Real estate investing has always been tough to crack, being expensive, slow, and tangled in red tape. Most people couldn’t invest beyond their own city. On top of it, legal red tape and big upfront costs shut them out. But that’s changing fast.

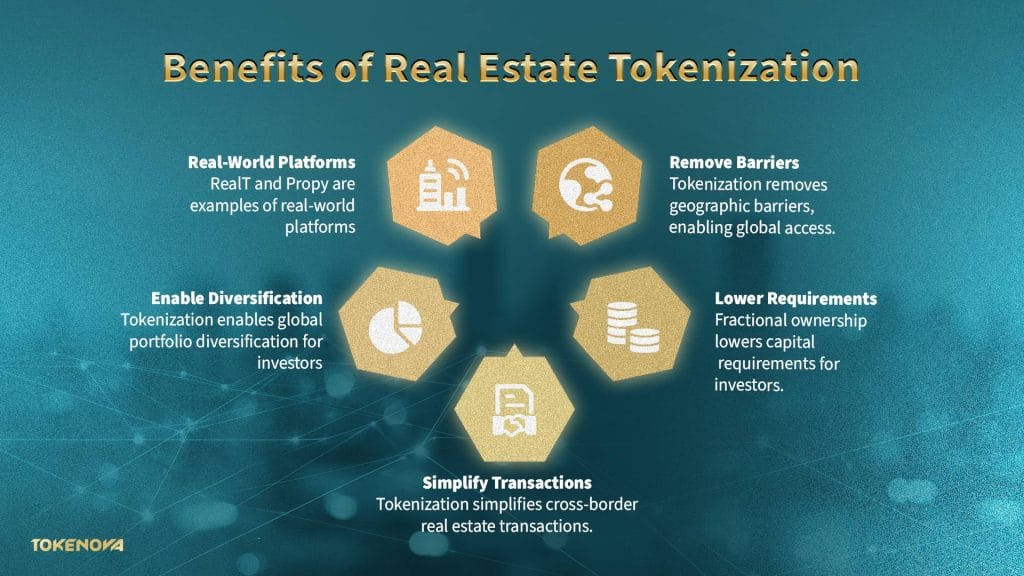

Thanks to blockchain, tokenization is taking hold as a new model. This blog breaks down how tokenization enables global access to real estate investments by removing geographic constraints, lowering capital requirements through fractional shared ownership, simplifying cross-border transactions, enabling global diversification, and powering real-world platforms like RealT and Propy.

Breaking Geographical Investment Barriers

Property deals used to stay close to home. Buying abroad meant wrestling with foreign laws, exchange rates, and managing assets from a timezone away. That’s where the pitch for how tokenization enables global access to real estate investments gets teeth.

Tokenization breaks the border. It converts property rights into digital tokens recorded on blockchain. So now, remote real estate investing isn’t a pipe dream. A buyer in Leipzig can hold a slice of a New York retail space or a Tokyo condo, instantly. No brokers. No red tape.

Platforms like RealT and Propy are already pushing this model, bringing fractional global property ownership to retail and institutional investors. The standard hurdles of cross-border property investment, such as legal tangles, currency volatility, and cultural frictions, are all tackled head-on.

Blockchain real estate investment gives every transaction a visible, tamper-proof trail. That’s less fraud, fewer disputes, faster transfers. As Primior and EY point out, this kind of worldwide property tokenization slashes costs, builds trust, and enhances transparency.

It’s not theory. It’s already reshaping international property market access to become efficient, digital, and finally open.

Lowering capital requirements through fractionalization

High property prices shut most people out of real estate. Buying even a modest place often means coming up with tens or hundreds of thousands up front. That steep entry point has always kept the average investor on the sidelines. This is another key area to prove how tokenization enables global access to real estate investments.

Through fractionalization, tokenization chops a real asset into bite-sized digital shares. You can own one or hundreds of tokens based on your budget. That’s not a metaphor but the actual structure of democratized real estate access.

According to Primior, this breaks the high-net-worth monopoly and opens up markets to everyone. Some platforms drop the minimum to just $50 per share.

RealT makes fractional ownership tokenization real by allowing investors to buy small ownership shares in U.S. properties. Each share earns rental income, which is automatically sent to the investor’s digital wallet. There’s no need to manage tenants or deal with paperwork, and you don’t need a huge deposit to start. On top of that, an EY report backs this up: tokenization doesn’t just lower the bar; it expands global property liquidity and builds a more inclusive system.

