The integration of blockchain technology and tokenization into waste management systems represents one of the most promising yet challenging frontiers in environmental sustainability. While the potential for creating transparent, incentivized recycling ecosystems appears revolutionary, the reality involves navigating complex risks that could undermine entire implementations.

As organizations worldwide explore tokenization in blockchain solutions for waste management, understanding the associated risks becomes crucial for making informed decisions. While comprehensive failure rate data for blockchain waste management implementations remains limited, research indicates that most tokenization projects face significant technical and regulatory challenges that can compromise implementation success.

This comprehensive analysis examines the critical risks organizations must consider before implementing tokenized waste management systems, providing actionable insights for decision-makers evaluating these innovative solutions.

Technical Risks in Waste Management Tokenization

The technical foundation of tokenized waste management systems presents multiple vulnerability points that can compromise entire operations. The biggest technical risk is represented by smart contract vulnerabilities, where badly written contracts may result in unanticipated asset loss or the exploitation of weaknesses.

Another major concern is algorithmic bias. Tokenization platforms combined with AI-powered sorting systems may regularly undervalue certain recyclables, increasing landfilling and harming recycling initiatives. Research in IEEE Access on blockchain waste management highlights various technical challenges in implementing these systems, including the need for careful consideration of algorithmic fairness and system design to prevent unintended consequences.

Threats to cybersecurity increase while working with distributed tokenized systems. Blockchain networks, in contrast to centralized databases, are vulnerable to special attack methods such as cross-chain bridge vulnerabilities, oracle manipulation, and 51 percent assaults. Academic research demonstrates that blockchain waste management systems require robust security frameworks, as the distributed nature of these systems creates multiple potential points of failure that must be carefully managed.

Blockchain scalability limitations further complicate technical implementation. According to a 2024 report by the Ethereum Foundation, Layer 2 solutions like Arbitrum now process 4,000+ transactions per second (TPS), making them viable for city-scale waste tracking, though pilot programs in Oslo (2023) still report 12% latency spikes during peak hours.

Read More: Exploring the 10 Types of Smart Contracts in Blockchain

Regulatory and Compliance Challenges

The regulatory landscape for tokenized waste management systems remains largely uncharted territory, creating significant compliance risks for early adopters. Asset tokenization regulation varies dramatically across jurisdictions, with some countries lacking any framework for waste-related tokens. For instance, the EU’s Markets in Crypto-Assets (MiCA) regulation, fully enforceable in 2024, classifies utility tokens like waste management rewards under ‘Category 3’—exempt from securities rules if they grant access to services. However, the SEC’s 2024 case against GreenToken clarified that similar U.S. projects may still face securities scrutiny.

Data privacy regulations present particular challenges when implementing tokenized systems. The European Union’s GDPR and similar regulations require specific data handling procedures that may conflict with blockchain’s immutable nature. Organizations must navigate the tension between transparency requirements for tokenized systems and privacy protection mandates.

Many jurisdictions still have unclear token classifications. Depending on their form and intended usage, waste management tokens may be categorized as commodities, securities, or utility tokens. This uncertainty creates compliance risks and potential legal liabilities for organizations implementing these systems. Understanding tokenization and tax regulation becomes crucial for proper compliance planning.

Environmental compliance adds another layer of complexity. While tokenization aims to improve waste management outcomes, regulatory bodies may scrutinize whether these systems actually deliver measurable environmental benefits or merely create the appearance of sustainability—a concern that directly relates to greenwashing risks.

If you’re considering implementing tokenized waste management solutions, consulting with regulatory experts can help navigate these complex compliance requirements and reduce implementation risks.

Read More: Web3 Legal: Startup Regulatory Framework

Market Volatility and Economic Risks

Economic instability represents a fundamental threat to tokenized waste management systems. Market volatility in sustainability tokens can undermine the economic incentives that drive participation in these systems. For instance, according to a 2024 study by CryptoCompare, sustainability-focused tokens like PowerLedger (POWR) and Energy Web Token (EWT) showed 35% higher 30-day volatility than Bitcoin in Q1 2024, with trading volumes dropping 18% during market downturns.

