Imagine owning a fraction of a luxury yacht, possessing a piece of a Picasso masterpiece, or participating in the profits of a bustling Manhattan skyscraper all with just a few clicks. No brokers, no hefty fees, and no geographical barriers just seamless, secure transactions. This isn’t a distant dream; it’s the unfolding reality brought to life by tokenization in capital markets. This groundbreaking technology is not just a buzzword; it’s a seismic shift that’s democratizing access to wealth and redefining the future of finance.

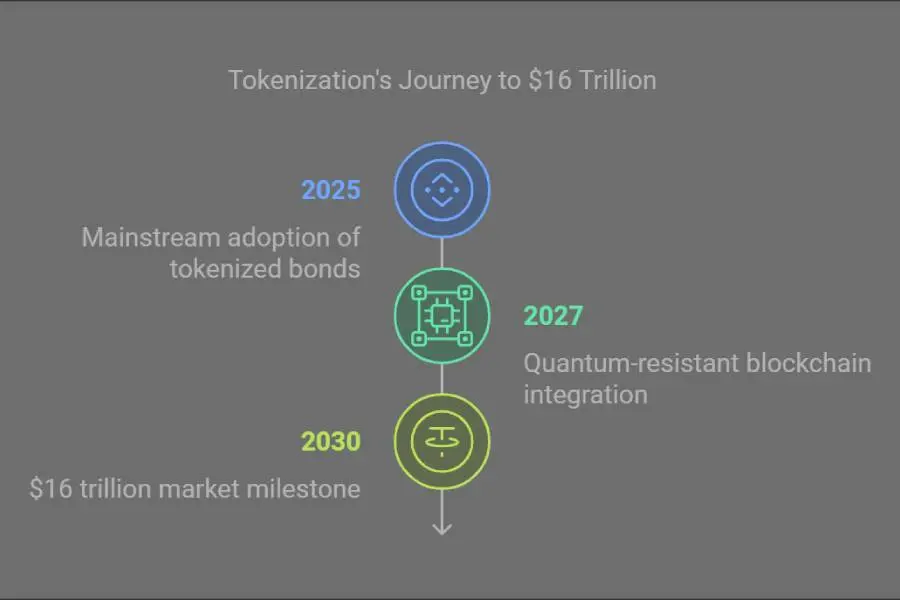

In the rapidly evolving landscape of global finance, blockchain in capital markets is emerging as a catalyst for innovation. By 2030, Boston Consulting Group predicts that tokenized assets could reach an astonishing $16 trillion. This isn’t merely a trend; it’s a transformation reshaping how we perceive ownership, investment, and value exchange. In this comprehensive exploration, we’ll delve deep into how tokenization works, its profound benefits, the challenges it faces, and its potential to revolutionize the financial world. Whether you’re an investor, a financial professional, or simply curious about the future of money, this article will provide you with the insights you need to navigate the tokenization revolution.

Understanding and Implementing Tokenization in Capital Markets

Tokenization integrates conventional financial assets with blockchain technology, enhancing liquidity, efficiency, and accessibility in capital markets.

What is Tokenization and How Does It Work?

At its core, tokenization is the process of converting rights to an asset into a digital token on a blockchain. These tokens represent ownership or participation rights and can be transferred, traded, or stored electronically. By leveraging blockchain technology, tokenization ensures that these digital representations are secure, transparent, and immutable.

