What if your NFTs could create long-term demand, loyalty, and passive income, not simply hype?

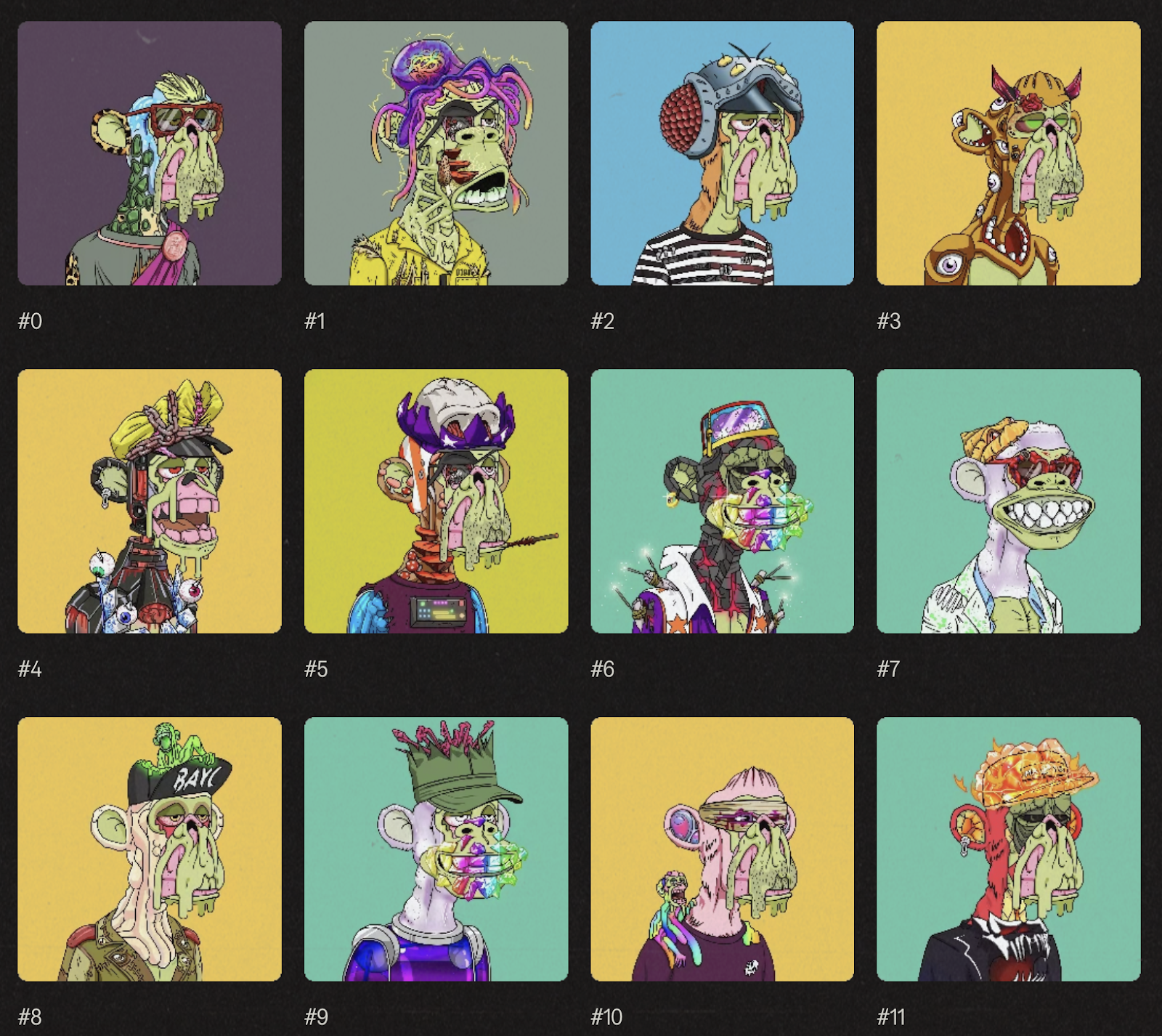

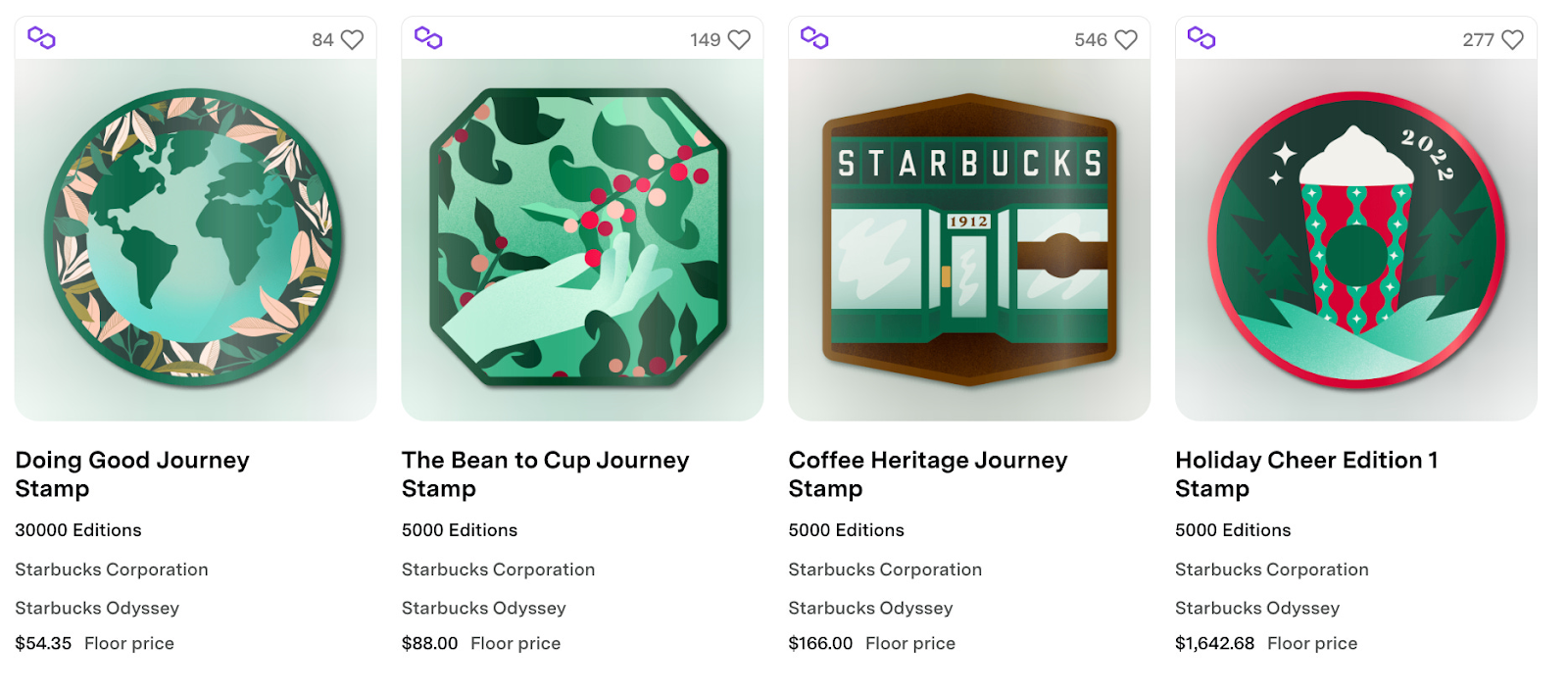

Poorly designed tokenomics have doomed numerous NFT projects, resulting in worthless assets for investors and damaged reputations for companies. The 2022 NFT crisis exposed projects that depended on speculative hype without sustainable incentives, leading to their downfall as holders sold off their tokens. Others failed due to excessive supply or lack of real benefits, while CryptoZoo faced legal issues for overpromising. In contrast, effective tokenomics can enhance NFTs as valuable commercial tools. The Bored Ape Yacht Club (BAYC) thrives with a fixed supply of 10,000 NFTs, generating significant royalties and engaging community activities. Similarly, Starbucks connects NFT rewards to its loyalty program, and VeeFriends provides access to seminars by Gary Vaynerchuk. Luxury brands like Dolce & Gabbana offer exclusive fashion week tickets, while Nike’s Swoosh system authenticates shoes through tokenization.

Well-designed tokenomics for company owners monetize intellectual property, increase consumer involvement, and provide continuous income sources.

This article shows how to create NFT economics that fit your objectives, steer clear of traps, and promote consistent value in the Web3 age.

What Precisely is NFT Tokenomics?