Cryptocurrency market fluctuations directly impact waste management token values. When token values decrease significantly, the economic incentive for proper waste sorting and recycling diminishes, potentially reducing system effectiveness. Research on the environmental impact of tokenization indicates that market volatility can undermine participant motivation and engagement in tokenized sustainability programs, though specific quantitative impacts vary by implementation.

Liquidity dangers provide further difficulties. Waste management tokens, in contrast to well-known cryptocurrencies, often have small trading markets, which makes it difficult for users to turn tokens into useful money. This illiquidity can lead to participant disengagement and system failure. Understanding how to make illiquid assets tradeable provides insights into potential solutions for these challenges.

Economic model sustainability requires careful consideration. Many tokenized waste management projects fail to establish viable long-term economic models, relying on external funding or speculation rather than genuine value creation. The Financial Stability Board’s analysis indicates that most tokenization initiatives remain at proof-of-concept stage due to unclear investor demand, interoperability challenges, and regulatory uncertainties, highlighting the importance of robust economic foundations.

Read More: Tokenization and Asset Financing: Transforming Finance

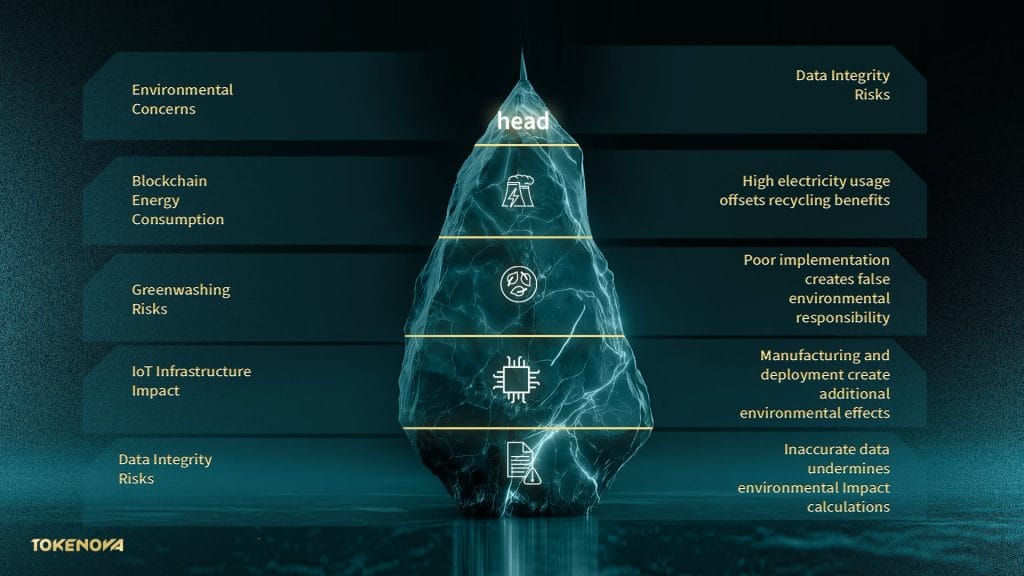

Environmental and Greenwashing Concerns

Perhaps ironically, tokenized waste management systems intended to improve environmental outcomes may create new environmental risks. Blockchain networks’ energy use, especially that of proof-of-work systems, might counteract the environmental advantages of better waste management.

Greenwashing represents a significant reputational and regulatory risk. Could tokenisation be the answer to greenwashing? explores how poorly implemented tokenization systems might create the appearance of environmental responsibility without delivering actual benefits.

Carbon footprint concerns extend beyond blockchain energy consumption. The manufacturing and deployment of IoT sensors, smart bins, and other infrastructure required for tokenized systems create additional environmental impacts that organizations must account for in their sustainability calculations. The environmental impact of asset tokenization requires careful evaluation to ensure genuine benefits.