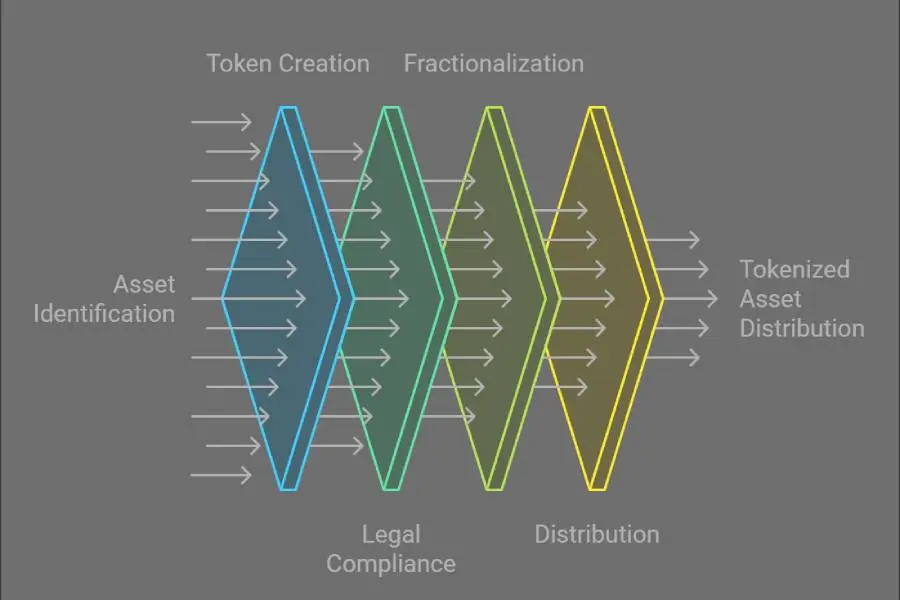

Implementing tokenization in capital markets involves several key steps:

Tokenization in capital markets is a transformative process that opens new opportunities for asset accessibility and liquidity. Let’s delve into the essential steps involved in this innovative approach.

Asset Identification and Valuation: The first step is to identify a suitable asset for tokenization, which could range from real estate and commodities to equities and intellectual property. The asset must have a clear valuation and ownership structure to facilitate a smooth tokenization process. For example, a commercial property valued at $100 million can be assessed to determine its market value, ensuring that each token accurately represents a fraction of the asset.

Legal and Regulatory Compliance: Navigating the legal landscape is crucial before tokenization. This involves ensuring compliance with securities laws, anti-money laundering (AML) regulations, and know-your-customer (KYC) requirements. Legal experts work to structure the token offering in a way that adheres to all relevant regulations, preventing legal complications down the line.

Token Creation and Smart Contracts: Once the asset is ready and legal considerations are addressed, digital tokens are created using blockchain technology. Smart contracts self-executing contracts with the terms directly written into code are employed to automate the execution of agreements, enforce compliance, and manage the distribution of assets. These contracts ensure that transactions occur seamlessly when predefined conditions are met.

Read More: Tokenization of Assets and Government Bonds

Fractionalization and Token Distribution: The asset is divided into smaller units, or fractions, each represented by a token. This fractional ownership allows more investors to participate by lowering the investment threshold. Tokens are then distributed to investors through platforms like Security Token Offerings (STOs) or Initial Coin Offerings (ICOs), depending on the regulatory framework.

Trading and Liquidity Provision: After the tokens are distributed, they can be traded on digital exchanges or secondary markets. Blockchain ensures that each transaction is recorded transparently and securely, enhancing trust among participants. Increased liquidity is one of the most significant advantages, as assets that were once illiquid can now be bought and sold with relative ease.چ

Settlement and Custody: Blockchain’s decentralized nature allows for near-instantaneous settlement of transactions, reducing counterparty risk and the need for intermediaries. Custody solutions are implemented to securely store digital assets, often involving advanced cryptographic methods to protect against cyber threats.

And now, the big question:

How Does Tokenization Transform Capital Markets?

Tokenization introduces a new paradigm in capital markets by streamlining processes, reducing costs, and broadening access. Traditional financial systems often involve multiple intermediaries brokers, custodians, clearinghouses that add complexity and expense. Tokenization simplifies this by utilizing the blockchain’s decentralized ledger, which records every transaction transparently and immutably.

For example, consider a commercial real estate property valued at $100 million. Traditionally, investing in such an asset would require substantial capital, limiting participation to institutional investors or ultra-high-net-worth individuals. Through tokenization, this property can be divided into 100,000 tokens valued at $1,000 each, allowing a much broader pool of investors to participate. This democratization of investment opportunities is a hallmark of tokenization’s potential.

Moreover, smart contracts automate compliance checks, distribution of dividends, and other administrative tasks, reducing operational costs and the potential for human error. Blockchain in capital markets also enhances security, as each transaction is encrypted and validated by a network of participants, making fraud and unauthorized alterations nearly impossible.