Derived from “token” and “economics,” tokenomics describes the structural and economic framework controlling a non-fungible token’s (NFT) lifetime, value proposition, and ecosystem dynamics. It includes the processes of determining an NFT’s scarcity, usefulness, distribution, and incentive systems, hence guaranteeing consistency between project objectives, user behavior, and market sustainability. Professionally, tokenomics is the blueprint for producing NFTs that provide long-term value instead of transient excitement, relevant to companies, artists, and developers exploring Web3.

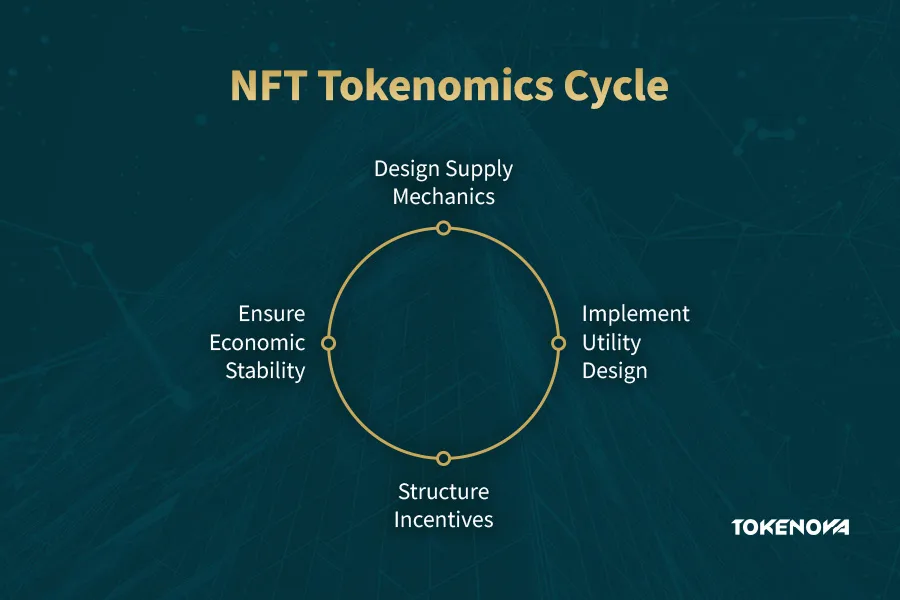

Key components include:

- Supply Mechanics: Scarcity creates value in supply mechanics. While dynamic approaches, such as Art Blocks‘ bonding curves, change price according to demand to balance accessibility and rarity, a fixed supply, like CryptoPunks’ 10,000 unique NFTs, nurtures exclusivity.

- Utility Design: NFTs have to provide significant advantages. Utility may be functional duties (e.g., Nike’s .Swoosh certifying shoes), ownership rights (e.g., tokenized real estate), or access rights (e.g., VeeFriends‘ admission to Gary Vaynerchuk’s conferences). Utility links the NFT to actual value, either digital or physical, hence, improving retention.

- Incentive Structures: Rewards promote holding and involvement. Staking enables holders to earn tokens by locking NFTs, dividends distribute earnings (e.g., royalty payouts), and buybacks limit circulating supply to improve value. Bored Ape Yacht Club (BAYC) is an example of this; it creates millions monthly for Yuga Labs by combining a 10,000-NFT limit with 2.5% secondary sale royalties and exclusive community activities.

While minimizing concerns like inflation or regulatory scrutiny, good tokenomics harmonize incentives among stakeholders—creators, holders, and secondary markets. For companies, the process involves designing NFTs that fit with fundamental products, whether they are monetizing IP, strengthening loyalty, or generating fresh income sources. Building confidence and increasing adoption in competitive Web3 environments depends on a strong tokenomic system, stress-tested for economic stability.

From a professional standpoint, tokenomics is the core of an NFT project’s success or failure, deciding whether it survives as a sustainable ecosystem or crumbles under market forces. From the experience of a blockchain strategist, projects have soared when they matched incentives with human behavior and crashed when they pursued short-term excitement. Tokenomics is about building trust, value, and loyalty in a distributed society, not just code. Based on actual events and their quantifiable effects, Tokenomics is crucial.

Read More: Utility Tokenomics: From Concepts to Applications

Why does Tokenomics Make or Break NFTs

Tokenomics, the economic foundation of NFTs, determines the success or failure of enterprises in Web3 environments, according to a professional blockchain expert. A strategic discipline, tokenomics drives sustainable value for creators, holders, and brands by aligning incentives and building trust. Strong designs provide ongoing income, loyalty, and brand equity; weak tokenomics cause market failures and lost confidence. Based on actual events with confirmed results, the following study clarifies why tokenomics is the defining element in NFT success.

