depends on the location and size of the office within the Ajman Free Zone or the mainland.

- Flexi-Desk: Cost-effective option for startups and small businesses.

- Dedicated Office: Private office space for larger teams and established businesses.

- Warehouse Facilities: For businesses requiring storage and logistics support.

Comparison of Costs Between Mainland and Free Zone Setups

Understanding the cost differences between mainland and free zone setups helps in making an informed decision based on your business needs and budget.

Mainland Setup

- Higher Setup Costs: Due to the requirement of a local sponsor and the need for physical office space.

- Local Sponsorship Fees: Ongoing fees paid to the local sponsor for their services.

- Licensing Fees: Typically higher compared to free zones, depending on business activity.

Free Zone Setup

- Cost-Effective Packages: Free zones offer various packages that include licensing, office space, and support services.

- Inclusive Services: Many free zone packages include additional services such as visa processing and administrative support.

- Flexible Payment Plans: Options to pay fees annually or in installments, providing financial flexibility.

Additional Costs to Consider

- Visa Fees: Costs for obtaining visas for employees and owners.

- Legal Fees: Expenses related to legal consultations and documentation.

- Insurance: Mandatory insurance coverage for employees and business operations.

- Marketing and Branding: Costs associated with promoting your business and establishing your brand presence.

Timeframe for Company Registration

The timeframe for company registration in Ajman depends on several factors, including the type of company, completeness of documentation, and the efficiency of the registration process. Understanding the typical duration and factors that may affect the timeline helps in planning your business setup effectively.

Typical Duration for Completing Registration Processes

Mainland Companies

- Estimated Timeframe: Approximately 4-6 weeks.

- Process: Involves local sponsor agreements, lease agreements, and multiple approvals from different government departments.

Free Zone Companies

- Estimated Timeframe: Typically 2-4 weeks.

- Process: Streamlined registration process with fewer approvals required, thanks to the one-stop-shop services provided by the free zone authority.

Factors That May Affect the Timeline

Like any other financial activity, many things may affect the timeline of the company registration process in Ajman.

Document Preparation

- Accuracy and Completeness: Delays in document submission due to incomplete or inaccurate paperwork can extend the registration process.

- Notarization and Attestation: Some documents may require notarization and attestation, adding to the processing time.

Regulatory Approvals

- Government Approvals: The speed at which necessary approvals are obtained from relevant authorities impacts the overall duration.

- Sector-Specific Regulations: Certain industries may have additional regulatory requirements that take longer to process.

Business Activity Complexity

- Simple vs. Complex Activities: Businesses with straightforward activities typically face a quicker registration process compared to those with complex or regulated activities.

- Additional Licensing Requirements: Specialized business activities may require extra licenses and permits, extending the registration timeline.

Efficiency of the Registration Agent

- Professional Assistance: Engaging a reliable and experienced registration agent can expedite the process by ensuring all requirements are met promptly.

- Communication and Coordination: Effective communication with authorities and timely follow-ups can significantly reduce delays.

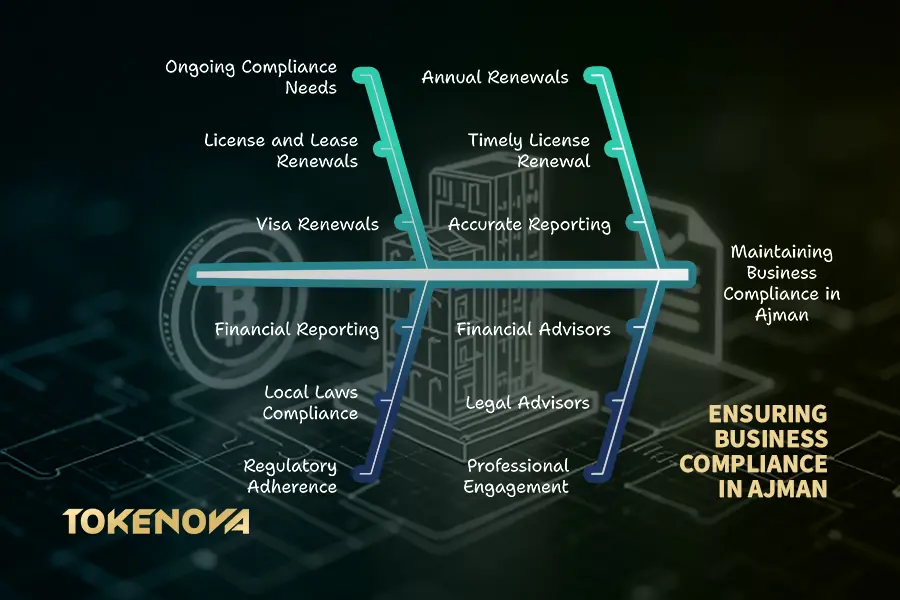

Post-Registration Requirements

After registering your company in Ajman, there are ongoing post-registration requirements to maintain compliance and ensure the smooth operation of your business. Adhering to these requirements is essential for sustaining your business and avoiding penalties.