Benefits of Tokenization in Capital Markets

Tokenized assets can be traded around the clock on digital exchanges, providing continuous liquidity beyond traditional market hours.

Increased Liquidity

One of the most transformative benefits of tokenization is the significant increase in liquidity for traditionally illiquid assets. Assets like real estate, fine art, and private equity stakes have historically been challenging to trade quickly due to high entry barriers and lengthy transaction processes. Tokenization enables fractional ownership, allowing these assets to be divided into smaller, more manageable units that can be easily bought and sold on digital platforms.

💡For instance, the tokenization of a high-value artwork allows investors to purchase a fraction of the piece, making it accessible to a wider audience. This not only democratizes access but also provides asset owners with a broader market to sell to, potentially increasing the asset’s overall liquidity and value.

Enhanced Accessibility for Investors

By lowering the minimum investment thresholds, tokenization opens up opportunities for a more diverse range of investors. Asset tokenization in financial markets means that individuals who were previously excluded from certain investment classes due to high capital requirements can now participate. This inclusivity fosters a more equitable financial landscape and allows for greater diversification in individual investment portfolios.

💡For example, tokenized real estate investments enable individuals to invest in properties across the globe without the need for significant capital or dealing with complex legal and logistical challenges. This global accessibility is a game-changer in how investors can diversify and manage their portfolios.

Reduced Transaction Costs

Traditional asset transactions often involve numerous intermediaries, each adding their fees to the process. These can include brokers, lawyers, banks, and custodians, leading to high transaction costs and extended settlement times. Tokenization streamlines this process by utilizing the blockchain’s peer-to-peer network, which eliminates the need for many intermediaries.

💡Smart contracts automate the execution of agreements, ensuring that once predefined conditions are met, transactions occur seamlessly without manual intervention. This automation not only reduces costs but also minimizes the potential for errors and disputes. The result is a more efficient market where transactions are faster and more cost-effective.

Read More: Tokenization of Alternative Investments: Unlocking New Opportunities

Improved Transparency and Security

Blockchain technology inherently provides a transparent and immutable ledger of all transactions. This transparency builds trust among participants, as every transaction is recorded and can be audited in real time. It reduces the risk of fraud and enhances accountability, which is particularly important in markets where trust is paramount.

💡Additionally, blockchain’s cryptographic security measures protect against unauthorized access and cyber threats. Each transaction is encrypted, and consensus mechanisms ensure that only valid transactions are added to the blockchain. This security is a significant improvement over traditional systems, where centralized databases can be vulnerable to hacking and data breaches.

Tokenization Technologies for Capital Markets

Several blockchain platforms are at the forefront of enabling tokenization in capital markets. Some of the most common ones are:

Ethereum: The most widely used platform for tokenization, thanks to its robust smart contract functionality and large developer community. Ethereum introduced the ERC-20 token standard, which has become the foundation for many tokenization projects. Its widespread adoption ensures extensive support and continuous innovation.

Hyperledger Fabric: An open-source blockchain framework hosted by The Linux Foundation, Hyperledger Fabric is designed for enterprise use. It offers modular architecture and privacy features suitable for organizations that require a permissioned network. Its flexibility allows businesses to tailor the blockchain to their specific needs.

Stellar: Focused on facilitating cross-border transactions with low fees and fast settlement times, Stellar is ideal for tokenizing assets with global investor bases. Its consensus protocol differs from proof-of-work, making transactions more energy-efficient and scalable.

Tezos and Polkadot: Emerging platforms that offer advanced governance features and interoperability, allowing for upgrades and communication between different blockchains without hard forks. These features enhance the adaptability and future-proofing of tokenization projects.

The Role of Smart Contracts in Capital Markets

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They play a critical role in tokenization by automating the enforcement of contractual obligations and compliance with regulatory requirements.

Key functions of smart contracts in tokenization include:

- Automating Transactions: Smart contracts execute transactions automatically when predetermined conditions are met, reducing the need for manual processing. This ensures that agreements are honored without delays.

- Enforcing Compliance: They can incorporate regulatory requirements, ensuring that only eligible investors can participate and that transactions comply with laws like AML and KYC regulations. This reduces the risk of non-compliance and associated penalties.