Avoiding the “Pump-and-Dump” Trap

Speculative excitement without permanent incentives caused huge sell-offs; therefore, 95% of the 2022 NFT collapse projects lost almost all value. Strategic tokenomics helps to offset such losses by promoting retention. Azuki’s ecosystem, which provides artist collaborations and unique virtual galleries, maintains a floor price 25% above collections. Maintaining pricing consistency under market volatility, World of Women’s tiered access offers VIP event invites for premium NFTs. With floor prices remaining above 50 ETH in 2023, CryptoPunks keep value based on community reputation under their rarity-driven approach. These initiatives demonstrate that to maintain confidence and value, tokenomics has to give long-term involvement top priority above short-term speculation.

Monetizing Beyond First Sales

Well-designed NFTs are dynamic income sources beyond first sales. Based on Cryptoslate, Yuga Labs’ Bored Ape Yacht Club (BAYC) makes $1.5M–$2.5M monthly from 2.5% secondary sale royalties, driven by strong trading volumes. With 5% royalties, Art Blocks’ generative art NFTs consistently provide creator money; top collections such as Chromie Squiggle produce $500,000 monthly. With the best plots earning $50,000 yearly from advertising leases, Decentraland’s LAND NFTs allow virtual billboards. These cases show how tokenomics may generate varied, continuous revenue by matching incentives, hence turning NFTs into sustainable assets for both producers and investors.

Tokenomics in line with brand strategy

To create real value, tokenomics must align with a brand’s identity. For example, Nike’s .Swoosh system uses NFTs to verify shoes, reducing counterfeiting and boosting Gen Z engagement through unique digital assets. The Sandbox enhances user interaction by offering NFT-based property ownership in its virtual environment, while Axie Infinity connects NFTs to in-game rewards, sustaining 1.6M traders in 2022.

Read More: Unlock Your Web3 Brand Strategy: A Comprehensive Guide

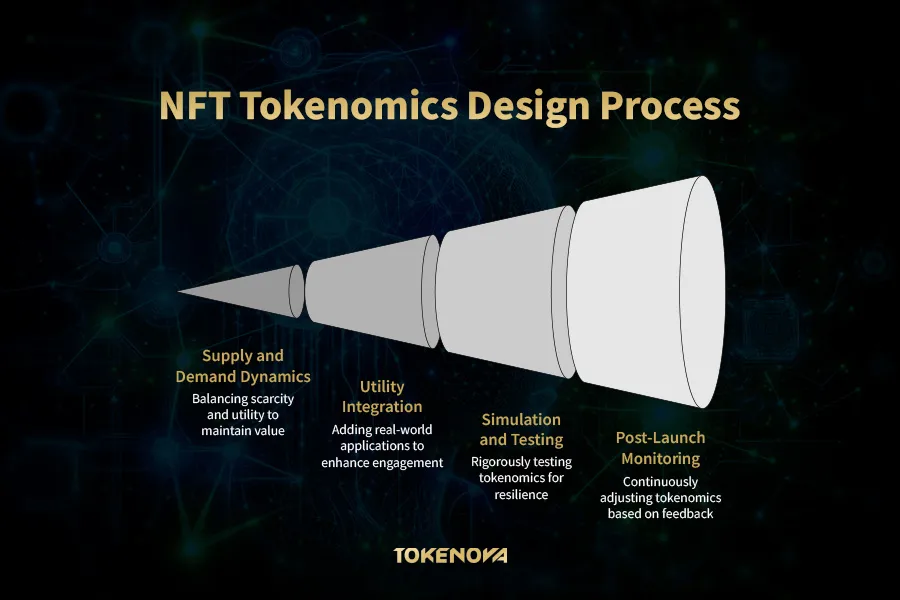

Designing Successful NFT Tokenomics

Creating NFT tokenomics that provide consistent value calls for a disciplined, data-driven method based on economic concepts and customized to the strategic goals of your company. Informed by industry best practices and real-world results, here is a thorough approach to create tokenomics that appeal to stakeholders, reduce risks, and achieve long-term success.