Ongoing Compliance and Licensing Needs

Maintaining your company’s status in Ajman involves several ongoing compliance and licensing obligations.

Annual Renewals

- License Renewal: Ensure timely renewal of your business license to continue operations without interruption.

- Office Lease Renewal: Renew your office lease agreement annually or as per the lease terms to maintain your physical presence.

- Visa Renewals: Regularly renew visas for employees and owners to comply with residency regulations.

Regulatory Compliance

- Adherence to Local Laws: Comply with all local laws and regulations governing business operations, employment, and taxation.

- Financial Reporting: Maintain accurate financial records and submit required financial statements to the relevant authorities.

- Health and Safety Standards: Ensure your business premises comply with health and safety regulations to protect employees and customers.

Importance of Annual Renewals and Reporting

Annual renewals and accurate reporting are essential to keep your company in good standing and ensure uninterrupted business operations. Failure to comply with these requirements can result in fines, suspension of business activities, or even the revocation of your business license.

Key Points:

- Timely Renewals: Avoid penalties by renewing licenses and permits before their expiration dates.

- Accurate Reporting: Submit required reports and financial statements accurately and on time.

- Continuous Compliance: Stay updated with changes in regulations and ensure your business adapts accordingly.

Maintaining Good Standing

To maintain your company’s good standing in Ajman, it’s crucial to:

- Stay Informed: Keep abreast of any changes in local laws and regulations that may affect your business.

- Engage Professionals: Work with legal and financial advisors to ensure ongoing compliance and address any issues promptly.

- Monitor Performance: Regularly review your business performance and make necessary adjustments to stay competitive and compliant.

Pro Tips for Entrepreneurs

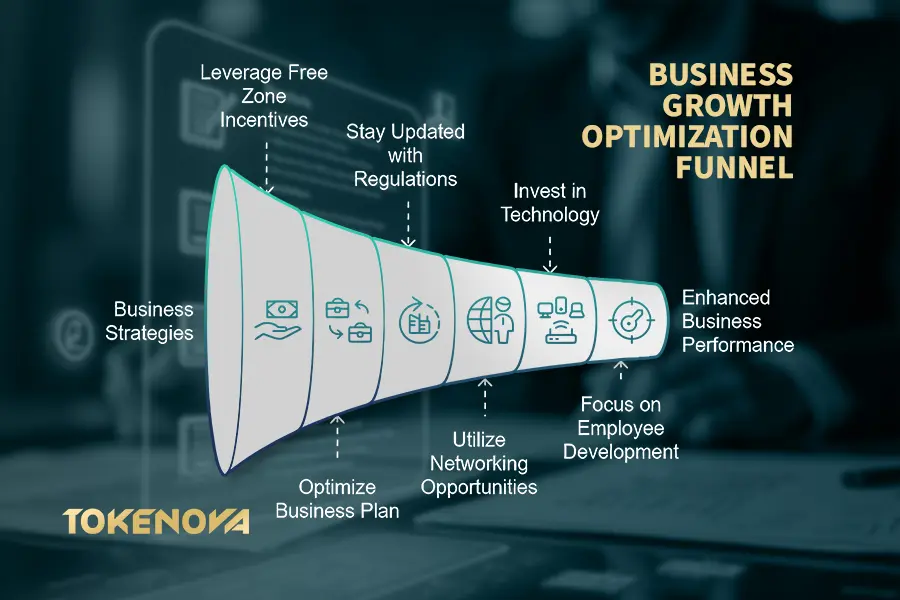

For businesses looking to maximize their potential and navigate the complexities of company registration in Ajman, here are some Pro Tips to consider:

Leverage Free Zone Incentives

Maximize your benefits by fully utilizing the tax exemptions and 100% ownership options available in Ajman Free Zone. Explore additional incentives such as grants, subsidies, and business support services offered by the free zone authority to enhance your operational efficiency and profitability.