- Managing Distributions: Dividends, interest payments, and other distributions can be automated, ensuring timely and accurate payments to token holders. This enhances investor trust and satisfaction.

- Facilitating Voting and Governance: Token holders can participate in governance decisions through smart contracts, enabling decentralized management of assets. This fosters a sense of ownership and involvement among investors.

By embedding these functions into code, smart contracts enhance efficiency, reduce costs, and minimize the potential for disputes and errors.

Emerging Technologies and Innovations

The field of tokenization is rapidly evolving, with several innovations enhancing its capabilities:

Interoperability Solutions: Projects like Polkadot and Cosmos are developing protocols that allow different blockchains to communicate. This interoperability is crucial for liquidity, enabling tokens to be traded across various platforms seamlessly and expanding the reach of tokenized assets.

Layer 2 Scaling Solutions: Technologies like the Lightning Network and sidechains aim to address blockchain scalability issues by processing transactions off the main chain, reducing congestion and fees. These solutions enhance the scalability and performance of tokenization platforms.

Zero-Knowledge Proofs: Advanced cryptographic methods that enhance privacy by allowing one party to prove to another that a statement is true without revealing any information beyond the validity of the statement itself. This is important for maintaining confidentiality while ensuring compliance, especially in sensitive financial transactions.

Decentralized Finance (DeFi) Integration: Combining tokenization with DeFi platforms allows for the creation of new financial instruments like decentralized exchanges, lending platforms, and yield farming opportunities, expanding the utility and attractiveness of tokenized assets. This integration fosters innovation and opens up new avenues for investment and financial management.

Read More: Tokenization in Venture Capital: A New Era

These innovations address current limitations and are key to the widespread adoption and success of tokenization in capital markets.

Regulatory Framework for Tokenization in Capital Markets

International regulatory bodies are working toward harmonized guidelines to ensure consistency in tokenization regulations across markets.

Current Regulations Impacting Tokenization

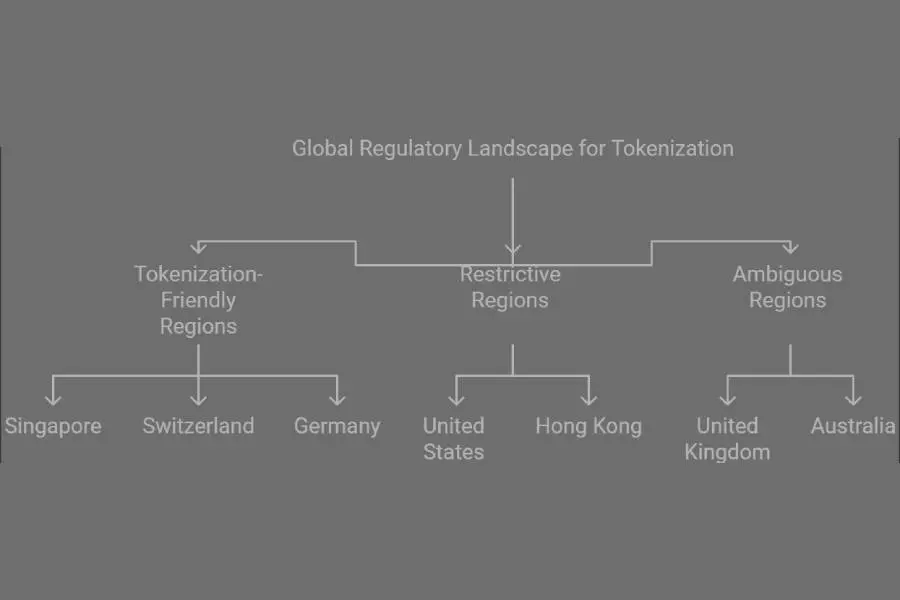

The regulatory landscape for tokenization is complex and varies significantly across different jurisdictions. Regulatory bodies are grappling with how to classify and regulate digital tokens, balancing innovation with investor protection.

United States: The Securities and Exchange Commission (SEC) treats most tokens as securities, subjecting them to federal securities laws. Companies must navigate regulations like the Securities Act of 1933 and comply with requirements for registration or qualify for exemptions. This stringent regulation ensures investor protection but can slow down tokenization projects.