Step 1: Define Unambiguous Strategic Goals

Your NFT project’s main objective should come first, as it guides every following decision. Do you aim to generate consistent income, build a devoted network, enhance brand exclusivity or expand your business model? For example, based on Econsultancy, Starbucks’ Odyssey initiative aims to deepen consumer loyalty by integrating NFTs into its rewards program—offering exclusive experiences and digital collectibles. Ledger Insights says luxury brands like Dolce & Gabbana have used NFTs to offer premium event access, aligning with their exclusivity-driven branding. B2B companies might use tokenization for operational efficiencies, such as simplifying license management or improving access control. Align your strategy with measurable KPIs like revenue, retention, or engagement.

Step 2: Design Supply and Demand Dynamics in

NFT value is closely tied to supply design. A fixed supply, such as CryptoPunks’ 10,000 NFTs, creates scarcity that boosts collector demand. Platforms like Art Blocks implement dynamic pricing models using bonding curves, where mint prices increase with demand (Art Blocks Docs). Oversupply, on the other hand, can lead to devaluation—as seen during the NFT downturn in 2022 when unlimited minting models flooded the market and drove prices down.

However, supply dynamics alone are not enough. Utility plays a critical role in sustaining long-term demand. NFTs with real-world applications—such as exclusive event access, in-game functionality, product authentication, or loyalty rewards—are more likely to retain user engagement and value after the initial hype cycle. For example, Nike’s .Swoosh platform integrates NFTs for access to exclusive product drops and experiences, adding tangible benefits beyond collectibility.

Projects that combine thoughtful supply models with clear, evolving utilities—like tiered perks, upgradeable NFTs, or token-gated services—tend to perform more consistently. This is especially relevant in sectors like gaming and e-commerce, where user behavior is driven by experience and benefit rather than scarcity alone.

Use simulation tools and historical data to model supply strategies, but ensure your tokenomics align with meaningful utility. This dual approach strengthens both the speculative and functional value of your NFTs, improving floor price stability and community retention.

According to 2023 data from various Dune Analytics dashboards, projects that offer ongoing utility and maintain capped supply tend to outperform those relying solely on artificial scarcity—though success still depends heavily on execution and community fit.

Read More: What Assets Can Be Tokenized

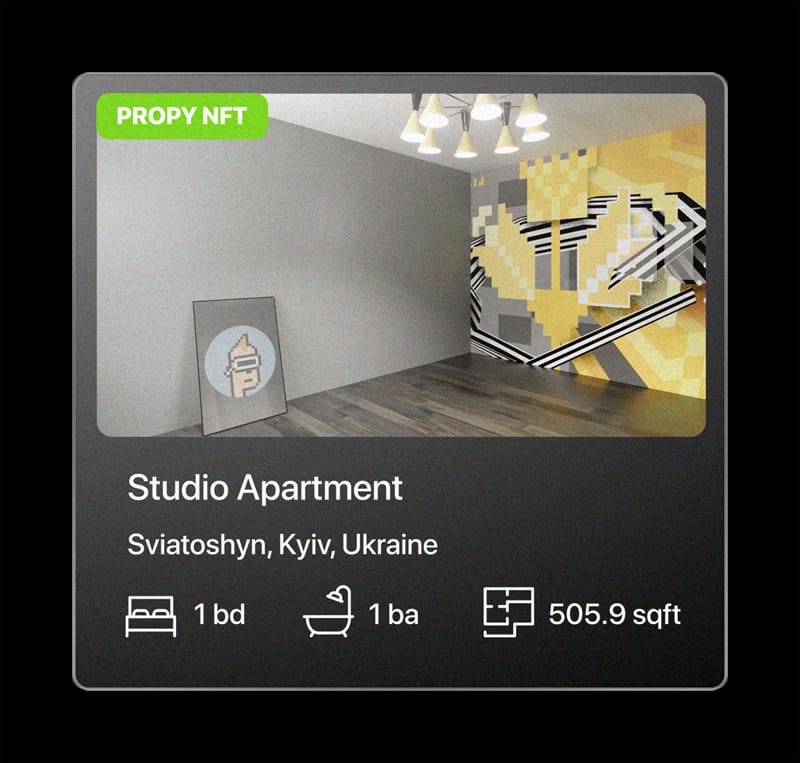

Step 3: Include Usefulness Increasing Basic Business Value

NFTs gain lasting relevance through utility. Rather than speculation, focus on functional integration. Nike’s.Swoosh platform integrates NFTs for product authentication and community engagement. Cool Cats NFTs, for instance, offer holders merchandise benefits and in-game perks that enhance retention. In real estate, companies like Propy use NFTs to streamline property transactions. Salesforce and other SaaS firms have experimented with NFT-based access control and rewards programs, enhancing user loyalty, though exact figures vary. Always ensure legal compliance, especially with U.S. securities laws, when embedding a utility into a token design.