That’s how tokenization enables global access to real estate investments in a manner that is practical, affordable, and scalable.

Cross-Border Transaction Simplification

Even after solving for distance and affordability, real estate investing still hits a wall: the deal itself. International property purchases are paperwork-heavy, time-consuming, and packed with middlemen. But this is another angle on how tokenization enables global access to real estate investments: by streamlining the entire transaction.

Traditionally, you’d need brokers, lawyers, banks, escrow, and title agents, each step adding time and fees. On top of that, crossing borders means handling conflicting legal systems and complex title verification.

Real estate tokenization clears the clutter. Smart contracts do the heavy lifting by auto-executing ownership transfers once payment hits the chain. This removes the need for traditional escrow services, slashes paperwork, and significantly lowers the chances of fraud or human error.

Primior estimates that automation alone can cut transaction costs by up to 50%. Platforms like Propy are proving the point by enabling blockchain-based property deals, like their completed sale in Kyiv, with all documents, signatures, and funds handled in one digital space.

This is the quiet revolution. Worldwide property tokenization removes friction from cross-border property investment and replaces it with clarity, speed, and trust.

Global Market Access and Diversification

Diversification is a bedrock of smart investing. But when it comes to real estate, the average investor rarely gets past their own ZIP code. Buying property abroad used to mean legal complexity, huge capital, and logistical nightmares. Now, here’s how tokenization enables global access to real estate investments at scale.

Instead of dropping $200,000 into one local property, an investor can now spread that across multiple international real estate tokens. For example, $20,000 in commercial Tokyo, another slice in a Dubai apartment, a Berlin storefront, and a Miami rental, all managed from a laptop. Realizse explains how this kind of diversification becomes practical through tokenization.

Access to New Markets without the Old Friction

Primior points out that this approach removes dependency on any single country’s economic cycle. Investors can tap into emerging markets or stable zones without needing a foreign bank account or legal entity.

All of this ties back to democratized real estate access. Platforms make it easy to track holdings, view income, and manage diverse portfolios. And Deloitte highlights how both retail and institutional players can now build hyper-personalized portfolios from global property tokens.

Real-world Success Stories and Platforms

The transformation of real estate through tokenization is not a distant future projection; it’s happening right now, driven by innovative platforms that are proving the model’s viability. These real-world examples powerfully illustrate how tokenization enables global access to real estate investments by turning theoretical benefits into tangible results.

Tokenova can help you explore tokenized real estate platforms like RealT or Propy. Think of it as a bridge between the tech and your investment strategy; we understand how to use these tools effectively, from evaluating opportunities to navigating cross-border transactions, and can consult you further with your real estate investing goals and aspirations.

RealT: Pioneering Fractional Ownership

RealT is one of the clearest examples of how tokenization enables global access to real estate investments. The platform lets users invest in U.S. residential properties for as little as $50, using tokenized shares. It’s already tokenized over 200 homes and serves more than 10,000 investors across 130 countries.

What makes RealT compelling is easy access and usability. Investors receive rental income every week in the form of stablecoin (USDC), which is sent directly to their digital wallets. This eliminates the need for wire transfers or dealing with foreign currency conversions, making cross-border property income straightforward and accessible.

Propy: Streamlining Global Transactions

Propy tackles another piece of the puzzle, cutting friction from the transaction side. Using blockchain and smart contracts, Propy automates property deals and reduces reliance on intermediaries. The company made history with the first blockchain-based sale of a property in Ukraine and has since moved over $1 billion in real estate.

It’s more than a flashy use case. By handling documentation, title transfers, and agreements digitally, Propy makes cross-border property investment operationally feasible. This is a big reason why Propy’s model is central to how tokenization enables global access to real estate investments.

Final Thoughts

Tokenization is no longer a theory. It’s actively changing how people invest in property across borders. From cutting down entry costs to simplifying legal steps through automation, the systems are running, and platforms like RealT and Propythe are real examples.

If you’re eyeing global real estate, tokenization opens markets that were previously off-limits. And with the right guidance, it’s not hard to navigate. Tokenova works with investors to help them use these platforms, structure deals smartly, and make cross-border investing less opaque and more achievable. If you’re curious where to begin, Tokenova can walk you through how these platforms work and how to make them part of your real estate strategy.