European Union: The Markets in Financial Instruments Directive II (MiFID II) and the upcoming Markets in Crypto-Assets Regulation (MiCA) provide frameworks for digital assets. These regulations focus on transparency, market integrity, and investor protection, requiring issuers to adhere to strict disclosure and compliance standards. The EU’s proactive approach fosters a regulated environment conducive to innovation.

Asia: Countries like Singapore and Japan have proactive regulatory environments. The Monetary Authority of Singapore (MAS) provides clear guidelines, allowing for regulated token offerings under certain conditions. Japan recognizes cryptocurrencies and tokens under the Payment Services Act, providing a legal framework for their use and exchange. These countries serve as hubs for blockchain innovation in Asia.

Other Regions: Regulatory stances in countries like China, India, and Russia are more restrictive, with bans or severe limitations on token offerings and cryptocurrency trading. These restrictions pose challenges for global tokenization projects seeking cross-border participation.

Compliance Requirements

Navigating compliance is a critical aspect of any tokenization project. Key requirements include:

1️⃣KYC/AML Procedures: Issuers must implement robust processes to verify the identities of investors, ensuring they are not involved in illicit activities. This involves collecting personal information, verifying documents, and monitoring transactions for suspicious activity. Effective KYC/AML measures are essential for maintaining regulatory compliance and investor trust.

2️⃣Securities Registration and Exemptions: Depending on the jurisdiction and the nature of the token, issuers may need to register the offering with regulatory bodies or qualify for exemptions. This involves preparing detailed disclosure documents and adhering to ongoing reporting obligations. Proper registration ensures legal recognition and protection for both issuers and investors.

3️⃣Investor Accreditation: Some offerings are restricted to accredited or institutional investors, requiring verification of investors’ financial status or professional qualifications. This ensures that only qualified individuals participate, reducing the risk of financial loss for inexperienced investors.

4️⃣Data Protection and Privacy Laws: Compliance with laws like the General Data Protection Regulation (GDPR) in the EU is essential when handling personal data during the KYC process. Protecting investor data builds trust and prevents legal repercussions related to data breaches or privacy violations.

Failing to meet these compliance requirements can result in legal penalties, fines, and reputational damage. Therefore, meticulous adherence to regulatory standards is paramount for successful tokenization projects.

Future Regulatory Trends and Expectations

Regulatory bodies are increasingly recognizing the importance of providing clarity and fostering innovation in tokenization:

Harmonization of Regulations: There is a move towards creating unified regulatory frameworks, especially within regions like the EU. This harmonization aims to reduce legal uncertainties and facilitate cross-border investments, making it easier for tokenization projects to operate internationally.

Regulatory Sandboxes: Many countries are establishing sandboxes where companies can test innovative financial products under regulatory supervision. This encourages experimentation while ensuring consumer protection, allowing tokenization projects to innovate without immediate regulatory burdens.

Adoption of Digital Asset Laws: Some jurisdictions are enacting specific laws to address digital assets, providing clear definitions and guidelines. For example, Malta’s Virtual Financial Assets Act establishes a comprehensive regulatory framework for digital assets, offering legal certainty for tokenization projects.

International Collaboration: Organizations like the Financial Action Task Force (FATF) are working on global standards for virtual assets, promoting consistency in AML and KYC practices. International collaboration ensures that regulatory measures are aligned, facilitating smoother global operations for tokenization projects.

As regulations evolve, issuers and investors must stay informed and adapt to ensure compliance and capitalize on new opportunities. Proactive engagement with regulators and continuous monitoring of regulatory changes are essential strategies for navigating the evolving landscape of tokenization in capital markets.

Use Cases of Tokenization in Capital Markets

Tokenization is rapidly transforming various sectors within capital markets, offering increased efficiency, liquidity, and accessibility.

Real Estate Tokenization

A notable example is the tokenization of the St. Regis Aspen Resort, a luxury hotel in Colorado. In 2018, the property was tokenized, and investors were offered security tokens representing ownership shares. This allowed accredited investors to participate in the hotel’s ownership with a minimum investment far lower than traditional real estate investment thresholds.(source)

Real estate tokenization exemplifies how asset tokenization in financial markets can democratize access to high-value investments, making real estate more liquid and accessible to a broader audience.