Step 4: Simulate, stress-test, and iterate

Resilient tokenomics needs rigorous modeling. Use tools like Chainlink for real-world data integration and platforms like Manifold or Mirror for custom contract deployment. Run simulations for economic volatility, oversupply, and legal disruptions. Yuga Labs reportedly uses economic modeling to maintain NFT value and royalty streams across its ecosystem. Test with pilot launches and community input to iterate. Consulting blockchain economists can offer critical perspectives on long-term sustainability.

Read More: An Ultimate Guide to Smart Contract Security

Step 5: Watch and adjust after launch

Tokenomics must evolve with user behavior and market conditions. Projects like Azuki implement community governance to refine offerings over time. We use analytics tools such as Nansen to monitor engagement, wallet activity, and market response. VeeFriends adjusted NFT utilities based on holder feedback, improving satisfaction and retention. Regular smart contract audits are essential for maintaining trust and avoiding vulnerabilities.

Key Takeaway: Winning NFT tokenomics combines strategic alignment with economic discipline. Companies may produce NFTs that provide observable return on investment by means of defined goals, supply optimization, significant utility integration, rigorous testing, and dynamic adaptation. Use resources, including OpenZeppelin for safe contracts, and seek advice from professionals to negotiate complexity. Your NFT initiative should not only start but also flourish.

Why Collaborate with Tokenova?

Tokenova, a leading Web3 consulting firm in the UAE, specializes in NFT tokenomics that deliver consistent value for high-net-worth companies. Our diverse team provides end-to-end solutions, including fund structuring, dApp development, tax advice, and UAE business registration. We offer comprehensive NFT audits and stress-testing for regulatory and market risks, creating tailored economic models for sectors like luxury, fintech, and real estate. Talk to our experts and get a free consultation before starting.

Mistakes & Risks to Avoid

Navigating NFT tokenomics calls for accuracy, as errors might result in financial losses, legal disputes, and harm to reputation. Professional blockchain specialists like Vitalik Buterin, co-founder of Ethereum, underline that badly constructed tokenomics often result from mismatched incentives. Backed by influencer Logan Paul, the CryptoZoo initiative best illustrates this trap. Promising unrealistic benefits like in-game revenue, it fell under litigation in 2023, with investors claiming fraud for unfulfilled promises. Buterin’s criticism of such initiatives emphasizes that there must be reasonable, attainable commitments to prevent community and legal reaction.

Another major danger is regulatory control. SEC Chairman Gary Gensler has often highlighted NFTs looking like unregistered securities, especially those with profit-sharing or staking incentives. Based on the Holleywoord reporter, the SEC’s 2023 lawsuit against Stoner Cats, an NFT initiative linked to Mila Kunis, led to a $1 million settlement for unregistered securities sales, hence stressing the requirement of compliance. To reduce such risks, involving legal professionals knowledgeable in KYC/AML and securities regulations is very essential.

Read More: Web3 Legal: Startup Regulatory Framework

Imitating rivals’ tokenomics without modification erodes brand identity. Citing initiatives like Meebits, which failed to stand apart from CryptoPunks, losing 40% of their floor price in 2022, blockchain analyst Anndy Lian observes that generic concepts do not connect with certain audiences. Other traps include limitless supply, which drove inflation in initiatives like Axie Infinity’s SLP token (down 90% from its 2021 high) and poor usefulness, like NFTs providing no real-world advantages, as demonstrated in unsuccessful celebrity drops like Paris Hilton’s 2021 collection.

Chainlink’s Sergey Nazarov advises utilizing tools like TokenSim to model economics and prevent imbalances. Work with blockchain auditors to guarantee smart contracts; transparency fosters trust as Yuga Labs’ open BAYC roadmaps promote it. To keep community trust, be honest about risks and fulfill commitments.