Optimize Your Business Plan

A well-structured business plan can expedite the registration process and attract potential investors. Ensure your business plan is comprehensive, detailed, and aligned with your business objectives. Highlight your market analysis, financial projections, and growth strategies to demonstrate the viability and potential of your business.

Stay Updated with Regulations

Regularly monitor changes in local laws and regulations to ensure ongoing compliance and take advantage of new opportunities. Join local business associations, subscribe to regulatory updates, and engage with legal advisors to stay informed about the latest developments that may impact your business operations.

Utilize Networking Opportunities

Actively participate in networking events, seminars, and industry forums within Ajman Free Zone. Building a strong network can lead to valuable partnerships, collaborations, and business opportunities that can drive your company’s growth and expansion.

Invest in Technology and Innovation

Adopt the latest technologies and innovative solutions to enhance your business operations and stay ahead of the competition. Investing in digital tools, automation, and cybersecurity can improve efficiency, reduce costs, and protect your business from potential threats.

Focus on Employee Development

Invest in the training and development of your employees to build a skilled and motivated workforce. Offering professional development opportunities, competitive salaries, and a positive work environment can improve employee satisfaction and productivity, contributing to your business’s overall success.

Explore Diversification

Consider diversifying your business activities to mitigate risks and capitalize on new market opportunities. Expanding your product or service offerings can help you reach a broader customer base and increase your revenue streams.

Maintain Strong Financial Management

Implement robust financial management practices to ensure the financial health of your business. Regularly review your financial statements, manage cash flow effectively, and seek professional financial advice to make informed business decisions and sustain growth.

Actionable Steps: Step-by-Step Guide with Tips

Conclusion

Ajman presents an exceptional opportunity for businesses looking to establish a strong presence in the UAE. With its strategic location, business-friendly policies, tax incentives, and robust infrastructure, Ajman is quickly becoming a preferred choice for entrepreneurs and established businesses alike. Registering a company here not only unlocks potential growth within the UAE but also offers seamless access to international markets across the Middle East, Africa, and Asia.

Ready to start your business journey in Ajman? Take the first step today by exploring the company registration options that best suit your business goals. Whether you’re an entrepreneur with a vision or a business ready to expand globally, Ajman’s supportive environment is here to help you succeed.

Get in touch with our team for expert guidance on the registration process, documentation, and everything you need to set up in Ajman. Embrace the possibilities in one of the UAE’s fastest-growing business hubs – your success starts here!

Key Takeaways

- Ajman is a thriving business hub with strategic advantages for company registration, including a strategic location, robust infrastructure, and business-friendly policies.

- Multiple company structures are available to suit various business needs, including local companies, sole proprietorships, Gulf joint companies, free companies, and economic services companies.

- Registering in Ajman Free Zone offers significant tax benefits, 100% foreign ownership, and access to international markets, making it an attractive option for international businesses.

- Understanding costs and timelines is crucial for effective business planning, with clear differences between mainland and free zone setups.

- Post-registration compliance ensures long-term success and operational continuity, emphasizing the importance of annual renewals and accurate reporting.

- Pro Tips for Seasoned Entrepreneurs highlight strategies to maximize benefits, optimize business plans, stay updated with regulations, and invest in technology and employee development.

By following this comprehensive guide, you can navigate the process of company registration in Ajman with confidence and set your business on a path to sustained growth and success in the UAE’s vibrant market.

What are the eligibility criteria for registering a company in Ajman Free Zone?

Eligibility criteria include having a viable business plan, necessary financial resources, and meeting specific documentation requirements set by the free zone authorities. Additionally, your business activity must be permitted within the free zone, and you must comply with any sector-specific regulations. Ensuring that your business aligns with the free zone’s strategic objectives can enhance your chances of a successful registration.

Can foreign investors own 100% of their company in Ajman Mainland?

Generally, foreign investors cannot own 100% of their company in Ajman Mainland without a local sponsor, except in specific sectors where 100% ownership is permitted under recent regulations. These exceptions are typically limited to certain professional services, industrial activities, and innovative business models. It is advisable to consult with local authorities or a professional business setup service to understand the current ownership regulations applicable to your business.

What are the renewal fees for maintaining a company in Ajman Free Zone?

Renewal fees vary based on the type of license and the size of the office space. It’s advisable to consult with the free zone authority for detailed and updated fee structures. Typically, renewal fees include the business license renewal, office lease renewal, and visa renewals. Some free zones may offer bundled packages that include multiple services at a discounted rate, providing cost savings and convenience for businesses.