Equity and Debt Instruments

Equity Tokenization: Companies, especially startups, are leveraging tokenization to raise capital more efficiently. By issuing tokens that represent shares, they can tap into a global investor base without the high costs of traditional IPOs. This approach simplifies the capital-raising process and provides investors with a more flexible investment option.

Debt Tokenization: Tokenizing bonds and loans improves the efficiency of debt markets. For example, the European Investment Bank issued a €100 million digital bond on the Ethereum blockchain, demonstrating the viability of tokenized debt instruments. Tokenized debt instruments allow for faster settlement, reduced counterparty risk, and greater transparency in debt markets.

Banks like JPMorgan and Citi have successfully executed bond tokenizations, showcasing efficiency gains and operational improvements. These examples highlight the transformative potential of tokenization in equity and debt markets.

Alternative Assets and Commodities

Art and Collectibles: Platforms like Maecenas allow investors to purchase shares in high-value artworks. This opens up the art market to a broader audience and provides artists and owners with new funding avenues. Fractional ownership in art enables investors to diversify their portfolios with alternative assets that were previously inaccessible.

Commodities: Companies are tokenizing commodities like gold, oil, and agricultural products. For instance, Digix offers tokens backed by physical gold stored in secure vaults, combining the stability of gold with the flexibility of digital assets. Commodity tokenization provides investors with easier access and enhanced liquidity, aligning traditional asset investment with digital trends.

These use cases demonstrate the versatility of tokenization and its potential to transform various segments of capital markets by making alternative assets more accessible, liquid, and transparent.

Intraday Repos and Financial Instruments

Innovation in Intraday Repos: Tokenization enables intraday repurchase agreements (repos), where securities are sold and repurchased within the same day. By using blockchain, these transactions can settle in minutes rather than days, significantly enhancing the speed and efficiency of financial operations.

Impact:

- Enhanced Liquidity Management: Financial institutions can optimize their liquidity positions more effectively, ensuring they have the necessary funds available when needed. This improved liquidity management reduces the risk of shortfalls and enhances financial stability.

- Reduced Risk: Faster settlement reduces exposure to counterparty default risk, as transactions are completed swiftly. This lower risk profile makes tokenized repos a safer option for financial institutions.

- Operational Efficiency: Automation through smart contracts reduces administrative burdens and errors, streamlining the entire process. This efficiency not only saves time but also lowers operational costs, making financial operations more cost-effective.

This application demonstrates the potential of blockchain in capital markets to optimize financial operations and risk management, showcasing how tokenization can revolutionize traditional financial instruments.

Strategic Guide: Maximizing Tokenization Potential in Capital Markets

To harness the full potential of tokenization in capital markets, businesses must adopt strategic approaches that address both technological and regulatory challenges. Here are practical steps for businesses considering tokenization:

Selecting the Right Blockchain Platform

Choosing the right blockchain platform is vital for a tokenization project’s success. Consider the following factors:

Scalability and Performance: Ensure the platform can handle high transaction volumes efficiently. Ethereum excels in smart contracts, while Stellar offers fast, low-cost global transactions.

Security Features: Assess the platform’s security protocols against cyber threats. Hyperledger Fabric is ideal for high-security tokenization projects due to its strong cryptographic measures.

Interoperability: Choose a platform that supports interaction with other blockchains. Polkadot and Cosmos enable seamless token trading across different systems.

Developer Community and Support: A strong developer community fosters innovation and support. Ethereum’s active community provides extensive resources for tokenization projects.