Read More: Top Asset Tokenization Challenges & How to Overcome Them

The Future of NFT Tokenomics

Driven by a push toward real-world applications and evolving user engagement, NFT tokenomics are entering a more mature phase. As blockchain expert Balaji Srinivasan has emphasized, the tokenization of real-world assets (RWAs)—like real estate, intellectual property, and digital identity—has the potential to bring real utility and shift ownership paradigms. This aligns with McKinsey & Company’s 2023 report, which estimates that tokenized financial assets could reach $2–4 trillion in value by 2030, signaling a significant economic transformation as blockchain infrastructure matures.

Dynamic NFTs are also gaining traction due to their programmability and utility. Projects like Adidas’ “Into the Metaverse” showcase how brands are using NFTs for customer engagement, loyalty, and authentication. While specific metrics vary, these initiatives exemplify how NFTs can evolve beyond collectibles into interactive brand assets.

Gamification and loyalty integration are further driving innovation. Starbucks’ Odyssey program blends digital collectibles with reward points to foster engagement and community participation. Though still in early phases, such models indicate how NFTs can be embedded into traditional customer journeys to drive long-term retention.

On the enterprise side, leading consulting firms, including Deloitte, have highlighted Web3’s potential to redefine customer loyalty and access control. While exact adoption rates remain speculative, token-gated commerce and digital identity systems are expected to see broader implementation by 2027 as more businesses experiment with pilot programs.

Projects like VeeFriends and Propy demonstrate real-world NFT applications—whether through event access or digital property titles—showing the expanding role of tokenomics in business operations. As the market matures, successful NFT ecosystems will rely not just on scarcity but on sustained utility, compliance, and a clear link to enterprise goals.

Read More: Asset Tokenization Trends

What is NFT Tokenomics?

NFT tokenomics is the structural and economic framework controlling an NFT’s lifetime, value proposition, and ecosystem dynamics. Derived from “token” and “economics,” it describes the processes determining an NFT’s scarcity, usefulness, distribution, and incentive systems. This aims to guarantee consistency between project objectives, user behavior, and market sustainability, providing long-term value instead of transient excitement.

What are the key components of NFT tokenomics?

Key components include supply mechanics, which use scarcity to create value through fixed or dynamic approaches. Utility design is another component, requiring NFTs to provide significant advantages like functional duties, ownership rights, or access rights, linking the NFT to actual value. Lastly, incentive structures promote holding and involvement through rewards like staking, dividends (royalty payouts), or buybacks.

Why is NFT tokenomics important?

From a professional standpoint, tokenomics is the core of an NFT project’s success or failure. It decides whether an NFT project survives as a sustainable ecosystem or crumbles under market forces. Badly constructed tokenomics have killed several NFT initiatives, while strategic tokenomics may turn NFTs into strong commercial instruments. Tokenomics is described as the economic backbone that decides whether enterprises flourish or fail in Web3 environments.

How can companies use NFT tokenomics?

For company owners, well-designed tokenomics can monetize intellectual property, increase consumer involvement, and provide continuous income sources. Companies like Starbucks use it to deepen consumer loyalty, Dolce & Gabbana offers premium event access, and Nike’s .Swoosh system verifies shoes via tokenization. They can also generate varied, continuous revenue beyond first sales, such as monthly royalties from secondary sales, as seen with Yuga Labs’ BAYC.

What makes NFT tokenomics successful?

Good tokenomics harmonize incentives among stakeholders—creators, holders, and secondary markets—while minimizing concerns like inflation or regulatory scrutiny. Success involves designing NFTs that fit with fundamental products and prioritizing long-term involvement above short-term speculation. Successful tokenomics combine thoughtful supply models with clear, evolving utilities and require a disciplined, data-driven method based on economic concepts and customized to strategic goals.

What common mistakes should be avoided in NFT tokenomics?

A major danger is mismatched incentives and overpromising unreachable usefulness, which can lead to legal issues, as seen with CryptoZoo. Regulatory control is another significant risk, especially for NFTs that might be considered unregistered securities, which led to a lawsuit against Stoner Cats. Imitating rivals’ tokenomics without modification can erode brand identity. Other traps include limitless supply, which drives inflation, and poor usefulness, providing no real-world advantages.

What is the future of NFT tokenomics?

The future is driven by a push toward real-world applications and evolving user engagement. This includes the potential tokenization of real-world assets (RWAs) like real estate and intellectual property. Dynamic NFTs, gamification, and loyalty integration are also gaining traction, with brands using NFTs for customer engagement, loyalty, and authentication. Token-gated commerce and digital identity systems are expected to see broader implementation as businesses experiment with pilot programs.