Data integrity risks can undermine environmental claims. If the data feeding tokenized systems is inaccurate or manipulated, the resulting environmental impact calculations become meaningless, potentially exposing organizations to greenwashing accusations and regulatory penalties.

Read More: The Role of Tokenization in Carbon Credits: A Comprehensive Guide

Social and Implementation Risks

Social acceptance and equitable participation present critical implementation challenges. Top Asset Tokenization Challenges include ensuring that tokenized systems don’t exacerbate existing social inequalities or exclude vulnerable populations from benefits.

Digital divide issues may prevent equitable participation in tokenized systems. Populations without smartphone access or digital literacy may be excluded from token-based incentive programs, creating social justice concerns and reducing system effectiveness.

Job displacement risks affect traditional waste management workers. Automation and tokenization may reduce employment opportunities in the waste sector, particularly for informal waste collectors who play crucial roles in many developing economies. Understanding the broader challenges in starting a Web3 company helps organizations prepare for these social implementation challenges.

Risk Mitigation Strategies and Best Practices

Successful tokenized waste management implementation requires comprehensive risk mitigation strategies. Organizations should conduct thorough technical audits, including smart contract security reviews and scalability testing, before deployment.

Regulatory engagement from project inception helps navigate compliance requirements. Working with legal experts and engaging with regulatory bodies early in the development process can prevent costly compliance failures later.

Economic model validation through pilot programs allows organizations to test tokenomics and participant behavior before full-scale implementation. Starting with small, controlled deployments helps identify and address economic risks in manageable environments. Consider exploring how to invest in tokenized assets for best practices in tokenization implementation.

Environmental impact assessment should include full lifecycle analysis of both the tokenization system and its environmental benefits. Organizations must demonstrate net positive environmental impact to avoid greenwashing accusations and ensure genuine sustainability benefits.

Read More: Audit Smart Contracts: Secure Your Investment

Conclusion

While tokenized waste management systems offer tremendous potential for creating sustainable, transparent, and efficient waste handling processes, the associated risks demand careful consideration and proactive mitigation strategies. Organizations considering these implementations must balance innovation with prudent risk management, ensuring that technological advancement serves genuine environmental and social benefits rather than creating new problems.

The key to successful tokenization lies in comprehensive planning, stakeholder engagement, and realistic assessment of both benefits and risks. By addressing technical vulnerabilities, navigating regulatory requirements, managing economic uncertainties, and ensuring social equity, organizations can harness the transformative potential of tokenized waste management while minimizing implementation risks.

For organizations ready to explore tokenized waste management solutions, starting with pilot programs and engaging experienced advisors can help navigate these complex challenges and increase the likelihood of successful implementation. The future of sustainable waste management may indeed be tokenized, but only for those who approach it with proper preparation and risk awareness.

Stay informed about the latest developments in blockchain technology, tokenization, and sustainable innovation by subscribing to our newsletter for expert insights and analysis.

What are the main security risks of tokenizing waste management systems?

The primary security risks include smart contract vulnerabilities, cybersecurity threats targeting blockchain networks, and potential exploitation of IoT devices used in waste collection systems.

How does market volatility affect tokenized waste management?

Token value fluctuations can reduce participant incentives for proper waste sorting and recycling, potentially undermining the entire system’s effectiveness when economic rewards become insufficient.

Can tokenized waste management systems actually cause environmental harm?

Yes, if the blockchain network’s energy consumption exceeds the environmental benefits of improved waste management, or if the system enables greenwashing without genuine sustainability improvements.

What regulatory challenges do organizations face with waste tokenization?

Key challenges include unclear token classification, data privacy compliance, varying international regulations, and potential securities law implications depending on token structure.

How can organizations mitigate risks when implementing tokenized waste management?

Best practices include conducting thorough security audits, engaging with regulators early, starting with pilot programs, and ensuring comprehensive stakeholder consultation throughout the implementation process.