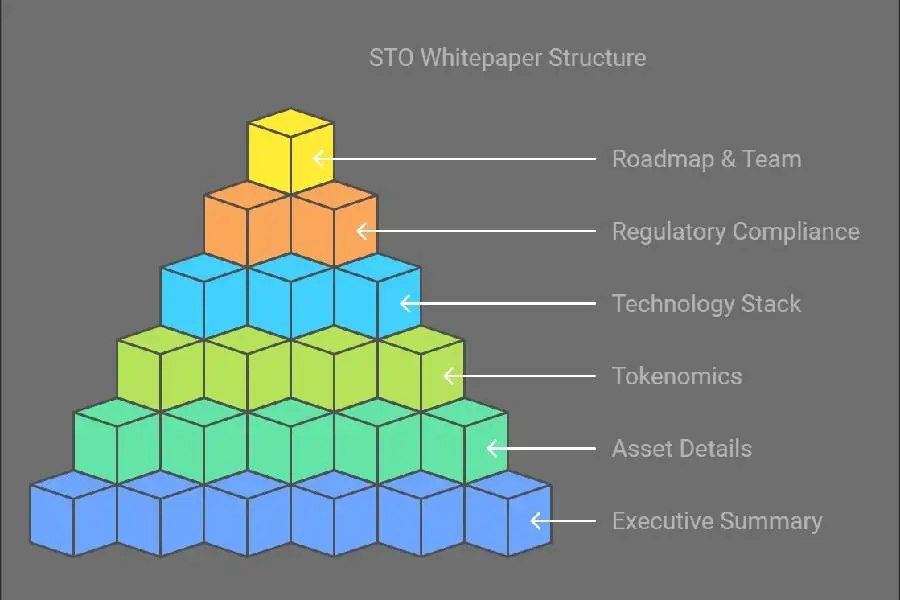

Preparing a Detailed Whitepaper for STOs

A comprehensive whitepaper is crucial for a successful Security Token Offering (STO), serving as a roadmap for investors. Include:

- Executive Summary: Summarize the project’s purpose and objectives.

- Asset Details: Describe the asset, its valuation, ownership structure, and potential investor returns.

- Tokenomics: Explain the token’s structure, distribution, utility, and investor incentives.

- Technology Stack: Outline the blockchain platform, smart contracts, security measures, and scalability solutions.

- Regulatory Compliance: Detail adherence to securities laws, AML/KYC regulations, investor accreditation, and applicable jurisdictions.

- Roadmap: Provide a timeline of development milestones, including token issuance and future expansions.

- Team and Advisors: Introduce the team and advisors, highlighting relevant expertise.

A well-crafted whitepaper builds investor confidence in the project’s legitimacy and potential.

Partnering with Tokenization Firms

Collaborating with tokenization firms like Tokenova can enhance project success by providing guidance through complex tokenization processes.

Navigating the Tokenization Landscape with Tokenova

As tokenization continues to reshape capital markets, having the right partner can make all the difference. Tokenova stands at the forefront of this revolution, providing streamlined, secure, and compliant tokenization services tailored to your needs.

Why Choose Tokenova?

- Expert Guidance: With a team of seasoned professionals in blockchain technology, finance, and legal compliance, Tokenova simplifies the tokenization process, ensuring your project is executed efficiently and effectively.

- Customized Solutions: Tokenova understands that every asset and business is unique. They offer personalized strategies that align with your specific objectives, whether you’re tokenizing real estate, intellectual property, or other assets.

- Regulatory Compliance: Navigating the complex regulatory landscape is challenging. Tokenova provides expert advice to ensure your project complies with all relevant laws and regulations, mitigating legal risks and building investor trust.

- Security and Trust: Prioritizing security, Tokenova implements robust protocols to protect your assets and investor information. Their focus on transparency and integrity enhances credibility in the tokenization process.

Take the Next Step

Embracing tokenization can unlock new opportunities and position your business at the cutting edge of financial innovation. Partnering with Tokenova empowers you to navigate this emerging landscape with confidence.

Visit Tokenova’s website today to learn more about how they can help you transform your assets and capitalize on the $16 trillion tokenization revolution.

Future Outlook for Tokenization in Capital Markets

Predicted Market Growth

The potential growth of tokenization is substantial. Take these stats for instance:

McKinsey & Company projects that tokenized securities could reach up to $5 trillion by 2030. This projection underscores the significant demand for more efficient and accessible financial instruments. (source)

Roland Berger estimates the market value of tokenized assets will exceed $10 trillion within the same timeframe, highlighting the growing interest and investment in tokenization technologies. (source)

Boston Consulting Group anticipates the market could hit $16 trillion, reflecting the immense momentum behind tokenization and its transformative potential in capital markets. (source)

These projections indicate strong confidence in tokenization’s ability to unlock value and transform capital markets, suggesting that it will become a dominant force in the financial landscape.

Potential Advancements in Technology

Emerging technologies will further enhance tokenization:

Quantum-Resistant Cryptography: Preparing for future threats posed by quantum computing to current cryptographic methods is essential. Developing quantum-resistant algorithms will ensure the long-term security of tokenized assets, safeguarding them against potential quantum-based attacks.

Artificial Intelligence Integration: AI can enhance trading algorithms, risk management, and personalized investment strategies. Integrating AI with tokenization platforms can improve decision-making processes, optimize investment outcomes, and provide deeper insights into market trends and investor behaviors.

Internet of Things (IoT) Connectivity: Tokenization of IoT data and devices could create new markets and investment opportunities. Connecting IoT with blockchain enables the tokenization of physical devices, opening up innovative use cases in various industries such as supply chain management, smart cities, and automated financial transactions.

These advancements will expand the capabilities and applications of tokenization, driving further adoption and integration into capital markets.

💡In a nutshell, tokenization is expected to have profound effects on traditional financial systems by redefining intermediaries’ roles, global market access, and regulatory evolution.

The financial industry must embrace change to remain relevant in the evolving landscape. Tokenization offers a pathway to a more inclusive, transparent, and efficient financial ecosystem, reshaping the way we invest and manage assets.

Conclusion

Tokenization in capital markets is more than a technological advancement; it’s a transformative force reshaping the financial industry’s very foundation. By leveraging blockchain technology, tokenization offers unprecedented opportunities for increased liquidity, accessibility, and efficiency. It democratizes investment, allowing a broader range of participants to engage in markets previously reserved for the elite.

As projections indicate a potential market value of $16 trillion by 2030, the impact of tokenization is set to be profound. However, realizing this potential requires navigating challenges such as regulatory complexities, technological limitations, and market adoption barriers. Partnering with experts like Tokenova can help mitigate risks and unlock the full benefits of tokenization.

The future of capital markets is being redefined. Tokenization stands at the forefront of this revolution, offering a more inclusive, transparent, and efficient financial ecosystem. Embracing this change will not only provide competitive advantages but also contribute to a more equitable global economy. Now is the time to engage, innovate, and lead in the tokenized world.

Key Takeaways

- Tokenization converts real-world assets into digital tokens using blockchain, enhancing liquidity, accessibility, and efficiency in capital markets.

- Benefits include reduced transaction costs, improved transparency, and democratized investment opportunities, making high-value assets accessible to a broader investor base.

- Challenges such as regulatory uncertainties and technological limitations exist, but ongoing advancements and supportive regulatory trends are paving the way for wider adoption.

- The tokenized asset market is projected to reach up to $16 trillion by 2030, indicating significant growth potential and a profound impact on traditional financial systems.

- Partnering with experts like Tokenova can help navigate the complexities of tokenization, ensuring compliance, security, and the realization of its full potential.

1. How does tokenization enhance liquidity in capital markets?

Tokenization increases liquidity by breaking down assets into smaller, tradable units called tokens. Fractional ownership allows more investors to participate, making it easier to buy and sell assets that were previously illiquid, such as real estate or fine art. This expanded pool of buyers and sellers enhances market liquidity and can lead to more accurate asset pricing.

2. What role does blockchain play in tokenization?

Blockchain serves as the foundational technology for tokenization. It provides a decentralized, immutable ledger that records all transactions securely and transparently. Blockchain ensures data integrity, prevents unauthorized alterations, and enables the use of smart contracts, which automate and enforce the terms of agreements without intermediaries. This results in increased efficiency, security, and trust among market participants.

3. Are tokenized assets secure and legally recognized?

Yes, when properly structured and compliant with relevant regulations, tokenized assets are secure and legally recognized. Security is enhanced through blockchain’s cryptographic features, which protect against fraud and unauthorized access. Legal recognition depends on adherence to securities laws and regulations in the applicable jurisdictions. Working with experienced legal advisors and complying with KYC/AML requirements ensures that tokenized assets are legitimate and enforceable.